Global Pet Supplements Market By Pet Type (Dogs, Cats, Freshwater Fish, & Others), By Form (Tablets/Pills, Powders, Chewables, and Others), By Application (Multivitamins, Skin & Coat, Prebiotics & Probiotics, Hip & Joints, and Others), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Dec 2023

- Report ID: 36032

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

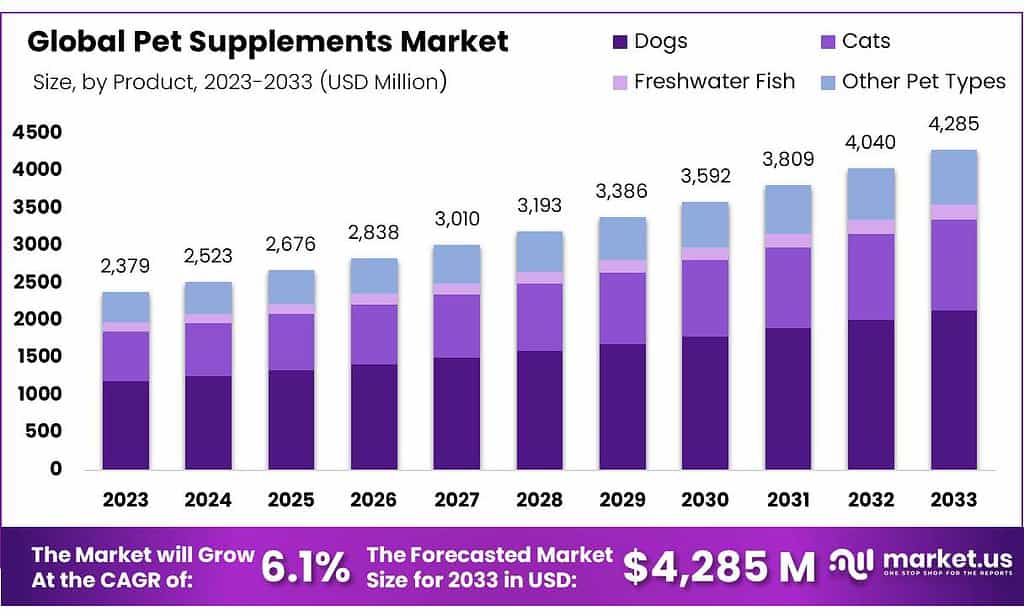

The Global Pet Supplements Market size is expected to be worth around USD 4,285 Million by 2033 from USD 2,379.0 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2032.

The global pet supplements market is currently experiencing rapid expansion, driven by various factors including the humanization of pets and its far-reaching ramifications as evidenced by the COVID-19 pandemic’s surge in pet adoptions combined with significant online demand for supplements for these pets.

This development has presented novel avenues for direct pet product sales to pet owners, offering smaller brands an opportunity to compete against established giants of the pet food industry. Furthermore, several trends are converging to drive demand for supplements for our four-legged friends.

Consumers today face numerous factors that have driven them away from pharmaceutical interventions: rising single-person households, skyrocketing vet care costs, and an aging pet population are just a few examples; with all this combined leading them to seek alternative solutions.

As lifestyles continue to adapt, the humanization of pets has seen an exponential surge in several countries due to the ever-expanding ownership among younger generations, and an associated change in perception – wherein pets become considered full family members – is at the root of market expansion.

Key Takeaways

- The global pet supplements market will be valued at US$ 2,379.0 Million in 2023.

- The global pet supplements market is projected to reach US$ 4,285 Million by 2033.

- Among pet types, dog pets accounted for the largest market share of 49.9%.

