Canada Tennis Market, by Product Types (Apparel , Footwear , and other ), by Application (Professional, Amateur, and other) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2024

- Report ID: 68600

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

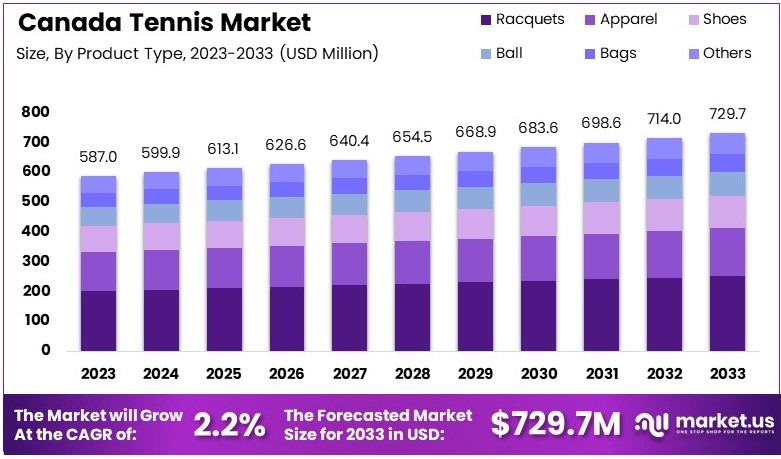

The Canada Tennis Market size is expected to be worth around USD 729.7 Million by 2033, from USD 587.0 Million in 2023, growing at a CAGR of 2.2% during the forecast period from 2024 to 2033.

Canada tennis refers to the sport of tennis played in Canada, encompassing recreational and competitive levels. It involves individual and team participation across various age groups. The sport is supported by organized tournaments, coaching programs, and national governing bodies promoting tennis development.

The Canada tennis market includes the infrastructure, equipment, and services supporting tennis activities. It caters to players, coaches, and institutions involved in the sport. The market emphasizes accessibility, high-quality facilities, and partnerships to grow tennis participation and enhance player performance.

Canada now ranks second globally, with 12.8% of its population playing tennis, according to the 2024 ITF report. This marks a 7.1% increase since 2021. The total number of players has grown to nearly 5 million, up from 3.9 million, highlighting strong growth despite challenges in providing year-round facilities.

In 2023, youth tennis participation in Canada grew by 11%, driven by increasing interest in the sport. Nearly 5 million Canadians played tennis, reflecting a broad demographic appeal. This surge creates opportunities for equipment manufacturers, training facilities, and local organizations to capitalize on the growing demand for tennis-related services.

The National Bank Open broke attendance records in 2023, drawing 175,000+ fans in Toronto and 219,000+ in Montreal. These events enhance the visibility of tennis in Canada, strengthening its position as a premier tennis destination while boosting local economies through sports tourism and sponsorships.

Government support and investments in tennis infrastructure are vital for sustaining this momentum. Policies encouraging youth participation and facility upgrades can help meet rising demand. Additionally, the global recognition of Canadian tennis fosters further growth opportunities at both local and international levels, ensuring long-term market expansion.

Key Takeaways

- The Canada Tennis Market was valued at USD 587.0 million in 2023 and is expected to reach USD 729.7 million by 2033, with a CAGR of 2.2%.

- In 2023, Racquets dominated product type with 34.4%, driven by growing participation and performance preferences.

- In 2023, Amateur End-Users led with 67.6%, reflecting recreational play dominance.

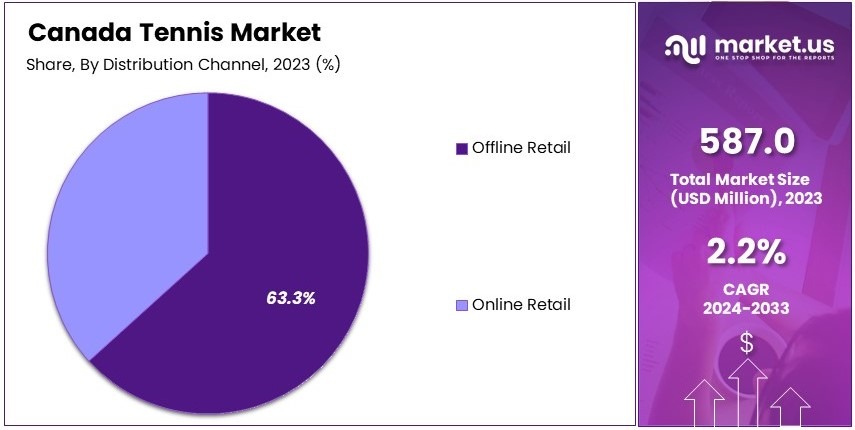

- In 2023, Offline Retail channels dominated with 63.3%, preferred for hands-on product selection.

