Global Cyclohexane Market By Application (Adipic acid, Caprolactam, and Other Applications), By End-Use (Nylon 6, Nylon 66, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 58832

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

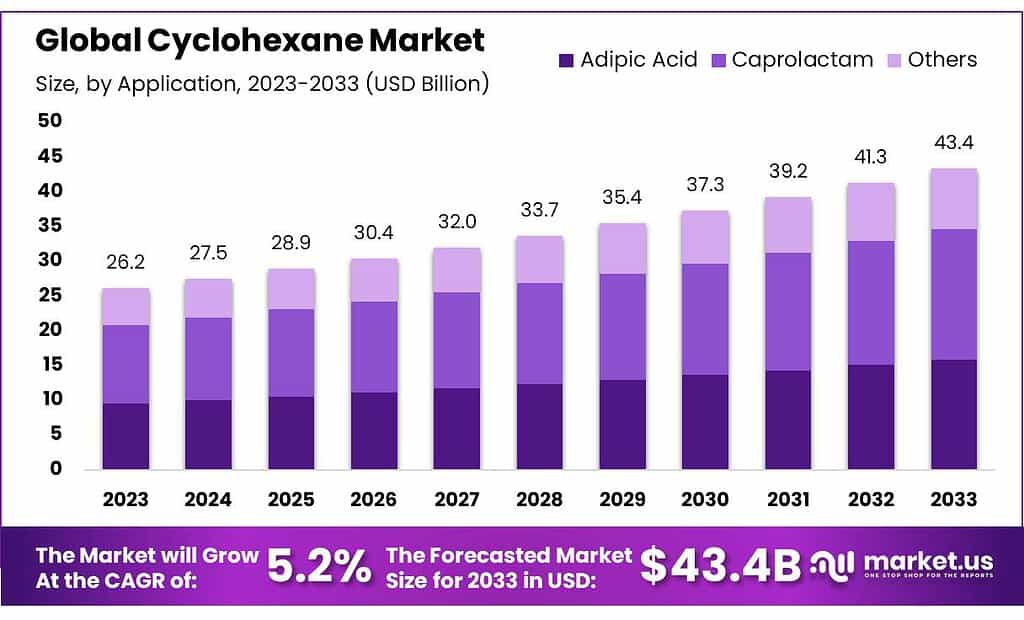

The Cyclohexane Market size is expected to be worth around USD 43.4 billion by 2033, from USD 26.15 Bn in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

The cyclohexane market refers to the global industry involved in the production, distribution, and utilization of cyclohexane, a colorless and flammable liquid cycloalkane.

Cyclohexane is a key chemical compound primarily used as a solvent in various industries, including but not limited to the production of adipic acid (a precursor for nylon manufacturing), as a solvent in the paint and coating industry, and in the pharmaceutical sector for extraction and synthesis purposes.

Cyclohexane, an intermediate product, produces adipic Acid and Caprolactam. The global cyclohexane industry is experiencing significant growth due to increased applications of cyclohexane across a variety of industries and the increasing demand for nylon products in engineered and automotive plastics.

It is also gaining popularity in the areas of food and beverage packaging, textile, electrical & electronic, and other industries. This has led to several regulations and legislative actions regarding safe use.

Key Takeaways

- Market Growth Projection: Cyclohexane Market is poised to reach USD 43.4 billion by 2033, rising from USD 26.15 billion in 2023, exhibiting a steady CAGR of 5.2%.

- Driver of Growth: Increased use in textiles and automotive industries drives the demand for cyclohexane, primarily used in producing adipic acid and caprolactam.

- Application Insights: Caprolactam held 43.2% of the market share in 2023 due to its role in manufacturing nylon, widely used in clothing and carpets.

- Price Dynamics: Cyclohexane prices fluctuated due to factors like production cessation, impacting profits for manufacturers, and achieving supply-demand equilibrium in Asian markets.