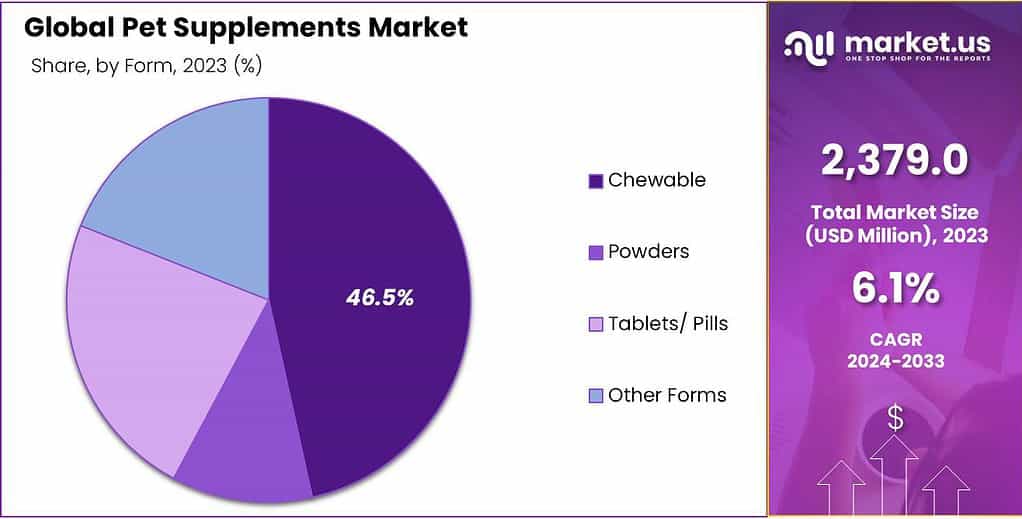

- Among forms, Chewable pet supplements accounted for the majority of the market share with 46.5%.

- Based on application, Hip & Joint is expected to account for the largest market share in 2023 with 18.0%.

- Among distribution channels, the offline stores hold a 61.2% revenue share.

- With 66% of U.S. households owning pets, there is a vast and diverse customer base for pet supplements. This widespread ownership indicates a substantial market opportunity for companies producing pet supplements.

- The substantial increase in pet spending from $123.6 billion in 2021 to $136.8 billion in 2022 reflects a growing willingness among pet owners to invest in their pets’ health and comfort. This includes expenditures on pet supplements, which are considered an integral part of pet care and well-being.

Pet Type Analysis

Dog Supplements Dominate The Global Pet Supplement Market Due To High Adoption Rates Of Dogs

The global pet supplements market can be divided up according to pet type into dogs, cats, freshwater fish, and others; out of these segments, the dogs segment held 49.9% revenue share as of 2023.

Dog supplements dominate the global pet supplements market due to a combination of factors including an increasing global pet dog population, more lavish spending by pet parents on health and wellness care for their canines, as well as numerous health problems prevalent among canines that supplements can address.

Additionally, this segment holds an impressive market share due to the abundance of supplements specifically formulated for dogs that address issues related to joint health, digestive wellness, and coat care. Dogs remain among the world’s most beloved companions!

According to the National Pet Owners Survey, many households in countries like the U.S. own dogs; this high adoption rate directly contributes to an expanding market for dog products such as supplements.

Form Analysis

Chewable Supplements Dominate The Market Due To Their Easy Consumption.

Form-wise, the market can be broken down further into chewables, powders, tablets/pills and other forms. Chewable supplements accounted for 46.5% market share by form in 2023 – cats and dogs particularly tend to find chewing more natural than swallowing pills or tablets!

Chewable supplements are designed to fit with their instinctive behavior of chewing food, making the administration of supplements simpler for both pets and their owners. Chewable supplements often come with flavors and textures designed specifically to entice pets’ tastebuds.

Pet owners find chewable supplements easier for ensuring their animals take in necessary supplements without resistance, leading to its popularity and market dominance in pet supplement industries.

Application Analysis

With Arthritis prevalence rising among pet population, Hip & Joint Supplements for Animals have expanded marketshare exponentially.

On the basis of application, the global pet supplements market can be divided into multivitamins, skin & coat, prebiotics & probiotics, hip & joint supplements (hips & joint are estimated to hold 18.0% market share), digestive health supplements such as digestive enzymes or digestive vitamins as well as other applications that promote joint health such as MSM for joint mobility and stability.

This segment’s growing appeal reflects pet owner awareness of joint issues among older or larger breeds that are susceptible to conditions like arthritis. Hip and joint supplements play a crucial role in providing mobility and quality of life to these pets as they age.

Distribution Channel Analysis

Immediate Accessibility Of Products at Offline Stores Makes it a Major Segment

The market is segregated into offline and online. Among these, the offline segment is estimated to account for the majority of revenue share of 61.2% by 2023. This implies that despite the growing trend and convenience of online transactions, a significant portion of consumers still prefer offline methods.

This could be due to various factors such as the tactile experience of shopping in physical stores, the immediacy of acquiring products, personal customer service, or distrust in online payment systems. Unlike online shopping, which involves waiting for delivery, offline shopping provides instant gratification. Customers can immediately obtain the product, which is particularly important in urgent situations, such as needing a specific pet supplement quickly.

