Global Automotive Aftermarket Size, Share, Growth Analysis By Replacement Part (Tire, Battery, Brake Parts, Filters, Body Parts, Lighting & Electronic Components, Wheels, Exhaust Components, Turbochargers, Others), By Distribution Channel (Retailers (OEMs, Repair Shops), Wholesalers & Distributors), By Service Channel (DIY (Do it Yourself), DIFM (Do it for Me), OE (Delegating to OEMs)), By Certification (Genuine Parts, Certified Parts, Uncertified Parts), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143055

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

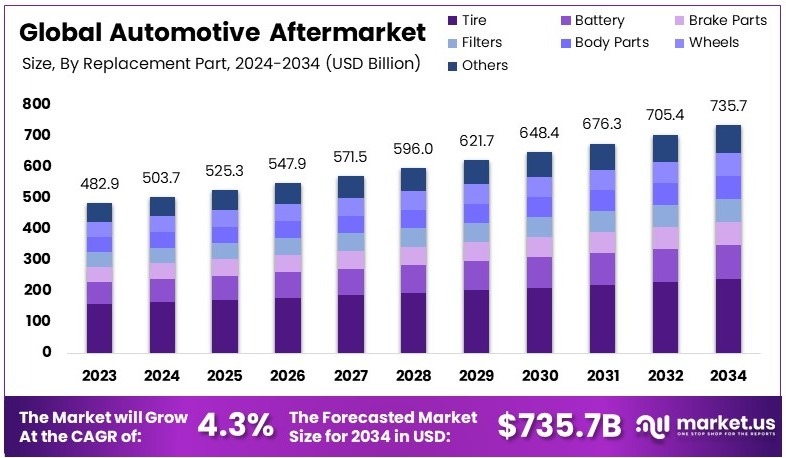

The Global Automotive Aftermarket size is expected to be worth around USD 735.7 Billion by 2034, from USD 482.9 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The automotive aftermarket includes parts, accessories, and services for vehicles after they are sold. It covers replacement parts, repairs, maintenance, and upgrades. Independent workshops, retailers, and manufacturers operate in this market. Consumers buy these products to improve vehicle performance, extend lifespan, or replace worn-out parts.

The automotive aftermarket market consists of businesses that supply replacement parts, accessories, and services. Growth is driven by vehicle aging, increased vehicle ownership, and rising consumer demand for customization. Key players include manufacturers, wholesalers, and retailers. The market is competitive, with companies offering innovative products and services to attract customers.

According to S&P Global Mobility, the average age of cars and light trucks in the U.S. reached a new high of 12.6 years in 2024. As a result, consumers are investing more in vehicle repairs and maintenance. Additionally, this increase in vehicle age boosts demand for replacement parts, creating strong growth potential for the automotive aftermarket.

Furthermore, the aging fleet provides stable opportunities for repair shops and car parts suppliers. Specifically, drivers prefer maintaining their current vehicles rather than purchasing new ones due to high new-car prices. Consequently, automotive businesses see steady demand, especially those providing affordable maintenance solutions and reliable services.

However, market competition remains intense among major brands like AutoZone, Advance Auto Parts, and O’Reilly Auto Parts. Nevertheless, smaller companies can successfully compete by offering specialized services or lower pricing. For instance, local garages focusing on personalized customer service or mobile repair solutions often stand out despite strong competition.

Moreover, on a wider scale, growth in the automotive aftermarket positively impacts the economy by creating jobs nationwide. Similarly, local communities benefit directly from employment opportunities provided by repair shops. For example, small towns often rely on automotive services for stable employment, thus keeping money circulating within local businesses.

Key Takeaways

- The Automotive Aftermarket was valued at USD 482.9 billion in 2024 and is expected to reach USD 735.7 billion by 2034, with a CAGR of 4.3%.

- In 2024, Tire dominated the replacement part segment with 32.6% due to its frequent replacement needs and critical role in vehicle safety.

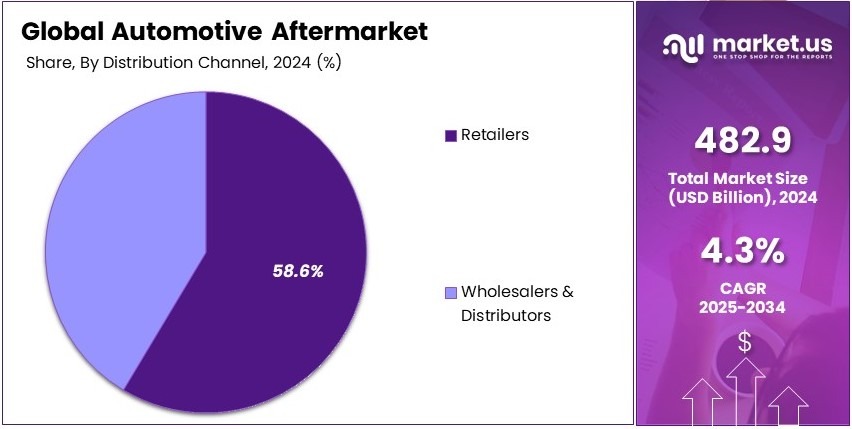

- In 2024, Retailers led the distribution channel with 58.6%, driven by strong consumer preference for direct purchases from OEMs and repair shops.

