Global Drilling Services Market By Mining Type (Metal, Coal, Mineral, Quarry), By Drilling Type (Directional Drilling, Non-Directional Drilling), By Application (Onshore, Offshore), By End-use (Oil & Gas, Mining, Water Exploration, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 130738

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

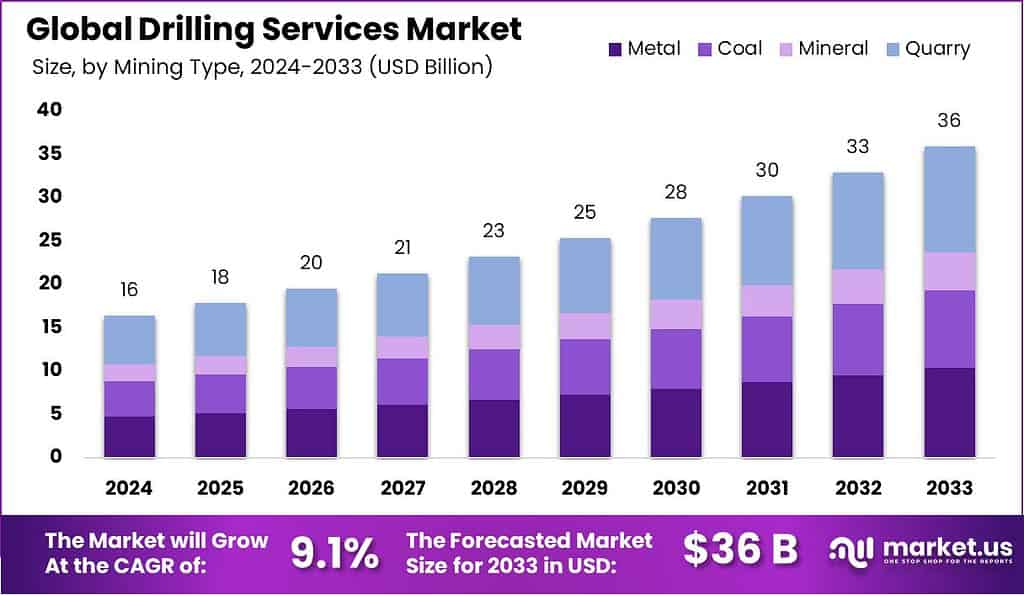

The Global Drilling Services Market is expected to be worth around USD 36.0 billion by 2033, up from USD 16.4 billion in 2023, and grow at a CAGR of 9.1% during the forecast period from 2024 to 2033.

The drilling services market is an essential segment of the global energy industry. It focuses on creating holes in the ground to extract oil, gas, and water or to conduct environmental and geological studies. This market provides the necessary equipment, expertise, and technology for drilling operations and plays a vital role in infrastructure development.

Government policies significantly influence the drilling services market, particularly through regulatory frameworks that prioritize safety and environmental impacts. These regulations often serve dual roles, acting both as drivers that facilitate market growth and as constraints that dictate operational practices. For instance, governments engaging in offshore drilling contracts, for offshore exploration, demonstrate an active push towards expanding market boundaries through the exploration of new reserves.

Moreover, the market is experiencing robust growth due to rising global energy demands and ongoing exploration for new oil and gas reserves. Technological advancements in drilling are also contributing to this growth by introducing more efficient and less environmentally damaging drilling techniques. The drilling services market is projected to grow at a compound annual growth rate (CAGR) of about 4% over the next five years, fueled by these technological innovations and increased energy demands, particularly in emerging markets.

Key Takeaways

- The Global Drilling Services Market is expected to be worth around USD 36.0 billion by 2033, up from USD 16.4 billion in 2023, and grow at a CAGR of 9.1% during the forecast period from 2024 to 2033.

- Metal dominated the Open Pit Drilling Services Market with a 29.4% share.

- Directional Drilling dominated with 56.4% of the Drilling Services Market.

