Global Additive Manufacturing Market By Component Analysis (Printers, Software, Materials, Services), By Technology Analysis (Material Extrusion, Powder Bed Fusion, Vat Polymerization, Direct Energy Deposition, Material Jetting, Sheet Lamination, Binder Jetting), By Application Analysis (Prototyping, Tooling, Functional Parts), By End-use (Analysis, Aerospace and Defence, Automotive and Transportation, Healthcare, Electrical and Electronics, Industrial, Consumer Goods, Power and Energy, Construction and Architecture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 37907

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

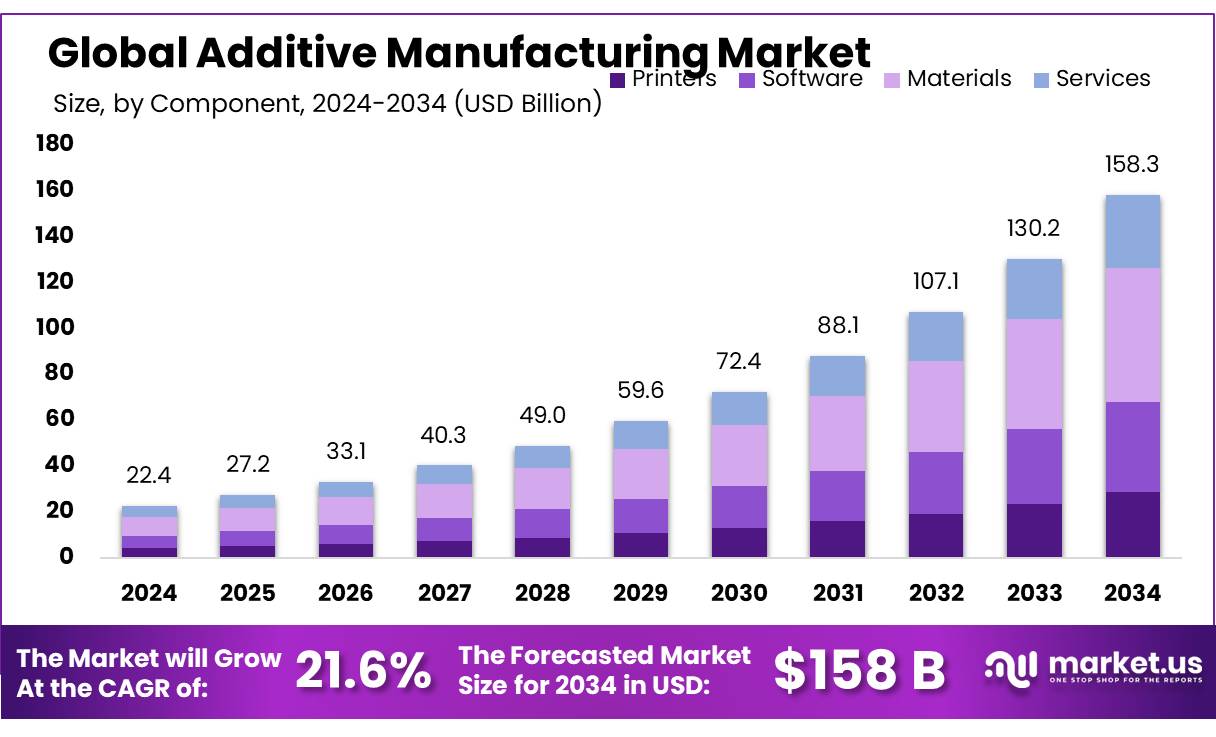

The Global Additive Manufacturing Market size is expected to be worth around USD 158.3 Bn by 2034, from USD 22.4 Bn in 2024, growing at a CAGR of 21.6% during the forecast period from 2025 to 2034.

Additive manufacturing (AM), also known as 3D printing, is a transformative technology that enables the creation of three-dimensional objects by adding material layer by layer based on a digital model. Since its emergence, Additive manufacturing has disrupted traditional manufacturing methods by allowing for greater design flexibility, reduced material waste, and shorter production cycles. The technology, which initially found its applications in rapid prototyping, has expanded to full-scale production across a wide array of industries, including aerospace, automotive, healthcare, and consumer goods.

The additive manufacturing market has seen substantial growth, with several industries increasingly adopting 3D printing to optimize their manufacturing processes. In aerospace, for example, AM is used to produce lightweight, durable components that contribute to fuel efficiency and enhance aircraft performance. In the automotive industry, Additive manufacturing facilitates the production of complex, customized parts and prototypes, offering solutions for faster time-to-market and cost reductions in spare part manufacturing.

