Sunflower Oil Market Size, Share, And Business Benefits By Type (High-Oleic, Mid-Oleic, Linoleic), By Product Type (Organic, Processed), By Packaging Type (Pouches, Jars, Cans, Bottles), By End User (Industrial, Commercial, Domestic, Others), By Distribution Channel (Direct Sales, Supermarket, Convenience Store, Specialty Store, E-Commerce, Others), By Nature (Conventional, Organic), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 136540

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Sunflower Oil

- By Type Analysis

- By Product Type Analysis

- By Packaging Type Analysis

- By End User Analysis

- By Distribution Channel Analysis

- By Nature Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

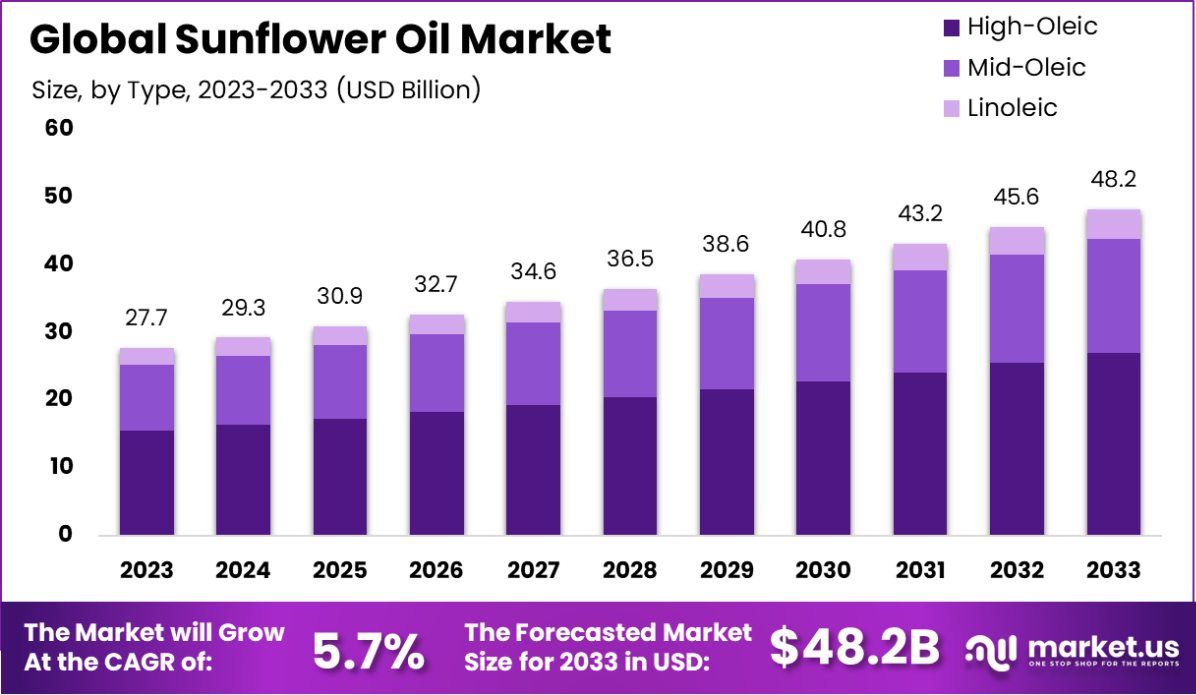

The Global Sunflower Oil Market is expected to be worth around USD 48.2 Billion by 2033, up from USD 27.7 Billion in 2023, and grow at a CAGR of 5.7% from 2024 to 2033.

The sunflower oil market is poised for substantial growth, driven by increasing consumer demand for healthier edible oils and heightened awareness of their nutritional benefits. Extracted from sunflower seeds, this oil is renowned for its light taste, high smoke point, and rich vitamin E content, making it a preferred choice among health-conscious individuals.

Its versatility spans multiple applications, including cooking, cosmetics, pharmaceuticals, and biofuel production, which amplifies its industrial appeal. Urbanization and rising disposable incomes in emerging economies have accelerated the adoption of sunflower oil in households and restaurants.

