Global 3D Printing Plastics Market By Product Type (Photopolymers, ABS & ASA, Polyamide/Nylon, Polylactic Acid, and Other Product Types), By Form (Filament, Ink, and Powder), By Application, By End-User Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 37953

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

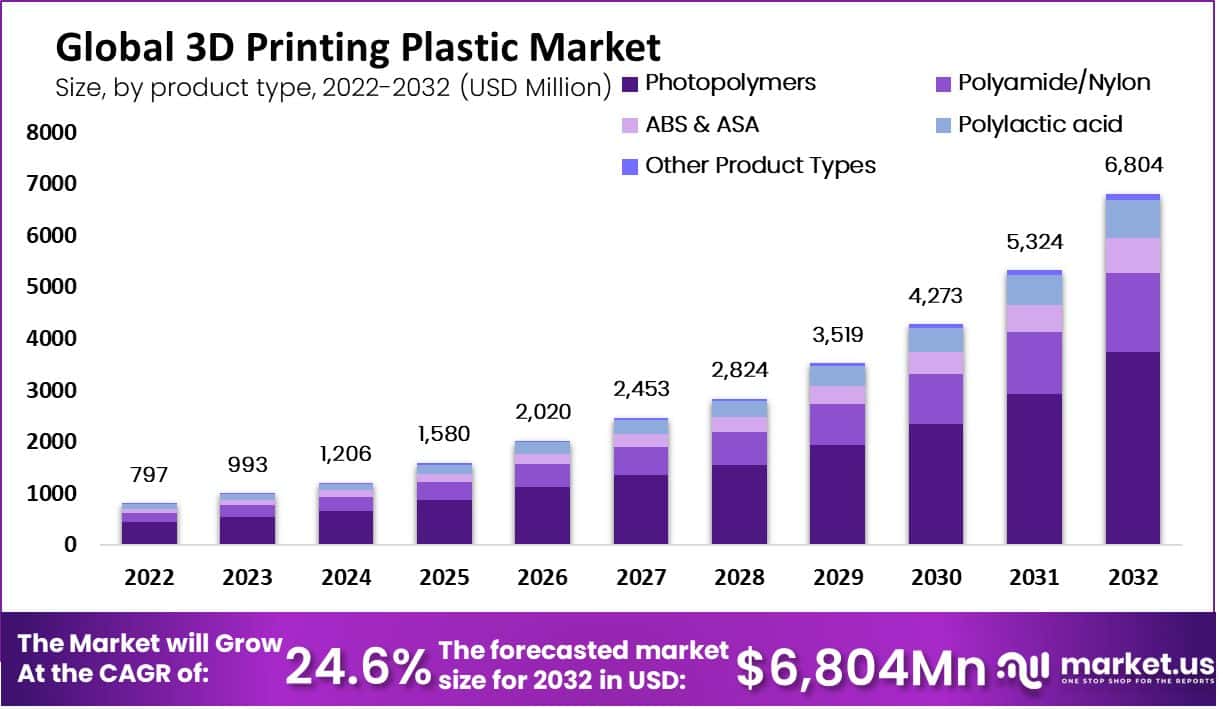

In 2022, the global 3D printing plastic market was valued at USD 797 million. Between 2023 and 2032, this market is estimated to register the highest CAGR of 24.6%. It is expected to reach USD 6804 million by 2032.

3D printing plastic is also known as additive manufacturing. 3D printing plastics Market is a material that provides 3-dimensional structures to solid objects. 3D printing plastics commonly use High Impact Polystyrene or HIPS, which is plastic filament used for dissolvable support structures in FDM printers. This extrudes at around 235°C and has a set of material properties that make it similar to ABS.

3D printing technologies are based on photo-polymerization that uses UV-sensitive resins to create objects layer by layer. Polycarbonate (PC) delivers high tensile strength along with high impact and heat resistance. The filaments used in 3D printing plastic are strong and biodegradable. That reduces plastic waste. 3D printing plastics are cost-effective alternatives to injection molding.

The demand for 3D printing plastics market size is increasing due to their high density and excellent efficiency. The recent technological advancements in additive manufacturing, such as powered bed fusion (PBF), direct energy deposition, binder jetting, and photo-polymerization (VPP) expected to drive the market during the forecast period.

