Global Precision Fermentation Ingredients Market Size, Share, And Growth Analysis By Microbe (Yeast, Algae, Fungi, Bacteria, Others), By Ingredient Source (Plant-Based Fermentation Ingredients, Animal-Based Fermentation Ingredients, Microbial-Based Fermentation Ingredients), By Ingredients (Whey and Casein Protein, Egg White, Collagen Protein, Heme Protein, Enzymes, Others), By End Use (Food and Beverages, Pharmaceutical, Cosmetics, Others) , Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145201

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

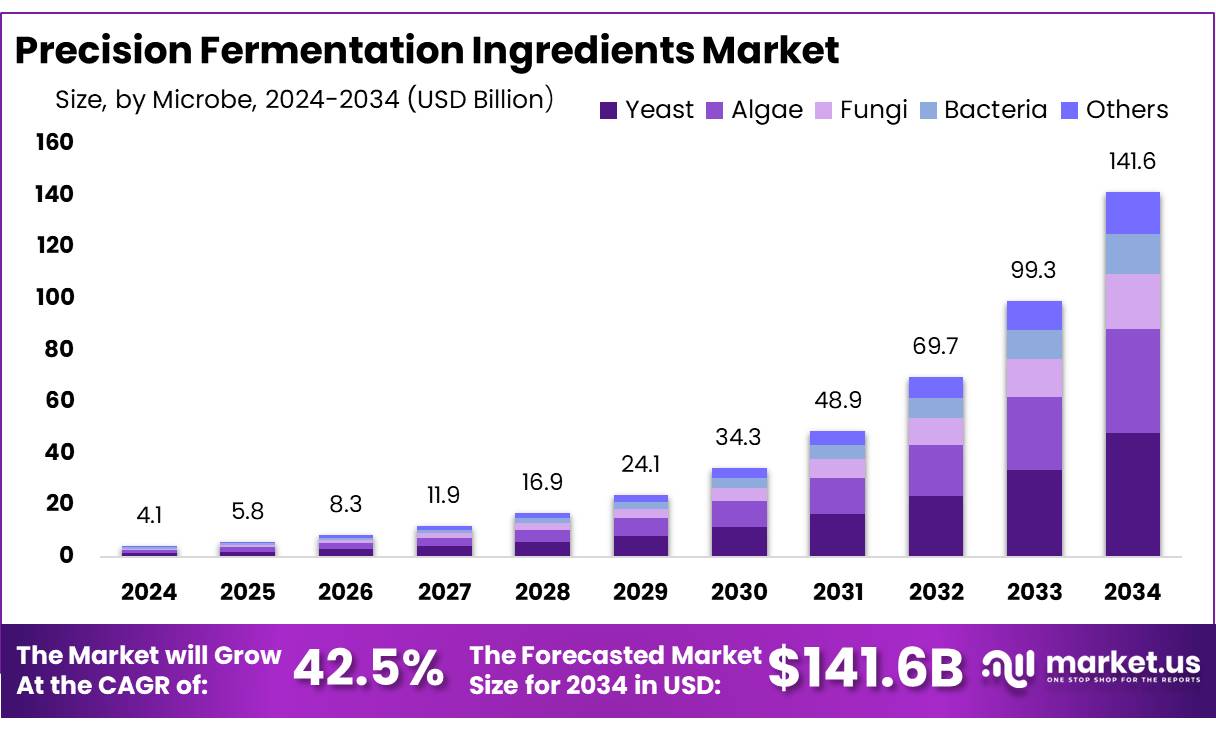

The Global Precision Fermentation Ingredients Market size is expected to be worth around USD 141.6 Bn by 2034, from USD 4.1 Bn in 2024, growing at a CAGR of 42.5% during the forecast period from 2025 to 2034.

Precision fermentation is a disruptive biotechnological innovation, enabling the controlled use of microorganisms such as yeast, bacteria, or fungi to produce complex organic compounds. Unlike traditional fermentation, which primarily aims at enhancing flavors or preserving food, precision fermentation focuses on producing specific, high-value ingredients such as proteins, enzymes, and growth factors, pivotal for industries like pharmaceuticals, agriculture, and particularly, food technology.

