Global Botanicals Market By Form(Fresh, Extracts), By Source(Roots, Fruits, Flowers, Leaves, Herbs, Spices, Others), By Application(Pharmaceuticals, Food and Beverage, Alcoholic Beverages, Sauces and Dressings, Bakery and Confectionery, Non-alcoholic Beverages, Others, Dietary Supplements, Tablets, Capsules, Soft Gels, Powders, Gummies, Liquids, Others, Personal Care & Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 42174

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

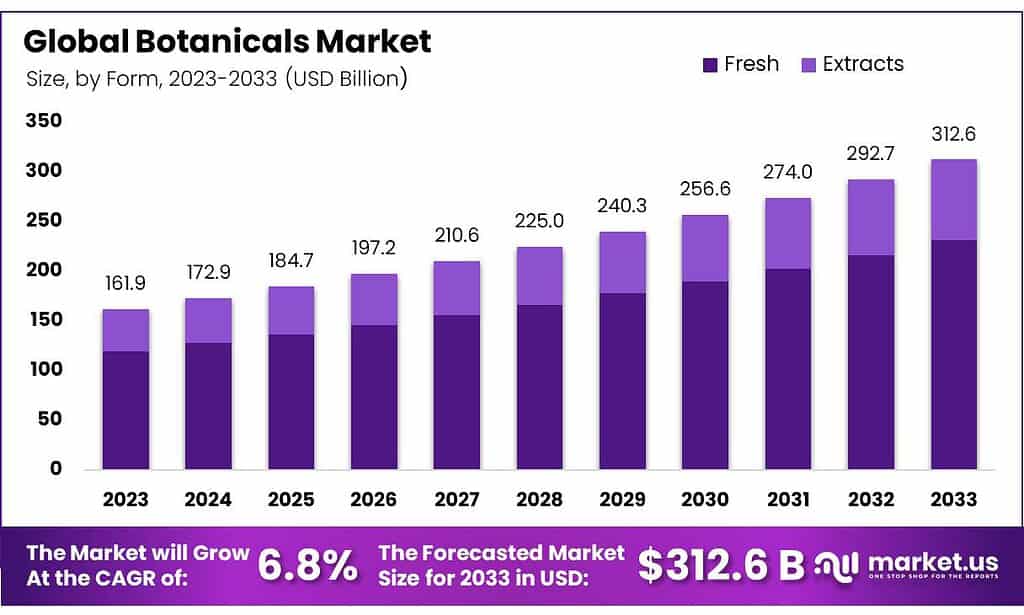

Global Botanicals Market size is expected to be worth around USD 312.6 billion by 2033 from USD 161.9 billion in 2023, this market is estimated to register a CAGR of 6.8%.

The botanicals market has been experiencing significant growth, driven by factors such as increasing awareness regarding clean-label products and a shift towards natural and sustainable consumer preferences. The market’s growth is indicative of a broader trend towards natural, plant-based products in various industries, reflecting a shift in consumer preferences and an increasing focus on health and wellness.

Historically, botanicals have been a cornerstone in traditional medicine across various cultures, dating back thousands of years. Ancient civilizations, such as the Egyptians, Chinese, and Greeks, extensively documented the use of plant-based remedies. These botanicals were not only used for treating ailments but also for spiritual, cosmetic, and culinary purposes.

Botanicals are not without their challenges. The regulation and standardization of botanical products can be complex due to the variability in plant-based materials. Ensuring quality, safety, and efficacy is crucial, particularly in the health-related industries. Furthermore, the sustainability of sourcing botanicals has become a significant concern, as overharvesting and habitat destruction threaten some plant species.

Key Takeaways

- The global botanicals market will be valued at US$ 161.9 Billion in 2023.

- The global botanicals market is projected to reach US$ 312.6 Billion by 2033.

- Among forms, fresh botanicals accounted for the largest market share of 74.0%.

- Among sources, root botanicals accounted for the majority of the market share with 27.4%.

