Global Carrot Powder Market Size, Share, And Business Benefits By Product Type (Organic, Conventional), By Extraction Method (Spray Drying, Freeze Drying, Drum Drying, Centrifugal Drying), By Particle Size (Coarse, Fine, Ultra-fine), By End-use (Food and Beverage Industry (Sausages, Cakes, Soups, Baby Foods, Confectionery, Jam, Fruit Juices, Others), Cosmetic Industry, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145355

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

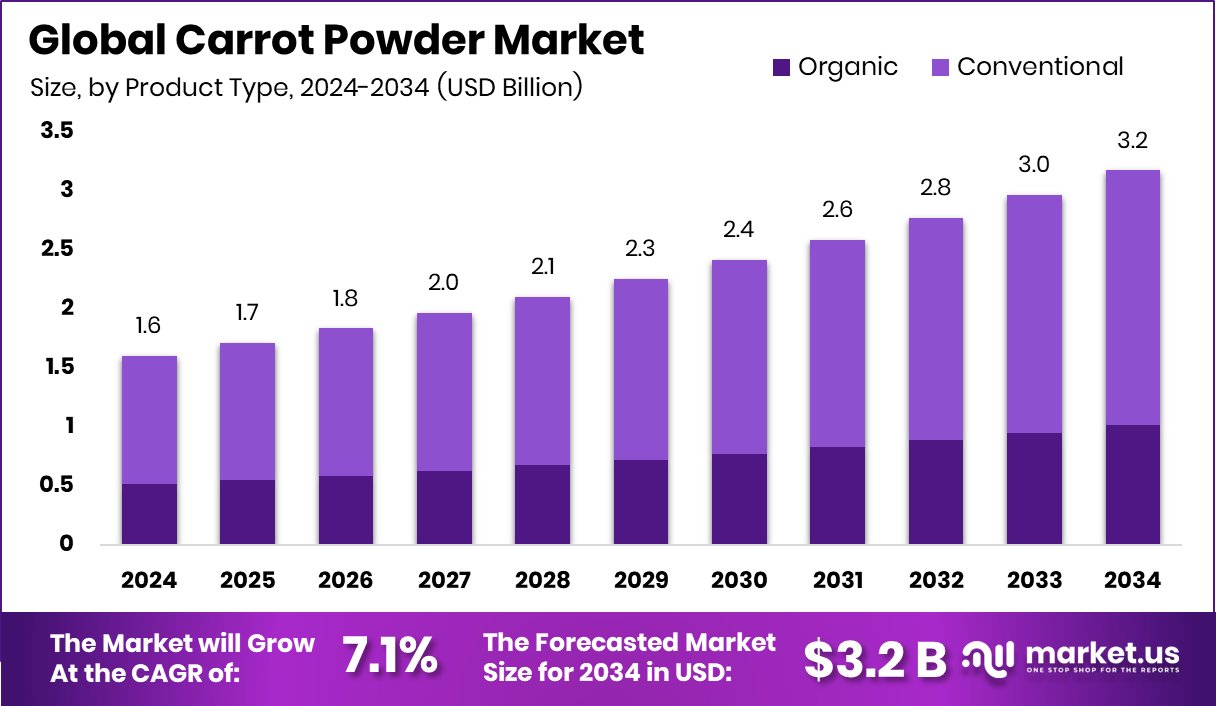

The Global Carrot Powder Market is expected to be worth around USD 3.2 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034. North America dominates the carrot powder market with a 43.40% share, reaching USD 0.6 Bn.

Carrot powder is a finely ground product made from dehydrated carrots, retaining their natural flavor, color, and nutrients. It is often used as a natural food coloring, flavoring, or nutritional ingredient in snacks, soups, sauces, baby foods, and smoothies. Since it’s shelf-stable, easy to store, and doesn’t spoil quickly, it’s a preferred option for both household and industrial use, especially in health-conscious formulations.

The carrot powder market is gaining momentum as clean-label and plant-based trends reshape the food and beverage sector. Consumers are actively seeking products with fewer synthetic additives and more natural ingredients, where carrot powder fits perfectly. Its rising use in convenience foods, functional drinks, and wellness-focused products adds to its widespread appeal.

One key growth factor is the surge in demand for organic and minimally processed food alternatives. Carrot powder, rich in beta-carotene and fiber, supports digestive health and immune function, appealing to health-aware consumers. Its ability to enhance both nutrition and flavor without artificial content makes it a versatile ingredient in modern diets.

