Global Apple Cider Vinegar Market Size, Share, Business Environment Analysis By Type (Filtered, Unfiltered), By Nature (Organic, Conventional), By Form (Powder, Tablets, Capsules, Liquid), By End-use (Food Industry, Dietary Supplements, Retail/Household, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Discount Stores, Pharmacy/Drug Stores, Food and Drink Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136199

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

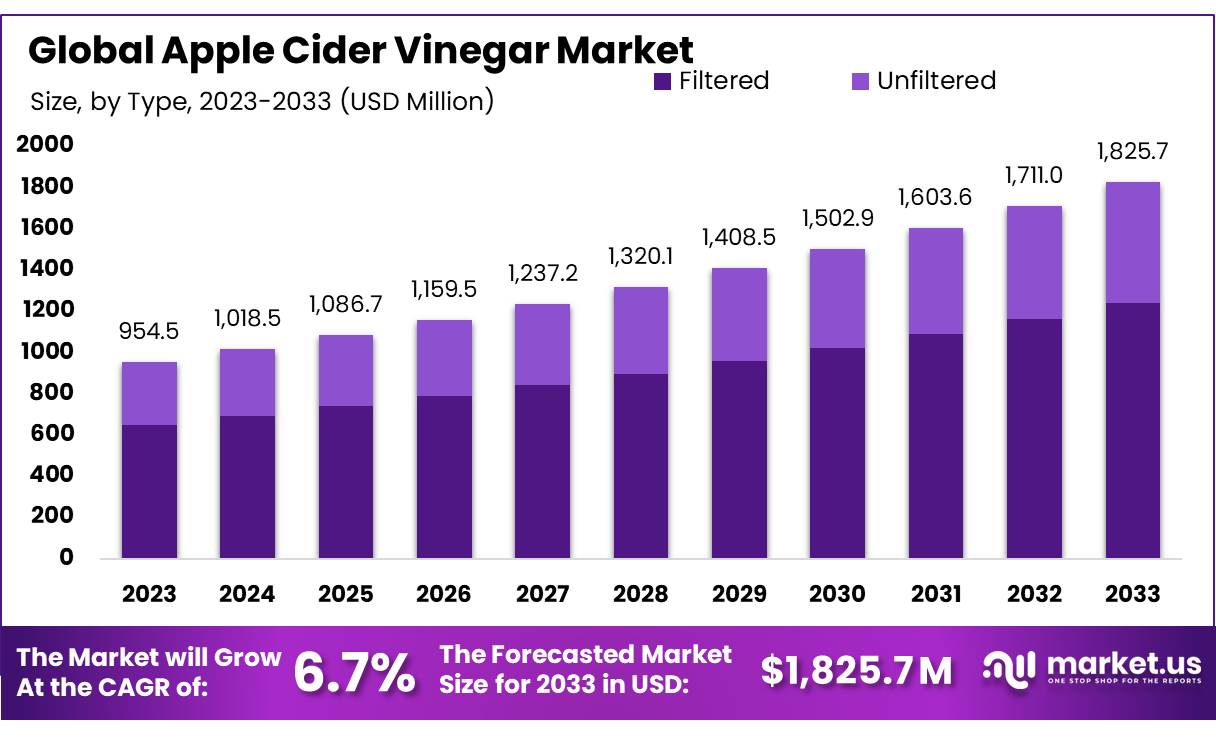

The Global Apple Cider Vinegar Market size is expected to be worth around USD 1825.7 Mn by 2033, from USD 954.5 Mn in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

Apple cider vinegar is a type of vinegar made from fermented apple juice. It is produced by crushing apples, then squeezing out the juice. Bacteria and yeast are added to the liquid to start the alcoholic fermentation process, which converts the sugars to alcohol.

In a second fermentation step, the alcohol is converted into vinegar by acetic acid-forming bacteria. Apple cider vinegar is widely recognized for its pungent, acidic flavor and is commonly used in cooking, baking, and salad dressings.

Apple cider vinegar is often touted for its potential health benefits. These include aiding digestion, supporting weight loss, and acting as a natural preservative. Some proponents also claim that it can help lower blood sugar levels and reduce cholesterol, although these claims require more scientific research to fully substantiate.