Additionally, industries such as pharmaceuticals and cosmetics are leveraging the oil’s antioxidant properties to create skincare products and health supplements, further broadening its reach. The rising demand for organic and non-GMO sunflower oil among health-conscious consumers has also catalyzed market expansion.

Health trends have significantly influenced the sunflower oil market, particularly as the prevalence of cardiovascular diseases and obesity increases. Consumers are shifting towards heart-healthy oils with low trans-fat and cholesterol levels.

Sunflower oil’s composition—rich in unsaturated fats and antioxidants—positions it as an ideal choice to meet these demands. This aligns with the surging popularity of plant-based diets, as sunflower oil is a suitable option for vegan and vegetarian lifestyles.

Government policies supporting oilseed cultivation, particularly in Europe and the Asia-Pacific region, have bolstered production capacities and stabilized supply chains. Sunflower oil’s adaptability to various climates ensures its cultivation remains a reliable agricultural practice, further supporting consistent supply in global markets.

Sunflower oil is broadly categorized into standard and high-oleic variants, each catering to distinct market segments. Standard sunflower oil contains 14–43% oleic acid, while high-oleic sunflower oil offers a significantly higher concentration of 75–90.7%, making it a premium choice for food manufacturers and cosmetic brands.

High-oleic sunflower oil’s extended shelf life and stability under high temperatures enhance its appeal, especially in gourmet cooking and premium skincare products. The adoption of advanced extraction techniques, such as cold pressing, has gained traction for ensuring the retention of nutritional value in sunflower oil.

This innovation aligns with the demand for premium product lines. Additionally, the integration of e-commerce platforms has facilitated direct consumer engagement, boosting market accessibility and fostering growth.

The global emphasis on sustainability has further elevated sunflower oil’s appeal due to its natural origin and biodegradable properties, offering an edge over synthetic alternatives in industrial applications.

Expanding sunflower cultivation in underutilized agricultural regions presents an opportunity to address supply challenges and reduce reliance on traditional producers. Moreover, the oil’s potential in biodiesel production offers a promising avenue amid the rising demand for renewable energy sources.

Key Takeaways

- The Global Sunflower Oil Market is expected to be worth around USD 48.2 Billion by 2033, up from USD 27.7 Billion in 2023, and grow at a CAGR of 5.7% from 2024 to 2033.

- In the Sunflower Oil Market, the Mid-Oleic type dominates By Type segment with a 56.5% market share.

- Processed sunflower oil leads By Product Type with a substantial 75.5% share, preferred for its versatility.

- Bottles are the favored Packaging Type in the sunflower oil market, holding a 66.4% share.

