Global Low-Fat Yogurt Market By Type (Flavored, Plain, Organic, Fruit, Others), By Nature (Organic, Conventional, By Distribution Channel (Convenience Store, Supermarkets and Hypermarkets, Specialty Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133035

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

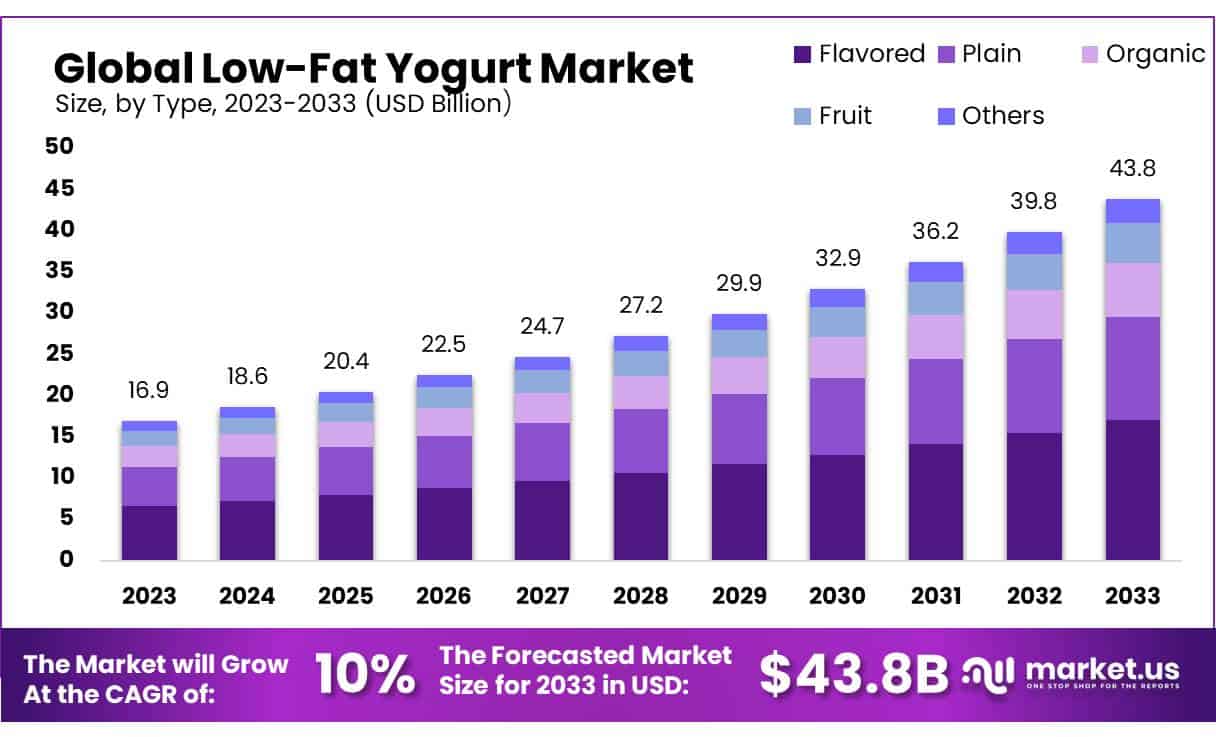

The Global Low-Fat Yogurt Market size is expected to be worth around USD 43.8 Bn by 2033, from USD 16.9 Bn in 2023, growing at a CAGR of 10.0% during the forecast period from 2024 to 2033.

Low-fat yogurt has gained significant popularity in recent years, driven by consumer demand for healthier dairy options and increasing awareness of the benefits of reduced fat intake. As of 2023, the global market for low-fat yogurt is valued at USD 25 billion and is expected to continue growing at a steady pace due to its popularity in both developed and emerging markets.

The World Health Organization (WHO) and FAO have consistently recommended reduced-fat dairy products as part of a balanced diet to manage cholesterol levels and promote heart health, contributing to the market’s expansion.

The primary end-use industries for low-fat yogurt are the food and beverage sector, particularly in the manufacturing of dairy products, smoothies, and snacks. Additionally, it is widely used in health and wellness applications due to its low-calorie and high-protein content, catering to health-conscious consumers.