- Onshore dominated the Drilling Services Market with a 56.2% share by application.

- The Oil & Gas sector dominated the Drilling Services Market with a 63.3% share.

- The APAC region leads the global drilling services market with a 38% share valued at $6.2 billion.

By Mining Type Analysis

In 2023, Metal dominated the Open Pit Drilling Services Market with a 29.4% share.

In 2023, Metal held a dominant market position in the Open Pit segment of the Drilling Services Market, capturing more than a 29.4% share. This prominence is largely due to increased demand for metals in various industries, including electronics and construction, where they are essential for manufacturing and infrastructure projects. The significant share also reflects the efficiency and cost-effectiveness of open pit mining methods, which are often preferred for their scalability and lower initial investment compared to underground operations.

Metal, Coal accounted for the second-largest market share. Despite global shifts towards renewable energy, coal remains integral in energy production, particularly in developing economies where it is a primary source of affordable energy. The sector continues to demand drilling services for the exploration and expansion of existing mines.

Mineral exploration also showed substantial activity, driven by the need for rare earth elements used in high-tech applications. This market segment benefits from advancements in drilling technology which allow for more precise and less invasive exploration, aligning with environmental regulations and sustainability goals.

By Drilling Type Analysis

In 2023, Directional Drilling dominated with 56.4% of the Drilling Services Market.

In 2023, Directional Drilling held a dominant market position in the By Drilling Type segment of the Drilling Services Market, capturing more than 56.4% share. This method, preferred for its precision and efficiency in reaching oil and gas reserves, significantly outpaced Non-Directional Drilling, which traditionally involves vertical drilling techniques.

The preference for Directional Drilling is attributed to its ability to access difficult-to-reach reservoirs and maximize production from mature fields, thus optimizing the extraction process in challenging environments. This method also facilitates multiple wells from a single pad, reducing environmental impact and operational costs.

Non-Directional Drilling remains critical for certain geographical areas where the geological structures are straightforward, thereby simplifying the drilling operations. However, the surge in complex field explorations and the need for advanced technological integration have bolstered the advancements and adoption of Directional Drilling, ensuring its growth trajectory remains robust in the foreseeable future.

By Application Analysis

In 2023, Onshore dominated the Drilling Services Market with a 56.2% share by application.

In 2023, Onshore drilling services held a dominant market position in the By Application segment of the Drilling Services Market, capturing more than a 56.2% share. This segment outperformed its counterpart, Offshore, due to several contributory factors. The preference for onshore drilling can be primarily attributed to lower operational costs and reduced logistical complexities compared to offshore operations.

Additionally, technological advancements and the development of unconventional extraction methods have further bolstered the efficiency and appeal of onshore drilling activities.

The Offshore segment, while smaller, is characterized by its high investment and technological requirements, which inherently limit its accessibility and expansion. Despite these challenges, offshore drilling remains critical, driven by diminishing onshore reserves and the increasing demand for deep-water exploration.

The strategic positioning and future growth potential of each segment are influenced by geopolitical factors, regulatory frameworks, and advancements in drilling technologies, which collectively shape the competitive landscape and investment opportunities within the global Drilling Services Market.

