Vegetable Puree Market Size, Share, And Business Benefits By Type (Carrot, Spinach, Tomato, Pumpkin, Others), By Nature (Organic, Conventional), By Application (Ready-to-Eat and Cook Products, Infant Nutrition, Beverages, Others), By Sales Channel (Direct Sales, Retail, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 136509

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

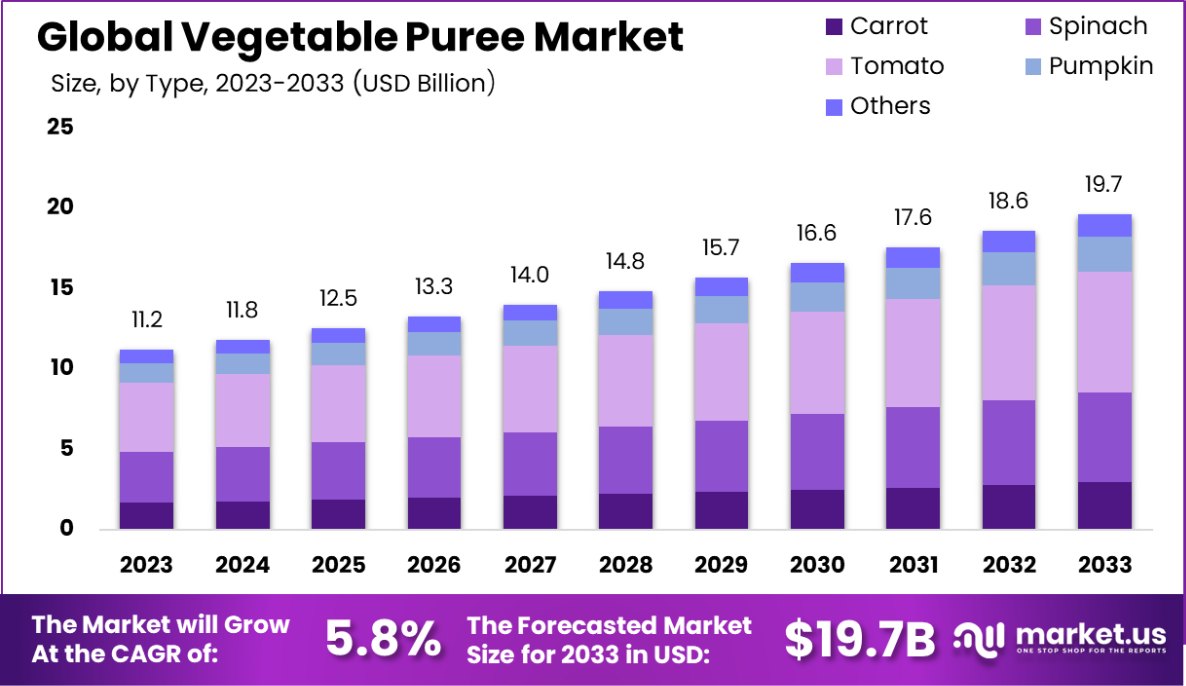

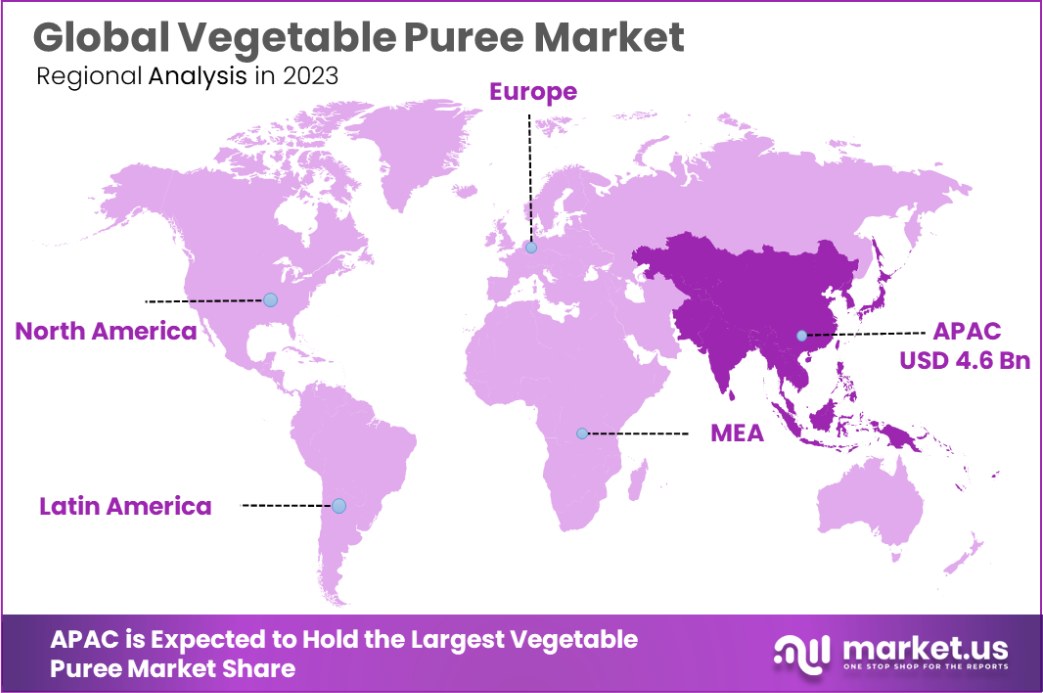

The Global Vegetable Puree Market is expected to be worth around USD 19.7 Billion by 2033, up from USD 11.2 Billion in 2023, and grow at a CAGR of 5.8% from 2024 to 2033. Asia-Pacific holds 41.6% of the vegetable puree market, USD 4.6 billion.

Vegetable puree refers to vegetables that have been ground, pressed, blended, or sieved to the consistency of a creamy paste or liquid. It includes a variety of vegetables, each offering unique flavors and nutrients, commonly used in cooking and baking to add texture, flavor, and nutritional value. Vegetable purees can serve as a base for soups and sauces, a healthy ingredient in baby foods, or a natural food coloring in various dishes.

The vegetable puree market encompasses the production, distribution, and sale of these pureed products. Driven by increasing consumer demand for convenient, healthy, and natural food options, the market has seen substantial growth. It caters to sectors such as baby food, beverages, dairy products, and ready-to-eat meals across both retail and commercial food industries.

The market is propelled by the rising popularity of clean-label products and plant-based diets, as well as the growing awareness of the health benefits associated with vegetable consumption. Moreover, innovations in packaging technology that extend shelf life while maintaining freshness also significantly contribute to market expansion.

The demand for vegetable puree is boosted by the increasing consumption of natural and organic foods among health-conscious consumers. Additionally, the expansion of the global baby food sector and the vegan population accelerates the demand for various types of vegetable purees.