According to the Food and Agriculture Organization (FAO), dairy consumption worldwide was approximately 187 million tons in 2022, with low-fat variants becoming a key part of the product offerings by dairy manufacturers.

In terms of government regulations, various regions have introduced guidelines to promote healthier eating habits. For instance, the U.S. Food and Drug Administration (FDA) has set clear nutritional standards for dairy products, encouraging manufacturers to reduce fat content without compromising the nutritional value of yogurt.

The European Union (EU) has also set limits on fat content in yogurt, with the definition of “low-fat” yogurt being restricted to products with a fat content of less than 1.5% per 100 grams, promoting healthier alternatives to whole-fat yogurt.

From a trade perspective, the global export of low-fat yogurt has been growing rapidly, particularly in regions like North America and Europe. The United States exported around USD 900 million worth of yogurt products in 2022, with low-fat variants representing a significant portion of this figure.

Germany, France, and the UK are key export hubs for low-fat yogurt, particularly for the growing Asian markets, where there is an increasing demand for Western dairy products. The European Commission reports that yogurt exports from the EU exceeded EUR 1.2 billion in 2023, with low-fat yogurt driving much of the demand.

Government and private sector investments are helping support the development of low-fat yogurt. Leading dairy companies such as Danone and Nestlé have invested significantly in expanding their portfolios of low-fat and probiotic yogurts to meet shifting consumer preferences.

Key Takeaways

- Low-Fat Yogurt Market size is expected to be worth around USD 43.8 Bn by 2033, from USD 16.9 Bn in 2023, growing at a CAGR of 10.0%.

- Flavored low-fat yogurt held a dominant market position, capturing more than a 39.2% share.

- Conventional low-fat yogurt held a dominant market position, capturing more than an 81.2% share.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 53.3% share.

- Asia Pacific (APAC) dominated the low-fat yogurt market, accounting for 35% of the total market share, valued at approximately USD 6.01 billion.

By Type

In 2023, Flavored low-fat yogurt held a dominant market position, capturing more than a 39.2% share. This segment’s popularity is driven by growing consumer demand for a variety of taste options, making flavored low-fat yogurt a convenient and appealing choice for health-conscious individuals.

Flavored varieties, which include options such as vanilla, strawberry, and mixed berries, cater to a wide range of taste preferences, helping to drive consumption across various demographics.

The Plain segment follows closely, offering a more natural yogurt option without added flavors or sugars. Plain low-fat yogurt is favored by those seeking a cleaner, unflavored option for culinary use or as a base for toppings and smoothies. Its simple composition appeals to consumers focused on minimal ingredients and the health benefits of probiotics.

Organic low-fat yogurt has gained traction due to the rising consumer preference for organic and sustainably sourced foods. In 2023, organic yogurts accounted for a growing share, as more consumers prioritize environmentally friendly and ethically produced products. These yogurts are typically made from milk sourced from organic farms, making them highly appealing to health-conscious and environmentally aware consumers.

The Fruit segment is also significant, as fruit-flavored low-fat yogurt combines the appeal of natural fruit flavors with the health benefits of yogurt. This segment is especially popular among younger consumers and those looking for a more nutritious alternative to sugary snacks.

