Europe DTH Drill Rigs Market By Type (Hydraulic DTH Drill Rig, Electric DTH Drill Rig, Pneumatic DTH Drill Rig, Other), By Depth Capacity (Shallow, Medium, Deep Hole), By Application (Quarries, Opencast Mines, Construction Projects, Other), By End-use (Mining, Construction), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: December 2024

- Report ID: 68247

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

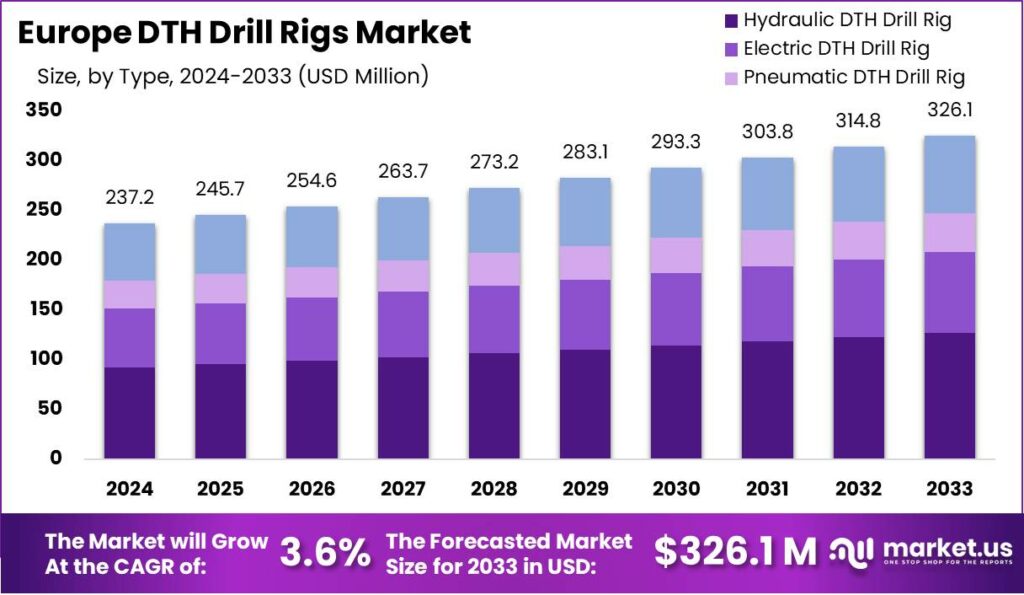

The Europe DTH Drill Rigs Market size is expected to be worth around USD 326.1 Million by 2033, from USD 237.1 Million in 2023, growing at a CAGR of 3.7% during the forecast period from 2024 to 2033.

The Europe DTH (Down-The-Hole) drill rigs market is dynamic, reflecting the region’s diverse industrial landscape. European companies emphasize sustainable mining and construction practices, driving demand for advanced DTH drill rigs.

These rigs are renowned for their efficiency and precision in drilling operations, catering to mining, quarrying, and civil engineering sectors. The robust infrastructure development across Europe further bolsters the market, as nations invest in building and expanding transport networks and residential areas.

Market demand for DTH drill rigs in Europe is strong, spurred by the region’s ongoing efforts to modernize infrastructure and expand industrial capacities. As the construction and mining sectors seek more environmentally friendly and technologically advanced equipment, DTH drill rigs are increasingly preferred for their ability to provide precise drilling with minimal environmental impact. This trend is particularly evident in Nordic countries, with a strong emphasis on sustainability.

The popularity of DTH drill rigs across Europe can be attributed to their adaptability and efficiency. These rigs can operate in diverse geographical and environmental conditions, from the freezing Arctic regions to the rugged terrains of the Alpine ranges. Their robustness makes them ideal for Europe’s varied landscape, ensuring their widespread adoption in urban construction projects and remote mining operations.

There are significant opportunities for market expansion in the European DTH drill rigs sector. With the European Union’s focus on reducing carbon emissions, there is a growing demand for rigs that can operate more cleanly and efficiently.

Innovations in rig technology, such as automation and electrification, present opportunities for manufacturers to lead in developing next-generation drilling equipment that aligns with Europe’s environmental goals.

Norway stands out in the European market, especially in the oil and gas industry. The country’s robust activities in natural gas production and recent oil discoveries in regions such as the North Sea, Norwegian Sea, and Barents Sea have heightened the demand for advanced drilling technology. In 2021, Norway invested approximately NOK 147 billion in the oil and gas sector, focusing on exploration and development, which reflects a significant commitment to enhancing its drilling capacities.

