Global Early Life Nutrition Market By Product Type (Infant Formula, First Age Formula, Follow-on Formula, Growing-up Formula, Specialty Formula, Baby Food, Prepared Food, Dried Food, Others), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145385

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

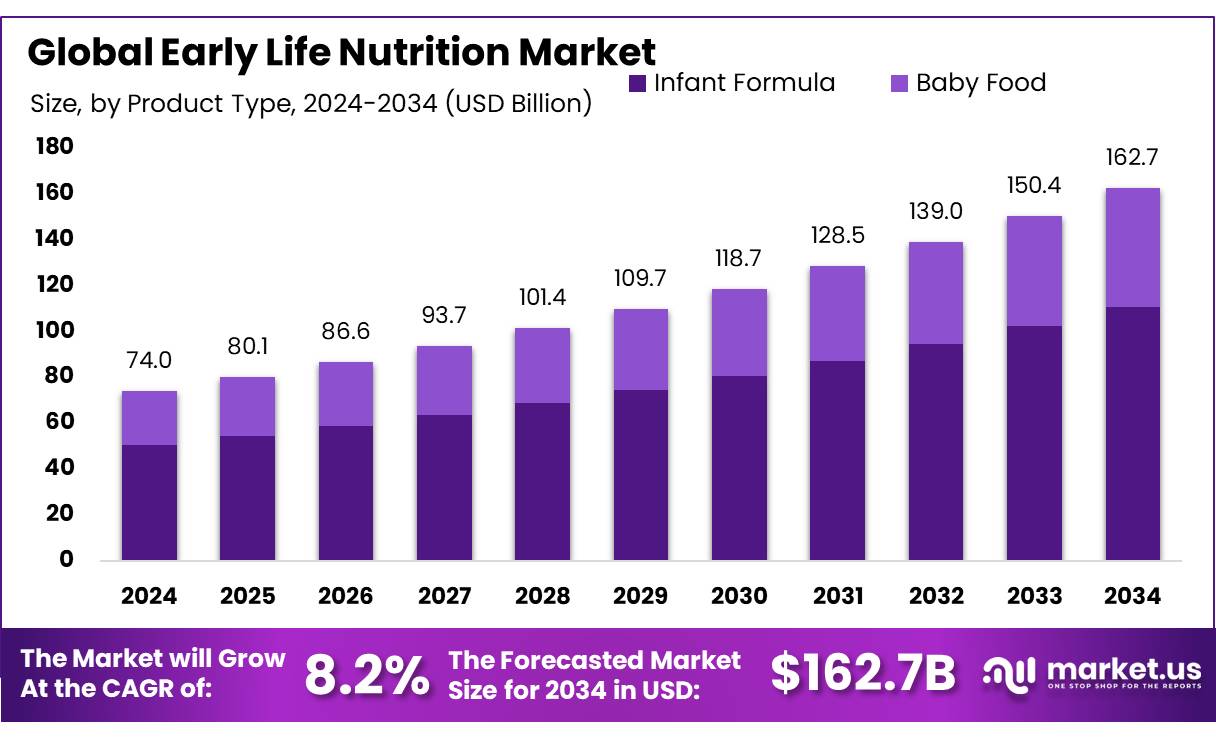

The Global Early Life Nutrition Market size is expected to be worth around USD 162.7 Bn by 2034, from USD 74.0 Bn in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034.

The Early Life Nutrition (ELN) sector in India is pivotal for ensuring the health and development of children from birth to six years. This industry encompasses a range of products and services aimed at providing essential nutrients during the critical early stages of life, laying the foundation for long-term well-being.

India faces significant challenges in child nutrition. According to the Global Nutrition Report, 34.7% of children under five years are stunted, 17.3% suffer from wasting, and 1.6% are overweight. Additionally, 58% of infants aged 0 to 5 months are exclusively breastfed, indicating progress toward breastfeeding targets.

The ELN industry is experiencing substantial growth, driven by increasing awareness of child nutrition, rising disposable incomes, and urbanization. The India Baby Food Market was valued at approximately USD 6.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of about 14% from 2024 to 2030. This growth reflects a shift toward packaged and convenient nutritional options for infants and young children.