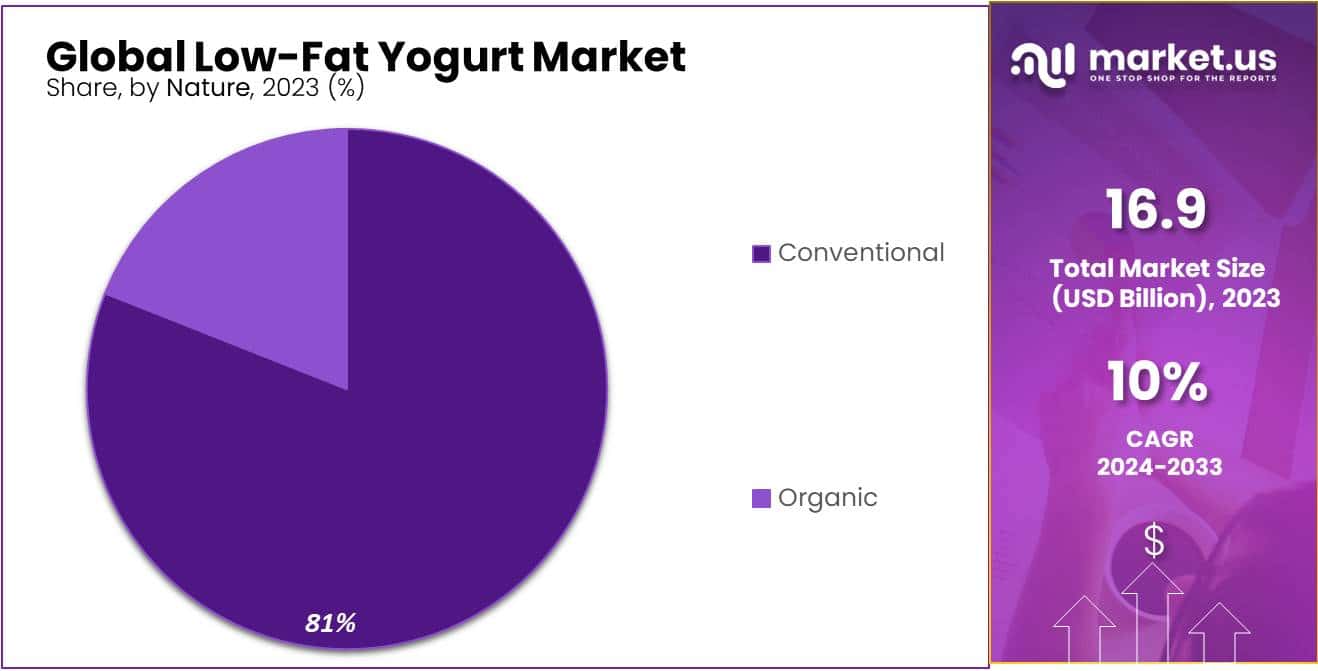

By Nature

In 2023, Conventional low-fat yogurt held a dominant market position, capturing more than an 81.2% share. This segment remains the largest due to its affordability, wide availability, and familiarity among consumers.

Conventional low-fat yogurt is typically made from milk produced through traditional farming methods, which makes it more accessible and cost-effective compared to organic alternatives. It continues to be the preferred choice for price-sensitive customers and those seeking a reliable, everyday dairy product.

The Organic segment is growing steadily, driven by increasing consumer demand for healthier, environmentally sustainable food options. Organic low-fat yogurt is produced using milk from cows that are raised without the use of synthetic pesticides, hormones, or antibiotics.

As awareness about the benefits of organic products rises, more consumers are choosing organic low-fat yogurt for its perceived health benefits and eco-friendly production methods.

By Distribution Channel

In 2023, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 53.3% share of the low-fat yogurt market. This segment continues to lead due to the wide product variety, competitive pricing, and convenience that these large retail chains offer. Supermarkets and hypermarkets provide easy access to various brands and flavors of low-fat yogurt, making them the go-to shopping destination for consumers seeking convenience and variety.

Convenience Stores are also an important distribution channel, accounting for a smaller but significant share. These stores attract customers looking for quick, on-the-go purchases. With extended hours and strategic locations, convenience stores offer consumers easy access to low-fat yogurt, especially for impulse buys or last-minute grocery needs. Although the variety in convenience stores is typically more limited, they play a key role in reaching time-sensitive shoppers.

Specialty Retailers cater to a niche market, focusing on organic, health-focused, and premium low-fat yogurt products. These retailers often offer unique or higher-end brands that emphasize quality and specialty ingredients. Although this segment has a smaller share compared to supermarkets, its importance is growing, especially as health-conscious and premium consumers seek personalized or organic yogurt options.

Key Market Segments

By Type

- Flavored

- Plain

- Organic

- Fruit

- Others

By Nature

- Organic

- Conventional

By Distribution Channel

- Convenience Store

- Supermarkets & Hypermarkets

- Specialty Retailers

- Others

Driving Factors

Rising Health Consciousness and Demand for Low-Calorie Alternatives

One of the key driving factors for the growth of the low-fat yogurt market is the increasing global demand for healthier, low-calorie food options, fueled by rising health awareness among consumers. As people become more health-conscious and seek to improve their diets, there has been a marked shift towards foods that offer nutritional benefits without compromising on taste.

