Global Soya Flour Market By Type (Defatted, Full-fat), By Application (Bakery and Confectionery, Meat Substitute, Soup and Sausages, Meat And Poultry, Others), By Distribution Channel (Convenience Stores, Departmental Store, Online Stores, Modern Trade, Direct Sales, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 132914

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

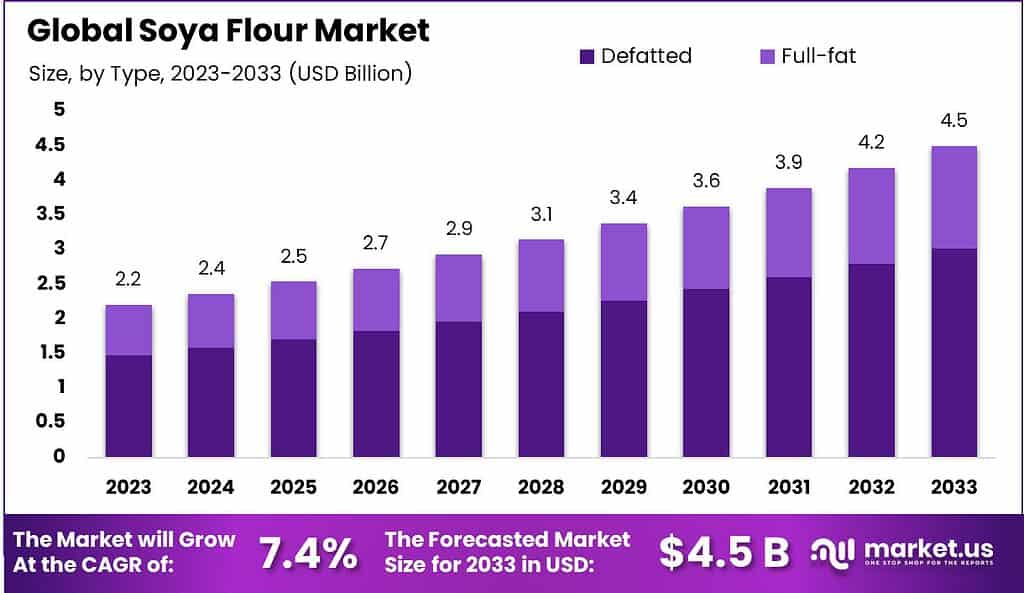

The Global Soya Flour Market size is expected to be worth around USD 4.5 Billion by 2033, from USD 2.2 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

The Soya Flour Market refers to the global industry focused on the production and distribution of flour derived from ground soybeans. Soya flour is a high-protein, gluten-free alternative to traditional wheat flour, used in various applications ranging from baked goods and snacks to plant-based food products and animal feed.

The market is driven by increasing consumer demand for plant-based, allergen-free, and nutrient-dense food options. Key growth factors include rising awareness of the health benefits of soy, the growing vegan and vegetarian food trends, and the expansion of the plant-based protein segment.

The market demand for soya flour has been steadily growing due to its rising popularity as a healthy alternative to traditional wheat flour. This demand is largely driven by an increasing awareness of the health benefits of soy-based products, such as high protein content, low carbohydrate levels, and the presence of essential fatty acids.

The popularity of the soya flour market has been growing steadily in recent years due to increasing awareness of its health benefits and the rising demand for plant-based foods. Soya flour is made from ground soybeans and is rich in protein, making it a popular choice for people looking for alternative sources of protein, especially among vegetarians and vegans. It is also gluten-free, which adds to its appeal for people with gluten sensitivities or celiac disease.

Governments in key markets have been increasingly supporting the growth of the soya flour industry through various initiatives. For example, the U.S. Department of Agriculture (USDA) has introduced programs aimed at boosting the agricultural output of soybeans and supporting the development of sustainable farming practices.