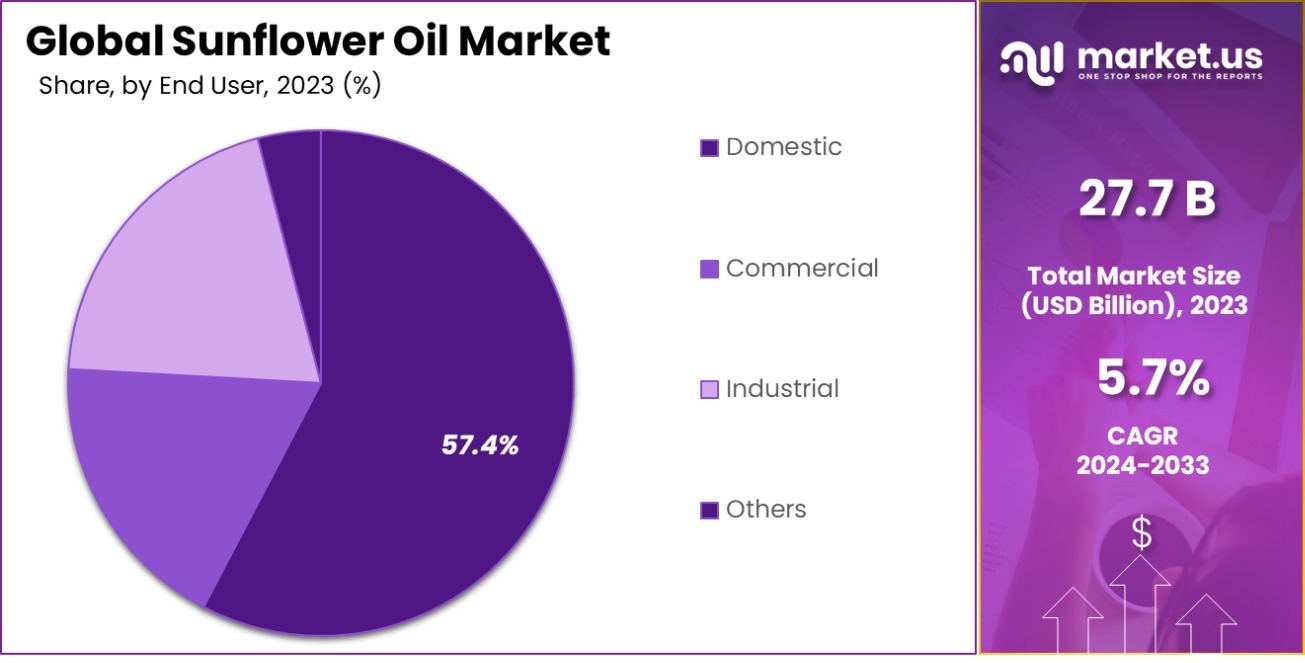

- Domestic users are the largest End-user group, consuming 57.4% of the market’s sunflower oil.

- Supermarkets are the leading Distribution Channel, distributing 46.4% of sunflower oil to consumers.

- Conventional sunflower oil dominates the By Nature category with an 82.3% share, highlighting traditional preferences.

Business Benefits of Sunflower Oil

The business benefits of sunflower oil are significant, particularly in developing regions where it supports agricultural and economic growth. In areas like Eastern Zambia, the sunflower value chain offers a viable income source for smallholder farmers, often with fewer inputs and on similar soils as staple crops like maize. This demonstrates sunflower oil’s role in promoting rural welfare and reducing poverty by providing a viable crop alternative that integrates well with local agricultural practices.

Moreover, efforts to refine sunflower oil can greatly improve its marketability, which benefits small entrepreneurs and farmers. Refining processes enhance the quality of sunflower oil by reducing impurities and preserving essential fatty acids, making the oil more appealing to consumers and retailers. This supports local industries and creates opportunities for higher profit margins from refined oil products.

Additionally, in response to global supply disruptions, initiatives such as blending sunflower oil with other vegetable oils have been explored to maintain stability and flavor in food products while addressing shortages. This not only aids in sustaining supply chains but also helps maintain economic stability for businesses reliant on vegetable oil for food production.

These factors highlight the importance of sunflower oil not just as a food product but as a crucial element in supporting sustainable agricultural practices, improving farmer livelihoods, and enhancing local economies through better processing and marketing practices.

By Type Analysis

In 2023, Mid-Oleic sunflower oil dominated its market segment, holding a significant 56.5% share due to its balanced fat composition.

In 2023, Mid-Oleic held a dominant market position in the By Type segment of the Sunflower Oil Market, with a 56.5% share. As consumers increasingly seek healthier oil options, Mid-Oleic sunflower oil has emerged as a preferred choice due to its balanced fat composition and versatility in cooking and food processing.

High-Oleic followed with a 30% market share, driven by its popularity in premium markets where its extended shelf life and high heat stability are highly valued, particularly in the snack food and bakery sectors. Linoleic sunflower oil, known for its essential fatty acid content, held the smallest share at 13.5%.

This segment’s growth is moderated by competition from other oils offering similar health benefits but with broader application capabilities or more competitive pricing. Overall, the sunflower oil market is characterized by a strong emphasis on health-oriented attributes, which significantly influence consumer preferences and shape market dynamics.

Manufacturers are focusing on innovative processing technologies to enhance the oil’s nutritional profile without compromising on taste or functionality, ensuring alignment with consumer trends toward healthier dietary choices.