Product Type Analysis

Racquets segment dominates with 34.4% due to high demand among players seeking performance and quality.

The Canada tennis market is primarily segmented by product type, with racquets leading the category at 34.4%. This dominance is driven by the consistent demand from both amateur and professional players who prioritize high-performance tennis racquets to enhance their game.

Power racquets are particularly popular among beginners and recreational players for their ease of use, while control racquets attract more advanced players seeking precision.

Tweener racquets, which offer a balance between power and control, cater to a wide range of players, contributing to the robust demand in this sub-segment. Apparel follows as a significant segment, with a diverse range of products including tops and dresses, T-shirts, jackets, skirts and shorts, trousers and tights, and others.

Each apparel sub-segment plays a crucial role in meeting the varied preferences and functional needs of tennis players, thereby supporting overall market growth. Shoes tailored for different court surfaces—hard court, clay court, and grass court—also form an essential part of the market, ensuring players have the appropriate athletic footwear for optimal performance. Additionally, the ball segment, comprising pressurized, pressureless, and practice balls, caters to different training and playing requirements.

Bags and other accessories, though smaller in market share, contribute to the comprehensive needs of tennis enthusiasts by providing convenient storage and transport solutions for equipment. The strong presence of racquets in the market underscores the importance of equipment quality and innovation in driving the Canadian tennis market forward.

End-Users Analysis

Amateur segment dominates with 67.6% due to widespread participation and recreational interest in tennis.

The Canadian tennis market is also categorized by end-users, with amateurs comprising the largest segment at 67.6%. This dominance is fueled by the sport’s accessibility and popularity among recreational players who engage in tennis for fitness, social interaction, and leisure.

The amateur segment’s substantial share reflects the increasing number of individuals taking up tennis as a hobby, supported by accessible facilities and community programs that encourage participation. Professional players, although a smaller segment, significantly influence the market through their demand for high-end equipment and apparel, as well as their role in promoting the sport through competitions and endorsements.

Junior players represent another important sub-segment, driven by youth development programs and the aspiration of young athletes to pursue tennis competitively. Each end-user sub-segment contributes uniquely to the market’s growth, with amateurs driving volume sales and other segments enhancing the market’s diversity and sustainability through specialized needs and higher-value products.

Distribution Channel Analysis

Offline Retail dominates with 63.3% due to established presence and customer preference for in-store experiences.

Distribution channels play a critical role in the Canadian tennis market, with offline retail leading at 63.3%. The dominance of offline retail is attributed to the established presence of physical stores where customers can experience products firsthand, receive personalized assistance, and make informed purchasing decisions.

Hypermarkets and supermarkets offer convenience and a wide range of products, making them popular among casual buyers. Specialty stores cater to dedicated tennis players by providing expert advice and a curated selection of high-quality equipment and apparel.

Sports retail chains, known for their extensive inventory and competitive pricing, attract a broad customer base, while department stores offer additional convenience by integrating tennis products with other sporting goods. The offline retail sector benefits from strong brand recognition and customer loyalty, which are crucial for sustained market growth.

On the other hand, online retail, comprising e-commerce platforms and company websites, is steadily growing due to the increasing preference for digital shopping, wider product availability, and competitive pricing. Although online retail holds a smaller market share, its growth is driven by technological advancements and changing consumer behaviors.

