Antioxidants Market Size, Share, And Strategic Business Review By Type (Natural, Synthetic), By Form (Dry, Liquid), By Source (Plant-Based, Animal-Based, Mineral-Based), By Application (Food and Feed Additives, Pharmaceuticals and Personal Care Products, Fuel and Lubricant Additives, Plastic, Rubber, and Latex Additives, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: February 2025

- Report ID: 136462

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

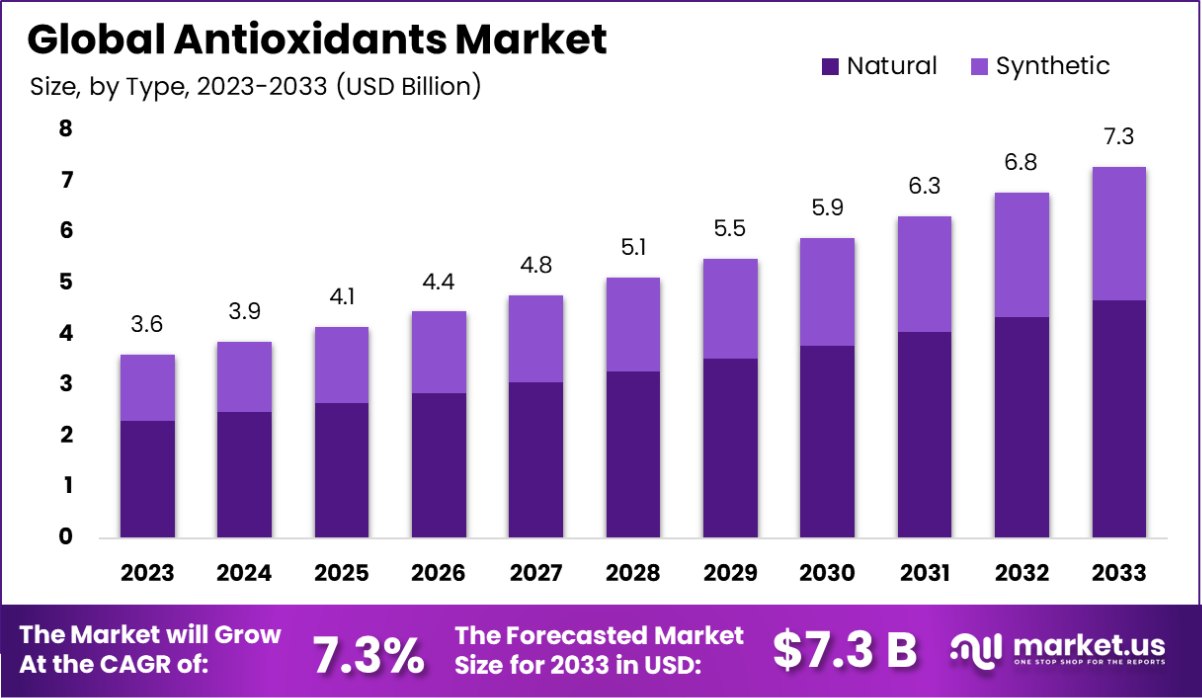

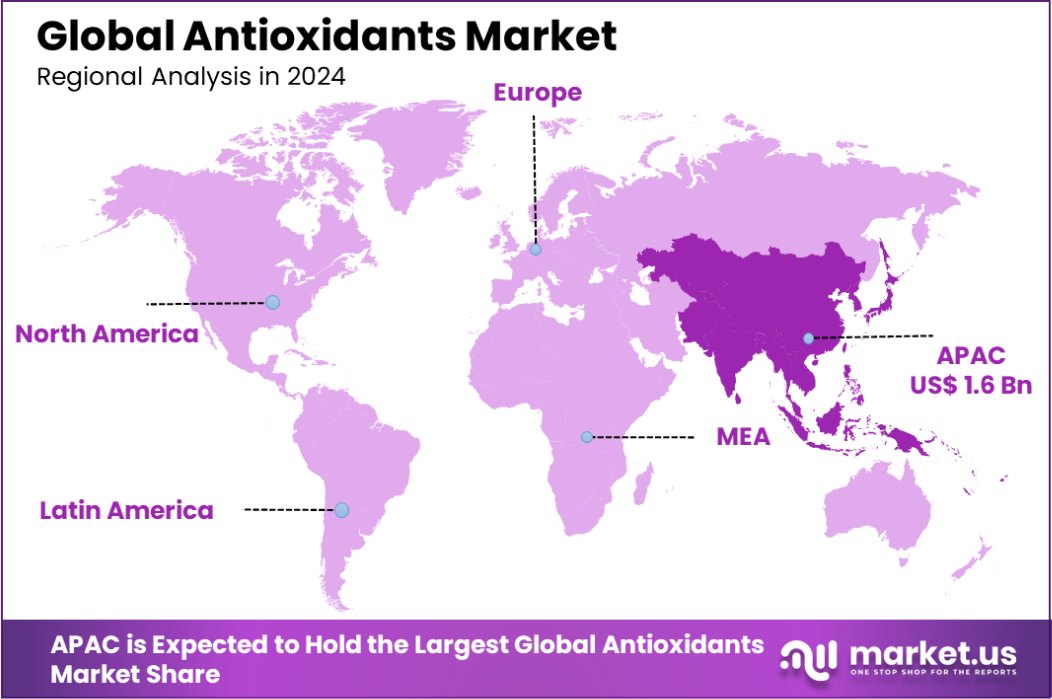

The Global Antioxidants Market is expected to be worth around USD 7.3 Billion by 2033, up from USD 3.6 Billion in 2023, and grow at a CAGR of 7.3% from 2024 to 2033. Asia-Pacific antioxidants market holds a 45.3% share, valued at USD 1.6 billion.

Antioxidants are compounds that inhibit oxidation, a chemical reaction that can produce free radicals, leading to chain reactions that may damage the cells of organisms. Antioxidants are widely used in dietary supplements, pharmaceuticals, and food preservation. Their primary role is protecting against oxidative stress and maintaining overall health.

The Antioxidants Market refers to the economic sector involved in producing, distributing, and selling antioxidant compounds. This market is influenced by the growing consumer awareness of health and wellness, the increasing prevalence of chronic diseases, and the rising demand for products with longer shelf lives in the food and beverage industry.

The growth of the antioxidants market can be attributed to increased consumer health consciousness and the global rise in chronic health issues such as heart disease and diabetes. This trend has heightened the demand for antioxidants in dietary supplements and functional foods that promote health and wellness.