By Product Type Analysis

Processed sunflower oil captured a dominant 75.5% market share, favored for its versatility and stability in various cooking applications.

In 2023, Processed held a dominant market position in the By Product Type segment of the Sunflower Oil Market, with a 75.5% share. This significant market share reflects the strong demand for processed sunflower oil across various industries, including food manufacturing, food service, and retail.

Processed sunflower oil is highly valued for its neutral flavor, light texture, and high smoke point, making it an ideal choice for frying, baking, and other cooking applications. Its widespread use in processed and packaged foods has further solidified its status as a market leader.

On the other hand, Organic sunflower oil accounted for the remaining 24.5% of the market. Although smaller in comparison, this segment has been experiencing rapid growth due to increasing consumer awareness about health and wellness, coupled with a rising preference for organic and non-GMO products.

Organic sunflower oil is often marketed as a premium product, appealing to health-conscious consumers looking for minimally processed options with traceable origins. The market for organic sunflower oil is expected to continue growing as more consumers opt for healthier and more sustainable dietary choices, potentially narrowing the gap with its processed counterpart in the coming years.

By Packaging Type Analysis

Bottles were the preferred packaging type in the sunflower oil market, claiming a 66.4% share, valued for their convenience and reusability.

In 2023, Bottles held a dominant market position in the By Packaging Type segment of the Sunflower Oil Market, with a 66.4% share. This dominant position is attributed to the consumer preference for bottled sunflower oil due to its convenience, reusability, and ease of storage. Bottles, especially plastic ones, are favored for their durability and lightweight, making them ideal for both retail and household use.

Following bottles, Jars accounted for 16.1% of the market share. Glass jars are popular among consumers who prioritize sustainability and the absence of chemical leachates, which preserves the oil’s purity and flavor. Cans held a 10.5% market share, appreciated for their long shelf life and robustness, which is particularly valued in the wholesale and food service sectors.

Lastly, Pouches made up 7% of the market. While they hold the smallest share, pouches are gaining traction due to their cost-effectiveness and lower environmental impact compared to other packaging types.

The segmentation within the packaging market reflects varied consumer preferences that balance functionality, cost, and environmental considerations. The ongoing shifts in consumer behavior towards more sustainable packaging solutions suggest potential growth opportunities for more eco-friendly options like pouches and jars shortly.

By End User Analysis

The domestic sector was the largest end-user of sunflower oil, commanding a 57.4% market share, driven by household cooking needs.

In 2023, Domestic held a dominant market position in the By End User segment of the Sunflower Oil Market, with a 57.4% share. This prevalence is primarily due to the widespread use of sunflower oil in home cooking and its status as a staple in many household kitchens.

Known for its light taste and high smoke point, sunflower oil is favored for various cooking methods, from frying to baking, making it a versatile choice for domestic users.

Commercial usage accounted for 26.3% of the market, driven by the hospitality sector, including restaurants and hotels, which value sunflower oil for its neutral flavor profile that does not overpower the taste of food.

The Industrial sector, which includes food processors and manufacturers of prepared foods, claimed 16.3% of the market share. In this sector, sunflower oil is often chosen for its nutritional benefits, such as low saturated fat content and high levels of Vitamin E.

The strong positioning of domestic use underscores the importance of health and cooking versatility in consumer choices, while the significant shares held by commercial and industrial users reflect the broad applicability of sunflower oil across different culinary and manufacturing applications.

By Distribution Channel Analysis

Supermarkets led the distribution channels for sunflower oil with a 46.4% share, offering wide accessibility and a variety of choices.

In 2023, Supermarkets held a dominant market position in the By Distribution Channel segment of the Sunflower Oil Market, with a 46.4% share. Supermarkets are a primary choice for consumers purchasing sunflower oil due to their widespread availability, variety of brand offerings, and the convenience of finding multiple grocery items in one location.

This channel’s strength is supported by robust supply chains and extensive retail networks that ensure sunflower oil is readily accessible to a broad consumer base. E-commerce followed with a 22.6% share, benefiting from the growing trend of online shopping and the increased convenience of home delivery.

