Global Carbon Trading Market By Type(Compliance, Voluntary), By Project Type(Avoidance/Reduction Projects, Removal/Sequestration Projects), By End-Use(Power, Energy, Aviation, Transportation, Industrial, Others) , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116049

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

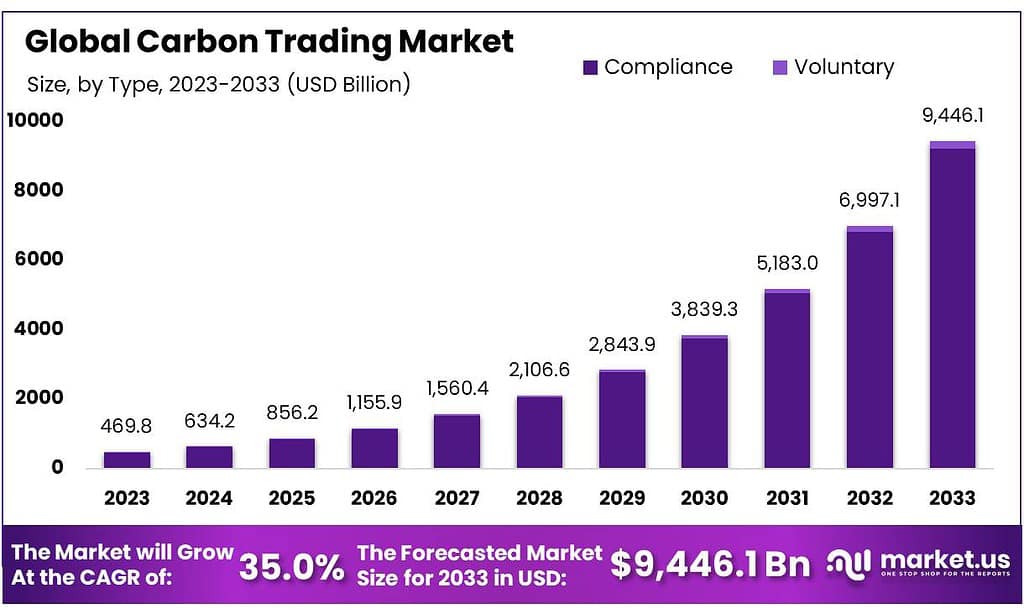

The global Carbon Trading Market size is expected to be worth around USD 9446.1 billion by 2033, from USD 469.8 billion in 2023, growing at a CAGR of 35.0% during the forecast period from 2023 to 2033.

The Carbon Trading Market is defined as a market-based mechanism that facilitates the buying and selling of permits to emit carbon dioxide and other greenhouse gases. It operates under the principle of cap-and-trade, where a limit (cap) is set on the total amount of certain greenhouse gases that can be emitted by industries, sectors, or countries. Entities that emit less than their allowance can sell their surplus permits to others who exceed their limits, creating a financial incentive for reducing emissions.

The primary objective of the carbon trading market is to mitigate the impact of climate change by controlling the amount of greenhouse gases released into the atmosphere. It is structured to incentivize the reduction of emissions in a cost-effective and economically efficient manner. By assigning a cost to carbon emissions, the market encourages companies, governments, and other entities to invest in cleaner technologies and practices.

The carbon trading market can be divided into two main types: compliance markets and voluntary markets. Compliance markets are regulated by mandatory national, regional, or international carbon reduction regimes, such as the European Union Emissions Trading System (EU ETS). In contrast, voluntary markets operate outside of compliance obligations, allowing corporations, individuals, and governments to purchase carbon offsets to mitigate their emissions for corporate social responsibility reasons or to achieve carbon neutrality.

Key Takeaways

- Projected Market Growth: Carbon Trading Market expected to reach USD 9446.1 billion by 2033, with a 35.0% CAGR from 2023.

- Market Mechanism: Facilitates emission permits exchange under cap-and-trade system, incentivizing emission reductions and sustainability.

- Market Segmentation: Compliance markets dominate with over 97.8% share, driven by regulatory mandates, while voluntary markets show notable growth.

- Key Project Types: Avoidance/Reduction projects lead with 65.8% market share, followed by Removal/Sequestration projects.

- End-Use Segments: The power sector leads with a 32.5% market share, followed by energy, aviation, transportation, industrial, and others.

By Type

In 2023, Compliance took the lead in the Carbon Trading Market, securing a dominant market position with over 97.8% share. This segment, driven by regulatory mandates, witnessed substantial growth as businesses and industries adhered to mandatory emission reduction standards. The demand for compliance credits surged, reflecting the market’s emphasis on meeting regulatory requirements for a sustainable and low-carbon future.