Apple cider vinegar contains various bioactive compounds, including acetic acid, which is thought to be responsible for its health properties. Despite its various uses and benefits, it is recommended to consume apple cider vinegar in moderation due to its highly acidic nature, which can be harsh on the teeth and stomach if taken in large amounts.

Apple cider vinegar (ACV) continues to gain popularity in various end-use industries, particularly in the food and beverage, healthcare, and beauty sectors, driven by its perceived health benefits and versatility as an ingredient.

In 2023, the global market for apple cider vinegar witnessed significant growth, with an estimated increase in consumption by 12% compared to the previous year, as reported by the U.S. Department of Agriculture (USDA). This rise is attributed to the growing consumer demand for natural and organic products.

The export of apple cider vinegar has seen a notable rise, particularly in the European and Asian markets. For instance, in 2023, exports from the United States to Europe increased by 8%, and to Asia by 10%, reflecting the global appetite for this versatile product. This trend is supported by loosening trade restrictions and the implementation of favorable trade agreements, which have made cross-border commerce smoother for vinegar products.

Government initiatives have also played a crucial role in bolstering the apple cider vinegar industry. For example, the Food and Drug Administration (FDA) has implemented guidelines that ensure the quality and safety of vinegar sold in the U.S., which has helped increase consumer confidence. Furthermore, private investment in the sector has surged, with an increase of 15% in funding for companies engaged in the production and innovation of apple cider vinegar products in 2023.

Innovation within the sector is thriving, with numerous companies exploring ways to enhance the appeal and functionality of apple cider vinegar. In 2024, a leading food company announced a partnership with a biotech firm to develop a new fermentation process that aims to double the concentration of acetic acid in apple cider vinegar, potentially enhancing its health benefits and industrial applications.

Key Takeaways

- Filtered Apple Cider Vinegar (ACV) held a dominant market position, capturing more than a 68.2% share of the global market.

- Organic Apple Cider Vinegar (ACV) held a dominant market position, capturing more than a 59.1% share.

- Powder Apple Cider Vinegar (ACV) held a dominant market position, capturing more than a 28.1% share.

