Global System on a Chip (SoC) Market By Type (Digital, Analog, and Mixed Signal), By End-use Industry (Automotive, Aerospace & Defense, IT & Telecommunication, Consumer Electronics, Industrial, Healthcare, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Dec. 2023

- Report ID: 107456

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

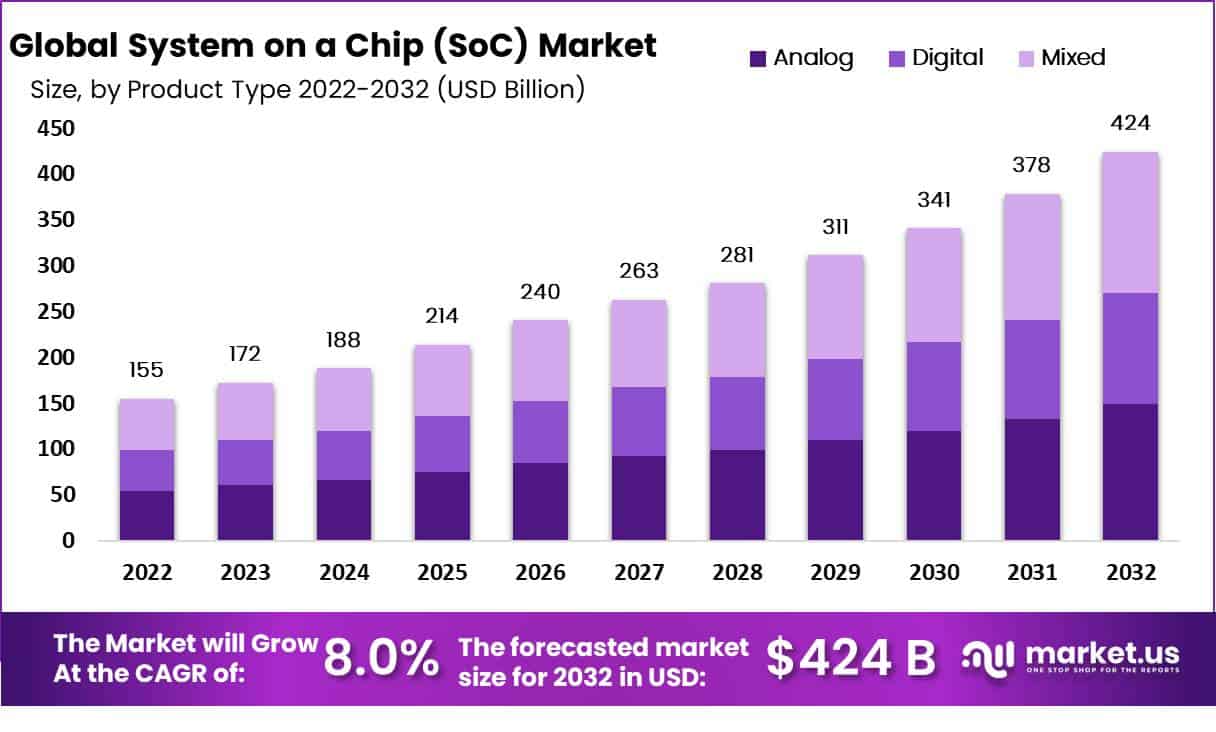

The global System On Chip (SoC) market is valued at USD 172.0 Billion in 2023. The overall demand for System On Chip (SoC)s is expected to develop at an 8.0% CAGR over the forecast period from 2023 to 2032. Global sales of System On Chip (SoC) are anticipated to reach USD 424 Billion by 2032.

System-on-chip (SoC) is an integrated circuit which integrates various digital, analog, mixed signal, and radio frequency functions. Components may include CPUs, system memories, peripheral controllers, GPUs, neural network circuitry and radio modems. SoCs offer many advantages over multi-chip systems including reduced power consumption and efficiency improvements while their single processor design helps reduce energy waste and costs significantly.

SoCs are commonly found in applications including signal processing, wireless communications, artificial intelligence (AI) research activities as well as general computing activities such as signal processing or computing activities requiring computing tasks.

Note: Actual Numbers Might Vary In Final Report

SoCs can be found in many electronic devices, from smartphones and tablets to laptops and wearables – as well as automotive systems. SoCs offer several advantages over multi-chip designs in terms of reduced size, weight, power consumption and cost.

Key Takeaways

- Market Valuation and Growth: The global System On Chip (SoC) market is valued at USD 172.0 Billion in 2023 and The market is expected to develop at an impressive CAGR of 8.0% from 2023 to 2032.

