Global Megawatt Charging System for EV Market By Charging Power (250 KW to 500 KW, 500 KW to 1 MW, Above 1 MW), By Charging Technology (Conductive Charging, Future Innovations, Inductive Charging), By Vehicle Type (Commercial Vehicles, Passenger Vehicles, Specialty Vehicles), By End-User (Commercial, Industrial, Residential), By Component (Charging Ports, Control Systems, Power Converters), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136454

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

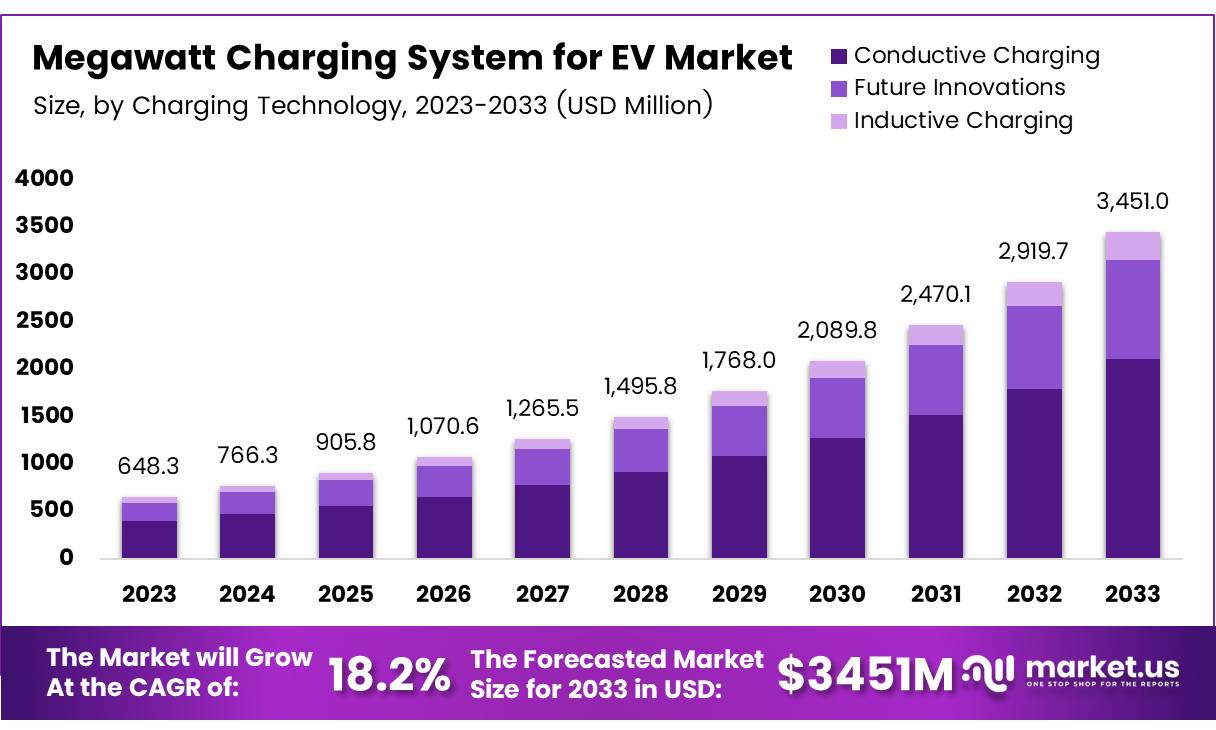

The Global Megawatt Charging System for EV Market size is expected to be worth around USD 3451 Million by 2033, from USD 648.3 Million in 2023, growing at a CAGR of 18.2% during the forecast period from 2024 to 2033.

The Megawatt Charging System (MCS) represents a significant advancement in the infrastructure for electric vehicles (EVs), particularly addressing the needs of heavy-duty transport such as trucks and buses.

Developed to provide high-power charging solutions, MCS can deliver up to 3.75 MW of power, enabling the rapid charging of vehicles with substantial battery capacities. This system is crucial for reducing downtime in commercial transport, enhancing the feasibility of EVs for logistic and public transportation sectors.

The market for Megawatt Charging Systems is poised for significant growth, driven by the global shift towards sustainable transportation solutions. This market encompasses the manufacturing, installation, and maintenance of high-power charging stations capable of MCS standards.

As governments worldwide incentivize the adoption of cleaner transportation technologies through regulations and investments, the infrastructure for electric vehicles, particularly in the commercial segment, is expanding rapidly.