The healthcare sector has embraced AM for personalized medical devices, implants, and prosthetics, a trend that has been accelerated by the ability to tailor these products to individual patient needs. In fact, the healthcare sector accounted for over 10% of the total additive manufacturing market in 2024, with expectations for steady growth due to increasing demand for custom medical solutions.

Several factors are fueling the growth of the global additive manufacturing market. One of the primary drivers is the increasing demand for product customization across industries. Unlike traditional manufacturing processes that rely on expensive molds and tooling, AM enables cost-effective, on-demand production of bespoke products. In healthcare, for instance, 3D printing is used to create custom implants and prosthetics, responding to the growing trend toward personalized medicine. This trend is not limited to healthcare; the automotive and consumer goods sectors also benefit from AM’s ability to produce tailor-made parts and products.

Another significant factor driving the market is the growing emphasis on sustainability. Traditional manufacturing methods generate substantial material waste, whereas additive manufacturing uses only the material necessary for the production of each part, significantly reducing waste and lowering energy consumption. As industries become more environmentally conscious, the adoption of AM is expected to continue growing, particularly in sectors like aerospace and automotive, where material efficiency and reduced carbon footprints are critical concerns.

Key Takeaways

- Additive Manufacturing Market size is expected to be worth around USD 158.3 Bn by 2034, from USD 22.4 Bn in 2024, growing at a CAGR of 21.6%.

- Materials held a dominant market position, capturing more than 36.10% of the global additive manufacturing (AM) market.

- Powder Bed Fusion (PBF) held a dominant market position, capturing more than 32.10% of the global additive manufacturing (AM) market share.

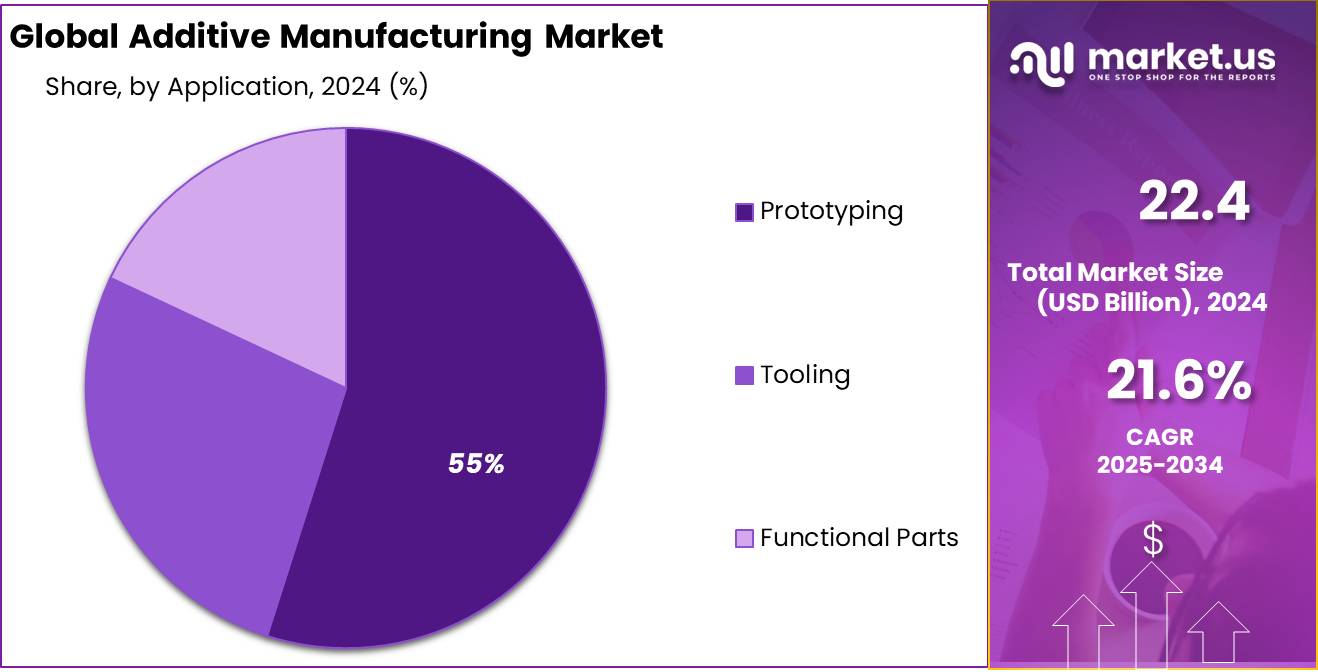

- Prototyping held a dominant market position, capturing more than 54.30% of the global additive manufacturing market share.