Key Takeaways

- Market Growth: The 3D printing plastic market was valued at USD 797 million in 2022 and is estimated to exhibit a remarkable CAGR of 24.6% between 2023 and 2032. By 2032, it’s expected to reach USD 6,804 million.

- 3D Printing Plastic Overview: 3D printing plastic, also known as additive manufacturing, is a process that creates three-dimensional structures for solid objects. It commonly uses materials like High Impact Polystyrene (HIPS) and photopolymers to create objects layer by layer.

- Applications in Aerospace: 3D printing plastics are increasingly being used in aerospace industries. Major players like Lockheed Martin, Airbus, and Boeing are adopting 3D-printed parts in aircraft production, reducing costs and enabling rapid, on-demand manufacturing.

- Automotive Industry: The automotive industry is also leveraging 3D printing plastics for cost-effective and rapid prototyping, ultimately saving time and expenses associated with traditional manufacturing methods.

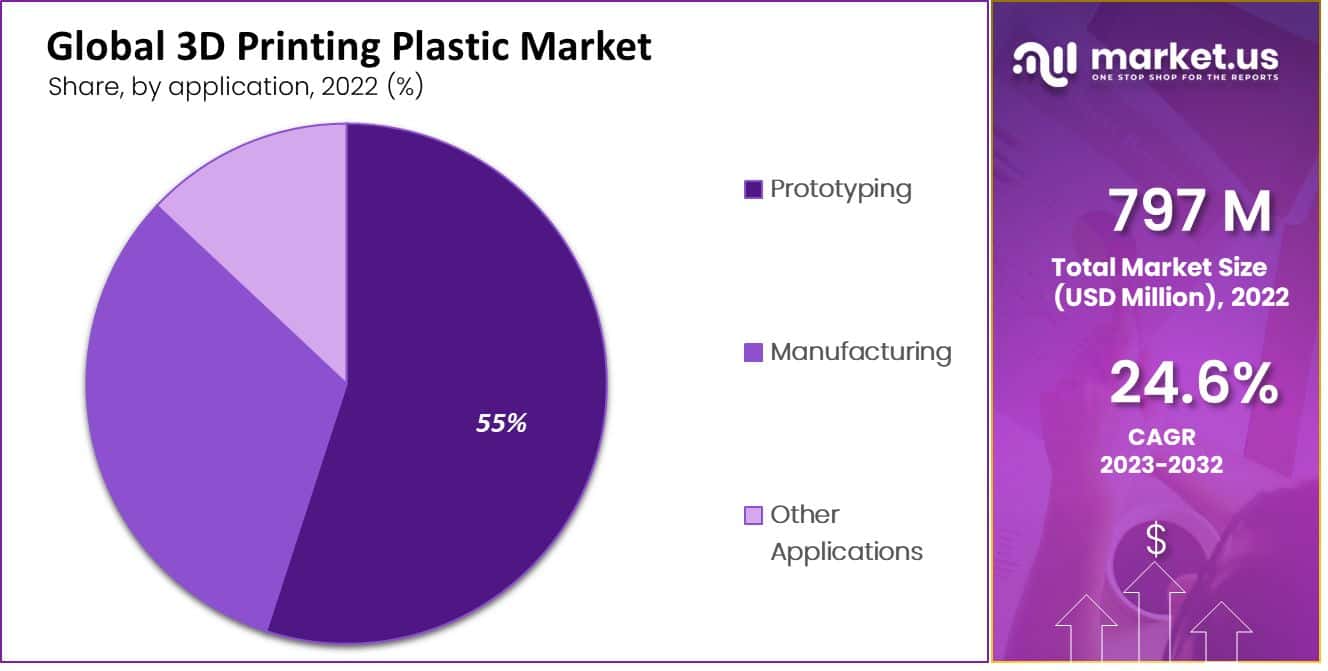

- Prototyping Dominance: In terms of application, prototyping is dominant in the market, accounting for 55% of the market revenue in 2022. 3D printing is preferred for prototyping as it allows for quicker concept modeling and design exploration.

- Product Types: Photopolymers are the dominant product type, representing 55% of the market revenue in 2022. Photopolymers are known for their versatility and compatibility with various 3D printing processes.

