Global Mining Drill Bits Market By Type (Rotary Bit, Fixed Cutter Bits, Roller Cone Bits, DTH Hammer Bit, Others), By Material (PDC Diamond, Tungsten Carbide, Steel, Others), By Operation (Diesel Operated Mining Drills, Battery/Electric Operated Mining Drills), By Drilling Technique (Rotary Mining Drill, Track Mining Drill, Compact Core Mining Drill, Down-the-Hole Mining Drill, Tophammer Mining Drill), By Mounting (Handhold Mining Drill, Pusherleg Mining Drill, Rig Mining Drill, Column and Bar Mining Drill, Carriage Mining Drill), By Drill Fluid Used (Liquid Filled, Foam Filled, Air Filled), By Size (Below 8 inches, 8 inches to 11 inches, Above 11 inches), By Application (Surface Mining, Underground Mining) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131118

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

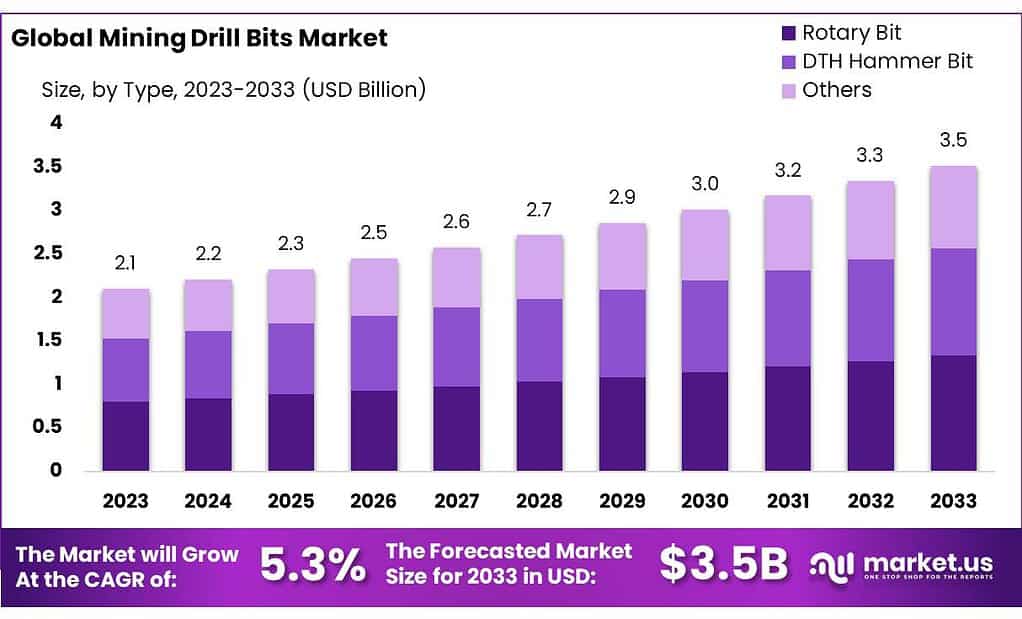

The Global Mining Drill Bits Market size is expected to be worth around USD 3.5 Bn by 2033, from USD 2.1 Bn in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Mining drill bits are specialized tools designed for drilling through earth and rock to access minerals and resources underground. These bits are a critical component of the mining equipment used in various types of drilling operations, such as rotary and down-the-hole drilling, which are common in the extraction of metals, oil, and gas. The effectiveness of mining drill bits is defined by their material composition and design, which must be tailored to penetrate different rock formations and withstand challenging conditions underground.

The demand is further supported by the rising industrial needs in sectors such as construction, electronics, and automotive, which rely on materials extracted through mining. Moreover, advancements in drilling technologies that allow for more efficient and safer operations also contribute to the increasing market demand. These technological innovations include improvements in drill bit materials and designs that extend the life of the bits and reduce environmental impact

The market popularity of mining drill bits is reflected in their significant role within the mining industry, driven by the escalating demand for efficient and advanced drilling solutions globally. The popularity and demand for these drill bits are underscored by their essential use in extracting natural resources—such as minerals, metals, and energy resources—which are fundamental to various industries including construction, manufacturing, and energy.

