Global Yogurt Drink Market By Type (Vegan, Conventional), By Product Type (Plain, Flavored), By Packaging (Bottles, Tetra Packs), By Distribution Channel (Hypermarkets And Supermarkets, Convenience Stores, Online, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: April 2025

- Report ID: 146659

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

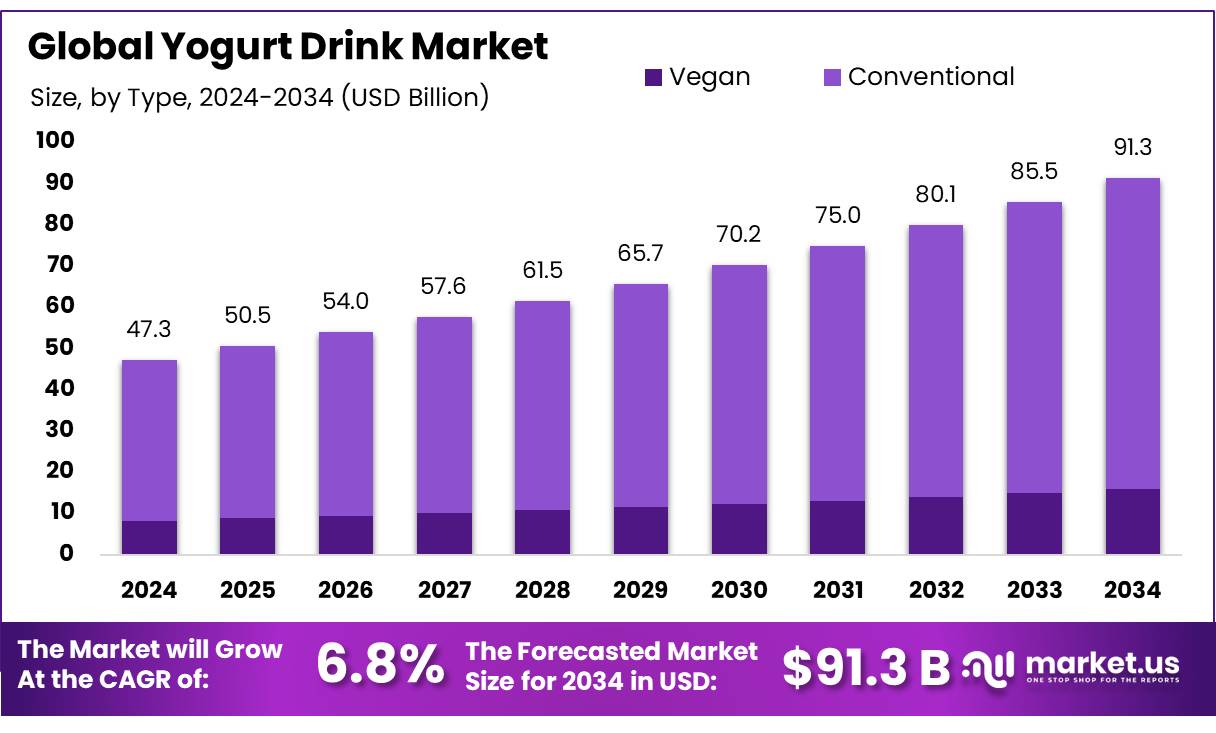

The Global Yogurt Drink Market size is expected to be worth around USD 91.3 Billion by 2034, from USD 47.3 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

The yogurt drink segment is fast becoming a standout category within the dairy industry, thanks to rising consumer demand for nutritious, easy-to-consume, and functional beverages. From kefir to drinkable yogurts and fruit-flavored variants, these products are now a daily pick for millions of health-conscious buyers. People are not just drinking them for taste anymore—they’re reaching for gut health, protein intake, and convenience all in one bottle.

The U.S. dairy industry continues to lead in production. According to the United States Department of Agriculture (USDA), more than 4.3 billion pounds of yogurt, including drinkable formats, are produced every year. This reflects growing demand in North America, where consumers are shifting from sugary beverages to healthier, fermented alternatives.