- Automotive & Transportation held a dominant market position, capturing more than 24.60% of the global additive manufacturing market share.

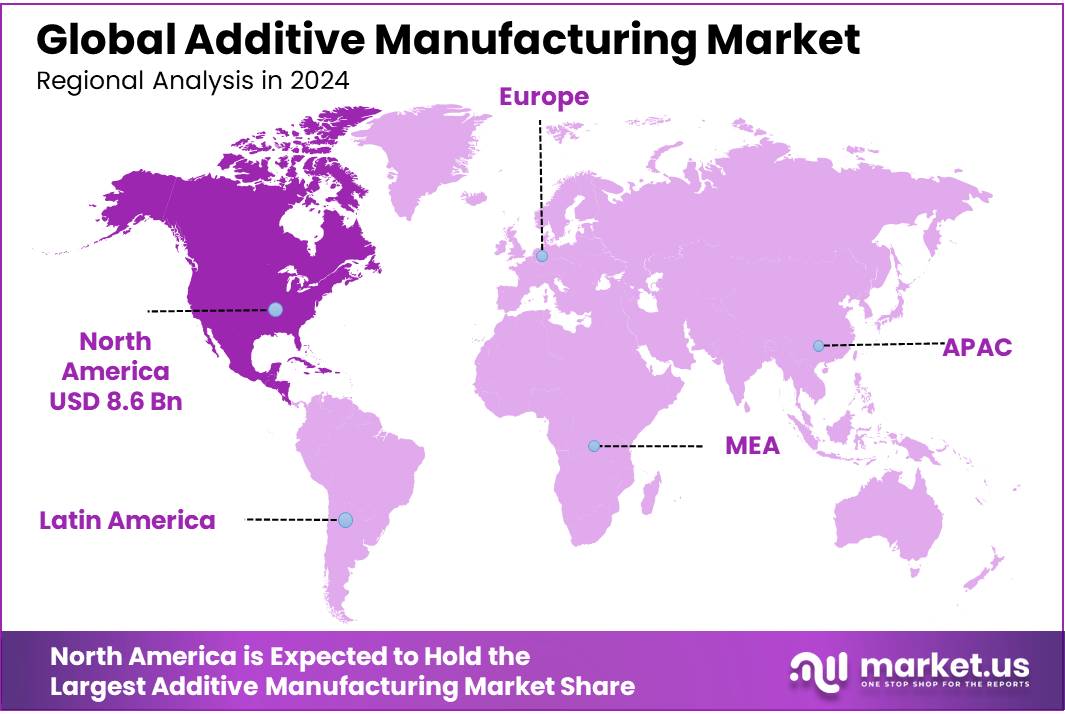

- North America continues to hold a dominant position in the additive manufacturing market, capturing over 38.6% of the global share, valued at approximately USD 8.6 billion.

By Component Analysis

In 2024, Materials held a dominant market position, capturing more than 36.10% of the global additive manufacturing (AM) market. This growth can be attributed to the continued advancements in material development and the increasing adoption of additive manufacturing technologies across various industries, including aerospace, automotive, healthcare, and consumer goods. The demand for a wide range of materials, including polymers, metals, ceramics, and biomaterials, has surged as companies increasingly utilize 3D printing to produce highly customized and complex components.

In the printer segment, industrial printers commanded a significant share in 2024. This segment’s growth is driven by the rising need for high-precision, high-volume production capabilities. Industrial 3D printers are capable of printing large-scale components with intricate geometries, offering immense advantages in industries such as aerospace and automotive. Desktop printers, while smaller in scale, continue to show steady growth due to their affordability and accessibility for small businesses, educational institutions, and home-based manufacturing.

Software for additive manufacturing, including design, inspection, printing, and scanning, is an essential enabler of the market. In 2024, the software segment witnessed substantial growth as manufacturers adopted more advanced software solutions to streamline the 3D printing process. Design software allows engineers to create highly detailed 3D models, while inspection software ensures quality control throughout the production process. The integration of scanning technology further enhances accuracy by enabling the digitalization of physical objects for reproduction.

The services segment, encompassing training, consulting, and maintenance services, is growing at a robust rate. As more companies adopt additive manufacturing technologies, the demand for professional services to manage installations, ensure machine uptime, and provide ongoing support is rising. Additive manufacturing service bureaus also play an essential role in providing on-demand 3D printing solutions for businesses that lack the infrastructure to support in-house production.