Government and regulatory influences also play critical roles in shaping the market. Environmental and safety regulations are significant, often driving the development of more eco-friendly and efficient drilling solutions.

Key Takeaways

- Mining Drill Bits Market size is expected to be worth around USD 3.5 Bn by 2033, from USD 2.1 Bn in 2023, growing at a CAGR of 5.3%.

- Rotary Bit segment held a dominant position in the mining drill bits market, capturing more than a 38.4% share.

- PDC (Polycrystalline Diamond Compact) Diamond held a dominant market position, capturing more than a 38.5% share.

- Diesel Operated Mining Drills held a dominant market position, capturing more than a 58.7% share.

- Rotary Mining Drill held a dominant market position, capturing more than a 33.4% share.

- Handhold Mining Drill held a dominant market position, capturing more than a 28.5% share.

- Liquid Filled drill bits held a dominant market position, capturing more than a 43.3% share.

- Below 8 inches held a dominant market position, capturing more than a 45.5% share.

- Surface Mining held a dominant market position, capturing more than a 64.5% share.

- Asia Pacific (APAC) stands as the dominating region, accounting for a substantial 37% of the market share, translating to USD 0.79 billion.

By Type

In 2023, the Rotary Bit segment held a dominant position in the mining drill bits market, capturing more than a 38.4% share. This type of bit is favored for its efficiency and effectiveness in various drilling operations, making it a popular choice across different mining applications.

Fixed Cutter Bits also play a crucial role in the market, known for their precision and minimal vibration during drilling. These bits are particularly valued in operations where maintaining the structural integrity of the drilled material is paramount.

Roller Cone Bits are distinguished by their rugged design and durability, making them suitable for tough drilling conditions. They are commonly used in oil and gas extraction but also find significant applications in hard rock mining environments.

DTH Hammer Bits are essential for deep hole drilling applications, offering high penetration rates and a unique hammering action that breaks hard materials more effectively than rotary methods. Their robust performance in challenging conditions boosts their demand in both mining and construction industries.

By Material

In 2023, PDC (Polycrystalline Diamond Compact) Diamond held a dominant market position, capturing more than a 38.5% share. PDC Diamond drill bits are favored in the mining industry for their exceptional durability and efficiency in drilling through hard rock formations. These bits are especially prevalent in oil and gas drilling but are increasingly used in mineral mining due to their long lifespan and effectiveness.

Following closely, Tungsten Carbide accounted for a significant portion of the market. Known for its toughness and resistance to wear and tear, tungsten carbide bits are ideal for drilling through abrasive materials. Their robust nature makes them suitable for a wide range of drilling applications, including both surface and underground mining.

Steel drill bits, while more traditional, still hold a substantial share due to their cost-effectiveness and versatility. These bits are commonly used for softer, non-abrasive rock types or where precise drilling is less critical. They are preferred in operations where equipment costs need to be minimized.

By Operation

In 2023, Diesel Operated Mining Drills held a dominant market position, capturing more than a 58.7% share. Diesel drills are preferred for their robust power and mobility, allowing them to be used in remote locations without access to electrical power grids. These drills are particularly valued in large-scale mining operations where their high torque and efficiency in tough drilling conditions are crucial.

Battery/Electric Operated Mining Drills are gaining traction, driven by the mining industry’s shift towards more sustainable practices. Although they currently hold a smaller market share, these drills are appreciated for their lower environmental impact and reduced noise levels, making them ideal for underground operations. The push for electrification in mining equipment is expected to boost the popularity of electric drills in the coming years as technology advances and regulatory pressures for cleaner mining increase.

By Drilling Technique

In 2023, Rotary Mining Drill held a dominant market position, capturing more than a 33.4% share. This type of drill is widely favored for its versatility and efficiency in various mining operations, able to handle a range of materials from soft soil to hard rock.