The digital platform has been especially appealing for purchasing larger quantities of specialty oils that may not be available in physical stores. Specialty Stores accounted for 12.5% of the market, catering to health-conscious consumers looking for organic or non-GMO sunflower oils, which are often found in these outlets.

Convenience Stores and Direct Sales held smaller shares, at 10.8% and 7.7% respectively. Convenience stores attract customers seeking quick purchases close to home or work, while direct sales are typically driven by manufacturers selling directly to consumers or businesses, often at discounted rates or in bulk.

By Nature Analysis

Conventional sunflower oil accounted for 82.3% of the market, preferred by consumers primarily for its affordability compared to organic variants.

In 2023, Conventional held a dominant market position in the By Nature segment of the Sunflower Oil Market, with an 82.3% share. This substantial market share is largely attributed to the widespread availability and cost-effectiveness of conventional sunflower oil compared to its organic counterpart.

Conventional sunflower oil is produced in larger volumes and is more accessible in various markets, making it a go-to option for both consumers and manufacturers looking for an economical choice without specific organic preferences.

On the other hand, Organic sunflower oil accounted for the remaining 17.7% of the market. Although it commands a smaller share, the demand for organic sunflower oil is on a steady rise, fueled by increasing consumer awareness about health, wellness, and sustainable agricultural practices.

Organic sunflower oil is often perceived as a healthier alternative due to its production methods, which avoid the use of chemical pesticides and fertilizers. As more consumers shift towards healthier and more environmentally friendly products, the market for organic sunflower oil is expected to grow, potentially closing the gap with its conventional counterpart in the future.

Key Market Segments

By Type

- High-Oleic

- Mid-Oleic

- Linoleic

By Product Type

- Organic

- Processed

By Packaging Type

- Pouches

- Jars

- Cans

- Bottles

By End User

- Industrial

- Commercial

- Domestic

- Others

By Distribution Channel

- Direct Sales

- Supermarket

- Convenience Store

- Specialty Store

- E-Commerce

- Others

By Nature

- Conventional

- Organic

Driving Factors

Growing Awareness of Health Benefits Drives Demand

The sunflower oil market is significantly driven by the growing consumer awareness of its health benefits. Rich in Vitamin E and low in saturated fat, sunflower oil is increasingly seen as a heart-healthy option. As health-conscious consumers continue to seek out dietary choices that support cardiovascular health and overall wellness, the demand for sunflower oil rises.

This trend is further amplified by medical and nutritional advice that often highlights the benefits of incorporating healthy oils into daily diets.

Versatility Across Culinary Applications Enhances Popularity

Sunflower oil’s mild flavor and high smoke point make it a preferred choice for a variety of cooking methods, including frying, baking, and salad dressings. This versatility enhances its appeal in both home kitchens and professional culinary settings.

Restaurants and food manufacturers particularly value sunflower oil for its ability to cook foods thoroughly without altering their natural flavors, making it a staple ingredient across multiple food service segments. This adaptability has cemented sunflower oil’s place in diverse cooking traditions worldwide.

Expansion of Retail and Online Distribution Channels

The expansion of retail formats and the surge in e-commerce have significantly contributed to the accessibility and popularity of sunflower oil. With supermarkets stocking an array of sunflower oil brands and varieties, consumers enjoy the convenience of choice and availability.

Simultaneously, the rise of online shopping platforms offers the ease of home delivery and the option to explore specialty products not always available in stores. This increased accessibility has made sunflower oil a readily available commodity in both developed and emerging markets.

Restraining Factors

Competition from Other Vegetable Oils Limits Market Share

Sunflower oil faces stiff competition from other vegetable oils like olive oil, soybean oil, and canola oil, each of which offers specific health benefits and culinary advantages. This competition can limit the market share of sunflower oil as consumers and manufacturers opt for alternatives based on price, health properties, or suitability for particular cooking methods.

The availability of these alternatives in the market provides consumers with choices that can detract from the demand for sunflower oil, especially in regions where other oils are produced locally and are more economically priced.

