Global Non-Grain-Oriented Electrical Steel Market By Thickness (0.35mm, 0.50mm, 0.65mm), By Type (Semi-Processed, Fully Processed), By Application (Household Appliances, Power Generation, AC Motors), Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 15054

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

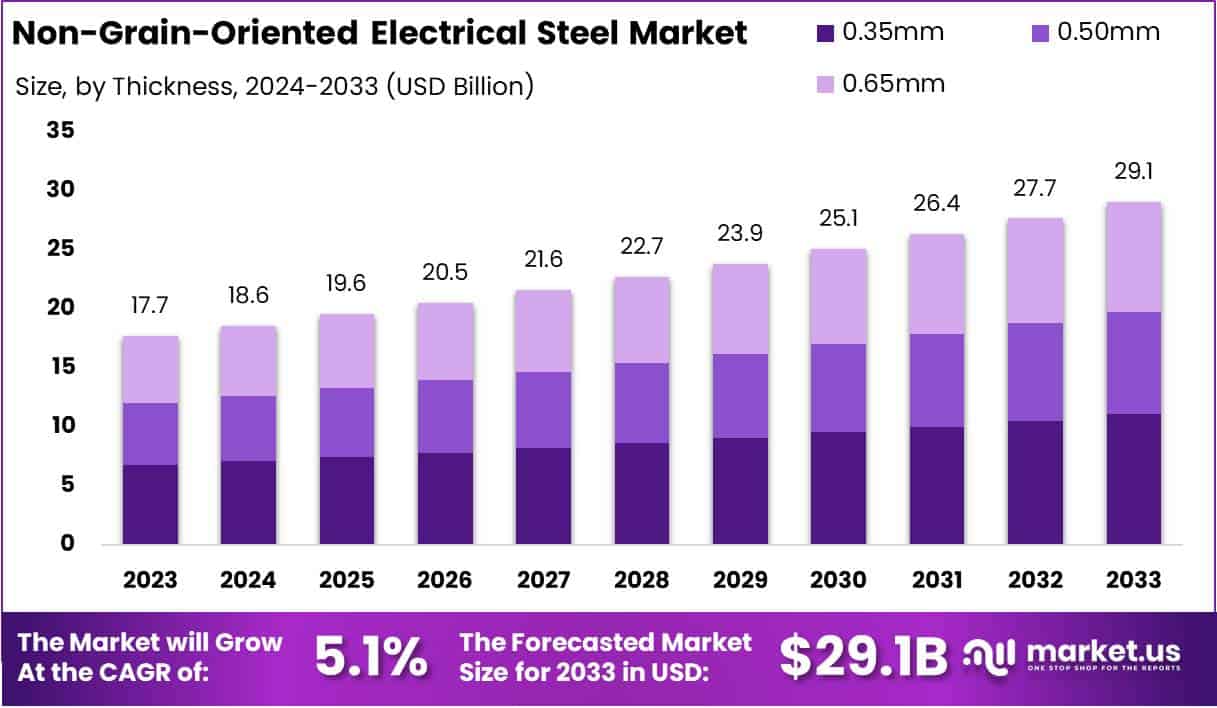

The Global Non-Grain-Oriented Electrical Steel Market size is expected to be worth around USD 29.1 Billion by 2033, from USD 17.7 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

Non-Grain-Oriented Electrical Steel (NGOES) is a type of specialty steel engineered for use in electrical applications where efficiency and durability are paramount. Unlike its counterpart, grain-oriented electrical steel, NGOES features a uniform grain structure, which allows for isotropic magnetic properties.

This makes it particularly suitable for applications such as electric motors, generators, and transformers operating at high speeds and variable loads. Its performance is defined by low core loss and high magnetic permeability, essential for minimizing energy wastage in electrical systems.

The Non-Grain-Oriented Electrical Steel Market encompasses the production, distribution, and application of NGOES across various industries. This market is a critical subset of the global steel industry, serving sectors such as automotive, energy, and consumer electronics.

The Non-Grain-Oriented Electrical Steel Market encompasses the production, distribution, and application of NGOES across various industries. This market is a critical subset of the global steel industry, serving sectors such as automotive, energy, and consumer electronics.With the rise of electrification and energy-efficient technologies, NGOES has become an indispensable material for manufacturing energy-saving components. The market’s growth trajectory is influenced by technological advancements, regulatory frameworks emphasizing energy efficiency, and increasing industrialization worldwide.

