Global Automotive Turbochargers Market Size, Share, Growth Analysis By Type (VGT, Wastegate Turbocharger, Electric Turbocharger), By Fuel Type (Gasoline, Diesel, Natural Gas), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)), By Material (Cast Iron, Aluminum), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 58439

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

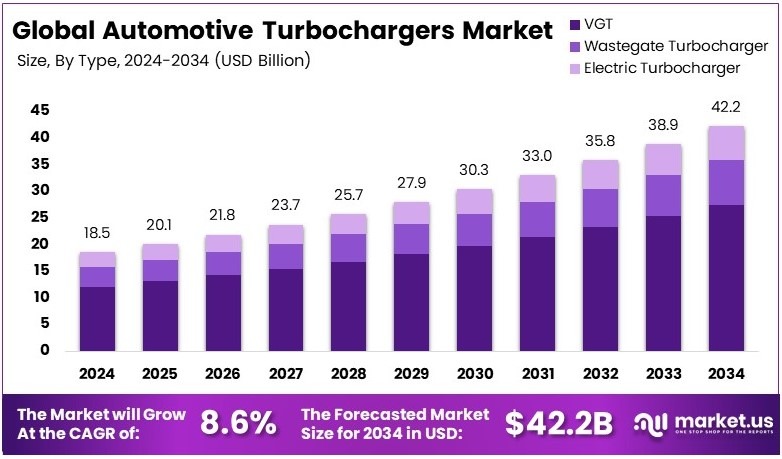

The Global Automotive Turbochargers Market size is expected to be worth around USD 42.2 Billion by 2034, from USD 18.5 Billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034.

Automotive turbochargers are devices designed to enhance engine power by pushing extra air into the combustion chambers. By utilizing exhaust gases to spin turbines, they increase airflow, thereby improving engine efficiency and performance. These devices are commonly employed in both passenger cars and commercial vehicles due to their ability to boost fuel economy and reduce emissions.

The market for automotive turbochargers involves the trading of turbocharging systems used in vehicles. This includes activities among manufacturers, suppliers, and aftermarket providers. The growth of this market is primarily fueled by the increasing demand for vehicles with better fuel efficiency and lower emissions.

Additionally, technological advancements and stringent environmental regulations further propel market growth. The market dynamics are also influenced by price competition and continuous innovation, which together drive global demand for turbochargers.

The automotive turbochargers market is experiencing robust growth, driven by stringent global emission standards. For instance, the Environmental Protection Agency (EPA) mandates a 56% reduction in emissions by 2032, compared to 2026 targets. Additionally, EU member states aim to cut greenhouse gas emissions by 55% by 2030 from 1990 levels, with goals of becoming climate neutral by 2050.

Furthermore, these regulations significantly increase the demand for automotive turbochargers, as they are crucial for meeting these new standards by enhancing engine efficiency and reducing emissions. This demand creates substantial opportunities within the market, making it highly competitive and dynamic. Manufacturers are continually innovating to provide more efficient and effective solutions.

Moreover, the broader impact of these turbochargers extends beyond compliance with environmental regulations. Locally, they contribute to reducing the overall carbon footprint of vehicles, aligning with governmental goals for a greener economy. Consequently, the market’s growth not only reflects an advancement in automotive technologies but also a crucial step towards sustainable development.

Key Takeaways

- Automotive Turbochargers Market was valued at USD 18.5 Billion in 2024 and is projected to reach USD 42.2 Billion by 2034, with an 8.6% CAGR.

- In 2024, Variable Geometry Turbochargers (VGT) led with 65.3%, benefiting from improved fuel efficiency and performance.

- In 2024, Gasoline Turbochargers held 52.7%, driven by increased demand for fuel-efficient gasoline engines.