In India, the world’s largest dairy producer, milk output reached 221 million metric tons in 2022–23 (Department of Animal Husbandry and Dairying). With this scale of production, the base for yogurt drinks is solid. Government schemes like the Dairy Processing and Infrastructure Development Fund and the National Programme for Dairy Development are actively supporting infrastructure upgrades and the rise of value-added products like yogurt drinks.

One of the biggest drivers behind this growth is the consumer love for probiotics. According to a 2022 report by Chr. Hansen, based on responses from 16,000 consumers across 16 countries, nearly 48% of respondents consumed probiotic foods or supplements daily or almost daily—primarily during breakfast, lunch, or snacks. This daily routine of probiotics is fueling the consistent rise in yogurt drink demand.

The push toward digestive health is also critical. As reported by GI Alliance in 2021, nearly 20 million Americans suffer from chronic digestive disorders. In one out of every four cases, surgery becomes necessary. This has pushed many consumers to embrace gut-friendly beverages like yogurt drinks to manage or avoid digestive issues naturally.

Key Takeaways

- Yogurt Drink Market size is expected to be worth around USD 91.3 Billion by 2034, from USD 47.3 Billion in 2024, growing at a CAGR of 6.8%.

- Conventional yogurt drinks continued to dominate the market, capturing an impressive 83.2% share.

- Flavored yogurt drinks maintained a dominant position in the market, securing more than a 63.4% share.

- bottles as a packaging format for yogurt drinks held a commanding market position, capturing more than a 72.9% share.

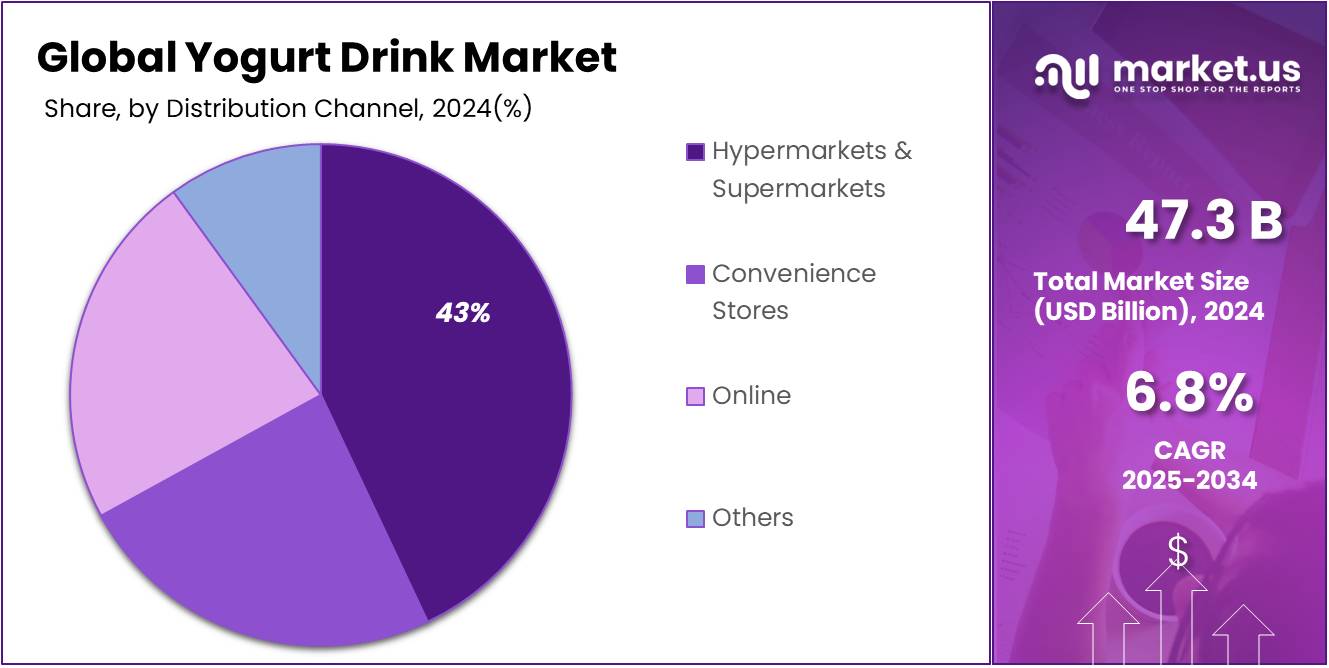

- Hypermarkets & Supermarkets maintained a dominant position in the distribution of yogurt drinks, securing a 43.4% market share.