Track Mining Drill followed in market share, appreciated for its mobility and stability. This drill is mounted on tracks, allowing it to navigate difficult terrain and perform well in rugged environments, which is essential for surface mining operations.

Compact Core Mining Drill is another important segment, known for its precision and ability to extract core samples. This drill is typically used in exploration activities to obtain clear and uncontaminated samples for mineral analysis.

Down-the-Hole (DTH) Mining Drill is recognized for its effectiveness in creating large and deep holes. DTH drills are especially useful in hard rock environments, providing consistent performance and reliability.

Tophammer Mining Drill rounds out the segment, known for its high penetration rate and efficiency in fractured rock conditions. This drill uses a top hammer to impact crush the rock, making it ideal for construction and quarrying tasks as well as mining.

By Mounting

In 2023, Handhold Mining Drill held a dominant market position, capturing more than a 28.5% share. This type of drill is highly valued for its portability and ease of use in tight spaces or uneven terrains, making it ideal for small-scale operations and quick drilling tasks.

Pusherleg Mining Drill is also a key player in the market, known for its ability to enhance drilling precision and reduce operator fatigue. This drill is often used in underground mining operations where support for the drill is necessary to handle tougher drilling conditions.

Rig Mining Drill commands a significant market segment, favored for its high-performance capabilities in large-scale mining projects. These drills are mounted on rigs, providing stability and support for heavy-duty drilling operations.

Column & Bar Mining Drill is designed for more accurate drilling in vertical or angled applications. This type of mounting is crucial for projects requiring precise hole placement, such as blasting and quarrying.

By Drill Fluid Used

In 2023, Liquid Filled drill bits held a dominant market position, capturing more than a 43.3% share. These bits are preferred for their efficiency in cooling and lubricating the drill bit and cutting surface, reducing friction and wear during drilling operations. This fluid type is particularly effective in deep drilling operations where heat dissipation is crucial.

Foam Filled drill bits also play a significant role in the market. Foam helps in lifting the drill cuttings to the surface and is beneficial in reducing the environmental impact compared to liquid systems. This type of drill fluid is suitable for unstable formations where it provides better hole cleaning and stability.

Air Filled drill bits are valued for their simplicity and cost-effectiveness. Using air as the drilling medium is common in less complex geological conditions where water sensitivity of the rock formations is a concern. Air systems are easier to maintain and are preferred in dry, shallow drilling applications where liquid or foam may not be necessary.

By Size

In 2023, drill bits sized “Below 8 inches” held a dominant market position, capturing more than a 45.5% share. These smaller-sized bits are highly favored for their versatility and efficiency in various drilling operations, particularly in tight and complex geological formations where precision is crucial. They are commonly used in mineral exploration and smaller extraction projects, as well as in construction and civil engineering for foundational work.

Drill bits sized “8 inches to 11 inches” also form a significant segment of the market. These mid-sized bits are ideal for larger scale operations that require deeper and wider drilling capabilities without the need for the extensive setup of the largest bits. They strike a balance between depth and precision, making them suitable for a wide range of mining and construction tasks.

Lastly, drill bits “Above 11 inches” are essential for major mining and quarrying operations where large diameter drilling is required. These bits are used in large-scale mineral extraction projects and are crucial for establishing initial access into new mining sites, as well as for large-scale civil engineering projects such as tunneling and large foundation setting.

By Application

In 2023, Surface Mining held a dominant market position, capturing more than a 64.5% share. This segment benefits from the widespread application of surface mining techniques, which are generally more cost-effective and safer than underground mining. Surface mining drill bits are designed to handle various terrains and rock types, making them versatile for extracting minerals like coal, precious metals, and aggregates close to the earth’s surface.