Demand is also driven by its functional benefits in food processing. It works as a thickener, natural dye, and flavor enhancer while reducing the need for chemical additives. This dual functionality positions it well in healthy foods and snack manufacturing.

Key Takeaways

- The Global Carrot Powder Market is expected to be worth around USD 3.2 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034.

- In the Carrot Powder Market, the conventional type holds 68.30% market share globally.

- Spray drying dominates extraction methods in the Carrot Powder Market with a 43.20% share.

- Fine particle size captures 54.30% of the Carrot Powder Market consumer preference.

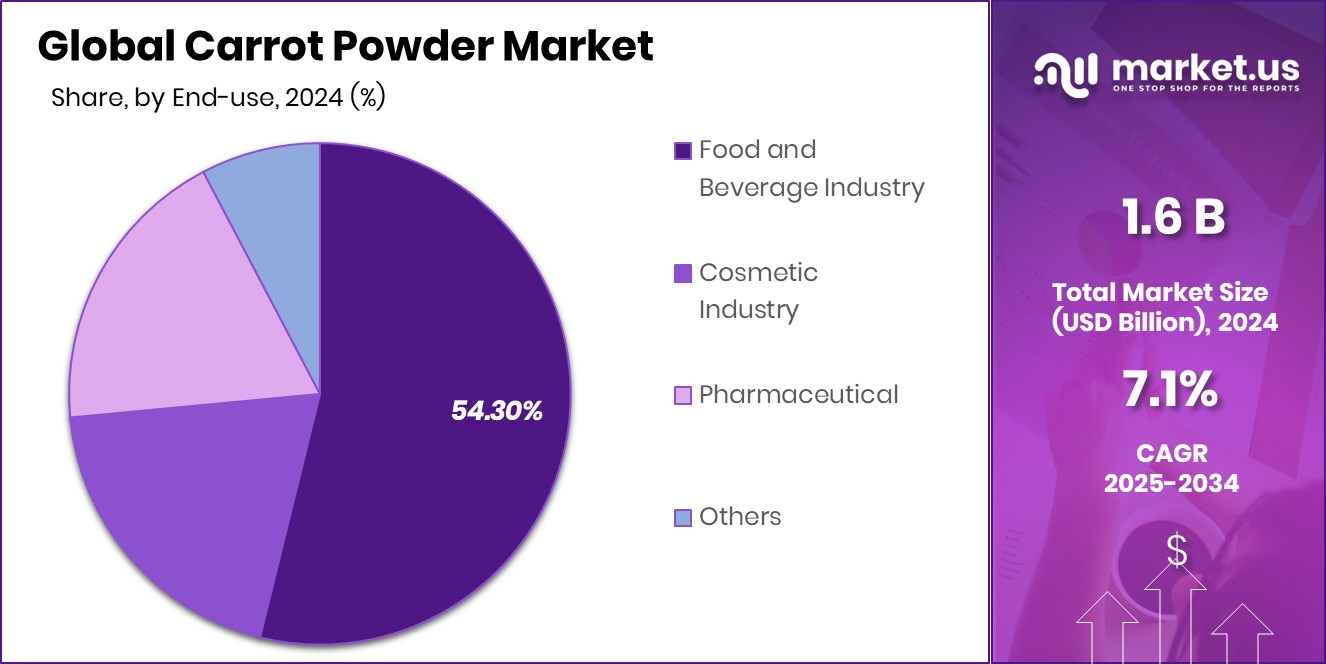

- The food and beverage industry drives 54.30% demand in the Carrot Powder Market segment.

- The carrot powder market in North America is valued at USD 0.6 Bn, with a 43.40% share.

By Product Type Analysis

Conventional carrot powder dominates with a 68.30% market share due to wide acceptance and cost-effectiveness.

In 2024, Conventional held a dominant market position in the By Product Type segment of the Carrot Powder Market, with a 68.30% share. This segment’s leadership can be attributed to its widespread availability, lower production costs, and established processing techniques. Conventional carrot powder continues to be favored by manufacturers in the food and beverage sector due to its consistent supply and cost-effectiveness.

The conventional product type also benefits from well-established agricultural practices and a broader consumer base, particularly in price-sensitive markets across Asia-Pacific and Latin America. In contrast, Organic carrot powder, though gaining traction due to the rising demand for clean-label and chemical-free products, accounted for a smaller market share in 2024. Limited organic farming acreage, higher certification requirements, and premium pricing have constrained its penetration, especially in developing regions.

