Global Flexible Display Market Size, Share, Statistics Analysis Report By Technology Type (OLED (Organic Light Emitting Diode), LCD (Liquid Crystal Display), EPD (Electronic Paper Display), Other Technology Types), By Material (Plastic, Glass, Other Materials), By Application (Smartphones and Tablets, Wearable Devices, Televisions, Digital Signage, Other Applications), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 134065

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

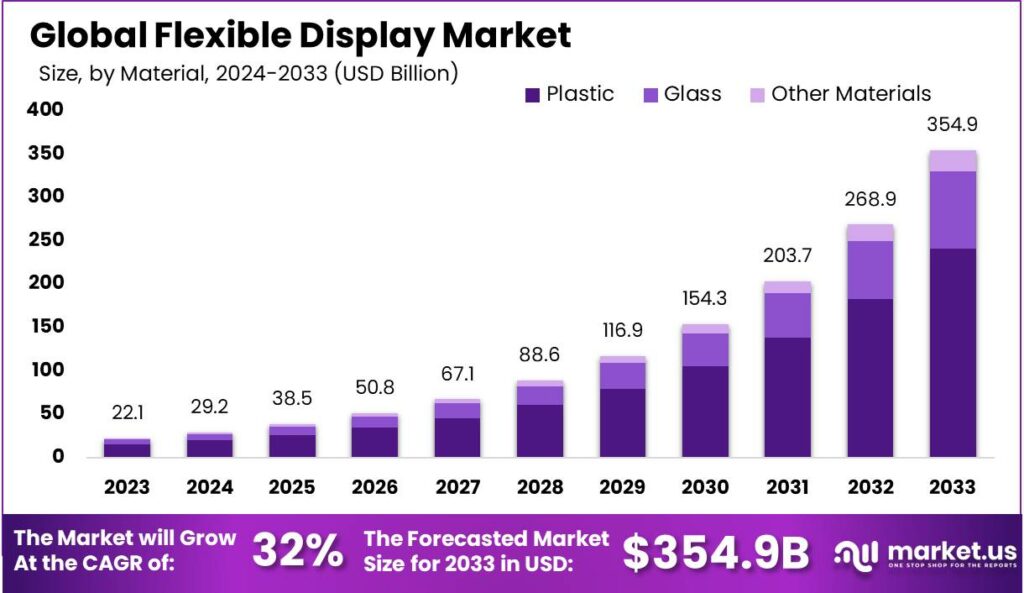

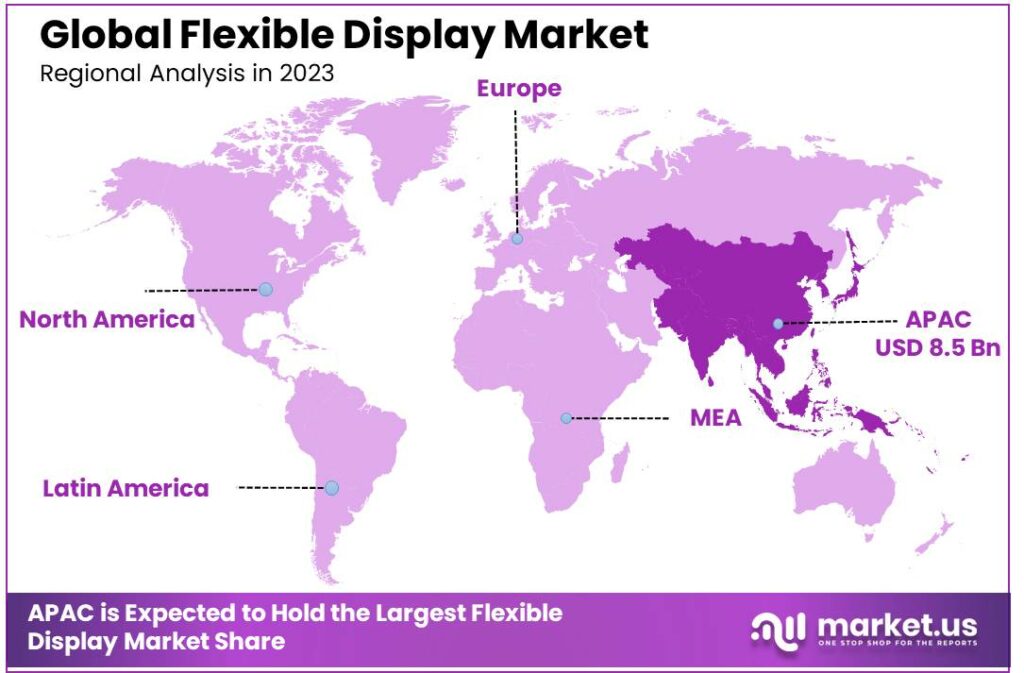

The Global Flexible Display Market size is expected to be worth around USD 354.9 Billion By 2033, from USD 22.1 Billion in 2023, growing at a CAGR of 32.00% during the forecast period from 2024 to 2033. In 2023, Asia-Pacific (APAC) dominated the flexible display sector, accounting for over 38.5% of the market share, which translated to approximately USD 8.5 billion in revenue.

A flexible display refers to a screen technology that allows the display to bend, fold, or stretch without compromising its performance or visual quality. Unlike traditional rigid displays, flexible displays can be integrated into a variety of devices and applications, offering a greater level of versatility. These displays are typically made using organic light-emitting diodes (OLEDs) or electronic paper (e-paper), which are both light, thin, and can be molded into different shapes.

The flexible display market has been witnessing rapid growth in recent years, driven by technological advancements, evolving consumer preferences, and increasing demand for innovative and portable electronic devices. The market is poised for further expansion, with flexible displays becoming integral components in smartphones, wearables, TVs, and automotive displays.

Companies across various industries are investing heavily in research and development to harness the potential of flexible display technology. As manufacturing processes improve and costs decrease, the adoption of flexible displays is expected to become more widespread, impacting sectors from consumer electronics to healthcare.

