Global Organic Baby Food Market By Type (Wet Food, Infant Milk Formula, Dry Food, Others), By Packaging Type (Jars, Pouches, Bottles, Boxes, Others), By Age Group (6 Months and Below, 6–12 Months, 1–3 Years), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Sales Channels, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136632

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

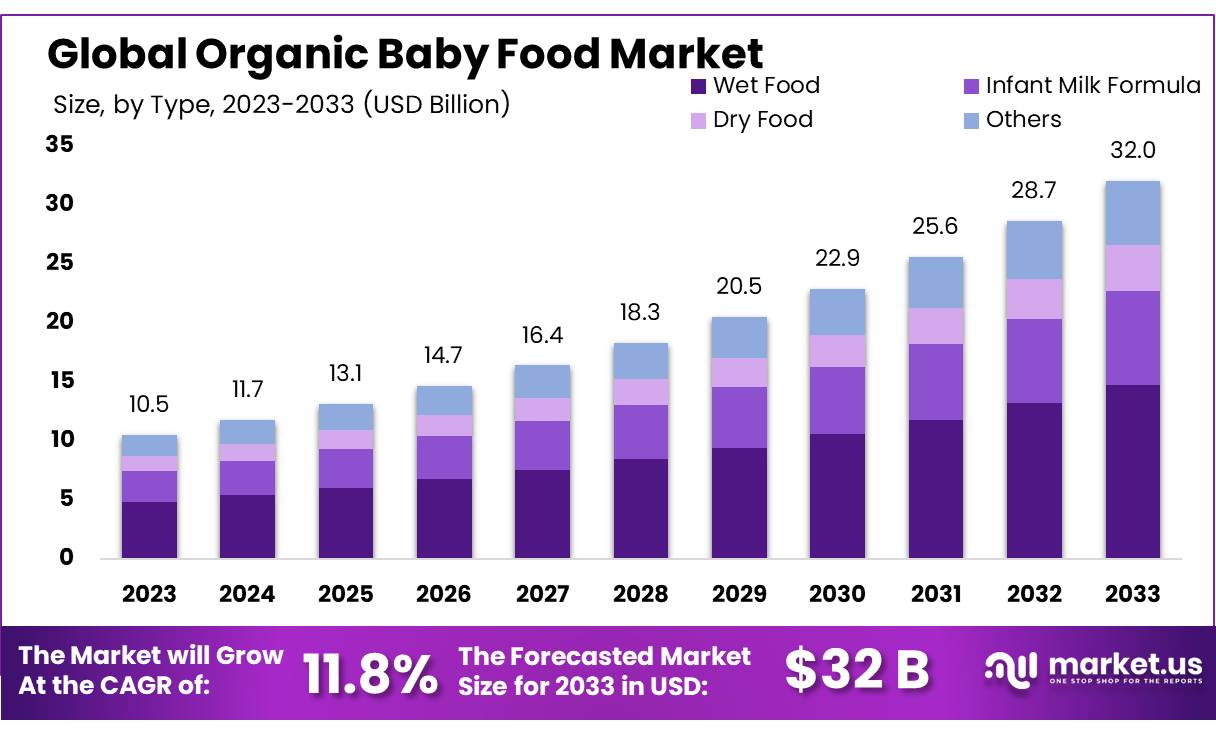

The Global Organic Baby Food Market size is expected to be worth around USD 32.0 Bn by 2033, from USD 10.5 Bn in 2023, growing at a CAGR of 11.8% during the forecast period from 2024 to 2033.

The Global Organic Baby Food Market has gained prominence as parents increasingly prioritize the nutritional and health benefits of organic products for their infants. Organic baby food, free from synthetic fertilizers, pesticides, and genetically modified organisms (GMOs), is perceived as a safer and healthier alternative to conventional baby food. This market has seen significant growth driven by rising awareness about food safety and a growing inclination towards sustainable and ethical consumption practices.

