Global Functional Food And Nutraceuticals Market By Product Type (Functional Food, Functional Beverages, Dietary Supplements), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Drug Stores/Pharmacies, Online Retail Stores, Other Distribution Channels) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145450

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

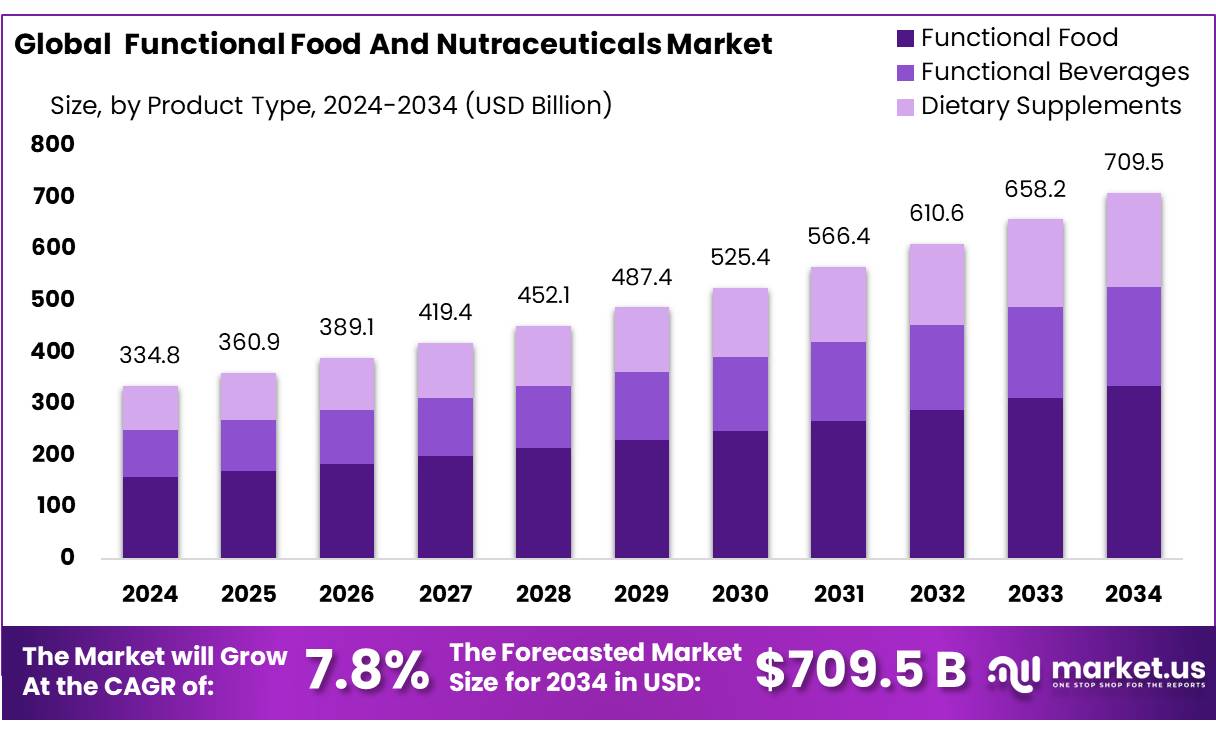

The Global Functional Food And Nutraceuticals Market size is expected to be worth around USD 709.5 Bn by 2034, from USD 334.8 Bn in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

The functional food and nutraceuticals industry has emerged as a key pillar in the global health and wellness economy, driven by rising consumer awareness of the link between diet and chronic disease prevention. Functional foods—defined as those providing health benefits beyond basic nutrition—and nutraceuticals, which include bioactive compounds such as vitamins, probiotics, polyphenols, and omega-3 fatty acids, have seen significant demand growth across both developed and developing economies.

According to the Food and Agriculture Organization (FAO), non-communicable diseases (NCDs) account for 74% of all global deaths, with poor diet being a leading contributing factor. As a response, national health strategies have begun integrating functional food components. The U.S. Department of Agriculture (USDA) noted that nearly 40% of U.S. adults used dietary supplements daily as of 2022. Additionally, the U.S. Food and Drug Administration (FDA) has approved several health claims on functional food labels, encouraging consumer confidence and manufacturer participation.

Government-led initiatives across multiple countries have further catalyzed industry development. For instance, Japan’s “Foods for Specified Health Uses” (FOSHU) framework has authorized more than 1,000 products as of 2023. Similarly, India’s Food Safety and Standards Authority of India (FSSAI) published the nutraceuticals regulation in 2016, and by 2023, over 4,000 products had been approved under this regulatory framework. The European Food Safety Authority (EFSA) reported that 1,800 applications for novel food ingredients and health claims had been submitted between 2007 and 2023, reflecting an industry-wide push toward scientific validation and market expansion.