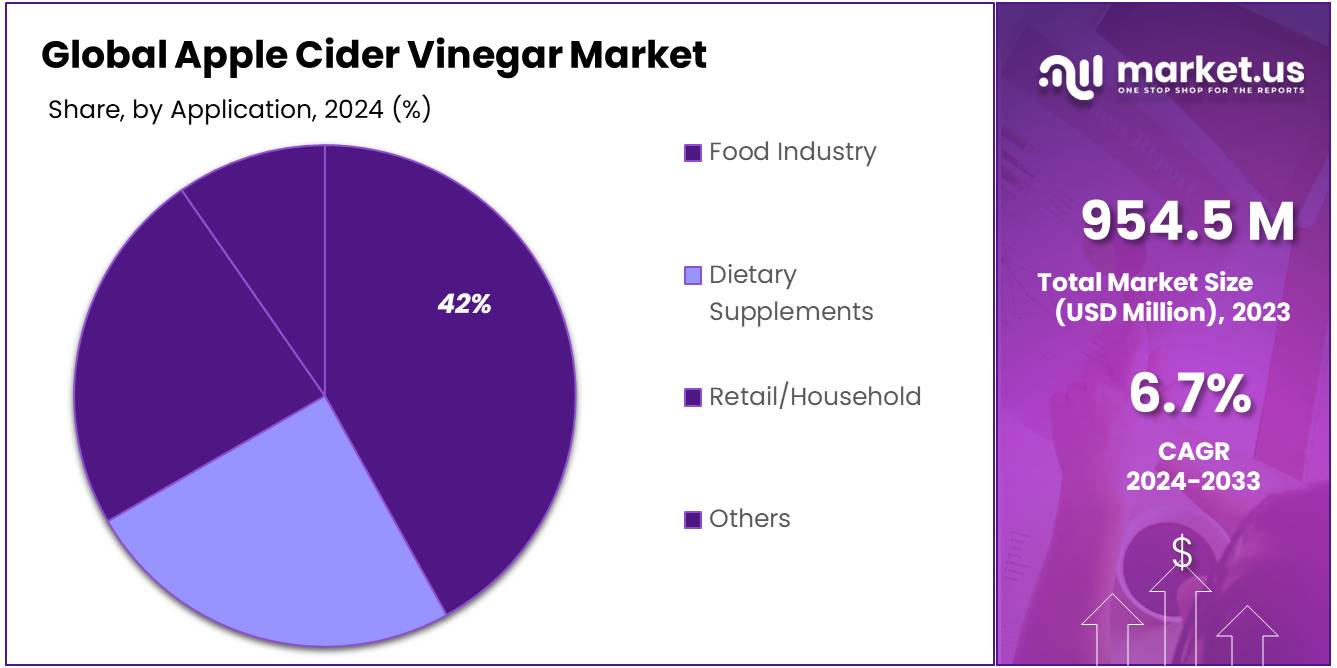

- Food Industry held a dominant market position, capturing more than a 39.1% share of the global Apple Cider Vinegar (ACV) market.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 48.1% share.

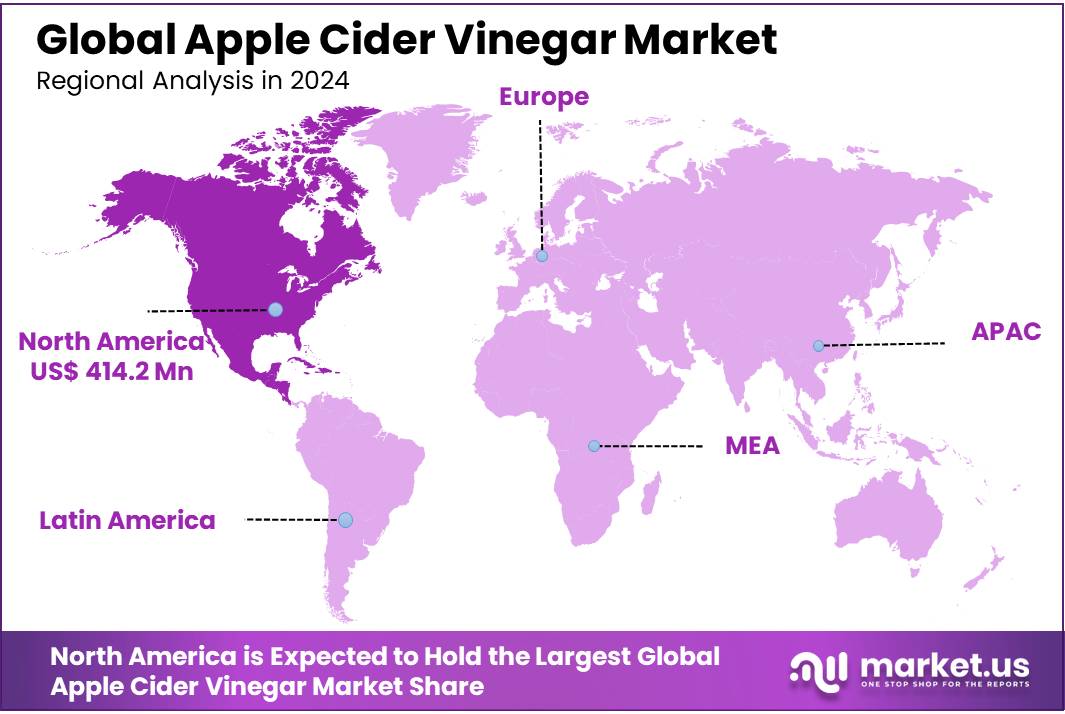

- North America stands as the dominant region, capturing 43.4% of the market, with a valuation of USD 414.2 billion.

Apple Cider Vinegar Business Environment Analysis

In recent years, there has been a significant shift towards health-conscious living, which has positively impacted the demand for apple cider vinegar. ACV is often touted for its potential health benefits, including weight management, improved digestion, and skin health. According to Mintel, 2023 saw a 12% increase in ACV consumption in the United States alone, driven by increasing awareness of its natural wellness properties.

The European Union (EU) has stringent regulations on food safety and labeling, which also apply to ACV products imported into the region. These regulations ensure that apple cider vinegar is manufactured to meet food safety standards, including pH level tests, and that it complies with organic certification for certain product categories. Additionally, the growing focus on halal and kosher certifications in regions such as the Middle East and Europe is influencing market dynamics.