By Technology Analysis

In 2024, Powder Bed Fusion (PBF) held a dominant market position, capturing more than 32.10% of the global additive manufacturing (AM) market share. This technology has become increasingly popular due to its ability to produce complex geometries with high accuracy and surface finish, making it ideal for industries such as aerospace, automotive, and healthcare. The rise in demand for high-performance, custom parts, particularly in metal applications, contributed to the growth of Powder Bed Fusion. Over the past five years, this technology has witnessed steady year-on-year growth, with a notable increase in adoption from 2020 to 2024 as industries focused more on reducing manufacturing time and material waste. This market segment is expected to continue expanding as advancements in laser systems and powder materials improve overall process efficiency and product quality.

Material Extrusion, primarily driven by Fused Deposition Modeling (FDM), is one of the most established and widely used additive manufacturing technologies, accounting for a significant portion of the global market share. In 2024, this segment saw substantial growth, with a steady rise in the number of desktop 3D printers used for prototyping, tooling, and low-volume production. From 2020 to 2024, FDM technology experienced a compounded growth rate, primarily fueled by increased adoption in educational institutions, small enterprises, and consumer markets. The cost-effective nature of material extrusion, along with its versatility in handling a wide range of thermoplastic materials, has contributed to its sustained demand.

Vat Polymerization technologies, including Stereolithography (SLA) and Continuous Digital Light Processing (cDLP), saw continued growth in 2024, driven by industries seeking high-precision, fine-detail parts, particularly for the jewelry, dental, and prototyping sectors. In 2024, this technology captured a significant market share, especially in regions with strong manufacturing sectors such as North America and Europe. Over the past few years, the growth of Vat Polymerization has been fueled by the improved efficiency of photopolymer resins, increased speed, and the growing affordability of SLA and cDLP printers.

In 2024, Direct Energy Deposition (DED) technologies, including Laser Engineering Net Shaping (LENS), showed robust growth, driven by the demand for rapid repair and prototyping of metal parts. These technologies are particularly favored in aerospace, defense, and energy sectors, where complex and durable components are required. DED technology’s ability to deposit materials layer by layer while adding them directly onto existing parts for repair or enhancement has spurred its adoption. Year-over-year, the DED segment demonstrated consistent growth, with applications increasingly expanding into large-scale manufacturing.

The Binder Jetting segment also experienced increased traction in 2024, driven by its cost-effectiveness for producing metal parts and large-scale industrial components. As the demand for complex metal parts in industries like automotive, aerospace, and heavy machinery grows, Binder Jetting has gained a foothold due to its ability to print a wide variety of materials, including metals, sand, and ceramics. This technology offers a key advantage in reducing material waste and post-processing time, making it an attractive option for companies focused on sustainable and efficient manufacturing.

Material Jetting technologies, such as Multi Jet Fusion (MJF) and Material Jetting, saw growing demand in 2024, especially for producing high-quality prototypes and parts with fine features. While this segment holds a smaller share compared to PBF or FDM, its ability to deliver parts with high resolution and smooth surfaces made it a preferred choice for industries such as electronics, consumer goods, and medical devices. Over the years, material jetting has seen incremental growth in its applications, with technological advancements improving its speed and material compatibility.

The Sheet Laminated Object Manufacturing (LOM)**, saw a moderate increase in adoption in 2024. This technology, which uses thin layers of material bonded together, is particularly useful for creating larger objects such as prototypes and tooling. Over the years, the growth of sheet lamination has been steady, with continued investment in reducing operational costs and improving material choices. The adoption of this technology has been slow in comparison to other 3D printing methods, but it remains a viable option in the manufacturing of large-scale components.

By Application Analysis

In 2024, Prototyping held a dominant market position, capturing more than 54.30% of the global additive manufacturing market share. This has been driven by the growing demand for rapid prototyping across industries such as automotive, aerospace, consumer goods, and healthcare. Companies increasingly rely on 3D printing to create accurate, cost-effective prototypes that can be quickly tested, modified, and iterated. The ability to rapidly develop prototypes has allowed businesses to reduce design cycle times and accelerate time-to-market for new products.

The Tooling segment has seen a gradual increase in adoption over the past few years, particularly for creating jigs, fixtures, and specialized manufacturing tools. In 2024, tooling accounted for a smaller yet significant share of the market, driven by the demand for customized tooling solutions that improve the efficiency and precision of manufacturing processes. As additive manufacturing continues to mature, more industries are recognizing the benefits of using 3D printing for tooling, including reduced lead times and the ability to produce parts that traditional methods cannot.