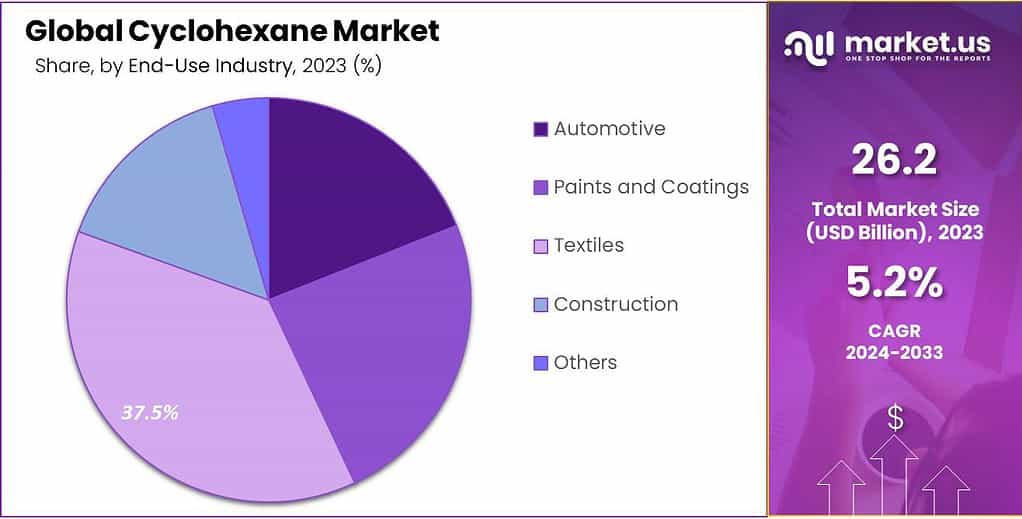

- End-Use Impact: Textiles dominated the market (37.5%) utilizing cyclohexane in nylon fiber production for clothing and carpets, while the automotive sector relied on it for durable components.

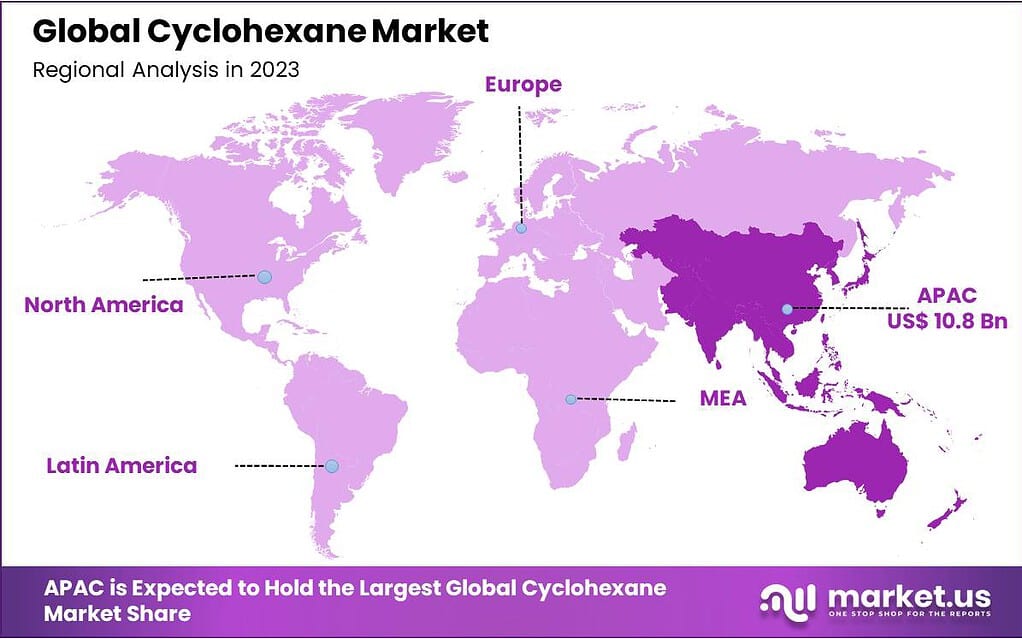

- Regional Influence: Asia Pacific (APAC) led the market in 2023 with over 41.2% revenue share, driven by high demand from economies like China and India due to urbanization and economic growth.

- Industry Players: Sinopec Limited and Sigma-Aldrich Corporation are among the key players, emphasizing app development, customization, and mergers to bolster market presence.

Application Analysis

In 2023, Caprolactam was the big shot in the Cyclohexane market, owning over 43.2% of the share. Caprolactam is a crucial ingredient for making nylon, found in products like clothing and carpets. Its widespread use in this field contributed significantly to its dominant position.