Demand in the antioxidants market is driven by the expanding processed food industry and the growing consumer preference for natural antioxidants sourced from plants. This shift is fueled by a broader consumer inclination towards natural and organic products, perceived as safer and healthier alternatives to synthetic options.

Significant opportunities in the antioxidants market arise from technological advancements in extraction and processing techniques, which improve the efficiency and cost-effectiveness of producing antioxidant-rich products. Additionally, expanding applications in cosmetics and personal care products for anti-aging purposes offer new avenues for market growth, capitalizing on the global anti-aging product trend.

The global antioxidants market is poised for significant growth, driven by an increasing awareness of health and wellness, and the rising prevalence of chronic diseases. Antioxidants, crucial in combating oxidative stress and inflammation, are pivotal in managing health conditions, including cardiovascular diseases, cancers, and immune system dysfunctions.

The market is further buoyed by robust research that underscores the efficacy of antioxidants in reducing disease prevalence. For instance, a study highlighted a weighted mean incidence rate of influenza/pneumonia mortality at 0.88 per 1000 person-years, indicating a critical need for effective preventive healthcare measures.

Furthermore, dietary antioxidants, such as vitamin C, play a substantial role in enhancing the body’s overall antioxidant capacity. It is noted that over 50% of the total antioxidant capacity (TAC) in serum can be attributed to vitamin C alone, emphasizing the significant impact of diet on health and the potential for market expansion in this sector.

