Global Lane Keep Assist System Market Size, Share, Growth Analysis By Function Type (Lane Departure Warning System, Lane Keeping System, Other Function Types), By Sensor Type (Video Sensors, Laser Sensors, Infrared Sensors, Other Sensor Types), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Other Vehicle Types), By Sales Channel (OEM, Aftermarket, Other Sales Channel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 56686

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

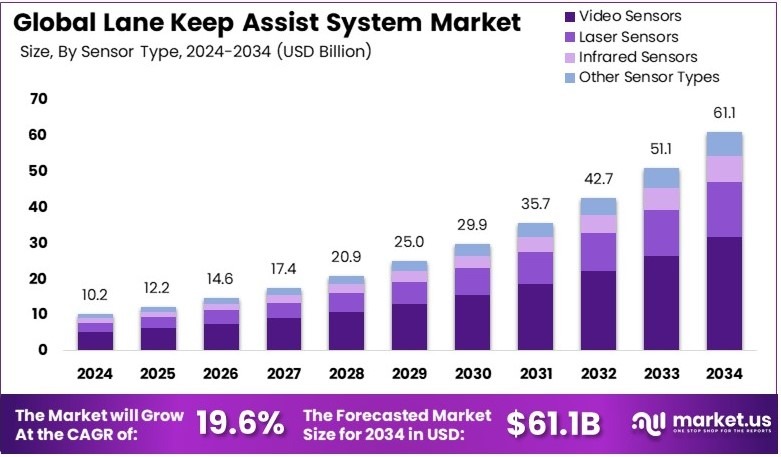

The Global Lane Keep Assist System Market size is expected to be worth around USD 61.1 Billion by 2034, from USD 10.2 Billion in 2024, growing at a CAGR of 19.6% during the forecast period from 2025 to 2034.

A Lane Keep Assist System is a safety feature in modern vehicles. It detects road lane markings and helps the driver stay within the lane. If the vehicle drifts, it gently steers it back. The system uses cameras and sensors to support safer driving and reduce accidents.

The Lane Keep Assist System Market includes all systems and technologies that help vehicles maintain lane position. It covers hardware, software, and vehicle integration. This market is growing due to rising road safety concerns and increased demand for driver assistance systems in both mid-range and luxury vehicles.

Lane Keep Assist Systems (LKAS) are gaining traction as drivers look for safer, easier driving experiences. These systems help vehicles stay within their lanes by gently adjusting steering. As more cars include semi-autonomous features, demand for LKAS continues to grow across both premium and mid-range vehicle segments.

The Lane Keep Assist System market is seeing steady growth due to rising safety standards and increased customer interest. Many car buyers now expect basic driver-assist features, making LKAS a key selling point. The market is moderately competitive, with brands focusing on improving dashboard camera and sensor accuracy to increase adoption.

According to NHTSA, a rule introduced in April 2024 will require most new vehicles to include automatic emergency braking by 2029. These systems must function at speeds up to 62 mph. This regulation could prevent 24,000 injuries and save 360 lives yearly. Similarly, the European Union now mandates such systems in all new vehicles from May 2024 onward.

As a result, governments are encouraging automakers to add more safety features, including LKAS. These systems work well with emergency braking and adaptive cruise control. On a local level, they help reduce lane-drift accidents, especially in urban traffic and on highways.

Furthermore, market saturation remains low in emerging economies. These regions are witnessing rising vehicle ownership and stronger interest in smart safety features. With this in mind, companies have an opportunity to expand by offering affordable LKAS in mid-range cars.

Meanwhile, competition in the market is growing. Leading firms are investing in advanced sensors, AI-based steering support, and lane recognition. These technologies help systems perform better in poor weather or faded lane markings. This makes LKAS more reliable and attractive to wider customer groups.

Key Takeaways

- The Lane Keep Assist System Market was valued at USD 10.2 billion in 2024 and is expected to reach USD 61.1 billion by 2034, with a CAGR of 19.6%.

- In 2024, Lane-Keeping System led the function type segment with 55%, ensuring enhanced road safety.

- In 2024, Video Sensors dominated the sensor type segment with 52%, attributed to their high reliability.