The sector encompasses a wide range of products, including purees, cereals, snacks, and infant formula. Strict regulatory frameworks govern the production and labeling of organic baby food, ensuring compliance with standards such as those set by the USDA Organic Certification and EU Organic Regulations. The market’s competitive landscape is shaped by innovation, with companies focusing on introducing new flavors, packaging solutions, and nutrient-enriched products to attract health-conscious parents.

Driving factors for the market include increased disposable incomes, urbanization, and a rise in the number of working mothers, which has driven demand for convenient yet nutritious baby food options. According to UNICEF, approximately 141 million babies are born annually, creating a substantial and sustained demand for infant nutrition products.

The growing awareness of the potential long-term health benefits of organic food, such as reduced exposure to harmful chemicals, has further spurred demand. Developed regions like North America and Europe, where consumers exhibit higher purchasing power and awareness, lead the market, while emerging markets in Asia-Pacific show significant growth potential due to rising middle-class populations.

Emerging trends in the market include a focus on plant-based and allergen-free baby food products, addressing dietary restrictions and preferences. The rise of e-commerce platforms has also revolutionized the distribution of organic baby food, offering parents easy access to a variety of options. Innovations in sustainable packaging, such as biodegradable pouches and glass jars, align with consumer preferences for environmentally friendly products. Additionally, clean-label trends have driven manufacturers to provide transparent ingredient lists, further building trust among consumers.

Future growth opportunities are anticipated in expanding geographic reach and enhancing product offerings. Regions like Africa and Latin America, where awareness and affordability of organic products are gradually increasing, represent untapped potential. Furthermore, advancements in food processing technology, such as high-pressure processing (HPP), are expected to enhance the nutritional profile and shelf-life of organic baby food.

Statistically, the global organic food market’s growth is reflected in rising organic farmland, which reached over 75 million hectares globally in 2021, according to FiBL (Research Institute of Organic Agriculture). With increasing investments in organic farming and a growing consumer base, the organic baby food market is poised for sustained expansion, driven by health-conscious parenting and global efforts towards sustainable agriculture.

Key Takeaways

- Organic Baby Food Market size is expected to be worth around USD 32.0 Bn by 2033, from USD 10.5 Bn in 2023, growing at a CAGR of 11.8%.

- Wet Food segment held a dominant position in the Organic Baby Food market, capturing more than 46.5% of the total market share.

- Jars held a dominant market position in the Organic Baby Food market, capturing more than a 38.2% share.

- 6–12 Months age group held a dominant market position in the Organic Baby Food market, capturing more than a 57.2% share.

