Global Baby Food and Infant Formula Market Size, Share, Growth Analysis By Type (Infant Formula, Baby Food), By Packaging Type (Bottles, Cans, Pouches, Others), By Distribution Channel (Store, Non-store), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 22898

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

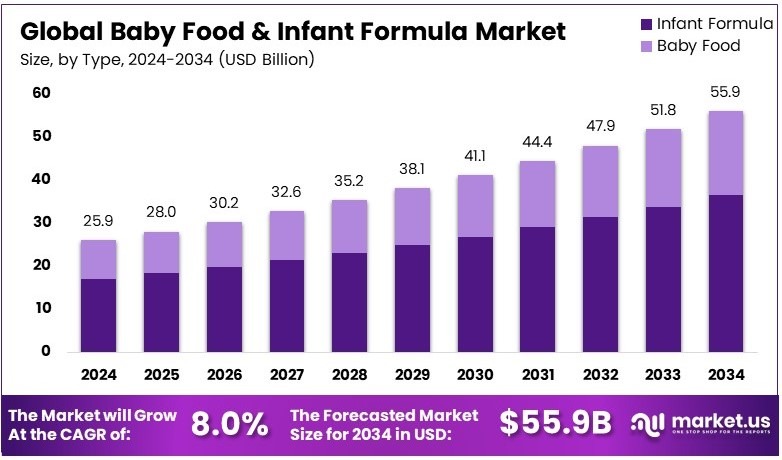

The Global Baby Food and Infant Formula Market size is expected to be worth around USD 55.9 Billion by 2034, from USD 25.9 Billion in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034.

Baby food and infant formula are specially prepared foods and nutritional products for young children and infants. These include milk-based formulas, purees, cereals, and ready-to-eat meals. Infant formulas are designed to provide balanced nutrition, substituting or complementing breast milk, ensuring healthy growth and development of babies.

Around 132.41 million babies were born globally in 2024, with 362,453 births daily. Notably, India contributed significantly with about 23,186,978 births. Therefore, strong demand for baby food and infant formula products continues, especially in densely populated countries like India, presenting attractive opportunities for market growth.

However, some markets face challenges due to declining birth rates. For instance, China’s birth rate dropped to just 6.4 births per 1,000 people in 2023. Consequently, major companies like Nestlé, Danone, Abbott, and local brands like Yili have diversified their products, targeting adult and senior nutrition to sustain business growth.

Meanwhile, concerns over product quality and nutritional standards persist. A study by The George Institute analyzed 651 baby food products in the U.S. and found approximately 60% failed World Health Organization guidelines. Specifically, 44% exceeded sugar recommendations, and 70% lacked adequate protein, potentially affecting consumer trust and market reputation.

In contrast, positive research findings offer growth opportunities. For instance, a Swedish study published in Pediatric Allergy and Immunology highlighted that introducing 13-14 different foods to infants at nine months reduced food allergies by 45%. Thus, companies may promote varied and nutritious products to attract health-conscious parents.

Overall, the baby food and infant formula market remains highly competitive. Established global brands compete fiercely with local players to win consumer loyalty. Therefore, maintaining high nutritional standards, transparency, and innovative product offerings becomes crucial to succeed in this crowded market and to retain customer trust.

Key Takeaways

- The Baby Food and Infant Formula Market was valued at USD 25.9 Billion in 2024 and is expected to reach USD 55.9 Billion by 2034, with a CAGR of 8.0%.

- In 2024, Infant Formula dominated the type segment with 65.2%, driven by growing demand for high-nutrition products.

- In 2024, Pouches led the packaging type segment with 38.4% due to convenience and extended shelf life.

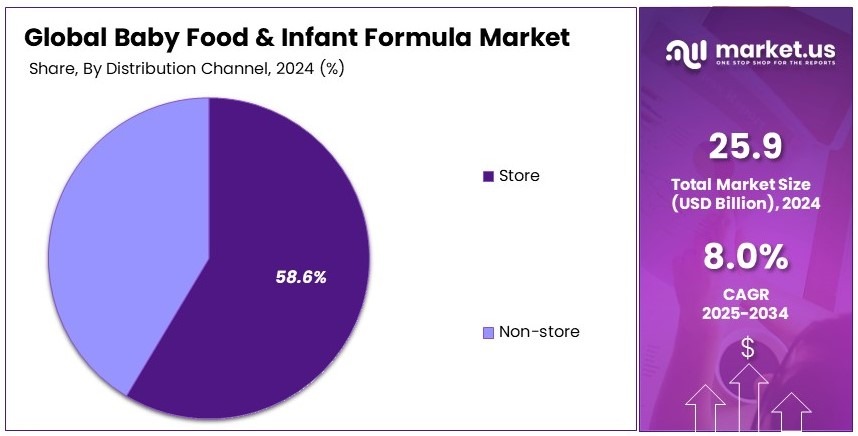

- In 2024, Store-based Distribution accounted for 58.6%, supported by consumer preference for in-person product selection.

