Global Agricultural Enzymes Market By Enzyme Type (Phosphatases, Dehydrogenases, Ureases, Proteases and Others) By Application (Crop Protection, Soil Fertility and Plant Growth Regulation) By Crop Type (Grains and Cereals, Oil Seeds and Pulses, Fruits and Vegetables, Other Crop Types) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 61767

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

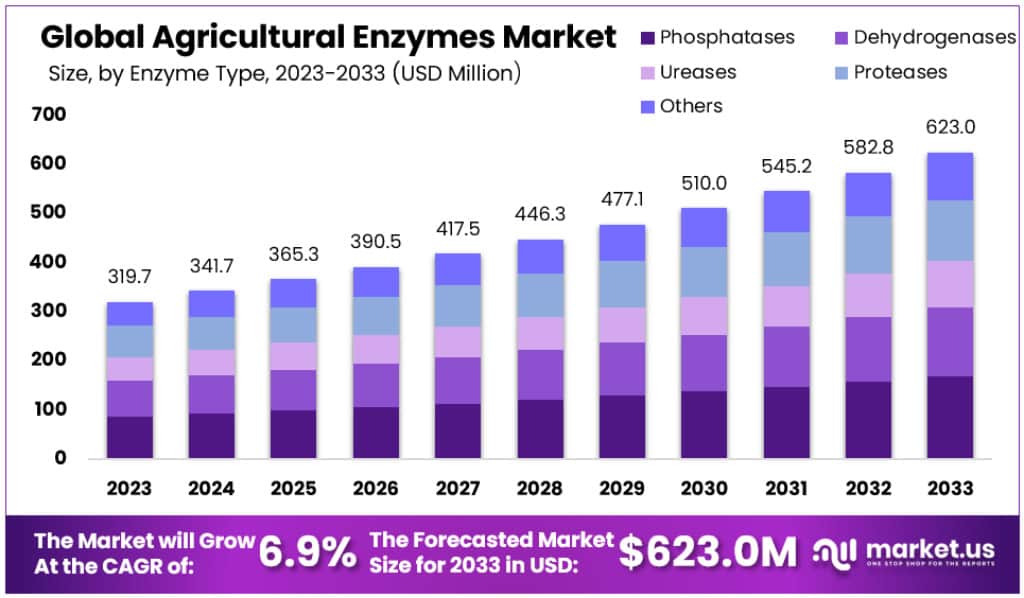

The Global Agricultural Enzymes Market size is expected to be worth around USD 623 Million by 2033, from USD 319.7 Million in 2023, growing at a CAGR of 6.9% during the forecast period from 2023 to 2033.

Agricultural enzymes are bioactive proteins that are used in agriculture to increase crop production, improve soil fertility, and protect crops from pests and diseases. These enzymes act as natural herbicides, pesticides, and fertilizers, and they accelerate chemical reactions by unblocking nutrients in the soil, making them available to plants. They also play a vital role in maintaining the health of plants, animals, and the environment.

Enzymes in agriculture are considered an environmentally friendly and sustainable approach to farming, providing benefits to both the soil and the crops. They are used as a healthier and organic alternative to chemicals, contributing to the overall productivity and sustainability of agricultural practices.

Key Takeaways

- The Agricultural Enzymes Market is projected to reach approximately USD 623 million by 2033, up from USD 319.7 million in 2023.

- This market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% from 2023 to 2033.

- In 2023, Phosphatases dominate the market with a 26.8% share due to their role in enhancing soil quality and crop yield.