Underground Mining, although with a smaller share, is critical for extracting deeper mineral resources that are not accessible via surface mining methods. Drill bits used in this application are specialized to withstand the challenging conditions of underground environments, including higher pressures and lower light and space conditions. This segment is essential for extracting valuable ores and minerals that lie deep beneath the earth’s surface, often driving innovation in drill bit durability and performance.

Key Market Segments

By Type

- Rotary Bit

- Fixed Cutter Bits

- Roller Cone Bits

- DTH Hammer Bit

- Others

By Material

- PDC Diamond

- Tungsten Carbide

- Steel

- Others

By Operation

- Diesel Operated Mining Drills

- Battery/Electric Operated Mining Drills

By Drilling Technique

- Rotary Mining Drill

- Track Mining Drill

- Compact Core Mining Drill

- Down-the-Hole Mining Drill

- Tophammer Mining Drill

By Mounting

- Handhold Mining Drill

- Pusherleg Mining Drill

- Rig Mining Drill

- Column & Bar Mining Drill

- Carriage Mining Drill

By Drill Fluid Used

- Liquid Filled

- Foam Filled

- Air Filled

By Size

- Below 8 inches

- 8 inches to 11 inches

- Above 11 inches

By Application

- Surface Mining

- Underground Mining

Driving Factors

Increasing Demand for Minerals and Metals

The mining drill bits market is significantly driven by the escalating global demand for minerals and metals. This demand is fueled by the continuous growth in sectors that rely heavily on these resources, such as construction, automotive, electronics, and energy. As these industries expand, the need for effective and efficient mining equipment, including drill bits, intensifies.

In 2023, the global emphasis on infrastructure development and technological advancements in drilling equipment further bolstered market growth. The integration of modern technologies in mining drill bits enhances their performance, thereby supporting the more extensive and challenging drilling operations required in today’s mining projects.

Moreover, the push towards renewable energy sources and the subsequent increase in mineral mining for materials critical to these technologies (like copper and lithium) play a crucial role in driving the demand for mining drill bits. The market’s expansion is also supported by investments in mining activities globally, as companies seek to capitalize on the increasing demand for raw materials.

Regions like Asia-Pacific, particularly countries with significant mineral reserves, lead in market share due to the high volume of mining activities. This regional dominance is propelled by the increased production of coal-fired power and the extensive industrial use of minerals in these areas.

Restraining Factors

Stringent Environmental Regulations

One of the major restraining factors for the growth of the mining drill bits market is the stringent environmental regulations imposed on mining activities. These regulations aim to mitigate the environmental impact caused by mining, including land degradation, water pollution, and disruption of biodiversity. Environmental policies require mining companies to adopt cleaner and more sustainable technologies, which often involve significant investment in new equipment and technologies.

For instance, regulations such as those under the Clean Water Act in the United States enforce strict limits on the discharge of pollutants into water bodies. These requirements necessitate advanced filtration and treatment solutions that can significantly increase operational costs for mining companies. Additionally, regulations often stipulate the reclamation of mining sites, which requires further investment to ensure that lands are returned to their natural state post-mining or are made suitable for other uses.

The need to comply with environmental standards not only increases the direct costs related to pollution control but also influences the type of technology and equipment that can be used. For example, the shift towards less invasive drilling techniques or the adoption of drill bits that minimize environmental disruption can lead to additional costs. These financial burdens can deter investment in new mining projects or lead to higher costs for mineral extraction, ultimately restraining market growth.

Moreover, the focus on reducing emissions and preventing environmental pollution has spurred innovation in drill bit technology, leading to the development of more efficient and less environmentally damaging solutions. However, the initial investment required for such innovations can be substantial, affecting the overall adoption rate of new technologies in the mining sector.

Growth Opportunity

Electrification of Mining Operations

A significant growth opportunity for the mining drill bits market lies in the electrification of mining operations. As the global mining industry shifts towards cleaner and more sustainable practices, the demand for electrically powered mining equipment is rapidly increasing. This transition is driven by the need to reduce greenhouse gas emissions and improve energy efficiency within the sector.

