Global Aluminum Foil Market By Type (Standard, Heavy Duty, Extra Heavy Duty), By Thickness (0.2 mm), By Alloy Type (1000 Series, 3000 Series, 5000 Series, 8000 Series, Others), By Application (Bags and Pouches, Wraps and Rolls, Blisters, Containers, Others), By End-use (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Building and Construction, Automotive and Transportation, Electrical and Electronics, Chemical and Petrochemical, Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 64625

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

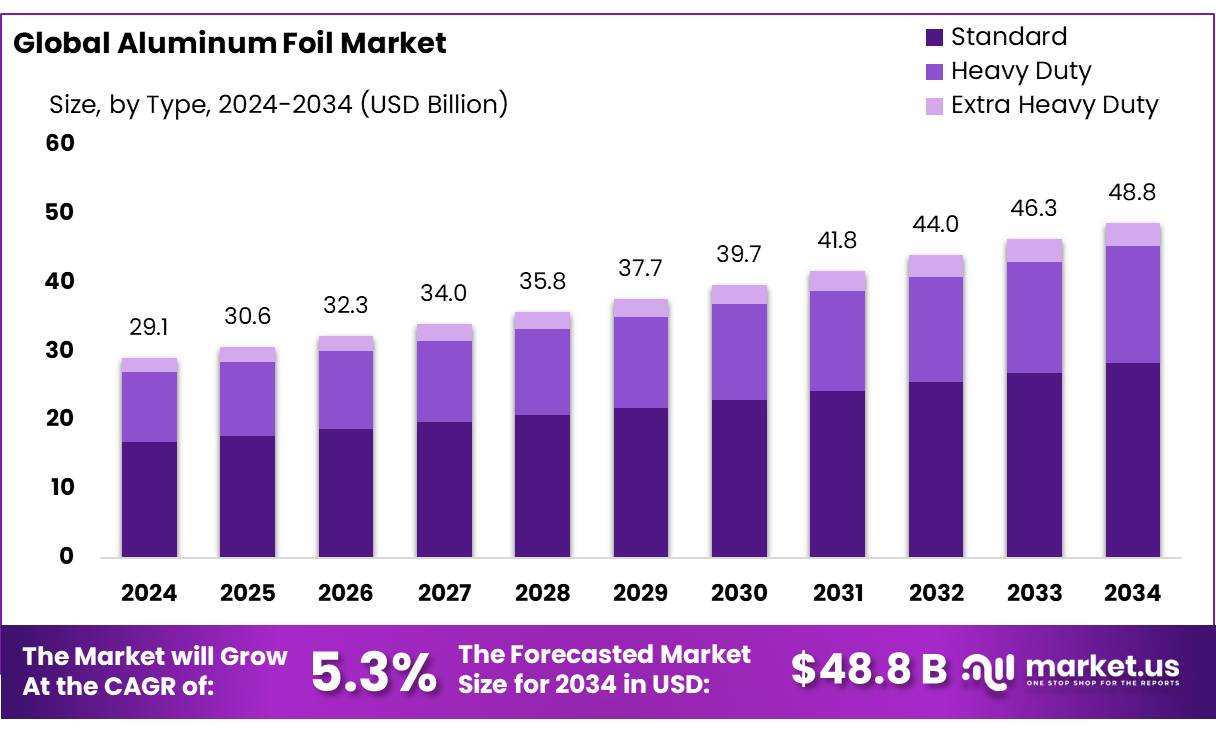

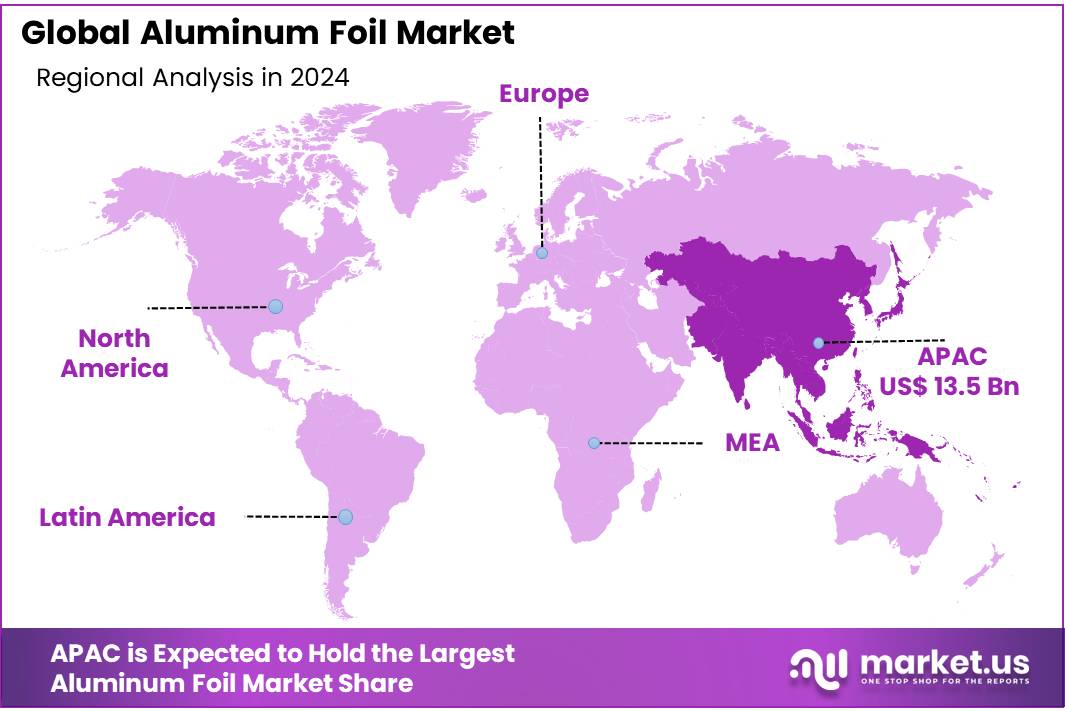

The Global Aluminum Foil Market size is expected to be worth around USD 48.8 Billion by 2034, from USD 29.1 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. Asia Pacific dominated a 46.70% market share in 2024 and held USD 13.5 Billion in revenue from the Air Compressor Market.

The global aluminum foil market has witnessed substantial growth over the past decade and is projected to continue expanding in the coming years. Aluminum foil, a versatile and sustainable material, is widely used across various industries, including packaging, construction, automotive, and electronics. The demand for aluminum foil is driven by its unique combination of characteristics, including light weight, flexibility, and resistance to moisture, oxygen, and light. These properties make it an ideal choice for food packaging, which remains the largest segment in the market.

Aluminum foil is manufactured by rolling aluminum sheets to thicknesses as low as 0.2 mm. The manufacturing process involves several stages of rolling, annealing, and cutting, resulting in a product that is used in diverse applications such as packaging, insulation, and industrial use. The market is highly fragmented with a mix of large multinational corporations and small to medium-sized players. The key global players in the aluminum foil market include companies like Reynolds Group Holdings, Novelis Inc., RUSAL, and Amcor, among others.