Cyclohexane can be used to make adipic and Caprolactam, which is then used to create many end-use products like nylon 6, nylon 66, and others. Nylon can be used as an end-use product to make threads that can be further processed into textiles and clothing. Caprolactam is used as the primary feedstock to make nylon 6; however, adipic acids are used to make nylon 66.

Caprolactam prices are low because Asian plants operate at their maximum capacity. Post-shale gas boom, prices have fallen by more than 30%, leaving manufacturers bankrupt. The prices rose in 2023-2032 as manufacturers stopped producing. However, they have not reached the optimal level to make a profit.

For a perfect supply-demand balance, Asian producers may need to reduce their production by up to 50%. Prices hovered around USD 1.2-1.4 per kg in the first quarter of 2021, as global crude oil prices reached their highest peak. This resulted in producers making a low profit because operating costs were high in areas where energy costs were high.

End-Use Analysis

In 2023, Textiles ruled the Cyclohexane market, claiming over 37.5% of the share. Cyclohexane plays an essential role in textile manufacturing, especially the production of nylon fibers used to produce clothing, carpets, and fabric materials.

Its popularity lies in both its wide application as a textile manufacturing material as well as its durability in production processes. The Automotive sector follows closely, relying on Cyclohexane for manufacturing nylon-based components used in vehicles. From durable engine parts to resilient interior materials, Cyclohexane-derived products contribute to enhancing the durability and performance of automotive components.

The majority of nylon manufacturers produce nylon resins and Caprolactam, thus allowing them to position themselves at all stages of the nylon value chain. Due to increasing awareness among consumers, the global demand for nylon is changing.

Маrkеt Ѕеgmеntѕ

By Application

- Adipic acid

- Caprolactam

- Other Applications

By End-Use

- Automotive

- Paints and Coatings

- Textiles

- Construction

- Others

Drivers

Rising demand for nylon products across industries like textiles, automotive components and consumer goods serves as a significant catalyst in driving the cyclohexane market forward. Due to nylon’s wide array of uses and durable qualities, its production requires increasing amounts of cyclohexane as an integral ingredient; as a result, this spike drives increased sales of cyclohexane which propels market expansion overall.

Automotive industries and other end-user verticals play a pivotal role in driving the cyclohexane market forward, driving the growth of this commodity chemical market. As these sectors prioritize lightweight materials for various applications, demand for nylon-based components increases significantly – this in turn increases demand for cyclohexane production, further driving market expansion.

Restraints

The growth of the cyclohexane market faces substantial hurdles due to several factors. Foremost among these are the increasing concerns regarding environmental safety and conservation. The market encounters challenges stemming from the volatility in raw material prices and a growing emphasis on environmental preservation.

Stringent government regulations aimed at reducing pollution significantly limit the growth potential of the cyclohexane market. Additionally, the availability of substitutes like phenol, utilized in caprolactam production, presents a hindrance to the market’s growth trajectory.

These challenges impede the market’s expansion, creating hurdles in maintaining a steady growth rate. The report outlines various aspects affecting the market, including recent developments, trade regulations, import-export dynamics, and production analyses. It also delves into value chain optimization, market share, and the impact of both domestic and localized market players.

The analysis highlights emerging revenue opportunities, shifts in market regulations, strategic growth approaches, market size, category growths, and application niches, encompassing aspects like product approvals, launches, geographic expansions, and technological innovations.

Opportunities

Cyclohexane market opportunities abound, particularly due to growing oil and gas industry demands for this chemical product. Cyclohexane plays a pivotal role in oil refining processes for producing gasoline and solvents – as this sector expands, so too will demand for this compound grow, creating promising opportunities in its market.

Furthermore, the surge in automobile production, particularly in the integration of nylon-based materials, opens up significant prospects. Nylon, renowned for its lightweight, durable, and high-performance characteristics, has found extensive use in various automotive applications.

With automobile manufacturers increasingly incorporating nylon-based components, there’s a corresponding surge in demand for cyclohexane, essential in the production of nylon. This trend creates an opportune moment for cyclohexane suppliers to cater to the escalating needs of a rapidly growing automotive industry.

Challenges

The cyclohexane market confronts several challenges that can impact its growth trajectory. One significant hurdle revolves around environmental concerns and safety regulations. As there’s a growing emphasis on environmental sustainability, coupled with stringent regulations to curb pollution, the cyclohexane market faces limitations in its expansion. Compliance with these regulations and ensuring environmentally safe practices poses a challenge for market players.