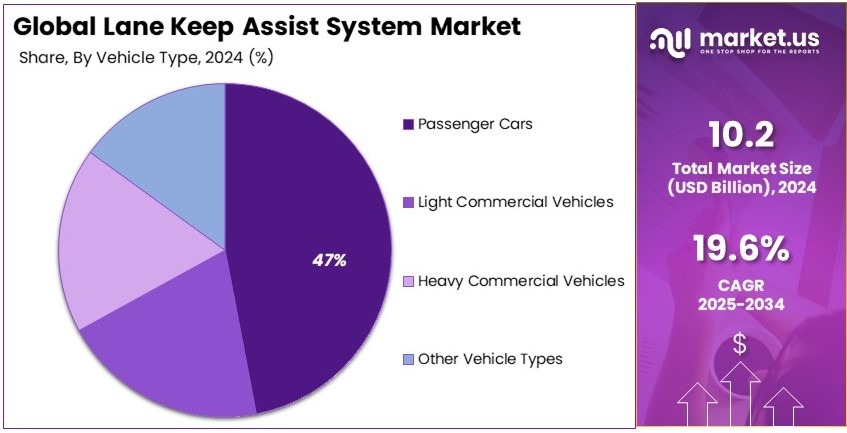

- In 2024, Passenger Cars led the vehicle type segment with 47%, driven by regulatory mandates for safety.

- In 2024, Aftermarket held 60% of the sales channel segment, supported by retrofitting demands.

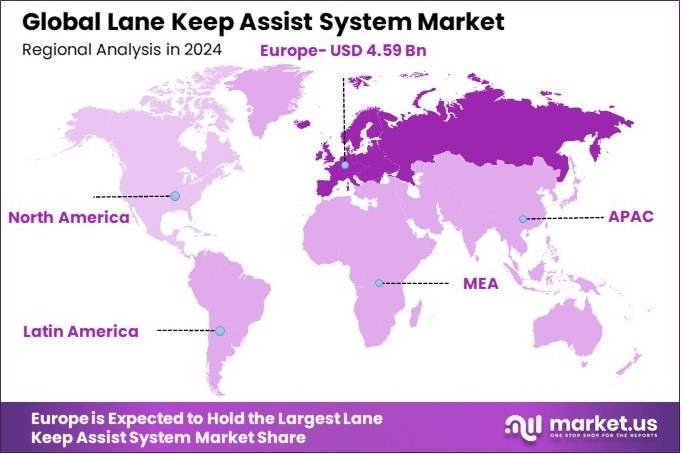

- In 2024, Europe accounted for 45% market share, valued at USD 4.59 billion, due to stringent safety regulations.

Function Type Analysis

Lane Keeping System dominates with 55% due to its effectiveness in preventing unintended lane departures.

The Lane Keeping System (LKS) leads the Function Type segment in the Lane Keep Assist System market, commanding a majority with a 55% market share. This dominance is attributed to the system’s crucial role in enhancing road safety by actively keeping the vehicle within its lane, which significantly reduces the risk of accidents caused by unintentional lane departures. The LKS is increasingly becoming a standard feature in new vehicles, reflecting its importance in modern automotive safety technologies.

Other function types include the Lane Departure Warning System, which alerts drivers when they begin to move out of their lane without signaling, playing a critical role in accident prevention. Meanwhile, other emerging technologies continue to develop, focusing on integrating multiple functions to enhance overall vehicle autonomy and safety.

Sensor Type Analysis

Video Sensors lead with 52% owing to their precision in real-time image processing.

Video sensors are the most prominent sub-segment within the Sensor Type category, holding a 52% share. Their effectiveness lies in providing high-resolution, real-time visual data that is crucial for accurate lane detection and vehicle positioning. This technology has become indispensable in the Lane Keep Assist System market because of its ability to adapt to various lighting and weather conditions, ensuring reliable operation.

Laser Sensors and Infrared Sensors are other important sub-segments. Laser sensors offer precise distance measurements and high-resolution maps of vehicle surroundings, whereas infrared sensors enhance vehicle sensing capabilities during nighttime or in low-visibility conditions, thereby supporting the primary functions of lane keep systems.

Vehicle Type Analysis

Passenger Cars dominate with 47% due to high demand for safety features in personal vehicles.

In the Vehicle Type segment, Passenger Cars take the lead with a 47% share, driven by consumer demand for advanced safety features in personal vehicles. As safety standards become stricter and consumers become more safety-conscious, automakers are increasingly equipping new models with advanced assistive technologies like lane keeping systems.

Light Commercial Vehicles and Heavy Commercial Vehicles also benefit from these technologies, which improve safety and reduce the likelihood of costly accidents in commercial operations. However, their adoption rates are currently lower compared to passenger cars, reflecting a slower integration of advanced safety systems in commercial fleets.

Sales Channel Analysis

Aftermarket dominates with 60% due to vehicle owners upgrading older models.

The Aftermarket sales channel leads with a 60% market share in the Lane Keep Assist System market. This high percentage reflects a significant trend of vehicle owners upgrading older models with modern assistive technologies, which are not originally installed during manufacture. The aftermarket provides a cost-effective solution for consumers looking to enhance safety features without investing in new vehicles.

Other sales channels include OEMs, where systems are integrated during the manufacturing process. Although this segment is smaller, it is expected to grow as more automakers begin to standardize lane keep assist systems in new vehicles. OEM integration ensures optimal system performance and vehicle compatibility, providing a seamless user experience.