In Brazil, government-backed initiatives like the National Soybean Production Program are designed to enhance soybean yield and promote sustainable agriculture. Similarly, India’s government has introduced measures to support domestic soybean production to reduce reliance on imports and improve food security.

Government regulations play a significant role in shaping the soya flour market, particularly in terms of food safety, quality standards, and environmental impact. For instance, in the European Union, the European Food Safety Authority (EFSA) sets regulations regarding the use of soy and its derivatives in food products, ensuring that they meet health and safety standards.

In the United States, the Food and Drug Administration (FDA) regulates the labeling of soy-based products and ensures compliance with GRAS (Generally Recognized As Safe) standards for food ingredients. Furthermore, GMO regulations are increasingly influencing the market, especially in countries like the US and Brazil, where genetically modified soybeans are widely cultivated.

The import-export dynamics of soya flour are largely driven by key producers like the United States, Brazil, and Argentina, which collectively dominate the global soybean production. The United States alone accounts for more than 40% of global soybean exports, with significant exports to Europe, China, and Southeast Asia.

Key Takeaways

- The Global Soya Flour Market size is expected to be worth around USD 4.5 Billion by 2033, from USD 2.2 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

- Defatted soya flour dominated the market with a 67.4% share, reflecting health trends.

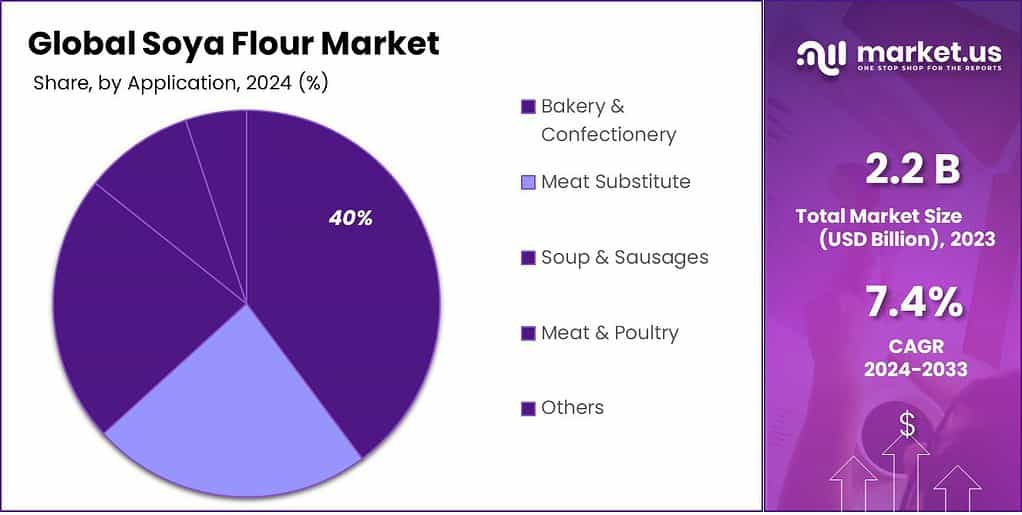

- The Bakery & Confectionery segment dominated the Soya Flour Market with a 38.6% share.

- Convenience Stores dominated the Soya Flour Market with a 39.5% share.