The precision fermentation sector has evolved significantly, propelled by consumer demand for sustainable and ethical products. With the plant-based food market projected to reach $162 billion by 2030, as noted by the Good Food Institute, the role of precision fermentation in creating animal-free dairy, egg, and meat products becomes increasingly consequential. The technology’s precision in replicating animal proteins not only meets the growing vegan and vegetarian trends but also addresses environmental concerns, making it a cornerstone of modern food science innovation.

By 2050, the global population is projected to hit 10 billion, posing a substantial challenge to food security. As per the Population Reference Bureau (PRB), the population is expected to increase by 75 million annually, or 1.1% each year. This population surge is likely to intensify the demand for food, including alternative protein sources.

In recent years, several governments have prioritized the development of alternative protein sources. Investment in research and development has focused on plant-based proteins, insect proteins, and lab-grown meat. In 2020, Singapore led the way by becoming the first country to approve the sale of cultivated meat. Similarly, the United States Department of Agriculture (USDA) announced initiatives to fund cultivated-protein research centers within the country.

Environmental sustainability, ethical concerns regarding animal welfare, and food security are key drivers propelling the precision fermentation market. Agriculture is responsible for approximately 30% of global greenhouse gas emissions, according to the United Nations Food and Agriculture Organization (FAO), and precision fermentation presents a viable solution to significantly reduce this footprint. Governments are also acknowledging the potential of this technology.

For instance, the European Union’s Farm to Fork Strategy, under the Green Deal, focuses on creating fair, healthy, and environmentally sustainable food systems, with a potential emphasis on biotechnological advancements like precision fermentation. In 2021, the U.S. Department of Agriculture allocated over $4 million in research grants to enhance the efficiency and sustainability of biobased products, indirectly advancing precision fermentation processes.

The precision fermentation sector holds substantial growth potential, driven by a growing global population and escalating pressure on natural resources. The demand for sustainable production methods is projected to rise as the market for alternative proteins, a primary application area for precision fermentation, is expected to expand by 14% annually through 2030, as reported by the FAO.

Key Takeaways

- Precision Fermentation Ingredients Market size is expected to be worth around USD 141.6 Bn by 2034, from USD 4.1 Bn in 2024, growing at a CAGR of 42.5%.

- yeast held a dominant market position within the precision fermentation ingredients sector, capturing more than a 34.40% share.

- plant-based fermentation ingredients held a dominant market position, capturing more than a 48.30% share.

- whey and casein protein held a dominant market position in the precision fermentation ingredients sector, capturing more than a 31.20% share.