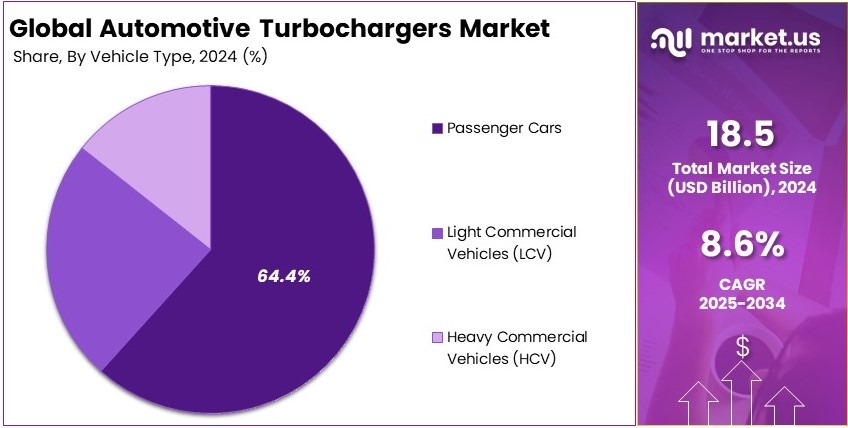

- In 2024, Passenger Cars dominated with 64.4%, fueled by rising adoption of turbocharged vehicles.

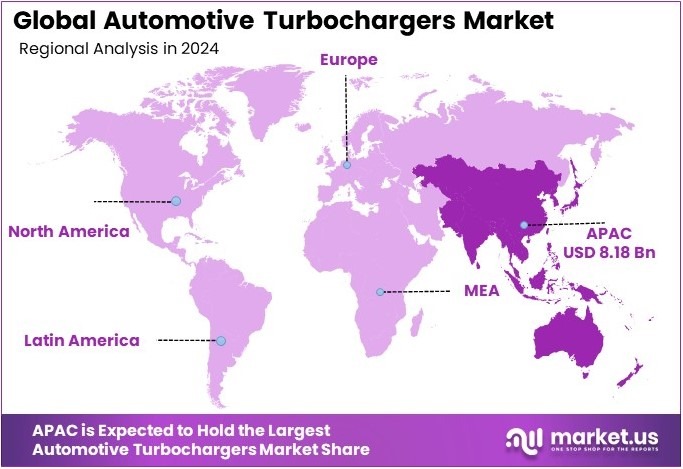

- In 2024, Asia Pacific led with 44.2% and a market value of USD 8.18 Billion, supported by strong automotive production.

Type Analysis

Variable Geometry Turbochargers (VGT) dominate with 65.3% due to their adaptability and efficiency in engine performance.

Variable Geometry Turbochargers (VGT) have emerged as the leading sub-segment within the automotive turbocharger market, boasting a significant 65.3% market share in 2024. This dominance is largely due to VGT’s ability to adjust the intake flow dynamically based on engine requirements.

This enhances the efficiency and performance of the engine across varying speeds and conditions. Their superior functionality in providing optimal power and reducing lag has made them a preferred choice among automotive manufacturers and consumers alike.

Wastegate Turbochargers play a pivotal role by managing engine pressure and enhancing fuel economy. They are simpler in design compared to VGTs, which makes them cost-effective and reliable for standard performance requirements.

Electric Turbochargers are gaining traction due to their ability to provide immediate boost to the engine without the typical delay seen in traditional turbochargers. Their integration into hybrid and electric vehicle technologies marks them as key contributors to the future growth of the turbocharger market.

Fuel Type Analysis

Gasoline dominates with 52.7% due to its wide usage in passenger vehicles.

Gasoline-powered vehicles continue to lead the turbocharger market with a 52.7% share in 2024, influenced by the high number of gasoline engines in passenger cars. The preference for gasoline turbochargers is attributed to their ability to enhance engine efficiency and performance while meeting stringent emission standards.

Diesel Turbochargers are essential for heavy-duty and commercial vehicles, providing the necessary torque and efficiency for large-scale transportation and heavy machinery. Their role remains critical in sectors where robust performance is paramount.

