Global Mango Puree Market By Source (Organic, Conventional), By Packaging (Cans, Pouches, P.E.T. Jars, Bottles), By Application (Infant Food, Bakery and Snacks, Ice Cream and Yoghurt, Dressings and Sauces, Others), By Distribution Channel (Convenience Stores, Specialty Stores, Online Retail, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: December 2024

- Report ID: 134654

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Source Analysis

- By Packaging Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

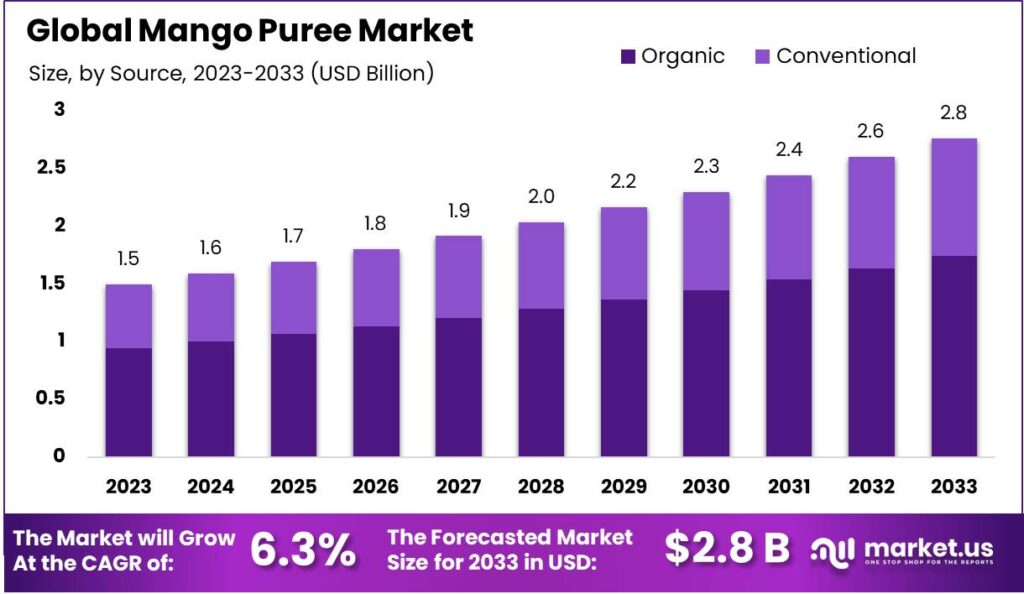

The Global Mango Puree Market size is expected to be worth around USD 2.8 Billion by 2033, from USD 1.5 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

The global mango puree market has experienced steady growth, driven by the increasing demand for healthy, versatile, and natural food ingredients. Mango puree’s widespread use in beverages, sauces, ice creams, and desserts, alongside its nutritional benefits such as vitamins and antioxidants, has made it a key ingredient in both the food and beverage industry and baby food products.

As consumer interest shifts towards cleaner labels and more health-conscious products, mango puree fits perfectly into the demand for natural, plant-based foods.

The surge in veganism, organic diets, and gluten-free trends has contributed to the market’s rise. Mango puree, being free from artificial additives, aligns with the shift toward clean-label, all-natural ingredients. Its versatility in a wide range of food products, from smoothies and juices to baby food and beauty products, has further expanded its appeal. Additionally, the increasing preference for tropical fruits, especially in beverages and desserts, has made mango puree a sought-after ingredient in many food categories.

The market for mango puree is expected to continue expanding, especially in emerging markets where packaged and processed food demand is on the rise. Opportunities in the organic and sustainably sourced product segments are also growing, driven by consumer demand for pesticide-free products. The rise of e-commerce and innovations in packaging open new opportunities for brands to reach global markets and offer specialized product lines like organic or sugar-free mango puree.

International expansion is becoming increasingly important, with regions like the Middle East and Latin America showing significant growth potential. As consumer awareness of health and wellness increases in developed markets, mango puree is seeing greater usage in plant-based, gluten-free, and health-focused products.

Export dynamics are also favorable, with India, Thailand, and the Philippines driving the global trade of mango puree. India, the world’s largest exporter, accounted for 30% of the global export volume in 2022, exporting more than 17,000 metric tons. In 2023, the global mango puree export market was valued at approximately $1.2 billion, with the U.S., Germany, and the UK being major importers.