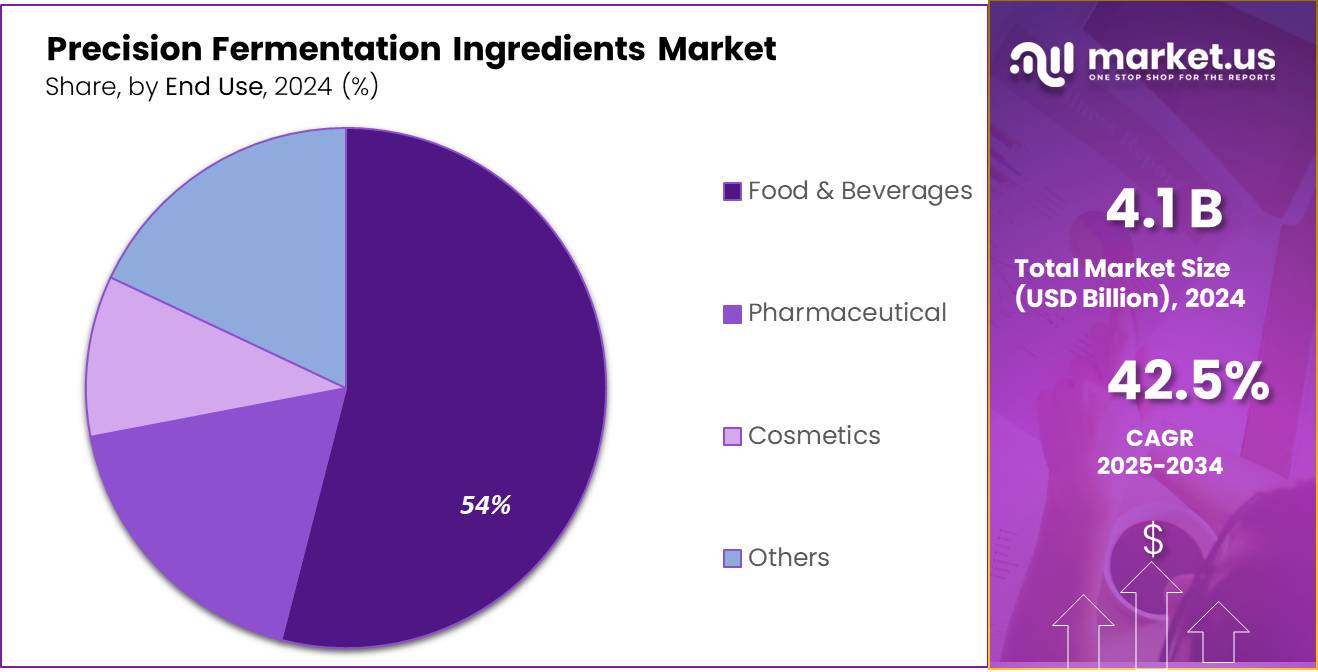

- food and beverages segment held a dominant market position in the precision fermentation ingredients market, capturing more than a 54.20% share.

By Microbe Analysis

Yeast Leads with Over a Third of the Market Share in Precision Fermentation Ingredients

In 2024, yeast held a dominant market position within the precision fermentation ingredients sector, capturing more than a 34.40% share. This notable market presence can be attributed to yeast’s crucial role in the production of a wide range of sustainable and high-demand products such as bioethanol, pharmaceuticals, and food additives.

Yeast’s versatility and efficiency in fermenting various substrates to produce valuable compounds make it a preferred microbe for both established and emerging applications in precision fermentation. Its continued dominance is supported by advancements in biotechnology that enhance yield and productivity, making yeast a key player in meeting the growing demand for eco-friendly and economically viable production methods.

By Ingredient Source Analysis

Plant-Based Fermentation Ingredients Command Nearly Half the Market in 2024

In 2024, plant-based fermentation ingredients held a dominant market position, capturing more than a 48.30% share. This segment’s strength stems from the rising consumer demand for sustainable and ethical products, which has driven the adoption of plant-based sources in fermentation processes. These ingredients are crucial for producing environmentally friendly alternatives to traditional animal-derived enzymes and proteins, catering to the vegan and vegetarian markets as well as those preferring plant-based diets.

The continued growth of this segment is fueled by technological advancements in fermentation techniques and the expanding range of applications in food, beverages, pharmaceuticals, and cosmetics. The significant market share underscores the pivotal role of plant-based ingredients in shaping the future of sustainable manufacturing practices.

By Ingredients Analysis

Whey & Casein Protein Secure Over 30% Market Share in Precision Fermentation

In 2024, whey and casein protein held a dominant market position in the precision fermentation ingredients sector, capturing more than a 31.20% share. The prominence of these proteins is largely due to their critical role in nutritional applications and food processing. Whey and casein are highly valued for their high-quality protein content, making them indispensable in the production of health-focused products like infant formulas, sports nutrition, and dietary supplements.

Their ability to enhance texture and flavor in food products further solidifies their market position. As consumers increasingly seek out protein-enriched diets for health and wellness benefits, the demand for whey and casein protein ingredients is expected to remain strong, supported by ongoing innovations in fermentation technology that improve efficiency and output.

By End Use Analysis

Food & Beverages Dominate Precision Fermentation Market with Over Half the Share in 2024

In 2024, the food and beverages segment held a dominant market position in the precision fermentation ingredients market, capturing more than a 54.20% share. This substantial market share is attributed to the widespread integration of fermentation ingredients in food production, which enhances flavor, shelf life, and nutritional value. The increasing consumer preference for natural and less processed food options has further propelled the use of these ingredients.