Key Market Segments

By Pet Type

- Dogs

- Cats

- Freshwater Fish

- Other Pet Types

By Form

- Chewable

- Powders

- Tablets/ Pills

- Other Forms

By Application

- Multivitamins

- Skin & Coat

- Prebiotics & Probiotics

- Hip & Joint

- Digestive Health

- Calming

- Other Applications

By Distribution Channel

- Offline

- Online

Driving Factors

Rising Pet Ownership and Population

Since COVID-19 came into force there has been a dramatic surge in pet ownership and population globally – driving increased demand for pet supplements as one of the primary drivers.

This trend can be observed through an increasing trend of individuals and households opting to adopt pets into their lives, leading to an exponentially expanding pet population across various regions.

But one of the key aspects is an increasing recognition of the emotional and psychological advantages pets provide to both individuals and families alike. Through companionship, stress reduction, unwavering affection provided by pets such as dogs and cats alike – one notable element has emerged from all this research.

This realization has prompted more households to embrace pet ownership, consequently expanding the consumer base for pet supplements. The concept of pet humanization is another driving force within this context. It signifies a perceptual shift where pets are regarded as integral members of the family unit rather than mere companions.

Thus, owing to this, there has been a positive approach to pet care and nutrition. These pet owners are significantly actively seeking ways to enhance their pets’ overall quality of life, mirroring the care and consideration extended to other family members.

Increase Awareness of Pet Health and Wellness Issues

Pet supplement sales have seen steady growth as pet owners become more informed about how to provide optimal health and well-being to their animals. With increased awareness comes an increase in pet supplements targeting various aspects of health such as immunity boosters, probiotics, and those for age-related conditions in pets.

Veterinarians play an instrumental role in informing pet owners about the advantages of supplements for specific health concerns like joint issues, digestive distress, or skin ailments in pets. Furthermore, with access to numerous online resources and social media platforms dedicated to animal wellness and nutrition information for pet care purposes – making informed decisions regarding pet supplements easier than ever! Continuing research advances show just how valuable supplements can be in managing and preventing various conditions amongst animals.

Restraints

Regulatory Challenges and Safety Concerns of Pet Supplements May Stifle Market Growth

As manufacturers in the pet supplements market operate globally, manufacturers often need to abide by various governmental frameworks and requirements in different countries – for instance those set out by FDA in the US may differ significantly from regulations found elsewhere (like Europe).

Diverse markets present companies with unique challenges when expanding internationally with their product lines. Furthermore, bringing a pet supplement onto the market often involves lengthy approval procedures; manufacturers need to provide evidence of safety and efficacy through clinical trials or toxicology analyses before being permitted on sale.

Small companies may find entering this market costly and time-consuming, which deters them from doing so. Furthermore, regulatory agencies closely examine labeling and claims made about pet supplement products; misleading or false claims could result in legal action or product recalls; supplements often compete with pharmaceutical products for pet ownership while some pet owners might prefer prescription medicines over supplements because they perceive them to be more effective or safer solutions.

Opportunity

Product Offering Customization and Innovation

At present, there’s an emerging trend towards personalized pet supplements tailored specifically for each animal based on factors like age, breed, health conditions and lifestyle considerations. Natural, organic, and non-GMO options represent an increased movement towards more eco-conscious living habits while technological innovations in production and distribution, including online platforms that facilitate easy access and subscription-based models offer significant opportunities for market expansion.

Emerging markets provide new growth avenues, thanks to rising pet ownership rates and an expanding understanding of pet health concerns. By cultivating strong veterinary partnerships to endorse products or develop clinically tested supplements, companies can bolster market credibility while using educational initiatives to inform pet owners of supplement benefits and allay any doubts over product efficacy and safety concerns.

Expanding E-Commerce and Online Sales Channels Set to Unlock Growth Opportunities in Global Pet Supplements Market

Expanding e-commerce sales channels provides pet supplement companies with an unprecedented way to reach a global market. While physical stores may only reach certain geographic regions, e-commerce platforms provide access all around the world – especially valuable when targeting international markets where pet ownership has increased significantly.

Businesses using digital sales platforms to connect with new customer bases across geographical barriers without physical expansion are taking advantage of its vast reach to gain customer access without geographical boundaries and time zone limitations getting in their way. Online channels also make shopping convenient as customers can do it any time of the day/night across time zones – which helps attract more customers while increasing sales for pet businesses by accommodating the diverse schedules of pet parents.