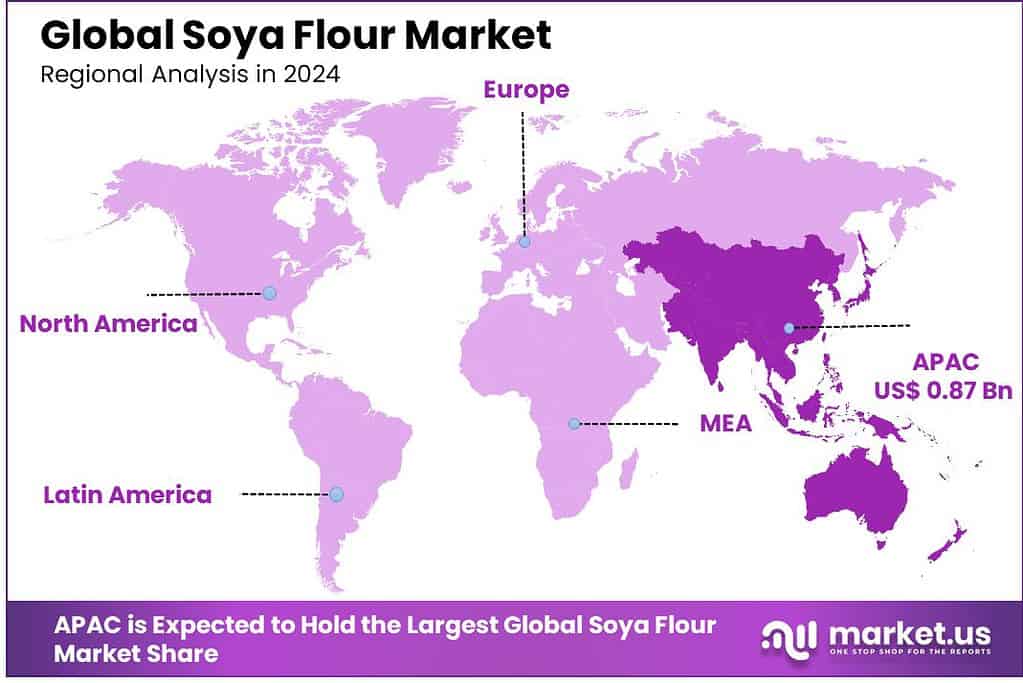

- The Asia Pacific region leads the soya flour market with a 37.5% share, valued at $0.87 billion.

By Type Analysis

Defatted soya flour dominated the market with a 67.4% share, reflecting health trends.

In 2023, Defatted soya flour held a dominant market position in the “By Type” segment of the Soya Flour Market, capturing more than a 67.4% share. This substantial market share reflects a strong preference among manufacturers and consumers for defatted soya flour, primarily due to its lower fat content, which aligns well with the growing trend towards healthier and lower-calorie food products.

Defatted soya flour is extensively utilized in various food applications including bakery products, cereals, and snacks, where it is prized for its ability to enhance nutritional content without significantly altering taste or texture.

Conversely, the Full-fat soya flour, which retains all the natural oils found in soybeans, accounted for the remainder of the market share. Full-fat soya flour is particularly valued in products where a higher fat content is desirable, such as in certain bakery goods, and for its ability to contribute to a richer flavor profile. It also finds applications in animal feed, where the higher oil and protein content is beneficial.

The market dynamics of soya flour are influenced by factors such as consumer dietary preferences, regional nutritional guidelines, and innovations in food technology that improve the taste and usability of soy products.

As health-conscious consumers increasingly opt for products with reduced fat content, the demand for defatted soya flour is expected to continue growing. However, the full-fat segment also remains relevant, driven by its specific applications in both human and animal nutrition, showcasing the diverse utility of soya flour in the global food and feed industries.

By Application Analysis

The Bakery & Confectionery segment dominated the Soya Flour Market with a 38.6% share.

In 2023, The Bakery & Confectionery segment held a dominant market position in the By Application segment of the soya flour Market, capturing more than a 38.6% share. This significant market share can be attributed to the increasing consumer preference for healthier baking alternatives and the rising awareness of gluten-free products. Soya flour, being high in protein and low in fat, has been increasingly incorporated into various bakery and confectionery products, thereby driving demand within this segment.

Following closely, the Meat Substitute segment also showcased a robust growth trajectory, driven by the shift towards plant-based diets and veganism. The versatility of soya flour to mimic the texture and nutritional profile of meat products has made it a preferred ingredient in this sector. This segment’s expansion is further supported by the ongoing innovation in food technology, which enhances the taste and appeal of soya-based meat alternatives.