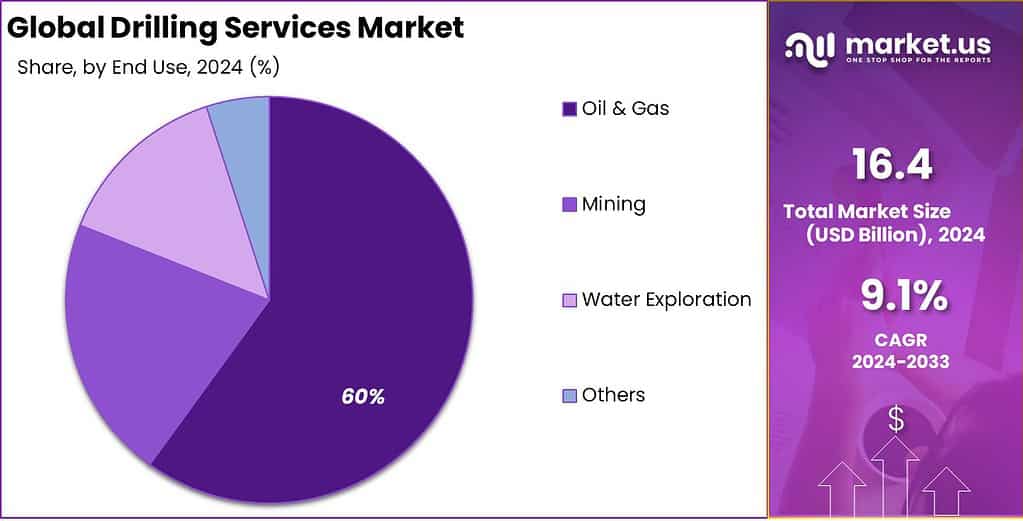

By End-use Analysis

In 2023, The Oil & Gas sector dominated the Drilling Services Market with a 63.3% share.

In 2023, The Oil & Gas sector maintained a dominant market position in the By End-Use segment of the Drilling Services Market, capturing more than a 63.3% share. This substantial market share is indicative of the sector’s central role in driving demand for drilling services, primarily fueled by the exploration and production activities in unconventional and offshore oil reserves.

The Oil & Gas sector, the Mining industry also represents a significant component of the market. It leverages drilling services for mineral exploration and extraction processes, contributing to advancements in drilling technologies that are increasingly efficient and environmentally sensitive. The adaptation to more stringent regulations and a shift towards sustainable mining practices are expected to further influence market dynamics.

Water Exploration is another vital sector within the drilling services market. This segment focuses on the exploration and development of water resources, which is crucial given the global increase in water scarcity issues. Technological innovations in drilling have enhanced the efficiency and reduced the environmental impact of water exploration.

Key Market Segments

By Mining Type

- Metal

- Coal

- Mineral

- Quarry

By Drilling Type

- Directional Drilling

- Non-Directional Drilling

By Application

- Onshore

- Offshore

By End-use

- Oil & Gas

- Mining

- Water Exploration

- Others

Driving factors

Increasing Global Energy Demand: Fueling the Expansion of Drilling Services

The escalating global demand for energy is a primary driver for the drilling services market. As populations grow and industrialization increases, particularly in emerging economies, the need for energy sources, both traditional and renewable, continues to surge. This heightened demand directly correlates with an increased need for drilling services to access both oil and gas reserves.

Statistical projections from industry analyses indicate that global energy consumption may rise by as much as 50% by 2050, underscoring the critical role of drilling services in meeting this future energy requirement.

Technological Advancements: Enhancing Efficiency and Capability

Technological advancements in drilling technologies significantly contribute to the market’s growth by increasing efficiency and reducing the environmental impact of drilling operations. Innovations such as automated drilling rigs, advanced seismic imaging technologies, and real-time data monitoring enable more precise and faster drilling, which can decrease overall project costs and timelines.

These advancements not only improve recovery rates but also extend the life of existing fields, making previously uneconomical reserves viable. For instance, the integration of AI and IoT in drilling operations has led to a more than 20% improvement in operational efficiency in some cases.

Investment in Offshore Exploration: Unlocking New Prospects

Investment in offshore exploration is critical as it taps into new and untapped reserves, driving the demand for drilling services. The shift towards deepwater and ultra-deepwater locations, characterized by their vast untapped reserves, requires sophisticated drilling services and expertise. The capital investment in offshore projects has been increasing, influenced by stabilizing oil prices and advancing extraction technologies, which make these ventures more financially feasible. For example, global spending on offshore drilling is projected to grow by over 7% annually, reflecting robust market opportunities for drilling service providers.