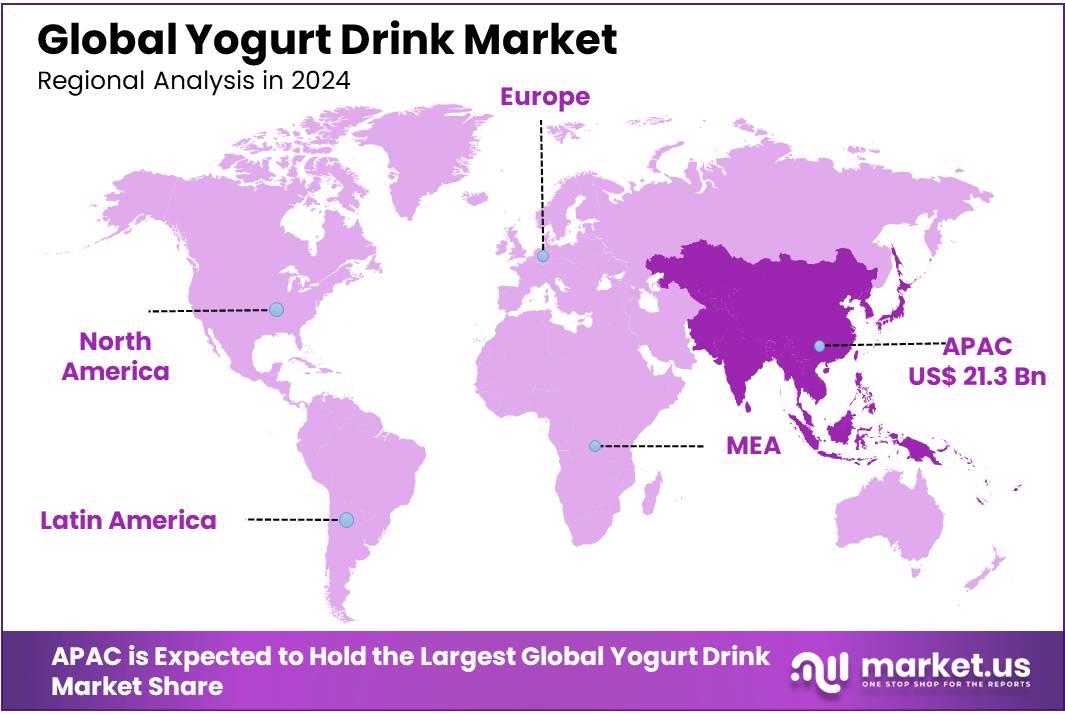

- Asia-Pacific (APAC) region held a commanding position, accounting for a substantial 45.20% market share, translating to a revenue of approximately USD 21.3 billion.

By Type

Conventional Yogurt Drinks Maintain Strong Market Lead with 83.2% Share

In 2024, Conventional yogurt drinks continued to dominate the market, capturing an impressive 83.2% share. This significant market presence underscores the enduring consumer preference for traditional yogurt drink formulations over novel alternatives. The popularity of conventional yogurt drinks stems from their established position in consumer diets, widespread availability, and consistent demand across various demographics. This segment’s stronghold is supported by a broad consumer base that values the familiar taste and trusted health benefits these drinks offer. As consumers continue to prioritize health without compromising on taste, conventional yogurt drinks remain a staple in daily diets, reflecting a robust segment performance in the yogurt drink industry.