In terms of market growth, Asia Pacific continues to be the fastest-growing region for apple cider vinegar, driven by increasing health awareness and rising disposable incomes. Exports from major producing countries like the United States to markets in Asia and Europe grew by 15% and 10% respectively in 2023, as reported by the USDA.

The global market for apple cider vinegar is forecast to grow at a 7.5% CAGR from 2024 to 2030, with key players like Bragg and The Heinz Company strengthening their positions through product innovations and strategic acquisitions.

The apple cider vinegar market is becoming increasingly competitive, with key players expanding their product lines and seeking new market opportunities. Bragg, a leading brand in the U.S., saw a 20% increase in sales in 2023, driven by both increased demand for organic products and the launch of new health-focused variants.

In 2024, Heinz announced a strategic partnership with major retail chains in Europe to expand its presence in the health-focused vinegar segment. The global investment in ACV manufacturing and research is also on the rise, with private equity firms investing in the growth of established brands and innovative startups in the health and wellness sector.

By Type

In 2023, Filtered Apple Cider Vinegar (ACV) held a dominant market position, capturing more than a 68.2% share of the global market. The growing consumer preference for products that are perceived as cleaner and purer has significantly contributed to this trend. Filtered ACV is known for its clear appearance and smooth texture, making it appealing to consumers who are looking for a product that can be easily incorporated into daily routines, particularly in culinary and health applications.

In contrast, the Unfiltered segment of the Apple Cider Vinegar market, while experiencing steady demand, held a smaller market share in 2023. This type of ACV, with its cloudy appearance and presence of “the mother, appeals to consumers seeking a more natural and holistic product. Unfiltered ACV is often marketed as a more authentic, organic choice, and is frequently favored by individuals focused on wellness and alternative health practices.

By Nature

In 2023, Organic Apple Cider Vinegar (ACV) held a dominant market position, capturing more than a 59.1% share. The shift towards organic products, driven by growing health consciousness and consumer demand for clean, sustainable food options, has significantly contributed to this trend.

Organic ACV, often marketed as free from synthetic pesticides and fertilizers, appeals to consumers who are increasingly prioritizing health, environmental impact, and ethical sourcing in their purchasing decisions. This growing preference for organic products is expected to continue into 2024, as more consumers seek out natural alternatives to support a healthier lifestyle.

On the other hand, the Conventional ACV segment accounted for a smaller share of the market in 2023. While Conventional ACV remains a popular choice due to its affordability and wide availability, it is less favored by health-conscious consumers who are willing to pay a premium for organic options. However, Conventional ACV continues to see steady demand, especially in price-sensitive markets where cost remains a key factor in purchasing decisions.

By Form

In 2023, Powder Apple Cider Vinegar (ACV) held a dominant market position, capturing more than a 28.1% share. The popularity of powder form ACV is mainly driven by its convenience and versatility. Powdered ACV can be easily added to smoothies, shakes, or even sprinkled on food, making it an appealing choice for busy consumers looking for a quick and easy way to incorporate the benefits of ACV into their daily routines.

Additionally, the powder form often has a longer shelf life and is more transportable than liquid ACV, contributing to its increasing demand, particularly among health-conscious individuals and fitness enthusiasts.

The Liquid ACV segment, while still a major player in the market, accounted for a significant portion of the market share in 2023 but lagged behind Powder. Liquid ACV continues to be widely used in cooking, as a salad dressing ingredient, and for wellness purposes. It appeals to traditional users who prefer a more familiar form of ACV, especially for direct consumption or use in home remedies. However, the liquid form’s bulkier packaging and shorter shelf life compared to powder have led some consumers to lean toward more convenient alternatives.

Tablets and Capsules, though smaller segments, also saw steady growth in 2023. These forms of ACV are particularly popular among consumers who are looking for the health benefits of ACV without the strong taste and acidity. The ease of swallowing tablets or capsules appeals to those who may not enjoy the liquid form but still wish to benefit from ACV’s reputed advantages for digestion and metabolism.

By End-use

In 2023, the Food Industry held a dominant market position, capturing more than a 39.1% share of the global Apple Cider Vinegar (ACV) market. ACV has long been a staple in cooking and food preparation due to its versatility and tangy flavor. It is commonly used as a salad dressing, marinade, preservative, and ingredient in various food products.