Several factors are driving the growth of the Non-Grain-Oriented Electrical Steel Market. Chief among them is the accelerating shift toward electrification in the automotive sector, particularly the production of electric and hybrid vehicles. These vehicles require high-performance electric motors, which rely heavily on NGOES for their efficiency.

Additionally, the global push for renewable energy sources, such as wind and solar, has spurred demand for NGOES in generators and transformers. Government initiatives promoting energy conservation and stringent regulations on carbon emissions further bolster market growth by incentivizing the adoption of energy-efficient materials.

Demand for NGOES is surging across multiple industries, driven by the need for higher efficiency and performance in electrical equipment. The automotive industry represents a significant share of this demand, with electric vehicle (EV) production expected to scale rapidly in the coming years.

Similarly, the energy sector’s growing investment in smart grids and renewable energy infrastructure is expanding the market for transformers and generators using NGOES. The consumer electronics industry also contributes, as NGOES is used in home appliances and other electrical devices that require energy-efficient components.

The Non-Grain-Oriented Electrical Steel Market presents several lucrative opportunities for stakeholders. Emerging markets in Asia-Pacific, particularly China and India, offer vast growth potential due to rapid industrialization and expanding energy needs. Technological advancements in steel manufacturing, such as the development of high-grade NGOES with reduced core loss, open new avenues for innovation and market differentiation.

Furthermore, the global shift toward decarbonization and the circular economy provides opportunities for companies to position themselves as leaders in sustainable steel production, leveraging NGOES to meet future energy efficiency standards.

According to Fastmarkets, China’s electrical steel exports reached 1.23 million tonnes in 2023, a slight 4% drop from 2022’s 1.28 million tonnes but still significantly higher than 860,959 tonnes in 2021. India remained the largest buyer in 2023, importing 189,184 tonnes or 15% of total exports. In the first quarter of 2024, exports rose 30% year-on-year to 356,726 tonnes, with India taking 58,896 tonnes or 17%.

China produced 15.28 million tonnes of electrical steel in 2023, up 15% from 2022, including 12.04 million tonnes of non-grain-oriented steel, an 8% rise. Production capacity is expected to reach 18-20 million tonnes by 2026.

According to Worldmetrics, India, the world’s second-largest steel producer, plays a critical role in the non-grain-oriented electrical steel market, with an annual turnover exceeding USD 100 billion and employment of over 2 million people. The industry has achieved a 20% reduction in energy intensity over the past decade, showcasing its commitment to sustainability.

Non-grain-oriented electrical steel, essential for electric motors and generators, is set to benefit from India’s growing infrastructure needs, including the government’s ambitious plan to build 100 airports by 2035. With the steel industry contributing approximately 2% to the manufacturing sector, this market is poised for robust growth as energy-efficient technologies gain prominence across automotive and industrial applications.

According to ExplodingTopics, the Non-Grain-Oriented Electrical Steel (NGOES) market is poised for significant growth, driven by the accelerating adoption of electric vehicles (EVs). The global EV industry, valued at over $250 billion, now boasts more than 40 million EVs on the road, with annual sales exceeding 6 million plug-in models.

Notably, China leads infrastructure development with over eight times more publicly available EVSE chargers than any other country, underscoring a robust demand for high-efficiency electrical components like NGOES. Meanwhile, Norway sets the benchmark in new EV registrations, signaling a strong shift toward sustainable mobility. As a critical material in EV motors and renewable energy applications, NGOES is well-positioned to capitalize on these trends.

Key Takeaways

- The Non-Grain-Oriented Electrical Steel Market is projected to grow from USD 17.7 billion in 2023 to USD 29.1 billion by 2033, at a CAGR of 5.1%.

- The 0.35mm thickness segment led the market with a 38% share in 2023, driven by its application in high-efficiency motors and transformers.

- Semi-Processed NGOES dominated with a 53% market share in 2023, due to its cost-efficiency and customization flexibility for manufacturers.

- The Power Generation segment accounted for over 40% of the market share in 2023, fueled by the demand for renewable energy infrastructure and grid modernization.

- Asia-Pacific led the market with a 36.2% share in 2023, driven by rapid industrialization, EV adoption, and renewable energy investments, particularly in China and India.

By Thickness Analysis

0.35mm Thickness Dominating Segment in Non-Grain-Oriented Electrical Steel Market with 38% Share

In 2023, the 0.35 mm thickness category held a dominant position in the Non-Grain-Oriented Electrical Steel Market, capturing more than 38% of the market share. This segment’s leadership is driven by its widespread use in high-efficiency motors and transformers, where minimizing energy loss is critical.