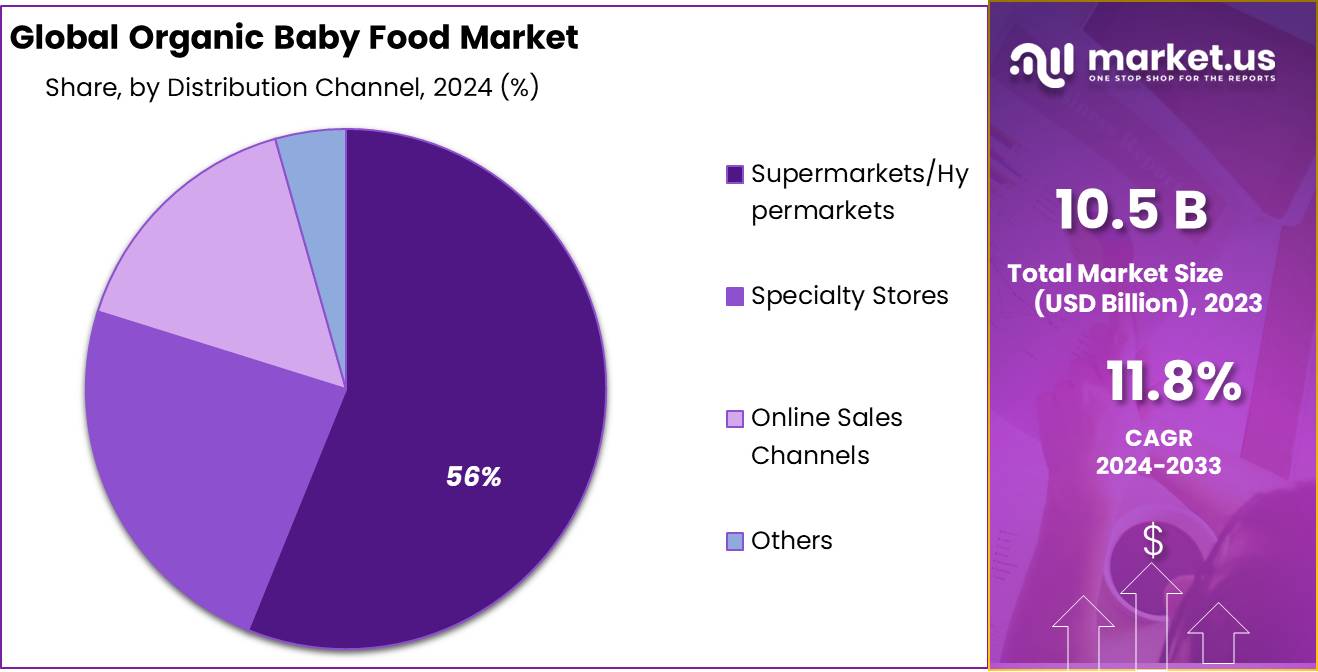

- Supermarkets/Hypermarkets held a dominant market position in the distribution of Organic Baby Food, capturing more than a 56.4% share.

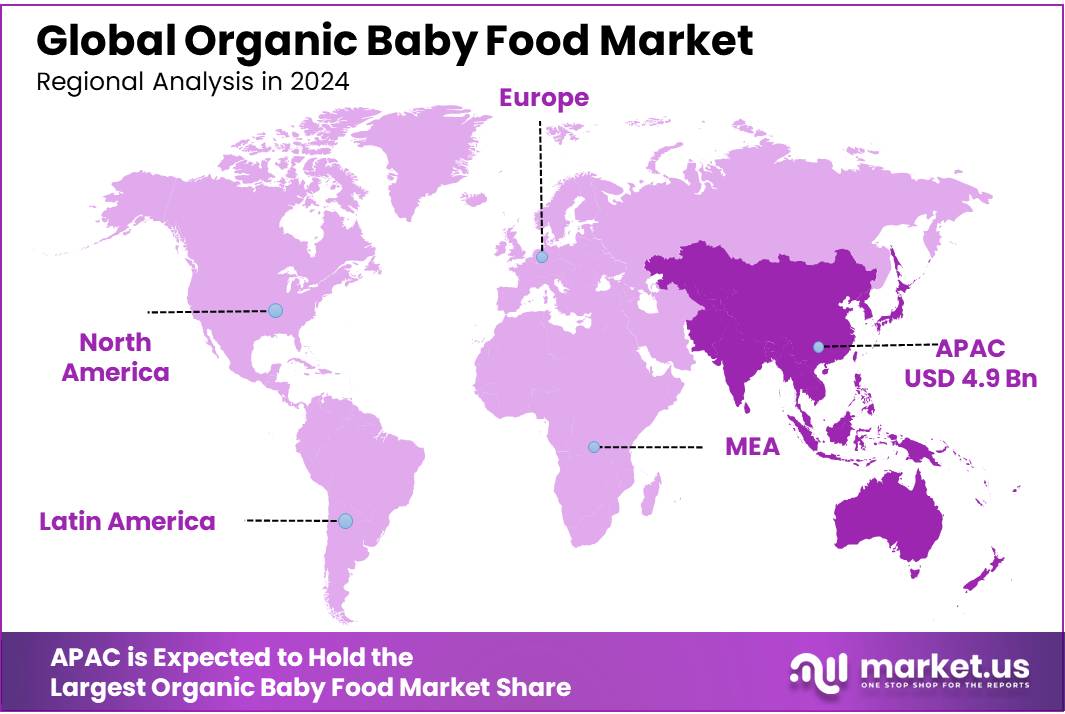

- Asia-Pacific (APAC) is the most dominant region, accounting for 47.9% of the market with revenues amounting to USD 4.9 billion.