The market is also shaped by various initiatives from both government and private sectors. Notable examples include contracts with major industry players such as Maersk Drilling, which provides well-intervention services. These initiatives are pivotal in boosting the operational efficiency and capabilities of DTH rigs, particularly in challenging offshore environments.

Technological advancements are crucial in this market. The integration of AI and IoT into drill rigs has revolutionized their operational efficiencies and predictive maintenance capabilities. These technologies not only boost productivity but also help in adhering to environmental standards by minimizing the ecological impact of drilling activities.

Overall, the European DTH drill rigs market is vibrant and dynamic, driven by technological innovations, strong market demand across various industries, and supportive government policies and investments. These elements collectively foster a conducive environment for the growth and evolution of this sector.

Key Takeaways

- The Europe DTH Drill Rigs Market size is expected to be worth around USD 326.1 Million by 2033, from USD 237.1 Million in 2023, growing at a CAGR of 3.7% during the forecast period from 2024 to 2033.

- Hydraulic DTH Drill Rig dominated the Europe DTH Drill Rigs Market By Type segment, capturing 38.3%.

- Medium depth capacity held a dominant 42.1% share in the Europe DTH Drill Rigs Market by depth.

- Construction Projects led the Application segment in the Europe DTH Drill Rigs Market with a dominant 37.4% share.

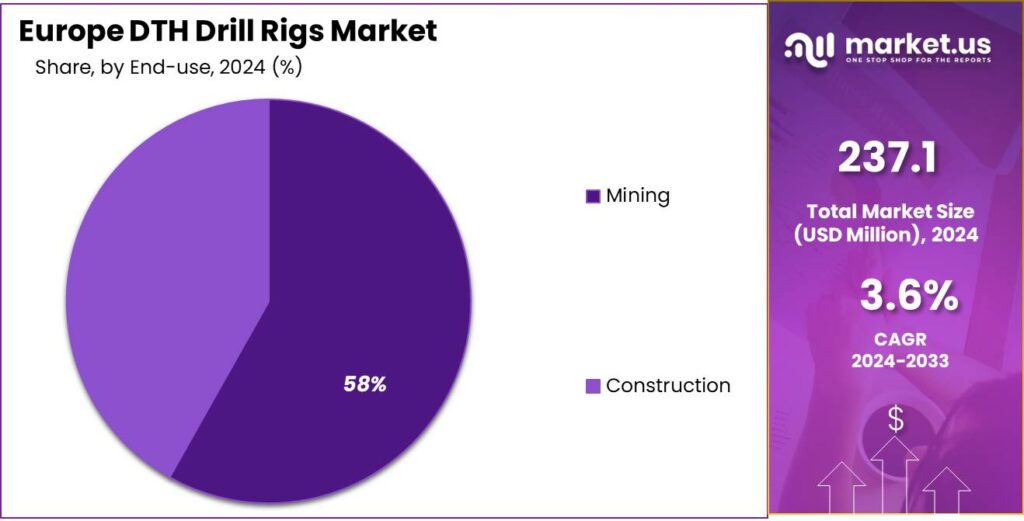

- Mining dominated the By End-use segment of the Europe DTH Drill Rigs Market with a 58.4% share.

By Type Analysis

In 2023, the Hydraulic DTH Drill Rig held a dominant market position in the “By Type” segment of the Europe DTH Drill Rigs Market, capturing more than a 38.3% share. The market is segmented into four main types: Hydraulic DTH Drill Rig, Electric DTH Drill Rig, Pneumatic DTH Drill Rig, and Other. The Hydraulic DTH Drill Rigs are preferred for their efficiency and effectiveness in tough drilling conditions, which has led to their substantial market share.

On the other hand, Electric DTH Drill Rigs are gaining traction for their environmental benefits and lower operational costs, appealing to markets with stringent emissions regulations. Pneumatic DTH Drill Rigs, known for their simplicity and reliability, cater to operations where electricity supply is inconsistent, thus securing their niche in the market.

The category labeled as Other includes various specialized rigs that cater to specific needs but do not hold a significant market share. Each type serves unique market needs, reflecting the diverse technological advancements and regulatory environments across Europe.

By Depth Capacity Analysis

In 2023, Medium held a dominant market position in the “By Depth Capacity” segment of the Europe DTH Drill Rigs Market, capturing more than a 42.1% share. The market is primarily divided into three depth capacities: Shallow, Medium, and Deep Hole.

Medium drill rigs are particularly favored due to their versatility in handling a wide range of drilling operations, making them suitable for both construction and mining applications across various European countries. Shallow rigs, while less versatile, are preferred for surface-level operations such as mineral exploration and infrastructure projects due to their cost-effectiveness and ease of operation.