The Soup & Sausages segment has utilized soya flour primarily for its functional properties, such as emulsification and moisture retention, which are essential in processed foods. Soya flour’s ability to improve the texture and shelf life of products has been pivotal in its adoption in soup mixes and sausages, thereby contributing to the growth of this segment.

In the Meat & Poultry segment, soya flour is extensively used as a binder and filler, which not only enhances the texture of the meat products but also increases their nutritional value. The cost-effectiveness of soya flour compared to other meat fillers has facilitated its adoption across various meat processing applications, underlining its growing importance in this sector.

By Distribution Channel Analysis

Convenience Stores dominated the Soya Flour Market with a 39.5% share.

In 2023, Convenience Stores held a dominant market position in the By Distribution Channel segment of the Soya Flour Market, capturing more than 39.5% of the market share. This segment’s success is largely attributed to the widespread availability and accessibility of convenience stores, which cater to consumers seeking quick and easy shopping options. As a primary retail outlet for soya flour, these stores benefit from high foot traffic and consumer familiarity, making them a critical point of sale for manufacturers.

Following closely are Departmental Stores, which account for a significant portion of the market. These stores typically offer a wider range of products compared to convenience stores, including various types of soya flour such as organic and non-GMO, which appeals to health-conscious consumers. The ability to offer diverse product options under one roof makes departmental stores an attractive shopping destination for customers looking for variety in their dietary choices.

Online Stores have also seen a notable increase in their market share. With the growing trend of e-commerce, consumers are increasingly turning to online platforms for their grocery shopping due to the convenience of home delivery and often competitive pricing. The online segment’s growth is further propelled by the rise in digital marketing and the expanding online presence of traditional retailers.

Modern Trade outlets, encompassing supermarket chains and hypermarkets, provide an extensive distribution network for soya flour. These establishments are strategically located in urban and suburban areas, offering a broad selection of food products, including specialized dietary options like soya flour. The modern trade’s emphasis on a one-stop shopping experience continues to attract a sizable consumer base, supporting its strong position in the market.

Direct Sales channels, although smaller in scale compared to the other segments, play a pivotal role in reaching niche markets and catering to specific consumer needs, such as bulk purchases or specialized dietary requirements. This segment benefits from direct interactions between manufacturers and consumers, which can enhance customer loyalty and provide valuable insights into consumer preferences.

Key Market Segments

By Type

- Defatted

- Full-fat

By Application

- Bakery & Confectionery

- Meat Substitute

- Soup & Sausages

- Meat & Poultry

- Others

By Distribution Channel

- Convenience Stores

- Departmental Store

- Online Stores

- Modern Trade

- Direct Sales

- Others

Driving factors

Rising Popularity of Plant-Based Diets

The global shift toward plant-based diets has emerged as a crucial driver in the expansion of the soya flour market. As more individuals adopt vegetarian and vegan lifestyles, driven by a blend of ethical, environmental, and health motivations, the demand for high-protein, plant-based alternatives has surged. Soya flour, derived from soybeans, offers a versatile, protein-rich option that aligns well with these dietary preferences.

Its ability to substitute for traditional wheat flour while providing essential amino acids makes it especially appealing in diverse culinary applications from baked goods to meat substitutes. This trend is reflected in market data that shows a robust correlation between the rise in plant-based dietary preferences and the increased consumption of soy-based products.

Health Consciousness and Nutritional Benefits

Health consciousness is another significant factor fueling the soya flour market. Today’s consumers are more informed about the nutritional content of their food and seek options that support a healthy lifestyle. Soya flour is low in saturated fats and cholesterol-free, which is particularly attractive to individuals looking to improve heart health and reduce cholesterol levels.

Additionally, it is rich in proteins, vitamins, and minerals, making it an excellent dietary component for weight management and overall well-being. This health-driven demand dovetails with the rising popularity of plant-based diets, as both trends emphasize the importance of sustainable and health-promoting dietary choices.