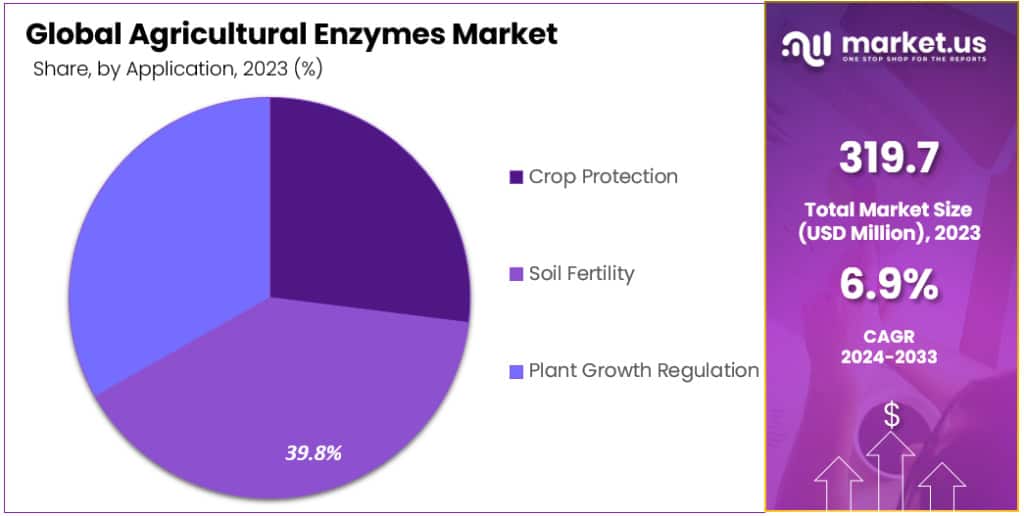

- Soil Fertility is the leading application segment in 2023, with a 39.8% market share.

- Grains and Cereals hold a dominant market position among crop types in 2023, with a 28.9% share.

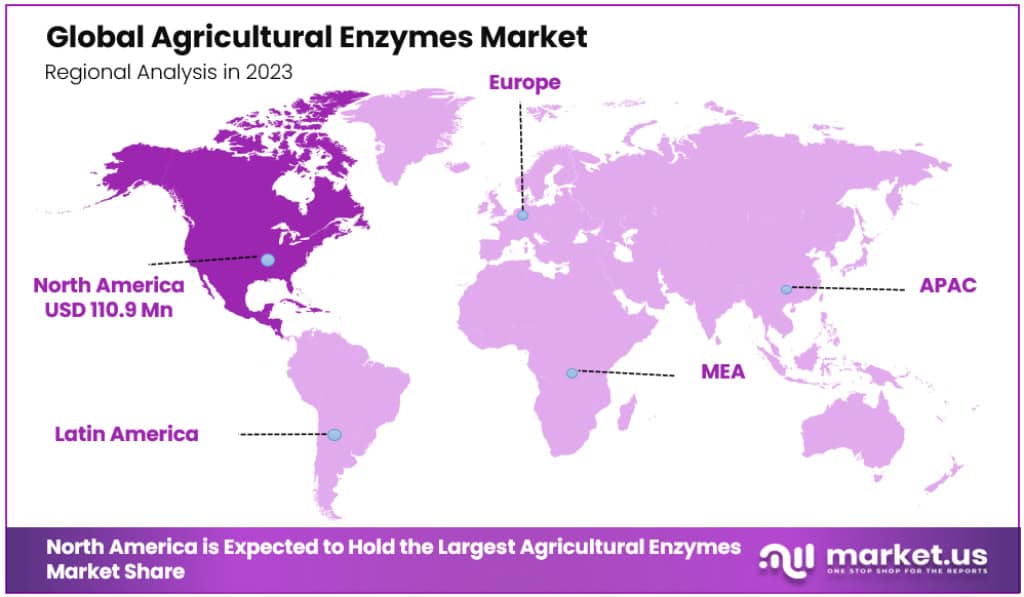

- In 2023, North America leads the Agricultural Enzymes Market with a 34.7% share, valued at USD 110.9 million.

Enzyme Type Analysis

In 2023, Phosphatases held a dominant market position, capturing more than a significant 26.8% share. This enzyme type, renowned for its role in soil fertility and plant growth, has gained prominence due to its widespread application in agriculture. The demand for Phosphatases is fueled by their effectiveness in releasing phosphate ions from organic compounds, thereby enhancing soil quality and crop yield.