Government initiatives play a crucial role in shaping the ELN landscape. The Integrated Child Development Services (ICDS), established in 1975, provides nutritional meals, preschool education, and primary healthcare to children under six and their mothers. As of March 2021, approximately 1.387 million Anganwadi and mini-Anganwadi centers were operational, offering supplementary nutrition and health services. Additionally, the Poshan Abhiyaan, launched in 2018, aims to reduce stunting, undernutrition, and low birth weight by 2% annually and anemia among young children, women, and adolescent girls by 3% annually.

Future growth opportunities in the ELN sector are substantial. Innovations in product formulations to address specific nutritional deficiencies, expansion of distribution networks to reach rural areas, and collaborations with healthcare professionals for awareness programs can drive market expansion. Furthermore, leveraging digital platforms for education and marketing can enhance consumer engagement and trust.

Key Takeaways

- Early Life Nutrition Market size is expected to be worth around USD 162.7 Bn by 2034, from USD 74.0 Bn in 2024, growing at a CAGR of 8.2%.

- Infant Formula held a dominant market position, capturing more than a 68.30% share.

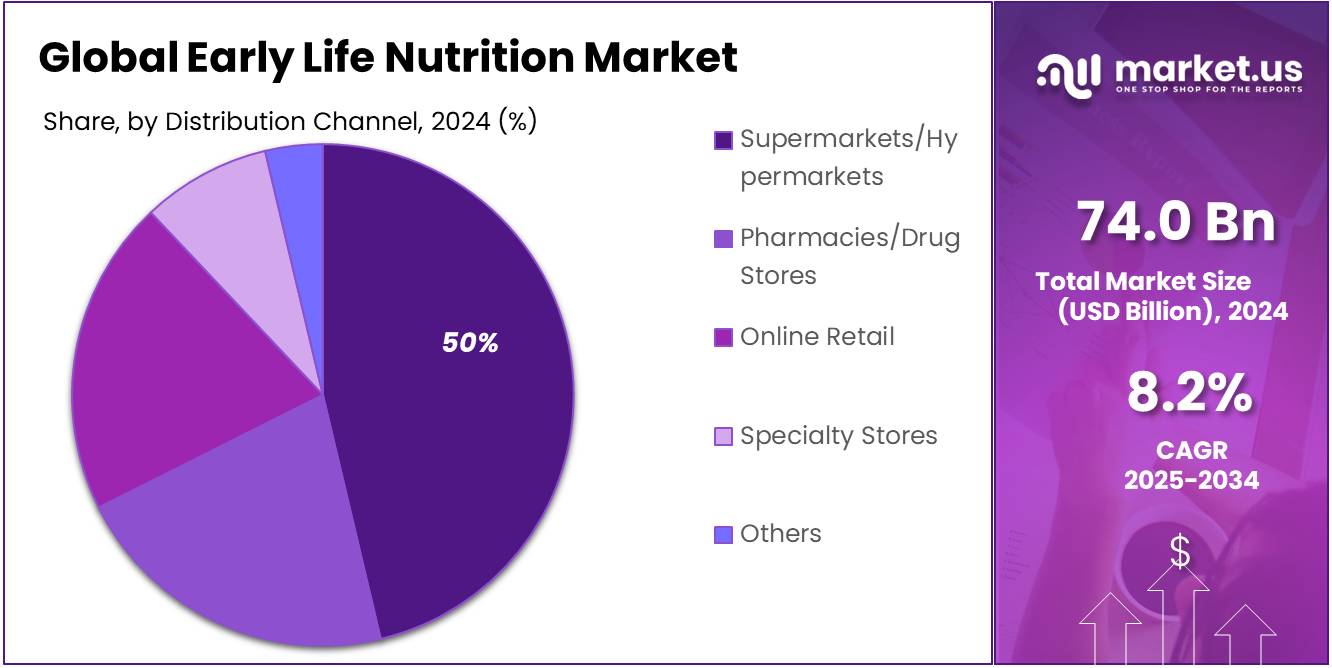

- Supermarkets/Hypermarkets held a dominant market position in the distribution of Early Life Nutrition products, capturing more than a 49.20% share.