The growing consumer inclination towards natural and plant-based products has also spurred the demand for nutritional supplements, which are expected to witness increased adoption owing to their health benefits and their role in disease prevention.

As the market evolves, key players and new entrants must focus on innovative product development and strategic collaborations to leverage the shifting consumer preferences towards healthier lifestyles.

Additionally, the antioxidants market is likely to see enhanced investment in research and development to explore new sources and applications of antioxidants, thereby ensuring sustained growth and market penetration globally.

Key Takeaways

- The Global Antioxidants Market is expected to be worth around USD 7.3 Billion by 2033, up from USD 3.6 Billion in 2023, and grow at a CAGR of 7.3% from 2024 to 2033.

- Fresh antioxidants hold the largest market share at 64.4% due to consumer health trends.

- Dry antioxidants follow closely, capturing 63.3% of the market with versatile application possibilities.

- Plant-based antioxidants dominate with 53.3%, reflecting the shift towards sustainable, natural ingredients.

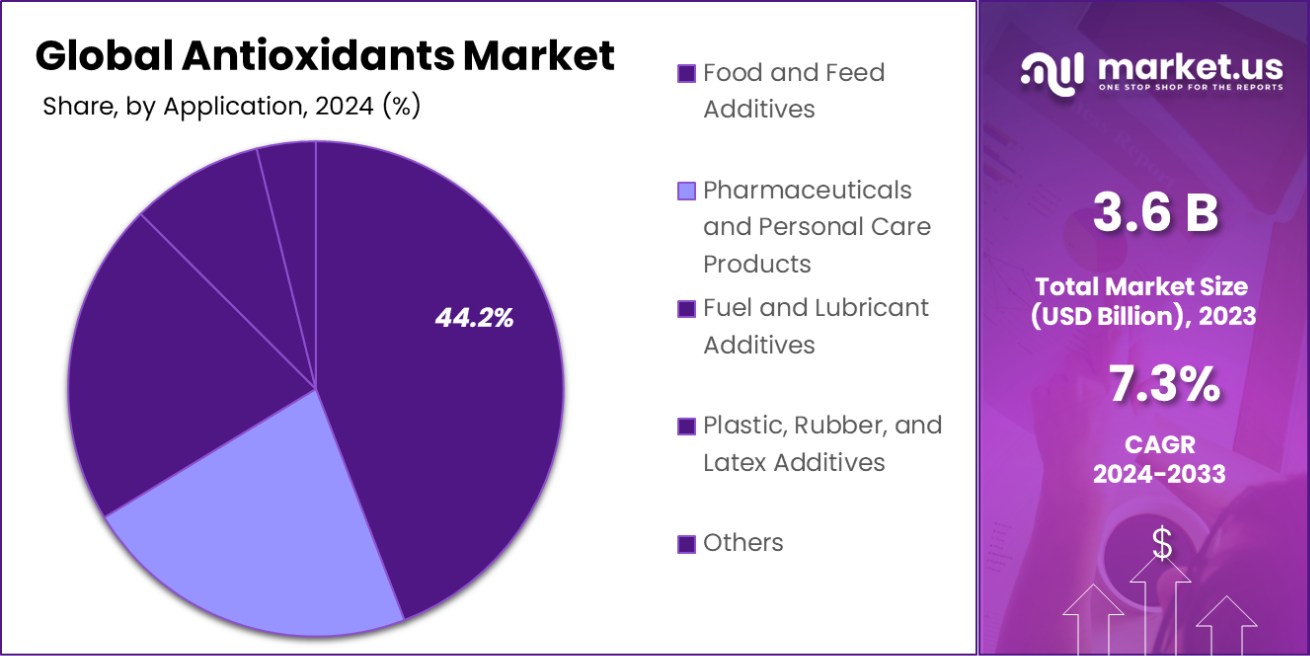

- Antioxidants in food and feed additives represent 44.2% of the market, enhancing product longevity.

