Global Onion And Shallot Flavor Market Size, Share, And Business Benefits By Type (Onion, Shallot), By Profile Type (Dehydrated, Boiled, Fried, Others), By Form (Liquid, Dry), By Category (Organic, Conventional), By Application (Household, Food Service Sector (Bakery Products, Condiments, Dairy Products, Processed Food and Snacks, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145170

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

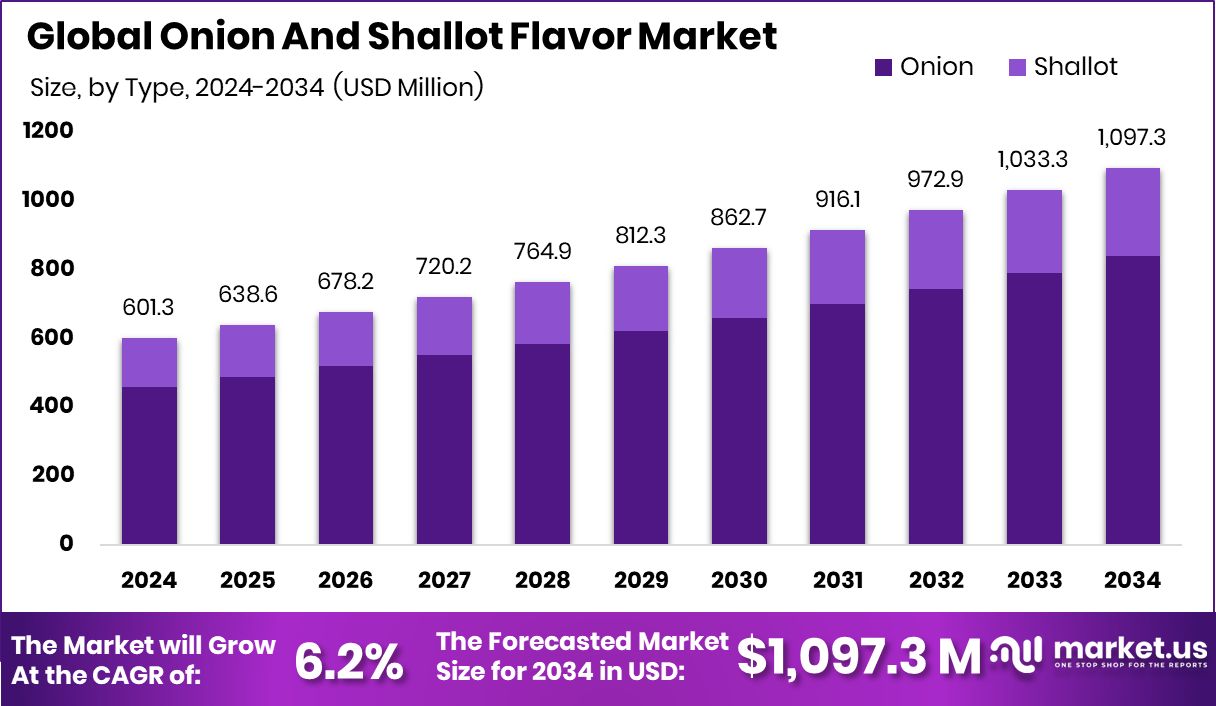

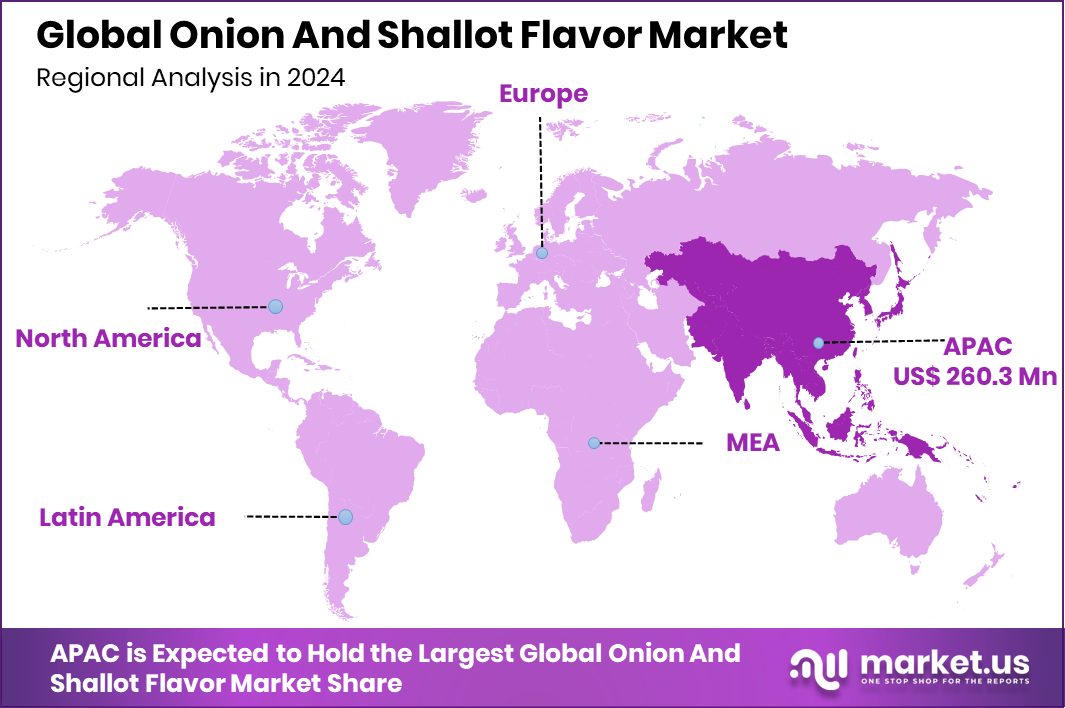

The Global Onion and Shallot Flavor Market is expected to be worth around USD 1,097.3 Million by 2034, up from USD 601.3 Million in 2024, and grow at a CAGR of 6.2% from 2025 to 2034. Asia-Pacific led regional consumption at 43.30%, highlighting market potential worth USD 260.3 million.

Onion and shallot flavor is a natural or synthetic additive used to replicate the distinctive savory, slightly sweet, and pungent notes of onions and shallots. It is commonly found in powdered, oil-based, or liquid form, designed for use in processed foods like soups, sauces, snacks, and ready-to-eat meals. These flavors are especially valuable in applications where fresh ingredients are impractical due to shelf life or production constraints.

