Global Micro-Mobility Charging Infrastructure Market Size, Share, Growth Analysis By Vehicle Type (E-Scooters, E-Bikes, E-Mopeds, Other Micro-Mobility Vehicles), By Charging Type (Wired Charging, Wireless/Inductive Charging), By Power Source (Solar Powered, Battery Powered), By End-Use (Residential Areas, Commercial Spaces, Public Spaces), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137786

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

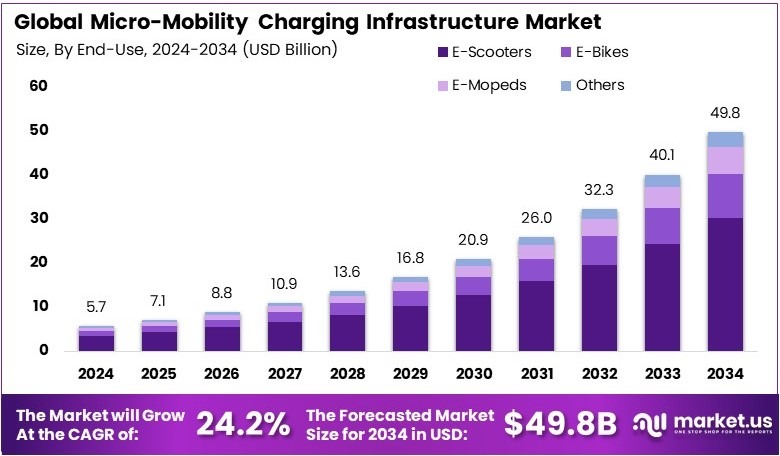

The Global Micro-Mobility Charging Infrastructure Market size is expected to be worth around USD 49.8 Billion by 2034, from USD 5.7 Billion in 2024, growing at a CAGR of 24.2% during the forecast period from 2025 to 2034.

Micro-mobility charging infrastructure includes facilities and equipment designed to charge small, electric vehicles such as e-scooters and e-bikes. These charging stations are typically located in public, urban areas to facilitate easy access and continuous use.

The micro-mobility charging infrastructure market involves the production, installation, and maintenance of charging stations for electrically powered, small vehicles. It serves cities looking to expand their urban transport options.

Micro-mobility charging infrastructure is becoming a key component in urban transportation networks. This infrastructure supports the growing number of e-scooters and e-bikes, vital for short-distance travel. Notably, the Oregon Department of Transportation has equipped 44 EV charging stations with micromobility charging facilities, enhancing accessibility and encouraging sustainable travel.

The micro-mobility charging infrastructure market is expanding rapidly due to its integration into global urban planning. For instance, in 2022, 158 U.S. communities had access to shared e-scooters. Additionally, Charge Enterprises is increasing its network, with centers that can charge over 70 e-scooters simultaneously, indicating a strong demand for these solutions.

Furthermore, the development of this infrastructure is influenced by several factors. The market’s growth is driven by increasing urbanization and the need for sustainable transport options. On a broader scale, it reduces urban congestion and pollution, while locally, it provides convenient charging solutions that support daily commutes.

Key Takeaways

- The Micro-Mobility Charging Infrastructure Market was valued at USD 5.7 Billion in 2024, and is expected to reach USD 49.8 Billion by 2034, with a CAGR of 24.2%.

- In 2024, E-Scooters dominate the vehicle type segment with 61.4% due to their popularity and urban mobility demand.

- In 2024, Wired Charging dominates the charger type segment with 50.7% as it remains the most accessible charging solution.

- In 2024, Battery-Powered options lead the power source segment with 53.6%, reflecting widespread adoption of battery technology.

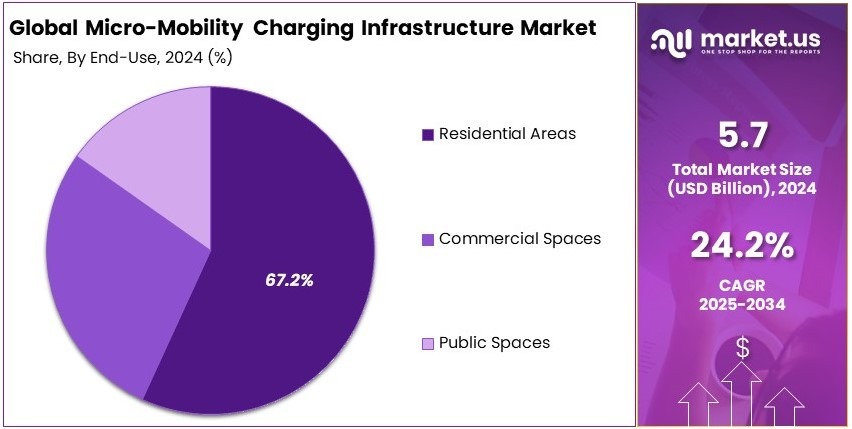

- In 2024, Residential Areas dominate the end-use segment with 67.2%, highlighting growing adoption of micro-mobility solutions in home settings.