One of the key advantages of e-commerce is its cost-effective distribution capabilities. Operating physical retail stores is costly due to expenses like rent, utilities, and staffing expenses; but with online sales, these costs are dramatically decreased and these savings can be channeled toward product development, marketing, or offering competitive prices that attract price-sensitive customers.

E-commerce platforms also facilitate efficient inventory management. Real-time tracking of inventory levels minimizes overstocking or understocking products and allows real-time cost control; further ensuring customer demand can always be fulfilled and leading to enhanced customer satisfaction.

Latest Trends

Focus on Natural and Organic Products Increases

As people worldwide embrace healthier living and opt for natural and organic products, pet owners have also adopted this lifestyle trend for themselves and their animals. Pet parents have become more attentive about what goes into the food and supplements their pets receive and are actively searching for products without artificial additives, preservatives, or fillers that they feed to their companion animals.

Demand has led to the development of numerous natural and organic pet supplements featuring ingredients like herbs, vitamins, and minerals sourced directly from organic farms. This trend is fuelled both by health concerns regarding synthetic additives as well as demands for more transparent labeling practices.

Pet owners require easily understandable information on the supplements they give their animals. As a result, this has given rise to products with transparent labels that detail natural and organic ingredients, often supported by certification from reliable organizations.

Geopolitical Impact Analysis

Geopolitical Tensions Have Deliberately Interfered with Market Growth of Pet Supplements Market Due to Fluctuations in Currency and Supply Chain Activities

Geopolitical events have had a substantial effect on the global pet supplements market in recent months. Of particular note is the Russia-Ukraine war which has hindered the chances of global economic recovery after the COVID-19 pandemic; leading to economic sanctions on various countries as well as commodity price inflation and supply chain disruption.

These factors have caused inflation across goods and services, impacting multiple markets including pet supplements. Economic sanctions have resulted from this issue as commodities surge and supply chains become disrupted; further impacting the pet supplements sales market despite strong economic development globally, due to factors like increased pet health awareness as well as product innovation. Although challenges persist within this segment of the pet healthcare market growth is projected.

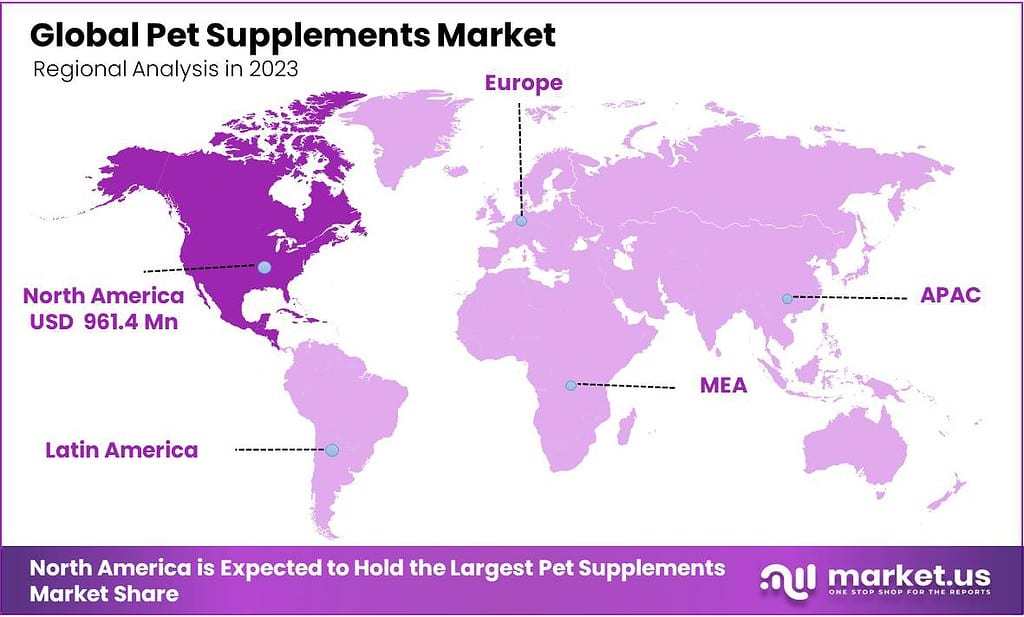

Regional Analysis

North America is considered to be the Most Profitable Market within the Global Pet Supplement Market.