The global push towards electrification of transport, especially in the commercial sector, presents substantial growth opportunities for the Megawatt Charging System market.

As per the International Energy Agency (IEA), the installation of public charging points surged by 55% in 2022, with over 900,000 new installations. This uptrend underscores the escalating demand for EV charging infrastructure, including high-capacity systems like MCS, which can efficiently serve the burgeoning fleet of electric trucks and buses.

Governmental support plays a pivotal role in the expansion of the MCS market. In the UK, for example, the number of public EV charging devices reached 49,220 by October 2023, illustrating a committed strategy to enhance EV infrastructure. Such government-led initiatives, coupled with regulations mandating or incentivizing the use of electric vehicles, are critical drivers for the adoption of high-power charging systems.

The strategic implementation of MCS technology is further supported by public accessibility to charging infrastructure. According to Pew Research, 64% of Americans live within 2 miles of a public EV charging station, a proximity that positively correlates with favorable views towards electric vehicles.

This widespread distribution of charging options, including high-power systems like MCS, is essential for broadening consumer and commercial acceptance of EVs. By reducing range anxiety and charging times—thanks to technologies like those from AmpControl, delivering up to 1 MW power—MCS is set to play a critical role in the transportation sector’s shift to sustainability.

Key Takeaways

- The global Megawatt Charging System for EV market is projected to reach USD 3.45 billion by 2033, growing at a CAGR of 18.2% from 2024 to 2033.

- Conductive Charging dominated the market in 2023, supported by robust infrastructure and reliable high-power solutions, ensuring fast charging for heavy-duty vehicles.

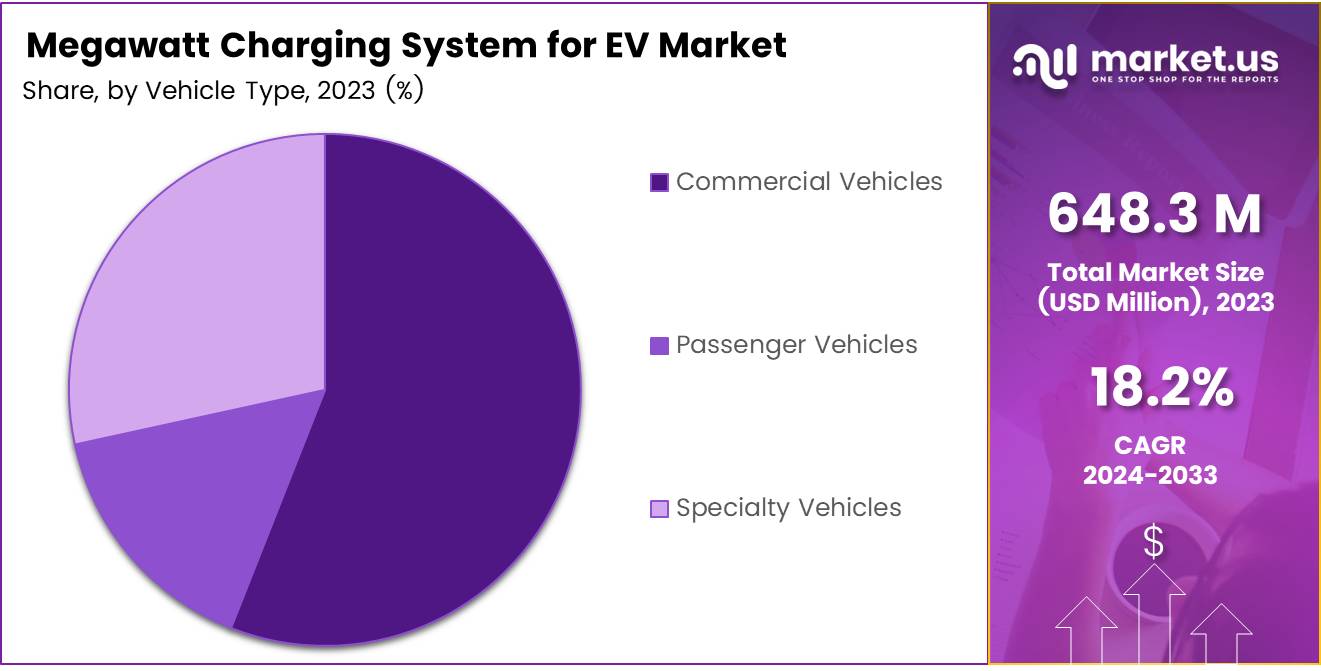

- Commercial vehicles, particularly buses, trucks, and vans, held the largest market share in 2023 due to the need for efficient, high-power charging solutions for fleet operations in urban logistics and public transport.