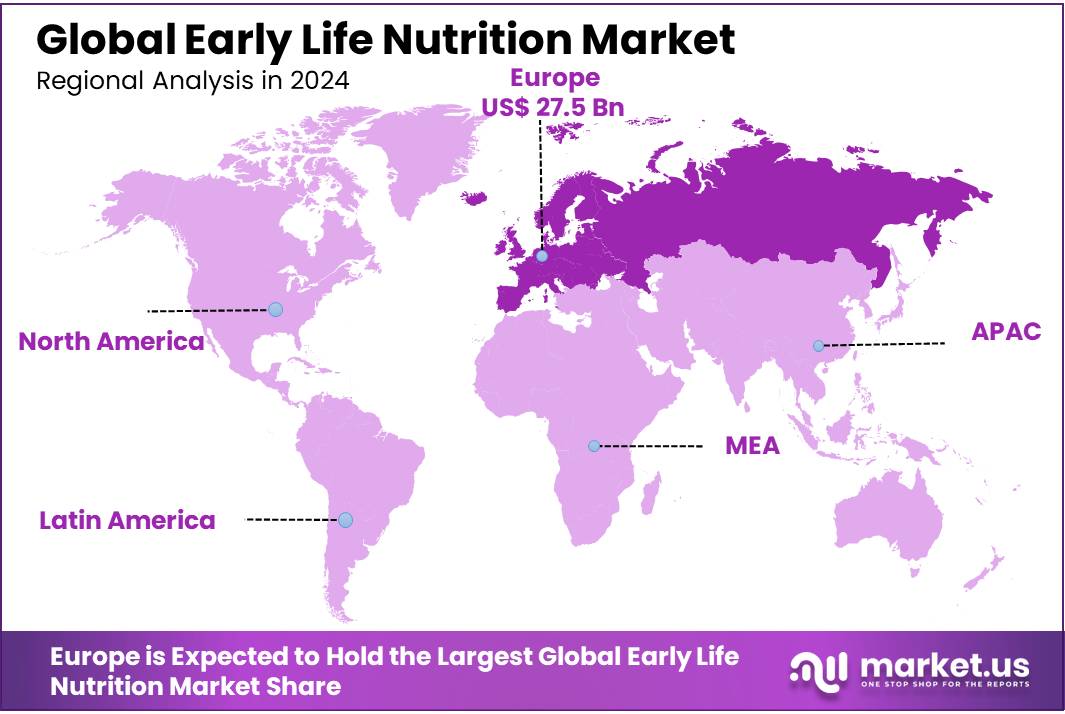

- European market for Early Life Nutrition captured a commanding 37.20% market share, valued at approximately USD 27.5 billion.

By Product Type

Infant Formula Leads with 68.30% Market Share Owing to Strong Demand

In 2024, Infant Formula held a dominant market position, capturing more than a 68.30% share of the Early Life Nutrition market. This substantial market share reflects the widespread trust and reliance placed on infant formula as a vital source of nutrition for infants, particularly when breastfeeding is not possible.

Manufacturers have responded to consumer demand by continually enhancing product formulations to more closely mimic the nutritional profile of breast milk, further solidifying the segment’s lead in the market. This ongoing development, coupled with increased awareness among parents about nutritional guidelines, has made infant formula the go-to choice in early life nutrition, ensuring its continued dominance in the market landscape.

By Distribution Channel

Supermarkets/Hypermarkets Command 49.20% of Market Share Due to Convenience and Variety

In 2024, Supermarkets/Hypermarkets held a dominant market position in the distribution of Early Life Nutrition products, capturing more than a 49.20% share. This segment benefits significantly from offering a one-stop shopping experience where consumers can access a wide array of early life nutrition options, including various brands and formulations of infant formulas and baby foods.

The convenience of comparing multiple products side by side, along with the immediate availability of goods, contributes to the continued preference for supermarkets/hypermarkets among parents and guardians. This distribution channel’s ability to provide value through promotions, discounts, and loyalty programs further cements its strong standing in the market.

Key Market Segments

By Product Type

- Infant Formula

- First Age Formula

- Follow-on Formula

- Growing-up Formula

- Specialty Formula

- Baby Food

- Prepared Food

- Dried Food

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies/Drug Stores

- Online Retail

- Specialty Stores

- Others

Drivers

Rising Awareness and Government Initiatives Boost Early Life Nutrition Market

One major driving factor for the growth of the Early Life Nutrition market is the increasing awareness among parents about the critical role of nutrition in the early stages of a child’s development. Governments and health organizations worldwide are actively promoting the benefits of proper early life nutrition, leading to a greater understanding and demand for specialized nutritional products.

For instance, the World Health Organization (WHO) emphasizes the importance of exclusive breastfeeding for the first six months of life and supports continued breastfeeding along with appropriate complementary foods up to two years of age or beyond. This guidance is widely disseminated through national health services, significantly influencing consumer preferences towards high-quality early life nutrition products.