Key Market Segments

By Product Type

- Racquets

- Power

- Control

- Tweener

- Apparel

- Tops & Dresses

- T-Shirts

- Jackets

- Skirts & Shorts

- Trousers & Tights

- Others

- Shoes

- Hard Court

- Clay Court

- Grass Court

- Ball

- Pressurized

- Pressureless

- Practice

- Bags

- Others

By Distribution Channel

- Online Retail

- E-commerce

- Company Website

- Offline Retail

- Hypermarket/Supermarket

- Specialty Stores

- Sports Retail Chains

- Department Stores

- Others

Drivers

Increasing Participation in Tennis Drives Market Growth

The Canada Tennis Market is experiencing robust growth, propelled by a variety of influential factors that collectively enhance the sport’s appeal and accessibility. A primary driving factor is the increasing participation in tennis among Canadians, fueled by extensive grassroots programs and public initiatives that aim to make tennis more accessible to people of all ages and backgrounds.

Additionally, the success of Canadian players on international stages has significantly boosted the sport’s popularity within the country. When local athletes achieve international recognition, it inspires national pride and stimulates interest in tennis, leading to increased participation and viewership.

Moreover, investments in tennis infrastructure, such as the development of new tennis facilities and the renovation of existing ones, provide enthusiasts with enhanced playing conditions and more accessible venues. These improvements not only benefit current players but also attract new participants by offering a better playing experience.

Furthermore, strategic partnerships between tennis associations and educational institutions help integrate tennis into school sports programs, creating early exposure among students. This not only boosts the sport’s popularity from a young age but also ensures a steady influx of new players into the market.

Restraints

Economic Constraints and Competitive Sports Alternatives Restrain Market Growth

The Canadian Tennis Market faces several restraining factors that collectively impact its growth potential. Economic constraints significantly hinder market expansion, as the cost of playing tennis, which includes club memberships, equipment, and coaching, can be prohibitively high for many potential players.

Moreover, tennis competes for public and private funding, attention, and participation with other sports that are more deeply ingrained in Canadian culture, such as hockey, soccer, and basketball. This competition is exacerbated by the high visibility and extensive support these sports receive at community and national levels, which often leads to a preference for them over tennis, both in terms of playing and viewing.

In addition, there is a notable lack of high-profile tennis tournaments held in Canada, which impacts the sport’s ability to attract sustained media attention and build a consistent fan base. Without regular, high-stakes competitions that draw international stars, tennis struggles to capture and maintain the public’s interest compared to sports that offer frequent and widely viewed events.

Opportunity

Expanding Tennis Facilities Provides Opportunities for Market Growth

The Canadian Tennis Market is primed for expansion, driven by several key opportunities that promise to elevate the sport’s presence and business viability across the nation. One significant opportunity lies in the continued expansion of tennis facilities. As new courts and training centers emerge, particularly in underserved areas, the accessibility of tennis improves, inviting more participants from diverse backgrounds.

Additionally, the adoption of modern technologies in tennis training and gameplay, such as video analysis tools and electronic line-calling systems, presents a considerable opportunity for market growth. These technologies improve player performance and engagement by offering detailed analytics and fair play, making the game more appealing to younger, tech-savvy generations.

Furthermore, the rise in lifestyle-oriented marketing strategies by tennis equipment manufacturers and retailers opens up expansive growth prospects. By promoting tennis not only as a competitive sport but also as a key component of a healthy lifestyle, these entities can tap into the larger fitness and wellness market.

Moreover, strategic collaborations between Canadian tennis organizations and international tennis bodies can amplify the market’s growth potential. These partnerships foster better training programs, attract top-tier coaches, and offer Canadian players more opportunities to compete internationally. Such collaborations enhance the visibility of Canadian tennis on the global stage, drawing more attention to Canada as a burgeoning hub for tennis talent and innovation.

Challenges

Harsh Climate and Limited Indoor Facilities Challenge Market Growth

The Canadian Tennis Market faces a series of challenging factors that collectively hinder its potential for growth. Among the most significant of these is the harsh Canadian climate, which restricts outdoor tennis activities for a considerable part of the year. The extended winter seasons and unpredictable weather limit the accessibility of outdoor courts, discouraging regular play and making it difficult for players to maintain consistent training and development.

The high costs associated with constructing and maintaining indoor tennis facilities also pose a significant challenge. These expenses can be prohibitive, deterring investment in new constructions and the necessary upgrades to existing facilities.