In particular, low-fat yogurt has gained popularity due to its health benefits, including its high protein content, probiotics, and lower calorie profile compared to full-fat yogurt and other dairy-based products.

Health-Conscious Consumer Preferences

In 2023, a significant segment of the global population, particularly in North America and Europe, has been opting for healthier alternatives. According to a report from the World Health Organization (WHO), nearly 39% of the global population aged 18 years and older was overweight in 2023, contributing to a heightened focus on reducing calorie intake and maintaining balanced diets.

As a result, low-fat yogurt has become a preferred snack or breakfast option, given its relatively low-calorie content (typically ranging from 90 to 150 calories per serving) while still providing essential nutrients like calcium, protein, and probiotics.

Government and Industry Initiatives

Government-led initiatives promoting healthy eating habits are also driving the demand for low-fat yogurt. For example, the U.S. Food and Drug Administration (FDA) has supported campaigns to reduce the intake of saturated fats, with a particular emphasis on dairy products.

Similarly, the European Union (EU) has implemented several public health strategies aimed at encouraging healthier eating and reducing obesity rates, directly benefiting the low-fat dairy market. These initiatives create a favorable environment for low-fat yogurt brands, reinforcing the trend of consumers gravitating toward healthier choices.

Shift Towards Low-Fat Dairy Products

The global shift toward low-fat and fat-free dairy products is evident across multiple regions. In 2023, the low-fat yogurt market in North America was valued at over USD 5.2 billion, and the demand for such products continues to grow at a rate of 4.6% annually.

This growth can be attributed to both health-conscious individuals seeking to reduce their intake of saturated fats and an increasing number of fitness enthusiasts who incorporate low-fat yogurt into their diets as a source of protein without adding excess calories. The market in Europe, which holds a similar growth trajectory, recorded a 6.1% increase in low-fat yogurt consumption in 2023, driven by similar health trends.

Role of Diet Trends and Innovation in Product Offerings

Dietary trends like Keto, Paleo, and Mediterranean diets also support the rising popularity of low-fat yogurt. While some of these diets focus on low-carb or high-protein foods, many people on these diets still include low-fat yogurt as a healthy, nutritious choice.

Additionally, product innovation in the sector has further fueled growth, with low-fat yogurt now available in a variety of flavors, textures, and functional formats such as probiotic-rich, lactose-free, and plant-based alternatives. The incorporation of fruit, natural sweeteners, and added protein is appealing to consumers, helping to position low-fat yogurt as both a nutritious and enjoyable food option.

Restraining Factors

Price Sensitivity and Cost of Production

One of the major restraining factors for the low-fat yogurt market is the price sensitivity of consumers, particularly in emerging markets, and the rising cost of production. While low-fat yogurt is often marketed as a healthier alternative, the higher cost of production compared to regular yogurt can lead to price premiums that make it less accessible to price-sensitive consumers.

This issue is especially pronounced in developing economies where disposable incomes are lower and consumer priorities often center around affordability. According to the Food and Agriculture Organization (FAO), nearly 30% of the global population lives in low-income regions, where purchasing decisions are heavily influenced by cost.

Increased Production Costs

The production of low-fat yogurt generally involves specialized processes to reduce fat content, while still maintaining the product’s taste, texture, and nutritional profile. These processes often require advanced equipment, higher quality raw materials, and additional ingredients, all of which increase the overall cost of production.

For instance, dairy farmers must provide milk with lower fat content, or additional steps may be needed to remove fat after the milk is processed. Additionally, the increasing costs of milk, labor, and energy in key dairy-producing countries are compounding the challenges. In 2023, global milk prices surged by 14%, driven by factors such as climate change, rising feed costs, and global supply chain disruptions.

Price Sensitivity in Developed Markets

Even in developed markets, such as North America and Europe, consumers are increasingly price-conscious, especially in times of economic uncertainty. As inflationary pressures affect household budgets, some consumers may opt for regular yogurt or other lower-cost alternatives.