Its superior performance characteristics, such as lower core loss and higher magnetic permeability, make it a preferred choice across industrial and automotive applications.

The 0.50 mm segment accounted for approximately 32% of the market share in 2023. This thickness is widely adopted for general-purpose motors and generators, where cost-effectiveness and moderate energy efficiency are key considerations. Its balanced performance profile ensures a steady demand, particularly in emerging markets.

The 0.65 mm thickness segment captured around 20% of the market in 2023. While it serves a more niche role, this segment remains relevant in applications requiring lower-cost materials for less demanding energy efficiency requirements. Its usage is prevalent in basic industrial machinery and certain types of power tools, where initial cost is a primary concern.

By Type Analysis

Semi-Processed Dominating Segment in the Non-Grain-Oriented Electrical Steel Market with a 53% Share in 2023

In 2023, Semi-Processed Non-Grain-Oriented (NGO) Electrical Steel secured its position as the dominant segment, capturing over 53% of the global market share. This segment’s growth is primarily driven by its widespread usage in applications where moderate electrical efficiency and cost-effectiveness are crucial, such as in standard motors, generators, and transformers across the automotive, industrial, and energy sectors.

The semi-processed variant offers manufacturers the advantage of completing the annealing process themselves, providing greater flexibility to achieve desired magnetic properties at lower costs. This customization potential makes it a preferred choice for manufacturers aiming to optimize performance for specific applications.

Meanwhile, the Fully Processed segment accounted for a smaller yet significant share, driven by demand from applications requiring superior energy efficiency and minimal energy losses.

Fully processed NGO steel is extensively used in high-efficiency motors, particularly in electric vehicles (EVs) and other premium-grade electrical equipment, where performance is non-negotiable. Although this segment holds a smaller share, its growth trajectory is promising, fueled by the rapid adoption of EVs and stringent energy efficiency regulations globally.

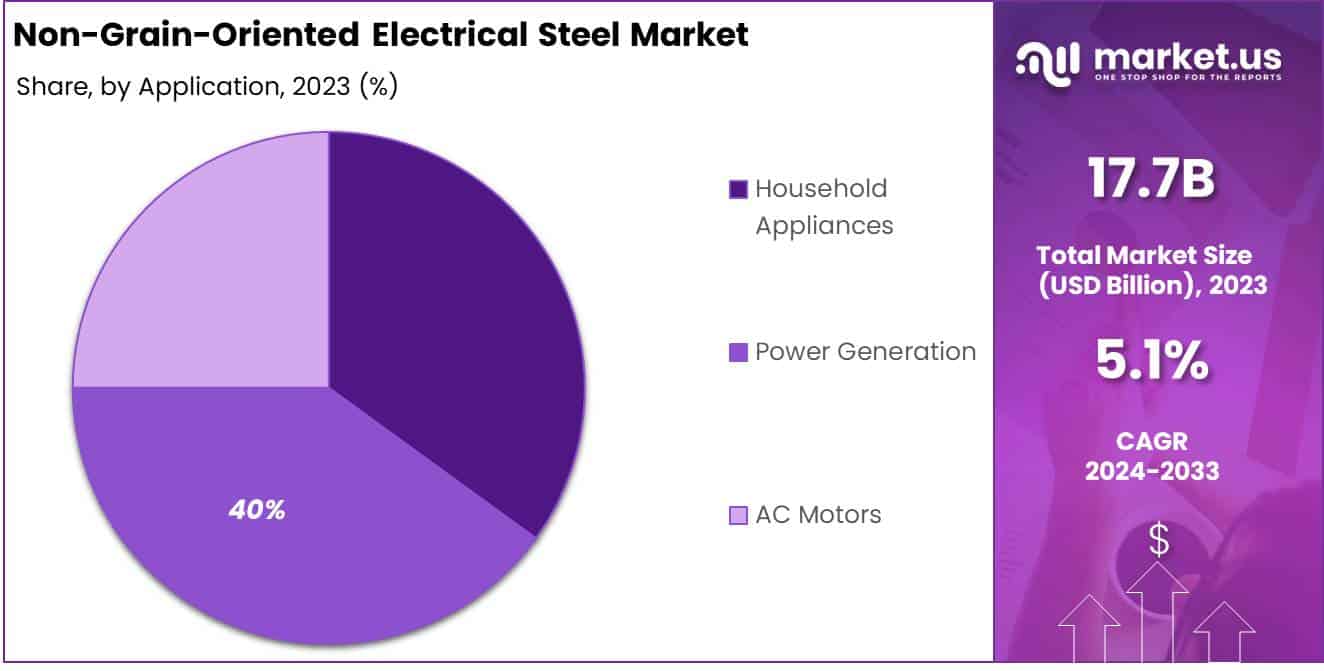

By Application Analysis

Power Generation Dominating Segment in Non-Grain-Oriented Electrical Steel Market with Over 40% Share in 2023