Key industry drivers include aging populations, urbanization, and growing health expenditures. The World Health Organization (WHO) forecasts that the number of people aged 60 and above will double from 1 billion in 2020 to 2.1 billion by 2050. This demographic shift is boosting demand for products targeting immunity, cognitive health, and cardiovascular wellness. Furthermore, global healthcare spending reached USD 9.8 trillion in 2022, accounting for 9.8% of world GDP, with a portion being redirected to preventive care via dietary supplements and functional foods.

Key Takeaways

- Functional Food And Nutraceuticals Market size is expected to be worth around USD 709.5 Bn by 2034, from USD 334.8 Bn in 2024, growing at a CAGR of 7.8%.

- Functional Food held a dominant market position, capturing more than a 47.30% share.

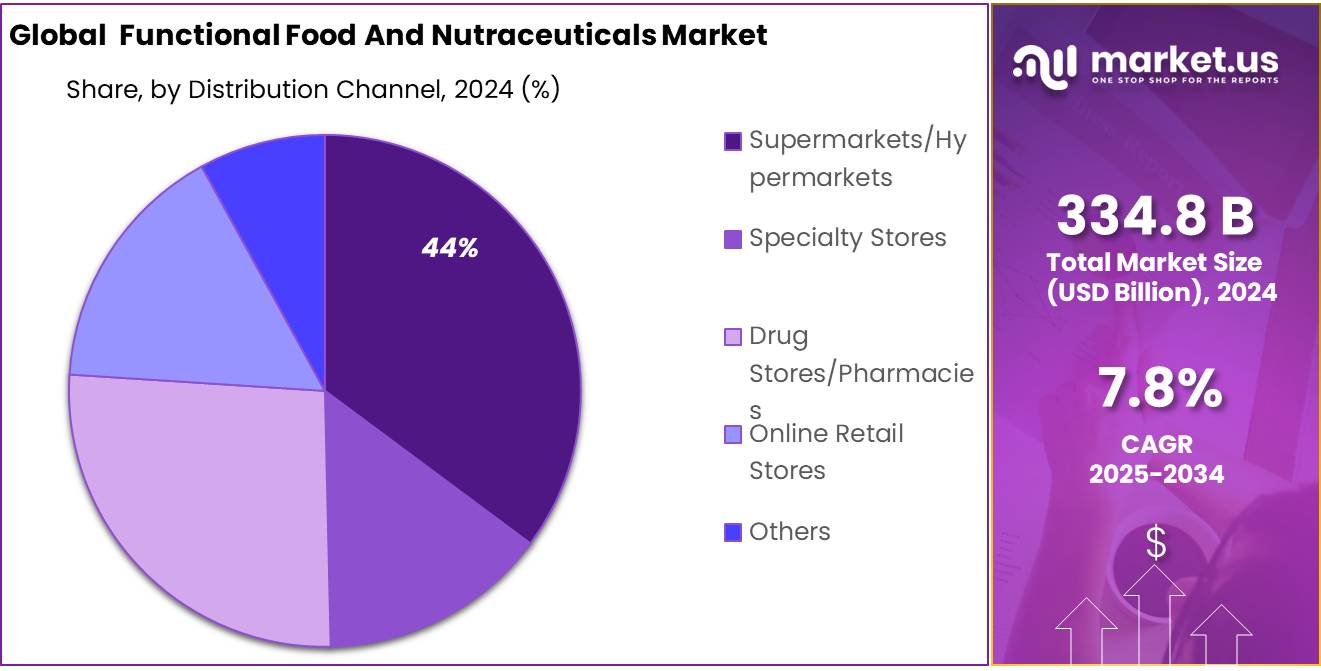

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 44.10% share.