Additionally, government programs aimed at improving nutritional outcomes for infants and young children play a crucial role. In the United States, initiatives like the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) provide nutritional education, breastfeeding support, and access to nutritionally appropriate foods, impacting the market positively by increasing the accessibility and affordability of early life nutrition products.

Moreover, the rise in working mothers has led to a higher reliance on commercially prepared infant formulas and baby foods as they seek convenient, nutritious options for their children’s dietary needs. This shift is particularly noticeable in urban areas, where fast-paced lifestyles make convenience a significant factor.

Restraints

High Cost of Infant Nutrition Products Limits Market Growth

A significant restraining factor in the Early Life Nutrition market is the high cost associated with premium infant nutrition products. For many families, especially in lower-income regions, the expense of specialized infant formulas and baby foods can be prohibitively high. This economic barrier prevents a considerable portion of the population from accessing these essential products, which are crucial for proper infant development.

Reports from the Food and Agriculture Organization (FAO) highlight the disparity in food affordability and its impact on nutritional choices in various parts of the world. The cost of infant formula, which can be several times more expensive than basic staple foods, places a heavy burden on household budgets, particularly in economies struggling with poverty and inflation.

Furthermore, government initiatives that aim to support infant nutrition often face budgetary constraints and may not reach all segments of the population effectively. While programs such as the WIC in the USA provide some relief by subsidizing the cost of infant formula for eligible families, similar support systems are limited or non-existent in many countries, leaving a gap in accessibility.

The economic challenge is compounded by the fact that the highest-quality, most nutritionally complete infant formulas are often priced at a premium. These products, which may include additional health benefits such as added probiotics or special formulations for babies with allergies, remain out of reach for a large segment of consumers, stifling the overall growth potential of the market.

Opportunity

Emerging Markets Offer Expansive Growth Opportunities in Early Life Nutrition

One of the most promising growth opportunities in the Early Life Nutrition market is the expanding consumer base in emerging economies. As countries in regions such as Asia, Africa, and Latin America experience economic growth, increasing incomes and urbanization are shifting consumer behavior towards more specialized and health-oriented products for infants and toddlers.

The Food and Agriculture Organization (FAO) and the World Health Organization (WHO) both emphasize the potential in these regions to significantly improve infant health outcomes through better nutrition. Their reports suggest that as awareness of the importance of early life nutrition increases, so does the demand for products that meet these needs.

Governments in these emerging markets are beginning to invest more in health and nutrition initiatives as part of broader public health strategies. For example, programs aimed at educating parents about the benefits of fortified foods and supplements for children’s development are gaining momentum. These initiatives are supported by international aid and the global health community, which see them as vital to reducing childhood malnutrition and enhancing early development.

Additionally, local manufacturers in these markets are starting to produce early life nutrition products at lower costs, which helps to make them more accessible to a broader segment of the population. This local production not only supports the economy but also ensures that the nutritional products are tailored to meet specific regional dietary needs and preferences, further driving consumer acceptance and market growth.

Trends

Plant-Based Formulas Gain Momentum in Early Life Nutrition

A significant trend reshaping the Early Life Nutrition market is the growing popularity of plant-based infant formulas. This shift aligns with broader dietary trends towards plant-based foods, driven by concerns over allergies, lactose intolerance, and a preference for vegan lifestyles. As parents increasingly seek out alternatives to traditional dairy-based formulas, manufacturers are responding with innovative solutions that use ingredients like soy, almond, rice, and oat.

The World Health Organization (WHO) acknowledges the importance of catering to diverse dietary needs in early childhood nutrition, supporting the development of safe and nutritious non-dairy alternatives. These plant-based options are not only designed to meet the nutritional standards required for infants but also offer a solution for families seeking vegan nutrition from the earliest stages of life.

Recent advancements in food technology have improved the nutritional profile of plant-based infant formulas, ensuring they provide adequate amounts of essential nutrients such as amino acids, vitamins, and minerals that are crucial for growth and development. These developments are crucial as the nutritional adequacy of infant formulas is a primary concern for health professionals and parents alike.

Market response has been overwhelmingly positive in regions with high levels of dietary awareness and health-conscious consumers. Urban centers, in particular, show a higher propensity towards adopting these new products, as access to information and alternative lifestyle choices are more prevalent.