There is ample opportunity for market expansion through the introduction of diverse vegetable varieties and blends that cater to regional tastes and dietary preferences. Furthermore, collaborations between puree manufacturers and food & beverage companies can open new avenues for creative applications of vegetable purees, enhancing their market presence and consumer appeal.

The vegetable puree market is experiencing significant growth, driven by increasing consumer preferences for healthy and convenient food options. The demand is primarily fueled by the growing awareness of the health benefits associated with the consumption of vegetable-based products.

This market trend is particularly evident in sectors where convenience and health intersect, such as baby foods, ready-to-eat meals, and smoothies. Furthermore, the rise in vegan and vegetarian lifestyles has propelled the adoption of vegetable purees as a staple in various cuisines globally.

The market is also witnessing innovation in packaging solutions that extend shelf life and enhance usability, making vegetable purees an attractive option for both manufacturers and consumers.

Supporting this trend are recent funding initiatives like the California Farm to School Incubator Grant Program, which awarded $52,800,000 to 195 projects in the 2023-24 period. These projects aim to incorporate local farm-grown fruits and vegetables into school meal programs, indirectly boosting the demand for vegetable purees in institutional settings.

Additionally, agriculture data from Vermont highlights a significant portion of crop production dedicated to processing; in 2022, 56% of harvested potato acres and 55% of sweet corn acres were utilized for producing vegetable purees and similar products.

These developments not only support the sustainable agriculture movement but also align with consumer trends favoring locally sourced and minimally processed foods.

