Global Light Duty Truck Market Size, Share, Growth Analysis By Vehicle Type (Pickup Trucks, Vans), By Fuel Type (Internal Combustion Engine (ICE), Electric Vehicles (EVs), Hybrid), By Application (Freight and Logistics, Construction, Retail and E-commerce, Other Commercial Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138558

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

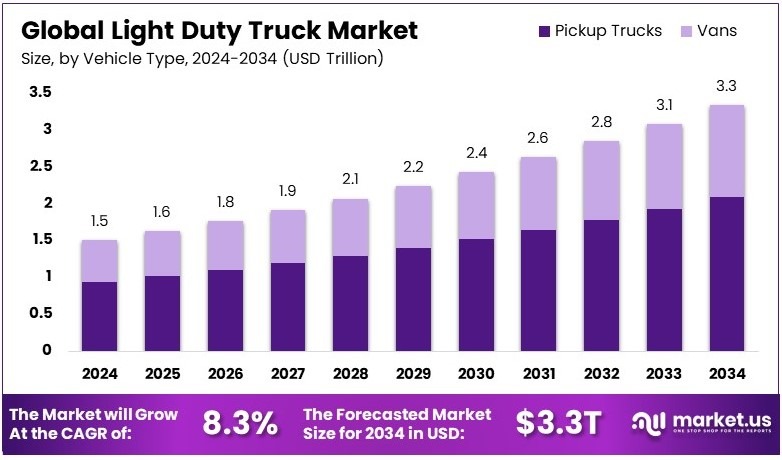

The Global Light Duty Truck Market size is expected to be worth USD 3.3 Trillion by 2034, increasing from USD 1.5 Trillion in 2024, with a CAGR of 8.3% during the forecast period from 2025 to 2034.

A light duty truck is a vehicle classified based on its payload capacity and design. Typically used for personal or commercial purposes, these trucks can handle cargo and towing but are smaller than heavier duty models, making them suitable for everyday use.

The light duty truck market includes the sales and distribution of light duty trucks to consumers and businesses. It caters to a variety of needs, from personal transportation to business logistics, and plays a crucial role in the automotive industry.

In the United States, light-duty trucks, which include pickups, vans, and SUVs, are integral to the backbone of the economy, serving critical roles in construction, agriculture, retail, and logistics. According to the U.S. Department of Transportation’s Bureau of Transportation Statistics, these vehicles are essential for the day-to-day operations of various industries. Despite the longstanding 25% tariff on imported light trucks imposed since 1964, these vehicles remain a staple in domestic business activities, underscoring their importance across numerous sectors.

The 25% tariff on imported light-duty trucks has been a double-edged sword for the U.S. automotive industry. This tariff, as analyzed by Robert Z. Lawrence, a professor at Harvard University, has insulated the industry from global competition for over four decades, which has both preserved market share and hindered innovation by reducing the incentive to compete with international manufacturers.

These trucks are vital for economic activities, facilitating not only transportation and logistics but also supporting jobs in sectors dependent on reliable and versatile vehicles. Their widespread use in sectors critical to the U.S. economy highlights their significant impact on both national and local scales, reinforcing their value in America’s economic framework.

Key Takeaways

- Light Duty Truck Market was valued at USD 1.5 Trillion in 2024, and is expected to reach USD 3.3 Trillion by 2034, with a CAGR of 8.3%.

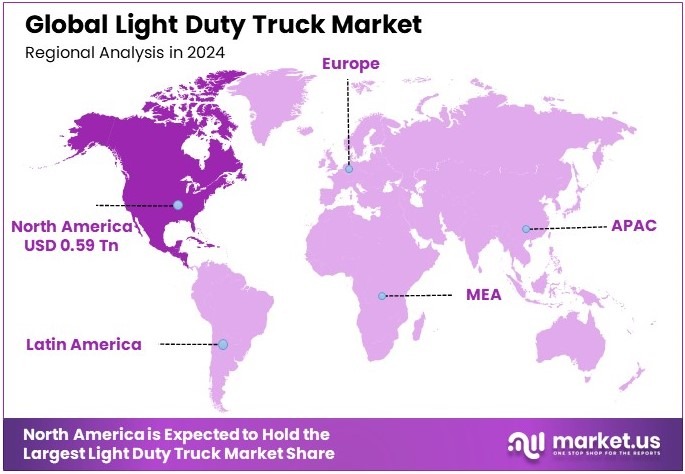

- In 2024, North America holds the dominant region with 39.5% and USD 0.59 Trillion, driving market growth.