- Definition of SoC: SoC (System-on-Chip) is an integrated circuit that combines various digital, analog, mixed signal, and radio frequency functions.

- Type Analysis: In 2023, the Digital segment dominated the SoC market due to the growing demand for digital processing capabilities across industries.

- End-Use Industry: In 2023, Consumer Electronics emerged as the dominant end-user industry for SoCs due to the demand for advanced electronic gadgets.

- Driving Factors: Growing Demand for IoT Devices is a major driver of SoC market growth.

- Restraining Factors: Complex Design Challenges in creating high-functionality SoCs lead to longer development cycles and higher costs.

- Growth Opportunities: Edge Computing presents a significant growth opportunity for SoCs, enabling real-time processing and reduced latency.

- Challenges: Miniaturization and Heat Management challenges arise as transistors shrink and functionality increases.

Type Analysis

In 2023, the System on a Chip (SoC) market exhibited distinct segmental dynamics, with the Digital segment taking a commanding lead, capturing a significant share of the market. The Digital segment’s dominance can be attributed to the growing demand for digital processing capabilities across various industries. This segment includes SoCs designed specifically for digital signal processing, data processing, and computational tasks.

The increasing adoption of digital technologies in sectors like telecommunications, consumer electronics, and automotive applications has driven the prominence of digital SoCs. Furthermore, advancements in semiconductor manufacturing have enabled the integration of more digital components into a single chip, enhancing performance and efficiency.

Meanwhile, the Analog segment also played a crucial role in the SoC market, catering to applications that require precise analog signal processing. Analog SoCs are widely utilized in areas such as audio processing, sensor interfaces, and power management. The demand for high-quality audio and sensor-driven applications has bolstered the Analog segment’s position in the market.

Additionally, the Mixed Signal segment, which combines both digital and analog components on a single chip, emerged as a significant player in the SoC landscape. This segment offers versatility and efficiency, making it ideal for applications where digital and analog functionalities coexist. Mixed Signal SoCs find application in diverse industries, including healthcare, industrial automation, and IoT devices.

End-Use Industry

In 2023, the System on a Chip (SoC) market displayed distinct segmental trends, with the Consumer Electronics segment emerging as the dominant player, capturing a substantial market share. This prominence can be attributed to the growing demand for more advanced and feature-rich electronic gadgets, which include tablets, smartphones smart TVs, and wearables.

Consumer Electronics SoCs have witnessed significant advances, which have enabled the use of high performance computing technology, efficiency in energy and integrating a range of functionalities in a single chip which improves the overall experience for users. The growth of the segment is fueled by the speed of technology advancements and the continuous search for smaller and robust electronic devices.

The Automotive sector has also has emerged as an important end-user industry for SoCs due to the increasing use electrical vehicles and advanced driver assistance systems (ADAS) and in-car infotainment systems. Automotive SoCs facilitate the integration of essential functionalities like sensor processing, connectivity, and automotive safety features, contributing to the industry’s growth.

Furthermore, the IT & Telecommunication segment maintained a robust presence in the SoC market, owing to the escalating demand for high-speed data processing, networking, and connectivity solutions. With the advent of 5G technology and the increasing reliance on cloud computing, IT & Telecommunication SoCs have witnessed substantial growth, addressing the evolving needs of the sector.

Aerospace & Defense also played a crucial role, with SoCs tailored for mission-critical applications, surveillance, and communication systems. The stringent requirements of this sector for reliability and security have driven the adoption of specialized SoCs. In addition, the Industrial, Healthcare, and Other segments have seen steady growth, as SoCs are increasingly deployed in industrial automation, medical devices, and various emerging technologies.

Driving Factors

- Growing Demand for IoT Devices: The rising use of Internet of Things (IoT) devices across all industries is driving market for SoCs. SoCs allow the necessary combination of connectivity, sensors and processing power needed for IoT applications.

- Mobile Device Proliferation: Due to the increasing use of tablets and smartphones, There’s an ongoing demand for more efficient and energy-efficient SoCs to meet the needs of mobile devices that are modern which is driving innovations in the marketplace.

- Rise of 5G Technology: The deployment of 5G networks is a significant driver for SoC market growth. 5G requires advanced SoCs to enable higher data speeds, low latency, and support for multiple connected devices.

- Automotive Advancements: The automotive industry’s pursuit of autonomous driving, advanced driver-assistance systems (ADAS), and in-vehicle entertainment systems is boosting the demand for SoCs tailored for automotive applications.

Restraining Factors

- Complex Design Challenges: Designing SoCs with increased functionality and performance is becoming more complex, leading to longer development cycles and higher costs, which can be a significant restraint.