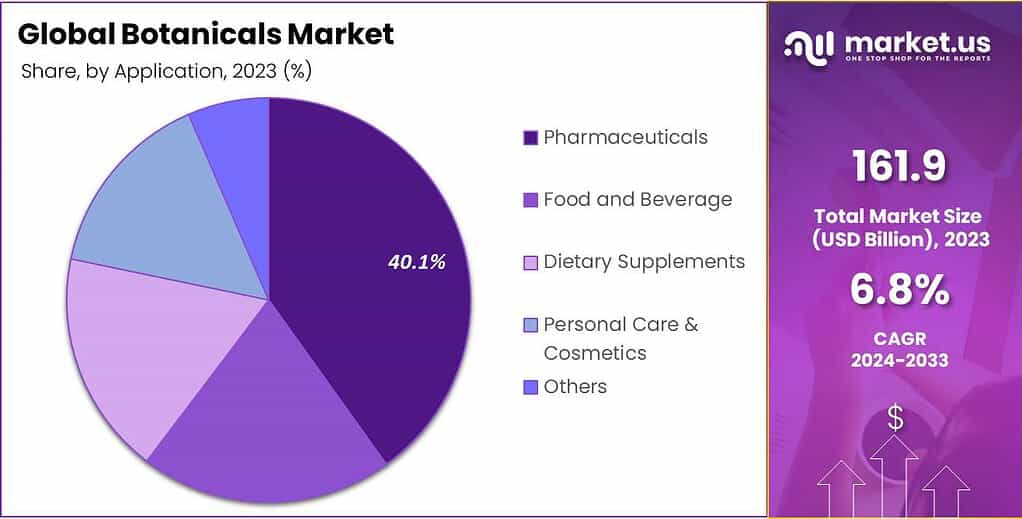

- Based on application, pharmaceuticals are expected to account for the largest market share in 2023 with 40.1%.

- Increasing demand for natural and organic products is expected to drive the market.

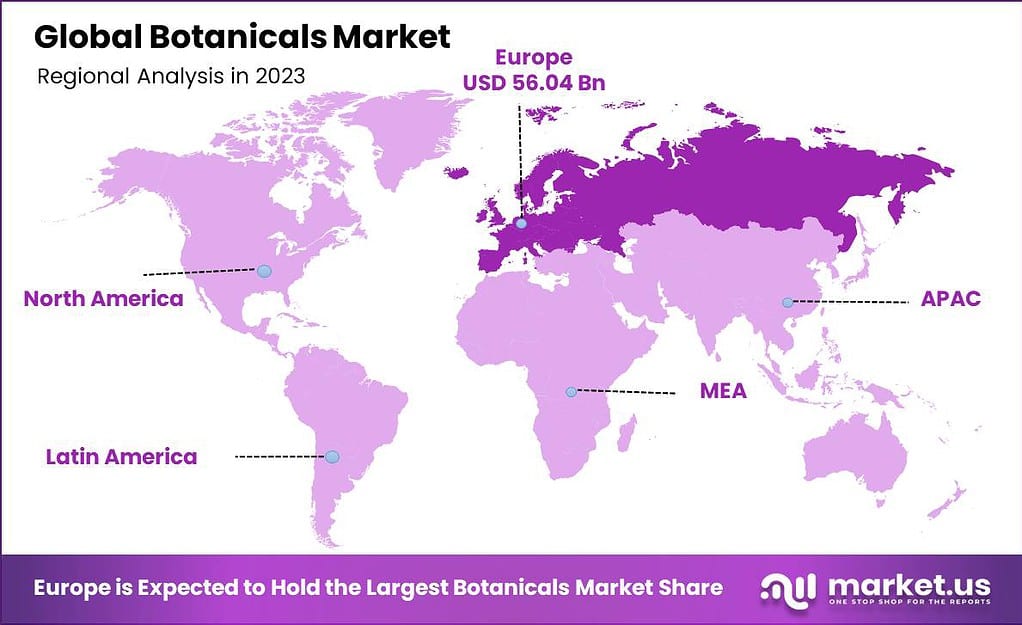

- Europe is the leading region in the global market with a revenue share of 34.6%.