Demand for Gluten-Free Products

The increasing prevalence of gluten intolerance and celiac disease has significantly impacted food consumption patterns, including a marked rise in the demand for gluten-free products. Soya flour naturally does not contain gluten, positioning it as an ideal alternative for consumers needing or choosing to avoid gluten. This has led to its expanded use in gluten-free baking and cooking, further supported by its nutritional profile and the growing health consciousness among consumers.

The gluten-free trend has not only broadened the consumer base for soya flour but also enhanced its application in food processing industries, thereby stimulating market growth.

Restraining Factors

Fluctuating Soybean Prices: Impact on Soya Flour Market Stability

Fluctuating soybean prices represent a significant restraining factor in the soya flour market. Soybeans, as the primary raw material for soya flour, directly influence production costs and pricing strategies. When soybean prices increase, the cost of producing soya flour escalates, leading to higher retail prices for soya flour-based products. This price volatility can deter manufacturers due to the unpredictability of cost planning and may lead to reduced profit margins.

For instance, periods of high volatility in soybean prices can result in cautious purchasing behaviors among producers who may delay buying raw materials, thus slowing down production cycles. This factor alone can restrain market growth as manufacturers and retailers struggle to manage cost-efficiency against consumer price expectations.

Consumer Price Sensitivity: A Dual-edged Sword

Consumer price sensitivity is closely tied to the fluctuating costs of raw materials such as soybeans. In markets where consumers are highly sensitive to price changes, any increase in the cost of soya flour can lead to a corresponding decline in demand. This sensitivity impacts the market in two significant ways: firstly, it pressures manufacturers to absorb costs, which can affect their profitability and willingness to invest in production expansion.

Secondly, it makes the market more competitive, as consumers might switch to cheaper alternatives, impacting the overall demand for soya flour. The elasticity of demand in this context shows that a small increase in price can lead to a proportionately larger decrease in consumption, especially in price-sensitive markets.

Availability of Substitute Products: Expanding Consumer Choices

The availability of substitute products poses a substantial threat to the soya flour market. Substitutes like almond flour, coconut flour, and other grain flour not only offer alternatives in terms of dietary preferences but also in price competitiveness. These alternatives are becoming more popular, particularly among health-conscious consumers and those with specific dietary restrictions such as gluten intolerance.

The proliferation of these substitute products can fragment the market share of soya flour, as consumers have more options to fulfill their nutritional and culinary needs. This factor is particularly impactful when combined with the above-mentioned price sensitivity and raw material price fluctuations, as it provides a compelling alternative during times of soya flour price increases.

Growth Opportunity

Expansion in Vegan and Vegetarian Diets

One of the primary drivers of soya flour market growth is the continued rise of vegan and vegetarian diets. With increasing awareness of the environmental and health benefits of plant-based diets, more consumers are opting for plant-based protein sources.

Soya flour, rich in protein and essential nutrients, has gained widespread adoption among consumers seeking alternatives to animal-based products. Its versatility makes it ideal for a range of applications, from meat substitutes to dairy alternatives, further bolstering its demand in the market.

Increased Use of Bakery Products

Soya flour is increasingly being incorporated into bakery products, including bread, cakes, and cookies, due to its ability to improve texture, moisture retention, and nutritional value.

As health-conscious consumers seek lower-gluten and higher-protein options, soya flour’s role in enhancing the nutritional profile of bakery items is expected to expand. Its functional properties, such as providing a light and airy texture, further increase its appeal to both producers and consumers.

Growth in the Packaged Food Sector

The growth of the packaged food sector presents another significant opportunity for soya flour. As consumers demand more convenient yet nutritious food options, the use of soya flour in ready-to-eat meals, snacks, and processed foods is on the rise. Its long shelf life and functional benefits, such as enhancing flavor and texture, make it an attractive ingredient for manufacturers looking to meet the growing demand for healthy, convenient products.