- Supply Chain Disruptions: The semiconductor industry faces supply chain disruptions due to factors like chip shortages and geopolitical tensions, which can impact the availability of critical components for SoCs.

- Data Privacy Concerns: As SoCs become integral to IoT devices, concerns about data privacy and security are growing. Ensuring robust security features in SoCs is a challenge.

- Regulatory Compliance: Compliance with evolving regulations related to energy efficiency and environmental standards can be a hurdle for SoC manufacturers, adding complexity to their development processes.

Growth Opportunities

- Edge Computing: The shift toward edge computing, where data processing occurs closer to the data source, presents a significant growth opportunity for SoCs, as they enable real-time processing and reduced latency.

- Artificial Intelligence (AI) Integration: Integrating Artificial Intelligence (AI) capabilities into SoCs offers immense growth potential, allowing devices to perform complex tasks like image recognition, natural language processing, and more efficiently.

- Custom SoC Solutions: Providing custom SoC solutions tailored to specific applications and industries can be a lucrative opportunity for manufacturers to meet unique demands.

- Green and Energy-Efficient SoCs: Developing energy-efficient SoCs aligns with the sustainability trend and offers growth potential, especially in IoT, mobile, and wearable devices.

Challenges

- Miniaturization and Heat Management: Shrinking transistors and increasing functionality lead to heat management challenges, as smaller chips generate more heat, which can affect performance and reliability.

- Cost-Effective Manufacturing: Achieving cost-effective manufacturing processes for complex SoCs while maintaining quality and performance standards is a constant challenge.

- Competitive Landscape: The SoC market is highly competitive, with numerous players vying for market share. Standing out and differentiating in this crowded market is a challenge.

- Legacy System Integration: Integrating advanced SoCs into existing legacy systems and ensuring backward compatibility can be challenging for industries with long product lifecycles.

Key Market Trend

- AI Acceleration: SoCs with dedicated AI accelerators are a key trend, enabling AI-powered applications to run efficiently on a wide range of devices.

- Heterogeneous Integration: The trend toward heterogeneous integration involves combining various technologies, such as CPUs, GPUs, and specialized accelerators, on a single chip to optimize performance.

- Security Emphasis: Security features within SoCs are becoming a crucial trend, with a focus on hardware-based encryption, secure boot, and protection against cyber threats.

- Quantum Leap in Performance: SoC designs are continuously pushing the boundaries of performance, with advanced manufacturing processes and architectural innovations delivering significant leaps in processing power and energy efficiency.

Key Market Segments

By Type

- Analog

- Digital

- Mixed

By End-Use Industry

- Automotive

- Aerospace and Defense

- IT and Telecommunication

- Consumer Electronics

- Industrial

- Healthcare

- Other

Regional Analysis

In 2023, North America held a dominant market position in the System on a Chip (SoC) market, capturing the largest share. The leadership of the region can be attributed to several key factors. North America, particularly the United States, remains at the forefront of technological advancement and has a robust collection of semiconductor makers and tech giants that drive the SoC market’s development.

In addition, the focus of North America to research and development, coupled with high consumer demand for high-end electronic devices has led to the widespread use of SoCs across a variety of applications that include smartphone, IoT devices, and automotive systems. The presence of top SoC manufacturers as well as an established technology infrastructure for the semiconductor sector further cements North America’s place on world SoC market.

Moving towards, Europe Moving to Europe, the SoC market is expected to grow significantly in 2023 with countries such as Germany, France, and the United Kingdom contributing to the regional prominent position. European industries, specifically in aerospace, automotive, and industrial automation have utilized SoCs to boost performance, energy efficiency and connectivity of their products. Additionally, the strict regulations in Europe have encouraged the use of SoCs in critical safety applications like autonomous vehicles and medical devices, accelerating the market’s growth.

In the Asia-Pacific (APAC) region, 2023 marked remarkable growth in the SoC market. APAC, with its vast population and thriving consumer electronics market, has become a focal point for SoC adoption. Countries such as China, Japan, and South Korea are home to the top semiconductor companies and smartphone manufacturers, which is driving the need for high-end SoCs. In addition, the rise of IoT technology, 5G technology along with smart manufacturing across APAC has further encouraged the growth of SoCs which makes one of the fastest-growing regions on the market.

Latin America displayed steady growth in the SoC market, driven by the region’s economic development and increasing consumer electronics consumption. Countries like Brazil and Mexico have witnessed a surge in smartphone adoption, leading to a higher demand for SoCs. Moreover, Latin American industries are gradually incorporating SoCs into applications like smart agriculture and healthcare, contributing to the market’s expansion.