Fluctuations in Sunflower Seed Prices Impact Costs

The cost of sunflower oil is highly dependent on the price of sunflower seeds, which can fluctuate due to various factors including weather conditions, agricultural practices, and geopolitical issues affecting sunflower-growing regions.

These fluctuations can lead to inconsistent pricing for sunflower oil, making budgeting difficult for both manufacturers and consumers. High volatility in seed prices can particularly deter large-scale buyers in the commercial sector, who prefer predictability in their ingredient costs to manage their financial planning effectively.

Regulatory and Environmental Challenges Affect Production

Stringent environmental regulations regarding agricultural practices can pose challenges for the production of sunflower oil. These regulations might limit the use of certain pesticides and fertilizers, affecting crop yields and quality.

Additionally, the increasing awareness and concern over environmental sustainability prompt consumers and companies to seek oils with lower environmental impacts. Sunflower oil production must adapt to these regulatory and consumer demands, which can increase production costs and affect market growth negatively if not managed efficiently.

Growth Opportunity

Rising Demand for Healthy Oils in Developing Countries

Emerging markets present significant growth opportunities for the sunflower oil industry as rising income levels and increasing health awareness drive demand for healthier dietary options. In developing countries, where Western dietary influences are becoming more prevalent, there is a growing preference for oils that offer health benefits, such as sunflower oil with its low saturated fat content.

As these markets continue to expand and urbanize, the adoption of sunflower oil is expected to increase, providing a substantial growth platform for producers and distributors.

Innovation in Product Formulation and Blending

There is a growing opportunity for innovation in the sunflower oil market through product development and oil blending techniques. By enhancing sunflower oil with other health-promoting oils, such as flaxseed or olive oil, manufacturers can cater to health-conscious consumers looking for oils with added benefits.

Additionally, developing formulations that offer higher smoke points or improved nutritional profiles can broaden the use of sunflower oil in various cooking techniques, from frying to baking, thereby attracting a wider range of consumers.

Expansion into Organic and Non-GMO Product Lines

As consumer demand for organic and non-GMO products continues to rise, there is a significant growth opportunity for sunflower oil producers to expand into these niches. Offering organic or non-GMO sunflower oil can attract health-conscious consumers who are willing to pay a premium for products that align with their dietary preferences and environmental values.

This shift towards cleaner labels and transparency in production processes can help brands differentiate themselves in a crowded market and capitalize on the premium pricing that these products often command.

Latest Trends

Increasing Popularity of High Oleic Sunflower Oil Variants

High oleic sunflower oil, known for its extended shelf life and stability at high temperatures, is becoming increasingly popular among consumers and manufacturers. This trend is driven by the oil’s suitability for high-heat cooking and industrial food production, which require oils that do not degrade easily.

High oleic variants also offer enhanced health benefits, such as a higher concentration of monounsaturated fats, aligning with consumer demands for healthier dietary options. This shift towards high-oleic sunflower oil is reshaping market offerings and consumer choices in the oil sector.

Sustainability Practices Influencing Consumer Purchasing Decisions

Sustainability is becoming a key factor in consumer purchasing decisions, and this is evident in the sunflower oil market. Consumers are increasingly looking for products that are sustainably sourced and produced with minimal environmental impact.

In response, companies are adopting more eco-friendly practices, such as using less water and energy during production and committing to deforestation-free supply chains. This trend towards sustainability not only helps protect the environment but also appeals to a growing segment of eco-conscious consumers, enhancing brand loyalty and market share.

Growth of Specialty and Artisanal Sunflower Oil Brands

The rise of specialty and artisanal brands in the sunflower oil market is a notable trend, particularly in premium segments. These brands often focus on small-batch production methods, unique flavor profiles, and artisanal quality, catering to gourmet food enthusiasts and consumers who prefer locally sourced or craft products.

This trend is supported by increasing consumer interest in the provenance and purity of their food, driving demand for oils that offer a distinct taste or health benefit not typically found in mass-produced oils. These specialty brands are carving out a niche in a market traditionally dominated by larger, mainstream brands.