By Product Type

Flavored Yogurt Drinks Lead with 63.4% Share Due to Consumer Preference for Variety

In 2024, Flavored yogurt drinks maintained a dominant position in the market, securing more than a 63.4% share. This commanding lead is largely attributed to the diverse range of taste preferences that flavored yogurt drinks cater to. From classic strawberry and vanilla to exotic mango and blueberry, these flavors not only satisfy the taste buds but also add an element of enjoyment to health-focused diets. Consumers’ growing inclination towards tasty yet nutritious options has propelled this segment to the forefront of the yogurt drink industry. As new flavors continue to emerge, flavored yogurt drinks are expected to retain their appeal, attracting both new and loyal consumers.

By Packaging

Bottled Yogurt Drinks Dominate with 72.9% Share, Reflecting Convenience and Portability

In 2024, bottles as a packaging format for yogurt drinks held a commanding market position, capturing more than a 72.9% share. This dominance is a testament to the convenience and portability that bottled yogurt drinks offer, making them a favored choice among consumers leading busy lifestyles. The ease of on-the-go consumption and the sturdy, user-friendly design of bottles enhance the product’s appeal, driving higher sales in both urban and suburban settings. As manufacturers continue to innovate with eco-friendly and attractive packaging designs to appeal to environmentally conscious consumers, the bottled segment is likely to maintain its lead in the yogurt drink market.

By Distribution Channel

Hypermarkets & Supermarkets Lead with 43.4% Share, Offering Extensive Reach and Variety

In 2024, Hypermarkets & Supermarkets maintained a dominant position in the distribution of yogurt drinks, securing a 43.4% market share. This significant presence underscores the critical role these large retail formats play in making yogurt drinks accessible to a broad consumer base. Hypermarkets and supermarkets offer a wide variety of yogurt drink options under one roof, catering to diverse consumer preferences with convenience. Their widespread geographical coverage and the ability to stock large quantities also ensure that consumers have constant access to their favorite yogurt drink brands and flavors. This channel’s dominance is supported by the ease of shopping it offers, making it a go-to option for families looking to fulfill their grocery needs, including health-oriented beverages like yogurt drinks.

Key Market Segments

By Type

- Vegan

- Conventional

By Product Type

- Plain

- Flavored

By Packaging

- Bottles

- Polypropylene

- Polystyrene

- Polyethylene Terephthalate

- Others

- Tetra Packs

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

Drivers

Rising Health Consciousness Fuels Yogurt Drink Demand

One of the primary driving factors for the yogurt drink market is the increasing health awareness among consumers globally. As people become more conscious of their dietary choices, the demand for nutritious and functional beverages like yogurt drinks is on the rise. These beverages are favored for their probiotic content, which supports digestive health and boosts immunity.

According to the United States Department of Agriculture (USDA), the consumption of yogurt, including yogurt drinks, has seen a steady increase over the past decade, with more than 4.3 billion pounds of yogurt produced in the U.S. alone in recent years (USDA). This statistic reflects a growing trend toward healthier eating habits among Americans, a pattern that is mirrored in other parts of the world as well.

In response to this health trend, governments are stepping up their efforts to promote nutritious food options. For instance, the Dietary Guidelines for Americans, published by the U.S. Department of Health and Human Services and the USDA, emphasize the importance of incorporating dairy products like yogurt into daily diets for all age groups. These guidelines are part of broader nutritional policies aimed at reducing lifestyle-related health issues, such as obesity and heart disease, which further encourages the intake of healthy and functional foods like yogurt drinks.

Moreover, in regions like Europe and Asia, similar health initiatives are promoting dietary shifts towards more nutritious products. In India, for instance, the National Dairy Development Board (NDDB) has launched several programs to enhance dairy consumption, focusing on the nutritional benefits of dairy products, including yogurt drinks. These initiatives not only educate the public about the health benefits of yogurt but also aim to increase the overall consumption of dairy products.

Restraints

Lactose Intolerance: A Key Challenge in Yogurt Drink Market Expansion

A significant restraining factor for the yogurt drink market is the prevalence of lactose intolerance among a considerable portion of the global population. Lactose intolerance affects individuals’ ability to digest lactose, a sugar found in milk and dairy products, leading to a reduction in the consumption of such products, including yogurt drinks.