Lastly, the Middle East and Africa (MEA) region also witnessed notable progress in the SoC market in 2023. MEA countries, diversifying their economies and investing in digital transformation, have increased the demand for SoCs in various sectors, including telecommunications, energy, and transportation. The growing emphasis on smart city initiatives and infrastructure development has further driven the adoption of SoCs in the region.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Top Key Players

- Google Inc (US)

- Amazon Web Services Inc. (US)

- Advanced Micro Devices Inc (US)

- BitMain Technologies Holding Company (China)

- Intel Corporation (US)

- Xilinx (US)

- SAMSUNG (South Korea)

- Qualcomm Technologies Inc. (US)

- NVIDIA Corporation (US)

- Wave Computing Inc. (US)

- Graphcore (UK)

- IBM Corporation (US)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

- Micron Technology Inc. (US)

Recent Development

- In September 2023, MediaTek and TSMC jointly revealed the successful development of their inaugural chip utilizing TSMC’s cutting-edge 3nm technology. This accomplishment involved taping out MediaTek’s flagship Dimensity system-on-chip (SoC), and the companies anticipate commencing volume production in 2024.

- In April 2023, Broadcom Inc. made an announcement regarding the production of Jericho3-AI, a groundbreaking development that establishes the industry’s highest-performance fabric for artificial intelligence (AI) networks. Jericho3-AI introduces revolutionary capabilities, including impeccable load balancing, congestion-free operation, ultra-high radix, and Zero-Impact Failover. These advancements ultimately lead to significantly reduced job completion times for any AI workload.

Report Scope

Report Features Description Market Value (2023) US$ 172 Bn Forecast Revenue (2032) US$ 424 bn CAGR (2023-2032) 8.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Digital, Analog, and Mixed Signal), By End-use Industry (Automotive, Aerospace & Defense, IT & Telecommunication, Consumer Electronics, Industrial, Healthcare, and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, and rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Google Inc (US), Amazon Web Services Inc. (US), Advanced Micro Devices Inc (US), BitMain Technologies Holding Company (China), Intel Corporation (US), Xilinx (US), SAMSUNG (South Korea), Qualcomm Technologies Inc. (US), NVIDIA Corporation (US), Wave Computing Inc. (US), Graphcore (UK), IBM Corporation (US), Taiwan Semiconductor Manufacturing Company Limited (Taiwan), Micron Technology Inc. (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a system on a chip (SoC)?An SoC (system on a chip) is an integrated circuit (IC) that unites all the components necessary for running a computer or electronic system onto one chip, including central processing unit (CPU), memory, input/output ports and additional components such as graphics processing units (GPUs), signal processors or wireless communication modules.

How big is System on Chip (SoC) Market?The global System On Chip (SoC) market is valued at USD 167.2 Billion in 2023. The overall demand for System On Chip (SoC)s is expected to develop at an 8.0% CAGR over the forecast period from 2023 to 2032. Global sales of System On Chip (SoC) are anticipated to reach USD 327.8 Billion by 2032

What are the key advantages of using SoCs in electronic devices?SoCs offer various advantages, including reduced power consumption, smaller form factors, increased performance, and lower costs due to the integration of multiple components into a single chip. They also facilitate the development of more compact and energy-efficient electronic devices.

What role do SoCs play in the development of the Internet of Things (IoT)?SoCs play an essential part in the development of IoT devices by providing necessary processing power and connectivity across a variety of applications ranging from smart home devices, wearables, industrial sensors and connected vehicles to connected cars. Their compact design and low power consumption make them well suited to various IoT implementations.

Who are the major players in the SoC market?Top Key Players: Google Inc (US), Amazon Web Services Inc. (US), Advanced Micro Devices Inc (US), BitMain Technologies Holding Company (China), Intel Corporation (US), Xilinx (US), SAMSUNG (South Korea), Qualcomm Technologies Inc. (US), NVIDIA Corporation (US), Wave Computing Inc. (US), Graphcore (UK), IBM Corporation (US), Taiwan Semiconductor Manufacturing Company Limited (Taiwan), Micron Technology Inc. (US)

System on a Chip (SoC) MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

System on a Chip (SoC) MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Google Inc (US)

- Amazon Web Services Inc. (US)

- Advanced Micro Devices Inc (US)

- BitMain Technologies Holding Company (China)

- Intel Corporation (US)

- Xilinx (US)

- SAMSUNG (South Korea)

- Qualcomm Technologies Inc. (US)

- NVIDIA Corporation (US)

- Wave Computing Inc. (US)

- Graphcore (UK)

- IBM Corporation (US)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

- Micron Technology Inc. (US)