Regional Analysis

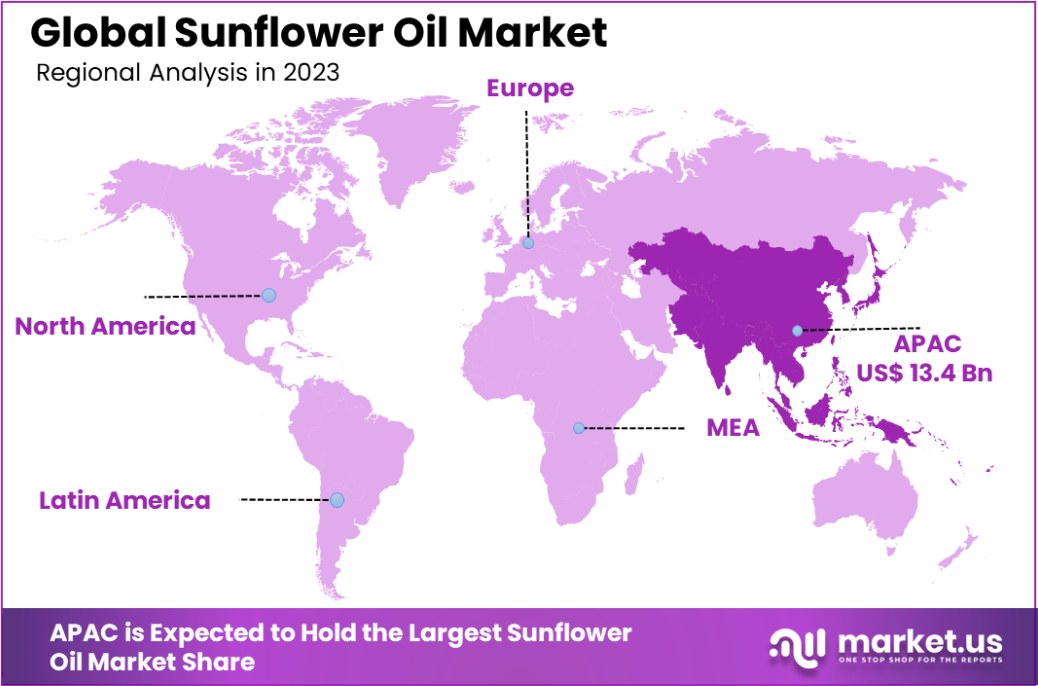

In 2023, the Asia-Pacific sunflower oil market held a 48.3% share, valued at USD 13.4 billion.

In 2023, the global sunflower oil market was prominently segmented by region, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia-Pacific emerged as the dominating region, holding a substantial 48.3% market share, with a valuation of USD 13.4 billion.

This dominance is driven by extensive agricultural activities and the increasing adoption of healthier cooking oils among the growing middle-class populations in countries such as China and India.

Europe also held a significant position in the market, attributed to its traditional cultivation of sunflower seeds and high consumer preference for sunflower oil as a dietary staple, particularly in Eastern European countries. North America, with its growing health-conscious population, has seen an uptick in demand for sunflower oil, leveraging its benefits such as high vitamin E content and low saturated fat levels.

The Middle East & Africa, and Latin America regions, although smaller in comparison, are experiencing gradual growth. In these regions, the demand is fueled by an increasing awareness of the health benefits associated with sunflower oil and a shift from traditional cooking fats to more heart-healthy oils.

Each of these regions contributes uniquely to the global market dynamics, influenced by cultural dietary habits, economic conditions, and evolving consumer preferences.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global sunflower oil market saw significant contributions from key players, each contributing to the industry’s dynamics through strategic expansions, product innovations, and market penetration efforts. Among these key companies, Cargill and Archer Daniels Midland Company stood out for their extensive market reach and comprehensive product portfolios.

Cargill, known for its robust supply chain capabilities, continued to expand its footprint in emerging markets, focusing on sustainability and high-efficiency production methods. Similarly, Archer Daniels Midland Company leveraged its global distribution network to cater to the rising demand for healthy oils, enhancing its processing technologies to ensure product purity and quality.