Form Analysis

The Fresh Segment Holds the Majority of Market Share Owing to Rising Consumer Trend Towards Fresh and Organic Products

Based on form, the global botanicals market is segmented into fresh and extracts. Among these, the fresh segment holds the majority of the revenue share of 74.0% in 2023. Fresh botanicals have a wide range of applications in industries such as food and beverage, pharmaceuticals, and cosmetics.

In the food industry, there is a growing demand for natural flavorings and ingredients, which boosts the market for fresh botanicals. Moreover, there has been a rising consumer trend towards natural and organic products, and fresh botanicals are often seen as more ‘natural’ compared to extracts or processed forms.

This trend is driven by increased health consciousness and a preference for products with minimal processing and additives.

Source Analysis

Chewable Supplements Accounted For The Largest Market Share Owing To Their Ease Of Consumption

Based on source, the market is further divided into roots, fruits, flowers, leaves, herbs, spices, and others. Among these, roots accounted for the largest market share in 2023, with 27.4% owing to their efficient medicinal properties. Botanicals derived from roots are increasingly popular for their health benefits, especially in the wellness field.

This rise in popularity is linked to growing health consciousness among consumers and an inclination towards natural products over synthetic ones. The demand for botanicals, including those from roots, has been further amplified by the global pandemic, leading to an increased focus on health and nutrition.

These trends have made botanicals, particularly root-based ones, essential in various applications such as functional beverages, food, and dietary supplements.

Application Analysis

Increasing Demand for Natural Medicines, the Pharmaceuticals Gaining the Market Share.

Based on application, the global botanicals market is segmented into pharmaceuticals, food and beverage, dietary supplements, personal care and cosmetics, and other applications. Among these, pharmaceuticals hold the majority of the market share at 40.1%.

There’s a growing global trend towards natural and alternative medicine. Botanicals, being natural, are increasingly preferred over synthetic drugs due to their perceived safety, efficacy, and fewer side effects. The pharmaceutical industry invests heavily in the research and development of botanicals.

This leads to the discovery and commercialization of new botanical-based pharmaceutical products. In some regions, there’s increasing regulatory support for botanical medicines. For instance, in Europe and Asia, there are well-established frameworks for the approval and use of herbal medicines.

Key Market Segments

By Form

- Fresh

- Extracts

By Source

- Roots

- Fruits

- Flowers

- Leaves

- Herbs

- Spices

- Others

By Application

- Pharmaceuticals

- Food and Beverage

- Alcoholic Beverages

- Sauces and Dressings

- Bakery and Confectionery

- Non-alcoholic Beverages

- Others

- Dietary Supplements

- Tablets

- Capsules

- Soft Gels

- Powders

- Gummies

- Liquids

- Others

- Personal Care & Cosmetics

- Others

Drivers

Increasing Demand for Natural and Organic Products Is Expected to Drive the Market.

The increasing demand for natural and organic products is a pivotal driver for the global botanicals market. Spanning across various industries, this demand signifies a profound shift in consumer preferences and market dynamics, directly impacting the cultivation, production, and marketing of botanical products. In recent years, there has been a significant shift in consumer behavior towards natural and organic products.

This transformation is rooted in a growing awareness of health and wellness, environmental concerns, and a desire for transparency in product ingredients. Consumers are increasingly skeptical about synthetic chemicals in their foods, personal care products, and medicines, leading to a heightened demand for products made from natural ingredients, including botanicals.

- Herbal supplement sales have been increasing each year for the last decade, and in 2020, for the first time, sales surpassed $10 billion.

The demand for natural and organic products has substantial economic implications. It directly translates into a growing market for botanicals, as they are key ingredients in these products. The trend towards natural and organic products is closely linked with sustainability and ethical sourcing concerns. Consumers are increasingly aware of the environmental impact of their purchases and are demanding products that are sustainably sourced.

This has led to a focus on ethical sourcing practices in the botanicals market, where suppliers are encouraged to adopt practices that are environmentally sustainable and socially responsible. This shift not only helps in preserving biodiversity but also ensures the long-term viability of the botanical industry. The demand for natural and organic products has spurred innovation across various sectors.