Electrifying mines can lead to a substantial increase in electricity demand, as electric mining equipment, such as haul trucks and drills, replace diesel-powered alternatives. For example, the global iron ore industry alone might see an increase of 20 to 30 terawatt-hours in electricity demand due to the electrification of mobile fleets. This shift not only requires significant investment in mining infrastructure but also opens up new markets for mining drill bits specifically designed for electrically powered equipment.

The move towards electrification is also fueled by external pressures including environmental regulations, investor expectations, and the social license to operate. Companies in the mining industry are increasingly setting ambitious carbon abatement commitments to meet these expectations. Transitioning to electric mining equipment helps reduce both direct emissions from operations and those associated with the generation of purchased energy.

Moreover, the adoption of electrification in mining aligns with broader trends in global energy consumption, where there is a significant push towards renewable sources. The integration of renewable energy sources into mining operations not only aids in meeting regulatory and societal expectations but also in reducing operational costs in the long term.

Latest Trends

Increased Adoption of Automated and Electrified Drill Bits

One of the most significant trends shaping the mining drill bits market is the growing adoption of automation and electrification within mining operations. As the industry pushes for greater efficiency and safety, automated drill systems that can operate with minimal human intervention are becoming increasingly popular. These systems not only improve operational efficiency but also reduce the likelihood of accidents and enhance the precision of drilling operations.

Additionally, the electrification of drill bits is gaining traction as part of the broader move towards electrifying mining equipment. This shift is driven by the need to reduce greenhouse gas emissions and improve energy efficiency in mining operations. Electrified drill bits are designed to work with electric or battery-operated drilling machinery, offering a cleaner alternative to traditional diesel-powered equipment.

The push for automation and electrification is also supported by advancements in material technology, particularly in the development of more durable and efficient drill bits that can handle a variety of geological conditions. For example, the use of polycrystalline diamond compact (PDC) and tungsten carbide materials in drill bits has been enhanced to improve their performance and lifespan, thus supporting the effective drilling in both surface and underground mining operations.

This trend is reflective of a broader industry shift towards embracing innovative technologies to meet the evolving demands of the mining sector, including the need for more environmentally friendly and cost-effective solutions. As these technologies continue to develop, they present significant growth opportunities for manufacturers and suppliers within the global mining drill bits market.

Regional Analysis

Asia Pacific (APAC) stands as the dominating region, accounting for a substantial 37% of the market share, translating to USD 0.79 billion. This leadership is driven by extensive mining activities across countries like China, India, and Australia, coupled with increasing investments in metal exploration and extraction. The region benefits from rich mineral reserves and a rapid expansion in industrial and infrastructural development, which sustains high demand for mining drill bits.

North America follows with significant contributions, particularly from the United States and Canada, where there is a strong focus on the extraction of energy resources like coal, oil, and natural gas. Technological innovations in drill bit manufacturing and stringent safety regulations in the mining sector further propel the market growth in this region.

Europe presents a mature market characterized by stringent environmental regulations and an increasing inclination towards sustainable mining practices. Countries such as Germany, the UK, and Russia are noted for their technological advancements in mining equipment, which aligns with the region’s focus on reducing environmental impact and enhancing efficiency.

Middle East & Africa (MEA) is identified as a growing market with potential, driven by the mineral-rich African continent and the oil-abundant Middle Eastern countries. Initiatives to explore new mining areas and invest in infrastructure development are key factors contributing to the market expansion in this region.

Latin America, with countries like Brazil, Chile, and Peru, is also notable for its extensive base of mineral resources, particularly in copper and iron ore mining. The region sees ongoing investments in mining technologies, which supports the demand for advanced drill bits.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The mining drill bits market features a robust lineup of key players, each contributing to technological advancements and the expansion of global mining capabilities. Companies such as Atlas Copco AB, Epiroc AB, and Sandvik AB, originating from Sweden, are prominent for their innovations in drilling technology and their substantial market presence globally. These companies have consistently introduced high-performance and sustainable drilling solutions that cater to both surface and underground mining operations.