Development of Unconventional Resources: Broadening the Market Scope

The development of unconventional resources, such as shale gas, tight oil, and oil sands, has transformed the energy landscape, particularly in North America. These resources require specialized drilling techniques like horizontal drilling and hydraulic fracturing, which are more complex and costly than conventional methods.

The expansion into these resources has significantly broadened the scope and geographic spread of the drilling services market, providing substantial growth opportunities. Notably, in the United States, unconventional resource development now accounts for approximately 70% of total oil and gas production.

Cost-Effectiveness of Onshore Drilling: Sustaining Market Viability

The cost-effectiveness of onshore drilling continues to make it an attractive option, especially in regions with extensive onshore reserves. Onshore drilling generally requires lower capital investment and operational costs compared to offshore drilling, making it a viable option for many producers, particularly in a low-price oil environment.

This cost advantage is crucial in maintaining the competitiveness of drilling services in onshore settings, particularly in cost-sensitive markets. It also allows for quicker setup and faster production start, which can be critical in rapidly changing market conditions.

Restraining Factors

Oil Price Volatility: A Fluctuating Foundation

Oil price volatility is a dominant factor that significantly restrains the drilling services market. The unpredictability of oil prices, driven by geopolitical tensions, changes in supply-demand dynamics, and global economic conditions, directly impacts investment decisions in drilling projects. For instance, lower oil prices can lead to reduced capital expenditure in new drilling activities as the return on investment becomes less attractive.

Conversely, high volatility discourages long-term planning, causing project delays or cancellations. This instability can be linked to a decline in market growth rates, as companies hesitate to commit to large-scale drilling operations without predictable financial outcomes.

Shift to Renewable Energy: Navigating a Paradigm Shift

The global shift towards renewable energy sources is gradually reshaping the energy market landscape, presenting a substantial restraint for the drilling services market. As governments and corporations commit to carbon neutrality goals, investments and policies favoring renewable energy sources like wind, solar, and hydroelectric power are increasing.

This shift not only diverts financial resources from traditional fossil fuel exploration but also influences public and political sentiment, further discouraging fossil fuel dependency. The combined effect of these trends is expected to constrain the growth opportunities for drilling services in the long term, as the energy sector evolves towards more sustainable practices.

Environmental Regulations: Compliance Costs and Operational Challenges

Stringent environmental regulations are increasingly being implemented to mitigate the environmental impacts of drilling operations, such as pollution and habitat disruption. These regulations, which often vary by region and intensity, compel drilling companies to invest in cleaner technologies and practices, increasing operational costs and extending project timelines.

For example, requirements for detailed environmental impact assessments and stricter emission standards can add to the upfront costs of drilling projects, reducing their overall feasibility and attractiveness. The necessity to comply with these environmental mandates not only heightens operational hurdles but also limits market expansion in ecologically sensitive areas.

Technological Challenges: Overcoming Innovation Barriers

The drilling services market faces significant technological challenges that hinder its growth. The development of high-efficiency, low-cost drilling technologies is crucial in maintaining competitiveness, particularly in environments that are technically difficult to access, like deep water or extreme arctic conditions.

Innovations such as automated drilling and enhanced oil recovery are essential to reduce costs and improve recovery rates; however, the high cost of research and development, coupled with the risk of unproven technologies, can restrain market growth.

Health and Safety Concerns: Prioritizing Personnel and Environmental Safety

Health and safety concerns in drilling operations also present significant restraints. The high-risk nature of drilling activities necessitates stringent safety protocols and measures, which can increase operational costs and reduce efficiency. Incidents related to drilling mishaps not only lead to human casualties and environmental disasters but also result in severe regulatory fines and loss of reputation.

Growth Opportunity

Expansion of Unconventional Resources

The global drilling services market is poised for significant growth primarily driven by the expansion of unconventional resources. As industries continue to explore alternative energy sources, the demand for specialized drilling services that can efficiently tap into these complex formations is expected to rise. This trend suggests substantial opportunities for service providers who are equipped with the technology and expertise necessary to exploit unconventional resources such as shale gas, tight oil, and coalbed methane.