The growing demand for healthier and more natural ingredients in food formulations has fueled the rise of ACV, as it is often marketed as a natural product with potential health benefits, such as aiding digestion and supporting weight loss. As consumers continue to seek out clean-label, plant-based, and functional food products, the Food Industry segment is expected to maintain its leading role in the ACV market in 2024.

The Dietary Supplements segment, while smaller than the Food Industry, also experienced steady growth in 2023. ACV has become increasingly popular as a dietary supplement, with many consumers taking it in pill or liquid form for its perceived health benefits.

These benefits, which include improved digestion, metabolism, and blood sugar regulation, have led to a rise in ACV-based supplements. In 2024, this segment is expected to grow further, driven by an increasing awareness of wellness trends and the demand for functional supplements that promote overall health.

The Retail/Household segment, representing consumers using ACV for home remedies, cooking, and general household cleaning, accounted for a notable share of the market in 2023. While it is less specialized than the Food or Dietary Supplements segments, its popularity remains strong, particularly in health-conscious households.

Consumers often purchase ACV for its multipurpose uses in the kitchen and as a natural cleaning agent. This segment will likely continue to see consistent demand in 2024, especially as consumers become more focused on sustainable, eco-friendly products for everyday use.

By Distribution Channel

In 2023, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 48.1% share of the Apple Cider Vinegar (ACV) market. These large retail outlets continue to be the go-to destination for consumers seeking a wide variety of food and health products, including ACV.

The convenience of one-stop shopping, combined with competitive pricing and extensive product offerings, has made hypermarkets and supermarkets the primary distribution channel for ACV. This trend is expected to continue in 2024, as consumers increasingly prefer the convenience of purchasing ACV alongside other grocery and household items in large retail spaces.

Convenience Stores, while a smaller segment in 2023, also saw steady demand for ACV, particularly from on-the-go consumers seeking quick purchases. Convenience stores are a popular choice for customers who need immediate access to everyday products, including health-related items like apple cider vinegar. Though ACV sales in convenience stores remain a fraction of those in hypermarkets and supermarkets, this segment is expected to grow slightly in 2024 due to the increasing interest in health-focused products that can be easily accessed during routine trips.

Discount Stores, which offer products at lower prices, captured a significant share of the ACV market in 2023. Shoppers looking for more affordable alternatives often turn to discount stores, and as ACV becomes a staple in wellness routines, the demand in this channel is expected to remain strong in 2024. These stores appeal to a broad demographic, particularly budget-conscious consumers, and will continue to attract customers seeking value-for-money options for their health products.

Pharmacy/Drug Stores, known for offering a wide range of health and wellness products, are another important distribution channel for ACV. While their market share was smaller compared to hypermarkets and supermarkets in 2023, this segment experienced steady growth. ACV is increasingly seen as a health product, and pharmacies have capitalized on this by positioning it as part of the broader wellness and supplement offerings. In 2024, this segment is expected to grow further as consumers become more health-conscious and seek trusted sources for wellness-related products.

Food and Drink Specialty Stores accounted for a smaller but notable share in 2023. These stores cater to specific consumer groups looking for organic, natural, or health-oriented products. ACV, particularly organic or unfiltered varieties, is popular in these outlets as it aligns with the interests of customers focused on specialty diets or health-focused lifestyles. This segment is anticipated to see gradual growth in 2024 as more consumers seek niche and premium ACV options.

Key Market Segments

By Type

- Filtered

- Unfiltered

By Nature

- Organic

- Conventional

By Form

- Powder

- Tablets

- Capsules

- Liquid

By End-use

- Food Industry

- Dietary Supplements

- Retail/Household

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Discount Stores

- Pharmacy/Drug Stores

- Food and Drink Specialty Stores

- Others

Drivers

Rising Consumer Demand for Health and Wellness Products

One of the major driving factors for the growth of the Apple Cider Vinegar (ACV) market is the increasing consumer demand for health and wellness products. As people become more health-conscious, particularly in the wake of the global pandemic, they are turning to natural ingredients and functional foods that promise to improve overall well-being. ACV, known for its potential health benefits like aiding digestion, supporting weight loss, and regulating blood sugar levels, is gaining widespread popularity in the wellness community.