This trend is reflected in the 2023 European Union (EU) report, which highlighted that 28% of European consumers were switching to more affordable dairy products due to rising living costs. In fact, in 2023, the low-fat yogurt market in Europe grew at a relatively slower rate of 2.3%, compared to the growth in other health-conscious segments, suggesting that price sensitivity continues to affect consumer behavior in this region.

Impact of Alternatives and Plant-Based Substitutes

Another factor contributing to the pricing challenge is the growing popularity of plant-based yogurt alternatives. These alternatives, often made from soy, almond, coconut, or oats, are increasingly perceived as healthier and environmentally friendly, appealing to both vegans and lactose-intolerant consumers. While these plant-based options are typically priced higher than traditional dairy products, they do not face the same production cost constraints as low-fat dairy yogurts.

According to the Plant-Based Foods Association (PBFA), the plant-based yogurt market grew by 15% in 2023, attracting a significant portion of health-conscious and environmentally aware consumers. The increasing availability and variety of plant-based yogurt alternatives thus pose a competitive challenge to the low-fat yogurt segment, particularly in terms of pricing.

Economic Factors and Global Supply Chains

The ongoing volatility in global supply chains, including the transport and distribution of dairy products, further exacerbates the cost issues. The World Bank reported in 2023 that supply chain disruptions due to factors like the COVID-19 pandemic, geopolitical tensions, and labor shortages resulted in higher transportation costs and delays in product availability. These disruptions, along with the increased costs of raw materials, directly impact the pricing structure for low-fat yogurt producers, ultimately influencing the price at which consumers can access the product.

Growth Opportunity

Rising Health Consciousness and Demand for Functional Foods

A major growth opportunity for the low-fat yogurt market is the increasing consumer demand for functional foods, driven by a heightened focus on health and wellness. As consumers become more health-conscious, they are seeking food products that not only offer basic nutritional value but also provide added health benefits. Low-fat yogurt, which is rich in protein, calcium, and probiotics, is well-positioned to meet this demand.

It aligns with the growing trend of consumers opting for foods that support digestive health, immune function, and weight management. According to the World Health Organization (WHO), the global incidence of obesity and related non-communicable diseases has been rising, contributing to a shift toward healthier diets. This trend is reflected in the increasing popularity of low-fat yogurt as a healthier snack and breakfast option.

Health Trends Supporting Low-Fat Yogurt Consumption

In 2023, more than 39% of adults globally were categorized as overweight or obese, as per the World Health Organization (WHO). This has sparked a global movement towards healthier eating habits. As part of this shift, many consumers are incorporating low-fat yogurt into their daily diets as a way to maintain a balanced, low-calorie, and nutrient-rich diet.

Low-fat yogurt, with its lower calorie content (often ranging between 90-150 calories per serving) and high protein and probiotic content, serves as a desirable alternative to high-calorie, sugar-laden snacks. In markets like North America and Europe, where health-consciousness is high, low-fat yogurt consumption has increased significantly, with the U.S. low-fat yogurt market projected to grow at a 4.7% CAGR from 2023 to 2028, according to estimates by the U.S. Food and Drug Administration (FDA).

Government Initiatives and Policies

Government initiatives aimed at promoting healthier lifestyles are also creating opportunities for the low-fat yogurt market. In developed regions like North America and Europe, governments have introduced public health policies encouraging reduced intake of saturated fats and increased consumption of low-fat dairy products.

In 2023, the European Commission launched a new initiative aimed at promoting healthy diets, which includes guidelines for reducing daily fat intake. This policy directly benefits low-fat dairy products, including low-fat yogurt, as consumers are encouraged to choose lower-fat options to improve their overall health. Similarly, in the U.S., the Healthy People 2030 initiative by the Department of Health and Human Services (HHS) aims to reduce obesity rates, supporting the demand for healthier dairy alternatives like low-fat yogurt.