Natural Gas Turbochargers are becoming more popular as part of the shift towards cleaner energy sources. They offer a viable alternative for reducing emissions in automotive applications, aligning with global environmental sustainability goals.

Vehicle Type Analysis

Passenger Cars dominate with 64.4% due to the high volume of personal vehicle usage.

Passenger cars hold the largest share of the turbocharger market at 64.4% in 2024, driven by the growing demand for personal mobility and the increasing adoption of turbocharged engines for better fuel efficiency and performance. The widespread use of turbochargers in passenger vehicles is a response to consumer demands for vehicles that combine environmental friendliness with performance and economy.

Light Commercial Vehicles (LCV) benefit significantly from turbochargers as they require enhanced power for cargo transportation within urban settings. Turbochargers help in improving fuel efficiency and reducing operational costs.

Heavy Commercial Vehicles (HCV) use turbochargers to meet the rigorous demands of long-distance and heavy-load transportation. Turbochargers in these vehicles are crucial for maximizing engine efficiency and longevity under challenging operational conditions.

Material Analysis

Cast Iron dominates with 58.8% due to its durability and heat resistance.

Cast Iron is the predominant material used in the manufacturing of turbochargers, with a market share of 58.8% in 2024. This material’s dominance is due to its high resistance to heat and wear, making it ideal for handling the extreme conditions within turbocharged engines. Cast iron ensures the longevity and reliability of turbochargers, which are essential for maintaining engine performance over time.

Aluminum Turbochargers are favored in applications where weight reduction is crucial, such as in racing and high-performance vehicles. Aluminum offers a lighter alternative to cast iron, providing significant advantages in terms of reducing overall vehicle weight and improving handling and fuel economy.

Key Market Segments

By Type

- VGT

- Wastegate Turbocharger

- Electric Turbocharger

By Fuel Type

- Gasoline

- Diesel

- Natural Gas

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

By Material

- Cast Iron

- Aluminum

Driving Factors

Engine Downsizing and Fuel Efficiency Push Drives Market Growth

The automotive turbochargers market is experiencing strong growth due to rising global fuel efficiency standards. Governments across Europe, the U.S., and Asia are enforcing strict emission limits. To meet these targets, automakers are turning to turbochargers. These systems help smaller engines deliver more power while consuming less fuel. This makes turbocharging a cost-effective solution for meeting regulations without sacrificing performance.

Another factor is the increasing use of turbochargers in gasoline-powered passenger cars. While diesel engines have used turbochargers for years, gasoline engines are now catching up. Carmakers are adding turbos to compact sedans and SUVs to improve power and efficiency. For example, many newer models in markets like India and China now come with small turbocharged engines as standard.

In addition, the demand for high-performance vehicles is growing, especially in emerging markets. Consumers in regions like Southeast Asia and Latin America are seeking powerful cars at affordable prices. Turbochargers provide the boost these engines need without raising engine size or cost.

Restraining Factors

Complex Designs and Maintenance Costs Restraints Market Growth

Despite its growing demand, the turbocharger market faces several challenges. One major restraint is the increasing complexity of engine systems. As automakers integrate turbochargers into modern engines, the overall design becomes more intricate. This creates challenges for assembly, tuning, and long-term durability.

Maintenance costs are also higher for turbocharged engines. These systems operate under high pressure and temperature, requiring special care. As a result, repairs can be more frequent and expensive. This may discourage some buyers, especially in price-sensitive regions. For example, in developing markets, vehicle owners often prefer simpler engines with lower service costs.

Another issue is turbo lag, the slight delay before the turbocharger activates. While new technologies aim to reduce this, it still affects user experience, especially during quick acceleration. This is a concern for drivers who expect instant throttle response.

Finally, tighter emission standards are placing stress on turbocharger performance. Engines must remain clean while still delivering power, which is difficult to balance. This often leads to higher development costs for manufacturers.