By Type

In 2023, the Wet Food segment held a dominant position in the Organic Baby Food market, capturing more than 46.5% of the total market share. This segment’s prominence is attributed to increasing consumer awareness of the nutritional benefits of wet organic baby food, which is often easier for infants to digest. Wet foods are typically high in moisture content, which helps in maintaining adequate hydration levels in infants. The convenience of ready-to-eat wet food pouches also contributes to their popularity among parents seeking nutritious and quick meal options for their children.

The Infant Milk Formula segment also played a significant role in the market. As a preferred alternative to breast milk, organic infant milk formulas are gaining traction due to their nutritional completeness and the presence of organic ingredients that reduce the exposure of infants to pesticides and other chemicals. This segment is especially appealing to parents who are unable to breastfeed or are looking for supplemental feeding options.

Dry Food, another key segment, includes products like cereals and snacks that are tailored for older infants and toddlers. The growth of this segment is driven by the increasing demand for portable and convenient feeding options. Organic dry baby foods are formulated to be easy to prepare, often requiring only the addition of water or milk, making them ideal for busy parents.

By Packaging Type

In 2023, Jars held a dominant market position in the Organic Baby Food market, capturing more than a 38.2% share. The popularity of jars as a packaging choice is largely due to their reusability and safety. Glass jars are free from chemicals that can leach into food, making them a preferred option for parents concerned about food purity. Additionally, they are easy to sterilize and can be recycled or repurposed, aligning with eco-friendly practices.

Pouches also represent a significant segment in the market. Their market share has grown due to the convenience they offer. Pouches are lightweight, unbreakable, and feature resealable caps, making them ideal for on-the-go feeding. Parents appreciate the ease of use and minimal cleanup required, making pouches a practical choice for busy lifestyles.

Bottles are another key packaging type, often used for liquid organic baby foods such as juices and milk formulas. The precise measurements on the side of the bottles help parents feed their babies the correct amount, adding an element of convenience and precision to baby feeding routines.

Boxes, typically used for dry organic baby food products like cereals and powdered formulas, offer the advantage of compact storage and ease of transport. They are also easy to stack, which is beneficial for both retailers and consumers looking to maximize shelf and pantry space.

By Age Group

In 2023, the 6–12 Months age group held a dominant market position in the Organic Baby Food market, capturing more than a 57.2% share. This segment’s significant share is primarily due to the transition period in a baby’s diet from milk to solid foods, which typically begins around six months of age. Organic baby foods designed for this age group are formulated to introduce babies to a variety of flavors and textures, helping to establish healthy eating habits early on. Products for this age group include purees and soft mashes, which are easier for babies to digest and are often designed to be nutritionally complete.

The segment for babies aged 6 Months & Below primarily includes organic infant formulas and some initial puree types. These products are crucial for parents who opt for organic options right from the outset, focusing on providing nutrition close to that of breast milk. This segment caters to a critical period of an infant’s developmental needs, where the emphasis is on high nutritional value without the exposure to pesticides and artificial ingredients commonly found in non-organic formulas.

For toddlers aged 1–3 Years, the market offers a diverse range of organic foods that include more complex textures and larger portions. This age group is characterized by rapid growth and developmental milestones that require increased caloric intake and nutrients. Organic baby food products for this group include a variety of cereals, snacks, and meals that support a toddler’s energy needs and taste preferences.