The onion and shallot flavor market is growing steadily, driven by the booming demand for convenience foods and snack items globally. As consumers lean toward ready-made, flavorful meals, food manufacturers are incorporating such flavors to enhance taste profiles without adding fresh onions or shallots, which can complicate storage and preparation.

Growth is fueled by the rising shift toward plant-based and clean-label products. These flavors offer a way to enhance umami and savory depth in vegetarian and vegan formulations, especially where meat-based flavors are not suitable. Natural variants are gaining popularity, reflecting the clean ingredient trend across multiple food categories.

Demand is also spurred by regional cuisines entering the global mainstream. With dishes like curries, stir-fries, and stews becoming more popular worldwide, onion and shallot flavorings help recreate authentic tastes in a scalable format for mass production.

Key Takeaways

- The Global Onion and Shallot Flavor Market is expected to be worth around USD 1,097.3 Million by 2034, up from USD 601.3 Million in 2024, and grow at a CAGR of 6.2% from 2025 to 2034.

- Onion type dominates the market, accounting for 76.50% due to its broader culinary versatility.

- Dehydrated profile holds 38.30% share, driven by its longer shelf life and easy integration.

- Liquid form leads with 58.40%, favored for consistent mixing in sauces, marinades, and dressings.

- The conventional category represents 82.30%, as it aligns with current food industry processing standards and costs.