Several factors are propelling the growth of the flexible display market. First, the increasing demand for lightweight, portable, and durable electronic devices is fueling the adoption of flexible displays. As smartphones, tablets, and wearables become thinner and more compact, consumers are seeking displays that are more adaptable and robust.

Another driving factor is the growing interest in flexible, foldable, and rollable screen designs, which enable new form factors for consumer electronics, such as foldable smartphones and bendable televisions. Additionally, advancements in OLED technology and the development of new materials are making flexible displays more affordable and commercially viable for manufacturers.

The demand for flexible displays is primarily driven by the consumer electronics sector, where there is a growing appetite for products that combine innovation with practicality. Flexible displays offer the potential for unique user experiences and new product designs, such as foldable smartphones, flexible wearables, and curved displays in automotive dashboards and smart home devices.

The demand is also growing in the automotive and healthcare sectors, where flexible displays can be used for in-car interfaces, wearable medical devices, and other applications that require durability and flexibility. As consumer awareness of these benefits increases, the market is expected to experience a surge in demand in the coming years.

The flexible display market presents numerous opportunities for businesses, particularly in product innovation and application diversification. Companies that can capitalize on the development of more cost-effective manufacturing techniques for flexible displays will have a significant advantage, especially as production scales up and materials become more widely available.

Additionally, new opportunities are emerging in industries such as automotive, where flexible displays are used for curved or flexible infotainment systems, and healthcare, where displays integrated into wearable health-monitoring devices are becoming increasingly popular. The potential to integrate flexible displays into emerging technologies like augmented reality (AR) and virtual reality (VR) also presents a substantial opportunity for growth.