Volatility in raw material prices is a pressing issue for the cyclohexane market. Fluctuations in the prices of key raw materials used in cyclohexane production can disrupt the market dynamics, affecting production costs and overall profitability.

This volatility necessitates careful management and strategies to mitigate the impact on market stability. Another challenge comes from the availability of substitutes, such as phenol, utilized in the production of caprolactam. These substitutes pose a threat to the market growth rate, offering alternatives that could potentially derail the demand for cyclohexane.

The cyclohexane market faces obstacles in terms of competition from other materials and substitutes in various applications. This competitive landscape requires cyclohexane suppliers to continually innovate and demonstrate the unique advantages of their product to retain market share and meet evolving industry demands.

Addressing these challenges requires proactive measures, including adapting to stringent environmental regulations, implementing effective pricing strategies to manage raw material volatility, and developing innovative approaches to differentiate cyclohexane from its substitutes. Finding sustainable solutions while maintaining competitiveness will be key in navigating these challenges for the cyclohexane market.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 41.2% in 2023. The region’s emerging economies, including India and China, are undergoing major economic changes. Cyclohexane has been in high demand due to the growing population and rising living standards.

China is the world’s largest consumer and producer of cyclohexane. China’s rapid urbanization and strong economic growth have resulted in a vibrant cyclohexane industry. The country is seeing a shift away from traditional to bio-based cyclohexane manufacturing due to increasing awareness and rising disposable income.

Europe accounted for more than 25% of global volume in 2021. The industry will continue to be driven by increasing consumption in the U.S. and China’s easy quality regulations. The industry will also be driven by the availability of abundant raw materials over the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global market for cyclohexane has a high level of competition and is very concentrated. The six largest companies accounted for the highest share of global production. The key players include Sinopec Limited and Sigma-Aldrich Corporation.

App development and customization are key elements to being competitive. There are frequent mergers to increase market share and diversify the application portfolio.

Маrkеt Kеу Рlауеrѕ

- BASF SE

- Cepsa

- Chevron Phillips Chemical Company LLC

- CITGO Petroleum Corporation

- Reliance Industries Limited

- Exxon Mobil Corporation

- Idemitsu Kosan Co.,Ltd.

- PTT Global Chemical Public Company Limited

- Merck KGaA

- Others

Recent Development

2023 Chevron Phillips Chemical: Developed a new technology for the production of cyclohexane from renewable feedstocks, such as plant oils and biomass.

2022 BASF: Expanded its cyclohexane production capacity in Germany by 10% to meet the increasing demand for nylon 6, which is made from cyclohexane.

Report Scope

Report Features Description Market Value (2023) USD 26.5 Bn Forecast Revenue (2033) USD 43.4 Bn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Adipic acid, Caprolactam, and Other Applications), By End-Use (Nylon 6, Nylon 66, and Other End-Uses) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Cepsa, Chevron Phillips Chemical Company LLC, CITGO Petroleum Corporation, Reliance Industries Limited, Exxon Mobil Corporation, Idemitsu Kosan Co.,Ltd., PTT Global Chemical Public Company Limited, Merck KGaA, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is cyclohexane, and where is it used in industries?Cyclohexane is a colorless, flammable liquid primarily used as a solvent in various industries like paint and coating, textiles, and pharmaceuticals. It's also a precursor in the production of adipic acid and caprolactam, essential for nylon manufacturing.

What are the challenges faced by the cyclohexane market?Challenges include fluctuations in crude oil prices (as cyclohexane is derived from crude oil), increasing competition from alternative solvents, and environmental concerns associated with its production and usage.

What are the major factors influencing the cyclohexane market growth?Factors include its extensive application in the manufacturing of nylon, growing demand for nylon fibers, increased use in pharmaceuticals, and its role as a solvent in various industries. Market dynamics also respond to raw material availability and price fluctuations.

-

-

- BASF SE

- Cepsa

- Chevron Phillips Chemical Company LLC

- CITGO Petroleum Corporation

- Reliance Industries Limited

- Exxon Mobil Corporation

- Idemitsu Kosan Co.,Ltd.

- PTT Global Chemical Public Company Limited

- Merck KGaA

- Others