North America held 40.4% of the global pet supplement market in 2023. North America, specifically the U.S., boasts one of the highest pet ownership rates worldwide (according to National Pet Owners Survey data); as such a high level of pet ownership naturally creates a larger demand for related products such as supplements.

North American pet owners have an increased awareness of their pets’ health and wellbeing. This awareness translates into increased spending on health products for them – such as supplements – which address joint, digestion, and skin conditions in pets. More informed owners may invest more heavily in such solutions for their own companion animals’ well-being.

North America boasts an advanced pet healthcare system with numerous veterinary professionals and pet healthcare facilities, which enables it to develop and distribute pet supplements as veterinarians prescribe or recommend these products to their clients. Numerous leading pet supplement manufacturers based in or with significant presence across North America invest heavily in research and development efforts, leading to innovative yet high-quality offerings on the market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players Are Evolving and Dominating Through Innovation in Product Development

Companies are increasingly focusing on creating tailored supplements catering to specific health concerns like joint health, digestive wellness, and immune system support. This specialization is driven by growing consumer awareness and demand for personalized pet care. Another significant strategy is the expansion of distribution channels.

Key players are actively enhancing their presence both in online and offline retail spaces. The online segment, in particular, has seen a surge due to its convenience and the increasing trend of e-commerce shopping. This includes partnerships with major online retailers and the development of user-friendly e-commerce platforms.

Market Key Players

- Nestle S.A. (Nestle Purina Petcare)

- Zoetis Inc.

- Elanco Animal Health Incorporated

- Virbac SA

- Dechra Pharmaceuticals PLC

- Nutramax Laboratories, Inc.

- Zesty Paws

- Mars, Incorporated

- NOW Foods

- Hill’s Pet Nutrition

- Other Manufacturers

Recent Developments

- In Jan. 2023, Purina Pro Plan Veterinary Diets announced a partnership with the American Veterinary Medical Foundation (AVMF) to support veterinarians and help pets in need through funds to the AVMF REACH Program. The campaign will offer up to $200,000 for AVMF. The REACH program aims to break down barriers to access to immediate veterinary care by increasing assistance and access to the most vulnerable communities.

- In May 2023, Virbac, a global animal health company, acquired 100% of the shares of its historical distributor in the Czech Republic and Slovakia, which became a part of the company. The acquisition was made to strengthen Virbac’s presence in Central Europe. This move is expected to allow Virbac to expand its reach in the pet dental health market in the region.

Report Scope

Report Features Description Market Value (2023) USD 2,379.0 Mn Forecast Revenue (2033) USD 4,285 Mn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Pet Type (Dogs, Cats, Freshwater Fish, and Other Pet Types), By Form (Chewable, Powders, Tablets/ Pills, and Other Forms), By Application (Multivitamins, Skin & Coat, Prebiotics & Probiotics, Hip & Joint, Digestive Health, Calming, and Other Applications) By Distribution Channel (Offline, and Online) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Nestle S.A. (Nestle Purina Petcare), Zoetis Inc., Elanco Animal Health Incorporated, Virbac SA, Dechra Pharmaceuticals PLC, Nutramax Laboratories, Inc., Zesty Paws, Mars, Incorporated, NOW Foods, Hill’s Pet Nutrition, and Other Manufacturers Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are pet supplements?Pet supplements are products designed to complement a pet's diet, providing additional nutrients, vitamins, minerals, or other beneficial substances to support their overall health and well-being.

Why do pets need supplements?Pets, like humans, may have nutritional gaps in their diets that supplements can address. Additionally, supplements can aid in addressing specific health issues, supporting mobility, improving coat condition, or boosting immune function.

Are pet supplements safe?Generally, pet supplements manufactured by reputable companies and following quality standards are safe. However, it's crucial to consult with a veterinarian before introducing any new supplements to your pet's diet, especially if your pet has underlying health conditions or is on medication.

Can supplements replace a balanced diet for pets?Supplements should complement a balanced diet but not replace it. A well-balanced and appropriate diet for your pet should be the primary focus, with supplements used to fill specific nutritional gaps or support health concerns.

-

-

- Nestle S.A. (Nestle Purina Petcare)

- Zoetis Inc.

- Elanco Animal Health Incorporated

- Virbac SA

- Dechra Pharmaceuticals PLC

- Nutramax Laboratories, Inc.

- Zesty Paws

- Mars, Incorporated

- NOW Foods

- Hill's Pet Nutrition

- Other Manufacturers