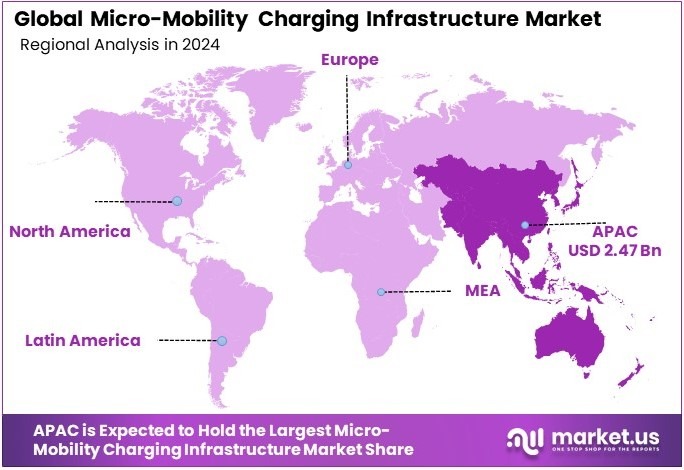

- In 2024, Asia Pacific dominates the region with 43.4% share, significantly boosting market growth by USD 2.47 Bn.

Vehicle Type Analysis

E-Scooters dominate with 61.4% due to their convenience and urban adaptability.

In the Micro-Mobility Charging Infrastructure Market, the “Vehicle Type Analysis” reveals that E-Scooters are the predominant sub-segment, holding a substantial 61.4% of the market share. This dominance is primarily due to the compact nature and ease of use of e-scooters.

It makes them highly suitable for urban environments where quick and nimble transportation is prized. E-Scooters appeal to city dwellers due to their ability to navigate through traffic more effectively than larger vehicles, significantly reducing commute times.

E-Bikes and E-Mopeds, though less dominant, contribute valuably to the market. E-Bikes offer a balance between physical activity and convenience, making them ideal for slightly longer distances or hilly areas. E-Mopeds, with higher power and speed, serve well for longer urban routes and can carry more than one rider, expanding their utility.

Charger Type Analysis

Wired Charging leads with 50.7% due to its reliability and widespread availability.

Within the “Charger Type Analysis,” Wired Charging emerges as the leading technology, commanding a 50.7% market share. This type of charging is favored for its reliability and the convenience of established infrastructure, which can often be found in residential and commercial settings.

Wired chargers are typically faster and more efficient than their wireless counterparts, offering users a quicker turnaround time, which is essential for the fast-paced urban life.

Wireless or Inductive Charging, while innovative, holds a smaller share due to the higher costs and currently lower efficiency rates. However, its potential for seamless integration into urban landscapes and its user-friendly nature (requiring no physical plugging in) positions it as a significant growth opportunity within the micro-mobility market.

Power Source Analysis

Battery-Powered sources dominate with 53.6% due to their energy efficiency and ease of integration into existing infrastructure.

The “Power Source Analysis” highlights that Battery-Powered solutions hold a majority of 53.6% in the market. This dominance is driven by the widespread availability and improving efficiencies of battery technologies, which are compatible with existing electrical grids and charging stations.

Battery power offers quick recharge capabilities and high energy density, making it ideal for the high-turnover needs of micro-mobility vehicles.

Solar-Powered charging, though less prevalent, offers significant environmental benefits and lower operating costs in the long run. As technology advances and costs decrease, solar charging is expected to play an increasingly important role, particularly in reducing the carbon footprint of micro-mobility solutions.

End-Use Analysis

Residential areas are the largest end-users, with 67.2% due to the convenience of home charging.

In the “End-Use Analysis,” Residential areas constitute the largest market segment at 67.2%. This significant share is largely due to the convenience and ease of charging micro-mobility vehicles at home. As urban residents increasingly adopt micro-mobility solutions for daily commutes, the ability to charge overnight or between uses without seeking out public charging stations presents a significant advantage.

Commercial and Public Spaces, while not as dominant, are essential for the comprehensive development of the micro-mobility infrastructure. Commercial spaces often provide charging stations as an amenity to attract eco-conscious customers, while public spaces are crucial for supporting commuters and tourists who rely on micro-mobility vehicles for short trips across the city.