- Filament Segment: The filament segment is dominant in the market, with a market revenue share of 70% in 2022. Polylactic acid (PLA) is the most common filament used in 3D printing plastic due to its affordability and versatility.

- Future Trends: The market is witnessing technological advancements, including improved 3D printing plastics with enhanced properties like strength and heat resistance. Additionally, there’s a growing focus on using recycled materials to address environmental concerns.

- Growth Opportunities: The automotive industry uses 3D printing plastics extensively for rapid prototyping, and the healthcare industry leverages it for customized implants and medical devices, creating growth opportunities. Construction industries are also adopting 3D printing for building components.

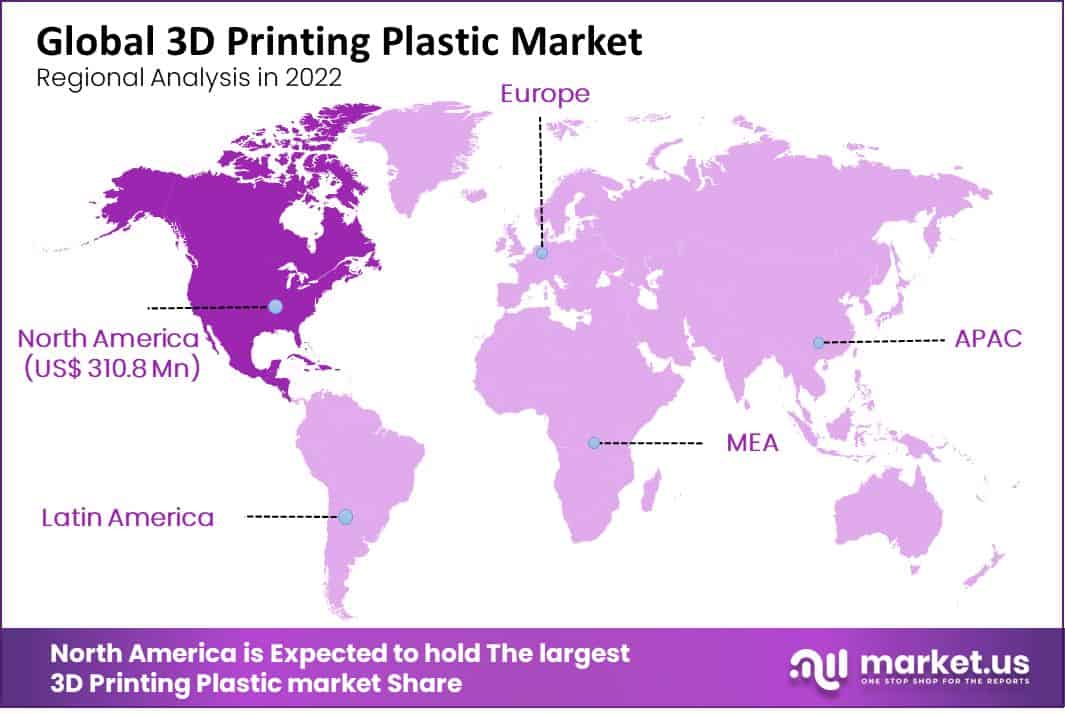

- Regional Dominance: North America is the dominant region in the market, accounting for 39% of the market revenue in 2022. This is driven by the increasing demand for 3D printing technologies in healthcare industries.

- Key Players: Major players in the 3D printing plastic market include 3D Systems Corporation, Arkema Inc., Stratasys Ltd., and other key players. These companies are focusing on expanding their businesses internationally and product innovations.

Driving Factors

Increasing Use in Aerospace Industries

3D printing allows the production of highly customized and personalized products, driving the need for 3D printing in the production of a variety of products. 3D printing is gaining popularity in aerospace & defense industries because it enables the rapid, on-demand manufacturing of components and helps in minimizing production costs. 3D printing offers aerospace manufacturers the opportunity of toolless manufacturing.

For prototyping, there are significant benefits of 3D printing in the aerospace industry as it allows engineers to develop new designs and ideas. 3D printing for the aerospace industry generally includes lightweight materials such as titanium and aluminum, nylon, digital ABS, etc. The major key players in aerospace industries, such as Lockheed Martin, Airbus, and Boeing, are increasingly adopting 3D-printed parts into their aircraft, driving the growth of the global 3D printing plastic market.

