Global Commercial Flooring Market By Product Type (Soft Coverings, Resilient, Non-resilient, Seamless, Wood and Laminates), By Application Healthcare, Education, Leisure and Hospitality, Retail And Commercial Buildings), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 12464

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

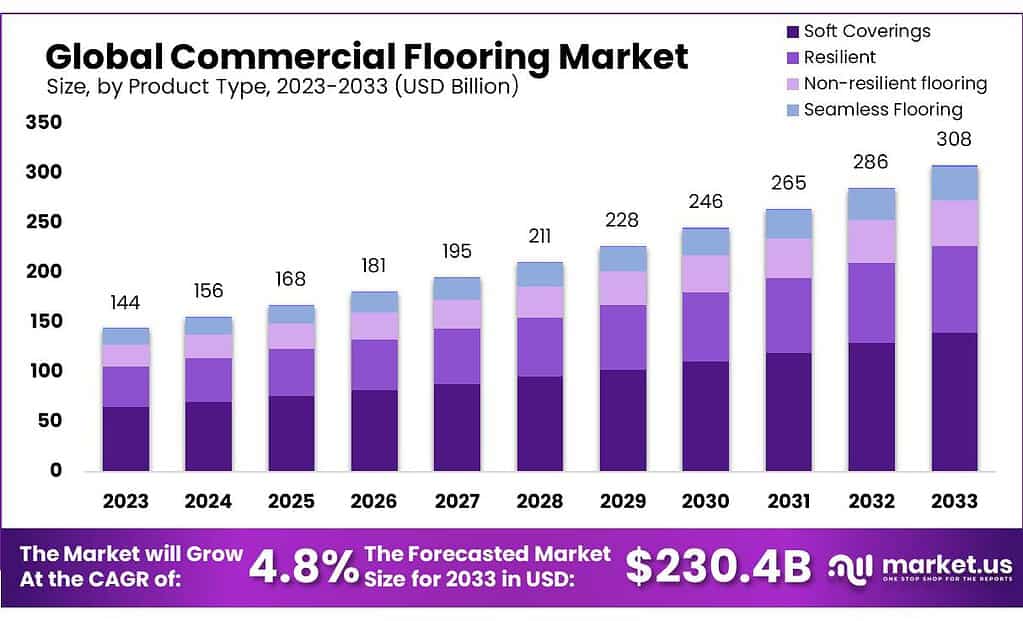

The Commercial Flooring Market size is expected to be worth around USD 308 billion by 2033, from USD 144 billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

The Commercial Flooring Market refers to the industry involved in providing flooring solutions specifically tailored for commercial and business environments. This encompasses a wide range of flooring materials, designs, and installation services that cater to the unique needs and requirements of commercial spaces, such as offices, retail stores, hotels, healthcare facilities, and industrial settings.

The market focuses on delivering durable, aesthetically pleasing, and functional flooring options that can withstand heavy foot traffic, maintain safety standards, and contribute to the overall ambiance and functionality of commercial spaces. Changing consumer lifestyles, escalating demand for insulation and rising construction demand are all contributing factors to market growth. These are the key driving factors.

Key Takeaways

- Market Growth: Commercial Flooring Market is to reach USD 308 billion by 2033, growing at a CAGR of 4.8% from 2023 (USD 144.21 billion in 2023).

- Wide Application: The market caters to various sectors, with Soft Coverings dominating at 46.9% in 2023.

- Commercial Buildings: Leading segment in 2023 with over 25.7% market share.

- Drivers: Demand for durable and aesthetically pleasing floors, eco-friendly materials, and tech integration.

- Restraints: Cost challenges, installation complexities, and maintenance demands may hinder adoption.

- Opportunities: Innovation in smart flooring, eco-friendly materials, customization, and simplified installation methods.

- Regional Dominance: APAC holds the largest revenue share at 46.2% in 2023, driven by infrastructure growth.

Product type analysis

In 2023, the commercial flooring market witnessed distinct segments dominating its landscape. Soft Coverings took the lead, holding more than 46.9% of the market. These comfy and good-looking coverings were used a lot in places like hospitals, schools, hotels, shops, and different kinds of buildings. They were liked for their soundproofing and how flexible they were, making them very popular.