- In 2023, the Asia-Pacific antioxidants market reached USD 1.6 billion, a 45.3% share.

Strategic Business Review of Antioxidants

Antioxidants play a crucial role in various industries, especially in food, healthcare, and cosmetics, due to their ability to neutralize harmful free radicals, thereby preventing oxidative damage. The global antioxidants market is driven by the increasing demand for natural preservatives in food products and the rising awareness of their health benefits.

In the food sector, antioxidants such as vitamin C, vitamin E, and flavonoids are essential in preventing spoilage and enhancing shelf life. These compounds help maintain nutritional value, flavor, and color in products, which is particularly vital for the growing demand for processed and packaged foods. According to the U.S. Food and Drug Administration (FDA), antioxidants in food products must meet specific guidelines to ensure safety and efficacy.

In healthcare, antioxidants are recognized for their potential to prevent chronic diseases, including cardiovascular diseases, cancer, and diabetes. They are often incorporated into dietary supplements aimed at improving overall well-being. The demand for such supplements is increasing globally, reflecting the rising focus on preventative healthcare.

The cosmetics industry also capitalizes on antioxidants, utilizing them in skin care products to reduce signs of aging and protect against environmental stressors. With the increasing trend toward natural ingredients, the market for antioxidant-based skincare products continues to expand.

By Type Analysis

Fresh antioxidants dominate the market with a substantial share of 64.4%, highlighting consumer preference for natural options.

In 2023, Fresh held a dominant market position in the “By Type” segment of the Antioxidants Market, with a 64.4% share. This segment is broadly categorized into natural and synthetic antioxidants.

The market dynamics reveal a strong preference for natural antioxidants, which accounted for a significant portion of the market share. The growing consumer awareness regarding health benefits associated with natural substances and their efficacy in preventing oxidative stress has propelled this demand.

On the other hand, synthetic antioxidants, while having a smaller slice of the market pie, play a crucial role due to their cost-effectiveness and extended shelf life capabilities. Industries such as food preservation, cosmetics, and pharmaceuticals leverage synthetic variants to enhance product stability and longevity, thereby driving their demand.

The overall market landscape is influenced by increasing health consciousness among consumers and the subsequent demand for products featuring ingredients that contribute to wellness and long-term health benefits. Companies are investing in R&D to innovate and expand their product lines with antioxidants that meet the consumer’s evolving preferences.

This strategic focus is not only enhancing their market presence but also setting the stage for robust competition among key players aiming to capitalize on both segments’ growth opportunities.

By Form Analysis

Dry antioxidants closely follow, holding 63.3% of the market, favored for their longer shelf life and stability.

In 2023, Dry held a dominant market position in the “By Form” segment of the Antioxidants Market, with a 63.3% share. This segment is primarily divided into dry and liquid forms. The preference for dry antioxidants can be attributed to their ease of storage, handling, and stability, which make them highly favorable in various applications including food products, feeds, and cosmetics.

The dry form’s versatility and efficacy in maintaining the integrity of active ingredients over extended periods have bolstered its adoption across industries.

Conversely, liquid antioxidants are utilized for specific applications where immediate solubility and dispersion are required. Although they account for a smaller portion of the market, their use in liquid food items, skincare products, and certain pharmaceutical formulations is critical. They offer distinct advantages such as uniform distribution and faster reaction times, which are essential in certain manufacturing processes.

The antioxidants market is witnessing significant growth driven by the increasing awareness of oxidative damage and the preventive health benefits of antioxidants. As manufacturers continue to innovate and improve product formulations to meet consumer demands, both dry and liquid forms are expected to see strategic developments aimed at expanding their application scope and market penetration.

By Source Analysis

Plant-based antioxidants lead with 53.3%, driven by growing demand for natural and sustainable ingredients in diets.