Furthermore, there is a challenge in attracting and retaining qualified coaches who are capable of developing players to compete at higher levels. Coaching in tennis requires not only skill and dedication but also often a substantial investment in certification and ongoing training.

Lastly, the Canadian Tennis Market contends with the challenge of geographic dispersion and the concentration of resources in urban centers. Many rural and remote areas lack the necessary facilities and programs to foster tennis growth, leading to unequal opportunities for participation and talent development.

Growth Factors

Innovative Programs and Partnerships Are Growth Factors for the Canada Tennis Market

The Canada Tennis Market is poised for growth, spurred by several key factors that promise to expand its reach and popularity. A crucial element driving this growth is the introduction of innovative tennis programs targeted at youth and schools. These initiatives are designed to foster early interest and participation in tennis, providing a structured pathway for skill development from a young age.

Another significant growth factor is the strategic partnerships between tennis clubs, local governments, and educational institutions. These collaborations help to extend the sport’s reach, making it more accessible to a broader audience. By working together, these entities can share resources, such as facilities and coaching expertise, and create more inclusive programs that cater to diverse communities across Canada.

Investment in coach development is also a key growth driver. By increasing the number and quality of tennis coaches, the sport can ensure that players at all levels receive the guidance and training they need to improve. This investment helps elevate the overall standard of play and competitiveness within Canada, creating a more vibrant and dynamic tennis community.

Lastly, the growth of competitive and recreational leagues across the country provides numerous opportunities for players to engage in regular match play, which is crucial for skill development and maintaining interest in the sport. These leagues cater to various skill levels and age groups, ensuring that tennis is accessible and enjoyable for everyone, from beginners to seasoned players.

Emerging Trends

Technology Integration and Health-Focused Initiatives Are Latest Trending Factors

The Canada Tennis Market is witnessing dynamic shifts driven by several emerging trends that are shaping its evolution and appeal. One of the most significant trends is the integration of technology into tennis. Innovations such as smart rackets with performance-tracking sensors and apps that offer personalized coaching insights are revolutionizing how players train and improve.

Another notable trend is the increasing emphasis on tennis as a health-focused activity. With growing awareness about the importance of physical fitness and mental well-being, more people are turning to tennis as a holistic exercise option. Tennis offers cardiovascular benefits, stress reduction, and social interaction, aligning perfectly with the rising demand for wellness-oriented lifestyles.

Additionally, the rise of eco-conscious initiatives within the tennis industry is gaining traction. Many manufacturers are shifting toward sustainable practices, producing rackets, balls, and apparel using eco-friendly materials. This trend resonates with environmentally conscious consumers who value sustainability in their purchasing decisions.

Furthermore, there is a growing preference for inclusive and community-driven tennis programs. Initiatives designed to welcome players of all skill levels, ages, and backgrounds are creating a more diverse and vibrant tennis community in Canada. Adaptive tennis programs for individuals with disabilities, as well as women-centric leagues, are prime examples of efforts to make the sport more accessible and inclusive.

Regional Analysis

Ontario Dominates with Significant Market Share

Ontario leads the Canada Tennis Market, accounting for a dominant share due to its strong tennis culture, advanced infrastructure, and high participation rates. The region benefits from numerous tennis facilities, both public and private, which cater to recreational and professional players. Its favorable climate during warmer months also supports outdoor play, further driving demand for tennis products.

Key factors driving this dominance include Ontario’s large urban population, which provides a robust consumer base for tennis equipment, apparel, and accessories. The region hosts several high-profile tennis events that promote the sport and generate enthusiasm among players and spectators.

Market dynamics in Ontario are influenced by its affluent population, which demands high-quality and premium tennis products. The growing popularity of youth tennis programs and community initiatives also supports the market, fostering interest and skill development. Retail channels, both online and offline, are well-established, ensuring that tennis products are widely available to meet diverse consumer needs.

Regional Mentions in Canada:

- Quebec: Quebec has a growing tennis market supported by community-based programs and cultural enthusiasm for sports. Its rich history of producing professional players contributes to steady participation rates.

- British Columbia: British Columbia’s tennis market benefits from its mild climate, allowing for year-round play. The presence of premium clubs and international tennis tournaments supports its growth.