Key Takeaways

- The Global Vegetable Puree Market is expected to be worth around USD 19.7 Billion by 2033, up from USD 11.2 Billion in 2023, and grow at a CAGR of 5.8% from 2024 to 2033.

- The Vegetable Puree Market sees tomatoes dominating with a significant share of 38.4% by type.

- A substantial 74.4% of the market consists of conventional vegetable purees, preferred for their availability and cost.

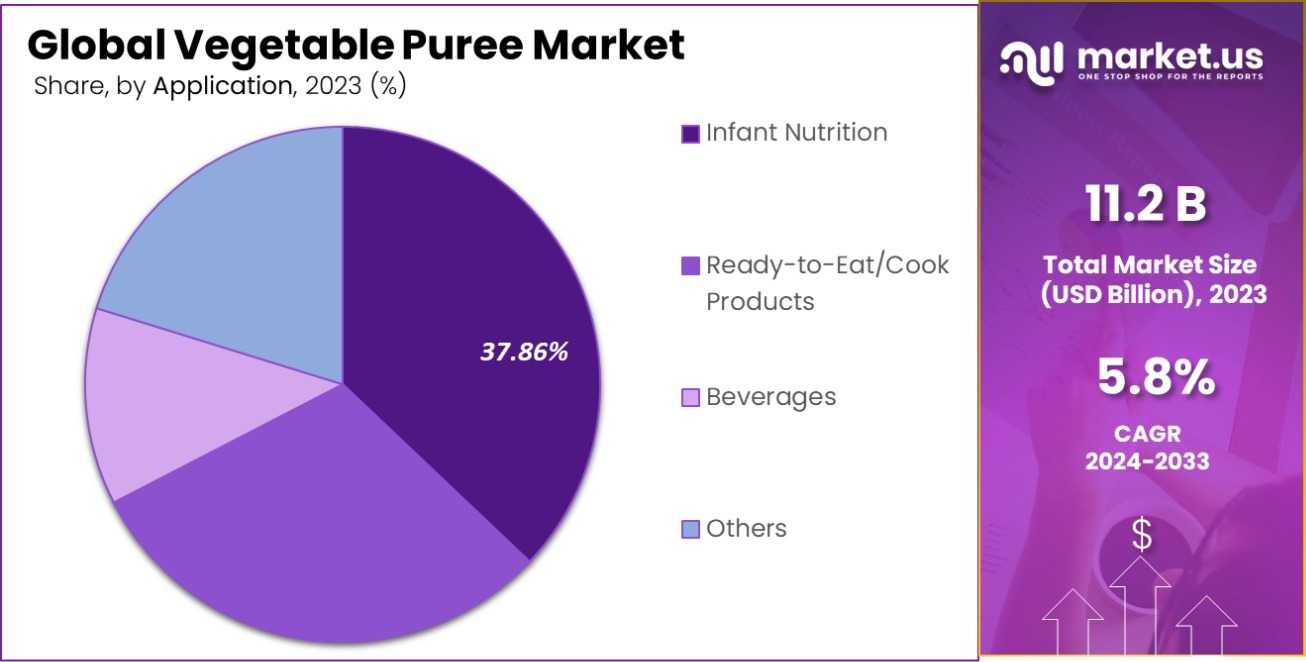

- Infant nutrition emerges as a leading application in the vegetable puree market, accounting for 37.86%.

- Retail channels hold a dominant position, distributing 54.4% of vegetable purees, enhancing consumer accessibility significantly.

- The Asia-Pacific vegetable puree market holds a 41.6% share, valued at USD 4.6 billion.

Business Benefits of Vegetable Puree

Vegetable puree, a versatile and nutrient-rich food ingredient, offers several business benefits. Firstly, the demand for vegetable puree is growing due to its health benefits. According to the United States Department of Agriculture (USDA), vegetables provide essential nutrients vital for the health and maintenance of your body.

A diet rich in vegetable products can reduce the risk of chronic diseases, including stroke, cardiovascular diseases, and certain cancers. This health factor significantly contributes to the market demand, making vegetable puree a lucrative product for businesses focusing on health-conscious consumers.

Additionally, vegetable purees are increasingly used in the baby food industry, which is experiencing a rise in demand. The USDA reports that introducing vegetables as one of the first foods in a baby’s diet is crucial for proper health and development.