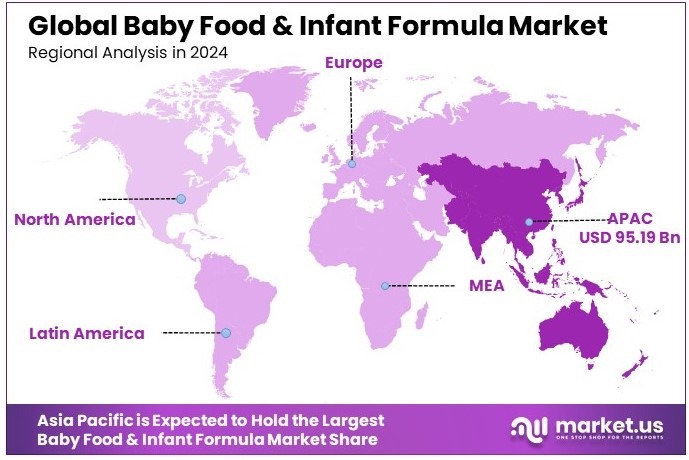

- In 2024, APAC held the leading regional market share at 37.2%, driven by rising birth rates and premium product adoption.

Type Analysis

Infant Formula dominates with 65.2% due to its essential nutritional components and ease of use for parents.

In the baby food and infant formula market, the Type segment highlights Infant Formula as the dominant force, commanding a 65.2% share. This segment’s growth is driven by the critical role formula plays in providing necessary nutrients when breastfeeding is not possible.

Infant formulas are developed to closely mimic mother’s milk, making them a vital dietary component for infants’ development. Manufacturers have continually innovated in this space, enhancing formula options to include organic and hypoallergenic varieties that cater to a broad range of health concerns and dietary restrictions.

The other sub-segment, Baby Food, although smaller in market share, plays a crucial role in the industry. This segment includes purees and solid foods that are introduced as infants grow. Baby food manufacturers are increasingly focusing on organic baby food and non-GMO ingredients, which aligns with the rising consumer demand for natural and safe products for children. This shift not only supports the health of the infant population but also builds trust and loyalty among parents seeking the best options for their children’s dietary needs.

Packaging Type Analysis

Pouches lead with 38.4% due to their convenience and innovation in packaging technology.

Packaging plays a pivotal role in the baby food and infant formula market, with Pouches taking the forefront at a 38.4% market share. This packaging type has gained popularity due to its convenience, safety, and innovation.

Pouches are easy to handle, reduce mess, and offer advanced sealing technology to preserve food quality and enhance shelf life. Their lightweight nature and portability make them ideal for on-the-go feeding, aligning perfectly with the needs of modern, mobile families.

Other packaging types such as Bottles and Cans also contribute to the sector. Bottles remain essential for liquid formulas and are favored for their reusability and sterilizability. Cans are predominantly used for powdered formulas and offer excellent protection from contamination and long-term storage benefits.

The category labeled ‘Others’ includes various innovative packaging solutions that cater to niche market demands, playing an integral part in the sustainability and environmental strategies of companies.

Distribution Channel Analysis

Store-based distribution dominates with 58.6% owing to consumer preference for purchasing through verified physical outlets.

Distribution channels are critical in the baby food and infant formula market, with Store-based channels leading at 58.6%. This dominance is supported by consumer preference for buying products from physical stores, where they can verify product integrity and have immediate access to necessities.

Physical retail also benefits from consumer trust, as parents often seek advice from store staff and appreciate the immediate product availability that stores offer.

Non-store channels, although smaller in market share, are growing rapidly, driven by the rise of e-commerce and the increasing comfort of consumers with online shopping. This channel offers convenience, often competitive pricing, and access to a wider range of products, which is particularly appealing to busy parents. As technology advances and logistic networks expand, non-store channels are expected to increase their market share, challenging the current dominance of traditional store-based distribution.

Key Market Segments

By Type

- Infant Formula

- Baby Food

By Packaging Type

- Bottles

- Cans

- Pouches

- Others

By Distribution Channel

- Store

- Non-store

Driving Factors

Parental Awareness and E-Commerce Expansion Drive Market Growth

Parents today are more informed about infant nutrition than ever before. With growing awareness of the benefits of organic food, many are choosing baby food products free from artificial preservatives, added sugars, and harmful chemicals.

Brands like Gerber and Earth’s Best cater to this demand by offering organic and non-GMO-certified options. Additionally, fortified infant formulas enriched with probiotics, DHA, and essential vitamins are becoming more popular. These products support cognitive development and gut health, making them a preferred choice for health-conscious parents.