Meanwhile, Deep Hole rigs, designed for deeper geological formations, are essential in extensive mining operations and geotechnical drilling but are often more costly and require higher technical expertise. The significant share held by Medium drill rigs highlights their critical role in meeting the diverse drilling demands across Europe, balancing depth capability with operational flexibility and cost.

By Application Analysis

In 2023, Construction Projects held a dominant market position in the By Application segment of the Europe DTH Drill Rigs Market, capturing more than 37.4% share. This segment significantly outperformed others due to the rising urbanization and infrastructural developments across Europe.

Quarries followed, leveraging their need for robust drilling solutions to extract materials like granite, limestone, and marble, essential for various construction and architectural projects. The demand in Opencast Mines also showed considerable market uptake, driven by the extraction of minerals and coal, which remains vital for energy and industrial processes.

The Other category, encompassing specialized applications such as exploration and environmental drilling, accounted for the smallest share but is expected to grow as new technologies and regulations emerge.

Collectively, these segments underline the diverse applications of DTH drill rigs, reflecting their critical role in supporting Europe’s expanding construction and mining activities. The market trends suggest a sustained demand for advanced drilling solutions that offer efficiency and precision, catering to the broad needs of these sectors.

By End-use Analysis

In 2023, Mining held a dominant market position in the By End-use segment of the Europe DTH Drill Rigs Market, capturing more than a 58.4% share. This substantial market share reflects the critical role of mining operations in utilizing DTH drill rigs for various extraction and exploration activities across Europe.

Mining, being integral to the procurement of essential minerals and other geological materials, relies heavily on efficient and robust drilling equipment, hence the high adoption rate of these rigs.

The Construction sector also plays a significant role in this market but trails behind Mining in terms of market share. Construction activities, which involve earthworks and foundation setting, increasingly incorporate DTH drill rigs; however, their usage is less intensive compared to the mining sector.

This sector’s demand is driven by urban development and infrastructural projects, which are pivotal in shaping the market dynamics within Europe.

Overall, the distinction in usage between these sectors underscores the tailored technological advancements and market strategies required to cater to the diverse needs of these end-users.

Key Market Segments

By Type

- Hydraulic DTH Drill Rig

- Electric DTH Drill Rig

- Pneumatic DTH Drill Rig

- Other

By Depth Capacity

- Shallow

- Medium

- Deep Hole

By Application

- Quarries

- Opencast Mines

- Construction Projects

- Other

By End-use

- Mining

- Construction

Driving factors

Increased Construction and Mining Activities in Europe

Europe has seen a rise in construction and mining activities, driving demand for DTH drill rigs. These rigs are essential for efficient drilling operations in both sectors. The increasing investment in infrastructure projects and the expansion of mining operations due to the growing demand for minerals are pivotal in boosting the sales of DTH drill rigs across the continent.

Advancements in Drilling Technology Enhancing Efficiency

Technological advancements in DTH drilling equipment, such as improved hydraulic systems and advanced monitoring software, have significantly enhanced the efficiency and accuracy of drilling operations. These improvements have made DTH drill rigs more attractive to industries that require precise and efficient drilling, thereby expanding the market in Europe.

Stringent Environmental Regulations Pushing for Better Equipment

Europe’s strict environmental regulations are compelling companies to invest in new DTH drill rigs that comply with these standards. Modern rigs are designed to reduce environmental impact, featuring lower emissions and better fuel efficiency. This regulatory push is a critical driver for the renewal and upgrade of old drilling equipment, fostering market growth.

Restraining Factors

High Cost of Advanced DTH Drill Rigs

The high initial investment required for advanced DTH drill rigs poses a significant barrier to market growth. These rigs incorporate sophisticated technologies that drive up costs, making them less accessible to small and medium-sized enterprises (SMEs) or startups in the drilling industry, potentially slowing market expansion.

Lack of Skilled Operators for Advanced Rigs

There is a noticeable shortage of skilled operators capable of handling the latest DTH drill rigs. The complexity of modern drilling equipment requires specialized training and expertise. This lack of adequately trained personnel can hinder the adoption of new technology and equipment, restraining market growth.

Market Fluctuations in the Mining Sector

The mining industry, a major user of DTH drill rigs, often experiences significant market fluctuations influenced by global economic conditions, regulatory changes, and commodity prices. These instabilities can lead to reduced investment in new drilling equipment, adversely affecting the DTH drill rigs market in Europe.

Growth Opportunity

Expansion into Renewable Energy Projects

As Europe shifts towards renewable energy, the demand for DTH drilling in geothermal energy projects is increasing. DTH drill rigs are essential for creating deep geothermal wells, a critical component of geothermal power plants. This shift represents a significant growth opportunity for the DTH drill rigs market.