On the other hand, the Voluntary segment, though holding a smaller market share, exhibited notable growth as businesses increasingly embraced eco-friendly practices. In 2023, the Voluntary segment demonstrated a growing trend, capturing the attention of environmentally conscious entities looking to offset their carbon footprint voluntarily. The rise of corporate sustainability initiatives and consumer awareness contributed to the expansion of the Voluntary Carbon Trading Market.

As the Carbon Trading Market evolves, the Compliance segment remains pivotal, driven by stringent environmental regulations. Simultaneously, the Voluntary segment is gaining momentum, reflecting a broader shift towards sustainable practices beyond regulatory obligations. The market dynamics underscore the dual influence of compliance requirements and voluntary efforts in shaping the carbon trading landscape.

By Project Type

In 2023, Avoidance/Reduction Projects took the lead in the Carbon Trading Market, securing a dominant market position with over 65.8% share. This segment witnessed substantial growth as businesses and industries prioritized initiatives focused on reducing or avoiding greenhouse gas emissions. The demand for projects aimed at minimizing carbon footprints was significant, driven by the global push towards sustainable and environmentally responsible practices.

On the other hand, Removal/Sequestration Projects, while holding a smaller market share, demonstrated notable growth in 2023. These projects gained attention as businesses sought innovative ways to capture and store carbon dioxide, contributing to carbon neutrality objectives. The increased emphasis on carbon sequestration reflected a broader industry shift towards comprehensive approaches to address climate change.

As the Carbon Trading Market evolves, Avoidance/Reduction Projects continue to play a pivotal role, aligning with the urgency to mitigate climate impacts. Simultaneously, Removal/Sequestration Projects are emerging as a vital component, showcasing a growing awareness of the importance of carbon capture and storage in the overall carbon trading landscape. The market dynamics highlight the dual significance of emission reduction and carbon sequestration initiatives in shaping sustainable practices across industries.

By End-Use

In 2023, Power emerged as the leader in the Carbon Trading Market, securing a dominant position with over a 32.5% share. This segment witnessed significant growth as the power sector actively engaged in carbon trading to meet emission reduction targets. With a focus on transitioning to cleaner energy sources, power companies sought carbon credits and offset projects to align with sustainability goals.

The Energy sector, while holding a substantial market share, demonstrated robust growth in 2023. The industry’s increasing emphasis on renewable energy sources and energy efficiency initiatives fueled the demand for carbon trading mechanisms. Companies within the Energy sector actively participated in carbon markets to balance their carbon footprint and contribute to a greener energy landscape.

Aviation and Transportation segments, although with a smaller market share, showcased noteworthy growth, reflecting the rising awareness of carbon emissions in these industries. Aviation and transportation companies engaged in carbon trading to offset emissions from their operations, aligning with global efforts to address climate change.

The Industrial segment also played a significant role in the Carbon Trading Market, contributing to sustainability objectives. As industries sought ways to reduce their carbon impact, carbon trading emerged as a strategic tool to support emission reduction initiatives.

Other sectors, encompassing a variety of industries, collectively contributed to the market’s dynamics, reflecting a growing awareness and commitment across diverse sectors to actively participate in carbon trading and adopt sustainable practices.

As the Carbon Trading Market evolves, the Power sector remains a key player, driven by the urgency to decarbonize the energy landscape. Simultaneously, the Energy, Aviation, Transportation, Industrial, and Other segments collectively shape the market’s trajectory, indicating a broader industry commitment towards carbon neutrality and environmental responsibility.

Market Key Segments

By Type

- Compliance

- Voluntary

By Project Type

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

By End-Use

- Power

- Energy

- Aviation

- Transportation

- Industrial

- Others

Drivers

Regulatory Policies and International Agreements

One of the primary drivers of the carbon trading market is the implementation of regulatory policies and international agreements aimed at reducing carbon emissions. Governments and international bodies, such as the United Nations Framework Convention on Climate Change (UNFCCC) and its Paris Agreement, have established frameworks that mandate or encourage the reduction of greenhouse gas emissions.

These frameworks often include mechanisms for carbon trading, such as the Clean Development Mechanism (CDM), which allows for the trade of emission reduction credits between countries and companies. Such policies compel industries to adopt cleaner technologies and practices, thereby stimulating the demand for carbon credits.

Corporate Sustainability Commitments

Increasingly, corporations are committing to sustainability and climate goals, including pledges to achieve carbon neutrality or net-zero emissions. This shift is driven by consumer demand for environmentally responsible practices, investor pressure, and the anticipation of stricter future regulations.