Moreover, the ongoing innovation in fermentation technologies that enable the cost-effective production of high-quality food additives supports the segment’s robust growth. The continued expansion of the food and beverages industry, coupled with rising health consciousness among consumers, ensures that this segment remains a cornerstone of the precision fermentation market.

Key Market Segments

By Microbe

- Yeast

- Algae

- Fungi

- Bacteria

- Others

By Ingredient Source

- Plant-Based Fermentation Ingredients

- Animal-Based Fermentation Ingredients

- Microbial-Based Fermentation Ingredients

By Ingredients

- Whey & Casein Protein

- Egg White

- Collagen Protein

- Heme Protein

- Enzymes

- Others

By End Use

- Food & Beverages

- Meat & Seafood

- Dairy Alternatives

- Egg Alternatives

- Others

- Pharmaceutical

- Cosmetics

- Others

Drivers

Increased Demand for Sustainable Protein Sources Drives Growth in Precision Fermentation

One of the major driving factors for the growth of the precision fermentation ingredients market is the increased demand for sustainable protein sources. As the global population continues to rise, projected to reach nearly 9.7 billion by 2050 according to the United Nations, the need for sustainable food production becomes more critical. Precision fermentation is positioned as a key technology capable of producing high-quality proteins with a lower environmental footprint compared to traditional animal farming.

Organizations such as the Food and Agriculture Organization (FAO) emphasize the importance of sustainable food production systems to meet the nutritional demands of the growing population while minimizing environmental impacts. The FAO has reported that traditional livestock farming is one of the significant contributors to environmental issues, including deforestation, water scarcity, and greenhouse gas emissions. In contrast, precision fermentation utilizes microorganisms to produce proteins and other food ingredients, requiring substantially less land and water, and generating fewer emissions.

The market is further bolstered by government initiatives that support sustainable agricultural practices and food technologies. For example, the European Union’s Farm to Fork Strategy aims to make food systems fair, healthy, and environmentally-friendly, which includes supporting innovative technologies like precision fermentation. This policy framework not only promotes sustainability but also encourages investment and research in alternative protein sources.

Restraints

Regulatory Hurdles Slow the Adoption of Precision Fermentation Ingredients

A significant restraining factor in the growth of the precision fermentation ingredients market is the complex and sometimes restrictive regulatory environment surrounding new food technologies. Precision fermentation, which involves using genetically modified organisms (GMOs) to produce food ingredients, faces stringent regulatory scrutiny in many countries, which can delay product launches and increase development costs.

In regions such as the European Union, the regulatory framework for GMOs is particularly rigorous. According to the European Food Safety Authority (EFSA), any GMO used in food production must undergo a comprehensive assessment to ensure its safety for human consumption. This process can be lengthy and costly, deterring many companies from pursuing innovation in this area. The EFSA’s standards require detailed studies on the genetic stability, potential allergenicity, and nutritional impacts of GMO-derived products, which must be submitted and approved before these products can be marketed.

Furthermore, public perception of GMOs continues to be a challenge. Despite scientific assurances, a significant portion of consumers remains skeptical about the safety and ethical implications of genetically modified food ingredients. This skepticism is often supported by advocacy groups that campaign against GMOs, influencing consumer choices and regulatory policies.

Governments and international bodies are aware of these challenges and have been working to address them. Initiatives like the International Service for the Acquisition of Agri-biotech Applications (ISAAA) aim to enhance understanding and acceptance of biotechnologies, including precision fermentation. However, despite these efforts, the pace of regulatory approvals remains a bottleneck, impacting the speed at which new fermentation-derived ingredients can reach the market.

Opportunity

Expanding into Alternative Proteins Offers Major Growth Opportunities for Precision Fermentation

The precision fermentation ingredients market is poised for significant growth with the expansion into alternative proteins, driven by shifting consumer preferences towards more sustainable and ethical food choices. The global alternative protein market is expected to reach $290 billion by 2035, according to a report by Boston Consulting Group (BCG) and Blue Horizon Corporation. This trend offers a substantial opportunity for precision fermentation technologies to play a critical role in developing novel protein sources that are both environmentally friendly and scalable.