In 2023, Power Generation held a dominant market position in the Non-Grain-Oriented Electrical Steel Market, capturing more than a 40% share. This segment benefits from the rising global demand for renewable energy sources and the modernization of power infrastructure.

Non-grain-oriented electrical steel is integral in manufacturing transformers, generators, and other key components, contributing to improved energy efficiency and reduced losses in power systems.

Household Appliances emerged as a vital segment, driven by growing consumer demand for energy-efficient and sustainable products. Non-grain-oriented electrical steel is widely used in components such as compressors and electric motors for refrigerators, washing machines, and air conditioners. In 2023, this segment maintained a stable market presence, supported by increasing urbanization and a shift towards smart appliances.

AC Motors represented a significant application area, fueled by rising industrial automation and the need for high-performance electric motors. Non-grain-oriented electrical steel enhances motor performance by reducing energy losses, which is critical in industrial and commercial settings.

The segment accounted for a considerable market share in 2023, with demand expected to grow as industries adopt more energy-efficient solutions.

Key Market Segments

By Thickness

- 0.35mm

- 0.50mm

- 0.65mm

By Type

- Semi-Processed

- Fully Processed

By Application

- Household Appliances

- Power Generation

- AC Motors

Driver

Electric Vehicle Expansion

The rapid expansion of electric vehicles (EVs) is a pivotal driver for the Non-Grain-Oriented Electrical Steel (NGOES) market in 2024. EVs depend on high-efficiency motors, and NGOES, known for its isotropic magnetic properties, plays a critical role in enhancing motor performance by minimizing energy losses. With global EV sales doubling in recent years and projections for continued growth, the demand for NGOES is expected to rise sharply.

Governments worldwide are incentivizing EV adoption through subsidies and infrastructure development, further stimulating this market. As electrification of transportation accelerates, the NGOES market is positioned for a significant upswing.

Moreover, the broader electrification trend across industrial sectors amplifies this growth. The efficiency gains offered by NGOES make it indispensable not only in EVs but also in industrial machinery and energy storage systems.

This convergence of technological advancement and sustainability aligns with global energy efficiency goals. Projections suggest that NGOES demand will grow in tandem with the electrification of key industries, reinforcing its role in the transition toward low-carbon economies

Restraint

Raw Material Price Volatility

The NGOES market faces significant challenges from the volatility in raw material prices, particularly silicon and steel. These core inputs are highly susceptible to price fluctuations due to geopolitical tensions, supply chain disruptions, and varying global demand.

In recent years, instability in major producing regions has led to unpredictable cost surges, placing financial strain on manufacturers and end-users. Such volatility can hamper market adoption, especially in cost-sensitive applications, as higher production costs often translate to increased prices for consumers.

This dynamic forces manufacturers to adopt risk mitigation strategies such as vertical integration or long-term supply contracts. However, these solutions may not fully neutralize the impact, especially in emerging markets where access to stable supply chains remains limited.

Until global raw material markets stabilize, this volatility will continue to act as a restraint, potentially limiting the broader adoption of NGOES in sectors where price competitiveness is crucial

Opportunity

Renewable Energy Infrastructure Boom

The global push for renewable energy infrastructure presents a transformative opportunity for the NGOES market. NGOES is vital in manufacturing wind turbine generators and solar panel inverters, both of which require high-efficiency electrical components to optimize energy conversion.

As countries accelerate the deployment of renewable energy projects to meet climate targets, the demand for NGOES in these applications is expected to surge. By 2028, significant growth is projected in regions investing heavily in renewable energy and smart grid development, providing a substantial market opportunity.

This growth is particularly pronounced in Asia-Pacific and Europe, where government policies and private investments are driving large-scale renewable energy projects.