- The Commercial sector led in 2023, driven by the increasing adoption of electric fleets and the demand for fast, efficient charging in commercial settings.

- Charging Ports had a significant share in the market in 2023, playing a key role in the overall infrastructure of megawatt charging systems.

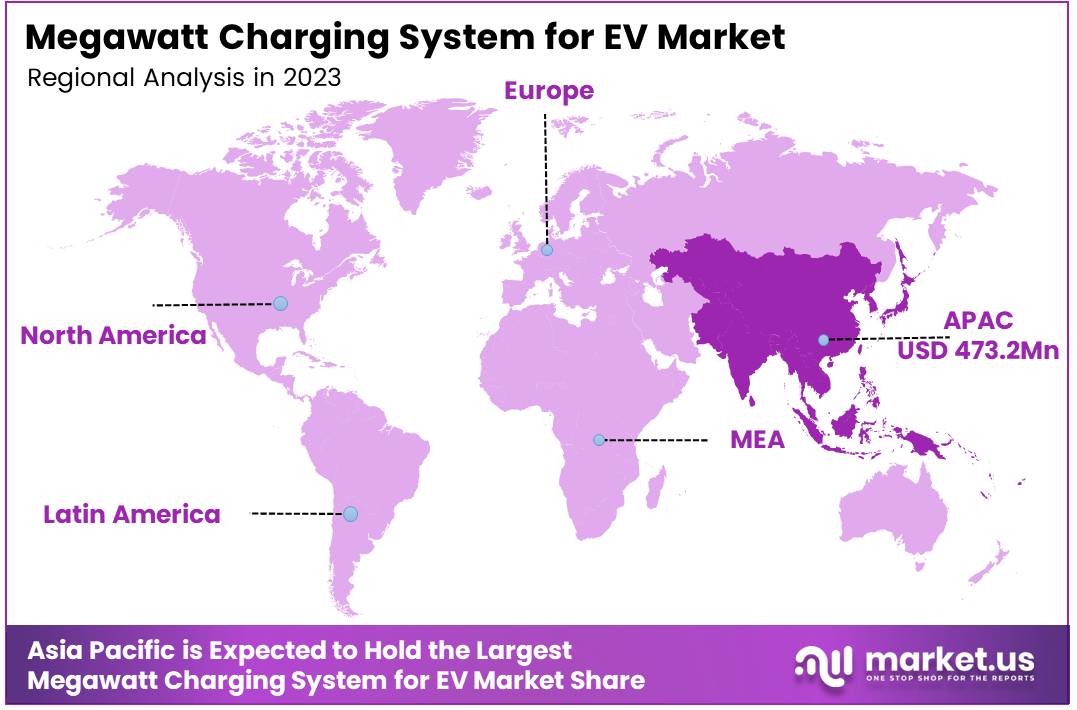

- The Asia Pacific region dominated the market, holding 73.5% of the global market share (USD 473.2 million), driven by the rapid growth of electric vehicle adoption in China, Japan, and South Korea.

Charging Technology Analysis

Conductive Charging Leads in Megawatt Charging System for EV Market

In 2023, Conductive Charging held a dominant market position in the By Charging Technology Analysis segment of the Megawatt Charging System for Electric Vehicles (EV) market.

This segment’s prominence can be attributed to its robust infrastructure development and the proven reliability of conductive charging solutions. The integration of high-power capabilities, ensuring rapid charging for heavy-duty vehicles, further solidifies its standing in the market.

Looking ahead, Future Innovations within this sector are poised to enhance the efficiency and accessibility of megawatt charging systems. Innovations are expected to focus on scaling the technology for broader applications and minimizing the environmental impact of charging infrastructures. This progress is essential for supporting the increasing adoption of electric vehicles globally.

Meanwhile, Inductive Charging is emerging as a viable alternative, offering the convenience of wireless charging. Though currently less prevalent than Conductive Charging, advancements in this technology are anticipated to drive its adoption forward.

The development of more efficient and cost-effective inductive systems could eventually redefine market dynamics, presenting a significant growth opportunity within the EV charging landscape.