To meet these commitments, companies are turning to the carbon trading market to offset emissions they cannot eliminate through direct reductions. This trend is expanding the demand for carbon credits, especially in the voluntary carbon market, and encouraging the development of new projects that can generate tradable carbon offsets.

Restraints

Complexity and Lack of Standardization

A significant restraint in the carbon trading market is its complexity and the lack of standardization across different trading schemes. Differences in rules, eligibility criteria, and credit types between various carbon markets can create confusion and inefficiencies, hindering participation. This complexity can discourage potential market entrants and limit the effectiveness of carbon trading as a tool for emissions reduction.

Concerns Over Market Integrity

Concerns over the integrity of carbon markets, including issues related to the additionality, permanence, and potential for greenwashing, act as a restraint. Critics argue that some carbon offset projects may not result in additional emission reductions or may overstate their impact. These concerns can undermine confidence in the carbon trading market, affecting the demand for credits and the willingness of stakeholders to engage.

Opportunities

Development of New Sectors and Technologies

The carbon trading market offers significant opportunities for the development of new sectors and clean technologies.

As industries seek cost-effective ways to reduce emissions, there is growing interest in innovative solutions such as carbon capture and storage (CCS), reforestation projects, and renewable energy technologies. The market can provide a financial mechanism to support these initiatives, driving technological advancement and the transition to a low-carbon economy.

Global Market Integration

There is a growing opportunity for the integration of regional and national carbon markets, creating a more unified global market. Such integration can enhance liquidity, reduce transaction costs, and increase the efficiency of carbon trading.

It can also facilitate the transfer of funds and technology between developed and developing countries, supporting global efforts to mitigate climate change. As countries and regions work towards linking their carbon markets, there is potential for creating a more robust and effective mechanism for reducing global greenhouse gas emissions.

Trends

Expansion of Carbon Pricing Initiatives

The carbon trading market is witnessing a significant trend in the expansion of carbon pricing initiatives across the globe. More countries and regions are implementing carbon taxes and cap-and-trade programs as part of their climate change mitigation strategies.

This expansion not only increases the scope and scale of the market but also enhances its liquidity and efficiency. As more sectors and greenhouse gases are covered by these schemes, the market is expected to grow, providing more opportunities for emissions reductions.

Technological Innovations and Digitalization

The market is also experiencing a trend toward the use of technological innovations and digitalization to improve transparency, integrity, and efficiency.

Blockchain technology, for example, is being explored for its potential to securely track and trade carbon credits, reducing the risk of fraud and double counting. Additionally, advancements in satellite monitoring and data analytics are improving the measurement and verification of emission reductions, increasing confidence in the quality of carbon credits.