Conagra Brands, Inc., Bunge Ltd., and Avril Group were also pivotal in shaping the sunflower oil market landscape. Conagra Brands has strategically positioned itself by integrating innovative packaging solutions, which appeal to the convenience-driven consumer segment.

Bunge’s focus on vertical integration has allowed it to control every stage of production, from cultivation to distribution, ensuring consistent quality and cost efficiency. Meanwhile, Avril Group has invested in organic and non-GMO sunflower oil products, capturing the niche market of health-conscious consumers.

Emerging players such as Delta Wilmar CIS and Kernel have capitalized on their regional strengths, particularly in Eastern Europe, a significant sunflower oil production and consumption hub. Their localized strategies, coupled with investments in modernizing their processing facilities, have enhanced their competitive edge.

The Asian and Middle Eastern markets have seen growth through companies like Adani Wilmar and Abu Dhabi Vegetable Oil, which are tapping into the expanding middle-class populations with their affordable and diverse product offerings. These companies have also embraced digital marketing strategies to enhance consumer engagement and brand visibility.

Overall, the strategic movements within these key companies reflect a broader trend toward innovation, sustainability, and regional market adaptation, aligning with global consumer trends and regulatory landscapes.

This adaptiveness not only supports their market position but also propels the sunflower oil industry forward, making it resilient in the face of fluctuating economic and environmental conditions.

Top Key Players in the Market

- Cargill

- Archer Daniels Midland Company

- Conagra Brands, Inc.

- Bunge Ltd.

- Hanoon Oil Factory

- Colorado Mills

- PPB Group Barhad

- Parakh Group

- Abu Bhabi Vegetable Oil

- Rein Oil CC

- Aston

- EFKO

- Oliyar Production

- Delizio

- Avril Group

- Optimusagro Trade

- RISOIL SA

Marico & Rein Oil CC - Macjerry Sunflower oil

- KAISSA Oil

- Adani Wilmar

- Kernel

- Delta Wilmar CIS

- UkrOliya LLC

Recent Developments

- In 2023, Cargill focused on developing high-oleic and organic sunflower oils, catering to the demand for healthier options. Their products, known for stability and neutral flavor, are non-GMO and USDA-certified organic, aligning with industry trends towards sustainable, health-focused ingredients.

- In 2023, Archer Daniels Midland Company (ADM) effectively catered to health-conscious consumers by offering a wide range of non-GMO sunflower oils. These products are designed for various applications like frying and baking, highlighting ADM’s commitment to quality, sustainability, and market adaptability.

Report Scope

Report Features Description Market Value (2023) USD 27.7 Billion Forecast Revenue (2033) USD 48.2 Billion CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (High-Oleic, Mid-Oleic, Linoleic), By Product Type (Organic, Processed), By Packaging Type (Pouches, Jars, Cans, Bottles), By End User (Industrial, Commercial, Domestic, Others), By Distribution Channel (Direct Sales, Supermarket, Convenience Store, Specialty Store, E-Commerce, Others), By Nature (Conventional, Organic) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cargill, Archer Daniels Midland Company, Conagra Brands, Inc., Bunge Ltd., Hanoon Oil Factory, Colorado Mills, PPB Group Barhad, Parakh Group, Abu Bhabi Vegetable Oil, Rein Oil CC, Aston, EFKO, Oliyar Production, Delizio, Avril Group, Optimusagro Trade, RISOIL SA, Marico & Rein Oil CC, Macjerry Sunflower oil, KAISSA Oil, Adani Wilmar, Kernel, Delta Wilmar CIS, UkrOliya LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill

- Archer Daniels Midland Company

- Conagra Brands, Inc.

- Bunge Ltd.

- Hanoon Oil Factory

- Colorado Mills

- PPB Group Barhad

- Parakh Group

- Abu Bhabi Vegetable Oil

- Rein Oil CC

- Aston

- EFKO

- Oliyar Production

- Delizio

- Avril Group

- Optimusagro Trade

- RISOIL SA Marico & Rein Oil CC

- Macjerry Sunflower oil

- KAISSA Oil

- Adani Wilmar

- Kernel

- Delta Wilmar CIS

- UkrOliya LLC