- Prairie Provinces: The Prairie Provinces show gradual growth in the tennis market, driven by increasing investments in sports facilities and youth training programs.

- Atlantic Canada: Atlantic Canada’s tennis market is emerging, with local initiatives and infrastructure development encouraging participation and boosting demand for affordable tennis products.

Key Regions and Countries covered in the report

Atlantic Canada

- Newfoundland and Labrador

- Prince Edward Island

- Nova Scotia

- New Brunswick

Central Canada

- Quebec

- Ontario

Prairie Provinces

- Manitoba

- Saskatchewan

- Alberta

West Coast

- British Columbia

Northern Canada

- Yukon

- Northwest Territories

- Nunavut

Key Players Analysis

The Canada tennis market features key players excelling in product innovation, endorsements, and brand presence. These companies cater to recreational and professional players alike.

Wilson Sporting Goods is a top player known for premium racquets and partnerships with professional players. Its innovative products dominate both retail and professional segments.

Yonex Co., Ltd. is recognized for advanced technology in racquets and strings. Its focus on high-performance products appeals to competitive players.

Nike, Inc. combines apparel, footwear, and equipment to capture the tennis market. Its strong brand recognition and sponsorships bolster its market share.

Adidas AG is a leading brand offering high-quality tennis footwear and apparel. Its focus on innovation and comfort strengthens its position in the Canadian market.

These companies drive market growth with quality products, endorsements, and strong customer engagement strategies.

Top Key Players in the Market

- Wilson Sporting Goods

- Yonex Co., Ltd.

- Nike, Inc.

- Adidas AG

- Babolat

- Head N.V.

- Dunlop Sports

- ASICS Corporation

- Prince Tennis

- K-Swiss

- Lacoste

- Völkl Tennis

- Gamma Sports

- Ame & Lulu

- Diadem Sports

Recent Developments

- Tennis Canada and National Bank: In September 2024, Tennis Canada and National Bank launched a campaign for Gender Equality Week, encouraging the public to wear purple—a color historically associated with feminist movements and symbolizing progress toward gender equity. This initiative is part of their ongoing “Game. Set. Equity.” strategy, which aims to advance gender equity across all levels of tennis in Canada.

- Tennis Canada: In October 2024, Tennis Canada introduced the Wheelchair Tennis Whole Player Development Pathway (WTWPDP), a comprehensive guide aimed at fostering lifelong participation in wheelchair tennis. The pathway is structured around seven stages—Discovery, Active Start, Fundamentals, Development, Consolidation, Performance, and Life as a Pro—addressing the unique needs of wheelchair tennis players.

Report Scope

Report Features Description Market Value (2023) USD 587.0 Million Forecast Revenue (2033) USD 729.7 Million CAGR (2024-2033) 2.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Racquets (Power, Control, Tweener), Apparel (Tops and Dresses, T-Shirts, Jackets, Skirts and Shorts, Trousers and Tights, Others), Shoes (Hard Court, Clay Court, Grass Court), Ball (Pressurized, Pressureless, Practice), Bags, Others), By Distribution Channel (Online Retail (E-commerce, Company Website), Offline Retail (Hypermarket or Supermarket, Specialty Stores, Sports Retail Chains, Department Stores, Others)) Regional Analysis Atlantic Canada – Newfoundland and Labrador, Prince Edward Island, Nova Scotia, New Brunswick; Central Canada – Ontario, Quebec; Prairies – Manitoba, Saskatchewan, Alberta; West Coast – British Columbia; Northern Canada – Yukon, Northwest Territories, Nunavut Competitive Landscape Wilson Sporting Goods, Yonex Co., Ltd., Nike, Inc., Adidas AG, Babolat, Head N.V., Dunlop Sports, ASICS Corporation, Prince Tennis, K-Swiss, Lacoste, Volkl Tennis, GAMMA Sports, Ame & Lulu, Diadem Sports Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NIKE Inc.

- Amer Sports Oyj

- Adidas AG

- ASICS Corp

- Under Armour Inc.

- Dunlop Sports Co. Ltd.

- Bridgestone Corp.

- Yonex Co.Ltd.

- Head

- Babolat and Authentic Brands Group (Prince Tennis).