Growth Opportunities

Electrification and Material Innovation Provides Opportunities

The turbochargers market is opening new doors through electrification and material advancements. One promising area is the use of turbochargers in hybrid and plug-in hybrid vehicles. These vehicles benefit from turbo systems by achieving better fuel efficiency without losing engine performance. Automakers are now combining electric motors with turbocharged engines for smoother power delivery.

Electrically assisted turbochargers are another innovation gaining ground. These systems use small electric motors to spin the turbo before exhaust pressure kicks in. This helps eliminate turbo lag and enhances response time. High-performance and luxury vehicles are starting to use this tech for faster acceleration and smoother driving.

Aftermarket demand is also growing. Vehicle owners are increasingly upgrading older engines with new turbo systems. This is especially popular among performance car enthusiasts. Turbocharger retrofitting allows them to boost power without changing the entire engine.

Additionally, lightweight materials such as titanium and advanced alloys are being used to build next-generation turbochargers. These materials reduce weight and heat, improving efficiency and engine balance.

Emerging Trends

Advanced Architecture and Green Applications Are Latest Trending Factor

Recent trends in the turbochargers market are redefining system design and application. One key trend is the growing use of twin-scroll and variable geometry turbochargers in premium vehicles. These designs help deliver faster response, better fuel economy, and smoother performance. Brands like BMW and Audi are already using them in their latest models.

Modular turbocharger architecture is also gaining momentum. Manufacturers are now designing turbo systems that can be scaled or adapted easily across different engine types. This helps lower production costs and speeds up product development. For example, one turbo platform may serve several vehicle models by adjusting core components.

In addition, waste heat recovery systems are integrating turbo technologies. These systems capture unused engine heat and convert it into additional energy. This improves overall fuel efficiency and supports cleaner vehicle operations.

Lastly, turbochargers are now being adapted for alternative fuel vehicles. Hydrogen-powered engines and synthetic fuel systems are beginning to use turbocharging to enhance combustion and output. This supports the automotive industry’s shift toward cleaner, low-emission powertrains.

Regional Analysis

Asia Pacific Dominates with 44.2% Market Share

Asia Pacific leads the Automotive Turbochargers Market with a 44.2% share, valued at USD 8.18 billion. This significant market presence is underpinned by the region’s robust automotive manufacturing sector and rising demand for fuel-efficient vehicles.

Key factors contributing to Asia Pacific’s dominance include rapid industrial growth, increased adoption of eco-friendly technologies, and government regulations supporting emissions reductions. The proliferation of automotive manufacturing in countries like China, Japan, and India further amplifies the demand for advanced turbocharging technologies, which enhance engine efficiency and performance.

The future influence of Asia Pacific in the global Automotive Turbochargers Market is projected to grow even stronger. With ongoing technological advancements and an increasing shift towards hybrid and electric vehicles that utilize turbochargers for performance enhancement, Asia Pacific is poised to expand its market share. This trend is expected to continue as the region focuses on sustainable and efficient automotive solutions.

Regional Mentions:

- North America: North America maintains a strong presence in the Automotive Turbochargers Market, driven by stringent environmental regulations and a shift towards more energy-efficient vehicles. The region’s commitment to reducing carbon emissions supports the adoption of turbocharged engines.

- Europe: Europe is a key player in the Automotive Turbochargers Market, with a focus on reducing vehicle emissions and enhancing fuel efficiency. European car manufacturers are leading in turbo technology innovations, significantly contributing to the region’s market growth.

- Middle East & Africa: The Middle East and Africa are gradually adopting automotive turbochargers, particularly in commercial vehicles. The region’s market growth is facilitated by economic diversification efforts and increased industrial activity.