- In 2024, OE (Delegating to OEMs) dominated the service channel with 65.7%, as customers rely on manufacturers for quality assurance.

- In 2024, Genuine Parts accounted for 53.7% in certification due to increasing consumer demand for reliability and manufacturer-backed warranties.

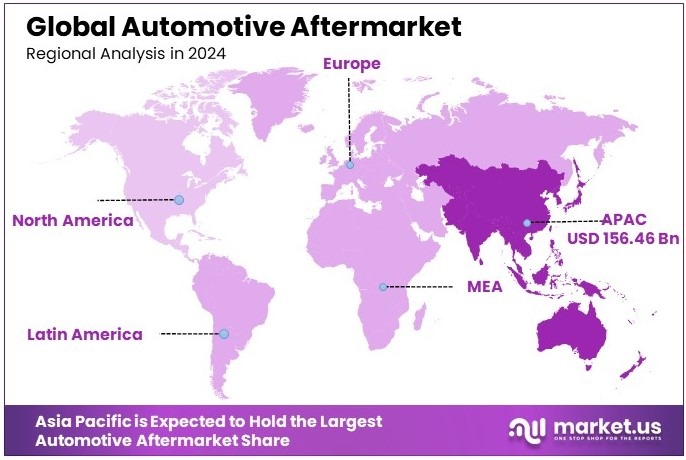

- In 2024, Asia Pacific dominated with 32.4% market share, contributing USD 156.46 billion, driven by expanding vehicle ownership and rising aftermarket demand.

Replacement Part Analysis

Tires dominate with 32.6% due to their critical role in vehicle safety and performance.

The Replacement Parts segment of the Automotive Aftermarket is prominently led by Tires, which account for 32.6% of the market. This sub-segment benefits significantly from regular wear and tear, driving consistent demand. Moreover, the increasing consumer preference for high-quality, durable tires enhances market growth.

Battery replacement follows, contributing to the market with its essential function in vehicle operation, particularly with the rise in electric vehicle adoption. Brake Parts, essential for safety, also see steady demand influenced by stringent regulations and the growing emphasis on performance vehicles.

Filters and Body Parts play crucial roles, with filters being vital for vehicle longevity and emissions control, and body parts demand driven by collision repairs. Lighting & Electronic Components are essential for functionality and compliance with safety regulations, seeing growth with technological advancements.

Wheels and Exhaust Components, though smaller, are vital for vehicle aesthetics and performance modifications. Turbochargers have gained popularity for boosting engine efficiency. The ‘Others’ category captures niche markets, including advanced driver-assistance systems (ADAS) components, which are gradually penetrating the aftermarket sphere.

Distribution Channel Analysis

Retailers dominate with 58.6% due to their direct consumer access and comprehensive service offerings.

In the Distribution Channel sector, Retailers hold the largest share, propelled by their ability to offer immediate product availability and installation services, making up 58.6% of the market. This segment benefits from both the physical and online presence, adapting to consumer buying behaviors.

OEMs and Repair Shops, although smaller, play significant roles. OEMs maintain a loyal customer base that prefers original parts for maintenance and warranty purposes. Repair Shops cater to the demand for professional service and expertise in installation.

Wholesalers & Distributors support the market by bridging manufacturers and various retail outlets, ensuring a steady supply of parts across regions, crucial for maintaining the distribution chain’s efficiency.

Service Channel Analysis

OE (Delegating to OEM’s) leads with 65.7% due to their trusted quality and warranty assurances.

The Service Channel is strongly dominated by OE (Original Equipment), where delegating to OEMs accounts for 65.7% of the market share. This preference is driven by consumer trust in the quality and compatibility of OEM parts, along with strong warranty offers that appeal to new car owners.

DIY (Do It Yourself) maintains a significant portion of the market, favored by consumers who seek cost savings and personal involvement in vehicle maintenance. DIFM (Do It for Me), although smaller, is crucial for customers preferring professional service to ensure quality and reliability.

Certification Analysis

Genuine Parts lead with 53.7% due to consumer trust in authenticity and quality.

In the Certification category, Genuine Parts take precedence, holding 53.7% of the market share. This dominance is attributed to consumer confidence in the authenticity and reliability of genuine parts, which are often preferred for maintaining vehicle integrity and resale value.