Vehicle Type Analysis

Commercial Vehicles Charge Ahead in 2023 Megawatt EV Charging Market

In 2023, Commercial Vehicles held a dominant market position in the By Vehicle Type Analysis segment of the Megawatt Charging System for EV Market.

The prevalence of commercial vehicles in this sector is driven by increasing demand for efficient, high-power charging solutions that can rapidly replenish the batteries of buses, trucks, and vans. These vehicles are integral to commercial fleets, especially in urban logistics and public transport, necessitating quicker turnaround times and higher uptime, which megawatt charging systems can facilitate.

Passenger Vehicles also integrated megawatt charging systems, though their adoption rate was slower compared to commercial vehicles. The growth in this category can be attributed to the rising consumer interest in electric cars that offer fast charging capabilities, aligning with a lifestyle that values speed and convenience.

Specialty Vehicles, including those used in industrial and off-road applications, showed a nascent but growing interest in adopting megawatt charging technologies. This sector’s growth is bolstered by the need for robust, high-energy solutions capable of operating in demanding environments, thus ensuring operational efficiency and sustainability.

Collectively, these segments underscore the diverse applications and escalating importance of megawatt charging systems in the electric vehicle market, highlighting significant growth potential across various vehicle types.

End-User Analysis

In 2023, Commercial Segment Dominated the Megawatt Charging System for EV Market

In 2023, the Commercial segment held a dominant market position in the By End-User Analysis category of the Megawatt Charging System for Electric Vehicles (EVs) market. This can be attributed to the increasing adoption of electric fleets and the growing demand for fast and efficient charging solutions in commercial settings.

The need for high-capacity charging infrastructure in logistics, transportation hubs, and fleet operations has driven significant investments into megawatt-level charging systems.

The Industrial segment also contributed significantly to market growth, supported by the integration of electric vehicles in heavy-duty applications such as construction, mining, and manufacturing. As industries transition towards sustainability and energy-efficient solutions, the demand for high-power charging systems has risen, though it remains behind the commercial sector in terms of adoption rates.

Meanwhile, the Residential segment, while showing steady growth, continues to trail both commercial and industrial sectors. Residential users typically require lower power capacities, which has delayed the widespread adoption of megawatt charging systems in this segment.

Component Analysis

Charging Ports Lead the Megawatt Charging System for EV Market in 2023, Driving Growth and Innovation

In 2023, Charging Ports held a dominant market position in the By Component Analysis segment of the Megawatt Charging System for Electric Vehicles (EV) market, contributing significantly to the overall market share.

This leadership can be attributed to the increasing demand for high-power charging infrastructure to support the rapidly expanding EV fleet worldwide. Charging ports serve as critical components, ensuring seamless and efficient energy transfer between the charging station and the vehicle, making them essential for large-scale adoption of fast-charging technologies.

Control Systems, while vital for managing the operations of the charging stations, accounted for a smaller proportion of the market compared to charging ports. These systems enable safe and efficient interaction between different charging components, ensuring optimal functionality and adherence to regulatory standards.

Power Converters, responsible for converting and regulating the electricity supply to the required specifications, also played a key role in the market. As the industry moves toward higher power levels, the demand for advanced power converters is expected to increase, albeit at a slower rate than charging ports, due to the higher technical complexity and cost of these systems.

Key Market Segments

By Charging Technology

- Conductive Charging

- Future Innovations

- Inductive Charging

By Vehicle Type

- Commercial Vehicles

- Passenger Vehicles

- Specialty Vehicles

By End-User Sector

- Commercial

- Industrial

- Residential

By Component

- Charging Ports

- Control Systems

- Power Converters

By Pricing Model

- Hybrid Plans

- Pay-Per-Use Models

- Subscription-Based Charging

By Charging Station Connectivity

- Networked Systems

- Stand-Alone Systems

Drivers

Values and Reasons Driving the Growth of Megawatt Charging System for EVs

The Megawatt Charging System (MCS) for electric vehicles (EVs) is gaining traction due to several key drivers that are reshaping the transportation sector. The rapid electrification of transportation is a leading factor, driven by the global push for reducing carbon emissions. As the shift towards electric commercial vehicles, such as buses and trucks, accelerates, the need for high-power charging solutions like MCS becomes increasingly critical.

In addition, government initiatives and regulations play a significant role in this growth. Policies supporting EV infrastructure, including financial incentives like grants and subsidies for charging stations, are encouraging investments in MCS and facilitating their widespread adoption.