Technological advancements are a cornerstone of the flexible display market’s rapid development. Key innovations in materials, such as the use of thin-film transistors (TFTs) and organic semiconductors, have significantly improved the performance, durability, and efficiency of flexible displays. The introduction of new manufacturing processes, including roll-to-roll production, has also reduced the cost of flexible displays, making them more accessible to a wider range of industries.

Key Takeaways

- The Global Flexible Display Market is projected to reach USD 354.9 billion by 2033, up from USD 22.1 billion in 2023, growing at a CAGR of 32.00% during the forecast period from 2024 to 2033.

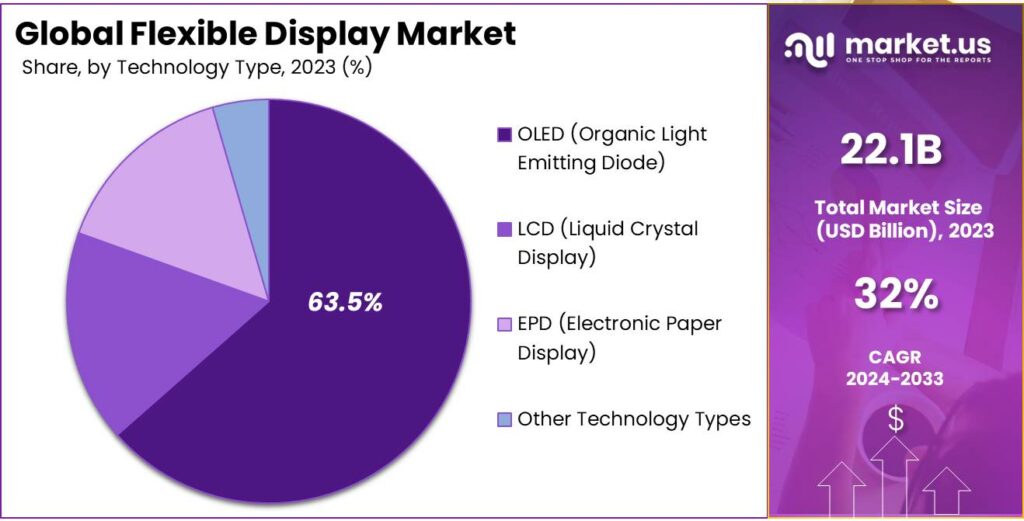

- In 2023, the OLED (Organic Light Emitting Diode) segment held a dominant position, capturing over 63.5% of the market share in the flexible display sector.

- The plastic segment dominated the market in 2023, accounting for more than 68.1% of the total share.

- The Smartphones and Tablets segment also led in 2023, capturing more than 30.4% of the total share in the flexible display market.

- Asia-Pacific (APAC) held the largest share of the flexible display market in 2023, with more than 38.5%, generating approximately USD 8.5 billion in revenue.

Technology Type Analysis

In 2023, the OLED (Organic Light Emitting Diode) segment held a dominant market position, capturing more than a 63.5% share of the flexible display market.

OLED technology’s widespread adoption in flexible displays can be attributed to its superior color reproduction, thinner profiles, and ability to be bent or shaped without compromising image quality. The organic materials used in OLED displays also consume less power compared to traditional LCDs, making them more energy-efficient.

OLED displays are also leading the market due to continued advancements in the technology, such as improvements in durability and production efficiency. Over the years, OLED has moved beyond just high-end consumer electronics into mass-market products, including foldable smartphones, curved TVs, and flexible wearables.

Another contributing factor to OLED’s market leadership is the ongoing reduction in manufacturing costs. As the production processes become more refined and scalable, OLED displays are becoming more affordable, driving their adoption in both high-end and budget-friendly products.

Material Analysis

In 2023, the plastic segment held a dominant position in the flexible display market, capturing more than 68.1% of the total market share. This segment’s leadership can largely be attributed to the inherent advantages that plastic offers in terms of flexibility, lightweight properties, and cost-effectiveness.

Unlike traditional glass displays, plastic materials are much more durable and resistant to breaking or shattering, making them ideal for flexible and foldable display technologies. Their ability to bend and stretch without compromising performance or display quality has made plastic the material of choice.