Because anti-microbial flooring products are becoming increasingly significant in the healthcare industry, carpets will become more popular. It is anticipated that Mannington and other businesses will invest more money in broadloom items for the medical industry shortly. This will have a big effect on the market for commercial flooring.

Over the next eight years, the market for resilient flooring is anticipated to expand dramatically because of its affordability and simplicity of installation. These goods come in a variety of materials, including vinyl, rubber, and linoleum, and are strong, adaptable, and elastic.

238.0 million square meters of seamless applications were used in commercial settings in 2021. These flooring options are perfect for vulnerable floors. Spills, Safety, sturdiness, ease of use, and cleanability are just a few of their many advantages.

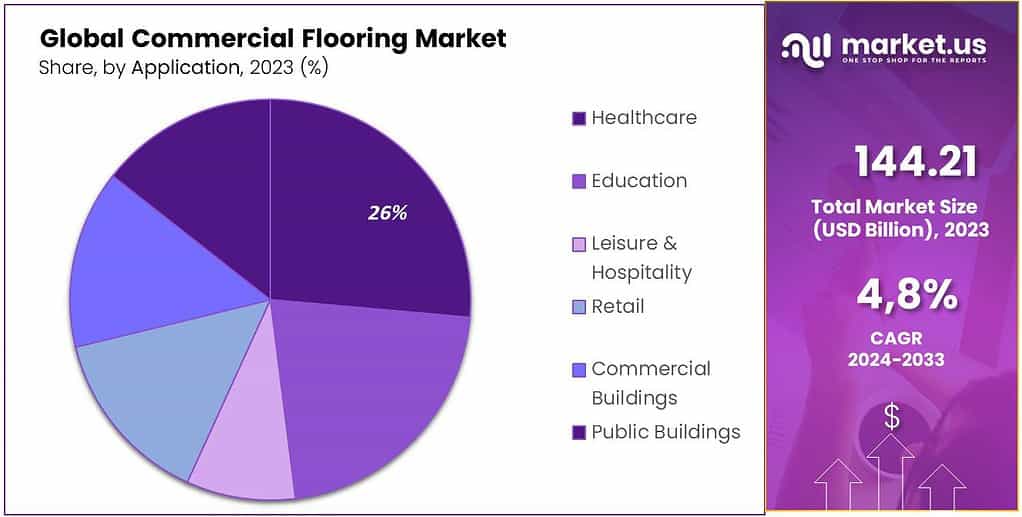

Application analysis

In 2023, the Commercial Buildings segment emerged as a leader, holding a significant market share of more than 25.7%. This segment includes various spaces like office buildings, business areas, and workspaces. They favored specific flooring types to suit their professional environment, emphasizing durability and aesthetics for lasting impressions.

Following closely, the Healthcare segment played a substantial role in the commercial flooring market. Hospitals and medical facilities required flooring designed for high traffic, hygiene, cleanliness, and patient safety. Healthcare flooring must be easily cleanable while remaining slip-resistant to protect patient wellbeing.

In public structures, such as offices of the government and municipal corporations, several floor surfaces may be employed. In public buildings, foot traffic is the heaviest. Demand for strong and long-lasting flooring materials will increase in public buildings during the upcoming years.

For commercial spaces, synthetic flooring is a consideration because normal floorings like wood or tile do not stand up well to repeated cleanings.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Soft Coverings

- Soft covering by application

- Healthcare

- Education

- Leisure & Hospitality

- Retail

- Commercial Buildings

- Public Buildings

- Soft covering by application

- Resilient

- Resilient by application

- Healthcare

- Education

- Leisure & Hospitality

- Retail

- Commercial Buildings

- Public Buildings

- Resilient by application

- Non-resilient flooring

- Non-resilient by application

- Healthcare

- Education

- Leisure & Hospitality

- Retail

- Commercial Buildings

- Public Buildings

- Non-resilient by application

- Seamless Flooring

- Seamless by application

- Healthcare

- Education

- Leisure & Hospitality

- Retail

- Commercial Buildings

- Public Buildings

- Seamless by application

- Wood & Laminates

- Wood & laminates by application

- Healthcare

- Education

- Leisure & Hospitality

- Retail

- Commercial Buildings

- Public Buildings

- Wood & laminates by application

By Application

- Healthcare

- Education

- Leisure & Hospitality

- Retail

- Commercial Buildings

- Public Buildings

Drivers

The building of new offices, shops, and hotels is making the need for tough and good-looking floors go up. These places need strong floors that also look nice, driving the demand for better flooring options. This helps the commercial flooring market to grow.