NGOES’s role in improving the efficiency of energy systems makes it an essential material for the evolving energy landscape. With renewable energy capacity set to increase exponentially, manufacturers of NGOES stand to benefit from long-term contracts and rising demand, securing their position in a rapidly expanding sector

Trends

Advancements in High-Performance NGOES

A key trend driving the NGOES market in 2024 is the development of advanced grades of NGOES, aimed at enhancing performance while reducing core losses. These innovations are critical in high-frequency applications such as electric motors for vehicles and compact transformers in urban infrastructure.

Research and development efforts are focused on producing thinner, more efficient steel, which improves energy conversion efficiency and reduces operational costs for end-users. Such advancements are not only improving performance but also aligning with sustainability goals, reducing the overall carbon footprint of electrical systems.

Additionally, innovations in coating technologies are enhancing the durability of NGOES, making it more resistant to wear and environmental degradation. These advancements are crucial as industries demand longer-lasting, high-efficiency materials for critical applications. This trend reflects a broader shift toward integrating advanced materials into sustainable energy systems, ensuring the NGOES market remains at the forefront of technological evolution

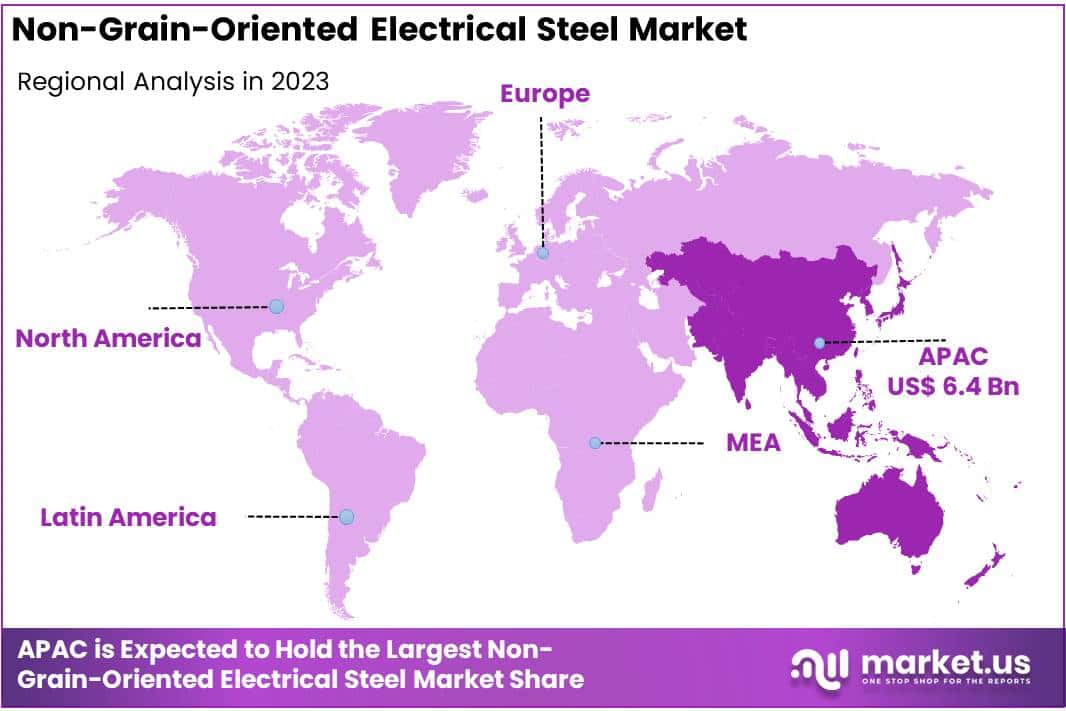

Regional Analysis

Asia-Pacific Leads Non-Grain-Oriented Electrical Steel Market with Largest Market Share of 36.2% in 2023

The non-grain-oriented electrical steel market displays considerable regional disparities, with Asia-Pacific cementing its position as the lead region, accounting for 36.2% of the global market share in 2023. The region’s market value reached an estimated USD 6.4 billion, underpinned by thriving manufacturing hubs, rapid urbanization, and a burgeoning demand for electric vehicles (EVs) and renewable energy infrastructure.

China alone accounts for over 60% of the region’s total market, driven by its vast electrical and electronics industries, while India’s ongoing electrification and industrial expansion further boost demand.

Europe holds the second-largest share, contributing approximately 28% to the global market, propelled by the EU’s aggressive climate goals and initiatives aimed at reducing carbon emissions. Countries like Germany and France lead in the adoption of energy-efficient technologies, particularly in the automotive and renewable energy sectors.