Latest Trends

Technological Advancements in Food Processing

Advances in food processing technologies are enabling the production of higher-quality soya flour with enhanced nutritional profiles. Techniques such as enzyme-based processing, micronization, and fermentation are improving the digestibility and bioavailability of nutrients in soya flour.

These innovations also contribute to better texture and flavor, making soya flour more versatile in a variety of food applications, from baked goods to plant-based meat alternatives. As food manufacturers adopt these technologies, the market is likely to see a wider range of products utilizing soya flour, appealing to a more diverse consumer base.

Health Benefits Driving Consumer Choices

In 2024, the growing consumer focus on health and wellness is expected to continue driving the demand for plant-based ingredients like soya flour. Recognized for its high protein content, fiber, and essential fatty acids, soya flour is gaining traction as a healthier alternative to wheat flour.

The increased awareness of its benefits for managing cholesterol, promoting heart health, and supporting weight management aligns with the rising trend of clean-label, functional foods. This shift is particularly prominent among health-conscious millennials and Gen Z consumers, who are seeking nutrient-dense, plant-based options.

Regulatory Support for Healthy Eating Initiatives

Regulatory support for healthier eating habits is becoming a critical driver for market growth. Governments around the world are increasingly implementing policies to promote plant-based diets as part of broader public health strategies.

In regions such as North America and Europe, regulations incentivizing the reduction of meat consumption and the adoption of plant-based alternatives are expected to increase demand for soya-based products, including soya flour. These initiatives not only support consumer choice but also enhance the sustainability profile of the food industry, encouraging manufacturers to innovate with plant-derived ingredients.

Regional Analysis

The Asia Pacific region leads the soya flour market with a 37.5% share, valued at $0.87 billion.

The Asia Pacific (APAC) region dominates the global soya flour market, accounting for approximately 37.5% of the market share, valued at $0.87 billion. This dominance is largely driven by the extensive production and consumption of soybeans in countries such as China, India, and Japan, where soy-based products are integral to local diets and industries.

In North America, the soya flour market is characterized by steady growth, driven by the United States and Canada. The market in this region is estimated to hold a share of around 24%. The demand is primarily fueled by the increasing use of soya flour in food processing, animal feed, and plant-based food products. With the rise of plant-based diets and a focus on sustainable protein sources, the North American market is poised for consistent expansion, supported by advancements in soy farming technologies and product innovation.

Europe holds a market share of approximately 20% and is witnessing growing interest in soya flour, particularly in countries like Germany, the UK, and France. The European market is primarily driven by the demand for vegan and vegetarian products, which has surged in recent years. Additionally, the European Union’s strict regulations around food safety and labeling standards have led to an increased consumer preference for certified organic and non-GMO soya flour, further contributing to market growth.

The Middle East & Africa (MEA) region represents a smaller yet emerging market for soya flour, with a share of approximately 10%. The growth in this region is primarily attributed to the rising demand for plant-based protein sources, particularly in North African countries and the Middle East, where soy consumption is gradually increasing. Additionally, soya flour is gaining traction in the animal feed industry, particularly in the dairy and poultry sectors, contributing to the market’s upward trajectory.

Latin America accounts for about 8.5% of the global soya flour market. The region is a significant producer of soybeans, particularly in Brazil and Argentina, which are among the world’s largest exporters. The growing use of soya flour in food processing, as well as in animal feed and pet food industries, is expected to drive regional growth. However, the market remains relatively smaller compared to other regions due to lower local consumption and competition from other protein sources.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Soya Flour Market is expected to be significantly shaped by the strategic movements of key players such as Archer Daniels Midland Company, Cargill, Incorporated, and DuPont, among others. Each company is positioning itself to adapt to the shifting demands of both consumers and regulatory environments, focusing on sustainability, product innovation, and supply chain optimization.