Companies want floors that match their style and logo. Stores and hotels especially want unique floors that look special. This need for fancy floors encourages companies to think of new ideas and helps the market to grow. Businesses across retail and hospitality emphasize unique floor designs to match their brand identities.

Companies really care about how their floors look to match their style. This makes the flooring industry come up with new ideas and cool designs, making the market bigger. Businesses are choosing eco-friendly materials like recycled stuff or bamboo for their floors. This helps the environment and makes new types of floors that people want, making the market grow. Innovative Technology Integration in flooring, such as smart flooring equipped with sensors, is becoming more prevalent.

These technological advancements, offering functionalities like foot traffic monitoring or energy efficiency, are gaining popularity in modern commercial spaces. The integration of technology in flooring solutions enhances efficiency and functionality, meeting the needs of contemporary businesses and contributing to the expansion of the commercial flooring market.

Restraints

Commercial Flooring Market Limitations Due to Cost, the commercial flooring market faces challenges related to cost. Premium materials often carry higher price tags that may present obstacles for some businesses operating with tight budgets or smaller enterprises. Due to these higher costs, superior flooring solutions may limit accessibility or adoption forcing companies to settle for cheaper but potentially less durable or visually appealing options instead.

Installation Complexities, Certain types of commercial flooring materials require special techniques or professionals for proper fitting, resulting in prolonged installation periods, increased labor costs, and potential disruptions to business operations. Businesses might experience difficulties finding skilled installers or managing downtime during installation; such complexities serve as deterrents to adoption of specific flooring solutions in the market.

Maintenance Demands, Commercial flooring options may present unique maintenance demands that could present obstacles for businesses. While certain materials might provide durability, they might require frequent or specialized maintenance that adds operational costs for businesses.

Maintenance demands could dissuade decision-makers from selecting particular flooring solutions, inhibiting widespread adoption in the market. These restraints pose challenges in terms of cost, installation complexities, and ongoing maintenance demands, impacting the accessibility and adoption of certain flooring solutions within the commercial flooring market.

Opportunities

Technological Advancements, The commercial flooring market is experiencing an explosion of technological innovations that present growth opportunities. Smart and interactive flooring solutions equipped with sensors or interactive features have become common in modern commercial spaces, giving manufacturers opportunities to provide cutting-edge solutions aligned with evolving business requirements.

There is an ever-increasing demand among commercial businesses for eco-friendly flooring materials, and businesses increasingly opt for recycled materials, bamboo and cork solutions as ways to meet environmental awareness goals and corporate sustainability initiatives. Manufacturers that invest in such sustainable flooring options take advantage of this trend to expand market presence and capitalize on this growing demand.

Customization and Design Trends in the Commercial Flooring Market, Businesses that prioritize aesthetics and branding when selecting flooring solutions prioritize customized flooring designs that align with their brand identities and interior design trends. This trend creates opportunities for innovative and unique flooring designs from manufacturers who can meet diverse customization demands.

Simplified Installation Methods, The market offers opportunities in developing user-friendly and straightforward installation flooring solutions. Manufacturers focusing on simplified processes that save both time and labor costs can capitalize on this opportunity to provide convenient flooring options that won’t disrupt businesses looking for efficient installation methods.

These opportunities for technological advances, sustainability, design trends and simplified installation methods open the doors to innovation within the commercial flooring market.

Challenges

Cost Constraints, The primary challenge in the commercial flooring market lies in cost considerations. Advanced and premium-grade flooring materials tend to carry higher price tags, which may present smaller businesses or those operating with tight budgets with difficulties justifying such investments.

Initial investments required might prevent some businesses from adopting them altogether and push them instead towards less durable or visually appealing but more cost-effective options that might cost less in initial outlay or maintenance expenses.