The Asia-Pacific region, led by China and India, dominates the aluminum foil market both in terms of production and consumption. In 2022, China accounted for nearly 40% of the global market share, primarily due to its large-scale manufacturing capabilities and the increasing demand for packaged food products. North America and Europe are also significant markets, driven by the need for sustainable packaging and growth in the automotive and construction sectors.

Several factors are contributing to the robust growth of the aluminum foil market. Firstly, the increasing demand for eco-friendly and recyclable packaging solutions is a major driver. As consumers and regulatory bodies push for more sustainable practices, aluminum foil, being 100% recyclable, presents a significant advantage over other packaging materials. This has led to its widespread adoption in food packaging, where it serves as a barrier to light, moisture, and air, extending the shelf life of food products.

Technological advancements in the use of aluminum foil in electronics, especially in flexible circuits and batteries, are expected to create new growth avenues. The ongoing development of 5G technology and electric vehicles (EVs) is likely to fuel demand for advanced aluminum foil products with high conductivity and thermal properties.

Key Takeaways

- Aluminum Foil Market size is expected to be worth around USD 48.8 Billion by 2034, from USD 29.1 Billion in 2024, growing at a CAGR of 5.3%.

- Standard aluminum foil held a dominant market position, capturing more than a 58.40% share of the overall market.

- 0.01-0.1 mm thickness range held a dominant market position, capturing more than a 46.30% share.

- 8000 Series held a dominant market position, capturing more than a 34.40% share of the aluminum foil market.