Regional Analysis

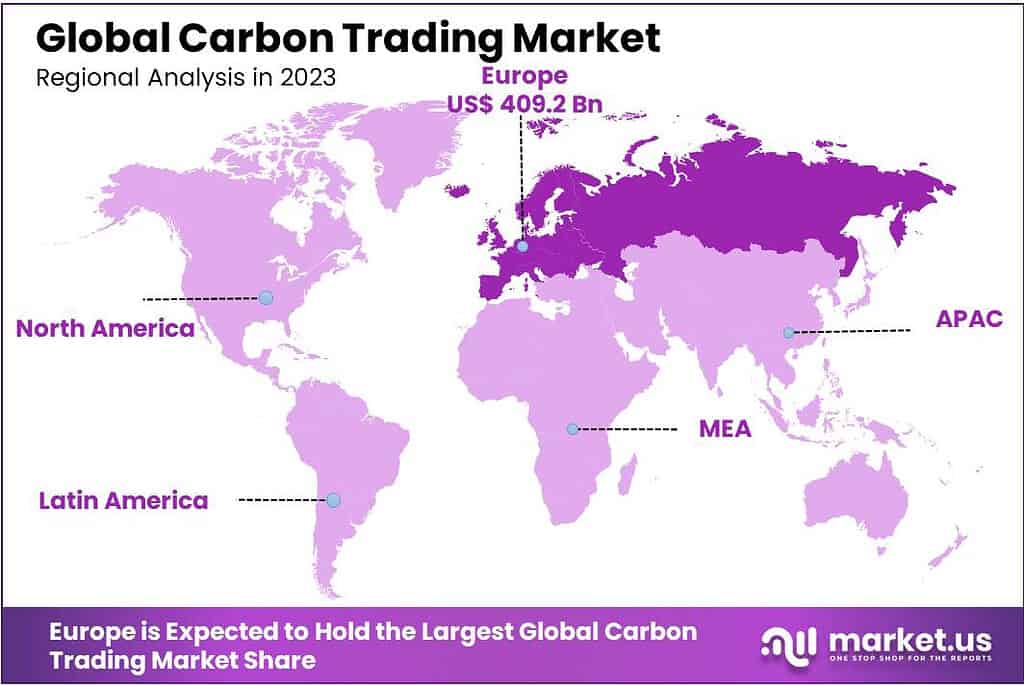

Europe is projected to be the dominant force in the global carbon trading market, with a significant market share of 87.1% as of 2023. This prominence is attributed to Europe’s leadership in implementing rigorous energy efficiency regulations and its commitment to sustainable practices.

The region’s governments have been instrumental in advocating for the reduction of carbon emissions and the minimization of energy consumption, setting a benchmark for global standards.

The stringent regulatory environment in Europe has catalyzed an unprecedented demand for carbon trading mechanisms, positioning them as essential tools in the quest to meet energy efficiency and emission reduction targets. This surge in demand underscores the critical role of carbon trading in facilitating Europe’s environmental objectives.

Additionally, Europe’s approach to preserving its architectural heritage while adhering to sustainability goals has underscored the adaptability and importance of carbon trading schemes. The integration of carbon trading into the management and retrofitting of historic and government-owned buildings showcases a unique blend of tradition and innovation, emphasizing energy conservation and emission reduction without compromising cultural and historical integrity.

The commitment to sustainability in Europe has also spurred significant advancements in research and development, leading to the innovation of sophisticated and environmentally friendly carbon trading solutions. These advancements have not only enhanced the efficiency of carbon trading mechanisms but have also established Europe as a global hub for carbon market innovation and leadership.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Carbon Trading Market, several key players have emerged as pivotal forces shaping the industry. These entities span a diverse spectrum, including governmental regulatory bodies, carbon exchange platforms, and consulting firms, each playing a crucial role in the market’s ecosystem.

Governmental regulatory bodies are instrumental in establishing and enforcing the rules that govern the carbon trading markets. Their policies and frameworks, such as the European Union’s Emissions Trading System (EU ETS) and the California Cap-and-Trade Program, set the stage for market operations and influence market dynamics significantly.

Market Key Players

- NativeEnergy

- CarbonBetter

- ClearSky Climate Solutions

- EKI Energy Services Limited

- Finite Carbon

- Torrent Power Limited

- South Pole Group

- 3Degrees Group, Inc.

- WGL Holdings Inc.

- Carbon Care Asia Ltd.

Recent Developments

NativeEnergy: A renowned non-profit organization, NativeEnergy focuses on developing and promoting renewable energy projects, often in collaboration with indigenous communities, while also offering carbon offsetting solutions. Their projects aim to reduce emissions and contribute to sustainable development goals.

CarbonBetter: This company provides a platform for businesses and individuals to purchase high-quality carbon offsets and invest in climate-friendly projects. They focus on transparency and verification of the carbon credits they offer.

Report Scope

Report Features Description Market Value (2022) USD 469.8 Bn Forecast Revenue (2032) USD 9446.1 Bn CAGR (2023-2032) 35.0% Base Year for Estimation 2022 Historic Period 2017-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Compliance, Voluntary), By Project Type(Avoidance/Reduction Projects, Removal/Sequestration Projects), By End-Use(Power, Energy, Aviation, Transportation, Industrial, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape NativeEnergy, CarbonBetter, ClearSky Climate Solutions, EKI Energy Services Limited, Finite Carbon, Torrent Power Limited, South Pole Group, 3Degrees Group, Inc., WGL Holdings Inc., Carbon Care Asia Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Carbon Trading Market?Carbon Trading Market size is expected to be worth around USD 9446.1 billion by 2033, from USD 469.8 billion in 2023

What is the CAGR for the Carbon Trading Market?The Carbon Trading Market expected to grow at a CAGR of 35.0% during 2023-2032.Who are the key players in the Carbon Trading Market?NativeEnergy, CarbonBetter, ClearSky Climate Solutions, EKI Energy Services Limited, Finite Carbon, Torrent Power Limited, South Pole Group, 3Degrees Group, Inc., WGL Holdings Inc., Carbon Care Asia Ltd.

-

-

- NativeEnergy

- CarbonBetter

- ClearSky Climate Solutions

- EKI Energy Services Limited

- Finite Carbon

- Torrent Power Limited

- South Pole Group

- 3Degrees Group, Inc.

- WGL Holdings Inc.

- Carbon Care Asia Ltd.