Key Market Segments

By Function Type

- Lane Departure Warning System

- Lane Keeping System

- Other Function Types

By Sensor Type

- Video Sensors

- Laser Sensors

- Infrared Sensors

- Other Sensor Types

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Other Vehicle Types

By Sales Channel

- OEM

- Aftermarket

- Other Sales Channel

Driving Factors

Safety Focus and Tech Adoption Drive Market Growth

The Lane Keep Assist System (LKAS) market is growing due to a stronger focus on road safety. Governments and safety organizations are encouraging the use of technologies that reduce accidents. LKAS helps prevent unintentional lane departures, which are a major cause of road crashes. This has led to its inclusion in many new vehicle models, especially where safety ratings influence buyer choices.

Consumer demand is also increasing for driver assistance technologies, not just in luxury cars but also in mid-range vehicles. Features like LKAS are now seen as essential, rather than optional, by many buyers. At the same time, improvements in sensor technology are making LKAS more effective. New cameras and ultrasound sensors provide better detection of lane markings and surroundings.

Additionally, the rise of autonomous driving technologies has pushed demand for lane-centering features. LKAS acts as a building block for full self-driving systems by controlling steering in certain conditions. As an example, brands like Toyota and Honda offer LKAS in several mid-segment models. Together, these trends are fueling the steady growth of the LKAS market by addressing both safety concerns and rising interest in smarter mobility.

Restraining Factors

Integration Complexity and User Skepticism Restraints Market Growth

Several factors are holding back the full potential of the Lane Keep Assist System market. First, integrating LKAS with other vehicle systems is complex and expensive. These systems require coordination between sensors, control units, and steering mechanisms. This raises both the initial cost and the expense of maintenance or repair, especially in regions with cost-sensitive buyers.

Another challenge is system reliability. LKAS can sometimes generate false alerts or fail under specific weather or road conditions, like faded lane markings or heavy rain. This affects driver confidence and leads to limited trust in the system. In addition, there is a lack of standardization in how LKAS is implemented across different markets. Varying road regulations and infrastructure quality create technical and compliance hurdles.

Many drivers also feel these assistive technologies are too intrusive. The system may intervene even when drivers believe they are in control, leading to discomfort or disabling of the feature. This resistance can limit usage, particularly among those unfamiliar with modern ADAS tools. Combined, these issues slow market growth, especially in areas where infrastructure and consumer awareness are still developing.

Growth Opportunities

Smart Mobility and Global Support Provides Opportunities

The Lane Keep Assist System market is set to benefit from several emerging opportunities. One of the most important is the use of machine learning to improve real-time decision-making. Advanced algorithms can help LKAS better understand road conditions and adapt more quickly, reducing errors and improving overall performance. This makes the system more dependable and user-friendly.

In addition, government support for Advanced Driver Assistance Systems (ADAS) is growing. Many countries now offer incentives or regulations encouraging the adoption of vehicle safety technologies. These initiatives are expected to expand the LKAS market, especially where automotive safety ratings influence consumer choices.

The rise of autonomous Mobility-as-a-Service (MaaS) models, such as ride-hailing fleets and driverless shuttles, is also creating new demand. These vehicles require reliable lane-keeping systems for safety and operational efficiency. Furthermore, LKAS is gaining ground in developing nations. As road infrastructure improves and vehicle ownership increases, the demand for safety features is expected to grow.

These trends present strong business opportunities for manufacturers and technology providers. Companies that invest in smarter, more accessible LKAS solutions will be well-positioned in the evolving global automotive landscape.

Emerging Trends

AI Enhancement and Electrification Are Latest Trending Factor

Several new trends are shaping the Lane Keep Assist System market. A major development is the use of advanced artificial intelligence (AI) to boost system accuracy and responsiveness. AI allows LKAS to interpret complex road scenarios more effectively. This leads to smoother steering assistance and fewer false warnings, making the driving experience more natural.

Another growing trend is the move toward electric and hybrid vehicles. These modern vehicle platforms often come equipped with the latest ADAS features, including LKAS. As the demand for electric vehicles increases, the adoption of LKAS is expected to follow.

Also, semi-autonomous features are being expanded in commercial fleets. Delivery trucks and shared vehicles now include LKAS to support driver safety and reduce fatigue. This trend is particularly strong in logistics and urban transport sectors, where efficiency and safety are top priorities.

Lastly, consumers are becoming more aware of vehicle safety systems. Education campaigns and product demonstrations are helping drivers understand the value of LKAS. This shift in mindset supports greater acceptance and use. As these trends continue, they will play a key role in shaping the future demand and development of lane-keeping technologies.

Regional Analysis

Europe Dominates with 45% Market Share

Europe leads the Lane Keep Assist System Market with a 45% share, totaling USD 4.59 billion. This dominance is driven by stringent vehicle safety regulations, high consumer demand for safety features, and the presence of leading automotive manufacturers.