Rapid Technological Changes, Commercial flooring manufacturers face a unique set of challenges from technology’s constant advancement. Staying abreast of rapid advancements requires substantial investments and constant innovation; staying abreast of trends while adapting solutions with evolving technologies can be demanding and financially strainsome for manufacturers.

Sourcing Environmental Materials, While sustainability offers numerous opportunities, it also poses unique challenges. Finding eco-friendly materials for flooring solutions may prove difficult as adhering to ethical sourcing practices and responsible supply chains may restrict material availability or drive up production costs.

Installation and Maintenance Complications, Some advanced flooring materials require complex installation techniques or ongoing maintenance that requires skilled professionals – which creates additional challenges for businesses that want to implement certain flooring solutions. Finding qualified installers may become challenging for them and managing ongoing efforts may become cumbersome – potentially hindering adoption efforts for certain flooring options.

These challenges include cost considerations, technological advancements, sustainable material sourcing needs and installation complexity – affecting accessibility and adoption rates of various flooring solutions in the commercial flooring market.

Regional Analysis

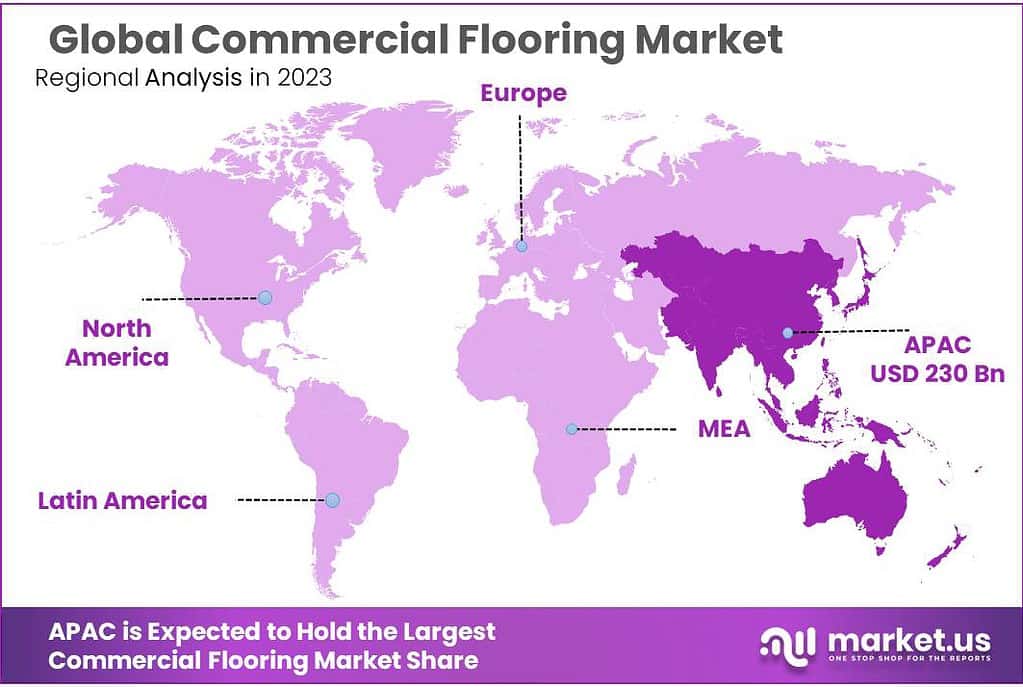

Asia Pacific (APAC) had the largest revenue share at over 46.2% in 2023. By the conclusion of the projection period, it is anticipated to be the region segment with the quickest growth. This is a result of infrastructure growth and the real estate markets in China and India experiencing tremendous growth. The need for spaces in non-residential buildings will rise in the area as well. Growth in population and rapid urbanization might be held responsible for this.

In 2021, the greatest market shares for commercial floorings were held by North America and Europe. Green building construction is predicted to expand in the U.S. by 2025, which would boost demand for lightweight and eco-friendly floor coverings. The severe VOC standards in the nation and padding materials will cause a reduction in the market share for softcover floorings.

Central and South America will be a significant market for commercial flooring in the upcoming years. The rapid expansion of the commercial construction industry, upcoming infrastructure projects, as well as the growth of the hotel industry are some of the main growth drivers for building materials, including paints and coatings, and floor coverings.