Nonetheless, the organic segment is expected to gain ground in upcoming years, supported by shifting consumer preferences toward health and sustainability. However, in 2024, Conventional products outpaced Organic alternatives, firmly holding the majority share of the market, driven by economic viability and extensive industrial application.

By Extraction Method Analysis

Spray drying holds a 43.20% share, preferred for preserving color, flavor, and nutritional content efficiently.

In 2024, Spray Drying held a dominant market position in the By Extraction Method segment of the Carrot Powder Market, with a 43.20% share. This method is widely adopted due to its efficiency in large-scale production, ability to preserve the flavor and nutritional profile of carrots, and cost-effectiveness. Spray drying involves rapidly drying carrot juice or puree with hot air, which ensures that the product retains its color, taste, and nutritional content, making it highly suitable for use in processed foods, beverages, and dietary supplements.

Spray drying’s dominance is further driven by its scalability, making it the preferred extraction method for manufacturers aiming to meet the growing demand for carrot powder in the food industry. Its widespread application in ready-to-eat meals, soups, and snacks highlights its relevance in the market.

While other methods, such as freeze drying, are used for premium carrot powders due to their higher nutritional retention, they command higher production costs. As a result, Spray Drying continues to dominate in terms of volume and cost efficiency. In 2024, Spray Drying’s established position in the market reflects its ability to deliver consistent quality and performance, maintaining a significant share within the extraction method segment of the Carrot Powder Market.

By Particle Size Analysis

Fine particle size leads with 54.30%, offering better solubility and smooth texture in formulations.

In 2024, Fine held a dominant market position in the By Particle Size segment of the Carrot Powder Market, with a 54.30% share. This segment’s leadership is driven by the growing demand for fine-textured carrot powders in various applications, such as beverages, bakery products, and baby food. Fine particle size powders are preferred for their smooth consistency, better dissolvability, and ease of integration into formulations, making them suitable for a wide range of food products.

Fine carrot powder is especially favored in the nutraceutical and functional food sectors, where product uniformity and texture are crucial for consumer acceptance. Its versatility and ability to blend seamlessly with other ingredients contribute to its strong position in the market. Furthermore, the fine particle size enhances the bioavailability of nutrients, making it an attractive option for health-conscious consumers.

Although Coarse particle size powders are utilized in certain applications, such as soups and snack foods, Fine carrot powder continues to dominate the market due to its superior texture, ease of use, and consumer preference. The growing trend toward functional foods and convenience products is expected to further solidify Fine’s leading market share in the Carrot Powder Market in 2024 and beyond.

By End-use Analysis

The food and beverage industry consumes 54.30%, driven by demand for natural colorants and flavoring agents.

In 2024, the Food and Beverage Industry held a dominant market position in the by-end-use segment of the Carrot Powder Market, with a 54.30% share. This sector’s leading position is driven by the widespread incorporation of carrot powder in a variety of food and beverage applications, including snacks, soups, sauces, and beverages. Carrot powder is valued for its natural flavor, color, and nutritional benefits, making it an ideal ingredient in products that appeal to health-conscious consumers.

The Food and Beverage Industry’s dominance is further supported by the increasing consumer demand for clean-label, natural, and functional ingredients. Carrot powder is considered a convenient and cost-effective alternative to fresh carrots, offering extended shelf life and easy integration into processed food products. Its versatility allows it to be used in both savory and sweet applications, enhancing its appeal across a broad range of food categories.

The sector’s significant share is also driven by the expanding trend toward plant-based and organic foods, where carrot powder is seen as a valuable addition due to its natural properties. As the Food and Beverage Industry continues to prioritize healthy and convenient ingredients, carrot powder’s market share in this segment is expected to remain strong in 2024 and beyond.

Key Market Segments

By Product Type

- Organic

- Conventional

By Extraction Method

- Spray Drying

- Freeze Drying

- Drum Drying

- Centrifugal Drying

By Particle Size

- Coarse

- Fine

- Ultra-fine

By End-use

- Food and Beverage Industry

- Sausages

- Cakes

- Soups

- Baby Foods

- Confectionery

- Jam

- Fruit Juices

- Others

- Cosmetic Industry

- Pharmaceutical

- Others

Driving Factors

Increasing Demand for Natural Ingredients in Foods

The growing consumer preference for natural and clean-label ingredients is a key driving factor in the Carrot Powder Market. As people become more health-conscious, they are increasingly seeking out foods that are free from artificial additives and preservatives.