Archer Daniels Midland Company (ADM), a leader in agricultural processing, is likely to continue leveraging its extensive network to ensure a stable supply of soybeans for flour production. ADM’s investment in new technologies and processing facilities will be crucial in maintaining its competitive edge, especially in regions with growing demand for plant-based products.

Cargill, Incorporated has consistently focused on sustainability and traceability, which are becoming increasingly important to consumers. Cargill’s ability to offer a product that is both environmentally friendly and high quality will likely attract health-conscious consumers and businesses looking for responsible suppliers.

DuPont, known for its innovations in the food ingredients sector, is expected to drive advancements in soya flour’s nutritional profile. Enhancements such as increased protein content or improved digestibility could make soy flour more appealing in various food applications, from baking to meat substitutes.

Additionally, companies like Bob’s Red Mill Natural Foods and SunOpta Inc. are poised to capitalize on the growing trend toward organic and non-GMO food products. These companies have established strong brands in niche markets that value transparency and natural ingredients, which could see significant growth as consumer preferences continue to evolve.

Market Key Players

- Archer Daniels Midland Company

- Bob’s Red Mill Natural Foods, Inc.

- Cargill, Incorporated

- Ceylon Spice Company

- CHS Inc.

- Devansoy Inc.

- DuPont

- Elite Spice Inc.

- Foodchem International Corporation

- Harvest Innovations

- HDDES Group

- Linyi Shanshong Biological Products Co. Ltd.

- McCormick & Company, Inc.

- Ruchi Soya Industries Ltd.

- Sakthi Soyas Limited

- Scoular Food Indigredients Group

- SDS Spices Pvt Ltd.

- Sinoglory Enterprise Group Co. Ltd.

- Sonic Biochem.

- SunOpta Inc.

- The Scoular Company

- Vippy Industries Ltd

Recent Development

- In April 2024, ADM announced the expansion of its plant-based ingredients portfolio, which includes a focus on soy-based products, such as soy flour. This expansion is part of the company’s broader strategy to meet the growing demand for plant-based food products.

- In March 2024, Bunge Limited introduced new sustainability initiatives in the production of soy flour. The company has committed to using more sustainable farming practices and reducing its carbon footprint in its soy supply chain.

Report Scope

Report Features Description Market Value (2023) USD 2.2 Billion Forecast Revenue (2033) USD 4.5 Billion CAGR (2024-2032) 7.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Defatted, Full-fat), By Application (Bakery & Confectionery, Meat Substitute, Soup & Sausages, Meat & Poultry, Others), By Distribution Channel (Convenience Stores, Departmental Store, Online Stores, Modern Trade, Direct Sales, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Archer Daniels Midland Company, Bob’s Red Mill Natural Foods, Inc., Cargill, Incorporated, Ceylon Spice Company, CHS Inc., Devansoy Inc., DuPont, Elite Spice Inc., Foodchem International Corporation, Harvest Innovations, HDDES Group, Linyi Shanshong Biological Products Co. Ltd., McCormick & Company, Inc., Ruchi Soya Industries Ltd., Sakthi Soyas Limited, Scoular Food Ingredients Group , SDS Spices Pvt Ltd., Sinoglory Enterprise Group Co. Ltd., Sonic Biochem., SunOpta Inc., The Scoular Company, Vippy Industries Ltd Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland Company

- Bob's Red Mill Natural Foods, Inc.

- Cargill, Incorporated

- Ceylon Spice Company

- CHS Inc.

- Devansoy Inc.

- DuPont

- Elite Spice Inc.

- Foodchem International Corporation

- Harvest Innovations

- HDDES Group

- Linyi Shanshong Biological Products Co. Ltd.

- McCormick & Company, Inc.

- Ruchi Soya Industries Ltd.

- Sakthi Soyas Limited

- Scoular Food Indigredients Group

- SDS Spices Pvt Ltd.

- Sinoglory Enterprise Group Co. Ltd.

- Sonic Biochem.

- SunOpta Inc.

- The Scoular Company

- Vippy Industries Ltd