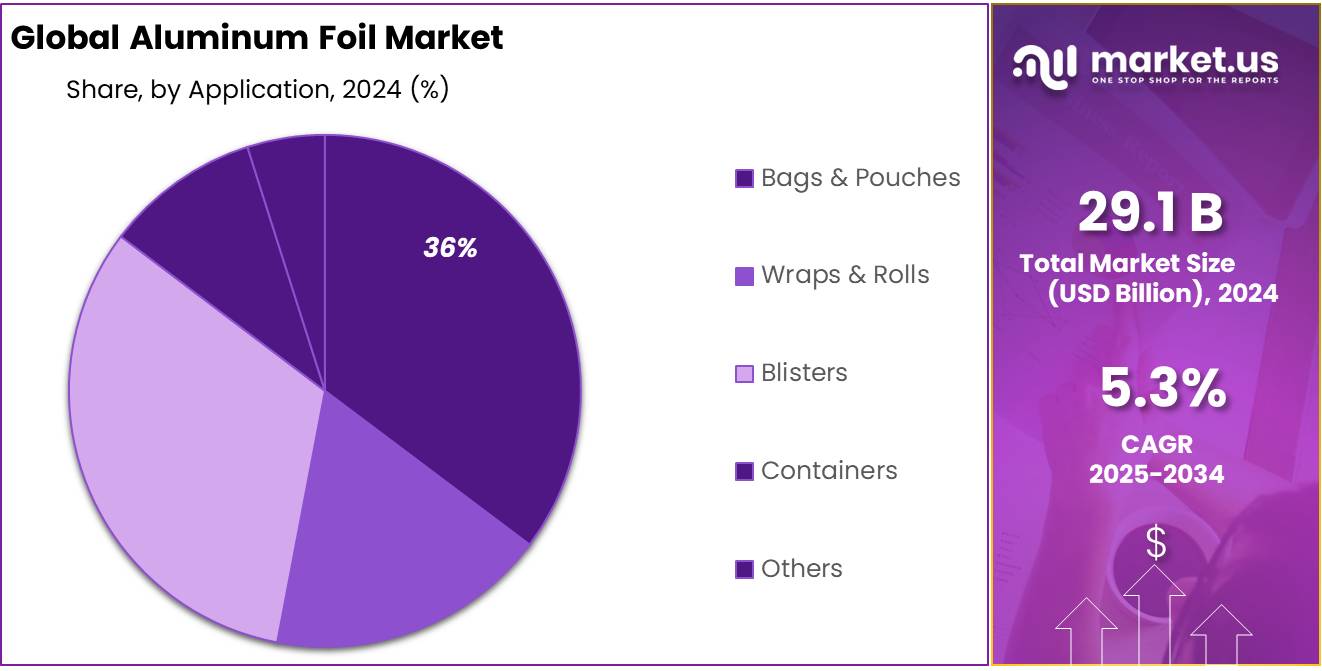

- Bags & Pouches held a dominant market position, capturing more than a 36.40% share of the aluminum foil market.

- Food & Beverages held a dominant market position, capturing more than a 41.30% share of the aluminum foil market.

- Asia Pacific (APAC) region dominated the aluminum foil market, capturing a significant 46.70% share and generating approximately $13.5 billion in revenue.

By Type Analysis

In 2024, Standard aluminum foil held a dominant market position, capturing more than a 58.40% share of the overall market. The popularity of standard aluminum foil is driven by its widespread use in both residential and commercial applications, particularly for food packaging, wrapping, and storage. Standard foil is known for its affordability and versatility, making it a go-to option for a variety of everyday tasks. Over the course of the year, this segment showed steady growth, fueled by consistent demand from consumers seeking reliable and cost-effective packaging solutions.

The Heavy Duty aluminum foil segment, while smaller than the standard type, held a significant share of the market, continuing to experience growth in 2024. This type of foil, typically thicker and more durable, is used in more demanding applications such as grilling, roasting, and industrial packaging. Its ability to withstand higher temperatures and offer greater strength made it a preferred choice for specific cooking and storage needs. Although the Heavy Duty segment didn’t surpass Standard foil in market share, it contributed steadily to the overall market, with a moderate increase in demand year-over-year.

The Extra Heavy Duty segment accounted for a smaller yet growing portion of the market in 2024. This type of foil is primarily used for heavy-duty industrial applications, including those requiring high heat resistance and durability, such as in automotive or aerospace industries. While this segment captured a smaller share, it saw a noticeable increase in usage driven by expanding industrial needs, particularly in sectors requiring robust packaging solutions that can withstand extreme conditions. However, the growth of this segment remains niche compared to the more general household usage seen in the Standard and Heavy Duty segments.

By Thickness Analysis

In 2024, the 0.01-0.1 mm thickness range held a dominant market position, capturing more than a 46.30% share of the aluminum foil market. This segment remains the most popular due to its versatility and wide application in both residential and commercial uses. The thin nature of this foil makes it ideal for everyday packaging needs, such as food storage, wrapping, and baking. It’s also commonly used in the foodservice industry, where ease of handling and cost-effectiveness are critical. The growth of the 0.01-0.1 mm segment was driven by a consistent rise in consumer demand, as it offers the right balance between performance and affordability.