By Distribution Channel

In 2023, Supermarkets/Hypermarkets held a dominant market position in the distribution of Organic Baby Food, capturing more than a 56.4% share. This segment’s strength is driven by the extensive variety and availability of products that these outlets offer, making them a one-stop solution for busy parents. Supermarkets and hypermarkets often provide a range of organic baby food brands and products under one roof, which allows parents to compare options and prices conveniently.

Specialty Stores also play a critical role in the distribution of organic baby food. These stores typically focus on health and wellness products and are valued for their curated selection of high-quality organic items. Specialty stores often offer expert advice and a higher level of customer service, which appeals to parents who are new to organic products or seeking specific dietary options for their babies.

Online Sales Channels have seen significant growth, characterized by the convenience of home delivery and the availability of online-exclusive products or discounts. This segment caters to digitally savvy consumers who prefer shopping online due to the ease of access to product reviews and the ability to shop around for the best prices.

Key Market Segments

By Type

- Wet Food

- Infant Milk Formula

- Dry Food

- Others

By Packaging Type

- Jars

- Pouches

- Bottles

- Boxes

- Others

By Age Group

- 6 Months & Below

- 6–12 Months

- 1–3 Years

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Sales Channels

- Others

Drivers

Increased Awareness of Health Benefits and Demand for Organic Products

One of the primary factors propelling the growth of the organic baby food market is the heightened consumer awareness regarding the health benefits of organic products. As more parents become conscious of the ingredients in their children’s food, the demand for organic, non-GMO, and chemical-free options is increasing significantly. This trend is complemented by a growing inclination towards products that are perceived as safer and healthier for infants, which has notably driven the demand for organic baby foods globally.

The global organic baby food market has seen a substantial rise in sales due to these changing consumer preferences. Parents are increasingly opting for organic products due to their benefits in promoting better health and are perceived as safer alternatives to conventional baby foods, which often contain pesticides and synthetic additives. This shift is evident across various regions, with significant market growth projected in North America and Europe due to the high consumer willingness to pay premium prices for health-oriented products.

Moreover, the market is witnessing a surge in demand facilitated by improved distribution networks, including supermarkets and online retail platforms. For instance, supermarkets and hypermarkets continue to dominate the distribution channel for organic baby food owing to their extensive reach and the availability of a wide variety of products under one roof. This segment alone constituted a substantial portion of the market share, underscoring the critical role these outlets play in making organic baby food accessible to a broader audience.

The organic baby food market’s growth is further supported by an increase in disposable incomes, especially in developing regions like Asia Pacific, which has become a significant market due to rising economic standards and changing lifestyles. The expansion in these regions is fueled by not only economic growth but also by an increasing number of new parents who are informed and mindful of the nutritional needs of their babies. This demographic shift is driving the regional demand for organic baby food products, thereby contributing to the overall market growth.

Restraints

High Production Costs and Stringent Regulatory Requirements

One significant restraining factor for the growth of the organic baby food market is the high cost of production associated with organic farming practices and certification requirements. Organic farming involves more labor-intensive practices compared to conventional farming, which generally results in higher costs. Additionally, obtaining certifications necessary to label products as organic is both a complex and costly process that can deter manufacturers from entering or expanding in the organic market. These higher costs often translate to higher retail prices for organic baby food products, which can limit consumer accessibility and market expansion.

The complexity of maintaining a stable supply chain for organic ingredients further complicates production. Organic baby foods require consistent quality and availability of organic raw materials, which can be challenging due to factors like weather conditions, crop failures, or fluctuations in demand. These challenges can disrupt production schedules, affect product availability, and lead to higher prices, potentially alienating price-sensitive consumers.

Moreover, the organic baby food market faces stringent quality control and regulatory standards imposed by governments and international food safety organizations. These regulations ensure the safety and quality of baby food products but also add another layer of challenge for producers. Complying with these standards involves rigorous testing and quality assurance processes, which can significantly increase production time and costs.