Dehydrogenases followed closely, marking a notable presence in the agricultural enzymes market. These enzymes, critical in soil microbial activity and organic matter decomposition, are instrumental in nutrient cycling. Their ability to facilitate the oxidation-reduction process in soil makes them invaluable for sustainable agricultural practices. The segment’s growth is attributed to the increasing adoption of eco-friendly farming techniques that prioritize soil health.

Ureases, another vital enzyme type, have shown a steady increase in market demand. These enzymes play a pivotal role in nitrogen management, a crucial element in crop cultivation. By hydrolyzing urea into usable ammonia, Ureases significantly contribute to nitrogen efficiency in agricultural settings. Their importance in reducing nitrogen loss and enhancing fertilizer efficiency underscores their growing market relevance.

Proteases, known for their protein degradation capability, have also carved a niche in the agricultural enzymes market. These enzymes are essential in breaking down proteinaceous compounds in soil, facilitating nutrient availability for plants. The rising interest in improving soil health and nutrient absorption efficiency has spurred the demand for Proteases.

Other enzyme types, encompassing a diverse range of functionalities, collectively contribute to the robustness of the agricultural enzymes market. These enzymes, including cellulases, amylases, and others, offer unique benefits in crop protection, soil fertility enhancement, and overall plant health. Their varied applications across different agricultural needs underscore the dynamic nature of the market.

Application Analysis

In 2023, Soil Fertility held a dominant market position, capturing more than a significant 39.8% share. This segment’s prominence is attributed to the growing emphasis on sustainable agriculture and soil health. Enzymes in this category, such as Phosphatases and Ureases, play a pivotal role in nutrient cycling and soil structure improvement. Their ability to enhance nutrient availability and support robust plant growth drives their demand in the agricultural sector.

Crop Protection, another critical segment, also commands a substantial portion of the market. Enzymes used in this sector, like Proteases and Chitinases, are instrumental in safeguarding crops against pests and diseases. Their natural origin and environmental compatibility make them highly preferable to chemical alternatives. The increasing adoption of integrated pest management practices that favor biological over chemical solutions has spurred the growth of this segment.

Plant Growth Regulation represents a dynamic and evolving segment within the agricultural enzymes market. Enzymes such as Auxins and Gibberellins are at the forefront, facilitating various growth processes in plants. They are essential in regulating growth patterns, enhancing stress tolerance, and improving crop yields. The drive toward maximizing agricultural productivity while maintaining ecological balance has elevated the importance of this segment.

Crop Type Analysis

In 2023, Grains and Cereals held a dominant market position, capturing more than a significant 28.9% share. This segment’s leadership stems from the high global consumption and production of staple crops like wheat, rice, and maize. Agricultural enzymes, such as Phosphatases and Proteases, play a crucial role in enhancing the yield and quality of these crops. They improve soil fertility and nutrient absorption, directly impacting the productivity of grains and cereals.

Oil Seeds and Pulses, another key segment, have also seen substantial market growth. These crops, including soybeans, sunflowers, and lentils, are vital for their nutritional value and oil content. Enzymes used in this segment contribute to better seed germination, soil nutrient management, and overall plant health. Their role in increasing oil seed and pulse yields aligns with the rising demand for plant-based proteins and oils.

Fruits and Vegetables represent a diverse and rapidly growing segment in the agricultural enzymes market. The use of enzymes in this category enhances crop resistance to diseases, improves shelf life, and increases nutrient content. This segment benefits from the global shift towards healthier eating habits and the rising demand for fresh produce. Enzymes like Cellulases and Pectinases are especially significant in this segment, aiding in fruit ripening and quality enhancement.

Other Crop Types, encompassing a variety of minor and specialized crops, form an essential part of the agricultural enzymes market. This segment includes crops like spices, herbs, and ornamental plants, each with specific enzyme requirements. The diversity within this segment reflects the versatility and adaptability of agricultural enzymes to different crop needs, underscoring their importance in a broad range of agricultural applications.