The <0.01 mm thickness segment, while smaller in comparison, still saw a steady demand increase in 2024. This ultra-thin aluminum foil is primarily used in highly specialized applications, such as in the pharmaceutical and cosmetic industries for protective packaging. Though it captured a smaller market share, its importance in these niche industries allowed it to maintain a steady, albeit modest, growth trajectory. The segment’s growth is expected to continue at a slower pace in 2025, as demand in specialized sectors continues to drive the use of this thin foil.

The 0.1-0.2 mm thickness range also experienced a moderate rise in demand throughout 2024. This thickness is often used in more demanding tasks, such as grilling, roasting, and other cooking techniques that require slightly thicker material for durability and heat resistance. The segment’s growth was supported by both the retail and foodservice sectors, where thicker foil is seen as more suitable for high-heat applications. Though it does not capture as large a share as the 0.01-0.1 mm segment, it has shown resilience in its performance and is expected to continue growing in 2025, especially with the increasing popularity of grilling and outdoor cooking.

The >0.2 mm thickness segment remained the smallest throughout 2024, primarily driven by industrial applications requiring extra strength and durability. This thick foil is used in heavy-duty sectors like automotive and construction for protective covering and insulation purposes. The segment’s share remained limited, but it saw a slight uptick in demand, particularly from industries needing high-performance materials. Despite its smaller market footprint, it is projected to see gradual growth in 2025 as industrial sectors continue to prioritize stronger, more durable materials for specialized applications.

By Alloy Type Analysis

In 2024, the 8000 Series held a dominant market position, capturing more than a 34.40% share of the aluminum foil market. The 8000 Series is widely used due to its versatile properties, including excellent formability and resistance to corrosion. This alloy type is highly favored for packaging applications, particularly in the food and beverage industry, as it provides a reliable barrier to moisture and light. The segment also benefits from its widespread use in the production of flexible packaging and aluminum foil products for household and industrial applications. Its continued growth can be attributed to the growing demand for lightweight yet durable materials, as well as its cost-effectiveness in large-scale manufacturing.

The 1000 Series, while not as dominant as the 8000 Series, continued to show solid performance throughout 2024. This alloy is primarily composed of pure aluminum and is known for its excellent corrosion resistance and high thermal and electrical conductivity. The 1000 Series is commonly used in applications where these properties are critical, such as in electrical conductors, heat exchangers, and certain packaging solutions. In 2024, the segment saw steady growth, driven by consistent demand in industries such as electronics and automotive. Although its share remains smaller compared to the 8000 Series, the 1000 Series is expected to maintain a steady growth trajectory into 2025.

The 3000 Series also experienced moderate growth in 2024. This alloy type is known for its excellent strength and good corrosion resistance, making it suitable for a variety of applications, including roofing, siding, and some food packaging. The 3000 Series’ strong performance in both industrial and consumer sectors helped it capture a notable share of the market. However, it remains behind the 8000 and 1000 Series in overall demand. This segment’s growth is expected to continue steadily in 2025, particularly as the construction and automotive sectors look for aluminum alloys with improved durability and strength.

The 5000 Series saw a slower but consistent growth rate in 2024. Known for its higher strength and excellent corrosion resistance in marine environments, the 5000 Series is primarily used in marine, automotive, and transportation applications. While it holds a smaller share of the market compared to the 8000 and 1000 Series, its growth is driven by specific industrial needs, especially in industries requiring robust and long-lasting materials for challenging environments.

By Application Analysis

In 2024, Bags & Pouches held a dominant market position, capturing more than a 36.40% share of the aluminum foil market. This segment continues to lead due to the growing demand for flexible packaging solutions across various industries. Aluminum foil bags and pouches are favored for their ability to preserve the freshness, flavor, and shelf life of products, making them particularly popular in the food and beverage sector. The segment also benefits from increased adoption in the pharmaceutical and personal care industries, where protective, moisture-resistant packaging is essential.

The Wraps & Rolls segment remained a strong performer in 2024, although it held a smaller share compared to Bags & Pouches. Aluminum foil wraps and rolls are widely used in both household and commercial applications for food storage, cooking, and grilling. The affordability, convenience, and versatility of foil wraps continue to drive its demand. This segment saw steady growth as consumers and foodservice providers sought reliable materials for packaging and food preparation.