Innovation and Product Diversification

In addition to health trends, innovation in the low-fat yogurt market is creating new growth opportunities. Manufacturers are introducing a wide variety of low-fat yogurt products that cater to specific dietary needs, such as lactose-free, high-protein, or probiotic-rich formulations. This diversification is attracting a broader consumer base, including individuals with dietary restrictions and fitness enthusiasts.

The rise in plant-based diets also opens up opportunities for the introduction of dairy-free, low-fat yogurt alternatives made from plant-based milks such as almond, soy, and coconut. According to the Plant-Based Foods Association, the plant-based yogurt segment grew by 15% in 2023, indicating strong demand for dairy-free alternatives. As consumer preferences evolve, manufacturers are responding with new product lines that combine low-fat and plant-based qualities, further expanding the market.

Growing Popularity in Emerging Markets

In emerging markets, the increasing adoption of Western dietary habits, along with rising disposable incomes, presents a significant opportunity for low-fat yogurt manufacturers. According to the Food and Agriculture Organization (FAO), dairy consumption in Asia-Pacific is expected to grow by 3.5% annually between 2023 and 2028, driven by an expanding middle class and greater health awareness.

Latest Trends

Increasing Demand for Plant-Based Low-Fat Yogurt

One of the key emerging trends in the low-fat yogurt market is the increasing demand for plant-based low-fat yogurt alternatives. As consumers become more health-conscious and adopt plant-based diets, there is a noticeable shift toward dairy-free options that still maintain the health benefits of traditional yogurt.

This trend is being driven by multiple factors, including health concerns, lactose intolerance, and growing environmental consciousness, as plant-based foods are perceived as more sustainable and eco-friendly.

Health Consciousness and Lactose-Free Preferences

Health-conscious consumers, particularly in North America and Europe, are increasingly avoiding dairy products due to lactose intolerance or a preference for foods perceived as healthier. According to a report from the National Institutes of Health (NIH), around 65% of the global population experiences some form of lactose malabsorption, which has led to an increased demand for lactose-free and dairy-free yogurt alternatives.

As a result, companies in the yogurt sector have expanded their product offerings to cater to this growing consumer base by introducing plant-based low-fat yogurt products made from almonds, coconuts, soy, and oats. These products not only serve those with lactose intolerance but are also appealing to vegans and environmentally conscious consumers who are seeking plant-based alternatives.

Government Support for Plant-Based Products

Governments worldwide are also encouraging the shift towards plant-based and low-fat food options, which is further accelerating the growth of this segment. In Europe, for instance, the European Commission’s Farm to Fork Strategy aims to promote healthy eating and more sustainable food systems.

This includes supporting the growth of plant-based food products to meet the nutritional needs of a diverse population. Additionally, the U.S. Department of Agriculture (USDA) and the Food and Drug Administration (FDA) have recognized the nutritional benefits of plant-based dairy alternatives, including their role in providing protein, vitamins, and probiotics while offering lower fat content compared to traditional dairy yogurt.

Sustainability and Eco-Conscious Consumption

The environmental impact of food production is another factor driving the growth of plant-based low-fat yogurt. Plant-based alternatives are often seen as more sustainable compared to dairy products, with lower greenhouse gas emissions and a smaller environmental footprint.

According to the Food and Agriculture Organization (FAO), plant-based foods require significantly less land, water, and energy to produce than animal-based products. This growing awareness of environmental sustainability is influencing consumer purchasing decisions. A survey by Nielsen found that 48% of global consumers are actively seeking products that contribute to sustainability, and this trend is particularly strong among younger consumers who are more inclined to choose plant-based and environmentally friendly options.

Innovation in Plant-Based Yogurt Products

The plant-based low-fat yogurt segment is also benefiting from significant product innovation. Manufacturers are focusing on improving the taste, texture, and nutritional content of plant-based yogurts to make them more comparable to traditional dairy yogurts. For instance, newer formulations now incorporate more probiotic strains, higher protein content, and natural flavorings.

Companies like Danone and Chobani have expanded their product lines to include a variety of plant-based low-fat yogurt options that appeal to different consumer preferences. In 2023, Danone’s plant-based yogurt range alone was valued at over USD 1.5 billion, showcasing the success of this trend.