Government initiatives, such as India’s “National Horticulture Mission,” along with subsidies, tax exemptions, and infrastructure development, continue to foster the growth of the mango puree sector. Private sector investments from major brands like PepsiCo and Coca-Cola, particularly in mango-based products, further bolster the market’s prospects.

Key Takeaways

- The Global Mango Puree Market size is expected to be worth around USD 2.8 Billion by 2033, from USD 1.5 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

- Conventional mango puree dominated with a 63.3% market share, followed by Organic.

- Pouches led the Mango Puree market with a 34.3% share, followed by Cans.

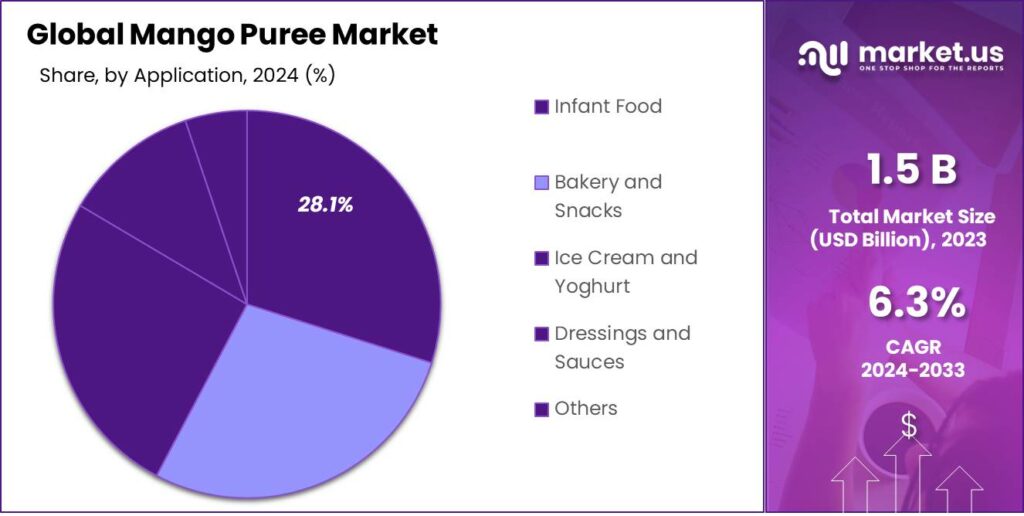

- In 2023, Infant Food dominated the Mango Puree market by application with a 28.1% share.

- Convenience Stores led the Mango Puree market by Distribution Channel with a 37.1% share.

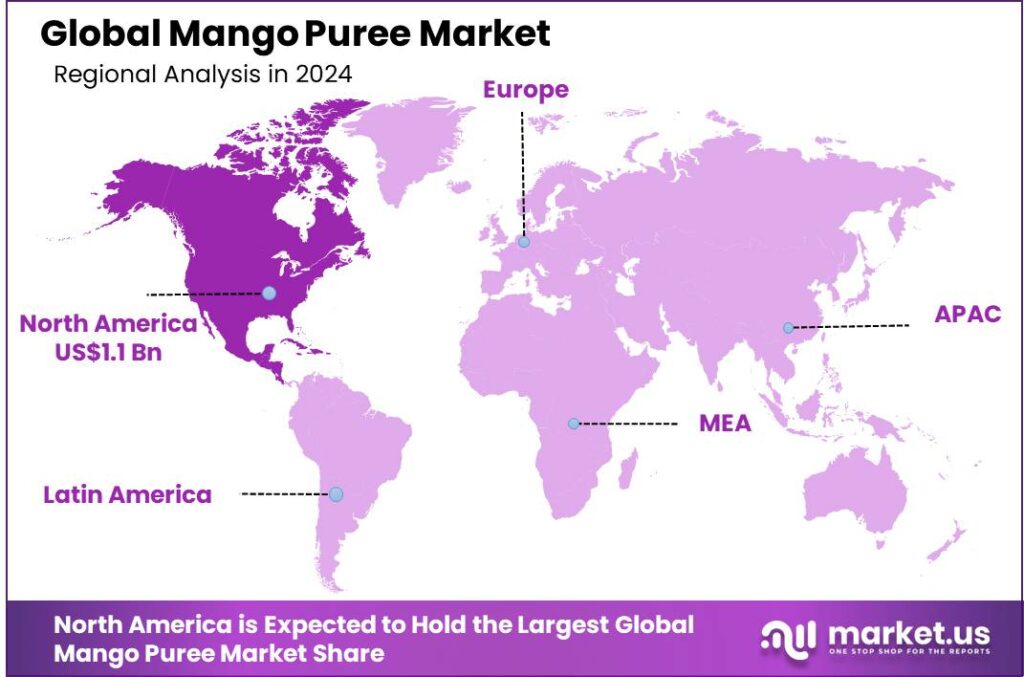

- Asia Pacific dominated the mango puree market with a 34.2% share, earning USD 0.5 billion.