In 2023, Plant-Based held a dominant market position in the “By Source” segment of the Antioxidants Market, with a 53.3% share. This segment includes plant-based, animal-based, and mineral-based sources. The strong inclination toward plant-based antioxidants is driven by the growing consumer preference for natural and sustainable ingredients, particularly in the health and wellness sectors.

These antioxidants, derived from fruits, vegetables, herbs, and spices, are favored for their beneficial properties and minimal side effects compared to synthetic alternatives.

Animal-based antioxidants, while having a smaller market share, are utilized for their unique properties in certain health supplements and cosmetic products. These antioxidants are sourced from various animal parts and are essential in niche markets that require specific health benefits linked to animal-derived ingredients.

Mineral-based antioxidants also play a critical role in the market, especially in industrial applications where they are used to prevent corrosion and aging in materials. Their utility in extending the life of products by combating oxidative stress adds a vital dimension to the antioxidants market.

Overall, the market is experiencing a shift towards more natural and eco-friendly sources of antioxidants, with plant-based options leading the way due to their wide acceptance and perceived health benefits. This trend is expected to continue as consumers increasingly opt for products that are not only effective but also environmentally responsible and ethically produced.

By Application Analysis

Within the antioxidants sector, food and feed additives represent 44.2%, reflecting their crucial role in product preservation.

In 2023, Food and Feed Additives held a dominant market position in the “By Application” segment of the Antioxidants Market, with a 44.2% share. This segment is further divided into food and feed additives, pharmaceuticals and personal care products, fuel and lubricant additives, and plastic, rubber, and latex additives.

The robust share held by food and feed additives can be attributed to the critical role antioxidants play in extending the shelf life of food products and maintaining the nutritional quality of animal feed.

As consumer demand for fresher, longer-lasting food products grows, and as the feed industry continues its expansion to support increased livestock production, the demand for effective antioxidant solutions in these sectors continues to surge.

Meanwhile, antioxidants in pharmaceuticals and personal care products are essential for protecting active ingredients from oxidative degradation, thus ensuring efficacy and safety. In the realms of fuel and lubricant additives, antioxidants help prevent oxidation that can cause fuel instability and equipment damage, which is vital for the automotive and manufacturing industries.

In the plastics, rubber, and latex industries, antioxidants are used to enhance the resilience and longevity of products by inhibiting oxidative degradation. This broad range of applications underscores the versatile and critical nature of antioxidants in industrial and consumer markets, reflecting a diversified demand across multiple sectors.

Key Market Segments

By Type

- Natural

- Synthetic

By Form

- Dry

- Liquid

By Source

- Plant-Based

- Animal-Based

- Mineral-Based

By Application

- Food and Feed Additives

- Pharmaceuticals and Personal Care Products

- Fuel and Lubricant Additives

- Plastic, Rubber, and Latex Additives

- Others

Driving Factors

Rising Demand for Natural Ingredients in Consumer Goods

The antioxidants market is witnessing significant growth driven by the increasing consumer preference for natural ingredients. This trend is particularly strong in the food, pharmaceutical, and cosmetic sectors where natural antioxidants are perceived as safer and healthier alternatives to synthetic versions.

The shift towards natural ingredients is fueled by rising health consciousness and a growing awareness of the adverse effects associated with artificial additives. As consumers continue to prioritize wellness and sustainability, the demand for plant-based antioxidants is expected to keep driving market expansion.

Enhanced Focus on Shelf Life and Product Stability

Manufacturers across various industries are intensifying their focus on extending product shelf life and enhancing stability. Antioxidants play a crucial role in achieving these objectives by preventing oxidative damage. This is vital not only in food and feed products but also in pharmaceuticals, cosmetics, and industrial goods.

As global supply chains become more complex and consumer expectations for long-lasting products increase, the reliance on effective antioxidant solutions continues to rise, further propelling market growth.