Certified Parts provide a balance between cost and quality assurance, making them a popular choice among consumers seeking affordability without compromising on standard. Uncertified Parts, though less preferred, remain relevant in price-sensitive segments, offering the lowest cost options with variable quality standards.

Key Market Segments

By Replacement Part

- Tire

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting & Electronic Components

- Wheels

- Exhaust Components

- Turbochargers

- Others

By Distribution Channel

- Retailers

- OEMs

- Repair Shops

- Wholesalers & Distributors

By Service Channel

- DIY (Do it Yourself)

- DIFM (Do it for Me)

- OE (Delegating to OEMs)

By Certification

- Genuine Parts

- Certified Parts

- Uncertified Parts

Driving Factors

Rising Vehicle Age and Customization Trends Drive Market Growth

The growing number of vehicles on the road is fueling demand for aftermarket parts. As cars last longer, owners seek replacement components to maintain performance and safety.

In addition, the rise in e-commerce platforms has made it easier for consumers to access aftermarket products. Online stores offer a wide range of parts, often at competitive prices, driving market expansion.

Moreover, vehicle customization is becoming more popular. Many drivers want to enhance their cars with high-performance upgrades, aesthetic modifications, or comfort features. This trend is especially strong among younger consumers who see their vehicles as an extension of their personality.

Furthermore, the electric vehicle (EV) aftermarket is gaining traction. As EV adoption rises, demand for specialized components such as battery management systems, charging accessories, and software updates is increasing. Aftermarket suppliers are adapting to cater to this growing segment.

Restraining Factors

Counterfeit Parts and Regulatory Challenges Restrain Market Growth

The presence of counterfeit automotive parts is a major challenge for the aftermarket industry. Fake components not only affect brand credibility but also compromise vehicle safety. Many consumers unknowingly purchase low-quality products, leading to frequent replacements and potential mechanical failures.

In addition, strict government regulations on vehicle modifications and emissions control impact the market. Authorities impose restrictions on aftermarket parts that alter a vehicle’s original performance, limiting customization opportunities.

Another barrier is the industry’s reliance on skilled labor. Many aftermarket parts require professional installation, which can be costly and time-consuming. A shortage of trained technicians further complicates the situation, causing delays in service.

Additionally, supply chain disruptions are affecting product availability. Events like global shipping delays and raw material shortages make it harder for manufacturers to meet demand. As a result, consumers experience longer wait times and higher prices for aftermarket components.

Growth Opportunities

AI, Subscription Models, and Green Parts Provide Opportunities

The automotive aftermarket is seeing new growth opportunities through technology and innovation. Artificial intelligence (AI) is playing a significant role in predictive maintenance. AI-powered diagnostics help vehicle owners detect issues early, reducing repair costs and improving efficiency. Companies integrating AI-driven solutions can offer smart maintenance services, increasing customer engagement.

Another promising area is subscription-based vehicle maintenance. Many consumers prefer predictable monthly costs for repairs and replacements instead of unexpected expenses. Subscription models allow businesses to establish long-term customer relationships while providing convenient service options.

Additionally, the demand for sustainable aftermarket parts is rising. Eco-friendly components, such as recycled car parts and biodegradable materials, are gaining traction among environmentally conscious buyers. Automakers and suppliers investing in green solutions are tapping into a growing market segment.

Furthermore, 3D printing is transforming the industry by enabling on-demand manufacturing. This technology reduces production costs and speeds up the availability of rare or custom parts. Companies that adopt 3D printing can quickly meet consumer needs, enhancing competitiveness.

Emerging Trends

Direct-to-Consumer Sales and Mobile Services Are Latest Trending Factors

The way consumers buy aftermarket products is changing, with direct-to-consumer (DTC) sales gaining popularity. More companies are selling parts directly to customers through online platforms, cutting out intermediaries and reducing costs. This approach provides better pricing and personalized customer experiences.

Another emerging trend is blockchain technology for supply chain transparency. Blockchain allows manufacturers and buyers to verify the authenticity of parts, reducing counterfeit risks. As trust in aftermarket products grows, more consumers are likely to invest in high-quality replacements.

In addition, mobile-based vehicle diagnostics are transforming how repairs are handled. Smartphone apps and connected devices now enable real-time vehicle monitoring, helping users identify problems early. This convenience encourages vehicle owners to stay proactive about maintenance.

Moreover, demand for high-performance and aesthetic vehicle lighting is rising. Many consumers upgrade their headlights, taillights, and interior lighting for improved visibility and style. LED and smart lighting solutions are particularly popular among car enthusiasts.

Regional Analysis

Asia Pacific Dominates with 32.4% Market Share

Asia Pacific leads the Automotive Aftermarket with a 32.4% share, valued at USD 156.46 billion. This dominance is fueled by rapid urbanization, increasing vehicle ownership, and strong local manufacturing bases.