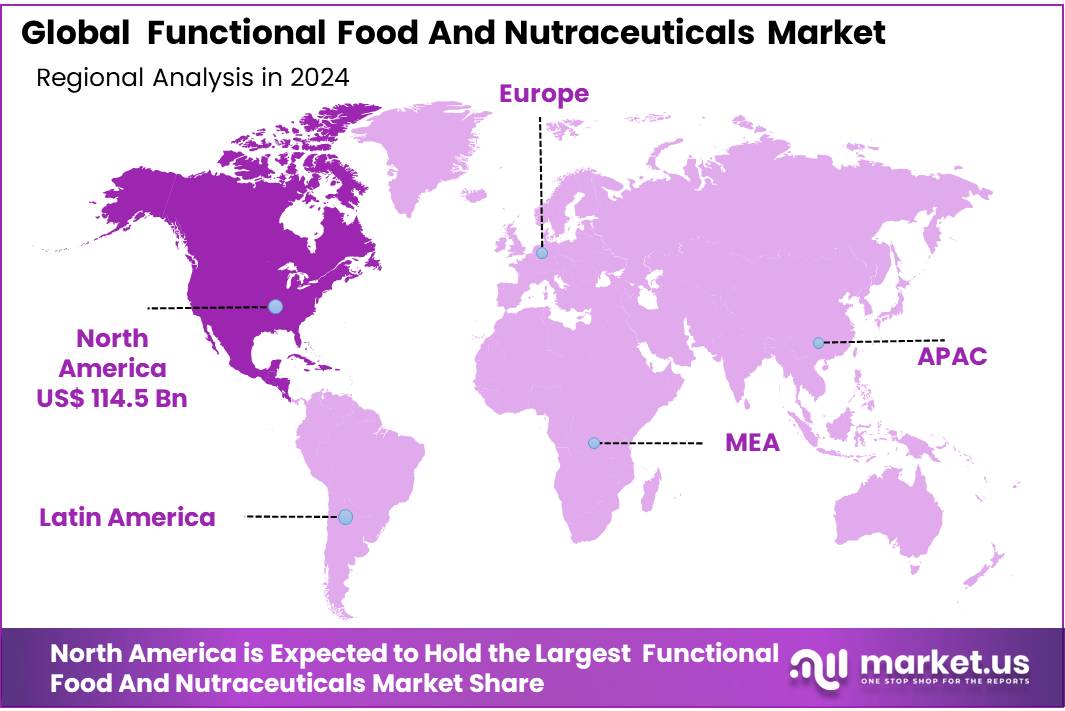

- North America dominated the Functional Food and Nutraceuticals Market, holding a substantial 34.20% share, which translated into a market value of approximately USD 114.5 billion.

By Product Type

Functional Food leads with 47.3% in 2024, driven by rising health awareness and dietary shifts

In 2024, Functional Food held a dominant market position, capturing more than a 47.30% share. This strong lead is mainly due to growing consumer interest in preventive healthcare, clean-label ingredients, and natural food-based wellness solutions. Products like fortified cereals, probiotic yogurts, omega-3-enriched snacks, and energy bars gained popularity, especially among millennials and aging populations looking for convenient ways to support immunity, digestion, and overall vitality.

The functional food segment continues to benefit from trends like plant-based eating and personalized nutrition. Entering 2025, this segment is expected to grow steadily, supported by innovation in protein blends, gut-friendly formulations, and on-the-go nutrition formats. New product launches and expanding retail shelf space, particularly in Asia-Pacific and North America, are further boosting the demand for functional food in everyday diets.

By Distribution Channel

Supermarkets/Hypermarkets dominate with 44.1% in 2024 thanks to easy access and strong product variety

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 44.10% share. This lead came from the convenience they offer—wide product ranges, competitive pricing, and the ability to physically check products before buying. Functional food and nutraceutical brands are focusing more on in-store displays and health-centric promotions in these outlets, attracting health-conscious shoppers. Many consumers still prefer buying such products alongside their regular groceries, making these retail chains the go-to option.

This channel is expected to grow further, supported by the expansion of modern retail infrastructure in developing countries and increased shelf space for wellness products. Additionally, combo offers, loyalty programs, and knowledgeable in-store staff are helping drive repeat purchases in this segment.

Key Market Segments

By Product Type

- Functional Food

- Cereals

- Bakery and Confectionery

- Dairy Products

- Snacks & Bars

- Other Functional Foods

- Functional Beverages

- Weight Management Drinks

- Nutritional Drinks

- Muscle Building Drinks

- Other Functional Beverages

- Dietary Supplements

- Vitamins & Mineral

- Herbal Supplements

- Protein Supplements

- Other Dietary Supplements

By Distribution Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Drug Stores/Pharmacies

- Online Retail Stores

- Other Distribution Channels

Drivers

Increased Consumer Awareness and Government Endorsement Propel Functional Food Growth

One major driving factor for the Functional Food and Nutraceuticals Market is the heightened consumer awareness regarding health and wellness, bolstered by supportive government initiatives. As lifestyles become increasingly hectic, more individuals are turning to functional foods and nutraceuticals to meet their nutritional needs and combat potential health issues.