Regulatory Support for Safe and Sustainable Additives

Global regulatory bodies are increasingly supportive of antioxidants that are safe and environmentally sustainable. This regulatory encouragement is prompting manufacturers to invest in research and development of antioxidants that meet these criteria, especially in highly regulated markets like food and healthcare.

The push for safer additives is not only improving product quality but also boosting consumer trust and satisfaction, which in turn fuels further growth in the antioxidants market.

Restraining Factors

High Costs Associated with Natural Antioxidant Production

The production of natural antioxidants involves significant costs due to the need for specialized extraction and processing technologies. This makes natural antioxidants more expensive compared to their synthetic counterparts.

The high cost can be a major barrier for manufacturers, particularly small and medium-sized enterprises, limiting their ability to adopt natural antioxidants widely across their product lines. This economic challenge is a key restraint in the market, as it affects the overall affordability and accessibility of natural antioxidant-enhanced products for consumers.

Stringent Regulatory and Compliance Requirements

Navigating the complex regulatory landscape can be a major hurdle for antioxidant producers. Regulatory approval processes are often lengthy and require substantial documentation and testing to demonstrate product safety and efficacy.

This increases the time and financial burden on companies, potentially delaying product launches and affecting market competitiveness. Such stringent regulations, especially in highly regulated sectors like food and pharmaceuticals, act as a significant restraint on the growth of the antioxidants market.

Volatility in Raw Material Supply and Prices

The antioxidants market is susceptible to fluctuations in the supply and pricing of raw materials, which can be influenced by environmental factors, geopolitical issues, and changes in agricultural practices. Such volatility can lead to inconsistent availability and cost spikes for key ingredients used in antioxidant production.

This unpredictability can disrupt production schedules, increase operational costs, and ultimately impact the profitability and strategic planning of companies involved in the antioxidants market.

Growth Opportunity

Expansion into Emerging Markets with Increasing Health Awareness

Emerging markets present a significant growth opportunity for the antioxidants market due to rising health awareness and increasing disposable incomes. Countries in Asia, Africa, and Latin America are experiencing a surge in demand for products that offer health benefits, including those containing antioxidants.

Tapping into these regions with tailored marketing strategies and localized product offerings can help companies capture new consumer segments and drive market expansion.

Innovation in Antioxidant Applications Across Industries

There is a growing opportunity for innovation within the antioxidants market as industries seek new ways to enhance product quality and extend shelf life. Developing novel antioxidant formulations that can be used in less traditional applications, such as biodegradable plastics and high-performance lubricants, opens up new avenues for growth.

Companies that invest in research and development to discover and commercialize these innovative applications are likely to gain a competitive edge and access new market segments.

Leveraging Trends in Clean Label and Organic Products

The clean label and organic product trends are creating substantial opportunities for growth in the antioxidants market. Consumers are increasingly looking for products with recognizable, natural ingredients and minimal processing.

Antioxidants derived from natural sources are perfectly aligned with this trend. Companies that focus on developing and marketing clean-label antioxidant solutions can capitalize on consumer preferences for transparency and healthfulness, particularly in the food, beverage, and personal care sectors.

Latest Trends

Increasing Utilization of Antioxidants in Nutraceuticals and Functional Foods

There is a growing trend in the use of antioxidants in nutraceuticals and functional foods, driven by the global shift towards preventive healthcare and wellness. As consumers become more health-conscious, they are increasingly seeking foods and supplements that can provide health benefits beyond basic nutrition.

Antioxidants are key components in this trend, praised for their ability to combat oxidative stress and associated health issues. This has prompted manufacturers to innovate and expand their product lines with antioxidant-rich offerings, creating a robust market for functional foods enhanced with these compounds.

Technological Advancements in Antioxidant Extraction and Stability

Technological advancements in extraction and stabilization techniques are shaping the antioxidant market, enabling the efficient capture and preservation of antioxidant properties. Innovations such as supercritical fluid extraction and encapsulation technologies are improving the efficacy and stability of antioxidants, making them more appealing for use in a wider range of products, including those subject to high-temperature processing or long shelf lives.