The market for baby food purees, including those made from vegetables, is projected to grow as more parents seek convenient, healthy options for their children, thus offering profitable opportunities for manufacturers.

By Type Analysis

Tomato purees dominate the market with a substantial 38.4% share by type.

In 2023, Tomato held a dominant market position in the “By Type” segment of the Vegetable Puree Market, with a 38.4% share. The segment also includes Carrot, Spinach, and Pumpkin, each contributing uniquely to the market’s dynamics.

Carrot puree, valued for its nutritional benefits and versatility, captured a significant 25.6% of the market. This is reflective of the growing consumer preference for nutrient-rich food products.

Spinach, another key player, held an 18.7% share, favored for its application in baby foods and health-conscious diets due to its high vitamin and mineral content. Meanwhile, Pumpkin puree, often used in seasonal food products and as a health supplement, accounted for 17.3% of the market.

The dominance of tomato puree can be attributed to its widespread use in various culinary applications across different cultures, including sauces, soups, and condiments. Its market share is bolstered by the increasing demand for convenient and ready-to-use food products among consumers globally.

Moreover, the versatility of these vegetable purees in blending with different ingredients for flavor and health benefits continues to drive their appeal in both residential and commercial food preparations.

By Nature Analysis

Conventional vegetable purees lead with 74.4% market share by nature category.

In 2023, Conventional held a dominant market position in the “By Nature” segment of the Vegetable Puree Market, capturing a substantial 74.4% share. As consumer preferences lean towards products perceived as more natural and less processed, conventional vegetable purees remain highly sought after due to their widespread availability and cost-effectiveness.

In contrast, the Organic segment accounted for a 25.6% share, reflecting a growing but still niche demand driven by increasing health consciousness and a preference for organically grown produce.

The broader market trends suggest that while organic offerings are gaining traction, especially in North America and Europe, the price sensitivity and limited availability of organic produce in developing regions keep conventional purees in the lead.

Manufacturers in the conventional segment benefit from well-established supply chains and economies of scale, which allow them to maintain lower price points and higher market penetration compared to their organic counterparts.

However, the increasing regulatory support for organic farming and the expanding retail presence of organic products are expected to boost the market share of organic vegetable purees gradually over the coming years.

By Application Analysis

Infant nutrition applications command 37.86% of the vegetable puree market by application.

In 2023, Infant Nutrition held a dominant market position in the “By Application” segment of the Vegetable Puree Market, with a 37.86% share. This segment’s robust performance is primarily attributed to the increasing consumer demand for nutritious and convenient feeding options for infants.

As parents and caregivers continue to seek out wholesome, easy-to-prepare meal options, vegetable purees have become a staple in infant diets, driving substantial market growth in this category.

Following closely, the Ready-to-Eat and Cook Products segment accounted for a significant portion of the market, with a 33.07% share. This growth is spurred by the rising consumer preference for convenience foods that require minimal preparation time, yet offer health benefits comparable to home-cooked meals.

The versatility of vegetable purees to integrate seamlessly into various culinary applications also boosts their popularity in this segment.

Meanwhile, Beverages, which include smoothies and blended drinks, captured a 29.07% market share. The trend towards health and wellness, particularly the incorporation of vegetables into diets in palatable forms, supports the expansion of this segment.

Consumers’ increasing inclination towards functional beverages that offer nutritional benefits without compromising taste has further propelled the demand for vegetable purees in the beverage sector.

By Sales Channel Analysis

Retail sales channels hold a majority with 54.4% of the market by sales.

In 2023, the Retail segment held a dominant market position in the “By Sales Channel” category of the Vegetable Puree Market, capturing a substantial 54.4% market share. This leadership is attributed to the extensive network of supermarkets, hypermarkets, and convenience stores offering a wide variety of vegetable purees that cater to the growing consumer demand for healthy and convenient meal options.

Retail outlets, with their strategic placement and diverse product range, have been crucial in making vegetable purees accessible to a broad consumer base, thereby driving sales significantly.