The Functional Parts segment, while smaller compared to prototyping, has been experiencing rapid growth, especially in sectors like aerospace, healthcare, and automotive. In 2024, functional parts accounted for a substantial portion of the additive manufacturing market as companies move toward producing final, end-use components directly via 3D printing. The ability to create parts with complex geometries that are lightweight and highly customized has driven demand for functional parts in industries focused on performance, reliability, and innovation.

By End-use Analysis

In 2024, Automotive & Transportation held a dominant market position, capturing more than 24.60% of the global additive manufacturing market share. This sector has seen tremendous growth, driven by the need for rapid prototyping, lightweight parts, and custom components. Over the past few years, automotive manufacturers have increasingly adopted 3D printing to streamline production, reduce material waste, and enhance vehicle performance. The ability to quickly prototype new designs and manufacture on-demand spare parts has been a key factor in the rise of additive manufacturing within this industry.

The Aerospace & Defence sector has also experienced robust growth, with additive manufacturing offering significant advantages in terms of weight reduction and the creation of complex parts that would be difficult or impossible to manufacture with traditional methods.

In the Healthcare sector, additive manufacturing has revolutionized the production of customized medical devices, implants, and prosthetics. The demand for personalized healthcare solutions, such as 3D-printed implants and surgical tools, has contributed to the steady growth of this segment.

The Electrical & Electronics industry is increasingly utilizing additive manufacturing to create intricate components and reduce the overall weight and complexity of electronic products. From 2020 to 2024, this segment has witnessed growth driven by demand for miniaturized electronic parts, 3D-printed circuit boards, and custom housings. 3D printing technologies allow for the fast prototyping of new electronic devices and help companies quickly test and modify designs, leading to faster product development cycles.

The Industrial sector has embraced additive manufacturing for both tooling and functional parts, leading to strong growth from 2020 to 2024. This includes the creation of customized jigs, fixtures, and replacement parts, which offer companies improved production efficiency and reduced downtime. Additive manufacturing is particularly valuable in industries like machinery, construction, and heavy equipment, where bespoke, low-volume parts are needed.

The Consumer Goods sector has seen steady growth in additive manufacturing, with applications ranging from customized products to unique prototypes. The rise in personalized products, as well as the ability to create small, on-demand runs, has driven the adoption of 3D printing in this sector. From 2020 to 2024, more brands have begun to incorporate 3D printing into their product development processes, helping them meet the growing consumer demand for customization and faster product iterations.

The Power & Energy sector has been increasingly adopting additive manufacturing for producing specialized components like turbine blades, heat exchangers, and other high-performance parts used in energy production. The ability to design complex geometries that are lightweight and efficient has been a key factor in the adoption of 3D printing technologies within this industry.

In the Construction & Architecture segment, additive manufacturing is playing a transformative role, particularly with 3D-printed buildings and structures. This sector has seen significant growth, driven by the ability to create custom architectural designs, lower construction costs, and reduce material waste.

Key Market Segments

By Component Analysis

- Printers

- Desktop Printer

- Industrial Printer

- Software

- Design

- Inspection

- Printing

- Scanning

- Materials

- Polymer

- Metal

- Ceramic

- Bio Materials

- Services

By Technology Analysis

- Material Extrusion

- Liquid Deposition Modelling

- Fused Deposition Modelling

- Powder Bed Fusion

- Selective Laser Melting

- Selective Laser Sintering

- Multi Jet Fusion

- Electron Beam Melting

- Vat Polymerization

- Stereolithography

- Continuous Digital Light Processing

- Daylight Polymer Printing

- Digital Light Processing

- Direct Energy Deposition

- Electron Beam AM

- Laser Engineering Net

- Material Jetting

- Sheet Lamination

- Binder Jetting

By Application Analysis

- Prototyping

- Tooling

- Functional Parts

By End-use Analysis

- Aerospace & Defence

- Automotive & Transportation

- Healthcare

- Electrical & Electronics

- Industrial

- Consumer Goods

- Power & Energy

- Construction & Architecture

- Others

Drivers

The continuous development of high-performance materials, such as advanced polymers, metals, and ceramics, has unlocked new possibilities for additive manufacturing applications, ranging from automotive and aerospace to healthcare and consumer goods. For instance, the development of biocompatible and biodegradable materials has paved the way for additive manufacturing to be used in medical implants and prosthetics, offering tailored solutions for individual patients. These advancements have not only expanded the scope of additive manufacturing but have also made it more viable for mass production, creating opportunities for industries to reduce manufacturing time and costs.