These technological improvements are not only enhancing product quality but also reducing waste and increasing the cost-effectiveness of antioxidant production.

Sustainability Practices Influencing Antioxidant Sourcing and Production

Sustainability practices are increasingly influencing the sourcing and production of antioxidants. As consumers and regulatory bodies demand more environmentally friendly and ethically sourced products, companies are responding by adopting sustainable practices throughout their supply chains.

This includes sourcing antioxidants from waste products, such as fruit peels and spent grains, and implementing more eco-friendly extraction methods. This trend not only responds to consumer demand for sustainability but also helps companies reduce environmental impact and improve the overall sustainability of their operations.

Regional Analysis

In 2023, the Asia-Pacific antioxidants market held a 45.3% share, valued at USD 1.6 billion.

In the global antioxidants market, regional dynamics significantly influence market trends and growth opportunities. Asia-Pacific emerges as the dominating region, holding a commanding 45.3% market share, with a valuation of USD 1.6 billion.

This region’s dominance is driven by rapid industrialization, increasing awareness of health and wellness, and growing consumer demand for natural and sustainable products. The extensive agriculture and food production sectors in countries like China and India contribute to the region’s leading position by integrating antioxidants extensively to improve food quality and shelf life.

North America and Europe also represent substantial markets, with advanced economies emphasizing the importance of antioxidants in health supplements and personal care products. In North America, consumer preferences for clean-label and organic products boost the demand for natural antioxidants.

Meanwhile, Europe’s stringent regulatory environment regarding food safety and sustainable sourcing supports market growth by pushing innovations in natural and eco-friendly antioxidants.

In contrast, the Middle East & Africa, and Latin America are smaller yet rapidly growing markets. These regions are experiencing increased demand due to rising health consciousness among consumers and improvements in healthcare infrastructure, which are gradually aligning with global trends towards healthier lifestyles.

As these regions continue to develop economically, the demand for antioxidants in food preservation, healthcare, and beauty products is expected to rise, offering significant growth potential in the global antioxidants landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global antioxidants market has seen robust activity, with key players navigating through dynamic market conditions to solidify their positions and capitalize on emerging opportunities. Companies like Archer Daniels Midland Company, BASF SE, and Evonik Industries AG continue to lead the market, driven by their extensive product portfolios, significant R&D investments, and strong global distribution networks.

These industry giants are increasingly focusing on sustainable and natural antioxidants, aligning with the global shift towards cleaner and greener ingredients.

Archer Daniels Midland Company has been proactive in expanding its footprint in natural antioxidants sourced from botanicals and other natural resources, catering to the surging demand in the food and beverage sector.

Similarly, BASF SE has been at the forefront of developing advanced synthetic antioxidants that offer superior stability and effectiveness, particularly in high-demand sectors such as plastics and rubber.

Emerging players like Camlin Fine Sciences Ltd. and Kemin Industries Inc. are also noteworthy, as they carve niches in specific regions and applications.

Camlin has been successful in penetrating markets in Asia and South America by offering tailored solutions that meet regional regulatory and consumer demands. On the other hand, Kemin has focused on innovation in animal feed antioxidants, enhancing feed quality and efficiency.

Moreover, the market sees a strategic inclination towards mergers, acquisitions, and partnerships to broaden technological capabilities and geographical reach. Companies like Clariant AG and Givaudan have engaged in partnerships to leverage their expertise in high-performance antioxidants for cosmetics and personal care products.

In essence, as the antioxidants market continues to evolve, key players are adapting by embracing sustainability, advancing technological integration, and expanding into new markets to meet the complex demands of modern consumers. This strategic adaptability is crucial for maintaining market leadership and addressing the competitive pressures of a globalized market environment.

Top Key Players in the Market

- 3V Sigma USA Inc.

- ADEKA Corporation

- Aland (Jiangsu) Nutraceutical Co. Ltd

- Archer Daniels Midland Company

- Barentz International BV

- BASF SE

- Beijing Tiangang Auxiliary Co., Ltd,

- Camlin Fine Sciences Ltd.