3D printing allows the manufacturing of a variety of parts within hours, which helps in the speed-up prototyping process. 3D printing plastic is much more cost-effective than traditional printing machines. The 3D printing plastic offers significant applications as they are lighter than metal equivalents.

The increasing demand for plastic printing in the automotive industry is driving market growth. In a single-step manufacturing process, 3D printing saves time and, therefore, costs associated with traditional printing machines. The increasing use of 3D printing plastics in household applications such as commercial refrigerators, air conditioners, and other appliances is driving market growth.

Restraining Factors

High Maintenance Costs

3D printing plastics are more expensive, usually for high-end materials. High maintenance costs of 3D printing machines are expected to have a negative impact on market growth.

The increasing environmental concerns related to the employment of plastics in printing and difficulties in recycling materials are expected to hinder market growth in the forecast period.

Product Type Analysis

The Photopolymers Segment is Dominant in the Market with the Largest Market Revenue Share

Based on product type, the 3D printing plastic market is classified into ABS & ASA, polyamide/nylon, photopolymers, polylactic acid, and other product types. The photopolymers segment was dominant in the market, with the largest market revenue share of 55% in 2022. The most commonly used photopolymer resins for 3D printing technologies in the market are SLA and DLP.

Photopolymers are light-sensitive material that changes physical properties when exposed to light. The use of photopolymers is common in 3D printing due to their versatility and compatibility with a variety of 3D printing processes. They are extensively utilized in different printing technologies, such as 3D jetting printing, inkjet, and polyjet.

The polyamide/nylon segment is expected to grow at the fastest CAGR during the forecast period. 3D printing using polyamide/nylon has a longer life span, making it an ideal material for producing end-use parts or functional prototypes. The nylon printing is attributed to warp and absorb moisture. The main benefit of 3D printing nylon is its excellent impact resistance and toughness.

Form Analysis

Filament Segment is Dominant in the Market with Largest Market Revenue Share

By form type, the 3D printing market is segmented into filament, ink, and powder. The filament segment was dominant in the market, with the largest market revenue share of 70% in 2022. The high-impact plastic filament is used for dissolvable support structures in FDM printers.

Polylactic acid or PLA is the most common 3D printing filament mostly used in plastic printing. This filament is affordable and versatile and, thus, has high demand in 3D plastic printing. The filament choice is very important in 3D plastic printing.

The inked segment is expected to grow at the fastest CAGR during the forecast period due to the increasing prevalence of smart inks. The demand for UV and LED curable inks is more in 3D plastic printing because they are ideal for printing on rigid plastic products.

Application Analysis

The Prototyping Segment is Dominant in the Market

Based on application, the 3D printing plastic market is segmented into prototyping, manufacturing, and other applications. The prototyping segment was dominant in the market, with the largest market revenue share of 55% in 2022.

The 3D printing plastics market share is used in prototyping applications to show how the 3D printing objects look. 3D printing in prototyping usually creates design files much faster than another traditional tooling-based prototyping process. This allows concept modeling allowing designers to explore different design ideas and test them before introducing them.

This method is faster, cheaper, and more accurate, so it has more demand in end-user industries. The manufacturing segment is expected to grow at the fastest CAGR during the forecast period due to its cost-effectiveness and high accuracy.

End-User Industries

Healthcare Segment is Dominant in the Market

On the basis of the end-user industry, the 3D printing market is classified into aerospace & defense, healthcare, automotive, electronics & consumer goods, and other end-user industries. The healthcare segment was dominant in the market, with the largest market revenue share of 39% in 2022.

Increasing revolution in healthcare industries driving the growth of this segment. 3D printing has significant applications in printing organ models. 3D printing can be used to produce patient-specific prosthetics, such as prosthetic limbs, that fit the patient’s unique anatomy, which helps in improving comfort and functionality.

The automotive industry segment is expected to grow at the fastest CAGR during the forecast period. 3D printing helps in quickly fabricating a prototype of physical parts or assembly. The increasing use of Fused Filament Fabrication (FFF) in the automotive sector is driving the demand for 3D printing plastic methods in the market.