According to data from the National Institutes of Health (NIH), approximately 65 percent of the global population has a reduced ability to digest lactose after infancy (NIH). This condition is particularly prevalent in East Asia, where more than 90% of adults may be lactose intolerant. Similarly, in the United States, it is estimated that about 36% of the population is lactose intolerant, with higher rates among people of African, Asian, Hispanic, and Native American descent.

The impact of lactose intolerance on the yogurt drink market is significant because it limits the consumer base, particularly in regions where lactose intolerance is prevalent. While many dairy producers have responded by developing lactose-free yogurt drinks, these products often come at a higher cost due to additional processing required to remove lactose or break it down into simpler forms that are easier to digest.

Government health organizations worldwide are increasing awareness about lactose intolerance and its dietary management, which could further influence consumer choices. For instance, the U.S. Department of Health & Human Services provides resources and guidelines on managing lactose intolerance, which includes recommendations on alternative dietary sources of calcium and other essential nutrients found in dairy products.

Opportunity

Plant-Based Innovations: Expanding Horizons in the Yogurt Drink Market

A significant growth opportunity in the yogurt drink market lies in the rising popularity of plant-based alternatives. This trend is driven by the increasing number of consumers adopting vegan diets, those who are lactose intolerant, and others looking to reduce their dairy intake for health or ethical reasons.

According to the United States Department of Agriculture (USDA), the demand for plant-based foods is seeing a significant upward trend, with sales of plant-based dairy alternatives expected to grow exponentially in the coming years. This shift is particularly notable in the yogurt sector, where plant-based options are increasingly finding shelf space alongside traditional dairy products (USDA).

The growth in plant-based yogurt drinks is not just a trend limited to the United States. Globally, countries in Europe and Asia are also witnessing a surge in consumer interest. For example, in the United Kingdom, market analysis has shown a steady increase in the sales of plant-based yogurt products, reflecting broader changes in consumer dietary habits towards more sustainable and animal-free alternatives.

Recognizing this shift, governments and health organizations are beginning to support the plant-based diet as part of national dietary guidelines, emphasizing the health benefits of such diets, including lower risks of heart disease, hypertension, diabetes, and certain types of cancer. These endorsements can play a crucial role in encouraging more consumers to try plant-based alternatives.

Trends

Functional Ingredients Enhance Appeal of Yogurt Drinks

One of the most compelling recent trends in the yogurt drink market is the incorporation of functional ingredients that cater to health-conscious consumers. This trend is driven by the increasing demand for food products that not only satisfy hunger but also provide health benefits.

Functional ingredients like probiotics, prebiotics, vitamins, and minerals are being added to yogurt drinks to enhance their nutritional profile. Probiotics, for instance, are live bacteria that have numerous health benefits, especially for the digestive system. The global probiotics market is thriving, with an expected increase in consumer spending on probiotic-fortified foods.

According to the National Center for Complementary and Integrative Health (NCCIH), nearly 4 million adults in the U.S. reported using probiotics or prebiotics (NCCIH), underlining the widespread acceptance and growing preference for these functional components in diets.

This trend is not just limited to the health aspects; it also includes the adaptation of yogurt drinks to meet dietary restrictions and preferences, leading to the creation of gluten-free, non-GMO, and low-sugar options. These innovations are meeting the demands of an increasingly informed consumer base that seeks transparency and health benefits from their dietary choices.

Government health organizations across the globe are actively promoting the benefits of a healthy diet, and functional foods like yogurt drinks are frequently highlighted in public health campaigns. These initiatives support market growth by educating consumers about the health benefits associated with functional ingredients in yogurt drinks.

Regional Analysis

Yogurt Drink Market Flourishes in APAC with Prominent Growth and Innovation

In 2024, the Asia-Pacific (APAC) region held a commanding position in the global yogurt drink market, accounting for a substantial 45.20% market share, translating to a revenue of approximately USD 21.3 billion. This dominance is primarily fueled by the growing consumer awareness regarding health and wellness, coupled with an increasing preference for convenient, nutritious food options among the populous countries of this region.