- Cargill Incorporated

- Clariant AG,

- Dalian Richfortune Chemicals Co., Ltd., and Chitec Technology Co., Ltd.

- Double Bond Chemical Ind. Co., Ltd.,

- Dover Chemical Corporation,

- Eastman Chemical Company

- Everspring Chemical Co., Ltd.

- Evonik Industries AG,

- Givaudan

- ICC Industries Inc.

- Kalsec, Inc.

- Kemin Industries Inc.

- Koninklijke DSM N.V.

- Nutreo N.V.

- Oxiris Chemicals S.A.,

- Rianlon Corporation

- SI Group, Inc.

- Solvay S.A.,

- SONGWON Industrial Group,

- TAIWAN DYESTUFFS & PIGMENTS CORP.

- Vitablend Nederland B.V.

Recent Developments

- In 2024, ADEKA Corporation is enhancing its antioxidant solutions 2024 with eco-friendly, sustainable products aimed at improving food shelf life and performance. The company is focusing on developing high-quality, environmentally conscious antioxidants for the food, cosmetics, and polymer industries.

- In 2023, Dover Chemical Corporation expanded its portfolio by introducing eco-friendly antioxidants, catering to the growing demand for sustainable solutions in the automotive and food packaging industries, and enhancing product longevity and performance in high-temperature applications.

Report Scope

Report Features Description Market Value (2023) USD 3.6 Billion Forecast Revenue (2033) USD 7.3 Billion CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural, Synthetic), By Form (Dry, Liquid), By Source (Plant-Based, Animal-Based, Mineral-Based), By Application (Food and Feed Additives, Pharmaceuticals and Personal Care Products, Fuel and Lubricant Additives, Plastic, Rubber, and Latex Additives, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3V Sigma USA Inc., ADEKA Corporation, Aland (Jiangsu) Nutraceutical Co. Ltd, Archer Daniels Midland Company, Barentz International BV, BASF SE, Beijing Tiangang Auxiliary Co., Ltd, Camlin Fine Sciences Ltd., Cargill Incorporated, Clariant AG, Dalian Richfortune Chemicals Co., Ltd., and Chitec Technology Co., Ltd., Double Bond Chemical Ind. Co., Ltd., Dover Chemical Corporation, Eastman Chemical Company, Everspring Chemical Co., Ltd., Evonik Industries AG, Givaudan, ICC Industries Inc., Kalsec, Inc., Kemin Industries Inc., Koninklijke DSM N.V., Nutreo N.V., Oxiris Chemicals S.A., Rianlon Corporation, SI Group, Inc., Solvay S.A., SONGWON Industrial Group, TAIWAN DYESTUFFS & PIGMENTS CORP., Vitablend Nederland B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3V Sigma USA Inc.

- ADEKA Corporation

- Aland (Jiangsu) Nutraceutical Co. Ltd

- Archer Daniels Midland Company

- Barentz International BV

- BASF SE

- Beijing Tiangang Auxiliary Co., Ltd,

- Camlin Fine Sciences Ltd.

- Cargill Incorporated

- Clariant AG,

- Dalian Richfortune Chemicals Co., Ltd., and Chitec Technology Co., Ltd.

- Double Bond Chemical Ind. Co., Ltd.,

- Dover Chemical Corporation,

- Eastman Chemical Company

- Everspring Chemical Co., Ltd.

- Evonik Industries AG,

- Givaudan

- ICC Industries Inc.

- Kalsec, Inc.

- Kemin Industries Inc.

- Koninklijke DSM N.V.

- Nutreo N.V.

- Oxiris Chemicals S.A.,

- Rianlon Corporation

- SI Group, Inc.

- Solvay S.A.,

- SONGWON Industrial Group,

- TAIWAN DYESTUFFS & PIGMENTS CORP.

- Vitablend Nederland B.V.