According to the U.S. Department of Energy, additive manufacturing has the potential to save between 30% and 70% of energy consumption compared to traditional manufacturing methods. The use of 3D printing in industries like aerospace, which involves intricate designs and complex geometries, allows manufacturers to optimize material use and reduce waste. A report by the National Institute of Standards and Technology (NIST) found that additive manufacturing could help companies achieve up to 90% reduction in material waste in certain applications. This capability has made additive manufacturing an attractive option for industries seeking to adopt more sustainable practices, as it enables precision manufacturing with minimal waste.

Governments and international bodies are also encouraging the adoption of additive manufacturing technologies, particularly in sectors such as healthcare and aerospace, through grants, tax incentives, and regulatory support. For example, in the United States, the Department of Defense (DoD) has invested heavily in additive manufacturing technologies to create parts and components for military applications, with the goal of reducing costs, improving supply chain efficiency, and increasing the lifespan of materials used in military systems. In 2020 alone, the DoD allocated over $65 million to support 3D printing initiatives in defense-related manufacturing.

One of the most notable trends in additive manufacturing has been the push towards industrial-scale 3D printing. Traditional manufacturing processes often require tooling and molds that are expensive and time-consuming to create. In contrast, additive manufacturing allows for direct-to-product manufacturing without the need for molds, enabling faster prototyping and reducing lead times. The flexibility in design offered by additive manufacturing has allowed manufacturers to create highly customized products that would be impossible or prohibitively expensive to produce using traditional methods. This has been particularly valuable in industries like healthcare, where personalized implants, prosthetics, and devices are in high demand.

As the additive manufacturing industry continues to grow, the ongoing development of new materials and improved 3D printing technologies is expected to drive even greater adoption. For example, the creation of metal 3D printing solutions has enabled manufacturers in industries like aerospace to produce highly complex metal parts with exceptional strength and precision. The ability to print these parts directly from digital files, without the need for traditional machining, has significantly reduced the cost of production, allowing for lighter and more efficient components.

Restraints

High Initial Investment and Operational Costs

One of the significant challenges facing the widespread adoption of additive manufacturing (AM) is the high initial investment required for 3D printers and the ongoing operational costs. While additive manufacturing can offer significant advantages, such as reduced waste, faster prototyping, and the ability to create complex geometries, the upfront cost of industrial-grade 3D printers can be prohibitively expensive for many businesses, particularly small and medium-sized enterprises (SMEs).

For example, a basic industrial 3D printer can cost between $10,000 to $50,000, while advanced machines used for metal or composite printing can cost hundreds of thousands of dollars. According to the National Institute of Standards and Technology (NIST), the cost of equipment and materials is often one of the top barriers to entry for companies considering the transition to additive manufacturing. This is especially challenging for industries with lower production volumes or for those with tight profit margins.

Additionally, the materials used in additive manufacturing are often more expensive than those used in traditional manufacturing methods. For instance, metals such as titanium and cobalt-chrome, which are often used for high-performance applications in aerospace and medical sectors, can cost up to 10 times more than the same materials used in conventional manufacturing processes. A report from The European Commission’s Joint Research Centre highlights that the high cost of raw materials for additive manufacturing, coupled with the complexity of the printing process, contributes to the overall high operational costs for companies in this sector.

While there are government initiatives aimed at supporting the adoption of additive manufacturing, the financial burden of transitioning to this technology remains a significant obstacle. The U.S. Department of Energy’s Manufacturing Extension Partnership (MEP) and the European Commission have introduced programs to support research and development (R&D) in additive manufacturing and to help companies access funding for technology upgrades. However, despite these efforts, the initial investment is still a major hurdle.

Furthermore, the cost of maintenance and expertise also adds to the financial strain. additive manufacturing systems require highly specialized personnel to operate, maintain, and troubleshoot, which can add to labor costs. According to a 2019 report by the U.S. Bureau of Labor Statistics, the average salary for a 3D printing technician is approximately $60,000 per year, which is significantly higher than that of traditional manufacturing workers.

Opportunity

Expansion of Additive Manufacturing in the Healthcare Sector

One of the major growth opportunities for additive manufacturing (AM) lies in its increasing use within the healthcare sector. The ability of additive manufacturing to produce highly customized, patient-specific medical devices, implants, and prosthetics is revolutionizing the industry, providing greater precision and improved patient outcomes. The healthcare market’s shift towards personalized medicine and the demand for individualized products has opened the door to additive manufacturing technologies, presenting significant growth potential.

According to a report by the U.S. Department of Health and Human Services, the healthcare sector is increasingly adopting additive manufacturing technologies due to their ability to reduce the cost of production and the time it takes to bring new medical products to market. This includes creating customized implants such as joint replacements, dental implants, and hearing aids tailored to individual patients’ specifications, thus improving the efficiency and success rate of medical procedures.