E-commerce is another key driver of market growth. Online platforms like Amazon, Walmart, and specialty baby food websites provide convenient access to a wide range of products. Direct-to-consumer sales allow brands to educate parents through personalized recommendations and subscription services.

Government initiatives promoting infant nutrition and safe breastfeeding alternatives further boost the market. Many countries implement guidelines ensuring that formula-fed infants receive optimal nutrition. These factors together create a strong demand for high-quality baby food and formula, driving overall market expansion.

Restraining Factors

Many developed countries and even some developing ones are seeing fewer births per year, which inherently limits the customer base for infant nutrition products. For instance, China’s birth rates have fallen in recent years, prompting concern for future formula demand. Companies like Feihe (a leading Chinese formula maker) forecast a stable market only by assuming policy changes (e.g., China’s move to allow three children) will stem the decline.

The lucrative nature of the baby food market has attracted many players, from global multinationals to local startups, leading to fierce competition. Brands often compete on price promotions (where allowed) and product differentiation, but stringent marketing regulations (discussed below) can limit traditional advertising.

Competition is especially stiff in key markets like China, where domestic brands have aggressively captured share from Western companies. Additionally, parallel imports and “gray market” formula (caregivers buying foreign formula via unofficial channels) create price pressure on domestic products.

The industry has encountered supply disruptions and safety scares that challenge consumer trust. Notably, in 2022 the U.S. faced a formula shortage after safety recalls shut down a major manufacturing plant, highlighting how concentrated production and strict regulations can bottleneck supply. Such incidents raise costs for manufacturers (due to recalls and new testing requirements) and can temporarily drive consumers to alternative feeding options. Ensuring consistent, safe supply in the face of these risks is an ongoing challenge.

Growth Opportunities

Plant-Based Formulas and Subscription Services Provide Opportunities

The demand for plant-based and dairy-free infant formulas is rising. Parents are looking for alternatives that cater to lactose intolerance, milk allergies, and vegan lifestyles. Companies like Else Nutrition and Sprout Organics are responding by developing soy-based, almond-based, and oat-based formulas. These options expand the market and attract health-conscious consumers who prefer plant-based diets for their infants.

Investment in research and development is another key opportunity. Brands are focusing on innovative formulations that enhance infant health. For example, nutrient-rich baby foods fortified with superfoods like quinoa, flaxseeds, and chia seeds are gaining traction. Scientific advancements also help improve digestibility and taste, making formulas more appealing to both parents and infants.

Subscription-based baby food delivery services offer another promising avenue for growth. Companies like Yumi and Little Spoon provide fresh, organic baby food delivered to customers’ doors. These services offer convenience and assurance of quality, attracting busy parents.

Furthermore, expansion into emerging markets presents a significant opportunity. Affordable, locally sourced baby food products can bridge the gap between nutrition and cost-effectiveness, ensuring broader accessibility. These opportunities collectively support market expansion, encouraging innovation and inclusivity in infant nutrition.

Emerging Trends

Organic and Digital Parenting Trends Are Latest Trending Factors

The shift towards organic and non-GMO baby food is shaping purchasing decisions. Parents today prefer products that are free from pesticides and artificial ingredients, driving demand for certified organic brands. Companies like Happy Baby and Plum Organics lead this trend, offering clean-label options. This shift highlights the growing preference for natural and minimally processed food options for infants.

Another major trend is the influence of digital parenting communities. Parents increasingly rely on online forums, social media groups, and parenting blogs to make informed choices about baby food. Influencer endorsements and peer recommendations play a crucial role in brand trust and purchasing decisions. As a result, brands invest in digital marketing and collaborations with parenting influencers to boost visibility.

Convenience-driven packaging solutions are also gaining momentum. Ready-to-feed (RTF) formulas and on-the-go baby food pouches make feeding easier for busy parents. Portable packaging, such as squeeze pouches and resealable containers, enhances product appeal.

Additionally, personalized nutrition solutions are emerging, allowing parents to customize baby food based on their child’s dietary needs. AI-driven apps and consultations help tailor meal plans, ensuring infants receive the right balance of nutrients.

Regional Analysis

Asia Pacific Dominates with 37.2% Market Share

Asia Pacific leads the Baby Food and Infant Formula Market with a 37.2% share and valuation of USD 95.19 Billion. This dominance stems from high birth rates, increasing consumer awareness about nutritional needs, and rising middle-class affluence in the region.

The region’s strong market share is supported by a shift towards urbanization and the growing acceptance of working mothers, which boosts demand for convenient and nutritious baby food products. Major players like Nestlé and Danone have expanded their footprint in this market, offering a range of products tailored to local tastes and dietary requirements.