The region’s emphasis on road safety and environmental concerns encourages the integration of advanced driver-assistance systems (ADAS) like lane keep assist. Additionally, European consumers show a high willingness to adopt new technologies, further boosting market growth.

Looking ahead, Europe’s influence in the global Lane Keep Assist System Market is expected to remain strong. The ongoing push for safer and more autonomous vehicles, coupled with supportive government policies and innovations by European automakers, will likely sustain the region’s market leadership.

Regional Mentions:

- North America: North America holds a significant share in the Lane Keep Assist System Market, supported by advanced automotive technology and a high adoption rate of safety features. The region’s focus on regulatory standards for vehicle safety propels the use of lane keep systems.

- Asia Pacific: Asia Pacific is rapidly growing in the Lane Keep Assist System Market, driven by expanding automotive production and increasing safety regulations in countries like China and Japan. The region’s technological advancements and large automotive market play a crucial role in its growth.

- Middle East & Africa: The Middle East and Africa are witnessing gradual growth in the Lane Keep Assist System Market. Investments in vehicle modernization and increased awareness of road safety are contributing to the region’s adoption of advanced safety technologies.

- Latin America: Latin America is embracing advanced automotive technologies, with an increasing focus on vehicle safety and emission regulations. The region is progressively adopting systems like lane keep assist to enhance road safety and comply with new automotive standards.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Lane Keep Assist System Market is led by key players that focus on safety technology, intelligent driving systems, and integration with vehicle platforms. The top four companies in this segment are Continental AG, Delphi Automotive PLC, Denso Corporation, and Robert Bosch GmbH.

These companies invest heavily in R&D to enhance sensor precision, software algorithms, and system response times. As vehicles become more intelligent, lane keep assist features are now closely linked with other driver-assist systems like automatic emergency braking and adaptive cruise control. These companies are working toward creating seamless driving experiences by combining multiple functions into one advanced safety system.

Robert Bosch GmbH and Denso Corporation have a global footprint and strong relationships with major automobile manufacturers. This allows them to deliver scalable solutions across various vehicle categories, from economy to luxury models. Continental AG and Delphi Automotive PLC bring deep expertise in automotive electronics and advanced driver-assistance systems (ADAS), supporting the mass adoption of lane-keeping systems.

Their competitive edge lies in innovation, strong customer relationships, and a focus on real-world driving conditions. These leaders are actively involved in global safety initiatives and government regulations that support the use of ADAS technologies.

The market outlook remains positive as these companies aim to enhance vehicle safety, reduce accidents, and support semi-autonomous driving. With rising demand in Europe, North America, and Asia Pacific, these key players are expected to maintain their dominance by staying ahead in technology, reliability, and global reach.

Major Companies in the Market

- Bendix

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- Hitachi Ltd

- Hyundai Mobis

- Magna

- Mobileye

- Panasonic Corp.

- Robert Bosch GmbH

- SDS

- Valeo

- Visteon

- WABCO Holdings Inc.

- ZF Friedrichshafen AG

- Other Key Players

Recent Developments

- China Automotive Systems and Jingzhou Henglong: On January 2025, China Automotive Systems announced that its subsidiary, Jingzhou Henglong Auto Parts Manufacturing, surpassed an annual production and sales volume of 5 million units in 2024, marking an 18.5% year-over-year growth. Additionally, the company commenced mass production of its R-EPS steering product, designed to support autonomous driving functions such as Lane Keep Assist (LKA) and Lane Follow Assist (LFA).

- Stellantis and Software-Driven Products: On June 2024, Stellantis unveiled multiple software-driven products aimed at enhancing the mobility experience for its customers. The company reported a 2.5-fold increase in global software revenues over three years, with a monetizable connected car parc expanding to 13.8 million vehicles. These advancements include features that support LKA functionalities, reflecting Stellantis’ commitment to integrating advanced driver assistance systems (ADAS) into its vehicle lineup.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Billion Forecast Revenue (2034) USD 61.1 Billion CAGR (2025-2034) 19.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Function Type (Lane Departure Warning System, Lane Keeping System, Other Function Types), By Sensor Type (Video Sensors, Laser Sensors, Infrared Sensors, Other Sensor Types), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Other Vehicle Types), By Sales Channel (OEM, Aftermarket, Other Sales Channel) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bendix, Continental AG, Delphi Automotive PLC, Denso Corporation, Hitachi Ltd, Hyundai Mobis, Magna, Mobileye, Panasonic Corp., Robert Bosch GmbH, SDS, Valeo, Visteon, WABCO Holdings Inc., ZF Friedrichshafen AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lane Keep Assist System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Lane Keep Assist System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch

- Denso Corporation

- ZF Friedrichshafen

- Delphi Automotive

- Continental

- Valeo