The Blisters segment, which is primarily used for pharmaceutical packaging, saw moderate growth in 2024. Aluminum foil blisters are used to package medications, providing excellent protection against moisture, light, and air, which helps maintain the efficacy and shelf life of pharmaceutical products. The segment’s growth is largely driven by the expanding global pharmaceutical industry, with increasing demand for blister packs for over-the-counter and prescription medications.

The Containers segment saw a stable performance in 2024, driven by aluminum’s lightweight and durable properties, which make it an ideal material for manufacturing containers for food, beverages, and other consumer goods. Aluminum containers are often used in ready-to-eat meals, takeaway food packaging, and beverage cans. This segment’s growth was fueled by the ongoing trend towards convenience foods and packaged meals, especially in the busy urban areas.

By End-use Analysis

In 2024, Food & Beverages held a dominant market position, capturing more than a 41.30% share of the aluminum foil market. The demand for aluminum foil in this sector remains high due to its ability to preserve food quality and extend shelf life. Aluminum packaging is particularly popular for snacks, ready-to-eat meals, and beverages, as it provides an excellent barrier against light, moisture, and air. The growing preference for convenient and portable food options, along with the increasing trend towards sustainable packaging solutions, further bolstered the demand for aluminum foil in this segment.

The Personal Care & Cosmetics segment also showed steady growth in 2024, driven by aluminum foil’s use in packaging for products like skincare, hair care, and cosmetics. Aluminum’s protective qualities make it an ideal material for preserving the integrity of sensitive cosmetic formulations, while its lightweight and eco-friendly nature appeal to both manufacturers and consumers. This segment’s growth is tied to the increasing global demand for beauty and personal care products, especially in emerging markets.

In the Pharmaceuticals sector, aluminum foil remains a critical material for packaging, particularly for blister packs, which protect medications from environmental factors. In 2024, the Pharmaceutical segment experienced moderate growth, fueled by the ongoing need for secure, tamper-proof packaging for both over-the-counter and prescription medications.

The Building & Construction industry also contributed to the aluminum foil market in 2024, though it held a smaller share compared to the food and beverage or pharmaceuticals sectors. Aluminum foil is widely used for insulation, offering excellent heat resistance and energy efficiency in both residential and commercial buildings. The construction boom, particularly in emerging economies, helped to push the demand for aluminum foil in this segment.

The Automotive & Transportation sector saw moderate growth in 2024, driven by aluminum’s role in lightweighting, thermal insulation, and soundproofing. Aluminum foil is increasingly used in vehicle parts, heat exchangers, and soundproof materials, helping manufacturers meet stringent fuel efficiency and environmental standards.

In the Electrical & Electronics industry, aluminum foil is used in capacitors, heat exchangers, and other electronic components due to its excellent conductivity and thermal properties. In 2024, this segment saw moderate but consistent growth, as the demand for electronic devices and renewable energy systems like solar panels continues to rise. As technology advances, the Electrical & Electronics segment is expected to see continued growth, particularly with the increasing use of aluminum in high-performance and energy-efficient electronics.

The Chemical & Petrochemical industry remained a smaller but significant end-use segment in 2024. Aluminum foil is used for packaging chemicals, oils, and other petrochemical products, where its resistance to corrosion and durability is highly valued. Although this sector didn’t see as rapid growth as Food & Beverages or Pharmaceuticals, steady demand from industrial applications allowed the segment to maintain a stable share.

The Oil & Gas industry also saw limited, but steady, demand for aluminum foil in 2024, primarily for insulation and protective coatings in offshore and onshore drilling operations. The need for robust and durable materials that can withstand extreme temperatures and corrosive environments helped to maintain this segment’s steady performance. However, as this market is more specialized, growth was slower compared to broader applications like food packaging or pharmaceuticals.

Key Market Segments

By Type

- Standard

- Heavy Duty

- Extra Heavy Duty

By Thickness

- <0.01 mm

- 0.01-0.1 mm

- 0.1-0.2 mm

- >0.2 mm

By Alloy Type

- 1000 Series

- 3000 Series

- 5000 Series

- 8000 Series

- Others

By Application

- Bags & Pouches

- Wraps & Rolls

- Blisters

- Containers

- Others

By End-use

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Building & Construction

- Automotive & Transportation

- Electrical & Electronics

- Chemical & Petrochemical

- Oil & Gas

- Others

Driving Factors

Increasing Demand for Sustainable Packaging Solutions

One major driving factor for the aluminum foil market is the increasing demand for sustainable packaging solutions. As global awareness of environmental issues grows, consumers and industries alike are seeking packaging materials that are both effective and eco-friendly. Aluminum foil, with its high recyclability and minimal ecological footprint when properly recycled, is becoming a preferred choice in this regard.