Carrot powder, made from a simple, natural vegetable, fits perfectly into this trend. It offers a convenient, long-lasting alternative to fresh carrots while retaining much of the nutritional value, color, and flavor.

As a result, food manufacturers are increasingly using carrot powder in a variety of products, including snacks, beverages, and baked goods, to meet the demand for healthier and more natural options. This trend is expected to drive continued growth in the carrot powder market.

Restraining Factors

High Production Costs of Organic Carrot Powder

One of the key restraining factors in the Carrot Powder Market is the high production cost associated with organic carrot powder. While there is a growing demand for organic products due to their perceived health benefits, the cost of organic farming is significantly higher than conventional methods.

Organic carrots require specific growing conditions, such as non-GMO seeds, natural fertilizers, and more labor-intensive cultivation practices. These factors drive up production costs, making organic carrot powder more expensive for manufacturers and consumers.

As a result, many companies prefer to use conventional carrot powder, which is more cost-effective, limiting the growth potential of the organic segment in the carrot powder market.

Growth Opportunity

Expansion of Carrot Powder in Plant-Based Foods

The growing popularity of plant-based diets presents a significant growth opportunity for the carrot powder market. As consumers increasingly seek vegan and vegetarian options, carrot powder serves as a versatile ingredient, enhancing the nutritional profile and visual appeal of plant-based foods.

Its rich content of vitamins, antioxidants, and natural color makes it an attractive addition to meat alternatives, dairy-free products, and other plant-based offerings. This trend aligns with the broader movement toward healthier and more sustainable food choices, positioning carrot powder as a key component in the development of innovative plant-based products.

Manufacturers can leverage this opportunity by incorporating carrot powder into their formulations to meet the evolving demands of health-conscious consumers.

Latest Trends

Increasing Demand for Natural and Organic Carrot Powder

The growing consumer preference for natural and organic products is significantly influencing the carrot powder market. As consumers become more health-conscious, they seek natural alternatives to synthetic additives in food and beverages.

Carrot powder, known for its nutritional benefits like high vitamin A content and antioxidants, fits perfectly within this trend. It is widely used in smoothies, snacks, and health supplements.

Organic carrot powder, in particular, has witnessed a surge in demand as consumers are increasingly aware of the benefits of pesticide-free products. The clean label trend further strengthens the demand for carrot powder, as it is perceived as a wholesome and safe ingredient for a variety of applications.

Regional Analysis

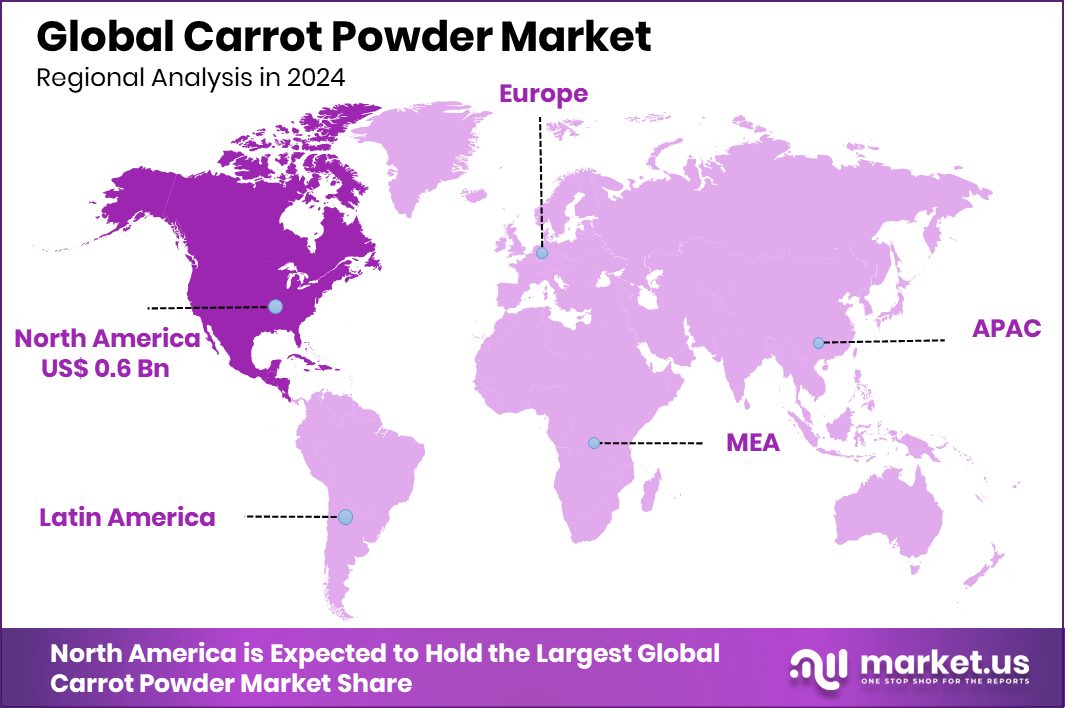

North America holds a 43.40% share in the carrot powder market, valued at USD 0.6 Bn.