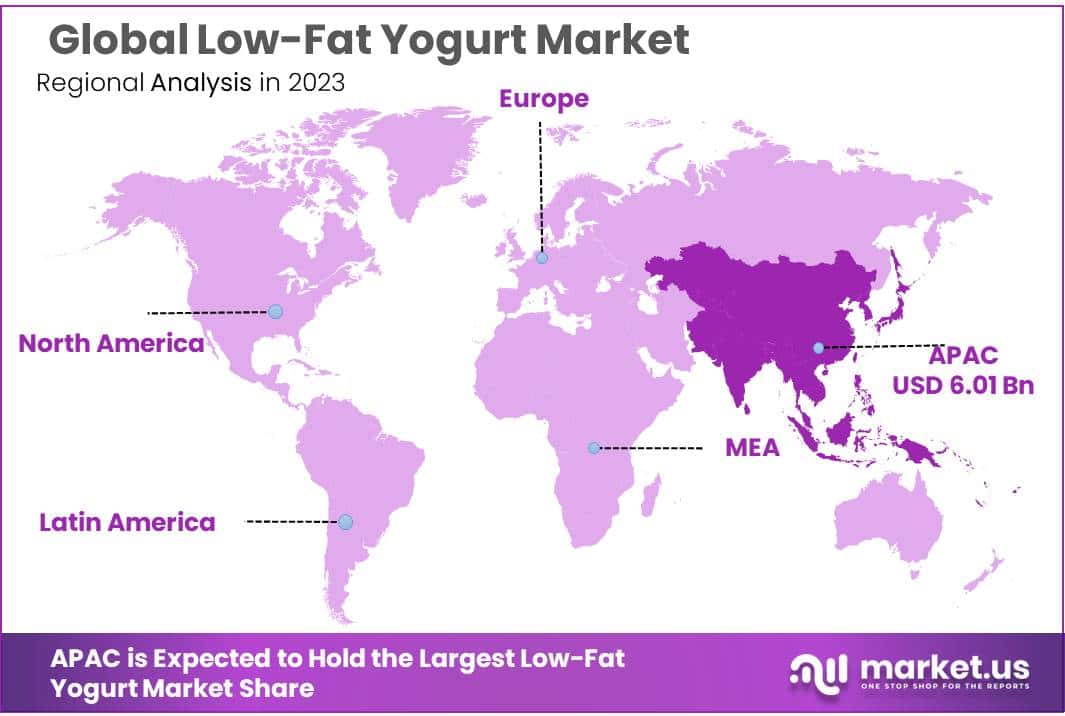

Regional Analysis

In 2023, Asia Pacific (APAC) dominated the low-fat yogurt market, accounting for 35% of the total market share, valued at approximately USD 6.01 billion. The strong growth in APAC is attributed to the increasing awareness of health benefits associated with low-fat yogurt, particularly in countries like China and India, where urbanization and rising disposable incomes are driving consumer demand for healthier food options.

Additionally, the increasing popularity of Western-style diets, along with growing concerns about obesity and lactose intolerance, has significantly boosted the demand for low-fat and probiotic-rich yogurt products in the region.

North America is another key region in the global low-fat yogurt market, capturing a substantial share due to high consumer preference for dairy products and an established market for healthy eating. In 2023, the North American market was valued at USD 3.5 billion, with the U.S. being the largest consumer of low-fat yogurt products. The demand is being driven by the increasing trend towards low-calorie and protein-rich snacks, as well as rising awareness about the importance of gut health and probiotics.

Europe follows closely behind with a significant share, driven by the region’s long tradition of yogurt consumption. In 2023, the European low-fat yogurt market was valued at USD 4.1 billion, with leading markets in Germany, France, and the UK. Europe has also witnessed a rise in plant-based and organic low-fat yogurt options, catering to growing consumer preferences for vegan and lactose-free products.

The Middle East & Africa and Latin America are emerging markets with moderate growth rates. In these regions, consumer awareness of the health benefits of low-fat yogurt is gradually increasing, but the market size remains smaller compared to more mature regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The low-fat yogurt market features a mix of well-established global brands and regional players. Key companies such as Danone, Nestlé, Chobani, and General Mills Inc. dominate the market, leveraging their broad distribution networks, established brand recognition, and diverse product portfolios.