Companies are investing in research and development to create new products that meet consumer expectations for natural ingredients. This includes developing new extraction technologies to derive potent botanical extracts, creating formulations that maximize the efficacyy and shelf-life of natural ingredients, and exploring lesser-known plants for their potential applications.

This is reshaping consumer preferences and influencing market dynamics across various industries. As this demand continues to grow, it presents opportunities for innovation, economic growth, and sustainable practices in the botanicals sector.

Expansion Of Botanicals in the Cosmetics Industry and Its Growing Demand in the Food and Beverage Industry Is Anticipated to Bolster the Market Growth

The expansion in the cosmetics industry and the growing demand in the food and beverage industry are substantial drivers positively impacting the global botanicals market. These sectors, with their evolving consumer preferences and innovative product developments, have created a significant uptick in the demand for botanical ingredients.

The cosmetics industry is witnessing a paradigm shift towards natural and organic products. Consumers are increasingly vigilant about the ingredients in their skincare and beauty products, prioritizing items with plant-based, non-toxic, and ethically sourced components. This shift is driven by a growing awareness of the health implications of synthetic chemicals and a broader societal trend towards sustainability.

There is an increasing preference for cosmetics made with natural ingredients, including botanicals, driven by consumer perceptions of these products being safer and more environmentally friendly. To capitalize on this trend, cosmetic companies are innovating and differentiating their products by incorporating botanical ingredients.

These ingredients are not only marketed for their functional benefits, such as anti-aging properties or skin nourishment but also for their appeal to environmentally conscious consumers. This strategy aligns with the growing segment of consumers who are willing to pay a premium for natural and sustainable products.

In the food and beverage industry, there is a pronounced shift towards health and wellness, with consumers seeking products that offer nutritional and health benefits. This trend is particularly evident in the surge of functional foods – foods fortified with health-promoting ingredients, including botanicals.

Companies are strategically positioning their products to cater to this demand, leveraging botanical ingredients for their natural appeal and health benefits. This positioning not only enhances product value but also aligns with consumer trends, thereby creating a competitive edge in the market.

Restraints

Stringent and Diverse Regulatory Landscape May Restrain the Market Growth

One of the primary factors restraining the global botanicals market is the stringent and diverse regulatory landscape. Botanicals, often used in dietary supplements, food additives, and pharmaceuticals, are subject to varying regulations across different regions and countries. For instance, in the United States, the Food and Drug Administration (FDA) regulates botanicals under the Dietary Supplement Health and Education Act (DSHEA), whereas in the European Union, the European Food Safety Authority (EFSA) has its set of guidelines.

This disparity in regulations can create significant challenges for companies operating in the global market, as they must navigate a complex web of compliance requirements. The impact of stringent regulations is also felt in the area of international trade. The lack of harmonization in regulatory standards can result in trade barriers, limiting the export and import of botanical products.

For instance, a botanical ingredient considered safe in one country might be restricted in another, affecting global supply chains and market access. This not only restricts the growth of the botanicals market but also limits consumer access to a diverse range of products. Moreover, in some regions, the regulatory framework for botanicals is still evolving, leading to uncertainty and reluctance among companies to invest in these markets.

The need for extensive documentation and compliance checks for botanical products can also lead to delays in market entry, thereby restraining market growth.

Opportunity

Growing Consumer Interest in Natural and Organic Products Expected to Create Lucrative Growth Opportunities in the Botanicals Market

One of the most significant opportunities for the global botanicals market is the increasing consumer demand for natural and organic products. This trend is driven by a growing awareness of health and wellness, where consumers are more conscious about the ingredients in their food, supplements, and personal care products.

Botanicals, being derived from natural sources, are perceived as safer and healthier alternatives to synthetic ingredients. This shift in consumer preferences presents a substantial opportunity for growth in the botanicals market.

The trend towards natural and organic products is also bolstered by the increasing availability and accessibility of these products. With advancements in distribution channels and e-commerce, consumers now have easier access to a wide range of botanical products from across the globe. This has led to increased exposure and acceptance of these products, further driving market growth.