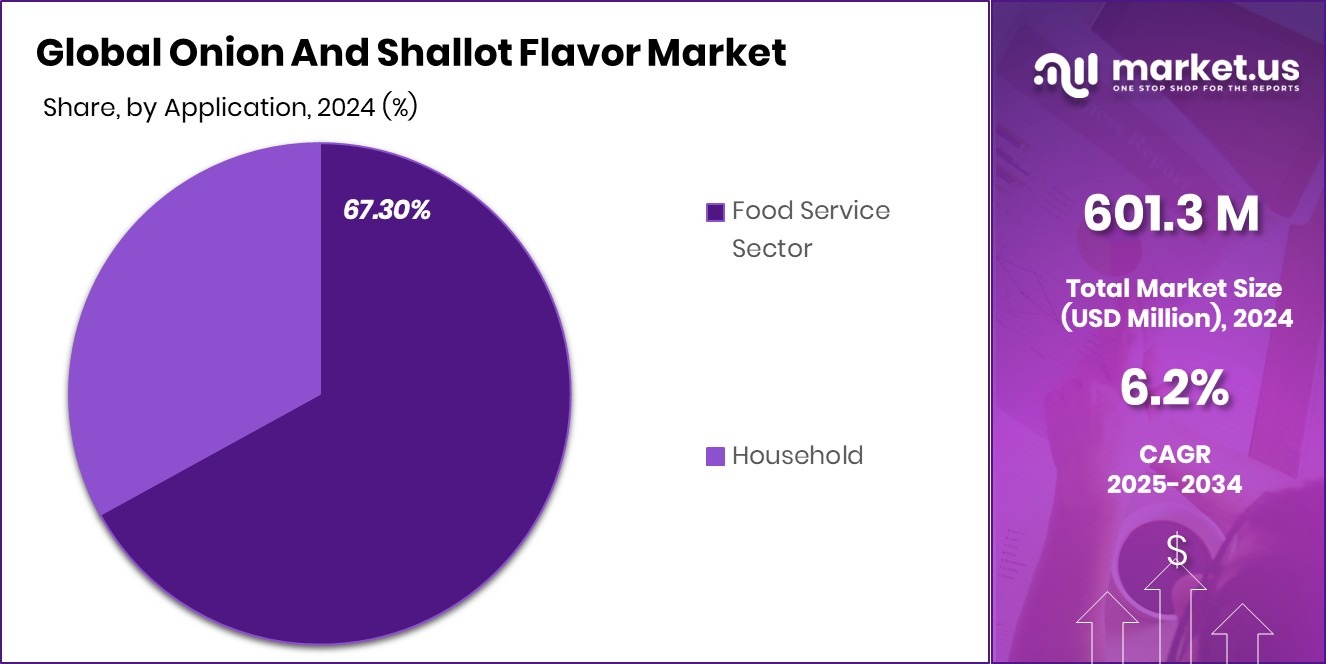

- The food service sector captures 67.30%, reflecting heavy usage in restaurants, catering, and quick-service menus.

- Strong demand for savory flavors in processed foods fueled growth in Asia-Pacific, hitting USD 260.3 million.

By Type Analysis

Onion type dominates the market share with a strong 76.50% presence.

In 2024, Onion held a dominant market position in the by-type segment of the Onion and Shallot Flavor Market, accounting for a 76.50% share. The high share is primarily attributed to the widespread use of onion flavor across a variety of food products, including soups, sauces, seasonings, snacks, and ready-to-eat meals. The onion flavor offers a strong, recognizable base note that enhances the overall depth and savory profile of processed food items, making it a go-to ingredient for manufacturers.

Shallot flavor, while niche, continues to gain traction in premium and gourmet applications where a milder, slightly sweet taste is preferred. However, it holds a comparatively smaller share due to limited mainstream adoption and higher cost of formulation.

The dominance of onion flavor is further reinforced by its cultural familiarity across multiple regional cuisines and its adaptability across different processing methods—whether dry, liquid, or encapsulated. Additionally, the growing demand for clean-label and plant-based food alternatives has driven greater use of natural onion flavorings as a substitute for meat-based umami enhancers.

By Profile Type Analysis

Dehydrated profile leads in preference, covering approximately 38.30% market demand.

In 2024, Dehydrated held a dominant market position in the By Profile Type segment of the Onion and Shallot Flavor Market, with a 38.30% share. This leading position is largely due to the convenience, long shelf life, and easy integration of dehydrated flavors in various processed food applications. Dehydrated onion and shallot flavors are widely used in dry mixes, seasoning blends, soups, and snack coatings where moisture content needs to be controlled without compromising on taste.

The popularity of dehydrated profiles also stems from their ability to deliver consistent flavor intensity during high-heat processing and extended storage. These characteristics make them a preferred choice among food manufacturers aiming for operational efficiency and flavor stability in mass production.

Compared to liquid or oil-based forms, dehydrated flavor profiles are more adaptable in powdered and shelf-stable product formats, which are increasingly in demand in global markets. With consumers seeking convenient, flavorful meal options, dehydrated onion and shallot flavors offer a practical solution that aligns with current product development trends.

By Form Analysis

Liquid form stands out, capturing 58.40% of total market applications.

In 2024, Liquid held a dominant market position in the By Form segment of the Onion and Shallot Flavor Market, with a 49.2% share. The dominance of the liquid form is driven by its superior blendability, quick flavor release, and versatility in food processing. Liquid onion and shallot flavors are widely used in soups, sauces, dressings, marinades, and frozen meals, where even dispersion and a fresh-cooked aroma are crucial for product appeal.

Manufacturers favor liquid formats for their ease of integration into both hot and cold applications. These flavors offer better control over intensity and are ideal for high-volume production environments where consistency in taste is essential. Liquid forms also align well with clean-label formulations, especially when derived from natural sources, supporting ongoing consumer demand for recognizable, transparent ingredients.