Key Market Segments

Based On Enzyme Type

- Phosphatases

- Dehydrogenases

- Ureases

- Proteases

- Others

Based On Application

- Crop Protection

- Soil Fertility

- Plant Growth Regulation

Based On Crop Type

- Grains and Cereals

- Oil Seeds and Pulses

- Fruits and Vegetables

- Other Crop Types

Drivers

- Growing Demand for Organic Food: The escalating global demand for organic food, reflecting a 2.2% increase in the US to USD ~58 billion in 2022, significantly drives the agricultural enzymes market. As consumers increasingly opt for health-conscious choices, the need for organic and chemical-free produce becomes paramount.

- Increasing Population and Food Safety Needs: With the global population surge, the demand for food safety and security intensifies. The agricultural enzymes market thrives on this need, offering solutions that enhance food production while conserving resources. Key players like Novozymes A/S and Monsato are innovating in microbial solutions through the BioAg Alliance, further propelling market growth.

- Adoption of Modern Farming Practices: Modern agriculture’s emphasis on eco-friendly and cost-effective solutions like agricultural enzymes aligns with the market’s growth trajectory. The shift towards products that enhance soil fertility, promote plant growth, and control microbes, aligns with the requirements of modern farming for higher yields.

Restraints

- Regulatory Challenges: Stringent regulations, such as those by the U.S. FDA, pose a challenge. If biological product problems are not resolved promptly, production may cease, creating a significant hurdle for market growth.

- Farmer Reluctance Towards Microbe-Derived Products: Despite their benefits, farmers show reluctance in adopting microbe-derived products due to concerns about performance, storage, and lack of awareness. This hesitance is a significant restraint in the market’s expansion.

Opportunities

- Inclination Towards Agro-Biologicals: The rising inclination towards biofertilizers, biopesticides, and bio-enzymes as alternatives to chemical fertilizers presents a substantial opportunity. According to a study by the Crop Science Society of the Philippines, agricultural enzymes could reduce the need for soil-applied fertilizers by up to 50%, reducing production costs without compromising yield.

- Expanding Organic Food Market: The expanding market for organic foods, with the US organic food sales growing by ~9% in 2022, opens vast opportunities for the agricultural enzymes sector. This growth indicates a significant shift towards sustainable farming practices.

Challenges

- Varied Performance of Microbial Enzymes: The performance variability of microbial enzymes with seasons and treatments presents a challenge. This inconsistency could affect crop yield, plant growth, and soil fertility, thereby influencing market adoption.

- Awareness and Education: The low awareness among farmers about the benefits of microbial products necessitates significant investment in marketing, education, and field trials. This challenge is crucial for the market’s expansion and acceptance among the agricultural community.

Trends

- Rising Health Concerns and Biochemical Poisoning Cases: Increasing health concerns due to biochemical poisoning cases globally have heightened awareness about the adverse effects of chemical pesticides, driving the demand for safer alternatives like agricultural enzymes.

- Technological Advancements in Farming: Developments in farming technologies, focusing on energy and water conservation, are trending in the market. These advancements are crucial in sustaining the market’s growth momentum.

- Segmentation Analysis: The cereals and grains segment, especially rice in the Asia-Pacific region, is anticipated to lead the market. Soil fertility products, vital for plant and groundwater protection, are expected to dominate the product type segment.

Regional Analysis

North America: A Leading Force

In 2023, North America is dominating the Agricultural Enzymes Market, holding a substantial 34.7% share with a market valuation of USD 110.9 million. This dominance is expected to continue, driven by advanced agricultural practices, significant investments in technology, and the presence of major industry players. T

he U.S. and Mexico, in particular, are making substantial investments in developing chemical-free products for agriculture. This is fueled further by stringent regulations set by the United States Department of Agriculture (USDA) regarding the import and export of microbial products, including enzymes. Such regulatory frameworks are catalyzing the growth of the agricultural enzymes business in the region.

Notable Growth in the U.S. and Canada

The U.S., as a major market player in North America, is advancing rapidly by adopting modern technologies in agriculture. The increasing costs and environmental impacts of chemical inputs are shifting the focus towards agricultural enzymes. For instance, in August 2022, the USDA launched a USD 300 million Organic Transition Initiative, aiming to bolster organic farming and the use of bio-based inputs.