According to the Aluminum Association, nearly 75% of all aluminum ever produced is still in use today, thanks to effective recycling processes. This remarkable statistic highlights aluminum’s sustainability and its appeal as a packaging material. In the food and beverage industry, this attribute is particularly valuable. Packaging materials need to be not only functional but also environmentally responsible to meet both consumer demands and regulatory standards.

The U.S. Environmental Protection Agency (EPA) has noted that recycling aluminum saves over 90% of the energy needed to produce aluminum from raw materials. This energy efficiency is a significant selling point for industries looking to reduce their environmental impact and operational costs. The EPA’s emphasis on recycling and sustainable practices has spurred many industries, including food and beverages, to adopt aluminum foil in their packaging solutions.

In the context of the food industry, major organizations such as the Food and Agriculture Organization (FAO) have underscored the importance of sustainable packaging in reducing food waste. Proper packaging, particularly in perishable goods, extends shelf life and reduces the carbon footprint associated with the disposal of spoiled food. Aluminum foil’s barrier properties against light, oxygen, and moisture make it an excellent material for preserving food quality and freshness.

Furthermore, government initiatives across various countries have been instrumental in driving the adoption of sustainable packaging materials. For example, the European Union’s Circular Economy Action Plan encourages the use of materials that are fully recyclable, such as aluminum, to create a more sustainable economy. This plan not only promotes aluminum foil in packaging but also supports the infrastructure for its recycling.

Restraining Factors

Rising Costs and Availability of Raw Materials

A significant restraining factor impacting the aluminum foil market is the rising costs and fluctuating availability of raw materials. These challenges are primarily driven by economic factors, trade policies, and environmental regulations, which can significantly impact the production costs and supply chain dynamics for aluminum foil manufacturers.

The price of aluminum, the primary raw material for aluminum foil, is subject to volatility based on global market conditions. According to data from the London Metal Exchange, aluminum prices have seen fluctuations ranging from $1,700 to $2,500 per metric ton over recent years. This variability can be attributed to several factors, including changes in global demand, trade tensions, and production adjustments in major aluminum-producing countries.

Trade policies play a crucial role in this dynamic. For instance, tariffs imposed on aluminum imports can elevate costs for manufacturers relying on imported raw materials, directly affecting the production costs of aluminum foil. Such policies not only increase the cost of raw materials but also lead to uncertainties in the supply chain, making it challenging for manufacturers to plan and execute cost-effective production schedules.

Environmental regulations also contribute to the cost structure. The production of aluminum is energy-intensive and has significant environmental impacts, leading to stringent regulations aimed at reducing these effects. For example, governments across the globe are implementing stricter emission standards and encouraging the adoption of greener technologies in aluminum production. While these initiatives are positive for the environment, they also increase the operational costs for aluminum producers, which in turn affects the price of raw materials for aluminum foil production.

In the food and beverage industry, where packaging costs are a significant component of product pricing, the rise in aluminum foil costs can lead to higher product prices or reduced margins. This impact is particularly acute for small and medium-sized enterprises (SMEs) that may not have the financial flexibility to absorb higher raw material costs or negotiate better terms with suppliers.

Furthermore, the food industry is under constant pressure to reduce packaging costs while maintaining product quality and compliance with food safety standards. In this context, the volatility in aluminum prices poses a considerable challenge, compelling companies to explore alternative materials or innovative packaging solutions that may offer more stable pricing and supply scenarios.

Growth Opportunity

Expansion into Emerging Markets

A significant growth opportunity for the aluminum foil market lies in its expansion into emerging markets. These regions, characterized by rapid urbanization, increasing disposable income, and changing lifestyles, are witnessing a growing demand for convenient, durable, and sustainable packaging solutions. Aluminum foil, with its excellent barrier properties and recyclability, is ideally positioned to meet these needs.

Emerging markets in Asia, Africa, and Latin America are experiencing robust growth in the food and beverage sector, driven by a burgeoning middle class and increased consumer spending on packaged goods. According to a report by the Food and Agriculture Organization (FAO), urban areas in these regions are seeing faster food consumption changes than rural areas, with a noticeable shift towards packaged and processed foods. This shift is largely due to the urban lifestyle, which emphasizes convenience and time-saving products.