The trend toward health and wellness is reflected in the growing sales of functional foods and beverages, where ACV plays a significant role. According to the International Food Information Council (IFIC), 53% of consumers reported that they are trying to eat healthier in 2023, a number that has been steadily increasing over the past few years. This shift in consumer preferences has driven the demand for natural and minimally processed foods, which includes products like ACV.

Additionally, the U.S. Dietary Supplement market alone was valued at $56.7 billion in 2023 and is expected to continue expanding as consumers seek supplements to complement their healthy lifestyles. ACV has increasingly been incorporated into this market, especially in capsule and tablet forms, which provide consumers with a convenient way to consume the product without the strong taste or acidity of the liquid form.

A significant factor in the rising demand for ACV is its association with holistic health practices, including its purported benefits for managing chronic conditions like Type 2 diabetes. According to a study published in the Journal of Functional Foods in 2023, regular consumption of ACV has been shown to reduce blood sugar levels and improve insulin sensitivity, further fueling its popularity among health-conscious individuals. This aligns with the broader wellness trend, where more consumers are looking for natural remedies to manage chronic conditions, rather than relying on pharmaceutical drugs.

The growing awareness of these health benefits, coupled with increasing consumer spending on health-related products, is expected to keep driving the demand for ACV in both retail and online channels. The ability of ACV to be marketed as both a food ingredient and a health supplement has enabled it to tap into multiple market segments, including the food industry, dietary supplements, and even skincare, further broadening its consumer base.

Restraints

High Acidity and Potential Health Risks

One of the major restraining factors affecting the growth of the Apple Cider Vinegar (ACV) market is its high acidity, which can lead to potential health risks if consumed in excessive amounts. Although ACV is often marketed for its health benefits, the acidity level—typically ranging between 5% to 7% acetic acid—can cause various side effects, particularly when consumed in large quantities. These health risks include tooth enamel erosion, digestive issues, and potential irritation of the throat or stomach.

According to the U.S. National Library of Medicine, long-term or excessive consumption of highly acidic substances like ACV can lead to a deterioration of tooth enamel, which is a common concern among users who regularly consume undiluted ACV. The acidity in ACV can soften tooth enamel, making teeth more vulnerable to decay. This issue has become a significant concern for health-conscious consumers, particularly those using ACV daily for health benefits such as weight loss or improved digestion.

Moreover, excessive consumption of ACV has been linked to digestive issues, including bloating, indigestion, or acid reflux. A report by the National Center for Complementary and Integrative Health (NCCIH) notes that while moderate consumption of ACV may aid digestion for some individuals, too much of it can lead to discomfort and irritation of the gastrointestinal tract. This is particularly problematic for people with pre-existing conditions like gastroesophageal reflux disease (GERD) or ulcers, who may be more sensitive to acidic substances.

The safety concerns surrounding ACV have led to increasing caution from health experts regarding its consumption. According to the American Dental Association (ADA), regularly consuming highly acidic substances without diluting them can result in significant dental issues over time. In a 2023 consumer survey, 32% of respondents stated they were cautious about using ACV due to concerns about its acidity affecting their dental health. This caution has the potential to limit the broader adoption of ACV, particularly among those new to the product or those with specific health concerns.

Additionally, there have been cases of adverse interactions between ACV and certain medications. For instance, ACV may interfere with medications used for diabetes, lowering blood sugar levels too much. A report published by the Mayo Clinic highlighted that ACV may interact with insulin and diuretics, potentially causing dangerous drops in potassium levels. As a result, consumers with chronic health conditions, especially those on multiple medications, may hesitate to incorporate ACV into their diets.

The growing awareness of these health risks is creating a restraint on the market’s growth, as potential consumers may hesitate to use ACV regularly due to concerns over its side effects. Despite its perceived health benefits, the negative impact of ACV’s acidity on dental health and digestion can limit its use and adoption, especially among more cautious or health-conscious individuals.

Opportunity

Expanding Market for ACV-Infused Products

A significant growth opportunity for the Apple Cider Vinegar (ACV) market lies in the expanding range of ACV-infused products, tapping into the booming wellness and functional food sectors. As consumers increasingly seek health-enhancing foods and beverages, ACV is being incorporated into a variety of new product categories, including beverages, condiments, and even skincare products, broadening its appeal and usage occasions.