Canada, too, is leaning towards bio-based agriculture, with its agricultural enzymes market growing due to increased agricultural land, investment, and government support. Despite pandemic-related disruptions, the Canadian organic sector saw its acreage increase by 19% to over 3.5 million acres.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The global agricultural enzymes market is a dynamic and competitive sector, marked by the presence of several key players implementing various strategic measures to expand their market share. These industry participants have been focusing on developing innovative microbial products aimed at sustainable crop production. For instance, Novozymes, a leading player, has formed the BioAg Alliance with Monsanto to develop and commercialize microbial solutions that enhance crop yield, benefiting agriculture, the environment, and consumers.

The market is witnessing a trend where companies are leveraging advanced technology to manufacture products more sustainably, conserving water and energy, and reducing waste. Prominent industry participants include Novozymes, Syngenta, BASF, Creative Enzyme, Enzyme India Pvt. Ltd., Aum Enzyme, Cypher Environmental, Afrizymes, and American Biosystems, Inc. These companies are extensively investing in research and development to diversify their product lines, contributing to the market’s growth.

Маrkеt Кеу Рlауеrѕ

- DuPont

- BASF SE

- Bayer AG

- American Biosystems

- Agrinos AS

- Novozymes A/S

- Stoller Enterprises Ltd

- Agricen

- Syngenta AG

- Bioworks Inc.

- Koninklijke DSM N.V.

- The Monsanto Company

- Corteva, Inc.

- Creative Enzyme

- Enzyme India Pvt. Ltd.

- Aum Enzyme

- Cypher Environmental

- Afrizymes

- Other Key Players

Recent Developments

- November 2023: BASF announces the launch of a new line of agricultural enzymes designed to improve crop yields and soil health.

- November 2023: Novozymes and Bayer CropScience announced a partnership to develop and commercialize new agricultural enzymes for use in biopesticides.

- December 2023: BioAg Alliance announces the successful completion of field trials for its new bio-fungicide based on agricultural enzymes.

Report Scope

Report Features Description Market Value (2023) USD 319.7 Million Forecast Revenue (2033) USD 623 Million CAGR (2023-2032) 6.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Enzyme Type (Phosphatases, Dehydrogenases, Ureases, Proteases and Others) By Application (Crop Protection, Soil Fertility and Plant Growth Regulation) By Crop Type (Grains and Cereals, Oil Seeds and Pulses, Fruits and Vegetables, Other Crop Types) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DuPont, BASF SE, Bayer AG, American Biosystems, Agrinos AS, Novozymes A/S, Stoller Enterprises Ltd, Agricen, Syngenta AG, Bioworks Inc., Koninklijke DSM N.V., The Monsanto Company, Corteva, Inc., Creative Enzyme, Enzyme India Pvt. Ltd., Aum Enzyme, Cypher Environmental, Afrizymes and Other Key Companies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the Agricultural Enzymes market?The Agricultural Enzymes market size is projected to generate revenues of approx. USD 319.7 Million in 2023

Q: What is the projected CAGR at which the Agricultural Enzymes market is expected to grow at?The Agricultural Enzymes market is expected to grow at a CAGR of 6.9% (2023-2033).

Q: List the key industry players of the Agricultural Enzymes market?DuPont, BASF SE, Bayer AG, American Biosystems, Agrinos AS, Novozymes A/S, Stoller Enterprises Ltd, Agricen, Syngenta AG, Bioworks Inc., Koninklijke DSM N.V., The Monsanto Company, Corteva, Inc., Creative Enzyme, Enzyme India Pvt. Ltd., Aum Enzyme, Cypher Environmental, Afrizymes and Other Key Companies.

Agricultural Enzymes MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Agricultural Enzymes MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- DuPont

- BASF SE

- Bayer AG

- American Biosystems

- Agrinos AS

- Novozymes A/S

- Stoller Enterprises Ltd

- Agricen

- Syngenta AG

- Bioworks Inc.

- Koninklijke DSM N.V.

- The Monsanto Company

- Corteva, Inc.

- Creative Enzyme

- Enzyme India Pvt. Ltd.

- Aum Enzyme

- Cypher Environmental

- Afrizymes

- Other Key Players