Key Market Segments

By Vehicle Type

- E-Scooters

- E-Bikes

- E-Mopeds

- Other Micro-Mobility Vehicles

By Charging Type

- Wired Charging

- Wireless/Inductive Charging

By Power Source

- Solar Powered

- Battery Powered

By End-Use

- Residential Areas

- Commercial Spaces

- Public Spaces

Driving Factors

Urban Mobility Growth Drives Market Expansion

The rising adoption of e-scooters and e-bikes in cities is driving the micro-mobility charging infrastructure market. Urban dwellers seek affordable, efficient, and eco-friendly transportation. These vehicles offer a practical solution for short commutes, encouraging greater adoption.

Government initiatives supporting green mobility add further momentum. Subsidies for electric vehicles (EVs), grants for charging stations, and incentives for sustainable projects encourage businesses to invest in infrastructure. Cities prioritize reducing emissions and congestion, making micro-mobility a preferred solution.

Additionally, the demand for shared micro-mobility services is expanding. Companies offering e-scooter or e-bike rentals need robust charging solutions. This demand fuels investments in public and private charging stations to support growing fleets.

The expansion of urban infrastructure also plays a significant role. Cities invest in dedicated lanes, parking zones, and multi-modal transit hubs. These efforts make micro-mobility vehicles safer and more convenient, boosting their popularity.

Restraining Factors

Urban and Technological Barriers Restrain Market Growth

Limited space in dense urban areas challenges the installation of micro-mobility charging infrastructure. Finding suitable locations for stations amidst traffic congestion, parking lots, and pedestrian zones is a significant hurdle.

Another obstacle is the lack of standardization in charging ports. Different manufacturers use proprietary designs, making compatibility an issue. This lack of uniformity complicates operations for shared service providers and hinders the expansion of public charging networks.

Emerging economies face additional challenges due to unstable electric grids. Frequent power outages and inconsistent electricity supply affect charging station reliability. Operators must invest in backup systems, increasing operational costs and limiting scalability.

In rural areas, the slow adoption of electric micro-mobility is another restraining factor. Limited demand in these regions discourages infrastructure investment. The focus remains on urban markets, leaving rural areas underserved and slowing overall market expansion.

Growth Opportunities

Advanced Charging Solutions Provide Opportunities

The development of wireless and inductive charging systems offers significant growth opportunities. These technologies enable hassle-free charging without physical connectors, making charging stations more user-friendly and efficient.

Solar-powered charging stations are also gaining traction. By leveraging renewable energy, these stations reduce dependence on traditional power grids and lower operational costs. This sustainable approach aligns with global environmental goals and appeals to eco-conscious users.

Battery-swapping technology is another promising innovation. Instead of waiting for a vehicle to charge, users can swap out depleted batteries for fully charged ones. This solution minimizes downtime, particularly for shared micro-mobility services, and improves user satisfaction.

Subscription-based charging services are also on the rise. For example, users can pay a monthly fee for unlimited access to charging stations. This model simplifies payment processes and encourages regular usage, creating a steady revenue stream for operators.

Emerging Trends

Smart and Sustainable Charging Solutions Are Latest Trending Factors

Smart EV charging solutions with real-time monitoring are gaining momentum. These systems allow operators to track usage patterns, energy consumption, and station performance. For instance, real-time data helps optimize station placement and predict maintenance needs, boosting efficiency.

App-based charging services are becoming increasingly popular. Through mobile apps, users can locate nearby stations, check availability, and make payments seamlessly. This convenience enhances user experience and encourages frequent usage of micro-mobility vehicles.

The growth of ultra-fast charging technologies is another noteworthy trend. Advanced chargers significantly reduce charging time, making micro-mobility more convenient for users. This innovation is particularly beneficial for shared service providers, ensuring quick turnaround times for fleets.

Sustainability remains a key focus, with a push toward using eco-friendly materials for charging station construction. For example, stations made from recycled or biodegradable materials align with environmental goals. This approach resonates with governments, businesses, and consumers seeking green solutions.

Regional Analysis

Asia Pacific Dominates with 43.4% Market Share

Asia Pacific leads the Micro-Mobility Charging Infrastructure Market with 43.4% of the global market share, valued at USD 2.47 billion. This dominance is driven by rapid urbanization, rising adoption of micro-mobility solutions, and significant government investments in infrastructure to support eco-friendly transportation alternatives.

Key factors include the high population density in urban areas, which boosts the need for efficient, sustainable transportation like e-scooters and e-bikes. Additionally, countries such as China, India, and South Korea have witnessed massive adoption of micro-mobility due to increasing environmental awareness and government support for green transportation initiatives. Advanced manufacturing capabilities in these nations further support the growth of charging infrastructure.