The rise in personalized healthcare is supported by government initiatives and regulations. For example, in the U.S., the Food and Drug Administration (FDA) has made strides in approving 3D-printed medical devices. By 2023, the FDA approved over 80 3D-printed medical devices, and the numbers are expected to rise as the technology becomes more advanced and more applications are identified.

Moreover, the integration of AM in healthcare has received support from organizations such as The National Institutes of Health (NIH), which is funding several projects to explore how 3D printing can be used in creating more affordable and effective prosthetics, as well as exploring bioprinting of tissues and organs. These innovations are driving the adoption of additive manufacturing in healthcare, not only in the U.S. but globally.

Governments are also investing in R&D to push the boundaries of additive manufacturing. For instance, in Europe, the European Commission has pledged to invest heavily in advanced manufacturing technologies, including 3D printing, as part of its Horizon 2020 program. This initiative is expected to facilitate the development of more cost-effective, efficient, and high-quality manufacturing methods for the healthcare sector, boosting the market for additive manufacturing-related products.

Trends

Adoption of Sustainability Initiatives in Additive Manufacturing

today technologies, particularly 3D printing, offer significant advantages when it comes to reducing material waste. Traditional manufacturing methods, such as milling and casting, often require the removal of large amounts of material from a larger block, which leads to waste. In contrast, additive manufacturing builds objects layer by layer, using only the exact amount of material needed. This precision helps conserve resources, reducing overall material consumption. According to the U.S. Environmental Protection Agency (EPA), the shift to more sustainable manufacturing practices has been critical, with additive manufacturing expected to reduce material waste by up to 50% in some industries.

Additionally, today enables the use of sustainable materials, further enhancing its eco-friendly reputation. Many companies are experimenting with biodegradable plastics, recycled materials, and even metals that can be reused in the production of 3D-printed parts. For example, Stratasys—a global leader in today technologies—has introduced FDM (Fused Deposition Modeling) 3D printers that allow businesses to use recycled materials for prototyping and production, helping to reduce their carbon footprint. In 2024, it is estimated that 20% of all 3D printing material sales will come from recycled or biodegradable materials.

Governments and industry organizations have also recognized the environmental benefits of additive manufacturing and are encouraging its adoption. The European Union has set ambitious sustainability goals, aiming to reduce CO2 emissions from industrial processes by 55% by 2030, and today is expected to play a significant role in this transformation. The U.S. Department of Energy (DOE) is providing funding to research and development projects that explore how AM can lower energy consumption in manufacturing. In fact, some government agencies are offering tax incentives for companies that adopt sustainable manufacturing practices, including the use of AM technology.

In the aerospace industry, today is already being leveraged to reduce the environmental impact of aircraft manufacturing. According to NASA, additive manufacturing is being used to produce lighter and more efficient components for space exploration, reducing the fuel consumption of rockets and spacecraft. In fact, NASA estimates that the use of 3D printing in spacecraft could reduce launch costs by up to 70% by producing parts on demand rather than shipping them from Earth.

The food industry is another sector where additive manufacturing’s sustainability benefits are gaining traction. While still in the early stages, 3D printing for food allows for the precise creation of meals, reducing food waste. Companies like Novameat are exploring the possibility of creating plant-based meat alternatives using AM technology, potentially reducing the environmental impact associated with traditional livestock farming, which is responsible for 14.5% of global greenhouse gas emissions according to the Food and Agriculture Organization (FAO).

Regional Analysis

In 2024, North America continues to hold a dominant position in the additive manufacturing market, capturing over 38.6% of the global share, valued at approximately USD 8.6 billion. The region’s leadership is attributed to a strong presence of key players in the 3D printing industry, alongside rapid technological advancements and significant investments in research and development. Countries such as the United States and Canada are leading the charge, with the U.S. alone contributing to a large portion of the market share due to the high demand in sectors like aerospace, automotive, and healthcare.

Europe holds the second-largest share in the market, with a robust presence of industrial sectors actively investing in AM technologies. The European Union has implemented favorable policies to support the growth of advanced manufacturing technologies, with countries like Germany, France, and the UK driving demand. The region is expected to grow steadily over the next few years. European manufacturers are increasingly using additive manufacturing for rapid prototyping and custom manufacturing solutions, particularly in the automotive and healthcare industries.