Direct Sales accounted for 30.1% of the market, reflecting its importance in B2B transactions, particularly involving bulk purchases by foodservice operators and large-scale food manufacturers. This segment benefits from direct relationships between puree manufacturers and large-scale buyers, optimizing supply chain efficiencies and enabling competitive pricing.

The Online segment, while smaller, held a 15.5% share of the market. This channel has been growing steadily, fueled by the increasing penetration of e-commerce and consumer preference for online shopping due to convenience and the ability to easily compare products and prices.

The growth in this segment is also supported by improvements in online retail logistics, expanding the availability and freshness of perishable products like vegetable purees.

Key Market Segments

By Type

- Carrot

- Spinach

- Tomato

- Pumpkin

- Others

By Nature

- Organic

- Conventional

By Application

- Ready-to-Eat/Cook Products

- Infant Nutrition

- Beverages

- Others

By Sales Channel

- Direct Sales

- Retail

- Online

- Others

Driving Factors

Increased Demand for Natural and Organic Ingredients

In recent years, there’s been a significant rise in consumer preference for natural and organic products. This shift is largely due to growing health awareness and concerns about artificial additives in food. Vegetable purees, being natural and often organic, fit well into this trend.

They are increasingly used as base ingredients in health-focused products like smoothies, baby foods, and ready meals. Manufacturers are responding by expanding their offerings in this segment, using vegetable purees to enhance the nutritional profile and appeal of their products without compromising on taste or quality.

Expanding Applications in Convenience Foods

The global surge in demand for convenience foods is a major driver for the vegetable puree market. As lifestyles become busier, consumers are turning towards quick and easy meal solutions that do not require lengthy preparation times.

Vegetable purees serve as an ideal solution by offering a way to incorporate vegetables into meals effortlessly, enhancing both the flavor and nutritional content. This convenience factor is particularly appealing in the context of rising health consciousness, where consumers seek faster ways to maintain a balanced diet.

Growth in the Baby Food Sector

The baby food sector has seen substantial growth, driven by an increasing number of working parents and heightened awareness about nutritional requirements for infants. Vegetable purees are essential in this market because they provide a versatile and safe way to introduce solid foods to babies.

These purees are rich in vitamins and minerals necessary for healthy development, making them a popular choice among parents. As manufacturers continue to innovate and expand their product ranges to include a variety of vegetable flavors, the demand for vegetable purees in the baby food industry continues to rise.

Restraining Factors

High Costs of Storage and Preservation

Storing and preserving vegetable purees involves significant costs, which can restrain market growth. These purees require specific temperature-controlled environments to maintain their freshness and nutritional quality, leading to higher logistics and storage expenses.

Additionally, the short shelf life of natural products demands efficient and rapid distribution channels to prevent spoilage. These factors increase the overall cost for manufacturers and distributors, potentially limiting the expansion of the vegetable puree market, especially in regions where cold storage facilities are inadequate or too expensive to maintain.

Fluctuations in Raw Material Availability

The availability of vegetables, which are the primary raw materials for purees, can be highly variable due to factors such as seasonal changes, adverse weather conditions, and agricultural diseases. These fluctuations impact the consistency of supply and can lead to volatility in pricing, posing a challenge for puree manufacturers who rely on a steady stream of raw materials.

This unpredictability can deter manufacturers from expanding their product lines or entering new markets, thus restraining the growth of the vegetable puree market.

Competition from Fresh Vegetables and Other Alternatives

While vegetable purees offer convenience, they still face stiff competition from fresh vegetables and other alternative forms like frozen or canned vegetables. Many consumers prefer fresh vegetables due to perceptions of better taste and nutritional value.

Additionally, the increasing popularity of ready-to-cook vegetable mixes and advancements in the preservation of fresh vegetables enhance their convenience factor, directly competing with purees. This competition can limit the growth potential of the vegetable puree market, as consumers have multiple options to meet their dietary preferences and convenience needs.

Growth Opportunity

Expansion into Emerging Markets with Rising Urbanization

Emerging markets present significant growth opportunities for the vegetable puree sector due to rapid urbanization and increasing disposable incomes. As more consumers in these regions adopt urban lifestyles, the demand for convenient, healthy food options like vegetable purees is expected to rise.