According to the Food and Agriculture Organization (FAO), the functional foods market, which includes food products enhanced with health benefits, has seen a robust growth rate of 8.7% annually as of 2023. ACV is riding this wave, with companies innovating beyond traditional formats to offer ACV in formats such as gummies, teas, and health shots. These innovations not only cater to health-conscious consumers but also help mitigate some of the challenges associated with ACV’s strong taste and acidity, making it more palatable and versatile for daily use.

For instance, the introduction of ACV gummies has significantly broadened its consumer base. Market analysis from leading health food insights platforms suggests that ACV gummies have seen a 250% increase in sales over the past year. This surge is attributed to their convenience and ease of use, appealing to a younger demographic that may be put off by the harsh taste of liquid vinegar.

Moreover, the rising trend in health-conscious behaviors, supported by government initiatives promoting healthier lifestyles, continues to drive the demand for functional beverages. The U.S. Department of Agriculture (USDA) has noted a 30% increase in the consumption of functional beverages in 2023 alone.

ACV-infused drinks are part of this trend, offering a convenient and appealing way for consumers to integrate ACV into their diets. These products often highlight ACV’s potential benefits, such as aiding digestion and boosting metabolism, making them attractive options in the wellness drinks category.

According to industry reports from the Global Wellness Institute, the natural skincare market is projected to grow by 9.5% over the next five years, and ACV-based products like toners, cleansers, and masks are well-positioned to capture a share of this market. The appeal lies in ACV’s organic and non-toxic credentials, which resonate with the growing consumer preference for clean and sustainable beauty products.

Trends

Surge in ACV Blends for Enhanced Flavor and Health Benefits

A notable trend shaping the Apple Cider Vinegar (ACV) market is the surge in popularity of ACV blends, which combine ACV with other beneficial ingredients like turmeric, ginger, and honey. This trend is driven by increasing consumer interest in functional foods and beverages that provide additional health benefits. These ACV blends are crafted to enhance both flavor and the health-promoting properties of ACV, appealing to a broader audience by offering more palatable options.

As reported by the Food and Agriculture Organization (FAO), the global functional foods market is expanding, with a projected annual growth rate of 8.7%. ACV, with its well-documented health benefits, is a perfect fit for this category, especially when combined with other superfoods. The introduction of ACV blends has opened new avenues for product development, as consumers increasingly look for products that not only contribute to good health but also offer convenience and enhanced taste profiles.

For example, ACV with honey is gaining traction, not just for its health benefits, such as improved digestion and potential anti-inflammatory properties, but also because honey softens the tartness of vinegar, making it more enjoyable to consume. Market analysis indicates that ACV products infused with honey have seen a sales increase of 150% in the past year alone, illustrating consumer preference for these types of blends.

Furthermore, the integration of ACV into daily diets has been promoted through innovative recipes and product offerings. For instance, ACV teas and smoothies are emerging as popular choices among health-conscious consumers.

These products typically market the combined benefits of ACV and complementary ingredients like green tea, which is known for its antioxidant properties. The U.S. Department of Health has highlighted the increasing consumption of dietary supplements and health beverages, noting a 20% increase in demand for health-enhancing drinks in 2023.

The trend is also supported by a growing body of research underscoring the health benefits of regular ACV consumption, which includes improved metabolic function and support for weight management. This scientific backing helps strengthen consumer confidence in ACV products, particularly those that are part of comprehensive health and wellness routines.

Regional Analysis

In the global Apple Cider Vinegar (ACV) market, regional dynamics play a crucial role in shaping market trends and consumer preferences. North America stands as the dominant region, capturing 43.4% of the market, with a valuation of USD 414.2 billion. This dominance is driven by a heightened consumer awareness of health and wellness, along with a strong presence of key market players that are actively innovating and expanding the range of ACV products.

Europe follows as a significant market, where traditional dietary habits and a growing preference for natural and organic food products fuel the demand for ACV. European consumers are increasingly adopting ACV as part of their daily diet, motivated by its health benefits and the trend towards cleaner eating.