By Source Analysis

In 2023, Conventional held a dominant market position in the Mango Puree Market, capturing more than a 63.3% share in the Conventional segment. The demand for conventional mango puree has been consistently high due to its cost-effectiveness and widespread availability, especially in large-scale production for food processing industries. This segment benefits from well-established supply chains and favorable farming conditions, which contribute to its lower production costs compared to organic variants.

The Organic Mango Puree segment has been witnessing a steady rise in demand, driven by the increasing consumer preference for clean-label, sustainable, and chemical-free food products. Organic mango puree, though priced higher than conventional varieties, is gaining traction among health-conscious consumers, especially in regions with rising disposable incomes. The organic segment held a significant portion of the market but trailed behind conventional puree, accounting for the remaining market share.

By Packaging Analysis

In 2023, Pouches held a dominant market position in the Mango Puree Market by Packaging, capturing more than a 34.3% share. The growing preference for convenient, lightweight, and easy-to-store packaging has significantly contributed to the popularity of pouches. Their consumer appeal is further enhanced by their cost-effectiveness, portability, and ability to retain the puree’s freshness over extended periods. Pouches are especially favored for single-use or family-sized portions, providing flexibility to both consumers and food manufacturers.

Cans followed as the second-largest packaging format, holding a substantial portion of the market share. They are well-regarded for their long shelf life and ease of transportation, making them a preferred choice for large-scale industrial use and export purposes. Canned mango puree is particularly popular in the food processing sector.

P.E.T. Jars and Bottles, though smaller in comparison, continue to see niche applications, primarily in premium or organic mango puree products. P.E.T. Jars, known for their durability and aesthetic appeal, are often chosen for high-end packaging, while Bottles are typically used for ready-to-drink or liquid mango products. Both packaging types maintain a strong presence due to their ability to provide product visibility and a high-quality consumer experience.

By Application Analysis

In 2023, Infant Food held a dominant market position in the Mango Puree Market by Application, capturing more than a 28.1% share. The increasing consumer demand for natural, nutritious, and chemical-free ingredients in baby food has driven the growth of mango puree in this segment. Its rich vitamin content, coupled with its smooth texture and mild sweetness, makes it an ideal base for infant food products, especially in purees, snacks, and first foods.

The Bakery and Snacks segment followed closely behind, driven by the growing trend of incorporating fruit-based flavors into healthier snack options. Mango puree is increasingly used as an ingredient in energy bars, fruit snacks, and baked goods, offering natural sweetness and nutritional benefits without added sugars.

The Ice Cream and Yoghurt segment also holds a notable share, with mango puree being a popular flavoring agent in dairy products, particularly in tropical or exotic ice creams and yogurts. This trend is fueled by consumer preference for innovative and indulgent flavors. Dressings and Sauces, while a smaller segment, continue to see growth as mango puree is increasingly used in salad dressings, marinades, and condiments, providing a natural sweet and tangy flavor.

By Distribution Channel Analysis

In 2023, Convenience Stores held a dominant market position in the Mango Puree Market by Distribution Channel, capturing more than a 37.1% share. The high consumer footfall in convenience stores, combined with their accessibility and extended operating hours, has made them the preferred shopping destination for impulse purchases of mango puree. These stores cater to a wide range of consumers seeking quick and easy access to popular food products, including ready-to-consume mango puree, which drives their dominance in this segment.

Specialty Stores followed as the second-largest distribution channel, holding a significant market share. These stores, which focus on organic, gourmet, and premium food items, are a key source for health-conscious consumers looking for high-quality or organic mango puree options. Specialty stores also offer a curated selection of products, which helps in creating a niche market for premium mango puree brands.

Online Retail has been gaining traction, particularly as e-commerce continues to grow. Consumers increasingly prefer the convenience of shopping from home, with many opting for bulk purchases or premium product options. The ease of online ordering, along with doorstep delivery, has driven the growth of mango puree sales through this channel.