North American entities like Caterpillar Inc., Boart Longyear, and Joy Global Inc. play critical roles in the supply of mining equipment, including drill bits that are essential for extracting various minerals and ores. Their products are known for durability and efficiency, which are crucial in the demanding environments of mining sites. Caterpillar, for instance, is not only a leader in the manufacturing of construction and mining equipment but also in developing new technologies that reduce environmental impact and enhance safety.

In Asia, companies like Mitsubishi Materials Corporation and Xiamen Prodrill Equipment Co., Ltd., along with Changsha Heijingang Industrial Co. Ltd. from China, underscore the region’s growing influence in the mining technology sector.

These firms specialize in producing a diverse range of drill bits, including those for specific applications such as rotary and DTH (Down-The-Hole) drilling. Their continued focus on R&D has allowed them to keep up with global demands and regulatory standards, thereby supporting the mining industries not only in Asia but around the world.

Top Key Players in the Market

- Atlas Copco AB

- Boart Longyear

- Brunner and Lay Inc.

- Caterpillar Inc.

- Changsha Heijingang Industrial Co. Ltd.

- Doosan Corporation

- Epiroc AB

- Glinik Drilling Tools

- Joy Global Inc.

- Komatsu Ltd

- Liebherr

- Metso Corporation

- MICON Drilling GmbH

- Mitsubishi Materials Corporation

- Robit Plc

- Rockmore International

- Sandvik AB

- Universal Drilling Technique, LLC

- Western Drilling Tools

- Xiamen Prodrill Equipment Co., Ltd.

Recent Developments

In 2023, Atlas Copco AB continued to strengthen its position in the mining drill bits market, showcasing a strong performance with notable achievements.

In 2023, Boart Longyear, a global leader in the provision of drilling services and equipment, continued to innovate in the mining drill bits sector.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Bn Forecast Revenue (2033) USD 3.5 Bn CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Rotary Bit, Fixed Cutter Bits, Roller Cone Bits, DTH Hammer Bit, Others), By Material (PDC Diamond, Tungsten Carbide, Steel, Others), By Operation (Diesel Operated Mining Drills, Battery/Electric Operated Mining Drills), By Drilling Technique (Rotary Mining Drill, Track Mining Drill, Compact Core Mining Drill, Down-the-Hole Mining Drill, Tophammer Mining Drill), By Mounting (Handhold Mining Drill, Pusherleg Mining Drill, Rig Mining Drill, Column and Bar Mining Drill, Carriage Mining Drill), By Drill Fluid Used (Liquid Filled, Foam Filled, Air Filled), By Size (Below 8 inches, 8 inches to 11 inches, Above 11 inches), By Application (Surface Mining, Underground Mining) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Atlas Copco AB, Boart Longyear, Brunner and Lay Inc., Caterpillar Inc., Changsha Heijingang Industrial Co. Ltd., Doosan Corporation, Epiroc AB, Glinik Drilling Tools, Joy Global Inc., Komatsu Ltd, Liebherr, Metso Corporation, MICON Drilling GmbH, Mitsubishi Materials Corporation, Robit Plc, Rockmore International, Sandvik AB, Universal Drilling Technique, LLC, Western Drilling Tools, Xiamen Prodrill Equipment Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Atlas Copco AB

- Boart Longyear

- Brunner and Lay Inc.

- Caterpillar Inc.

- Changsha Heijingang Industrial Co. Ltd.

- Doosan Corporation

- Epiroc AB

- Glinik Drilling Tools

- Joy Global Inc.

- Komatsu Ltd

- Liebherr

- Metso Corporation

- MICON Drilling GmbH

- Mitsubishi Materials Corporation

- Robit Plc

- Rockmore International

- Sandvik AB

- Universal Drilling Technique, LLC

- Western Drilling Tools

- Xiamen Prodrill Equipment Co., Ltd.