For example, in the United States, the “MyPlate” initiative by the USDA encourages Americans to make healthier food choices. It promotes incorporating fruits, vegetables, grains, protein foods, and dairy into diets, which aligns with the core offerings of functional foods. These government-backed programs significantly influence public perception and contribute to the growing trend of health-oriented food choices.

Furthermore, leading food organizations such as the World Health Organization (WHO) emphasize the importance of balanced diets rich in essential nutrients to prevent malnutrition and chronic diseases. The WHO’s guidelines on reducing sugar intake and increasing the consumption of vitamins and minerals directly support the market for functional foods, which are often fortified with these essential nutrients.

In addition, the rise in preventive healthcare measures and the increasing prevalence of chronic diseases such as diabetes and heart conditions have prompted consumers to opt for functional foods. These products often contain heart-healthy omega-3s, fibers, and plant sterols, which are advertised to help manage or reduce the risk of such health issues.

Restraints

High Cost of Functional Foods Limits Market Reach

A significant restraining factor for the growth of the Functional Food and Nutraceuticals Market is the high cost associated with these products. Despite their health benefits, the premium pricing of functional foods and nutraceuticals can be prohibitive for many consumers, particularly in less affluent regions.

The process of developing functional foods involves extensive research and development, often incorporating expensive ingredients that are high in specific nutrients or have been processed using advanced technologies. For instance, foods fortified with omega-3 fatty acids, antioxidants, and probiotics often come at a higher price point due to the cost of these compounds and the complexity of their integration into consumer products.

Furthermore, the stringent regulatory standards that govern the food and health industries add another layer of expense. These regulations ensure product safety and efficacy but also require significant investment from companies to meet compliance. For example, the European Food Safety Authority (EFSA) mandates rigorous testing and evidence collection to substantiate health claims made by functional food products, which can be a costly process.

Economic factors also play a critical role in this context. In regions with lower purchasing power parity, the consumer base for premium-priced health products is naturally smaller. This economic divide is evident in the varying rates of functional food consumption across different socio-economic groups globally.

Opportunity

Exploring Plant-Based Innovations: A Lucrative Avenue for Growth in Functional Foods

A major growth opportunity within the Functional Food and Nutraceuticals Market lies in the burgeoning sector of plant-based products. This trend is driven by a combination of environmental concerns, health trends, and changing dietary preferences toward more sustainable and ethical food choices.

Recent years have seen a significant shift in consumer behavior, with more people adopting vegetarian, vegan, or flexitarian diets. This shift is supported by findings from health organizations like the World Health Organization (WHO), which has highlighted the health benefits of plant-based diets, including lower risks of heart disease, high blood pressure, diabetes, and certain types of cancer.

The plant-based food market has responded dynamically to these dietary shifts. Innovations in this space include not only meat substitutes but also a wide array of functional foods enriched with plant-based proteins, fibers, vitamins, and minerals. These products cater to consumers seeking wellness-focused diets without compromising on taste or nutritional value.

For instance, the introduction of vegan omega-3 supplements, derived from algae instead of fish oil, caters to the vegan market while providing essential fatty acids necessary for cardiovascular health and cognitive function. Similarly, plant-based yogurts fortified with probiotics and plant sterols are making waves among health-conscious consumers looking for dairy-free alternatives.

Moreover, government initiatives across various countries to promote health and sustainability further support this trend. For example, the European Union’s Farm to Fork Strategy aims to make food systems fair, healthy, and environmentally-friendly, which includes supporting shifts towards more plant-based diets.

Trends

Personalized Nutrition: Tailoring Health One Bite at a Time

A significant trend in the Functional Food and Nutraceuticals Market is the rise of personalized nutrition, which leverages individual health data to tailor dietary recommendations and products. This trend is gaining momentum as consumers increasingly seek solutions that are specifically adapted to their unique health needs, lifestyle choices, and genetic profiles.

Advancements in technology and biometrics have enabled companies to offer personalized dietary advice and functional food products. For example, DNA-based diets and AI-driven apps analyze genetic markers to recommend nutrients that could optimize individual health outcomes. This approach is supported by research from reputable organizations like the National Institutes of Health (NIH), which has explored the role of genomics in nutrition through initiatives like the Precision Nutrition Program. This program aims to develop more targeted and effective dietary interventions based on individual differences in genes, environments, and lifestyles.