The region’s significant growth is bolstered by expanding middle-class populations and rising disposable incomes, which increase demand for automotive repairs and enhancements. Additionally, Asia Pacific benefits from the presence of major automotive players and extensive production facilities, which ensure a steady supply of aftermarket parts.

Looking ahead, Asia Pacific’s influence on the global Automotive Aftermarket is expected to increase, driven by advancements in automotive technologies and growing consumer awareness of vehicle maintenance. The trend towards electric vehicles and digital services will likely expand the aftermarket scope in the region, potentially boosting its market share.

Regional Mentions:

- North America: North America holds a substantial portion of the Automotive Aftermarket, supported by high vehicle ownership and a culture of vehicle maintenance and customization. The region’s well-established supply chain and distribution networks facilitate efficient aftermarket operations.

- Europe: Europe is a key player in the Automotive Aftermarket, driven by stringent vehicle safety and emissions regulations. The region’s focus on environmental sustainability and high-quality manufacturing standards underpin its aftermarket activities.

- Middle East & Africa: The Middle East and Africa are experiencing growth in the Automotive Aftermarket due to increasing vehicle sales and an expanding road infrastructure. Investments in transportation and economic diversification are key growth drivers for the region’s aftermarket sector.

- Latin America: Latin America is seeing an uptick in the Automotive Aftermarket, propelled by economic recovery and increasing motorization rates. The region’s aftermarket is supported by improving logistics networks and a growing focus on vehicle maintenance due to older vehicle fleets.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Automotive Aftermarket is highly competitive, with major companies driving innovation and expanding their market presence. The top four players in this industry are Robert Bosch GmbH, Continental AG, Denso Corporation, and ZF Friedrichshafen AG. These companies dominate the market due to their extensive product portfolios, global distribution networks, and continuous advancements in automotive technology.

Robert Bosch GmbH leads with its wide range of aftermarket solutions, including braking systems, batteries, filters, and spark plugs. Its strong focus on research and development allows it to introduce advanced automotive components that enhance vehicle performance and efficiency.

Continental AG is another key player, excelling in tire technology, electronic components, and vehicle safety systems. The company invests in smart mobility solutions and innovative automotive software, keeping it ahead in the competitive aftermarket space.

Denso Corporation plays a crucial role with its high-quality automotive electronics, air conditioning systems, and fuel injection technologies. Its commitment to sustainability and energy-efficient products makes it a strong player in the growing demand for eco-friendly aftermarket solutions.

ZF Friedrichshafen AG specializes in drivetrain, chassis, and safety systems. It focuses on electrification and automated driving technologies, helping shape the future of the aftermarket industry.

These companies continue to dominate by expanding their product lines, adopting digital solutions, and strengthening their supply chain operations. Their influence in the market is expected to grow as vehicles become more connected and technologically advanced.

Major Companies in the Market

- 3M Company

- Continental AG

- Cooper Tire & Rubber Company

- Delphi Automotive PLC

- Denso Corporation

- Federal-Mogul Corporation

- HELLA KGaA Hueck & Co.

- Robert Bosch GmbH

- Valeo Group

- ZF Friedrichshafen AG

- Others

Recent Developments

- RealTruck Inc.: On January 2025, RealTruck Inc. acquired Vehicle Accessories Group (VAI), marking the largest transaction in the company’s history. This strategic acquisition is expected to strengthen RealTruck’s product portfolio and broaden its market reach.

- MidOcean Partners: On November 2024, MidOcean Partners acquired Arnott Industries, a key player in suspension products for the automotive aftermarket. This acquisition is aligned with MidOcean’s strategy to deepen its investments in the automotive aftermarket sector.

Report Scope

Report Features Description Market Value (2024) USD 482.9 Billion Forecast Revenue (2034) USD 735.7 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Replacement Part (Tire, Battery, Brake Parts, Filters, Body Parts, Lighting & Electronic Components, Wheels, Exhaust Components, Turbochargers, Others), By Distribution Channel (Retailers (OEMs, Repair Shops), Wholesalers & Distributors), By Service Channel (DIY (Do it Yourself), DIFM (Do it for Me), OE (Delegating to OEMs)), By Certification (Genuine Parts, Certified Parts, Uncertified Parts) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M Company, Continental AG, Cooper Tire & Rubber Company, Delphi Automotive PLC, Denso Corporation, Federal-Mogul Corporation, HELLA KGaA Hueck & Co., Robert Bosch GmbH, Valeo Group, ZF Friedrichshafen AG, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Company

- Continental AG

- Cooper Tire & Rubber Company

- Delphi Automotive PLC

- Denso Corporation

- Federal-Mogul Corporation

- HELLA KGaA Hueck & Co.

- Robert Bosch GmbH

- Valeo Group

- ZF Friedrichshafen AG

- Others