The growth in these markets is not just driven by consumer demand but also by the supportive policies of local governments aiming to improve food safety standards and promote sustainable packaging solutions. For example, India’s National Action Plan on Climate Change emphasizes the importance of reducing waste through recycling initiatives and has introduced various incentives for industries that adopt green technologies. This policy framework supports the use of materials like aluminum foil, which are 100% recyclable and align with the country’s sustainability goals.

Moreover, the expansion into these markets is facilitated by the development of retail infrastructure and the proliferation of supermarkets and hypermarkets, which are crucial for the distribution of packaged goods. These retail spaces increase the visibility and accessibility of products using aluminum foil packaging, further driving its demand.

However, tapping into these emerging markets also requires addressing unique challenges such as logistical complexities, local competition, and the need to adapt marketing strategies to fit cultural nuances. Companies looking to capitalize on these opportunities often partner with local firms to navigate these challenges effectively, leveraging local expertise and networks.

In addition to food and beverage, the healthcare sector in these regions presents another lucrative avenue for the growth of aluminum foil. The pharmaceutical market in emerging economies is growing rapidly, thanks to increased healthcare spending and government initiatives to enhance healthcare infrastructure. Aluminum foil’s role in pharmaceutical packaging, especially in blister packs, is critical for ensuring the protection and longevity of medical products. The material’s barrier properties against moisture, light, and oxygen play a vital role in maintaining the efficacy of pharmaceuticals.

Furthermore, the automotive and electronics sectors in emerging markets are expanding, with a rising demand for lightweight and durable materials. Aluminum foil is used in various applications within these industries, including thermal insulation and electromagnetic shielding. This diversification in applications presents multiple avenues for growth beyond traditional food packaging.

Latest Trends

Rising Demand for Eco-Friendly and Recyclable Packaging

One of the latest trends in the aluminum foil market is the growing demand for eco-friendly and recyclable packaging, driven by heightened environmental awareness among consumers and stricter sustainability regulations by governments. As industries, particularly food and beverage, pivot toward reducing their environmental footprint, aluminum foil has emerged as a key player due to its high recyclability and minimal environmental impact when reused effectively.

According to the World Economic Forum, nearly 300 million tons of plastic waste are produced every year, and less than 10% of it is recycled. This alarming statistic has pushed companies to explore sustainable alternatives to plastic. Aluminum foil, which is 100% recyclable and requires only 5% of the energy to recycle compared to its initial production, is becoming an attractive option for manufacturers. In food packaging, where single-use materials are prevalent, aluminum foil offers a more sustainable solution while maintaining excellent barrier properties.

Government initiatives worldwide are also fueling this trend. For example, the European Union’s Single-Use Plastics Directive aims to ban or restrict single-use plastic items and promote materials that are recyclable and reusable. Similarly, the U.S. Environmental Protection Agency (EPA) has launched campaigns to increase recycling rates for materials like aluminum, emphasizing its role in reducing landfill waste and conserving energy. These initiatives encourage industries to adopt aluminum foil as a sustainable packaging alternative.

In the food sector, major companies are integrating aluminum foil into their sustainability strategies. For instance, Nestlé has committed to making 100% of its packaging recyclable or reusable by 2025, with aluminum foil playing a significant role in achieving this goal. Similarly, Unilever has started replacing multi-layer plastic packaging with recyclable aluminum foil in select products. These shifts by industry leaders signal a broader transition toward eco-friendly packaging.

Consumers are also playing a vital role in this trend. A survey by the GlobalWebIndex revealed that 66% of consumers are willing to pay more for sustainable products. This preference for environmentally friendly solutions has pushed businesses to adopt aluminum foil in their packaging designs, particularly in premium and organic product lines. The material’s ability to preserve freshness while aligning with green values has made it a preferred choice among environmentally conscious consumers.

Technological advancements are further enhancing the appeal of aluminum foil. Innovations such as thinner foil gauges and improved recycling processes are helping manufacturers reduce material usage without compromising functionality. For example, researchers are developing advanced coatings for aluminum foil that improve its barrier properties, making it suitable for even more applications while remaining fully recyclable.

Regional Analysis

In 2024, the Asia Pacific (APAC) region dominated the aluminum foil market, capturing a significant 46.70% share and generating approximately $13.5 billion in revenue. This dominance is driven by rapid industrialization, urbanization, and the growing demand for packaged food, beverages, and pharmaceuticals across key economies like China, India, and Japan. China, as the largest producer and consumer of aluminum foil in the region, plays a crucial role in driving market growth due to its vast manufacturing base and government initiatives to promote sustainable materials.