The APAC market’s growth is significantly driven by countries like China, India, and Japan, where yogurt drinks are not only seen as a healthy snack or beverage option but also as an integral part of the cultural diet. In China and India, rapid urbanization and the expansion of retail infrastructure have made yogurt drinks more accessible to the urban middle class, who are increasingly health-conscious and open to trying new dietary trends. This consumer base is particularly receptive to innovations in flavors and formulations, such as the inclusion of traditional and local ingredients that resonate with regional tastes and preferences.

Moreover, the presence of major dairy producers and yogurt brands in the region plays a crucial role in the market’s expansion. These companies are actively investing in marketing strategies and distribution networks to capture the growing demand. For instance, local brands in Japan and South Korea are introducing yogurt drinks that incorporate local flavors and functional ingredients aimed at improving gut health, which is a significant trend across the region.

Government initiatives across APAC countries also support the growth of the dairy and yogurt drink industry by promoting dairy consumption as part of a balanced diet and investing in dairy farming practices to boost production. These efforts ensure a steady supply of raw materials for yogurt drink production, thereby supporting the sustainability and growth of the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Danone S.A. is a global leader in the dairy industry, known for its strong emphasis on health-driven products. Their range of yogurt drinks is popular worldwide, combining innovation with nutritional benefits to cater to health-conscious consumers. Danone’s commitment to sustainability and health has strengthened its market presence, positioning it as a key player in promoting wellness through its product offerings.

Yakult Honsha Co., Ltd. specializes in probiotic yogurt drinks, renowned for their signature product, Yakult. The company’s focus on digestive health products has garnered a loyal consumer base globally. Yakult’s dedication to scientific research and development in the field of probiotics underscores its competitive edge in the yogurt drink market.

Meiji Holdings Co., Ltd. offers a wide range of dairy products, including yogurt drinks that are well-received in the Asian market. Their products are designed to enhance health benefits, emphasizing quality and nutritional value. Meiji’s innovative approach to dairy production and marketing strategies continues to drive its growth in the competitive yogurt drink sector.

Top Key Players in the Market

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Meiji Holdings Co., Ltd.

- Chobani, LLC

- Fonterra Co-operative Group Ltd.

- Arla Foods Amba

- Lactalis Group

- Benecol Ltd.

- General Mills Inc.

- FrieslandCampina

- Pillars Yogurt

- Morinaga Nutritional Foods, Inc

- Dana Dairy

- Actimel

- Yili

- Other Key Players

Recent Developments

In 2024, Yakult Honsha continued to expand its global presence, reaching consumers in over 40 countries, which is a testament to its robust distribution network and effective marketing strategies. The company’s commitment to research in microbiology ensures that its products are backed by scientific evidence, enhancing consumer trust.

In 2024, Chobani continued to enhance its market presence, emphasizing its commitment to using only natural ingredients and non-GMO products, which appeals strongly to health-conscious consumers globally. The company’s yogurt drinks are noted for their creaminess and variety of flavors, which stand out in a crowded marketplace.

Report Scope

Report Features Description Market Value (2024) USD 47.3 Bn Forecast Revenue (2034) USD 91.3 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Vegan, Conventional), By Product Type (Plain, Flavored), By Packaging (Bottles, Tetra Packs), By Distribution Channel (Hypermarkets And Supermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Danone S.A., Yakult Honsha Co., Ltd., Meiji Holdings Co., Ltd., Chobani, LLC, Fonterra Co-operative Group Ltd., Arla Foods Amba, Lactalis Group, Benecol Ltd., General Mills Inc., FrieslandCampina, Pillars Yogurt, Morinaga Nutritional Foods, Inc, Dana Dairy, Actimel, Yili, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Meiji Holdings Co., Ltd.

- Chobani, LLC

- Fonterra Co-operative Group Ltd.

- Arla Foods Amba

- Lactalis Group

- Benecol Ltd.

- General Mills Inc.

- FrieslandCampina

- Pillars Yogurt

- Morinaga Nutritional Foods, Inc

- Dana Dairy

- Actimel

- Yili

- Other Key Players