The market in the APAC region will increase as a result of ongoing projects, population growth, fast urbanization, and the expansion of infrastructure facilities in China and India.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

- Latin America

Key Players Analysis

Hanwha, LG Hausys, and China National Building Material Co. Ltd. are major players in the commercial flooring market. Nora, Milliken Floor Covering is also a participant. Novalis, Tajima Tkflor, NOX Corporation, and Toli Flooring are other key players. To help shoppers choose the right product for their needs, vendors are continually innovating new goods.

Due to the global presence of many manufacturers, this industry is fragmented. In 2015, prominent market shares were held by Tarkett, Mohawk Industries, Armstrong Flooring, Inc., Interface Inc., and Tarkett. These companies offer a wide range of flooring options. These companies accounted for 22.6% of the total 2021 share.

Commercial flooring companies aim to increase their market share by expanding their customer base. These manufacturers also focus on distribution, new product launches, and product expansion to gauge future demand patterns for emerging applications. Key players in the market are expected to benefit from the existing and emerging applications.

Companies are also working to expand their product range by improving the quality of existing flooring materials and introducing new value-added products that meet end-user needs. Key industry players also employ other strategies to expand their operations, such as collaborations and acquisitions.

Маrkеt Кеу Рlауеrѕ

- Amtico

- The Armstrong Flooring, Inc.

- Congoleum

- Flowcrete (RPM)

- Forbo International SA

- Gerflor

- Interface, Inc.

- IVC Group

- James Halstead Plc.

- Mannington Mills, Inc.

- NOX Corp.

- Tkflor

- Nora

- Toli Flooring

Recent Developments

In June 2022, Mohawk Industries, Inc. and Grupo Industrial Saltillo established an agreement for the first party to pay the latter US$ 293 million in cash for its ownership of the Vitromex ceramic tile company.

In April 2022, Blanchon Group recently acquired RIGO, a company that designs and manufactures wood finishing materials and paints specifically tailored for historic structures.

In February 2022, Paceline Equity Partners LLC acquired AHF Products, an internationally recognized hard surface flooring manufacturer.

Report Scope

Report Features Description Market Value (2022) US$ 144 Bn Forecast Revenue (2032) US$ 308 Bn CAGR (2023-2032) 4.8% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Soft Coverings, Soft covering by application, Healthcare, Education, Leisure & Hospitality, Retail, Commercial Buildings, Public Buildings, Resilient, Resilient by application, Healthcare, Education, Leisure & Hospitality, Retail, Commercial Buildings, Public Buildings, Non-resilient flooring, Non-resilient by application, Healthcare, Education, Leisure & Hospitality, Retail, Commercial Buildings, Public Buildings, Seamless Flooring, Seamless by application, Healthcare, Education, Leisure & Hospitality, Retail, Commercial Buildings, Public Buildings, Wood & Laminates, Wood & laminates by application, Healthcare, Education, Leisure & Hospitality, Retail, Commercial Buildings, Public Buildings), By Application(Healthcare, Education, Leisure & Hospitality, Retail, Commercial Buildings, Public Buildings) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amtico, The Armstrong Flooring, Inc., Congoleum, Flowcrete (RPM), Forbo International SA, Gerflor, Interface, Inc., IVC Group, James Halstead Plc., Mannington Mills, Inc., NOX Corp., Tkflor, Nora, Toli Flooring Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Commercial Flooring Market?Commercial Flooring Market size is expected to be worth around USD 308 billion by 2033, from USD 144 billion in 2023

What is the projected CAGR at which the Commercial Flooring Market is expected to grow at?The Commercial Flooring Market is expected to grow at a CAGR of 4.8% (2023-2033).What is the Commercial Flooring Market?The Commercial Flooring Market is an industry that provides flooring solutions designed for commercial and business environments. It includes a wide range of flooring materials and installation services tailored to the needs of commercial spaces such as offices, retail stores, healthcare facilities, and more.

-

-

- Amtico

- The Armstrong Flooring, Inc.

- Congoleum

- Flowcrete (RPM)

- Forbo International SA

- Gerflor

- Interface, Inc.

- IVC Group

- James Halstead Plc.

- Mannington Mills, Inc.

- NOX Corp.

- Tkflor

- Nora

- Toli Flooring