Compared to dry or encapsulated forms, liquid flavors reduce preparation time and eliminate the need for rehydration, making them highly efficient in commercial kitchens and industrial settings. Their stability in emulsified and oil-based recipes further boosts their utility across diverse product categories.

By Category Analysis

The conventional category remains preferred by 82.30%, reflecting mainstream flavor usage trends.

In 2024, Conventional held a dominant market position in the By Category segment of the Onion and Shallot Flavor Market, with a 58.40% share. This segment’s lead is primarily due to the widespread availability, cost-effectiveness, and scalability of conventional flavor production methods. Food manufacturers prefer conventional onion and shallot flavors for their consistency, high yield, and suitability for large-scale applications across snacks, seasonings, soups, and frozen meals.

Conventional flavor variants also benefit from well-established sourcing and processing infrastructure, allowing producers to maintain stable supply chains and competitive pricing. This advantage makes them an attractive option for mid- to large-scale food companies aiming to maintain product affordability without compromising on taste.

While natural and clean-label trends are growing, many mainstream products continue to rely on conventional formulations to meet consumer expectations for bold, savory flavors at accessible price points. Additionally, conventional flavors are compatible with a wide range of food matrices and processing techniques, from frying to freeze-drying, adding to their versatility.

By Application Analysis

The food service sector drives demand, accounting for 67.30% of total consumption needs.

In 2024, the Food Service Sector held a dominant market position in the By Application segment of the Onion and Shallot Flavor Market, with a 67.30% share. This substantial share is attributed to the high-volume demand for consistent, ready-to-use flavors in restaurants, catering services, quick-service chains, and institutional kitchens.

Food service providers prioritize efficiency and consistency, both of which are well supported by flavor formats tailored for commercial use, such as liquid and dehydrated forms. These flavors reduce prep time, ensure menu uniformity across locations, and support fast-paced kitchen operations.

The dominance of this segment also reflects changing consumer habits, with more people dining out or ordering food frequently. The food service industry’s constant need to deliver flavorful, cost-effective meals drives the uptake of these flavors across global markets.

Key Market Segments

By Type

- Onion

- Shallot

By Profile Type

- Dehydrated

- Boiled

- Fried

- Others

By Form

- Liquid

- Dry

By Category

- Organic

- Conventional

By Application

- Household

- Food Service Sector

- Bakery Products

- Condiments

- Dairy Products

- Processed Food and Snacks

- Others

Driving Factors

Rising Demand for Processed and Ready Meals

One of the biggest driving factors in the Onion and Shallot Flavor Market is the rising demand for processed and ready-to-eat meals. As more people lead busy lifestyles, there’s a growing need for convenient food options that don’t compromise on taste. Onion and shallot flavors help enhance the flavor of frozen meals, instant noodles, canned soups, and snack items without needing fresh ingredients.

Food manufacturers prefer these flavors because they are easy to use, have a long shelf life, and deliver a consistent taste. This demand is especially high in urban areas and among working individuals who prioritize speed and flavor.

Restraining Factors

Limited Shelf Life of Natural Flavor Variants

A key restraining factor in the Onion and Shallot Flavor Market is the limited shelf life of natural flavor variants. While consumers are increasingly choosing clean-label and natural products, natural onion and shallot flavors tend to be less stable compared to synthetic ones.

They are more sensitive to heat, light, and moisture, which can cause flavor degradation over time. This makes them harder to store, transport, and use in certain food applications—especially those involving long production or shelf cycles.

For food manufacturers, this creates challenges in maintaining consistent flavor quality in finished products. As demand for natural options grows, the industry must find better preservation and formulation methods to avoid compromising product performance and customer satisfaction.

Growth Opportunity

Expanding Use in Plant-Based Food Products

A major growth opportunity in the Onion and Shallot Flavor Market lies in their expanding use in plant-based food products. As more consumers switch to vegetarian and vegan diets, food brands are focusing on enhancing taste without using meat or animal-based ingredients.

Onion and shallot flavors offer a rich, savory profile that adds depth to plant-based burgers, sausages, soups, and dairy alternatives. These flavors help mimic the umami taste often found in meat, making plant-based meals more satisfying.

Their versatility also allows easy use across frozen, packaged, and ready-to-eat categories. As the plant-based movement grows globally, manufacturers have a strong opportunity to innovate with these flavors and meet the rising demand for flavorful, meat-free food options.