- In 2024, Pickup Trucks dominate the vehicle type segment with 62.7% due to their versatility in commercial applications.

- In 2024, Electric Vehicles (EVs) lead the fuel type with 38.5% owing to increasing environmental regulations.

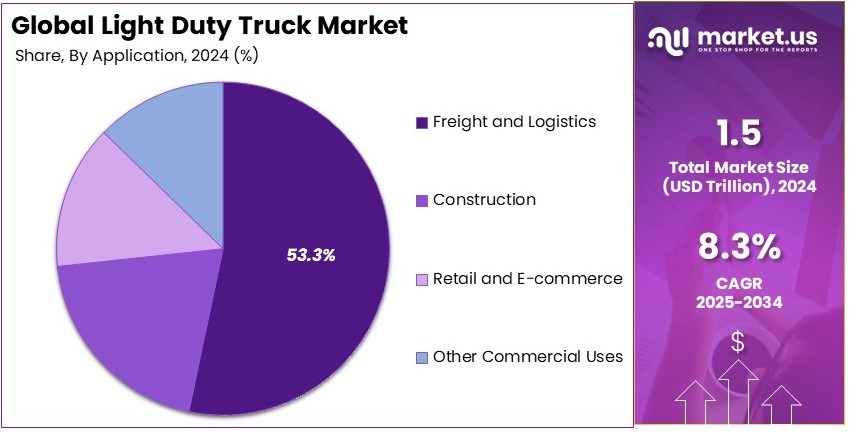

- In 2024, Freight and Logistics dominate the application segment with 53.3% because of the growth in e-commerce.

- In 2024, Hybrid fuel type accounts for 21.5%, offering a balance between performance and efficiency.

Vehicle Type Analysis

Pickup trucks dominate with 62.7% due to their versatility and robustness.

The Light Duty Truck Market has seen significant growth in the pickup truck segment, which currently dominates with a market share of 62.7%. Pickup trucks are favored for their robustness and versatility, making them suitable for a wide range of activities from personal use to commercial applications like freight and logistics.

In urban and suburban settings, pickup trucks are also a common sight due to their adaptability for personal use and small-scale commercial activities. The ability to equip these trucks with various modifications makes them highly appealing for specific industries, including construction and small businesses that need a reliable vehicle capable of carrying heavy loads.

Moreover, the comfort and advanced features typically offered in modern pickup trucks appeal to a broad consumer base, blending functionality with the convenience of everyday use.

Vans, while holding a smaller market share, are crucial for specific sectors, particularly in urban logistics and services. These vehicles are primarily used by companies for deliveries and by service providers who require a mobile workspace.

Vans are tailored for city environments, offering efficient storage solutions and easier maneuverability compared to larger trucks. Their role in the e-commerce boom cannot be overlooked, as they are integral to last-mile delivery services, which are essential for the rapid delivery expectations of modern consumers.

Fuel Type Analysis

Electric Vehicles (EVs) dominate with 38.5% due to environmental concerns and innovation in technology.

The shift toward sustainability has significantly impacted the Light Duty Truck Market, with Electric Vehicles (EVs) leading the segment at 38.5%. This dominance is driven by increasing environmental awareness and the push for emission reduction in the automotive industry. EVs in the light-duty truck category offer lower operating costs and reduced environmental impact, making them attractive to companies aiming to green their fleet and improve public perception.