Precision fermentation is uniquely capable of producing specific proteins, enzymes, and other nutritional ingredients with high efficiency and minimal resource use. This technology enables the creation of animal-free proteins that mimic traditional animal-based products in taste and texture, which is crucial for consumer acceptance. For instance, fermentation-derived proteins can be used to produce dairy alternatives, meat substitutes, and unique nutritional supplements that cater to the growing vegan and flexitarian populations.

Government initiatives also support the growth of this sector. For example, the United States Department of Agriculture (USDA) has invested in research and development projects that explore innovative food production technologies, including precision fermentation. These initiatives aim to bolster food security while reducing the environmental impact of agriculture.

Trends

Personalized Nutrition Emerges as a Key Trend in Precision Fermentation

One of the most exciting trends in the precision fermentation ingredients market is the rise of personalized nutrition, which leverages biotechnological advancements to create customized food products tailored to individual health needs and preferences. The concept is gaining traction as consumers increasingly seek diet plans and nutritional products that align specifically with their genetic profiles, lifestyle choices, and health goals.

Precision fermentation plays a crucial role in this trend by enabling the production of specialized proteins and nutrients that can be optimized for individual consumption. This technology allows for the manipulation of microorganisms to produce specific ingredients that cater to unique dietary requirements, such as allergen-free proteins or enhanced-nutrient foods.

Supporting this trend, research initiatives and government funding are increasing. For instance, the National Institutes of Health (NIH) in the United States has launched programs like the Nutrition for Precision Health, powered by the All of Us Research Program, which aims to integrate precision medicine and nutrition to tailor dietary recommendations based on individual biological profiles.

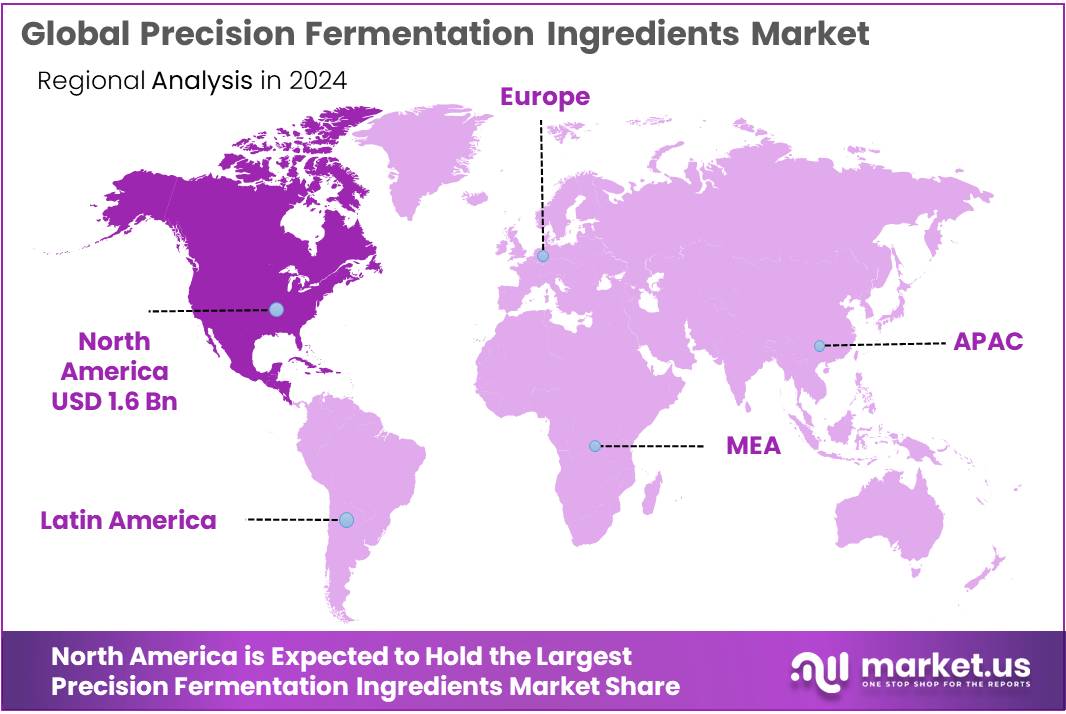

Regional Analysis

In 2024, North America held a commanding position in the precision fermentation ingredients market, capturing an impressive 41.20% market share, which translates to approximately $1.6 billion in revenue. This dominance is largely attributed to the region’s robust technological infrastructure, significant investments in biotech and food tech research, and a strong regulatory framework that supports innovation in food technologies.