Integration of IoT and Automation in Drilling Operations

Integrating IoT and automation technologies in DTH drill rigs can lead to more efficient, safer, and cost-effective drilling operations. The trend towards digitalization in industrial operations is a key opportunity for growth, as companies seek to gain real-time insights and enhance operational efficiency through data-driven decisions.

Development of Eco-Friendly and Electric Drill Rigs

The increasing focus on sustainability in Europe provides a substantial opportunity for the development and adoption of eco-friendly and electric DTH drill rigs. These rigs offer lower emissions, reduced noise levels, and greater energy efficiency, aligning with the environmental goals of both governments and private sectors.

Challenge

Regulatory Hurdles Impacting Operational Efficiency

In Europe, the Direct-to-Home (DTH) drill rigs market faces significant regulatory challenges. Stringent environmental laws and safety regulations, aimed at reducing the environmental footprint and ensuring worker safety, often lead to lengthy permit processes and increased operational costs.

These regulations vary widely across European countries, complicating compliance for companies operating in multiple jurisdictions. This not only increases the time to market but also requires substantial investment in equipment and training to meet diverse standards, impacting overall market growth and operational efficiency.

High Equipment Costs and Maintenance Expenses

The European DTH drill rigs market is grappling with the high costs associated with purchasing and maintaining advanced drilling equipment. These rigs, essential for efficient drilling operations, represent a major capital expenditure for companies.

Additionally, the sophisticated technology and specialized components involved necessitate regular maintenance, which can be costly.

This financial burden is particularly challenging for smaller operators and can deter new entrants, limiting market competition and innovation. The need to balance cost with technological advancement is a critical challenge for stakeholders in this industry.

Competition from Renewable Energy Projects

As Europe pushes toward renewable energy, investment in traditional energy sectors, including those requiring DTH drilling, is witnessing a decline. This shift is driven by governmental policies and subsidies favoring renewables over fossil fuels, which directly impacts the demand for DTH drill rigs used primarily in oil, gas, and mining sectors.

The competition for funding and resources is intensifying, compelling DTH drill rig providers to innovate and diversify their offerings to stay relevant. This challenge is pivotal as it dictates the strategic direction of companies within the market.

Emerging Trends

The Europe DTH Drill Rigs market is currently witnessing several dynamic changes with significant trends shaping its future. One of the primary trends is the increasing integration of automation and remote control technologies in drill rigs. These innovations enhance drilling efficiency, precision, and safety, making operations smoother and less labor-intensive.

Furthermore, there is a notable shift towards the use of eco-friendly and electric drill rigs, driven by the need to meet stringent environmental regulations and corporate social responsibility goals. These rigs are designed to reduce emissions and noise pollution, and some models are equipped with hybrid engines that can utilize renewable energy sources.

Another trend is the adoption of advanced materials and design techniques in the construction of drill rigs. The use of high-strength alloys and composites makes the rigs lighter and more durable, which is especially beneficial in remote and challenging environments. This not only reduces transport and setup times but also extends the lifespan of the equipment.

Additionally, the increasing application of digital technologies, such as real-time data analytics and telemetry, is improving the monitoring and management of drilling operations. This enables predictive maintenance, which minimizes downtime and lowers operational costs.

Business Benefits

The adoption of these emerging trends brings several business benefits to stakeholders in the Europe DTH Drill Rigs market. Firstly, the integration of automated systems and remote control capabilities reduces the need for direct human intervention, which enhances safety and allows operations in hazardous or inaccessible areas without risking worker safety. This also leads to higher precision in drilling, which can improve project outcomes and efficiency.

The use of eco-friendly technologies and electric drill rigs not only helps companies comply with environmental regulations but also reduces operational costs associated with fuel consumption. Companies using electric or hybrid rigs can see a reduction in fuel costs by up to 30%, directly impacting their bottom line.

Moreover, the shift towards sustainable practices enhances a company’s reputation, making it more attractive to investors and clients who prioritize environmental responsibility.

Furthermore, the utilization of advanced materials and modular design increases the flexibility and scalability of drilling operations. This allows companies to adapt quickly to changing project requirements and market conditions, maintaining competitiveness in a fast-paced industry.

The ability to conduct real-time monitoring and data analysis also ensures that companies can make informed decisions, optimize performance, and maintain equipment more effectively, reducing unexpected costs and delays.

Overall, the Europe DTH Drill Rigs market is set for transformative growth, driven by technological advancements and a shift towards sustainability. Companies that embrace these changes can expect to see significant benefits in operational efficiency, cost reduction, and competitive positioning in the global market.