Key Market Segments

By Source

- Organic

- Conventional

By Packaging

- Cans

- Pouches

- P.E.T. Jars

- Bottles

By Application

- Infant Food

- Bakery and Snacks

- Ice Cream and Yoghurt

- Dressings and Sauces

- Others

By Distribution Channel

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Driving factors

Increasing Demand For Natural And Healthy Ingredients

One of the major drivers of the global mango puree market is the growing consumer demand for natural and healthy ingredients in food and beverage products. As consumers become more health-conscious, they are actively seeking clean-label products that do not contain artificial additives, preservatives, or flavorings.

Mango puree fits perfectly into this trend as it is a natural, nutrient-rich product, high in vitamins, antioxidants, and fiber. With the increasing popularity of plant-based, organic, and gluten-free diets, the demand for natural fruit purees has surged, particularly in the dairy, confectionery, and beverage sectors.

Mango puree, often used in smoothies, fruit drinks, and dessert products, meets consumer preferences for fresh, nutrient-packed ingredients. As people also embrace the idea of reducing sugar intake, the naturally sweet profile of mango puree makes it an appealing option for manufacturers aiming to create healthier alternatives. This demand aligns with the rise of healthy lifestyle choices, driving the global market for mango puree.

Restraining Factors

Price Volatility Of Mangoes

One of the key challenges in the mango puree market is the price volatility of mangoes, the primary raw material used in puree production. Mangoes are highly dependent on weather conditions, seasonal cycles, and farming practices, which make their availability and price subject to fluctuations. Unpredictable weather events, such as droughts or excessive rainfall, can significantly impact mango yields and, consequently, the supply of mango puree.

When the supply of mangoes is low due to poor harvests, prices for raw mangoes tend to rise, which directly affects the production cost of mango puree. For manufacturers, this means that they may face difficulties in maintaining consistent pricing for their puree products. The increased production costs can either lead to higher prices for consumers or reduced profit margins for companies.

Additionally, in regions where mango cultivation is less established, the procurement and transportation of mangoes can incur additional logistical costs, further impacting market dynamics. As the mango puree market grows, managing these price fluctuations remains a critical restraint.

Growth Opportunity

Expansion In Emerging Markets

The mango puree market has significant growth opportunities in emerging markets, particularly in Asia, Africa, and Latin America. These regions have a large population base and a growing middle class with rising disposable incomes, leading to an increased demand for processed food products. As urbanization continues, people are becoming more exposed to convenience foods, which are often made with fruit purees like mango.

Furthermore, many of these regions have abundant mango cultivation, offering a local supply advantage for manufacturers looking to enter these markets. The increasing popularity of smoothies, fruit juices, and ready-to-eat snacks made from mango puree presents a lucrative opportunity for producers. In addition, the rise in the consumption of vegan, vegetarian, and organic foods, particularly in younger generations, aligns with mango puree’s natural and healthy attributes.

International trade agreements and improved distribution channels have further opened the doors for market players to expand into these emerging economies. As a result, emerging markets represent an attractive area for growth, both in terms of production and consumption of mango puree.

Challenge

Supply Chain And Transportation Issues

A significant challenge in the mango puree market is the complexity of its supply chain and the transportation of mangoes from farms to processing facilities. Mangoes are highly perishable and require careful handling throughout the supply chain, from harvesting to processing. In many mango-producing countries, inadequate infrastructure and transportation systems can lead to delays in getting fresh mangoes to processing plants, compromising their quality and increasing waste.

Additionally, mangoes need to be processed quickly after harvest to maintain their flavor and nutritional value. This urgency can put pressure on manufacturers to manage their supply chains efficiently, often requiring temperature-controlled storage and rapid transportation methods, which can increase costs.

In some regions, logistical challenges such as poor roads, limited cold storage facilities, and inefficiencies at ports can further complicate the distribution process. These supply chain hurdles can result in a higher cost structure and affect the overall profitability of mango puree production. Overcoming these challenges through improved infrastructure and more efficient logistical operations will be key to the sustained growth of the market.

Emerging Trends

The Global Mango Puree Market Is Driven By Plant-Based Products, Organic Demand, And Advanced Processing Technologies.

The global mango puree market is experiencing a series of emerging trends, driven by evolving consumer preferences and advancements in food technology. One significant trend is the increasing use of mango puree in plant-based and dairy-free products. As consumers opt for more vegan, lactose-free, and gluten-free diets, the demand for fruit-based alternatives has surged.

Mango puree, with its natural sweetness and smooth texture, is being incorporated into dairy-free ice creams, plant-based yogurts, and vegan smoothies, meeting the rising demand for healthier and more inclusive food options.