North America holds a substantial market share, supported by high demand from the food and beverage, pharmaceutical, and automotive sectors. The region’s focus on sustainability and advanced recycling technologies further bolsters the use of aluminum foil. The U.S., in particular, remains a key contributor due to its established packaging industry and consumer demand for convenient, eco-friendly products.

In Europe, the aluminum foil market is buoyed by strict environmental regulations and a well-developed recycling infrastructure. The European Union’s initiatives to reduce single-use plastics have accelerated the shift toward aluminum foil as a sustainable alternative, with major growth in countries like Germany, France, and the UK.

Middle East & Africa and Latin America, though smaller contributors, are showing steady growth. Increasing urbanization, improved living standards, and growing investments in food and pharmaceutical sectors are driving demand in these regions. While their market shares remain modest, expanding industrial bases and supportive government policies hint at future potential for growth.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The aluminum foil market is characterized by the presence of several prominent players, each contributing to market growth through innovation, extensive production capacities, and strategic collaborations. RusAL, one of the world’s largest aluminum producers, plays a critical role in the market with its focus on sustainable production and advanced recycling technologies.

Similarly, Carcano Antonio S.p.A. stands out for its expertise in producing high-quality aluminum foil tailored for pharmaceutical and food packaging applications, further strengthening its presence in Europe. Aditya Birla Management Corporation Pvt. Ltd., through its subsidiary Hindalco Industries, is a key player with a vast global footprint and a focus on eco-friendly foil products.

Eurofoil and UACJ Foil Corporation are pivotal in driving innovation in lightweight and high-strength aluminum foil products, catering to sectors such as aerospace and automotive. Companies like Jindal (India) Limited and Zhejiang Junma Aluminium Industry Co., Ltd. are leading contributors in the Asia-Pacific region, leveraging their advanced manufacturing capabilities to meet the growing demand for aluminum foil in food, beverage, and industrial applications.

Global players like Amcor plc and Reynolds Consumer Products dominate in consumer packaging, offering sustainable and convenient solutions for households and food service industries. Henan Huawei Aluminium Co., Ltd. and Assan Aluminum Industry and Trade Inc. focus on innovative production techniques, enhancing the performance and durability of aluminum foil. Companies such as Shanghai Metal Corporation and Eramco continue to strengthen the market with diverse product offerings, catering to niche applications.

Top Key Players

- RusAL

- Carcano Antonio S.p.A.

- Aditya Birla Management Corporation Pvt. Ltd.

- Eurofoil

- UACJ Foil Corporation

- Jindal (India) limited

- Zhejiang Junma Aluminium Industry Co., Ltd.

- Amcor plc

- Henan Huawei Aluminium Co., Ltd

- Assan Aluminum Industry and Trade Inc.

- Reynolds Consumer Products

- Shanghai Metal Corporation

- Eramco

- Other Key Players

Recent Developments

- November 2024 RUSAL, the company announced plans to reduce aluminum production by 250,000 tons due to high alumina costs and economic uncertainties.

- In 2024, Carcano expanded its converting production unit by 25,000 square meters, focusing on pharmaceutical-grade aluminum foil.

Report Scope

Report Features Description Market Value (2024) US$ 29.1 Bn Forecast Revenue (2034) US$ 48.8 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Standard, Heavy Duty, Extra Heavy Duty), By Thickness (<0.01 mm, 0.01-0.1 mm, 0.1-0.2 mm, >0.2 mm), By Alloy Type (1000 Series, 3000 Series, 5000 Series, 8000 Series, Others), By Application (Bags and Pouches, Wraps and Rolls, Blisters, Containers, Others), By End-use (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Building and Construction, Automotive and Transportation, Electrical and Electronics, Chemical and Petrochemical, Oil and Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape RusAL, Carcano Antonio S.p.A., Aditya Birla Management Corporation Pvt. Ltd., Eurofoil, UACJ Foil Corporation, Jindal (India) limited, Zhejiang Junma Aluminium Industry Co., Ltd., Amcor plc, Henan Huawei Aluminium Co., Ltd, Assan Aluminum Industry and Trade Inc., Reynolds Consumer Products, Shanghai Metal Corporation, Eramco, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- RusAL

- Carcano Antonio S.p.A.

- Aditya Birla Management Corporation Pvt. Ltd.

- Eurofoil

- UACJ Foil Corporation

- Jindal (India) limited

- Zhejiang Junma Aluminium Industry Co., Ltd.

- Amcor plc

- Henan Huawei Aluminium Co., Ltd

- Assan Aluminum Industry and Trade Inc.

- Reynolds Consumer Products

- Shanghai Metal Corporation

- Eramco

- Other Key Players