Regional Analysis

European Early Life Nutrition Market Captures 37.20% Share, Valued at USD 27.5 Billion in 2024

In 2024, the European market for Early Life Nutrition captured a commanding 37.20% market share, valued at approximately USD 27.5 billion. This significant market portion underscores Europe’s robust demand and well-established infrastructure for infant and early childhood nutritional products. The region’s focus on high-quality, regulated products, coupled with a high awareness among parents about nutritional guidelines, drives this substantial market penetration.

European consumers exhibit a strong preference for organic and natural products, reflecting broader regional trends towards sustainability and health-conscious choices. This preference is supported by stringent EU regulations that ensure product safety and quality, enhancing consumer trust and further propelling market growth. Additionally, initiatives by governments across Europe to promote breastfeeding, coupled with programs supporting parents with infant nutrition, contribute positively to the market dynamics.

Moreover, Europe is home to some of the world’s leading companies in the Early Life Nutrition sector. These companies are at the forefront of innovation, frequently launching new products that cater to the specific nutritional needs of infants and young children, such as hypoallergenic formulas and plant-based options. The presence of these industry leaders not only drives regional market growth but also sets trends that influence global markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé S.A. stands as a global leader in the Early Life Nutrition market, renowned for its extensive range of infant formulas, cereals, and baby food products. The company’s commitment to scientific research and innovation ensures that its offerings meet the highest standards of nutrition and safety. Nestlé’s strong market presence is bolstered by its global distribution capabilities and deep understanding of dietary needs across diverse cultures, making it a trusted name among parents worldwide.

Danone S.A. is a prominent player in the Early Life Nutrition market, emphasizing sustainable and organic product lines that appeal to health-conscious consumers. Its well-known brands, such as Aptamil and Nutrilon, offer scientifically formulated products that support early life development. Danone’s strong focus on innovation and sustainability, coupled with global reach, positions it favorably in the competitive market landscape.

Abbott Laboratories excels in the Early Life Nutrition sector with its popular Similac brand, among others. The company focuses on providing tailored nutrition for various health needs, including formulas for premature babies and those with specific dietary requirements. Abbott’s commitment to high-quality manufacturing practices and clinical research ensures its products support the overall health and development of infants, reinforcing its position as a key player in the market.

Top Key Players

- Nestlé S.A.

- Abbott Laboratories

- Danone S.A.

- Walgreen Co.

- China Mengniu Dairy Company Limited

- Reckitt Benckiser Group

- Royal FrieslandCampina N.V.

- Arla Foods amba

- The Hain Celestial Group

- Holle baby food AG

- Perrigo Company plc

- The Kraft Heinz Company

- Dana Dairy

- Baby Gourmet Foods Inc.

- Bellamy’s Organic

- Other Key Players

Recent Developments

In 2024, Nestlé S.A. continued to solidify its position as a dominant force in the Early Life Nutrition sector. With sales reaching CHF 15.8 billion, the company maintained a substantial market presence, focusing on early childhood nutrition which represents 55% of its activities in this category.

In 2024, Walgreen Co. has increasingly focused on enhancing its role in the Early Life Nutrition sector, particularly through its extensive retail network. The company leverages its widespread store presence to provide accessible health and wellness products, including a variety of infant nutrition solutions.

Report Scope

Report Features Description Market Value (2024) USD 74.0 Bn Forecast Revenue (2034) USD 162.7 Bn CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Infant Formula, First Age Formula, Follow-on Formula, Growing-up Formula, Specialty Formula, Baby Food, Prepared Food, Dried Food, Others), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestlé S.A., Abbott Laboratories, Danone S.A., Walgreen Co., China Mengniu Dairy Company Limited, Reckitt Benckiser Group, Royal FrieslandCampina N.V., Arla Foods amba, The Hain Celestial Group, Holle baby food AG, Perrigo Company plc, The Kraft Heinz Company, Dana Dairy, Baby Gourmet Foods Inc., Bellamy’s Organic, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Early Life Nutrition MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Early Life Nutrition MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé S.A.

- Abbott Laboratories

- Danone S.A.

- Walgreen Co.

- China Mengniu Dairy Company Limited

- Reckitt Benckiser Group

- Royal FrieslandCampina N.V.

- Arla Foods amba

- The Hain Celestial Group

- Holle baby food AG

- Perrigo Company plc

- The Kraft Heinz Company

- Dana Dairy

- Baby Gourmet Foods Inc.

- Bellamy's Organic

- Other Key Players