Advancements in battery technology and more extensive charging infrastructure have also made EVs more practical for everyday use and commercial applications. Government incentives and tighter emission regulations worldwide have accelerated the adoption of electric trucks, particularly in urban areas where pollution reduction is a priority. This shift is not just about compliance; it’s also about companies recognizing the long-term savings and reliability of EVs over traditional internal combustion engines.

Internal Combustion Engine (ICE) vehicles and hybrids still play significant roles in the market. ICE trucks are prevalent due to their established technology and wide availability. They are favored in regions and sectors where electric infrastructure is lacking or where initial costs of EVs are still prohibitive.

Hybrid trucks serve as a transitional technology, offering improvements in fuel efficiency and reduced emissions over traditional ICE vehicles without the need for full electrification. Hybrids are particularly appealing to businesses looking to reduce their carbon footprint while maintaining the flexibility of fuel use.

Application Analysis

Freight and Logistics dominate with 53.3% due to the e-commerce surge and globalization.

The application of light duty trucks in freight and logistics currently dominates the market with a share of 53.3%, propelled by the exponential growth of e-commerce and the increasing need for transportation solutions that can navigate both urban and rural settings effectively.

Light duty trucks are integral to the supply chain, facilitating the efficient movement of goods across varying distances. The rise in online shopping has necessitated reliable and flexible delivery systems, where light duty trucks excel due to their capacity to handle diverse loads and operate in different environments.

Light duty trucks are also widely used in the construction industry, supporting operations by transporting materials and equipment to and from sites. Their adaptability makes them ideal for small to medium-sized projects where larger vehicles might be impractical.

In the retail sector, especially e-commerce, light duty trucks are crucial for the last-mile delivery, directly affecting consumer satisfaction by ensuring timely deliveries. Other commercial uses include serving utilities and municipal services, where these trucks are configured for specific tasks such as maintenance, landscaping, and waste collection.

Key Market Segments

By Vehicle Type

- Pickup Trucks

- Vans

By Fuel Type

- Internal Combustion Engine (ICE)

- Electric Vehicles (EVs)

- Hybrid

By Application

- Freight and Logistics

- Construction

- Retail and E-commerce

- Other Commercial Uses

Driving Factors

Growing Demand for Efficient and Sustainable Transportation

The Light Duty Truck Market is growing significantly due to several interconnected factors. One primary driver is the increasing demand for efficient logistics and transportation solutions. Businesses rely on light duty trucks to transport goods promptly, ensuring customer satisfaction and streamlined operations. These vehicles are particularly crucial for industries where timely delivery impacts revenue and brand loyalty.

Another major contributor is the rise of e-commerce and last-mile delivery services. With online shopping becoming a dominant trend, companies need versatile and reliable trucks to handle the growing volume of orders. Light duty trucks are ideal for navigating urban areas, ensuring quick deliveries to end consumers.

Favorable government policies also play a pivotal role in market expansion. Governments worldwide are introducing incentives and subsidies for low-emission vehicles, encouraging businesses to adopt greener transportation options. These measures help reduce the environmental impact of logistics operations while making such vehicles more accessible.

Small businesses and startups further fuel this demand. As new enterprises emerge, their need for cost-effective transportation solutions grows. Light duty trucks, known for their versatility and lower operational costs, are becoming the go-to choice for these businesses. Together, these factors create a strong demand for light duty trucks, driving the market forward.

Restraining Factors

Challenges Hindering Market Expansion

Despite its growth potential, the Light Duty Truck Market faces several challenges that hinder its expansion. Fluctuating fuel prices pose a significant issue for businesses. When fuel costs rise, operating expenses increase, placing financial strain on companies managing large fleets. This unpredictability in fuel prices can disrupt budget planning and profitability.

High initial investment and ownership costs are another barrier to market entry, particularly for small and medium-sized businesses. Purchasing a fleet of light duty trucks requires significant upfront capital, deterring many companies from expanding or upgrading their operations. Even leasing options can sometimes be financially burdensome.