Another reason plastic dominates the market is the rapid advancement in plastic OLED (OLED) technology, which has significantly enhanced its performance and visual quality. These plastic-based displays offer high resolution, superior brightness, and contrast, which have been key factors in their widespread adoption.

Furthermore, the plastic segment benefits from ongoing research and development in new materials, such as polyethylene terephthalate (PET) and polyimide (PI), which are pushing the boundaries of what flexible displays can achieve. These innovations are enabling plastic displays to become thinner, more energy-efficient, and more durable, enhancing their competitiveness in the market.

Application Analysis

In 2023, the Smartphones and Tablets segment held a dominant market position, capturing more than 30.4% of the total share in the flexible display market.

This significant market share can be attributed to the increasing consumer demand for mobile devices with advanced features such as foldable displays, which offer enhanced portability and usability. Flexible displays enable manufacturers to create thinner, lighter, and more durable devices, driving innovation in the smartphone and tablet industry.

The smartphone industry has always been a driving force for display technology advancements, and the introduction of foldable and flexible screens has allowed manufacturers to offer more innovative products. Consumers are drawn to the appeal of larger screens in compact devices, and flexible displays cater to this need by offering screens that can bend without compromising on performance.

The tablet segment also benefits from the same trend, with flexible displays enabling the production of lightweight, portable tablets that are more resistant to cracks and damage compared to traditional glass screens. As demand for tablets rises in sectors like education, entertainment, and business, flexible displays are key to improving user experience by offering better screen durability, energy efficiency, and design flexibility.

Key Market Segments

By Technology Type

- OLED (Organic Light Emitting Diode)

- LCD (Liquid Crystal Display)

- EPD (Electronic Paper Display)

- Other Technology Types

By Material

- Plastic

- Glass

- Other Materials

By Application

- Smartphones and Tablets

- Wearable Devices

- Televisions

- Digital Signage

- Other Applications

Driver

Growing Consumer Demand for Portable Devices

The increasing demand for portable and multifunctional consumer devices is one of the main drivers behind the flexible display market. With the rise of smartphones, smartwatches, foldable tablets, and other wearable tech, consumers are seeking lightweight and compact products without sacrificing screen size or functionality.

Flexible displays, which allow for curvable and foldable features, meet this demand by providing devices that are both portable and visually appealing. This technology enables manufacturers to create larger screens without increasing the device’s size, making them highly attractive to tech-savvy consumers. Additionally, as innovation in flexible displays continues, the integration of bendable OLED screens in new categories such as flexible TVs and curved gaming monitors is expected to drive growth further.

Restraint

High Manufacturing Costs

The production of flexible displays, especially OLED-based screens, requires specialized equipment and advanced materials, which results in high manufacturing costs. The complexity of the fabrication process, including the integration of thin, flexible substrates and the precise layering of organic materials, makes the production process both time-consuming and expensive.

As a result, the high production cost of flexible displays remains a restraint for widespread adoption, particularly in budget-conscious markets. While technology improvements may reduce these costs over time, the current price of flexible display devices remains a challenge for manufacturers aiming to scale production. This cost factor limits the accessibility of flexible displays to only premium devices, preventing mass-market penetration.

Opportunity

Advancement in Wearable Technology

As the demand for fitness trackers, smartwatches, and augmented reality (AR) glasses continues to rise, flexible displays can help revolutionize the form and functionality of wearable devices. Flexible displays offer a lightweight, space-efficient solution, allowing for larger and more user-friendly screens while maintaining comfort and mobility.

In the future, flexible displays could be integrated into clothing, glasses, or even skin patches, providing seamless connectivity and real-time data access in a way traditional devices cannot. As consumers seek increasingly sophisticated and personalized wearables, the ability of flexible displays to integrate into various form factors presents a unique growth opportunity for companies involved in wearable tech.