Digitalization and Automation

Digitalization and automation represent transformative forces within the drilling services sector. By integrating advanced digital tools and automated systems, drilling operators can enhance efficiency, reduce operational costs, and minimize human error. The adoption of technologies such as real-time data monitoring, predictive maintenance, and automated drilling solutions is set to escalate, providing a competitive edge to early adopters and innovators in the market.

Rise in Deepwater Drilling Projects

The surge in deepwater drilling activities is another critical factor driving market growth. With the depletion of onshore and shallow offshore reserves, oil and gas companies are increasingly venturing into deeper waters. This shift necessitates advanced drilling services that can handle the complexities and heightened technical requirements of deepwater environments, thereby opening new avenues for growth in this segment.

Increased Investment in Renewable Energy

Investments in renewable energy sources are indirectly benefiting the drilling services market, particularly through geothermal energy projects, which require drilling expertise similar to that used in oil and gas exploration. This diversification into renewable energy sectors allows drilling companies to tap into new markets and reduce dependency on the traditional oil and gas sector.

Focus on Safety and Environmental Sustainability

Enhancing safety and environmental sustainability continues to be a priority, influencing both regulatory frameworks and corporate policies. Drilling service providers are increasingly investing in technologies and practices that reduce the environmental impact of drilling activities and improve safety protocols. This not only helps in complying with stringent environmental regulations but also in building a positive corporate image, crucial for securing contracts and fostering long-term partnerships.

Latest Trends

Investment in Advanced Technologies

The drilling services market is expected to see significant capital infusion into advanced technologies. Industry leaders are prioritizing innovations in drilling equipment and techniques to enhance efficiency and reduce operational costs. This trend is driven by the necessity for more precise extraction methods and the need to access challenging reservoirs, underscoring a shift towards more sophisticated drilling solutions.

Focus on Sustainability

Sustainability is becoming a cornerstone of strategic planning within the drilling services sector. Companies are increasingly adopting environmentally friendly practices and integrating sustainable technologies to minimize their ecological footprint. This focus extends to improving waste management practices, reducing emissions, and optimizing resource utilization, which is pivotal in maintaining regulatory compliance and securing a license to operate.

Digital Transformation

Digital transformation is set to redefine the drilling services landscape. The integration of digital tools such as real-time data analytics, IoT, and AI-driven predictive maintenance systems is enhancing operational agility and decision-making. These technologies not only promise greater operational efficiencies but also aim to bolster safety measures by predicting equipment failures before they occur.

Increased Demand for Deepwater Drilling

As onshore oil reserves become depleted, there is an escalating demand for deepwater drilling services. This segment of the market is experiencing robust growth, driven by the pursuit of untapped reserves in deep-sea locations. This trend is expected to continue, with technological advancements supporting safer and more efficient extraction methods at greater depths.

Managed Pressure Drilling (MPD)

Managed Pressure Drilling (MPD) is gaining traction as a solution to the technical challenges presented by uncontrolled reservoir pressures. MPD techniques are increasingly viewed as essential for enhancing control over the drilling environment, thereby improving safety and minimizing non-productive time. This adoption highlights the industry’s proactive approach to tackling complex drilling dynamics and optimizing operational performance.