Latest Trends

Onion-Flavored Snacks Gain Popularity in Market

A notable trend in the Onion and shallot-flavored market is the increasing popularity of onion-flavored snacks. Consumers are seeking innovative and savory snack options, leading to the introduction of products like French Onion Popcorn. This snack combines the rich, umami taste of French onion soup with the convenience of ready-to-eat popcorn, appealing to those desiring gourmet flavors in accessible formats.

The success of such products reflects a broader movement towards incorporating classic, comforting flavors into modern snack items. As this trend grows, manufacturers have the opportunity to develop a variety of onion and shallot-flavored snacks, meeting the evolving preferences of consumers and expanding their market presence.

Regional Analysis

In 2024, Asia-Pacific dominated the market with a 43.30% share, reaching USD 260.3 million.

In 2024, Asia-Pacific emerged as the dominating region in the Onion and Shallot Flavor Market, accounting for a 43.30% share and reaching a market value of USD 260.3 million. This growth is primarily supported by the rising demand for processed foods, snacks, and ready-to-eat meals across densely populated markets such as China, India, and Southeast Asia.

The region’s strong food manufacturing base and rapid urbanization are key drivers of flavor ingredient consumption. North America followed as a prominent market, supported by consistent consumer demand for savory flavor enhancements in frozen meals, snacks, and restaurant-style foods. Europe also showed stable growth, backed by a mature food processing industry and a rising preference for convenient, gourmet-style products.

Meanwhile, the Middle East & Africa region recorded modest adoption levels, with growing interest from the food service sector driving gradual market penetration. Latin America experienced steady demand, particularly from fast-food and packaged meal segments. However, limited local production capabilities in MEA and Latin America slightly constrained market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Azelis Group NV continues to strengthen its role as a major distributor of specialty food ingredients, including onion and shallot flavors. The company’s strategic acquisitions and expanding distribution network across Europe and Asia are helping it offer localized flavor solutions to food manufacturers. Azelis’ technical expertise and application labs play a pivotal role in formulating customized onion and shallot flavor blends to match regional taste preferences, especially for clean-label and plant-based food products.

Boardman Foods, Inc., a U.S.-based processor, has carved out a niche through its vertically integrated operations. The company leverages its control over raw material sourcing to ensure consistent flavor quality and stability. Its investment in dehydration and freezing technologies supports large-scale supply to industrial clients in sauces, soups, and ready-to-eat meals.

Flavor Dynamics, Inc. is a strong player in the natural and artificial flavoring space, with onion and shallot forming a core segment of its savory flavor portfolio. The company is known for its agile R&D and speed-to-market capabilities. In 2024, it focuses on enhancing natural flavor intensity while reducing sodium levels, a key priority for health-conscious manufacturers.

Top Key Players in the Market

- Azelis Group NV

- Boardman Foods, Inc

- Flavor Dynamics, Inc

- Matrix Flavours & Fragrances Sdn Bhd

- Mevive International Food Ingredients Pvt Ltd

- Sensient Technologies Corporation

- Stringer Flavour. Ltd

- Symrise

- T.Hasegawa USA Inc

Recent Developments

- In January 2025, Sensient acquired Endemix, a Turkish company specializing in natural food color solutions. This acquisition enhances Sensient’s capabilities in natural ingredient offerings, potentially benefiting its onion and shallot flavor profiles.

- In September 2024, T. Hasegawa USA Inc., a leader in custom flavor and fragrance creation, acquired Abelei Flavors, Inc., a company specializing in sweet brown, citrus, and fruit flavors for the food, beverage, and nutrition industries. This acquisition expanded T. Hasegawa’s flavor portfolio and technical capabilities in North America.

Report Scope

Report Features Description Market Value (2024) USD 601.3 Million Forecast Revenue (2034) USD 1,097.3 Million CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Onion, Shallot), By Profile Type (Dehydrated, Boiled, Fried, Others), By Form (Liquid, Dry), By Category (Organic, Conventional), By Application (Household, Food Service Sector (Bakery Products, Condiments, Dairy Products, Processed Food and Snacks, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Azelis Group NV, Boardman Foods, Inc, Flavor Dynamics, Inc, Matrix Flavours & Fragrances Sdn Bhd, Mevive International Food Ingredients Pvt Ltd, Sensient Technologies Corporation, Stringer Flavour. Ltd, Symrise, T.Hasegawa USA Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Onion And Shallot Flavor MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Onion And Shallot Flavor MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Azelis Group NV

- Boardman Foods, Inc

- Flavor Dynamics, Inc

- Matrix Flavours & Fragrances Sdn Bhd

- Mevive International Food Ingredients Pvt Ltd

- Sensient Technologies Corporation

- Stringer Flavour. Ltd

- Symrise

- T.Hasegawa USA Inc