Challenge

Durability and Longevity

Despite their promising potential, flexible displays still face a significant challenge in terms of durability and longevity. Traditional rigid displays, such as those used in smartphones, are well-known for their ability to withstand daily wear and tear. However, flexible displays are more prone to damage due to their bending and folding nature.

While advances have been made in creating tougher flexible displays, issues like screen cracking, pixel degradation, and reduced lifespan still persist. Additionally, the materials used in flexible displays, such as organic compounds in OLED screens, can degrade over time, leading to color fading and image retention issues. This durability challenge remains a major concern for manufacturers and consumers alike, as they may be hesitant to invest in products with uncertain long-term reliability.

Emerging Trends

One of the most significant trends is the integration of bendable and foldable screens into smartphones, tablets, and wearables. Companies like Samsung, LG, and Huawei have been pioneering foldable smartphones, which have already made a significant impact on the market.

Another emerging trend is the use of flexible OLED (Organic Light Emitting Diode) displays. OLED technology offers vibrant colors, high contrast ratios, and energy efficiency, and when combined with flexible substrates, it opens up new possibilities for curved, bendable, or even stretchable displays.

Additionally, there is growing interest in transparent and stretchable displays. These could be used for heads-up displays in vehicles, smart windows, or even clothing that adapts to the wearer’s movements. The rise of 5G technology is also likely to boost the demand for flexible displays, as consumers and businesses seek devices that can handle high-speed connectivity in compact and adaptable formats.

Business Benefits

Flexible displays offer businesses a wide range of benefits, particularly in terms of product design, user experience, and cost-efficiency. One of the most significant advantages is the ability to create innovative, compact, and versatile devices.This flexibility appeals to both consumers and manufacturers, as it enhances portability and convenience.

Moreover, the ability to create curved or wraparound screens enables companies to produce unique devices that stand out in a crowded market. This can be especially important in industries such as consumer electronics, automotive, and fashion, where design aesthetics play a crucial role in customer appeal.

From a business perspective, flexible displays can also lead to cost savings in manufacturing. As the technology matures, production costs for flexible displays are expected to decrease, making them a more affordable option for manufacturers.

Regional Analysis

In 2023, Asia-Pacific (APAC) held a dominant market position in the flexible display sector, capturing more than a 38.5% share, translating to a revenue of approximately USD 8.5 billion. This region’s leadership is largely driven by the presence of key manufacturing hubs in countries like South Korea, Japan, China, and Taiwan, where major companies such as Samsung, LG, BOE, and Sharp are based.

These companies are at the forefront of flexible display technology innovation and mass production, allowing APAC to lead both in terms of manufacturing output and technological advancements. Moreover, the rapid adoption of flexible display devices, including foldable smartphones and smartwatches, is particularly strong in countries like China and South Korea, where consumers are highly receptive to the latest tech innovations.

The APAC region also benefits from a highly developed electronics and semiconductor ecosystem, which supports the production of flexible displays at scale. China, in particular, is a critical player in the supply chain, both as a producer of flexible display panels and as a large consumer market for smartphones, tablets, and other electronic devices that incorporate flexible screen technology.

In markets like South Korea and Japan, the trend of high-end smartphones with foldable screens is gaining momentum, with companies like Samsung leading the way with their Galaxy Z series. The success of these devices has spurred other companies in the region to invest in flexible display technology, further strengthening APAC’s dominance.

Furthermore, the increasing consumer base in APAC countries, coupled with a growing middle class with higher purchasing power, is contributing to the surge in demand for flexible display-equipped devices. The region’s growing emphasis on smart cities, connected technologies, and wearable devices is also expanding the application of flexible displays in sectors beyond consumer electronics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The flexible display market is highly competitive, with several leading players who are pioneering technological advancements and driving market growth.