The region’s market dynamics reflect the impact of growing middle-class populations and their preference for affordable, convenient transport options. The integration of renewable energy into charging systems and the rise of smart city projects amplify Asia Pacific’s influence in this sector. China, for example, leads in deploying solar-powered micro-mobility charging stations, enhancing the region’s green footprint.

Regional Mentions:

- North America: North America is a significant market player, focusing on integrating advanced technologies and renewable energy into charging infrastructure. The adoption of shared e-scooters in cities like Los Angeles drives regional growth.

- Europe: Europe prioritizes sustainability and green energy in micro-mobility charging. Strong government policies supporting e-mobility and urban planning innovations contribute to steady growth.

- Middle East & Africa: Middle East and Africa are emerging markets, with countries like the UAE investing in green transportation. Smart city projects and e-mobility initiatives are key growth drivers.

- Latin America: Latin America is steadily adopting micro-mobility, with countries like Brazil leading the way. Urban congestion and increasing environmental awareness drive the need for efficient charging infrastructure.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Micro-Mobility Charging Infrastructure Market is growing rapidly, driven by key players leveraging innovation and strategic partnerships to expand their presence. Among these, Swiftmile, Charge, EVBox, and Lime are the top four companies shaping the industry’s landscape.

Swiftmile leads with its focus on solar-powered and eco-friendly charging solutions for e-scooters and e-bikes. Its emphasis on sustainability and smart technology integration helps cities reduce emissions while promoting efficient urban mobility. Swiftmile’s partnerships with municipalities and private operators further strengthen its market position.

Charge specializes in developing modular and scalable charging stations for shared micro-mobility fleets. The company’s solutions are designed for urban environments, offering convenience and adaptability to high-traffic areas. Charge’s focus on easy installation and user-friendly systems makes it a preferred choice for operators looking to optimize fleet operations.

EVBox is a major player in the electric vehicle charging space, extending its expertise to micro-mobility infrastructure. Known for its advanced technology and reliability, EVBox offers durable charging stations that support both individual users and fleet operators. Its commitment to sustainability and innovation enhances its competitive edge in the market.

Lime, a global leader in micro-mobility services, integrates charging infrastructure as part of its operational strategy. By investing in efficient and widespread charging networks, Lime ensures its e-scooters and e-bikes remain accessible and reliable for urban commuters. Its large-scale operations and brand recognition make it a key player in the market.

These companies drive the Micro-Mobility Charging Infrastructure Market by combining technology, sustainability, and strategic partnerships. Their innovative approaches to urban mobility solutions contribute to the growth of eco-friendly transportation and enhance the overall efficiency of micro-mobility networks.

Major Companies in the Market

- Swiftmile

- Charge

- Bikeep

- PBSC Urban Solutions

- EVBox

- GetCharged Inc. (Charge)

- Urban Electric Networks Ltd.

- CycleHop

- Zagster

- Lime

- Bird

- Spin

- Scoot Networks

Recent Developments

- Steer Automotive Group & ARC Group: On January 2025, Steer Automotive Group, a leading UK-based vehicle repair service provider, expanded its operations by acquiring Accident Repair Centre (ARC) Group. ARC Group, operating across southwest England with 23 manufacturer approvals, enhances Steer’s regional presence and service capabilities.

- Performance Plus Quick Oil Change & Sparkle Car Care Centers: On February 2023, Performance Plus Quick Oil Change, a US-based oil change and car wash company, acquired Sparkle Car Care Centers. This acquisition is expected to deepen and strengthen Performance Plus’s position as a leader in the automotive care sector by achieving synergy between the two leading companies.

Report Scope

Report Features Description Market Value (2024) USD 5.7 Billion Forecast Revenue (2034) USD 49.8 Billion CAGR (2025-2034) 24.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (E-Scooters, E-Bikes, E-Mopeds, Other Micro-Mobility Vehicles), By Charging Type (Wired Charging, Wireless/Inductive Charging), By Power Source (Solar Powered, Battery Powered), By End-Use (Residential Areas, Commercial Spaces, Public Spaces) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Swiftmile, Charge, Bikeep, PBSC Urban Solutions, EVBox, GetCharged Inc. (Charge), Urban Electric Networks Ltd., CycleHop, Zagster, Lime, Bird, Spin, Scoot Networks Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Micro-Mobility Charging Infrastructure MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Micro-Mobility Charging Infrastructure MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Swiftmile

- Charge

- Bikeep

- PBSC Urban Solutions

- EVBox

- GetCharged Inc. (Charge)

- Urban Electric Networks Ltd.

- CycleHop

- Zagster

- Lime

- Bird

- Spin

- Scoot Networks