Personalized nutrition is not just about combating health issues but also about enhancing overall wellness. Products such as customized vitamin packs, protein blends, and functional snacks are tailored to support everything from mental clarity and energy levels to gut health and immune responses.

Regional Analysis

In 2024, North America dominated the Functional Food and Nutraceuticals Market, holding a substantial 34.20% share, which translated into a market value of approximately USD 114.5 billion. This significant market presence is underpinned by a well-established wellness culture and high consumer awareness about health and nutrition. The U.S. leads the region, driven by increasing health concerns and a growing elderly population seeking dietary supplements to mitigate age-related ailments.

The North American market is characterized by high demand for products such as omega-3 enriched foods, probiotic yogurts, and fortified functional beverages. These preferences align with the broader trends of combating lifestyle diseases such as obesity, diabetes, and cardiovascular conditions, which are prevalent in the region.

The adoption of functional foods is further encouraged by the proactive initiatives from both government and private sectors promoting healthy eating habits. For example, Canada’s revamped food guide emphasizes plant-based diets and has influenced both food manufacturers and consumers towards more nutritious and functional food options.

Technological advancements in food science and biotechnology within the region also play a crucial role in driving the market. Innovations in nanoencapsulation and microencapsulation techniques have improved the delivery and efficacy of active ingredients, making functional foods more appealing and effective.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé S.A. remains a global leader in the functional food and nutraceuticals space, driven by its strong research capabilities and diverse product portfolio. The company has expanded its offerings in health-focused categories, including fortified cereals, probiotic yogurts, and plant-based beverages. Through its Nestlé Health Science division, it focuses on nutritional therapies and supplements.

PepsiCo, Inc. is actively growing its footprint in the functional food and nutraceuticals market through its health-oriented brands like Naked Juice, Quaker Oats, and Gatorade. The company focuses on providing convenient nutrition via protein bars, energy drinks, and fiber-rich snacks. PepsiCo’s strategy emphasizes innovation in functional beverages and plant-based products.

Kellogg Company plays a key role in the functional food market, especially in fortified cereals and snack bars. Its offerings are enriched with vitamins, minerals, and fiber to promote digestive health, energy, and heart wellness. The company’s continued focus on health-forward products through brands like Special K and Kashi reflects a strategic shift toward functional, better-for-you foods. Kellogg also invests in reformulating legacy products to reduce sugar and boost nutritional content, catering to the growing health-aware population.

Top Key Players

- Nestlé S.A.

- PepsiCo, Inc.

- Kellogg Company

- Herbalife International of

- America, Inc.

- Danone S.A.

- Now Health Group, Inc. (NOW Foods)

- Alticor Inc. (Amway Corporation)

- Red Bull GmbH

- Abbott Laboratories

- Bayer AG

- Nu Skin Enterprises, Inc.

- Nature’s Sunshine Products, Inc.

- The Hain Celestial Group, Inc.

- Other Key Players

Recent Developments

In 2024, Nestlé S.A. reported total sales of CHF 91.4 billion, with its Health Science division playing a key role in the company’s growth strategy. The division focuses on nutrition, health, and wellness products, including functional foods and nutraceuticals.

In 2024, PepsiCo, Inc. reported a slight revenue increase to USD 91.9 billion, up from approximately USD 91.5 billion in 2023. The company focused on expanding its functional beverage portfolio to meet growing consumer demand for healthier options.

Report Scope

Report Features Description Market Value (2024) USD 334.8 Bn Forecast Revenue (2034) USD 709.5 Bn CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type (Functional Food, Functional Beverages, Dietary Supplements), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Drug Stores/Pharmacies, Online Retail Stores, Other Distribution Channels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestlé S.A., PepsiCo, Inc., Kellogg Company, Herbalife International of, America, Inc., Danone S.A., Now Health Group, Inc. (NOW, Foods), Alticor Inc. (Amway Corporation), Red Bull GmbH, Abbott Laboratories, Bayer AG, Nu Skin Enterprises, Inc., Nature’s Sunshine Products, Inc., The Hain Celestial Group, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Functional Food And Nutraceuticals MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Functional Food And Nutraceuticals MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé S.A.

- PepsiCo, Inc.

- Kellogg Company

- Herbalife International of

- America, Inc.

- Danone S.A.

- Now Health Group, Inc. (NOW Foods)

- Alticor Inc. (Amway Corporation)

- Red Bull GmbH

- Abbott Laboratories

- Bayer AG

- Nu Skin Enterprises, Inc.

- Nature's Sunshine Products, Inc.

- The Hain Celestial Group, Inc.

- Other Key Players