Key Market Segments

By Product Type

- Photopolymers

- ABS & ASA

- Polyamide/Nylon

- Polylactic Acid

- Other Product Types

By Form

- Filament

- Ink

- Powder

By Application

- Prototyping

- Manufacturing

- Other Applications

End-User Industry

- Aerospace & Defense

- Healthcare

- Automotive

- Electronics & Consumer Goods

- Other End-User Industries

Growth Opportunities

Increasing Demand in End-User Industries

The automotive industry is one of the largest industries that use 3D printing plastics, as it allows rapid prototyping of the parts and components that reduce time and cost. 3D printing plastics are used in the production of car interiors, dashboards, and exterior parts of vehicles.

The healthcare industry is rapidly adopting 3D printing plastics to produce customized implants, prosthetics, and medical devices. This technology is accurate and effective production of medical products, which helps in better patient outcomes.

The construction industries are adopting 3D printing technologies to produce building components such as walls, roofs, and facades. Thus increasing applications of 3D printing plastic technologies in end-user industries such as aerospace & defense, healthcare, automotive, electronics, and & consumer goods are expected to create lucrative growth opportunities in the market.

Latest Trends

Technological Advancements in 3D Printing Plastic Machines

The development of new 3D printing plastics with improved properties, such as increased strength, flexibility, and heat resistance, is expanding the use of 3D printing plastic technologies in various industries. The concerns regarding the environment are rising.

Therefore, the use of recycled materials in 3D printing plastic is increasing. Several key players in the 3D printing plastic market are focusing on market strategies such as merging, acquisition, collaboration, and competitive pricing to stay competitive in the market.

Regional Analysis

North America Region is Dominant in the Market with Largest Market Revenue Share

North America was dominant in the market, with the largest market revenue share of 39% in 2022. The growth of the region is propelled by increasing demand for 3D printing technologies in healthcare industries.

The presence of major key players in the 3D printing plastic market, such as Stratasys and 3D System Corporation driving the regional growth of the market. Also, the technological advancement rate in North America is driving market growth.

The increasing need for 3D printing plastic technologies in aerospace, automotive, electronics, and consumer goods industries is driving the demand for these technologies in the market.

The Asia Pacific region is expected to grow at the fastest CAGR during the forecast period due to increasing revolutions in automotive industries. Asia Pacific is the home of major companies in the automotive industry. Thus increasing technological advancements and rising use in automotive industries are expected to create lucrative opportunities in the market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The major players in the 3D printing plastic market are focusing on expanding their businesses in foreign countries. Several key players are focusing on product innovations and competitive pricing to obtain a competitive edge in the market.

The major key players in the 3D printing plastic market include 3D Systems Corporation, Arkema Inc., Envisiontec Inc., Stratasys Ltd., SABIC, Materialise NV, HP INC., Eos GmbH Electro Optical Systems, PolyOne Corporation, Royal DSM N.V., and Other Key Players.

Market Key Players

- 3D Systems Corporation

- Arkema Inc.

- Envisiontec Inc.

- Stratasys Ltd.

- SABIC

- Materialise NV

- HP INC.

- Eos GmbH Electro Optical Systems

- PolyOne Corporation

- Royal DSM N.V.

- Other Key Players

Recent Developments

- In 2022, Envision TEC started producing pre-factory printers using Texas Instrument DLP projectors. This DLP 3D printing process allows extremely high resolution, excellent surface finish, and accurate details.

- In 2021, Stratasys announced the acquisition of RP Support Ltd. (RPS), which makes large stereolithographic 3D printers.

Report Scope

Report Features Description Market Value (2022) USD 797 Mn Forecast Revenue (2032) USD 6,804 Mn CAGR (2023-2032) 24.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Photopolymers, ABS & ASA, Polyamide/Nylon, Polylactic Acid, and Other Product Types; By Form- Filament, Ink, and Powder; By Application- Prototyping, Manufacturing, Other Applications; By End-User Industry- Aerospace & Defence, Healthcare, Automotive, Electronics & Consumer Goods, Other End-User Industries Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3D Systems Corporation, Arkema Inc., Envisiontec Inc., Stratasys Ltd., SABIC, Materialise NV, HP INC., Eos GmbH Electro Optical Systems, PolyOne Corporation, Royal DSM N.V., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA