Global Almond Oil Market By Type (Sweet and Bitter) By Application (Cosmetics & Personal Care, Food Industry, Pharmaceutical Industry and Others) By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Pharmacy and Online) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 19514

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

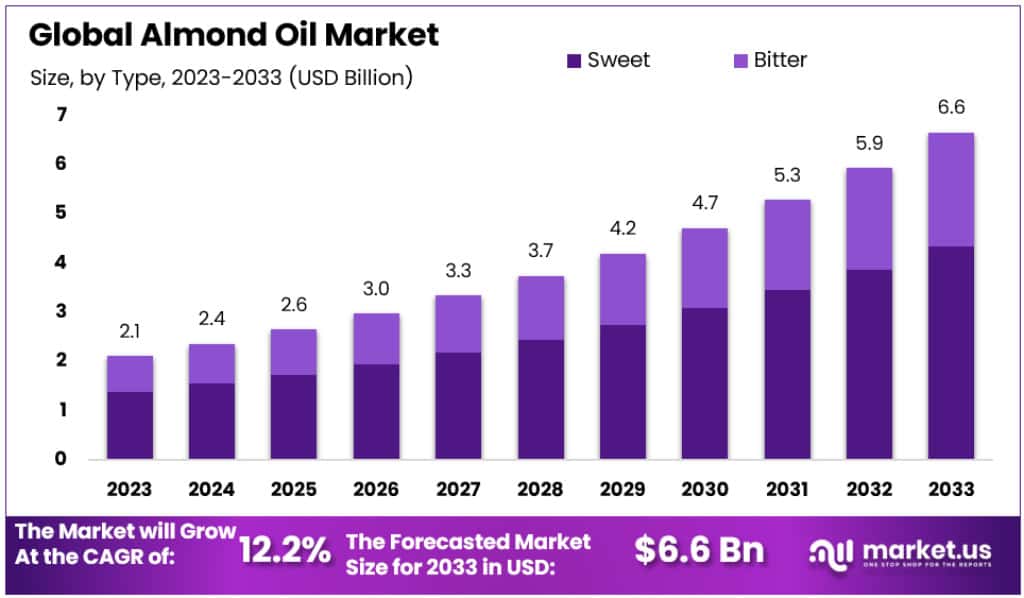

The Global Almond Oil Market size is expected to be worth around USD 6.6 Billion by 2033, from USD 2.1 Billion in 2023, growing at a CAGR of 12.2% during the forecast period from 2023 to 2033.

Almond oil is a type of oil extracted from almonds, which are nutritional powerhouses full of healthy fats, fiber, phytochemicals, vitamins, and minerals. It is rich in vitamin E, magnesium, and other minerals, making it a great source of antioxidants that can help reduce inflammation in the body and lower the risk of cardiovascular disease.

Unrefined almond oil is made by pressing raw almonds without the use of high heat or chemical agents, which helps it retain much of its nutrient content. Almond oil is a popular ingredient in natural beauty products due to its emollient properties, which help prevent water loss from the skin and keep the skin, hair, and scalp soft and hydrated.

Key Takeaways

- The Global Almond Oil Market is projected to reach a value of USD 6.6 Billion by 2033.

- In 2023, the market was valued at USD 2.1 Billion.

- The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 12.2% during the forecast period from 2023 to 2033.

- Sweet Almond Oil held a dominant market share in 2023, accounting for over 65.3% of the market.

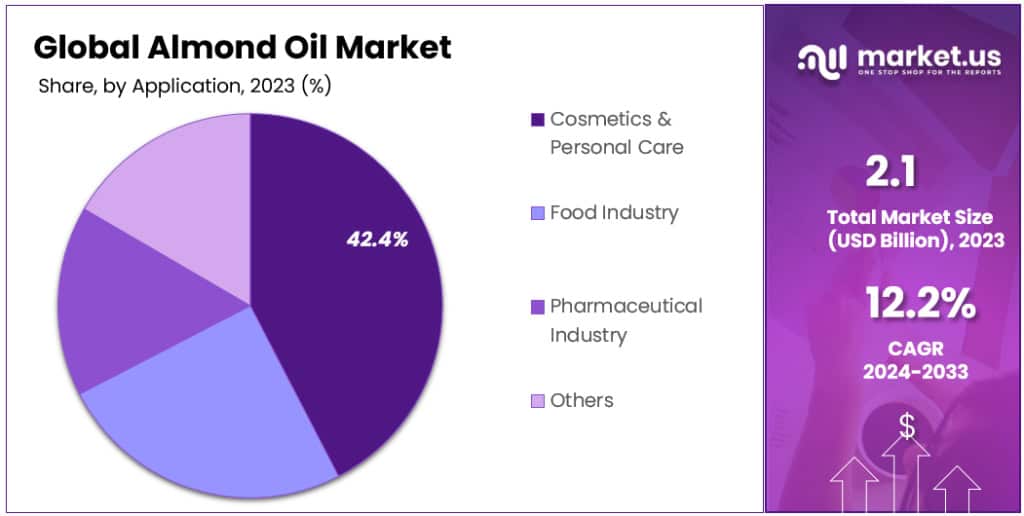

- The Cosmetics & Personal Care segment led the market in 2023, capturing more than 42.4% of the market share.

- Hypermarkets and supermarkets were the leading distribution channels in 2023, offering convenience and a wide range of products.

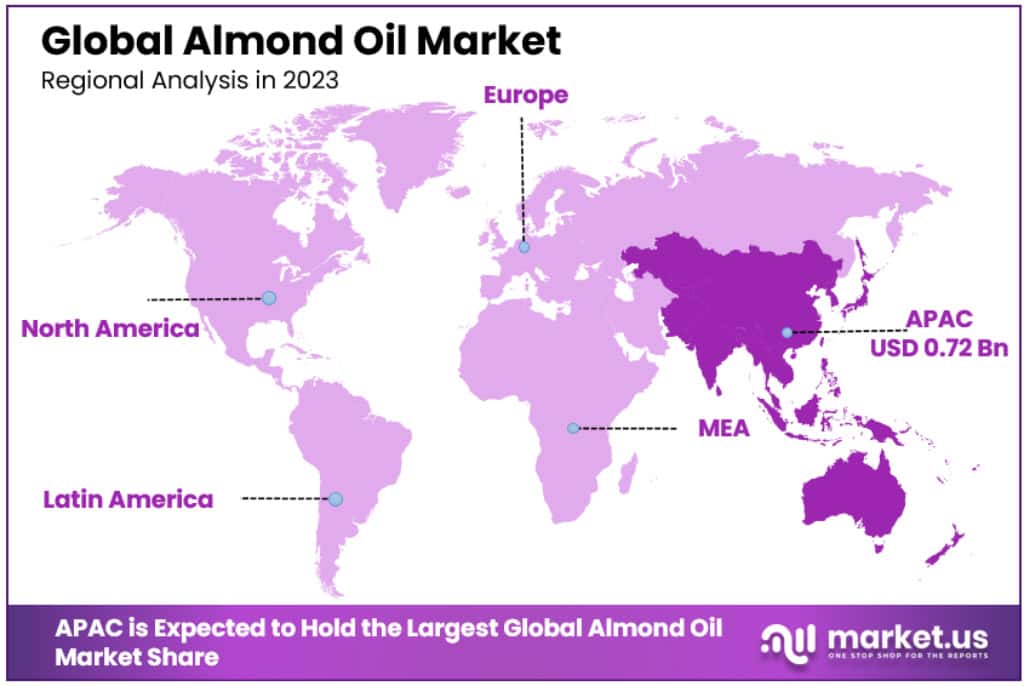

- In 2023, the Asia Pacific region dominated the market with a substantial 34.5% share, amounting to USD 0.72 Billion.

- North America and Europe also experienced significant growth in the almond oil market.

Type Analysis

In 2023, Sweet held a dominant market position, capturing more than a 65.3% share. This segment’s prominence can be attributed to its versatile applications across various industries. Sweet Almond Oil, renowned for its mild flavor and multifaceted usage, continues to captivate a broad spectrum of consumers. Its adaptability for culinary and cosmetic applications contributes markedly to its market allure.

In culinary contexts, Sweet Almond Oil enhances gourmet dishes, salad dressings, and baking recipes, boosting its popularity among food aficionados. Concurrently, its inclusion in natural skincare and haircare products like lotions, serums, and shampoos leverages the growing trend towards organic ingredients in personal care routines. This dual-functionality of Sweet Almond Oil underscores its versatility, enabling it to meet diverse consumer needs.

In contrast, Bitter Almond Oil, constituting a good amount of share in the global market, presents a distinct segment. This variant, initially containing toxic elements, undergoes refinement to eliminate these components before utilization. Despite its initial toxicity, Bitter Almond Oil offers several health benefits, including antifungal properties, pain and spasm relief, intestinal worm and bacteria elimination, sedative effects, and use as a purgative. Post-detoxification, it finds application in flavoring edibles, thereby carving a niche in the almond oil market.

Application Analysis

In 2023, the Cosmetics & Personal Care segment held a dominant market position in the almond oil industry, capturing more than a 42.4% share. The surge in this segment can be attributed to the escalating demand for natural ingredients in cosmetics and personal care products. In recent years, there has been a significant shift towards organic and chemical-free products, spurred by heightened consumer awareness and strict government regulations, such as the European Commission’s ban on certain types of parabens in 2014. These factors collectively foster the incorporation of almond oil in various cosmetic formulations.

Almond oil, renowned for its conditioning properties and rich vitamin content, has become an integral component in the manufacturing of a wide range of cosmetic products. It enhances the texture and absorption of body lotions, face creams, soaps, bath oils, hair care products, makeup, and sun tanning products. The continuous innovation in body and skincare products presents endless opportunities for the application of almond oil, further driving its demand in the cosmetics sector.

In addition to cosmetics and personal care, the almond oil market is diversified across various applications, including the food industry, pharmaceutical industry, and other sectors. Within the food industry, the rising trend of healthy lifestyles and demand for nutritious ingredients have led to innovative product launches, like Pip & Nut Ltd’s vegan almond butter in 2019, which is free from palm oil and rich in almond oil. This reflects the growing consumer inclination towards health-conscious food choices and the integration of almond oil in culinary applications.

In the pharmaceutical industry, almond oil’s therapeutic properties, such as anti-inflammatory and immune-boosting effects, position it as a valuable ingredient. Its application in pharmaceuticals aligns with the increasing preference for natural remedies and supplements.

Distribution Channel Analysis

In 2023, Hypermarkets and supermarkets emerged as the leading distribution channels in the almond oil market, capturing a significant share. This dominant position can be attributed to their extensive reach and the convenience they offer consumers in accessing a wide range of products under one roof. Hypermarkets and supermarkets have become preferred shopping destinations for almond oil due to their ability to stock a variety of brands and types, catering to diverse consumer preferences. This segment benefits from high consumer foot traffic and the advantage of physical product examination, which often influences purchasing decisions.

Specialty Stores, holding a considerable market share, specialize in offering a curated selection of almond oil products. These stores often attract customers seeking specific types of almond oil, such as organic, cold-pressed, or therapeutic grades. Their focused approach allows for a more personalized shopping experience, with knowledgeable staff providing guidance and information. This segment appeals to health-conscious and discerning customers who prioritize quality and specialized products.

The Pharmacy segment, with a notable market presence, caters to consumers seeking almond oil for health and wellness purposes. Pharmacies are trusted sources for therapeutic-grade almond oil, often recommended for medicinal or topical use. This channel benefits from the perception of product authenticity and quality assurance, making it a go-to option for customers looking for almond oil with specific health benefits.

Online sales channels have shown remarkable growth, driven by the convenience of e-commerce and the expanding digital literacy of consumers. This segment offers the advantage of easy accessibility, a wider selection of products, and competitive pricing. The growth of online sales is further fueled by detailed product information, customer reviews, and the ease of home delivery, making it an increasingly popular choice for purchasing almond oil.

Key Маrkеt Ѕеgmеntѕ

Based on Type

- Sweet

- Bitter

Based on Application

- Cosmetics & Personal Care

- Food Industry

- Pharmaceutical Industry

- Others

Based on the Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Pharmacy

- Online

Drivers

- Health Awareness and Cosmetic Applications: A key driver for the almond oil market is the rising health consciousness among consumers. The oil is known for reducing heart risks, such as arrhythmias, and lowering blood pressure and triglyceride levels. In the cosmetic industry, its role as an excipient, reepithelization agent, and lubricant has been pivotal. According to a study, the market CAGR is expected to climb, partly due to the demand for natural ingredients in cosmetics and personal care products.

- Natural Ingredient Preference: The shift towards natural and organic products has been a significant market propellant. The awareness of harmful synthetic chemicals in cosmetics has led to an increased preference for almond oil. A report indicates that the global almond oil market thrived on this trend, especially in sectors where almond oil is a primary ingredient, like lotions and shampoos.

- Marketing and Endorsements: The almond oil market has also benefited from strategic marketing and endorsements. Brand reputation, nutritional value, and safety have influenced consumer purchasing behaviors, with media playing a crucial role in raising awareness.

Restraints

- Environmental Challenges and Cost: Almond production faces climatic and environmental constraints, impacting supply and price. Almond trees require specific temperatures (30 to 35°C) and cool winters. Regions like Europe and North America rely heavily on imports due to unsuitable climates, leading to higher costs. The almond oil market is further restrained by its higher price point compared to other oils, particularly in regions with lower disposable income.

- Health Risks: Overconsumption of almond oil may lead to weight gain, increased cholesterol, and allergic reactions, posing a challenge to market growth.

Opportunities

- Pharmaceutical Applications: The increasing application of almond oil in pharmaceuticals presents a significant opportunity. Public initiatives emphasizing health and fitness have opened new avenues for the use of almond oil in medicinal products.

- Growing Demand in Personal Care: The rising popularity of home-made personal care remedies, facilitated by internet access, has increased the demand for almond oil in personal care products.

Challenges

- Processing Costs: The high processing cost of almond oil increases its market price, making it less accessible to consumers, especially in less affluent regions.

Trends

- Natural Cosmetics and Baby Care Products: The expansion of the natural cosmetics industry and the growing use of almond oil in natural baby care products are key trends. Parents are increasingly choosing almond oil for its mildness and hypoallergenic properties. Additionally, its use in gourmet cooking and salad dressings has garnered attention for its health benefits and unique flavor.

- Aromatherapy and Skin Treatments: The growing demand for aromatherapy and the use of almond oil in treating skin conditions like eczema and pimples are trending. Almond oil’s beneficial properties in treating kidney problems, diabetes, and anemia further add to its market appeal.

Regional Analysis

In 2023, the Asia Pacific region is dominating the Almond Oil Market with a substantial 34.5% share, amounting to USD 0.72 Billion. This region’s significant growth, projected to continue from 2019 to 2026, is primarily attributed to various factors. The increasing consumption of almond oil due to its rich nutritional content and its use as a peanut butter substitute are key contributors.

Additionally, the integration of almond oil with natural oils by manufacturers in this region further boosts its market growth. According to BW Business World, India’s almond production in the 2023-2033 period was estimated at 1,000 Metric Tonnes, significantly contributing to the market’s expansion.

North America and Europe are also showing considerable growth in the almond oil market. The appeal of almond oil in these regions is linked to its gluten-free qualities, spurring its use in food production like bakery items, breakfast cereals, and snacks. Moreover, substantial investments in research and development for almond oil utilization are noted. As per the Los Angeles Times, California in the USA accounts for 82% of global almond production, making it a pivotal player in the market.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The almond oil market is characterized by a dynamic competitive landscape, shaped by the presence of both established players and emerging new entrants. These companies are engaging in strategic product innovation and development, aiming to cater to the evolving demands for natural and organic personal care products. They are increasingly focusing on strategic collaborations, partnerships, and mergers to consolidate market positions and extend their geographical reach.

Major players like AOS Products Private Limited, Ashwin Fine Chemicals & Pharmaceuticals, Blue Diamond Growers, Inc., and others are concentrating on expanding their customer base by offering specialized products with enhanced nutritional benefits. For example, in December 2017, Blue Diamond Growers introduced a 100% pure sweet almond oil, designed to enrich massage oils, personal care products, and cosmetics, emphasizing its importance for healthier hair and skin. Similarly, Pip & Nut Ltd launched a vegan almond butter in April 2019, which is free from palm oil and rich in almond oil, underlining the innovative approaches in product development.

These companies are also extending their reach into developed countries to maximize technology penetration and customer engagement. Establishing research and development centers and forming strategic alliances with investment firms are pivotal strategies being adopted. These efforts are directed towards launching new, innovative technologies in response to customer needs, with a special focus on developing countries and untapped markets.

Market Key Players

- AOS Products Private Limited

- Ashwin Fine Chemicals & Pharmaceuticals

- Blue Diamond Growers, Inc.

- Caloy Quality Natural Oils

- Eden Botanicals

- Jiangxi Baicao Pharmaceutical Co., Ltd.

- Jiangxi Xuesong Natural Medicinal Oil Co., Ltd.

- Liberty Vegetable Oil Company

- Mountain Ocean

- NOW Foods

- Proteco Oils

- Now Health Group

- Provital Group

- La Tourangelle, Inc.

- ESI S.p.A.

- Bajaj Consumer Care

- Ecomil

- Gustav Heess GmbH

- Jedwards International, Inc.

- Other Key Companies

Recent Developments

Company Acquisitions:

- December 2023: Blue Diamond Almonds, a leading almond producer, acquires a majority stake in California-based Nature’s Intent, a company specializing in organic and cold-pressed almond oil. This move strengthens Blue Diamond’s presence in the premium almond oil segment.

- December 2023: International Flavors & Fragrances (IFF) announces the acquisition of ABC Extracts, a company known for its high-quality almond oil extracts. This acquisition bolsters IFF’s portfolio of natural ingredients for the food and beverage industry.

New Product Developments:

- December 2023: California-based company Almond Innovations launches a new line of infused almond oils featuring botanical blends for specific purposes like relaxation, muscle recovery, and sleep improvement.

- December 2023: Australian brand Essano introduces a new range of certified organic and cold-pressed almond oil haircare products, catering to the growing demand for natural hair care solutions.

- December 2023: French cosmetics giant L’Oréal unveils a new premium facial serum infused with cold-pressed almond oil and hyaluronic acid, promising anti-aging and moisturizing benefits.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Billion Forecast Revenue (2033) USD 6.6 Billion CAGR (2023-2032) 12.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sweet and Bitter) By Application (Cosmetics & Personal Care, Food Industry, Pharmaceutical Industry and Others) By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Pharmacy and Online) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AOS Products Private Limited, Ashwin Fine Chemicals & Pharmaceuticals, Blue Diamond Growers, Inc., Caloy Quality Natural Oils, Eden Botanicals, Jiangxi Baicao Pharmaceutical Co., Ltd., Jiangxi Xuesong Natural Medicinal Oil Co., Ltd., Liberty Vegetable Oil Company, Mountain Ocean, NOW Foods, Proteco Oils, Now Health Group, Provital Group, La Tourangelle, Inc., ESI S.p.A., Bajaj Consumer Care, Ecomil, Gustav Heess GmbH, Jedwards International, Inc., Other Key Companies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the Almond Oil market size?The Almond Oil market size is USD 2.1 Billion in 2023.

Q: What is the CAGR for the Almond Oil market?The Almond Oil market is expected to grow at a CAGR of 12.2% during 2023-2032.

Q: Who are the key players in the Almond Oil market?AOS Products Private Limited, Ashwin Fine Chemicals & Pharmaceuticals, Blue Diamond Growers, Inc., Caloy Quality Natural Oils, Eden Botanicals, Jiangxi Baicao Pharmaceutical Co., Ltd., Jiangxi Xuesong Natural Medicinal Oil Co., Ltd., Liberty Vegetable Oil Company, Mountain Ocean, NOW Foods, Proteco Oils, Now Health Group, Provital Group, La Tourangelle, Inc., ESI S.p.A., Bajaj Consumer Care, Ecomil, Gustav Heess GmbH, Jedwards International, Inc., Other Key Companies.

-

-

- AOS Products Private Limited

- Ashwin Fine Chemicals & Pharmaceuticals

- Blue Diamond Growers, Inc.

- Caloy Quality Natural Oils

- Eden Botanicals

- Jiangxi Baicao Pharmaceutical Co., Ltd.

- Jiangxi Xuesong Natural Medicinal Oil Co., Ltd.

- Liberty Vegetable Oil Company

- Mountain Ocean

- NOW Foods

- Proteco Oils

- Now Health Group

- Provital Group

- La Tourangelle, Inc.

- ESI S.p.A.

- Bajaj Consumer Care

- Ecomil

- Gustav Heess GmbH

- Jedwards International, Inc.

- Other Key Companies