Another emerging trend is the growing preference for organic and sustainably sourced mango puree. With consumers becoming more environmentally conscious, there is a rising demand for food products that are both healthy and ethically produced.

Organic mango puree, which is free from pesticides and chemical fertilizers, is gaining traction among health-conscious consumers, particularly in markets like North America and Europe. Additionally, brands are increasingly focusing on sustainable farming practices, such as fair trade certifications and eco-friendly packaging, to appeal to ethically-minded consumers.

Furthermore, innovations in food processing technology are improving the quality and shelf life of mango puree. The use of advanced methods like high-pressure processing (HPP) helps preserve the nutrients and natural flavors of the mango while extending the product’s shelf life without the need for artificial preservatives. These innovations are making mango puree more accessible to a global audience, as manufacturers can now offer fresher, longer-lasting products to consumers worldwide.

Business Benefits

Mango Puree Offers Business Opportunities Through Sustainability, Cost Efficiency, And Product Diversification In Healthy Food Markets.

Mango puree offers a range of business benefits for companies operating in the food and beverage industry, especially those looking to innovate and cater to the growing demand for natural, healthy products. First, mango puree can help companies differentiate their products in a crowded marketplace.

The natural sweetness and rich flavor of mango make it an attractive ingredient for manufacturers aiming to create unique, high-quality offerings. Whether used in beverages, confectionery, or frozen desserts, mango puree adds value by enhancing the taste profile of a product, making it more appealing to health-conscious consumers.

Additionally, the versatility of mango puree opens up opportunities for businesses to tap into multiple market segments. Its application spans across various food categories, from smoothies and juices to baked goods and sauces. This wide range of potential uses enables manufacturers to target diverse customer bases and expand their product portfolios. For example, a company that specializes in dairy products can introduce mango-flavored yogurt, while a beverage brand can launch a line of mango-based juices or ready-to-drink smoothies.

Another business benefit is the scalability of mango puree production. As demand for healthy, natural ingredients grows, the global supply of mangoes is also increasing, which allows businesses to scale production accordingly.

Additionally, technological advancements in processing techniques have made it easier to produce mango puree on a large scale while maintaining high-quality standards. The availability of both conventional and organic mango puree gives companies the flexibility to cater to different consumer preferences, tapping into both mainstream and niche markets.

Finally, the positive perception of mango puree as a healthy and nutrient-rich product can enhance brand reputation. Consumers are increasingly seeking clean-label products that align with their wellness goals. By incorporating mango puree into their offerings, companies can position themselves as brands that prioritize health, sustainability, and natural ingredients, building long-term customer loyalty.

Regional Analysis

Asia Pacific dominated the mango puree market with a 34.2% share, earning USD 0.5 billion.

In 2023, Asia Pacific held a dominant market position in the global mango puree market, capturing more than a 34.2% share, with revenue totaling USD 0.5 billion. This region’s leadership can largely be attributed to its extensive mango production capabilities, particularly in countries like India, Thailand, and the Philippines, which are major exporters of mangoes and mango-based products.

Asia Pacific not only benefits from low-cost production but also enjoys a strong local demand for mango puree, driven by growing preferences for healthy, natural, and plant-based food products.

India, as the world’s largest producer of mangoes, plays a pivotal role in the growth of this market. The country’s abundant mango production, alongside improvements in processing technologies, has contributed to the region’s leading market share.

In fact, India alone accounts for more than 40% of global mango production, positioning it as a key player in the mango puree supply chain. Additionally, the increasing popularity of processed fruit products in emerging markets such as China and Southeast Asia further strengthens Asia Pacific’s dominance.

The expanding middle-class population in Asia Pacific also plays a crucial role in the rising demand for mango puree, as these consumers are more inclined toward healthy and premium food options. This trend is reflected in the growing availability of mango puree in supermarkets, online platforms, and the food service industry.

Furthermore, the region’s innovative food processing methods, such as high-pressure processing (HPP), are improving the quality, shelf life, and nutritional value of mango puree, making it a more viable option for international markets.

As the market continues to expand, Asia Pacific is expected to maintain its leadership, driven by both local consumption and export opportunities. The region’s favorable climate for mango cultivation, coupled with its expanding food processing capabilities, ensures a steady supply of mango puree, which will be key to sustaining its dominant position in the global market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Mango Puree market is shaped by several key players, each contributing significantly to its growth, innovation, and competitive landscape. Notably, 7D Mangoes stands out for its strategic focus on sustainable sourcing and innovative processing techniques, ensuring high-quality mango puree that meets the increasing demand for organic and clean-label products. With a strong presence in North America, the company is capitalizing on the rising consumer preference for healthy and natural fruit-based products.

Superior Foods Inc., on the other hand, brings scale and reliability to the market, leveraging its robust distribution network across the U.S. The company’s diverse product portfolio, including mango puree and concentrates, addresses the growing demand from both food manufacturers and the hospitality sector, where mango is increasingly sought after for its rich flavor and versatility.

Nestlé S.A., a global leader, is also making notable strides in the mango puree sector, particularly through its emphasis on product innovation and sustainability initiatives. As consumers become more health-conscious, Nestlé’s efforts to introduce nutritious and convenient mango-based products align well with current market trends, including the demand for dairy alternatives and smoothies.

Finally, Symrise AG brings its extensive expertise in flavoring and food ingredients to the market. The company is well-positioned to leverage its global presence and R&D capabilities to introduce new mango-flavored products, catering to the growing demand in the food and beverage sectors for exotic and tropical flavors. Symrise’s ability to deliver both taste and consistency will continue to support its competitive position in the mango puree market.

These companies, with their strong market presence and innovation-driven approaches, are poised to capitalize on the growing demand for mango puree, driven by health-conscious consumers and an expanding food and beverage industry.

Market Key Players

- 7D Mangoes

- Superior Foods Inc.

- Varadaraja Foods Private Limited

- Mother India Farms

- Galla Foods

- Tree Top Inc.

- AGRANA Group

- Kiril Mischeff

- Foods Pty Ltd

- Nestlé S.A.

- The Hain Celestial Group

- Newberry International Produce Limited

- Symrise AG.

- Riviana Foods Pty Ltd

- Kiril Mischeff

- Döhler GmbH

- FPD Food International, Inc.

- Navya Foods

- Jain Farm Fresh

- Lemonconcentrate S.L.U

- Capricorn

- Aditi Foods

Recent Development

- In June 2024, Del Monte announced a strategic partnership with the EcoPackaging Initiative, committing to a 100% sustainable packaging solution for its mango puree products. The company plans to reduce its carbon footprint by 25% over the next 3 years and increase sales by 10% within the first year of launching eco-friendly packaging.

- In April 2024, Dole Sunshine Company revealed an investment of USD 10 million to promote sustainable mango farming practices in India, ensuring a steady supply of organic mangoes for puree production. This initiative aims to increase the company’s mango puree production capacity by 15% over the next two years to meet growing demand in North America and Europe.

- In March 2024, Haldiram’s, a major Indian food manufacturer, announced the launch of a new range of plant-based, dairy-free mango puree-based desserts and snacks. The company is capitalizing on the growing demand for vegan and gluten-free products, with projections to generate USD 50 million in revenue from this new product line by the end of 2024.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Billion Forecast Revenue (2033) USD 2.8 Billion CAGR (2024-2032) 6.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Organic, Conventional), By Packaging (Cans, Pouches, P.E.T. Jars, Bottles), By Application (Infant Food, Bakery and Snacks, Ice Cream and Yoghurt, Dressings and Sauces, Others), By Distribution Channel (Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape 7D Mangoes, Superior Foods Inc., Varadaraja Foods Private Limited, Mother India Farms, Galla Foods, Tree Top Inc., AGRANA Group, Kiril Mischeff, Foods Pty Ltd, Nestlé S.A., The Hain Celestial Group, Newberry International Produce Limited, Symrise AG., Riviana Foods Pty Ltd, Kiril Mischeff, Döhler GmbH, FPD Food International, Inc., Navya Foods, Jain Farm Fresh, Lemon concentrate S.L.U, Capricorn, Aditi Foods Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 7D Mangoes

- Superior Foods Inc.

- Varadaraja Foods Private Limited

- Mother India Farms

- Galla Foods

- Tree Top Inc.

- AGRANA Group

- Kiril Mischeff

- Foods Pty Ltd

- Nestlé S.A.

- The Hain Celestial Group

- Newberry International Produce Limited

- Symrise AG.

- Riviana Foods Pty Ltd

- Kiril Mischeff

- Döhler GmbH

- FPD Food International, Inc.

- Navya Foods

- Jain Farm Fresh

- Lemonconcentrate S.L.U

- Capricorn

- Aditi Foods