Another crucial driver is the advancements in battery technology, which have led to faster charging times and longer vehicle ranges, making the use of MCS more viable, particularly for heavy-duty commercial vehicles. These improvements help overcome challenges related to long charging periods, which are a key concern for fleet operators.

Lastly, the growing demand for electric commercial vehicles is also fueling the need for MCS. As industries like logistics and transportation adopt more sustainable practices, the demand for electric trucks and buses continues to rise.

Restraints

High Initial Costs and Technical Challenges for Megawatt Charging Systems

The adoption of Megawatt Charging Systems (MCS) for electric vehicles (EVs) faces several constraints that could slow its widespread deployment. One of the main challenges is the high initial investment required to set up MCS infrastructure.

The cost of installing MCS technology is considerably higher than that of traditional charging systems, making it a significant financial burden for charging station operators and utility providers. This can limit the number of stakeholders able to invest in MCS, particularly smaller players or those in regions with limited funding.

Additionally, MCS systems require specialized equipment and more complex installations, further adding to the cost. Another key barrier is the technical and safety challenges that come with the high power demands of MCS. These systems need to handle much higher voltage and current levels, which increases the risk of issues like overheating and electrical faults.

Managing heat dissipation efficiently is critical to prevent potential damage to the system or pose safety risks to users. Moreover, the complexity of the system’s design can lead to difficulties in maintenance and repairs, which could further discourage adoption.

As a result, while the Megawatt Charging System holds promise for accelerating EV adoption, its higher costs and the technical and safety hurdles associated with its deployment pose significant barriers to widespread implementation in the short term.

Growth Factors

Growth Opportunities for Megawatt Charging System (MCS) in the EV Market

The Megawatt Charging System (MCS) for electric vehicles (EVs) is poised for significant growth due to several key opportunities.

First, the development of ultra-fast charging technology is expected to drastically reduce charging times, making EVs more convenient for users. This technological advancement will likely open up new markets, particularly in regions where fast charging infrastructure is limited or where vehicle uptime is crucial.

Additionally, integrating MCS infrastructure with renewable energy sources, such as solar or wind power, could bolster the sustainability of EV charging. This would not only appeal to eco-conscious consumers but also align with global efforts to reduce carbon emissions, potentially positioning MCS as a key player in the green energy transition.

The global expansion into emerging markets presents another promising opportunity. With automotive sectors rapidly growing in regions like Asia, Latin America, and Africa, MCS infrastructure could meet the increasing demand for electric vehicles, supporting large-scale adoption.

Lastly, the adoption of innovative business models, such as subscription-based services, pay-per-charge options, or mobile charging solutions, could further enhance the accessibility and affordability of MCS.

Emerging Trends

Key Factors Shaping the Megawatt Charging System (MCS) Market for Electric Vehicles

The Megawatt Charging System (MCS) for electric vehicles is gaining significant attention due to several key trends that are shaping its future. One of the prominent factors is the ongoing standardization efforts aimed at creating uniform protocols and connectors. These efforts ensure that MCS can be used across different vehicle brands and regions, making it easier for both consumers and infrastructure providers.

Technological convergence is another critical trend, with MCS systems increasingly integrating with emerging technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI). This convergence enhances the overall efficiency and intelligence of charging stations, enabling real-time monitoring, predictive maintenance, and optimized energy usage.

Furthermore, the user experience is being significantly improved with advancements in user interfaces, making the process of locating and using MCS charging stations simpler and more intuitive.

Lastly, a growing emphasis on safety innovations is evident, particularly given the high power levels involved in MCS systems. Manufacturers are prioritizing safety features, including advanced fire protection, surge protection, and secure connection mechanisms, to mitigate the risks associated with fast-charging technologies.

Regional Analysis

Asia Pacific Dominating the Megawatt Charging System for EV Market with 73.5% Share (USD 473.2 Million)

The Asia Pacific region holds a dominant position in the global megawatt charging system for electric vehicles (EVs) market, accounting for 73.5% of the market share, valued at USD 473.2 million. This dominance is driven by the rapid growth of electric vehicle adoption in key markets such as China, Japan, and South Korea.

China, in particular, leads the region with substantial government support for EV infrastructure development and high levels of investment in fast-charging technologies. As a result, the demand for scalable and high-performance charging systems is accelerating.

Regional Mentions:

North America, the market is expanding steadily due to increasing investments in electric vehicle infrastructure and rising adoption rates of EVs, especially in the United States and Canada. The region is expected to experience moderate growth, as federal and state-level initiatives continue to support EV infrastructure development, particularly for high-speed, high-capacity charging systems.