These markets offer untapped potential for manufacturers to introduce their products to a growing consumer base that is becoming more health-conscious. By capitalizing on these trends and establishing strong distribution networks, companies can significantly increase their market penetration and consumer base in these fast-developing regions.

Innovative Blends for Dietary Supplements and Functional Foods

The health and wellness trend is pushing consumers towards dietary supplements and functional foods that offer additional health benefits beyond basic nutrition. Vegetable purees can serve as an excellent base for these products, providing natural color, flavor, and nutritional enhancement.

Manufacturers have the opportunity to innovate by creating new blends of vegetable purees that cater to specific health needs such as immunity boosting, digestive health, or energy enhancement. This innovation can open new channels in health food stores, pharmacies, and specialty markets, further driving the market growth.

Strategic Partnerships with Food Service Providers

There is a growing opportunity for vegetable puree manufacturers to collaborate with food service providers, including restaurants, cafeterias, and catering services. By forming strategic partnerships, puree manufacturers can secure steady demand as these services look to improve the nutritional content and flavor of their offerings.

This collaboration not only expands the market reach of vegetable purees but also enhances the visibility and utility of purees in various culinary applications, from casual dining to high-end restaurants, thereby promoting their use on a larger scale.

Latest Trends

Rising Popularity of Exotic and Ethnic Flavors

The global palette is becoming more adventurous, with consumers increasingly seeking exotic and ethnic flavors in their foods. This trend is extending into the vegetable puree market, where there’s a growing interest in purees made from less common vegetables or those typical to specific culinary traditions, such as taro, yucca, or okra.

Manufacturers are responding by expanding their product lines to include these unique flavors, catering to a more culturally diverse customer base, and differentiating their offerings in a competitive market. This diversification not only attracts food enthusiasts but also immigrants seeking familiar tastes from their home countries.

Focus on Clean Label and Organic Purees

Consumers are increasingly demanding transparency in food labeling, with a strong preference for products that contain natural, organic ingredients and are free of additives and preservatives. The vegetable puree market is responding by shifting towards clean-label products that highlight the purity and simplicity of the ingredients.

This trend is particularly strong in the baby food and health food segments, where the demand for organic purees is rapidly growing. Manufacturers that emphasize these aspects in their product development and marketing strategies are likely to see increased consumer trust and loyalty.

Integration of Vegetable Purees in Plant-Based Diets

The shift towards plant-based diets for health, ethical, or environmental reasons is a significant trend influencing the food industry. Vegetable purees are playing a crucial role in this movement by providing a versatile, nutrient-rich base for vegan and vegetarian dishes.

They are being increasingly used as substitutes for animal-based ingredients in recipes, offering texture and flavor enhancements in everything from baked goods to meat alternatives. As the plant-based market continues to expand, the role of vegetable purees as a dietary staple is expected to grow, presenting ample opportunities for innovation and market expansion.

Regional Analysis

The Asia-Pacific vegetable puree market holds a 41.6% share, valued at USD 4.6 billion.

The global vegetable puree market is segmented across various regions including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Dominating these regions is Asia-Pacific, holding a substantial market share of 41.6% and valued at USD 4.6 billion, driven primarily by increasing urbanization and the expanding food service industry, particularly in China and India.

In North America, the market is propelled by high consumer demand for natural and organic food products, leading to a greater incorporation of vegetable purees in diverse food applications. Europe follows closely, where stringent food quality regulations and a growing preference for clean-label products enhance the demand for organic and non-GMO purees.

In the Middle East & Africa, the market is gradually expanding, supported by rising health awareness and urban growth, particularly in countries like the UAE and Saudi Arabia. This region shows potential for significant growth with increased investments in food processing technologies.

Lastly, Latin America is witnessing growth in the vegetable puree market due to the rising demand for convenient and healthy food options, spearheaded by Brazil and Mexico. Overall, while Asia-Pacific remains the largest market, other regions are also showing robust growth trajectories due to evolving consumer preferences and increased health consciousness.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global vegetable puree market continues to be highly competitive with key players such as Astral Foods Ltd., Baby Gourmet Foods Inc., BRF S.A., and Conagra Brands, Inc., among others, playing significant roles. These companies are strategically enhancing their market positions through innovations in product offerings and expanding their global footprints.