Additionally, the rising consumer interest in traditional and alternative medicine, particularly in regions like Asia, provides a significant opportunity for the expansion of the botanicals market. Traditional remedies, which often utilize botanical ingredients, are gaining popularity as complementary or alternative health approaches.

The growing consumer interest in natural and organic products is not a transient trend but appears to be a long-term shift in consumer behavior. This presents a significant opportunity for companies in the botanicals market to innovate and expand their product offerings to meet the evolving demands of health-conscious consumers. By capitalizing on this trend, the botanicals market can achieve substantial growth in various sectors, including food and beverages, dietary supplements, and personal care products.

Trends

Technological Advancements in Cultivation and Processing

Another significant trend in the global botanicals market is the technological advancements in the cultivation and processing of botanical ingredients. Innovations in agricultural technology, such as controlled environment agriculture (CEA), hydroponics, and vertical farming, are revolutionizing the way botanicals are grown.

These technologies enable the cultivation of high-quality botanicals with a smaller environmental footprint, as they often require less water and land compared to traditional farming methods. Controlled environment agriculture also allows for year-round production, independent of climatic conditions, ensuring a consistent and reliable supply of botanical ingredients.

The technological advancements in the cultivation and processing of botanicals are key drivers of innovation in the market and are expected to continue shaping the industry in the years ahead.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Disrupted the Growth of the Botanicals Market Owing to Fluctuations in Currency and Supply Chain Activities

The evolving geopolitical landscape can indirectly influence these factors through its impact on global trade, supply chains, and economic conditions, which in turn affect consumer behavior and market The global pandemic has increased the consumer focus on health and nutrition. In Europe, a key region in the global botanicals market, there has been a substantial increase in revenue.

Factors contributing to this include a growing middle class, diet-conscious individuals, and rising disposable income. This growth is also influenced by the shift from carbonated beverages to healthier options such as matcha and kombucha. The European market’s interest in botanicals such as fruit, cocoa, vanilla, coffee, tea, and floral botanicals is shaping the industry’s direction.

Spain, for instance, has expanded its botanical product lines beyond supplements to include the food and beverage market. In the Asia Pacific region, the botanicals market is expected to see the highest revenue growth. This is influenced by factors such as the rise of e-commerce and changing consumer preferences towards ready-to-eat and ready-to-drink products that use botanical ingredients.

In North America, the expansion of health drinks and bio-based drugs for health benefits such as blood sugar control and weight management is driving the botanical extracts market.

Regional Analysis

Europe is estimated to be the Most Lucrative Market in the Global Botanicals Market.

Europe holds the largest share, with 34.6% of the global botanicals market in 2023. European consumers have shown a strong preference for natural and clean-label products. This trend is driven by increasing health consciousness and a shift towards more sustainable and organic consumption patterns. European consumers are particularly interested in products that are both healthful and environmentally friendly, which botanicals often represent.

Europe’s food and beverage industry is highly developed and diverse, integrating botanicals in various products such as ready-to-drink beverages, functional foods, and health supplements. The region’s strong culinary traditions and evolving tastes also contribute to the demand for botanical ingredients in cooking and food preparation. European regulations and policies often favor the use of natural ingredients in consumer products.

This regulatory framework supports the growth of the botanicals market, encouraging manufacturers to invest in natural, plant-based ingredients. Europe has a significant cosmetic and personal care industry, where there is a growing trend towards natural and clean beauty products.

Botanical ingredients are increasingly used in skincare and beauty products due to their perceived benefits and consumer demand for natural alternatives to synthetic ingredients. Europe’s strategic location and well-established trade routes facilitate the import and export of botanical products, contributing to the region’s strong market position.

Key Regions

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players Are Evolving and Dominating Through Innovation in Product Development

Key players in the global botanicals market are evolving and asserting their dominance through a combination of strategic initiatives and innovative practices. These companies are focusing on developing new and innovative products to meet the growing demand for natural and clean-label products.

This product innovation is often targeted at new formulations that cater to specific health benefits or consumer preferences. The key players in the global botanicals market are successfully navigating market challenges and opportunities through innovation, strategic expansion, and continuous investment in R&D, thereby solidifying their market dominance.