- Latin America: Latin America is seeing increased adoption of automotive turbochargers, driven by the need for more efficient and powerful engines in both passenger and commercial vehicles. The trend towards modernizing vehicle fleets is supporting the growth of the turbocharger market in this region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The automotive turbochargers market is driven by innovation, performance efficiency, and strict emission standards. The top four companies leading this market are Garrett Motion, Mitsubishi Heavy Industries Ltd., Cummins Inc., and Robert Bosch GmbH. These players hold strong positions due to their technology, global reach, and partnerships with major automakers.

Garrett Motion is a well-established leader known for its advanced turbo technologies. The company focuses on fuel efficiency, emission reduction, and electric boosting systems. It supplies turbochargers for passenger cars, commercial vehicles, and hybrid applications worldwide.

Mitsubishi Heavy Industries Ltd. has a strong presence in both OEM and aftermarket segments. The company is known for compact, high-performance turbochargers. It continues to invest in electric turbos and hybrid systems to meet global environmental regulations.

Cummins Inc. is a major player in the commercial vehicle turbocharger space. It benefits from its in-house engine manufacturing, allowing better system integration. The company focuses on durability, power output, and emission control solutions, especially for heavy-duty vehicles.

Robert Bosch GmbH brings strong R&D capabilities and system-level expertise. The company produces high-efficiency turbochargers that support downsized engines. Bosch’s experience in engine management systems gives it an edge in offering complete turbo solutions.

These top players lead the market through continuous innovation, strong supply chains, and collaborations with automotive OEMs. Their focus on lightweight materials, electric turbochargers, and regulatory compliance helps address growing demand for cleaner and more powerful engines. As vehicle electrification grows, these companies are also exploring hybrid turbo technologies. Their global operations, technical expertise, and focus on sustainability position them as key drivers of future market growth.

Major Companies in the Market

- Garrett Motion

- Continental GT

- Aptiv PLC

- Turbonetics

- ABB

- Cummins Inc.

- Ningbo Motor Industrial Co. Ltd.

- Precision Turbo and Engine Inc.

- Robert Bosch GmbH

- Mahle

- Rotomaster International

- Mitsubishi Heavy Industries, Ltd.

Recent Developments

- American Axle & Manufacturing and Dowlais: On January 2025, American Axle & Manufacturing agreed to acquire British car parts maker Dowlais for £1.2 billion. This strategic move aims to strengthen their position in the evolving automotive sector, particularly with the transition to electric vehicles. The acquisition price of 85.2 pence per share represented a 25% premium over Dowlais’s prior closing price. Dowlais, operating primarily as GKN Automotive, supplies 90% of the world’s carmakers and employs approximately 30,000 people globally.

- VivoPower and Future Automotive Solutions and Technologies (FAST): On September 2024, VivoPower International announced a merger with Canada-based hydrogen technology firm FAST, creating a combined entity valued at $1.13 billion. The merged company will be headquartered in the United Kingdom to potentially benefit from government incentives aimed at decarbonizing the electricity sector by 2030. Following the announcement, VivoPower’s shares rose by 3.7% in after-hours trading.

Report Scope

Report Features Description Market Value (2024) USD 18.5 Billion Forecast Revenue (2034) USD 42.2 Billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (VGT, Wastegate Turbocharger, Electric Turbocharger), By Fuel Type (Gasoline, Diesel, Natural Gas), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)), By Material (Cast Iron, Aluminum) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Garrett Motion, Continental GT, Aptiv PLC, Turbonetics, ABB, Cummins Inc., Ningbo Motor Industrial Co. Ltd., Precision Turbo and Engine Inc., Robert Bosch GmbH, Mahle, Rotomaster International, Mitsubishi Heavy Industries. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Turbochargers MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Turbochargers MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Garrett Motion

- Continental GT

- Aptiv PLC

- Turbonetics

- ABB

- Cummins Inc.

- Ningbo Motor Industrial Co. Ltd.

- Precision Turbo and Engine Inc.

- Robert Bosch GmbH

- Mahle

- Rotomaster International

- Mitsubishi Heavy Industries. Ltd