Stringent emissions standards and regulatory compliance also add complexity to the market. Governments are enforcing stricter environmental laws, pushing companies to invest in cleaner technologies. While these measures support sustainability, they also increase costs for manufacturers and fleet operators, who must adopt advanced systems to meet compliance requirements.

Limited range and insufficient charging infrastructure for electric trucks present additional challenges. Electric vehicles are crucial for reducing emissions, but without adequate charging networks, their adoption remains slow. This lack of infrastructure limits the practicality of electric light duty trucks, particularly for long-distance transportation.

Growth Opportunities

Strategic Opportunities for Market Growth

The Light Duty Truck Market is ripe with opportunities for innovation and strategic growth. One key area is the development of multi-utility vehicles tailored for varied applications. Trucks that can serve multiple purposes, from cargo transport to specialized services, offer businesses greater flexibility and value, appealing to a diverse customer base.

Strategic partnerships with technology providers are another promising avenue. By integrating advanced connectivity features like GPS tracking, telematics, and fleet management software, companies can offer enhanced services to their customers. These technologies improve operational efficiency and provide businesses with actionable insights into fleet performance.

Diversification into rental and leasing services is a smart strategy for market players. Offering flexible rental plans allows businesses to use light duty trucks without committing to large upfront costs. This model is particularly appealing to small enterprises and seasonal operators who need short-term transportation solutions.

Innovative financing and leasing options further enhance market opportunities. Customized financial packages make it easier for small businesses to acquire trucks. For example, low-interest loans, deferred payment plans, or subscription-based leasing can attract more buyers and ensure steady market growth.

Emerging Trends

Emerging Trends Shaping the Market

Several emerging trends are shaping the future of the Light Duty Truck Market. The growing consumer demand for trucks with advanced safety features is a notable trend. Features such as collision avoidance systems, adaptive cruise control, and lane-keeping assist are becoming essential, ensuring safer operations for drivers and businesses.

Platform-based business models in vehicle sales are gaining traction. Online platforms are transforming how companies buy and sell light duty trucks, making the process faster and more transparent. Businesses can compare prices, specifications, and financing options with ease, streamlining the purchasing experience.

Enhancing user experience through digital interfaces and mobile apps is another trend influencing the market. These tools allow fleet operators to manage vehicles efficiently, track deliveries in real-time, and monitor performance metrics. By simplifying fleet management, these digital solutions save time and reduce operational complexities.

Lastly, the focus on sustainability is driving innovation in green logistics solutions. Companies are adopting electric or hybrid light duty trucks, optimizing delivery routes, and using renewable energy to charge fleets. These sustainable practices not only reduce emissions but also align businesses with global environmental goals, ensuring their relevance in an increasingly eco-conscious market.

Regional Analysis

North America Dominates with 39.5% Market Share

North America leads the Light Duty Truck Market with a 39.5% market share, amounting to USD 0.59 trillion. The region’s dominance is driven by strong consumer demand, robust infrastructure, and a deep-rooted automotive culture. Light-duty trucks, including pickups, are popular for personal and commercial use due to their versatility and reliability.

The market thrives on North America’s preference for larger vehicles, which aligns with consumer lifestyles and business needs. For instance, pickup trucks are widely used by contractors, small business owners, and outdoor enthusiasts. Furthermore, automakers like Ford, GM, and RAM continue to innovate with advanced features, such as electric and hybrid options, boosting their appeal. North America also benefits from favorable government policies and incentives for electric and hybrid vehicles, further enhancing market growth.

Regional characteristics such as large suburban areas, long commutes, and a high dependency on personal vehicles drive the demand for light-duty trucks. The infrastructure in the region, including extensive highways and rural areas, supports the use of these trucks for both work and leisure. Additionally, the high purchasing power of consumers in North America contributes to the popularity of premium models with advanced features.

Regional Mentions:

- Europe: Europe holds a smaller share of the Light Duty Truck Market, with demand focused on compact and efficient trucks. Stringent emission regulations and a strong push for electric vehicles are shaping the market.