Market Key Players

To expand their market reach, these players are also investing in increasing the production capacities of their existing plants or setting up new production facilities. This expansion not only caters to the growing market demand but also helps in diversifying their product portfolio. Research and Development (R&D) is a critical area of focus for these companies.

By investing in R&D, they can bring forth new botanical extracts and ingredients that meet the evolving needs of the market, particularly in terms of quality, efficacy, and sustainability. In addition to these strategies, market leaders are also engaging in geographic expansion, partnerships, collaborations, mergers, and acquisitions.

These strategies help them to tap into new markets, leverage synergies, and enhance their competitive edge.

- The Archer-Daniels-Midland Company

- International Flavors& Fragrances, Inc.

- Koninklijke DSM N.V.

- Givaudan

- Carbery Group

- Sidomuncul

- Martin Bauer GmbH & Co. KG

- Bell Flavors & Fragrances

- Lipoid-Kosmetik

- Prakruti Products

- Eu Yan Sang

- Herbanext Laboratories, Inc.

- Ransom Naturals Ltd

- Blue Sky Botanics

- Indesso

- Other Manufacturers

Recent Developments

- In May 2023, DSM and Firmenich merged, forming a new entity that assembles one of the most extensive innovation and creation communities in the fields of nutrition, health, and beauty. Boasting a workforce of nearly 30,000 and unparalleled capabilities rooted in over a century of pioneering scientific advancements, DSM-Firmenich is poised to be a pioneer in redefining, producing, and blending essential nutrients, flavors, and fragrances.

- In November 2023, MartinBauer declared the accomplished acquisition of Husarich GmbH, a well-regarded supplier of spices and herbs serving diverse sectors within the food industry. This acquisition stands as a significant achievement in the company’s expansion strategy, enhancing its prowess in the realm of the food industry.

- In October 2022, Givaudan Active Beauty launched Siliphos, a natural alternative to retinoids, which is extracted from milk thistle fruits and powered by Phytosome technology. Siliphos acts directly on collagen production to provide a natural, safe, and efficient skincare solution, suitable for delicate skin.

Report Scope

Report Features Description Market Value (2023) US$ 161.9 Bn Forecast Revenue (2033) US$ 312.6 Bn CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form (Fresh, and Extracts), By Source (Roots, Fruits, Flowers, Leaves, Herbs, Spices, and Others), By Application (Pharmaceuticals, Food and Beverage, Dietary Supplements, Personal Care and cosmetics, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape The Archer-Daniels-Midland Company, International Flavors& Fragrances, Inc., Koninklijke DSM N.V., Givaudan, Carbery Group, Sidomuncul, Martin Bauer GmbH & Co. KG, Bell Flavors & Fragrances, Lipoid-Kosmetik, Prakruti Products, Eu Yan Sang, Herbanext Laboratories, Inc., Ransom Naturals Ltd, Blue Sky Botanics, Indesso, and Other Manufacturers Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are botanicals?Botanicals are plant-derived substances often used for medicinal or therapeutic purposes. They encompass a wide range of plants, herbs, roots, flowers, and extracts with various health and wellness benefits.

What are the main applications of botanicals?Botanicals find applications in diverse industries such as pharmaceuticals, cosmetics, food and beverages, dietary supplements, and aromatherapy due to their natural healing, flavoring, and aromatic properties.

What are the current trends in the botanicals market?The market is experiencing increased demand for natural and organic products, driving the growth of botanicals. Consumers are seeking clean-label products, leading to a surge in botanical-based supplements, skincare, and herbal teas.

-

-

- The Archer-Daniels-Midland Company

- International Flavors& Fragrances, Inc.

- Koninklijke DSM N.V.

- Givaudan

- Carbery Group

- Sidomuncul

- Martin Bauer GmbH & Co. KG

- Bell Flavors & Fragrances

- Lipoid-Kosmetik

- Prakruti Products

- Eu Yan Sang

- Herbanext Laboratories, Inc.

- Ransom Naturals Ltd

- Blue Sky Botanics

- Indesso

- Other Manufacturers