These factors create substantial barriers for organic baby food manufacturers, influencing the overall market dynamics by restricting the ease of production and distribution of organic baby food products. This, in turn, can hinder the market’s growth by limiting the range of products available to consumers and the ability of manufacturers to respond to rising global demand efficiently. These economic and regulatory pressures require companies to be highly vigilant and adaptive, but they also limit the pace at which the organic baby food market can expand.

Opportunity

Expansion in Emerging Markets

A significant growth opportunity for the organic baby food market lies in its expansion within emerging markets, particularly in the Asia-Pacific region. This area is experiencing rapid urbanization and a notable increase in middle-class income, which are key drivers propelling the demand for organic baby food. As disposable incomes rise, more consumers are able to afford premium products, including organic baby foods that offer safer and healthier alternatives to conventional options. The growing health consciousness among parents in these regions, coupled with a heightened awareness of the benefits of organic products, is significantly boosting market growth.

Additionally, the organic baby food market is benefiting from strong governmental support in countries like China, where there are subsidies and incentives for organic farming and certification. This governmental backing is not only enhancing the growth and development of the market but also bolstering consumer confidence in organic products.

Technological advancements in food processing, such as high-pressure processing and freeze-drying, are also creating growth opportunities for the organic baby food market. These technologies help in retaining the nutrients and freshness of baby food without the use of additives, aligning with consumer demand for pure and minimally processed foods. Moreover, companies are increasingly focusing on product diversification, introducing a variety of organic baby food products, including snacks, purees, and ready-to-eat meals, which cater to different stages of infant development and dietary needs

The shift towards direct-to-consumer sales models and the increase in online retailing are other critical growth avenues. These channels allow organic baby food brands to reach consumers directly, enhancing customer relationships and enabling faster response to changing consumer preferences. The convenience of online shopping, combined with the ability to offer personalized nutrition and engage with health-conscious parents through digital platforms, is significantly driving the market’s expansion

Trends

Focus on Clean Labels and Plant-Based Options

One of the most significant trends in the organic baby food market is the increasing demand for clean-label and plant-based products. Parents are more vigilant than ever about what they feed their children, seeking products that are not only organic but also transparent about their ingredient lists.

This trend is part of a broader shift towards healthier, more sustainable eating practices, reflecting a deepening concern among consumers about food safety, nutrition, and environmental impact. The popularity of plant-based diets has extended into the baby food sector, with more brands offering products that use plant proteins and are free from animal products, catering to health-conscious families.

Another key trend is the introduction of innovative flavors and ingredients in organic baby food products. Manufacturers are venturing beyond traditional options to include global flavors and superfoods, aiming to cater to a palette that is both nutritious and diverse. This not only helps in attracting parents looking for new and healthy options for their children but also aligns with the increasing globalization of consumer taste preferences.

Sustainability continues to be a strong trend, with an increasing number of organic baby food brands investing in eco-friendly packaging solutions. This includes the use of biodegradable, recyclable, or reusable materials that appeal to environmentally conscious consumers. The focus on reducing packaging waste is not just about appealing to consumer preferences but also about brands acknowledging their role in environmental stewardship.

Advancements in food technology such as high-pressure processing and freeze-drying are being adopted to enhance the preservation of nutrients and freshness in organic baby foods. These technologies allow for the production of baby food that is as close to its natural state as possible, without the need for preservatives or additives, which is a strong selling point for parents concerned about food purity.

Regional Analysis

Asia-Pacific (APAC) is the most dominant region, accounting for 47.9% of the market with revenues amounting to USD 4.9 billion. This substantial market share is driven by rising disposable incomes, increasing urbanization, and growing awareness about the benefits of organic products. Countries like China and India are pivotal, with their large populations and increasing adoption of Western dietary habits favoring organic baby food products.

North America follows as a significant market, characterized by high consumer awareness and stringent organic certification standards which bolster the demand for safe and healthy baby food options. The region benefits from the presence of established players and advanced distribution networks that effectively reach a broad consumer base.