- Asia Pacific: Asia Pacific is a rapidly growing market for light-duty trucks, fueled by industrial expansion and urbanization. Countries like China and India are key contributors to this growth, leveraging trucks for logistics and construction.

- Middle East & Africa: The Middle East and Africa are witnessing steady growth, driven by construction and infrastructure projects. Light-duty trucks are vital for transporting goods in remote and developing areas.

- Latin America: Latin America is emerging as a potential market for light-duty trucks, supported by the agriculture and mining sectors. The region’s focus on modernizing its logistics infrastructure is aiding market growth.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Light Duty Truck Market is dominated by industry leaders like Ford Motor Company, General Motors Company, Toyota Motor Corporation, and Nissan Motor Co., Ltd. These companies maintain leadership through innovation, strong brand recognition, and diverse product portfolios.

Ford and General Motors lead the U.S. market, offering iconic light-duty trucks such as the Ford F-Series and Chevrolet Silverado. These models are renowned for their durability, power, and advanced features, appealing to both personal and commercial buyers. Their commitment to electrification is evident with models like the Ford F-150 Lightning and GMC Hummer EV, which cater to the growing demand for sustainable transportation.

Toyota and Nissan, known for their reliability and fuel efficiency, have strong market positions in Asia and North America. Toyota’s Hilux and Tacoma, along with Nissan’s Frontier, are popular among consumers who value practicality and performance. These companies emphasize innovation and affordability, making them competitive globally.

With rising demand for fuel-efficient and electric trucks, these players are investing heavily in R&D to stay ahead. Their focus on hybrid and electric models, coupled with global distribution networks, ensures continued market leadership in the light-duty truck segment.

Major Companies in the Market

- Ford Motor Company

- General Motors Company

- Toyota Motor Corporation

- Nissan Motor Co., Ltd.

- Stellantis N.V. (RAM Trucks)

- Isuzu Motors Limited

- Mitsubishi Motors Corporation

- Mahindra & Mahindra Ltd.

- Volkswagen AG

- Hyundai Motor Company

- Kia Corporation

- Tata Motors Limited

- Ashok Leyland

- Suzuki Motor Corporation

Recent Developments

- Penske Automotive Group: On January 8, 2024, Penske Automotive Group completed the acquisition of Rybrook Holdings, adding 15 premium dealerships in the United Kingdom. This expansion is expected to generate approximately $1 billion in annualized revenue, strengthening Penske’s position in the light-duty truck and commercial vehicle market.

- Volkswagen’s Traton: On October 28, 2024, Traton, Volkswagen’s truck unit, reported a 3% increase in revenue for the first nine months of 2024, totaling €35.3 billion. Despite a challenging market, the company remained profitable, with its Scania brand achieving a return on sales of 14.4%.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Trillion Forecast Revenue (2034) USD 3.3 Trillion CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Pickup Trucks, Vans), By Fuel Type (Internal Combustion Engine (ICE), Electric Vehicles (EVs), Hybrid), By Application (Freight and Logistics, Construction, Retail and E-commerce, Other Commercial Uses) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ford Motor Company, General Motors Company, Toyota Motor Corporation, Nissan Motor Co., Ltd., Stellantis N.V. (RAM Trucks), Isuzu Motors Limited, Mitsubishi Motors Corporation, Mahindra & Mahindra Ltd., Volkswagen AG, Hyundai Motor Company, Kia Corporation, Tata Motors Limited, Ashok Leyland, Suzuki Motor Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ford Motor Company

- General Motors Company

- Toyota Motor Corporation

- Nissan Motor Co., Ltd.

- Stellantis N.V. (RAM Trucks)

- Isuzu Motors Limited

- Mitsubishi Motors Corporation

- Mahindra & Mahindra Ltd.

- Volkswagen AG

- Hyundai Motor Company

- Kia Corporation

- Tata Motors Limited

- Ashok Leyland

- Suzuki Motor Corporation