Europe is also witnessing growth in the megawatt charging system market, driven by regulatory support for clean energy technologies and stringent emission regulations. Leading markets such as Germany, France, and the UK are significantly contributing to the demand for advanced EV charging solutions, with European policymakers actively pushing for infrastructure upgrades to meet future electric vehicle adoption targets.

In Middle East & Africa, the market remains in the early stages of development but shows promise, particularly with increasing government interest in sustainability and EV adoption. In Latin America, although the market is small, the region is gradually adopting electric mobility solutions, with growing interest in developing the necessary charging infrastructure to support these transitions.

Overall, the Asia Pacific region continues to dominate the megawatt charging system market, largely due to technological advancements, government incentives, and the rapid growth of electric vehicle fleets across the region.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Megawatt Charging System (MCS) for Electric Vehicles (EVs) market is witnessing significant growth, driven by increasing demand for high-power charging solutions for electric trucks and heavy-duty vehicles. Key players in this market include ABB, Tesla, Siemens, ChargePoint, BYD, Electrify America, Delta Electronics, Phoenix Contact, Tritium, and Webasto, each contributing to the acceleration of MCS infrastructure development.

ABB continues to be a dominant player, leveraging its extensive experience in electrical systems and industrial automation. The company’s solutions are designed for ultra-fast charging, with a focus on scalability for commercial fleets and logistics. Siemens similarly focuses on scalable charging infrastructure, emphasizing energy-efficient, flexible, and future-proof solutions that integrate seamlessly into existing grids.

Tesla, with its strong EV presence and Supercharger network, is a key competitor, often leading the way in fast-charging technology, although its approach is typically more proprietary, focused on Tesla vehicles. On the other hand, ChargePoint and Electrify America are making strides with extensive public charging networks, positioning themselves as key enablers of the EV ecosystem.

BYD, as both a vehicle manufacturer and a charging solution provider, benefits from vertical integration, enabling it to offer comprehensive EV and charging solutions.

Delta Electronics and Phoenix Contact focus on power conversion and optimization, while Tritium and Webasto are innovating in high-power DC charging technologies, targeting both heavy-duty vehicle markets and the growing need for faster charging solutions in the public sector.

Top Key Players in the Market

- ABB

- Tesla

- Siemens

- ChargePoint

- BYD

- Electrify America

- Delta Electronics

- Phoenix Contact

- Tritium

- Webasto

Recent Developments

- In January 2024, the Biden-Harris Administration announced $623 million in grants aimed at expanding the national electric vehicle (EV) charging network, enhancing access to clean energy transportation. These funds are part of a broader initiative to increase EV adoption and infrastructure across the U.S.

- In August 2024, the Department of Transportation (DOT) awarded $521 million in EV charging grants, focusing on addressing the slowdown in electric vehicle sales growth by improving charging accessibility. The grants are intended to support infrastructure upgrades and boost consumer confidence in EV adoption.

- In June 2024, applications opened for $1.3 billion in funding to further expand the national electric vehicle charging network and alternative fueling infrastructure. This funding is aimed at enhancing infrastructure in underserved areas, helping to accelerate the transition to a cleaner, more sustainable transportation system.

- In January 2024, nearly $150 million in grant funding was allocated to bolster and upgrade existing EV charging infrastructure in the U.S. The investment is designed to address growing demand for EV charging stations, supporting the broader transition to electric vehicles and reducing range anxiety for users.

Report Scope

Report Features Description Market Value (2023) USD 648.3 Million Forecast Revenue (2033) USD 3451 Million CAGR (2024-2033) 18.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Charging Power (250 KW to 500 KW, 500 KW to 1 MW, Above 1 MW), By Charging Technology (Conductive Charging, Future Innovations, Inductive Charging), By Vehicle Type (Commercial Vehicles, Passenger Vehicles, Specialty Vehicles), By End-User (Commercial, Industrial, Residential), By Component (Charging Ports, Control Systems, Power Converters) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, Tesla, Siemens, ChargePoint, BYD, Electrify America, Delta Electronics, Phoenix Contact, Tritium, Webasto Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Megawatt Charging System for EV MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Megawatt Charging System for EV MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Tesla

- Siemens

- ChargePoint

- BYD

- Electrify America

- Delta Electronics

- Phoenix Contact

- Tritium

- Webasto