Europe is known for its strict regulations regarding organic farming and food production, which ensure high-quality organic baby food products. The demand in Europe is also propelled by strong consumer preferences for non-GMO and clean-label products. Countries like Germany, France, and the UK are key contributors to the region’s market growth.

Latin America and the Middle East & Africa (MEA), while smaller in comparison, are emerging as potential growth areas. In Latin America, Brazil leads the market, while the Middle East & Africa are gradually recognizing the benefits of organic products, driven by an increasing expatriate population and rising health consciousness among the new generation of parents.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The organic baby food market features a diverse array of key players, each contributing uniquely to its growth and innovation. Among these, Nestlé S.A. and Danone S.A. stand out as industry giants with a broad global presence and extensive product lines.

These companies are known for their significant investment in research and development, enabling them to offer a wide variety of organic baby food products that cater to different dietary needs and preferences. Nestlé and Danone are heavily invested in expanding their organic offerings, responding to the increasing demand for clean-label, non-GMO, and organic products.

On the other hand, specialized companies like HiPP GmbH & Co. Vertrieb KG and The Hain Celestial Group focus on organic and natural products, positioning themselves as leaders in the organic segment by emphasizing sustainable practices and high-quality ingredients. HiPP is renowned for its organic certifications and commitment to environmental sustainability, while Hain Celestial offers a range of organic baby food products under various brand names, appealing to health-conscious consumers.

Emerging players like Amara Organics and Baby Gourmet Foods Inc. also play critical roles in the market by focusing on innovative and specialized products. For instance, Amara Organics emphasizes the use of minimal processing to retain the nutritional integrity of organic ingredients, and Baby Gourmet focuses on flavorful, organic meals that appeal to both babies and parents. Companies such as Arla Foods and Kewpie Corporation contribute to the diversity of the market with unique offerings like organic milk formula and vegetable-based baby foods, respectively.

Top Key Players

- Abbott laboratories

- Amara Organics

- Arla Foods

- Baby Gourmet Foods Inc.

- Danone S.A.

- GMP Dairy

- Hero Group

- HiPP GmbH & Co. Vertrieb KG

- Kewpie Corporation

- Kraft Heinz Canada ULC

- Nestlé S.A.

- North Castle Partners, LLC.

- Plum Organics

- Pristine Organics Pvt Ltd.

- The Hein celestial group

- Yashili International Group Co., Ltd.

Recent Developments

In 2023, Abbott Laboratories regained its leading position in the U.S. infant formula market, measured by volume. The company reported a 10.44% increase in organic sales, contributing to total revenues of $5.16 billion in the organic baby food segment.

In 2024, Amara’s valuation increased to $22.74 million, reflecting its growth and the rising consumer preference for organic baby food.

Report Scope

Report Features Description Market Value (2023) USD 10.5 Bn Forecast Revenue (2033) USD 32.0 Bn CAGR (2024-2033) 11.8% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Wet Food, Infant Milk Formula, Dry Food, Others), By Packaging Type (Jars, Pouches, Bottles, Boxes, Others), By Age Group (6 Months and Below, 6–12 Months, 1–3 Years), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Sales Channels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott laboratories, Amara Organics, Arla Foods, Baby Gourmet Foods Inc., Danone S.A., GMP Dairy, Hero Group, HiPP GmbH & Co. Vertrieb KG, Kewpie Corporation, Kraft Heinz Canada ULC, Nestlé S.A., North Castle Partners, LLC., Plum Organics, Pristine Organics Pvt Ltd., The Hein celestial group, Yashili International Group Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott laboratories

- Amara Organics

- Arla Foods

- Baby Gourmet Foods Inc.

- Danone S.A.

- GMP Dairy

- Hero Group

- HiPP GmbH & Co. Vertrieb KG

- Kewpie Corporation

- Kraft Heinz Canada ULC

- Nestlé S.A.

- North Castle Partners, LLC.

- Plum Organics

- Pristine Organics Pvt Ltd.

- The Hein celestial group

- Yashili International Group Co., Ltd.