In Asia Pacific (APAC), the market is projected to grow rapidly, driven by the expansion of the manufacturing sector in countries like China, Japan, and India. The growing adoption of 3D printing in automotive, aerospace, and electronics manufacturing is expected to further boost market growth. Additionally, the rise of digital manufacturing and government-backed initiatives for innovation is promoting the widespread use of AM technologies in the region.

Latin America and Middle East & Africa are emerging markets for additive manufacturing, with regional growth primarily driven by small- and medium-sized enterprises (SMEs) in the automotive and aerospace sectors, but their share remains relatively smaller compared to the leading regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The additive manufacturing market is highly competitive, with leading players such as Stratasys, Ltd., 3D Systems, Inc., and ExOne driving innovations and market growth. Stratasys and 3D Systems are among the pioneers in the 3D printing space, offering comprehensive solutions across industries including aerospace, automotive, healthcare, and consumer goods. ExOne, focusing primarily on industrial-grade metal 3D printing, has gained significant market share by providing customized solutions for clients in heavy industries.

EOS, Materialise NV, and General Electric (GE). EOS is a leader in metal and polymer-based additive manufacturing, particularly well-regarded for its powder-bed fusion technology, which is widely adopted in the aerospace and automotive sectors. Materialise NV stands out for its expertise in software for 3D printing, and its solutions are increasingly integrated into industries like healthcare, where they enable customized medical implants and devices.

General Electric, through its GE Additive division, is a major player, leveraging 3D printing to transform production processes in industries such as aerospace, particularly with metal additive manufacturing for jet engines. In addition to these, HP Inc., Renishaw plc, and SLM Solutions Group AG are key contributors, advancing technologies in both polymer and metal additive manufacturing, as well as supporting the push towards automation and sustainability in production.

Autodesk, Inc., BASF SE, and Arkema have made significant contributions to the market with software development and advanced materials for 3D printing. BASF SE, for example, is a leading supplier of industrial materials, while Höganäs AB and voxeljet AG focus on powder metal and industrial solutions, enhancing the material options available for 3D printing.

Market Key Players

- Proto Labs, Inc.

- Stratasys, Ltd.

- 3D Systems, Inc.

- ExOne

- EOS

- Materialise NV

- General Electric

- HP Inc.

- Renishaw plc

- SLM Solutions Group AG

- voxeljet AG

- Desktop Metal

- 3DCeram

- Autodesk, Inc.

- Canon, Inc.

- Dassault Systèmes SE

- EnvisionTec, Inc.

- Optomec, Inc.

- Organovo Holdings Inc.

- BASF SE

- Höganäs AB

- Arkema

- Other Key Players

Recent Developments

- In 2024, Stratasys has reported revenues exceeding USD 1.2 billion, marking a steady year-on-year growth rate of approximately 6%.

- In 2024, 3D Systems, Inc. continues to be a significant player in the additive manufacturing sector, with an estimated market share of 20.4%, contributing to a global revenue of approximately USD 1.1 billion.

Report Scope

Report Features Description Market Value (2024) US$ 22.4 Bn Forecast Revenue (2034) US$ 158.3 Bn CAGR (2025-2034) 21.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component Analysis (Printers, Software, Materials, Services), By Technology Analysis (Material Extrusion, Powder Bed Fusion, Vat Polymerization, Direct Energy Deposition, Material Jetting, Sheet Lamination, Binder Jetting), By Application Analysis (Prototyping, Tooling, Functional Parts), By End-use (Analysis, Aerospace and Defence, Automotive and Transportation, Healthcare, Electrical and Electronics, Industrial, Consumer Goods, Power and Energy, Construction and Architecture, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Proto Labs, Inc., Stratasys, Ltd., 3D Systems, Inc., ExOne, EOS, Materialise NV, General Electric, HP Inc., Renishaw plc, SLM Solutions Group AG, voxeljet AG, Desktop Metal, 3DCeram, Autodesk, Inc., Canon, Inc., Dassault Systèmes SE, EnvisionTec, Inc., Optomec, Inc., Organovo Holdings Inc., BASF SE, Höganäs AB, Arkema, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Additive Manufacturing MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Additive Manufacturing MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Proto Labs, Inc.

- Stratasys, Ltd.

- 3D Systems, Inc.

- ExOne

- EOS

- Materialise NV

- General Electric

- HP Inc.

- Renishaw plc

- SLM Solutions Group AG

- voxeljet AG

- Desktop Metal

- 3DCeram

- Autodesk, Inc.

- Canon, Inc.

- Dassault Systèmes SE

- EnvisionTec, Inc.

- Optomec, Inc.

- Organovo Holdings Inc.

- BASF SE

- Höganäs AB

- Arkema

- Other Key Players