The future influence of Asia Pacific in the global Baby Food and Infant Formula Market is expected to grow due to ongoing urbanization and increased health awareness among parents. The region’s expanding economic status and supportive government policies on infant nutrition will likely further enhance its market share.

Regional Mentions:

- North America: North America is a significant player in the Baby Food and Infant Formula Market, with strong demand driven by health-conscious consumers and advanced food safety regulations. The market benefits from the presence of global brands and a trend towards organic and non-GMO products.

- Europe: Europe maintains a robust market share in the Baby Food and Infant Formula sector, supported by stringent safety standards and a preference for organic products. High awareness regarding infant health and nutrition among European parents continues to drive the market’s growth.

- Middle East & Africa: The Middle East and Africa are seeing growth in the Baby Food and Infant Formula Market, driven by a young population and increasing urbanization. The region is slowly adopting Western dietary habits, contributing to the rise in demand for packaged baby food.

- Latin America: Latin America’s market is growing due to increasing female workforce participation and rising awareness of infant nutrition. Local and international companies are tapping into this potential by expanding their product offerings in the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The sector is moderately consolidated, especially in infant formula. Just a handful of corporations capture a large share of global formula sales. The top players include Nestlé S.A., Danone S.A., Abbott Laboratories, and Reckitt Benckiser Group (which owns Mead Johnson Nutrition). These four companies together account for a significant portion of the market.

Nestlé (with brands like Gerber, NAN, S-26, and Cerelac) is often cited as the largest, with an estimated 10%+ of the global baby formula market by revenue (it has an even larger share in baby foods overall, given its ownership of Gerber).

Danone (maker of Aptamil, Nutrilon, Cow & Gate, etc.) and Abbott (Similac, Eleva) also each command substantial shares, particularly in premium formula. Reckitt’s Enfamil line is a market leader in North America and has international presence. Apart from these, Heinz/Kraft Heinz is notable in baby foods (especially snacks and purees) and FrieslandCampina and Mead Johnson (now part of Reckitt) are big in formula ingredients and certain regional markets.

In recent years, Chinese domestic companies have become dominant in China’s huge formula market – for example, Feihe and Yili. Feihe has grown to over 26% market share in China by 2023, surpassing international brands in that country, which in turn boosts its global standing. However, outside China, these local companies have limited presence.

Overall, North America and Europe used to be the strongholds of the top multinationals, but Asia-Pacific’s rise has reshuffled the competitive order. The Asia-Pacific region now represents the largest portion of sales (in part because it includes China), and within that region, local players (Feihe, Yili, Mengniu in China; Meiji in Japan; GCQ in Korea, etc.) hold considerable share alongside the big global firms.

This means the global market share of Nestlé or Danone might appear lower as the pie has grown with regional brands. Still, these leading companies invest heavily in R&D, marketing (within regulatory constraints), and distribution to maintain their edge worldwide.

Major Companies in the Market

- Nestlé

- Walgreen Co.

- Nutricia

- Abbott

- The Hain Celestial Group

- Holle Baby Food AG

- China Mengniu Dairy Company Limited

- Perrigo Company plc

- The Kraft Heinz Company

- DANA DAIRY GROUP

Recent Developments

- Nestlé: On March 2025, Nestlé implemented a premiumization strategy in response to declining global birth rates. The company is focusing on higher-priced baby food products, such as Sinergity, NAN, and Illuma, and targeting a 2–3% compound annual growth rate in its nutrition division from 2025 to 2027. Additionally, Nestlé is expanding its offerings to include supplements and fortified foods for the elderly.

- A2 Milk Company: On February 2025, A2 Milk Company upgraded its annual revenue guidance following a robust first half driven by increased demand in China and expansion strategies. The company declared its first dividend of NZ8.5 cents per share and is exploring merger and acquisition opportunities, including potential market expansion into Vietnam.

Report Scope

Report Features Description Market Value (2024) USD 25.9 Billion Forecast Revenue (2034) USD 55.9 Billion CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Infant Formula, Baby Food), By Packaging Type (Bottles, Cans, Pouches, Others), By Distribution Channel (Store, Non-store) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nestlé, Walgreen Co., Nutricia, Abbott, The Hain Celestial Group, Holle baby food AG, China Mengniu Dairy Company Limited, Perrigo Company plc, The Kraft Heinz Company, DANA DAIRY GROUP Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Baby Food and Infant Formula MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Baby Food and Infant Formula MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé

- Walgreen Co.

- Nutricia

- Abbott

- The Hain Celestial Group

- Holle Baby Food AG

- China Mengniu Dairy Company Limited

- Perrigo Company plc

- The Kraft Heinz Company

- DANA DAIRY GROUP