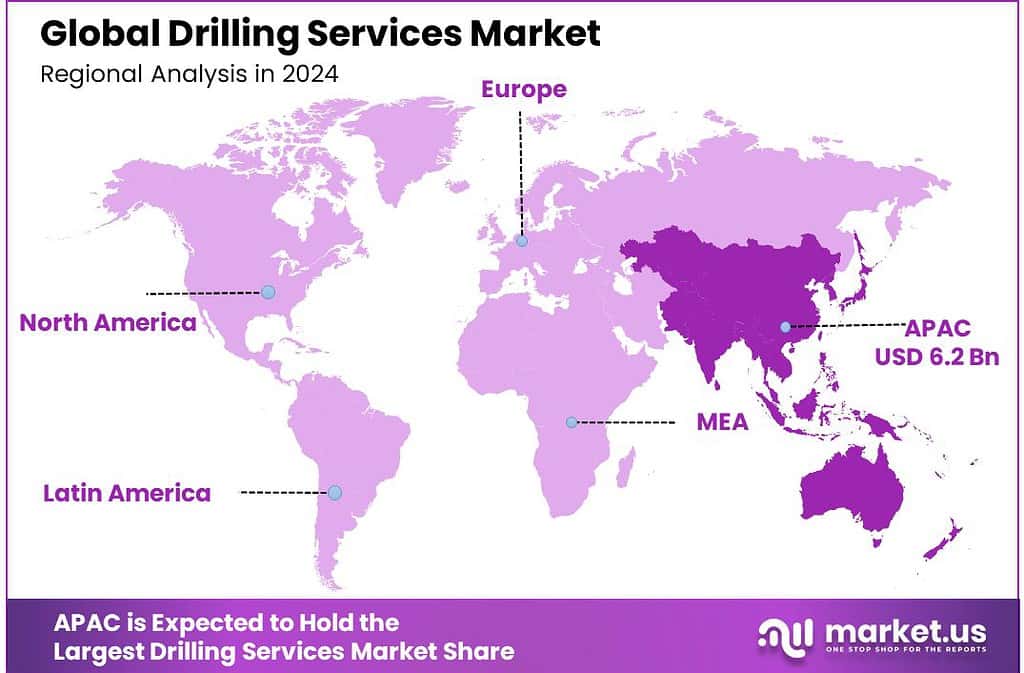

Regional Analysis

The APAC region leads the global drilling services market with a 38% share valued at $6.2 billion.

The global drilling services market is segmented into several key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America, each exhibiting distinct market dynamics and growth potentials.

Asia Pacific (APAC) emerges as the dominant region, holding a substantial 38% market share, valued at $6.2 billion. This region’s market leadership is attributed to extensive offshore drilling activities, particularly in countries like China, Australia, and India, coupled with increasing investments in energy exploration and production.

North America follows, driven by technological advancements in drilling techniques and the robust presence of oil reserves, particularly in the U.S. and Canada. The region’s focus on maximizing oil and gas production from shale formations and deep-water exploration continues to boost demand for sophisticated drilling services.

Europe shows a moderate growth trajectory in the drilling services market, influenced by stringent environmental regulations and a steady shift towards renewable energy sources. However, the region’s focus on maintaining energy security through domestic oil and gas production, particularly in the North Sea, sustains the demand for drilling services.

Middle East & Africa (MEA), with its rich petroleum reserves, remains a significant market. The growth here is powered by continuous development in both onshore and offshore sectors, with Saudi Arabia and the UAE being pivotal markets. The region’s strategic initiatives to enhance oil production capacities are likely to propel the demand for advanced drilling services.

Latin America, particularly Brazil and Venezuela, also plays a critical role due to its untapped offshore oil fields and the recent liberalization of its hydrocarbon sector. The region is witnessing an influx of foreign investments aimed at exploring the vast pre-salt reserves, which, in turn, boosts the regional drilling services market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global drilling services market presents a competitive landscape dominated by established players along with emerging innovators. Key companies such as Schlumberger, Halliburton, and Baker Hughes continue to assert their dominance, leveraging comprehensive service portfolios and global operational footprints. These industry stalwarts benefit from extensive R&D capabilities and strategic alliances, enhancing their market presence.

Emerging players like Gyrodata and Stockholm Precision Tools AB (SPT) are making significant inroads through technological innovations in gyroscopic drilling and precision measurement tools. Their focus on specialized services allows for targeted market penetration, particularly in complex and challenging drilling environments.