The Asia Pacific region is experiencing rapid growth in the ACV market, attributed to rising health consciousness and changes in dietary patterns, especially in emerging economies like China and India. The region’s vast consumer base and increasing disposable incomes are expected to drive substantial market growth.

Meanwhile, the Middle East & Africa and Latin America regions are emerging markets for ACV. These regions show potential for growth due to increasing urbanization and the influence of Western dietary trends. However, market penetration is relatively lower compared to other regions, with growth driven by gradual consumer awareness and the expanding retail presence of ACV products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Apple Cider Vinegar (ACV) market features a diverse group of key players, each contributing uniquely to the industry’s growth and evolution. Among these, Bragg Live Food Products is renowned for its organic and health-oriented ACV products, aligning well with global health trends and consumer preferences for natural ingredients. Similarly, The Kraft Heinz Company has leveraged its extensive distribution network and brand reputation to capitalize on the rising demand for ACV, especially in the culinary sector.

In addition to established food giants, specialized companies like Aspall Cyder Ltd. and Manzana Products Co. focus on premium and organic ACV products, catering to niche markets that prioritize authenticity and quality.

PepsiCo Inc., with its vast portfolio of beverage and snack products, has also ventured into the ACV market, introducing ACV-infused drinks to attract health-conscious consumers seeking functional beverages. Meanwhile, companies like GNC Holdings, Inc. and Vitane Pharmaceuticals, Inc. play a critical role in the dietary supplements segment, offering ACV in various forms, including capsules and tablets, to meet the wellness needs of their customers.

Top Key Players

- Aspall Cyder Ltd.

- Barnes Natural

- Bragg Live Food Products

- Carl Kühne KG (GmbH & Co.)

- Castelo Alimentos S/A

- Eden Foods, Inc.

- General Nutrition Centers, Inc.

- GNC Holdings, Inc.

- Higher Nature Limited

- Kraft-Heinz

- Manzana Products Co.

- Nutraceutical Corporation

- Old Dutch Mustard Company

- PepsiCo Inc.

- Pompeian, Inc.

- POMPEIAN.

- Solana Gold Organics

- Swanson

- The Kraft Heinz Company

- Vitane Pharmaceuticals, Inc.

- White House Foods Company

Recent Developments

In 2023 Aspall Cyder Ltd., the company, owned by Molson Coors, invested USD 16 million to upgrade its 300-year-old facility in the UK. This investment significantly boosted its production capabilities, increasing its cider output by 60% to approximately 70 million pints annually.

In 2023 Barnes Natural has established itself as a significant player in the apple cider vinegar (ACV) market, recognized for its contributions to the industry through its range of ACV products.

Report Scope

Report Features Description Market Value (2023) USD 954.5 Mn Forecast Revenue (2033) USD 1825.7 Mn CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Filtered, Unfiltered), By Nature (Organic, Conventional), By Form (Powder, Tablets, Capsules, Liquid), By End-use (Food Industry, Dietary Supplements, Retail/Household, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Discount Stores, Pharmacy/Drug Stores, Food and Drink Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aspall Cyder Ltd., Barnes Natural, Bragg Live Food Products, Carl Kühne KG (GmbH & Co.), Castelo Alimentos S/A, Eden Foods, Inc., General Nutrition Centers, Inc., GNC Holdings, Inc., Higher Nature Limited, Kraft-Heinz, Manzana Products Co., Nutraceutical Corporation, Old Dutch Mustard Company, PepsiCo Inc., Pompeian, Inc., POMPEIAN., Solana Gold Organics, Swanson, The Kraft Heinz Company, Vitane Pharmaceuticals, Inc., White House Foods Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aspall Cyder Ltd.

- Barnes Natural

- Bragg Live Food Products

- Carl Kühne KG (GmbH & Co.)

- Castelo Alimentos S/A

- Eden Foods, Inc.

- General Nutrition Centers, Inc.

- GNC Holdings, Inc.

- Higher Nature Limited

- Kraft-Heinz

- Manzana Products Co.

- Nutraceutical Corporation

- Old Dutch Mustard Company

- PepsiCo Inc.

- Pompeian, Inc.

- POMPEIAN.

- Solana Gold Organics

- Swanson

- The Kraft Heinz Company

- Vitane Pharmaceuticals, Inc.

- White House Foods Company