Astral Foods Ltd. and BRF S.A. are focusing on sustainability and traceability in their supply chains, catering to the rising consumer demand for ethical and environmentally friendly products. This approach not only aligns with global sustainability trends but also enhances brand loyalty and trust among consumers.

Baby Gourmet Foods Inc. specializes in organic and natural baby food products, including vegetable purees. Their focus on premium, safe, and nutritious options positions them well in the niche but growing segment of health-conscious parents.

Conagra Brands, Inc. and General Mills, Inc. are leveraging their extensive distribution networks to expand the availability of their vegetable puree products. They are also investing in marketing and R&D to create products that meet the evolving tastes and dietary preferences of a diverse consumer base.

Nestlé S.A. and The Kraft Heinz Company are leading in innovation by incorporating vegetable purees into new product lines, such as plant-based meals and snacks, addressing the increasing consumer shift towards vegetarian and vegan diets.

Ingredion Incorporated and Dohler GmbH are enhancing their capabilities in the ingredient sector by developing advanced vegetable puree solutions that offer enhanced flavor, color, and nutritional benefits, catering especially to the beverage and convenience food markets.

SVZ Industrial Fruit and Vegetable Ingredients and Sun Impex focus on the B2B sector, providing high-quality purees to food manufacturers and service providers, thereby enabling these companies to deliver products that are consistent in quality and taste.

Top Key Players in the Market

- Astral Foods Ltd.

- Baby Gourmet Foods Inc.

- BRF S.A.

- Conagra Brands, Inc

- Conrox Agro and Food Pvt.

- Del Monte Foods Inc.

- Dohler GmbH

- Encore Fruit Marketing Inc.

- General Mills, Inc.

- Ingredion Incorporated

- JBS S.A.

- Kagome Co. Ltd.

- Kellanova

- Kraft Foods Group, Inc.

- Nestlé S.A.

- Nikken Foods Co. Ltd.

- Sun Impex

- SVZ Industrial Fruit and Vegetable Ingredients

- The Kraft Heinz Company

- Unilever PLC

Recent Developments

- In 2024, Astral Foods Ltd. reported a recovery in their Poultry Division with revenue up by 7.7%, driven by improved sales volumes and realizations. However, the Feed Division saw a 15.2% revenue decline due to lower feed prices and sales volumes.

- In 2023, BRF S.A. launched 138 new products, focusing on market needs with 72 in Brazil and 66 globally, including healthy and sustainable vegetable purees. Their continuous innovation integrates advanced technologies and consumer insights to maintain high quality and safety standards.

Report Scope

Report Features Description Market Value (2023) USD 11.2 Billion Forecast Revenue (2033) USD 19.7 Billion CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Carrot, Spinach, Tomato, Pumpkin, Others), By Nature (Organic, Conventional), By Application (Ready-to-Eat and Cook Products, Infant Nutrition, Beverages, Others), By Sales Channel (Direct Sales, Retail, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Astral Foods Ltd., Baby Gourmet Foods Inc., BRF S.A., Conagra Brands, Inc, Conrox Agro and Food Pvt., Del Monte Foods Inc., Dohler GmbH, Encore Fruit Marketing Inc., General Mills, Inc., Ingredion Incorporated, JBS S.A., Kagome Co. Ltd., Kellanova, Kraft Foods Group, Inc., Nestlé S.A., Nikken Foods Co. Ltd., Sun Impex, SVZ Industrial Fruit and Vegetable Ingredients, The Kraft Heinz Company, Unilever PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vegetable Puree MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Vegetable Puree MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Astral Foods Ltd.

- Baby Gourmet Foods Inc.

- BRF S.A.

- Conagra Brands, Inc

- Conrox Agro and Food Pvt.

- Del Monte Foods Inc.

- Dohler GmbH

- Encore Fruit Marketing Inc.

- General Mills, Inc.

- Ingredion Incorporated

- JBS S.A.

- Kagome Co. Ltd.

- Kellanova

- Kraft Foods Group, Inc.

- Nestlé S.A.

- Nikken Foods Co. Ltd.

- Sun Impex

- SVZ Industrial Fruit and Vegetable Ingredients

- The Kraft Heinz Company

- Unilever PLC