Key Regions and Countries

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Key Players Analysis

In the Europe DTH (Down-the-Hole) Drill Rigs Market, several key players are poised to make significant contributions in 2024. Among these, four companies stand out due to their innovative approaches, strategic market positioning, and robust product offerings: Atlas Copco, Sandvik, Caterpillar Inc., and Komatsu.

Atlas Copco has consistently been at the forefront of the development of mining equipment and DTH drill rigs. The company is known for its focus on sustainable productivity solutions, which is increasingly important in today’s environmentally conscious market. Their commitment to innovation is evident in their advanced automation capabilities and energy-efficient technologies. Atlas Copco’s position in the European market is strengthened by its extensive service network and strong brand reputation.

Sandvik is another major player, renowned for its engineering expertise and cutting-edge technology in DTH drilling. Sandvik’s drill rigs are particularly noted for their precision and efficiency, which reduce operational costs and increase productivity. The company’s investment in R&D has led to some of the most durable and reliable rigs available, making them a preferred choice for tough mining and construction projects.

Caterpillar Inc. brings its vast experience in heavy machinery to the DTH drill rigs market, offering robust equipment that is tailored to the harsh environments typically found in mining. Caterpillar’s integration of smart technology and data analytics into its equipment allows for enhanced performance monitoring and maintenance, ensuring high uptime and longer equipment life.

Komatsu, with its dedication to quality and reliability, continues to challenge market norms by integrating IoT and artificial intelligence into its drill rigs. This integration helps in optimizing drilling operations and improving safety standards. Komatsu’s approach to market expansion through partnerships and acquisitions has also allowed it to leverage new technologies and expand its geographic footprint.

These companies are expected to drive growth in the Europe DTH Drill Rigs Market through technological advancements, strategic market expansion, and a focus on customer-centric solutions. Their efforts are likely to not only enhance their own market positions but also push the entire industry towards more efficient and sustainable drilling operations.

Market Key Players

- AB Volvo

- Atlas Copco

- Bauer AG

- Casagrande

- Caterpillar

- Caterpillar Inc.

- Hitachi Construction

- Joy Global(P&H)

- Komatsu

- Liebherr Group

- MAIT

- Sandvik

- STREICHER Group

- Sunward Intelligent Equipment Co. Ltd.

- Trevi-Finanziaria Industriale S.p.A.

Recent Development

- In May 2024, Epiroc launched a new smart DTH drill rig model equipped with advanced IoT technology for real-time performance monitoring. The company expects a 15% increase in sales in the European market in the next 12 months, valued at €30 million. The smart rig is designed to improve fuel efficiency and reduce maintenance costs by up to 10%.

- In March 2024, Atlas Copco expanded its manufacturing facility in Germany to increase the production of its DTH drill rigs. The new facility is expected to ramp up production by 20%, aiming for a €50 million increase in sales within the next 3 years. This expansion will allow Atlas Copco to meet the growing demand for drilling equipment in the European mining and construction sectors.

- In January 2024, Sandvik announced its acquisition of a prominent DTH drill rig manufacturer to expand its product offerings and strengthen its market position in Europe. This move is expected to increase Sandvik’s annual revenues by approximately €150 million, boosting its share in the European DTH drill rig market by 5-6%.

Report Scope

Report Features Description Market Value (2023) USD 237.1 Million Forecast Revenue (2033) USD 326.1 Million CAGR (2024-2032) 3.6% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Hydraulic DTH Drill Rig, Electric DTH Drill Rig, Pneumatic DTH Drill Rig, Other), By Depth Capacity (Shallow, Medium, Deep Hole), By Application (Quarries, Opencast Mines, Construction Projects, Other), By End-use (Mining, Construction) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AB Volvo , Atlas Copco , Bauer AG, Casagrande, Caterpillar , Caterpillar Inc., Hitachi Construction , Joy Global(P&H) , Komatsu , Liebherr Group, MAIT, Sandvik , STREICHER Group, Sunward Intelligent Equipment Co. Ltd., Trevi-Finanziaria Industriale S.p.A. Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Europe DTH Drill Rigs MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Europe DTH Drill Rigs MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AB Volvo

- Atlas Copco

- Bauer AG

- Casagrande

- Caterpillar

- Caterpillar Inc.

- Hitachi Construction

- Joy Global(P&H)

- Komatsu

- Liebherr Group

- MAIT

- Sandvik

- STREICHER Group

- Sunward Intelligent Equipment Co. Ltd.

- Trevi-Finanziaria Industriale S.p.A.