Danone, one of the largest players in the yogurt segment, has made significant investments in the low-fat yogurt category, particularly through its Activia and Oikos brands, both of which offer probiotic and low-fat yogurt options. Similarly, Nestlé has a strong presence in the low-fat yogurt market with its range of healthy dairy products, including Yogurt Division and plant-based alternatives.

Regional players such as Bright Dairy and Food (China), Juhayna Food Industries (Egypt), and Byrne Dairy (U.S.) also contribute to the market, focusing on regional preferences and local dairy production. Chobani, a leader in the U.S. low-fat yogurt market, has significantly expanded its presence by introducing a variety of flavors and promoting the health benefits of low-fat, protein-rich options.

Fage International S.A., Muller UK & Ireland Group, and Yakult Honsha (known for probiotic-based products) have similarly expanded their portfolios to cater to growing consumer demand for healthy, low-fat, and nutrient-dense yogurts.

In addition, companies like Kraft Foods, Tillamook, and Lausanne Dairies focus on leveraging innovative formulations, such as incorporating organic ingredients and probiotics, which align with evolving consumer preferences for clean label and functional food options.

Ultima Foods Inc. and Jesa Farm Dairy also offer region-specific products, tailoring their offerings to local tastes and dietary needs. These players are expected to continue driving growth through strategic product innovations, acquisitions, and marketing campaigns targeted at health-conscious consumers.

Top Key Players in the Market

- Bright Dairy and Food

- Brookside Dairy Limited

- Byrne Dairy

- Chobani

- CP-Meiji Company Ltd.

- Danone

- Fage International S.A.

- General Mills Inc.

- Gopala

- Jalna Dairy Foods

- Jesa Farm Dairy

- Juhayna Food Industries

- Kraft Foods Groups

- Lausanne Dairies

- Muller UK & Ireland Group

- NANCY’S

- Nestle

- Parmalat S.p.A. (Lactalis American Group Inc)

- Rainy Lanes Dairy Foods Ltd.

- Tillamook

- Ultima Foods Inc.

- Wallaby Yogurt Company

- Yakult Honsha

Recent Developments

In 2023 Bright Dairy and Food, the company increased its production capacity by 12%, and its yogurt products, including low-fat varieties, contributed to an 18% year-over-year increase in dairy sales.

In 2023, Brookside reported a revenue of approximately USD 1.2 billion, with a growing portion of this revenue coming from its range of yogurt products, including low-fat variants.

Report Scope

Report Features Description Market Value (2023) USD 16.9 Bn Forecast Revenue (2033) USD 43.8 Bn CAGR (2024-2033) 10% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Flavored, Plain, Organic, Fruit, Others), By Nature (Organic, Conventional, By Distribution Channel (Convenience Store, Supermarkets and Hypermarkets, Specialty Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bright Dairy and Food, Brookside Dairy Limited, Byrne Dairy, Chobani, CP-Meiji Company Ltd., Danone, Fage International S.A., General Mills Inc., Gopala, Jalna Dairy Foods, Jesa Farm Dairy, Juhayna Food Industries, Kraft Foods Groups, Lausanne Dairies, Muller UK & Ireland Group, NANCY’S, Nestle, Parmalat S.p.A. (Lactalis American Group Inc), Rainy Lanes Dairy Foods Ltd., Tillamook, Ultima Foods Inc., Wallaby Yogurt Company, Yakult Honsha Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bright Dairy and Food

- Brookside Dairy Limited

- Byrne Dairy

- Chobani

- CP-Meiji Company Ltd.

- Danone

- Fage International S.A.

- General Mills Inc.

- Gopala

- Jalna Dairy Foods

- Jesa Farm Dairy

- Juhayna Food Industries

- Kraft Foods Groups

- Lausanne Dairies

- Muller UK & Ireland Group

- NANCY'S

- Nestle

- Parmalat S.p.A. (Lactalis American Group Inc)

- Rainy Lanes Dairy Foods Ltd.

- Tillamook

- Ultima Foods Inc.

- Wallaby Yogurt Company

- Yakult Honsha