The Carrot Powder Market is experiencing substantial growth across various regions, with North America leading the charge. North America holds the dominant share, accounting for 43.40% of the global market, valued at USD 0.6 billion. This growth is driven by increasing demand for natural and organic ingredients in food products, with consumers opting for healthier, additive-free alternatives.

In Europe, the market is also witnessing notable growth, bolstered by a rising consumer focus on clean-label products and organic food options. The Asia Pacific region is rapidly emerging, with increasing adoption of carrot powder in beverages, snacks, and dietary supplements. The demand in Asia Pacific is attributed to the growing health-conscious population and the expanding functional food market.

The Middle East & Africa region, although smaller in market share, is showing potential due to a rise in health trends and growing awareness of the benefits of natural ingredients. Latin America presents opportunities as well, driven by a burgeoning food processing industry and increased consumer interest in plant-based alternatives.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global carrot powder market continues to thrive, driven by increasing consumer demand for healthy, plant-based products. Key players such as Farmvilla Food Industries, Kalsec, and PENTA PURE FOODS have positioned themselves as pivotal contributors to this growth, each bringing unique strengths to the market.

Farmvilla Food Industries, known for its expertise in dehydrated vegetable products, has built a solid reputation for providing high-quality carrot powder. The company’s strategic focus on sustainability and innovative dehydration techniques ensures that its products retain nutritional value, which appeals to health-conscious consumers and the growing demand for clean-label ingredients.

Kalsec, a leader in the spice and seasoning industry, offers carrot powder that not only serves as a natural flavor enhancer but also taps into the growing trend of functional ingredients. Their strong emphasis on research and development has enabled Kalsec to deliver high-quality, versatile carrot powder suitable for a wide array of applications, from food and beverages to personal care.

PENTA PURE FOODS, with its commitment to delivering premium natural food ingredients, focuses on the production of carrot powder that meets the stringent demands of both the food and nutraceutical sectors. Their consistent product quality and innovation make them a competitive player in the market, particularly as the demand for plant-based and organic products rises.

Top Key Players in the Market

- ADM

- Biofinest

- Diana Group

- Dohler

- Farmvilla Food Industries

- Kalsec

- PENTA PURE FOODS

- Sensient Technologies Corporation

- Z Natural Foods

- Arat Company Pjs

- Henan Fitaky Food Co., Ltd

- Kagome Co., Ltd.

- Naturz Organics

- World Spice Inc.

Recent Developments

- In December 2023, ADM expanded its flavor portfolio by agreeing to acquire UK-based FDL, a developer of premium flavor and functional ingredient systems, enhancing its European foodservice presence. In early 2024, ADM further strengthened its flavor offerings by acquiring Revela Foods, a leader in dairy flavorings with $240 million in sales, bolstering its North American savory flavors segment.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 3.2 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organic, Conventional), By Extraction Method (Spray Drying, Freeze Drying, Drum Drying, Centrifugal Drying), By Particle Size (Coarse, Fine, Ultra-fine), By End-use (Food and Beverage Industry (Sausages, Cakes, Soups, Baby Foods, Confectionery, Jam, Fruit Juices, Others), Cosmetic Industry, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Biofinest, Diana Group, Dohler, Farmvilla Food Industries, Kalsec, PENTA PURE FOODS, Sensient Technologies Corporation, Z Natural Foods, Arat Company Pjs, Henan Fitaky Food Co., Ltd, Kagome Co., Ltd., Naturz Organics, World Spice Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM

- Biofinest

- Diana Group

- Dohler

- Farmvilla Food Industries

- Kalsec

- PENTA PURE FOODS

- Sensient Technologies Corporation

- Z Natural Foods

- Arat Company Pjs

- Henan Fitaky Food Co., Ltd

- Kagome Co., Ltd.

- Naturz Organics

- World Spice Inc.