Samsung Electronics Co., Ltd. is arguably the most dominant player in the flexible display market, holding a significant share due to its strong presence in display technology. Samsung has been at the forefront of foldable display innovations, with its Galaxy Z series of smartphones showcasing its OLED-based flexible screens.

LG Corporation is another major player in the flexible display market, particularly known for its expertise in OLED technology. LG has pioneered flexible OLED displays for a wide range of applications, from TVs to automotive displays and wearable devices.

BOE Technology Group Co., Ltd. is a prominent Chinese company that has rapidly expanded its presence in the global flexible display market. BOE has become a key supplier of flexible OLED displays, competing closely with Samsung and LG in the smartphone display sector.

Top Opportunities Awaiting for Players

The flexible display market is brimming with opportunities for players to capitalize on, as the technology continues to evolve and gain traction across various industries.

- Expansion into Wearables and Fashion Tech: One of the most promising areas for flexible displays is the wearable tech market. Devices like smartwatches, fitness trackers, and augmented reality (AR) glasses are increasingly integrating flexible screens to offer more immersive and ergonomic experiences.

- Adoption in Automotive Sector: The automotive industry represents another significant growth area for flexible displays. As automakers move toward creating smarter, more connected vehicles, flexible displays are being used in dashboards, control panels, and even rearview mirrors.

- Growth in Consumer Electronics (Foldable Smartphones & Laptops): The most immediate and obvious opportunity lies in the growing consumer electronics market, particularly foldable smartphones and laptops. As leading brands like Samsung, Huawei, and Motorola have already demonstrated, flexible displays are revolutionizing mobile devices by allowing for larger screens in compact, portable designs.

- Potential in Healthcare and Medical Devices: The healthcare sector is another area where flexible displays hold great promise. As medical devices become more advanced and user-friendly, there is an increasing need for displays that can conform to different surfaces and provide high levels of readability.

- Opportunities in Digital Signage and Retail: Flexible displays are also making waves in digital signage and retail applications. Retailers are increasingly seeking ways to capture consumer attention with interactive, eye-catching displays. Flexible screens can be used in creative ways, such as in storefront windows, curved advertisements, or dynamic in-store signage that adapts to the environment.

Top Key Players in the Market

- Samsung Electronics Co., Ltd.

- LG Corporation

- BOE Technology Group Co., Ltd.

- Royole Corporation

- Visionox

- AUO Corporation

- E-Paper Innovation LTD

- Sharp Corporation

- Viewpointec

- Unilumin

- Other Key Players

Recent Developments

- In January 2024, at CES 2024, Samsung Display will unveil its cutting-edge foldable technology, set to shape the future of the display industry. The company will showcase its innovations under the theme “All-in Innovative Tech: Paving the New Journey” at the event in Las Vegas, USA, from January 9–12.

- In November 2024, LG Display has revealed a groundbreaking stretchable display technology that pushes the boundaries of screen innovation. Unveiled at LG Science Park in Seoul, the new prototype can stretch up to 50 percent, setting a new industry record for the highest stretchability, according to LG.

Report Scope

Report Features Description Market Value (2023) USD 22.1 Bn Forecast Revenue (2033) USD 354.9 Bn CAGR (2024-2033) 32.00% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology Type (OLED (Organic Light Emitting Diode), LCD (Liquid Crystal Display), EPD (Electronic Paper Display), Other Technology Types), By Material (Plastic, Glass, Other Materials), By Application (Smartphones and Tablets, Wearable Devices, Televisions, Digital Signage, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co., Ltd., LG Corporation, BOE Technology Group Co., Ltd., Royole Corporation, Visionox, AUO Corporation, E-Paper Innovation LTD, Sharp Corporation, Viewpointec, Unilumin, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flexible Display MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Flexible Display MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co., Ltd.

- LG Corporation

- BOE Technology Group Co., Ltd.

- Royole Corporation

- Visionox

- AUO Corporation

- E-Paper Innovation LTD

- Sharp Corporation

- Viewpointec

- Unilumin

- Other Key Players