Companies such as Devico AS and Brownline are gaining traction by offering unique directional drilling solutions that reduce operational costs and increase drilling accuracy. Their technology-driven approaches are appealing to operators seeking efficiency in unconventional resource extraction.

Mid-tier players like Axis Mining Technology and Icefield Tools Corporation continue to carve out market share by focusing on niche applications and bespoke technologies. Their agility and customer-centric strategies enable rapid response to evolving market demands.

Furthermore, firms like Nabors Industries and National Oilwell Varco are capitalizing on digital technologies and automation to offer more integrated and intelligent drilling solutions. This trend is increasingly critical as the industry moves towards more sustainable and responsible drilling practices.

Market Key Players

- Gyrodata

- Schlumberger

- Stockholm Precision Tools AB (SPT)

- Icefield Tools Corporation

- Devico AS

- Brownline

- Axis Mining Technology

- Scientific Drilling

- Inertial Sensing One AB

- Nabors Industries

- Halliburton

- Weatherford

- TechnipFMC

- China Oilfield Services Limited

- Oceaneering

- AnTech

- Compass Directional Guidance, Inc.

- Drill Tech Solution

- Unitech Drilling Company Limited

- DIDRILLSA LTDA

- VES Survey International

- Archer – the well company

- Superior Energy Services

- Baker Hughes

- Petrofac

- Huracan Pty Ltd.

- Leam Drilling Systems LLC

- National Oilwell Varco

- AlMansoori Specialized Engineering

- NewTech Services

Recent Development

- In February 2024, Sandvik introduced the “Golden Shank,” a new anti-corrosion coating for drill shanks designed to enhance service life and reduce drilling costs per meter. This technology aims to withstand harsh conditions often found in underground mines, where corrosive water is used as a flushing medium.

- In November 2023, Des Nedhe Development, associated with the English River First Nation, and Team Drilling LP signed a cooperation agreement for drilling operations in the Athabasca Basin, northern Saskatchewan. This agreement specifically involves the McArthur River Project and the Wheeler River Project, with potential expansion to other projects within the traditional territory of the English River First Nation.

Report Scope

Report Features Description Market Value (2023) USD 16.4 Billion Forecast Revenue (2033) USD 36.0 Billion CAGR (2024-2032) 9.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Mining Type (Metal, Coal, Mineral, Quarry), By Drilling Type (Directional Drilling, Non-Directional Drilling), By Application (Onshore, Offshore), By End-use (Oil & Gas, Mining, Water Exploration, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Gyrodata, Schlumberger, Stockholm Precision Tools AB (SPT), Icefield Tools Corporation, Devico AS, Brownlin, Axis Mining Technology, Scientific Drilling, Inertial Sensing One AB, Nabors Industries, Halliburton, Weatherford, TechnipFMC, China Oilfield Services Limited, Oceaneering, AnTech, Compass Directional Guidance, Inc., Drill Tech Solution, Unitech Drilling Company Limited, DIDRILLSA LTDA, VES Survey International, Archer – the well company, Superior Energy Services, Baker Hughes, Petrofac, Huracan Pty Ltd., Leam Drilling Systems LLC, National Oilwell Varco, AlMansoori Specialized Engineering, NewTech Services Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Gyrodata

- Schlumberger

- Stockholm Precision Tools AB (SPT)

- Icefield Tools Corporation

- Devico AS

- Brownline

- Axis Mining Technology

- Scientific Drilling

- Inertial Sensing One AB

- Nabors Industries

- Halliburton

- Weatherford

- TechnipFMC

- China Oilfield Services Limited

- Oceaneering

- AnTech

- Compass Directional Guidance, Inc.

- Drill Tech Solution

- Unitech Drilling Company Limited

- DIDRILLSA LTDA

- VES Survey International

- Archer - the well company

- Superior Energy Services

- Baker Hughes

- Petrofac

- Huracan Pty Ltd.

- Leam Drilling Systems LLC

- National Oilwell Varco

- AlMansoori Specialized Engineering

- NewTech Services