The United States, in particular, is a major hub for biotechnological advancements, hosting numerous leading companies and startups in the precision fermentation space. These organizations are not only innovating in the production of traditional fermentation products but are also pioneering the development of novel ingredients for a variety of applications including dairy and meat alternatives, functional foods, and pharmaceuticals.

Moreover, consumer demand in North America for sustainable and ethical food options is driving the growth of the market. The increasing awareness among consumers about the environmental and health impacts of their food choices has led to a higher demand for clean-label and plant-based products, which precision fermentation can provide.

Government initiatives also play a crucial role in supporting the market. For instance, programs that promote sustainable agriculture and food safety, alongside investments in biotechnology research, continue to provide a favorable environment for the growth of precision fermentation industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Every Co. has distinguished itself in the precision fermentation market by producing animal-free proteins using advanced biotechnology. Their focus is on creating proteins that can seamlessly replace traditional animal-derived ingredients, particularly for use in the food and beverage industry. The company’s innovation in bioengineering not only meets increasing consumer demands for sustainable products but also addresses environmental concerns associated with traditional animal farming.

Motif FoodWorks specializes in improving the taste, texture, and nutrition of plant-based foods through precision fermentation. Their technology enhances the sensory experience of vegan and vegetarian products, making them more appealing to a broader audience. This focus on sensory qualities helps bridge the gap between plant-based and traditional animal products, aiming to revolutionize the alternative protein market.

Formo (formerly known as Legendairy Foods) is Europe’s first company to specialize in the creation of animal-free dairy products using precision fermentation. Their focus on crafting real dairy proteins without the use of animals is part of a broader effort to sustainably meet global dairy demand. Their innovative approach helps reduce the environmental impact of dairy farming while providing consumers with genuine dairy taste and texture.

Top Key Players in the Market

- Geltor

- The Every Co.

- Motif FoodWorks, Inc.

- Imagindairy Ltd.

- Formo

- Eden Brew

- Change Foods

- Myco Technology

- Fybraworks Foods

- Remilk Ltd.

- Melt&Marble

- Nourish Ingredients Pty Ltd.

Recent Developments

In 2024, The Every Co. plans to further penetrate the foodservice sector with Every Egg, providing a sustainable and cholesterol-free alternative that aligns with the growing consumer demand for ethical and environmentally friendly food options.

Motif FoodWorks has focused on the production of proteins and other ingredients that mimic the properties of animal-derived products without the environmental footprint.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Bn Forecast Revenue (2034) USD 141.6 Bn CAGR (2025-2034) 42.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Microbe (Yeast, Algae, Fungi, Bacteria, Others), By Ingredient Source (Plant-Based Fermentation Ingredients, Animal-Based Fermentation Ingredients, Microbial-Based Fermentation Ingredients), By Ingredients (Whey and Casein Protein, Egg White, Collagen Protein, Heme Protein, Enzymes, Others), By End Use (Food and Beverages, Pharmaceutical, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Geltor, The Every Co., Motif FoodWorks, Inc., Imagindairy Ltd., Formo, Eden Brew, Change Foods, Myco Technology, Fybraworks Foods, Remilk Ltd., Melt&Marble, Nourish Ingredients Pty Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Precision Fermentation Ingredients MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Precision Fermentation Ingredients MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Geltor

- The Every Co.

- Motif FoodWorks, Inc.

- Imagindairy Ltd.

- Formo

- Eden Brew

- Change Foods

- Myco Technology

- Fybraworks Foods

- Remilk Ltd.

- Melt&Marble

- Nourish Ingredients Pty Ltd.