North America, capturing nearly 20% of the market, sees strong contributions from the U.S. and Canada, where the focus on advanced manufacturing and grid modernization supports growth. The region benefits from substantial government investment in smart grids and the expansion of EV infrastructure.

The Middle East & Africa and Latin America collectively account for around 16% of the global market. These regions are witnessing increasing investments in power infrastructure and industrialization, particularly in countries like Saudi Arabia, South Africa, and Brazil. Despite their smaller market share, these regions are poised for accelerated growth, supported by ongoing urbanization and energy sector reforms.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global non-grain-oriented (NGO) electrical steel market is poised for significant growth, driven by advancements in electrification and increasing demand for energy-efficient technologies. Key players in this market are leveraging innovation, strategic partnerships, and regional expansions to maintain competitive advantage.

Longbank Steel and Tata Steel are capitalizing on their diversified portfolios and strong market presence in Asia and Europe, positioning themselves as leaders in supplying high-quality NGO steel for automotive and industrial applications. Similarly, Nucor Corporation and NLMK Group have focused on expanding their production capacities and developing low-carbon steel products to cater to the growing demand in North America and Europe.

ArcelorMittal S.A., a global leader, continues to drive innovation through its advanced steel grades tailored for electric vehicles (EVs) and renewable energy sectors. Meanwhile, China-based players like Shougang Group and Baosteel Group Corporation dominate the domestic and regional markets, supported by robust government initiatives and investments in infrastructure and clean energy.

POSCO and Nippon Steel Corporation are also aggressively investing in R&D to enhance their product offerings, targeting the burgeoning EV market in Asia-Pacific.

European players such as Voestalpine Group and thyssenkrupp Steel are strategically focused on sustainable steel production, aligning with stringent EU regulations and growing consumer demand for green technologies.

Additionally, niche companies like Aperam S.A. and Arnold Magnetic Technologies provide specialized solutions, particularly in high-performance sectors such as aerospace and electronics. Collectively, these players are shaping the competitive dynamics of the NGO electrical steel market, driving innovation and sustainability across the value chain.

Top Key Players in the Market

- Longbank Steel

- Tata Steel

- Nucor Corporation NLMK

- ArcelorMittal S.A.

- Shougang Group

- thyssenkrupp Steel

- Baosteel Group Corporation

- POSCO

- Nippon Steel Corporation

- Voestalpine Group

- Yieh Corporation

- Aperam S.A.

- Arnold Magnetic Technologies

- Other Key Players

Recent Developments

- In April 2024, ArcelorMittal Calvert announced plans for a state-of-the-art manufacturing facility in Calvert, Alabama. The plant will produce 150,000 metric tons of non-grain-oriented electrical steel annually, a material deemed critical for clean energy. To support this project, the company received $280.5 million in tax credits through the U.S. Inflation Reduction Act’s 48C program.

- In 2024, thyssenkrupp Steel has introduced a new slitting line at its Motta Visconti plant in Italy. This line, designed for high-efficiency electrical steel, processes 500 meters of material per minute, doubling production capacity. The investment targets the growing demand for ultra-thin steel in electric vehicle motors.

- In 2024 JFE Steel Corporation and JSW Steel Limited, through their joint venture JSW JFE Electrical Steel, signed an agreement in October 2024 to acquire thyssenkrupp Electrical Steel India. This acquisition will strengthen their foothold in the electrical steel market, pending regulatory approvals.

Report Scope

Report Features Description Market Value (2023) USD 17.7 Billion Forecast Revenue (2033) USD 29.1 Billion CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Thickness (0.35mm, 0.50mm, 0.65mm), By Type (Semi-Processed, Fully Processed), By Application (Household Appliances, Power Generation, AC Motors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Longbank Steel, Tata Steel, Nucor Corporation NLMK, ArcelorMittal S.A., Shougang Group, thyssenkrupp Steel, Baosteel Group Corporation, POSCO, Nippon Steel Corporation, Voestalpine Group, Yieh Corporation, Aperam S.A., Arnold Magnetic Technologies, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Non Grain-oriented Electrical Steel MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Non Grain-oriented Electrical Steel MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Longbank Steel

- Tata Steel

- Nucor Corporation NLMK

- ArcelorMittal S.A.

- Shougang Group

- thyssenkrupp Steel

- Baosteel Group Corporation

- POSCO

- Nippon Steel Corporation

- Voestalpine Group

- Yieh Corporation

- Aperam S.A.

- Arnold Magnetic Technologies

- Other Key Players