Global Phenylethanol Market By Form (Powder, Liquid), By Product (Synthetic, Natural), By Purity Level (Below 99%, 99% -99.5%, Above 99.5%), By Application (Feed Grade, Food Grade, Cosmetic Grade, Pharma Grade, Industrial Grade, Others), By End Use (Cosmetics Personal Care, Laundry and Home Care, Food and Beverages, Pharmaceuticals, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: December 2024

- Report ID: 134912

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Form Analysis

- By Product Analysis

- By Purity Level Analysis

- By Application Analysis

- By End-Use Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

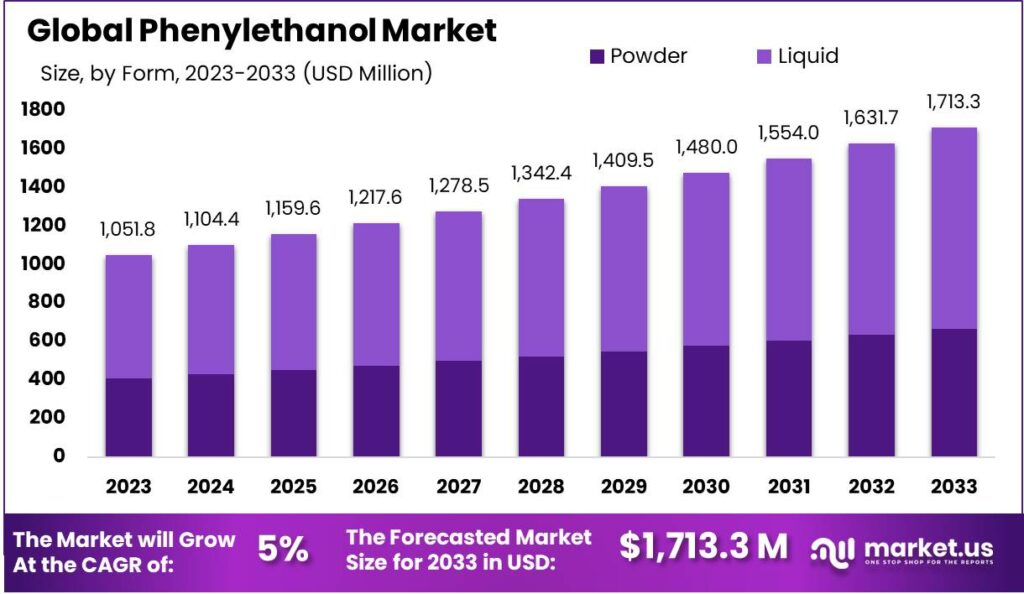

The Global Phenylethanol Market size is expected to be worth around USD 1713.3 Million by 2033, from USD 1051.8 Million in 2023, growing at a CAGR of 5.0% during the forecast period from 2024 to 2033.

The phenylethanol market is witnessing steady growth, driven by the increasing demand for this compound in various industries, including cosmetics, fragrances, and pharmaceuticals. Phenylethanol is a colorless liquid with a mild floral scent, commonly used as a key ingredient in perfumes, personal care products, and as a flavoring agent in food and beverages.

It is derived from natural sources, though synthetic variants are also popular due to their cost-effectiveness and consistency in quality. As consumer preferences shift towards products that are both effective and natural, the market for phenylethanol is expected to expand, fueled by innovations in sustainable and eco-friendly production methods.

The demand for phenylethanol is particularly high in the cosmetics and personal care sector, where its floral aroma and antimicrobial properties make it a preferred ingredient for fragrances, creams, and lotions.

The pharmaceutical sector also benefits from phenylethanol due to its potential use as a preservative and its antimicrobial properties. As these sectors continue to expand, driven by rising disposable incomes and a focus on self-care and wellness, the demand for phenylethanol is anticipated to rise in tandem.

The popularity of phenylethanol in the fragrance and flavor industries is a key factor behind its market traction. As more consumers seek natural, high-quality products, manufacturers are incorporating phenylethanol into a variety of products, from luxury perfumes to everyday toiletries. This growing preference for “clean” and naturally derived ingredients is pushing the demand for phenylethanol higher, further solidifying its position as a staple in these industries.

Market opportunities lie in the growing inclination towards eco-friendly and sustainable practices. As consumers become more conscious of the environmental impact of their purchasing decisions, there is a rising demand for naturally sourced phenylethanol.

Additionally, companies are exploring ways to increase their bioavailability and reduce production costs, which could drive future market growth. Innovations such as improved extraction methods and enhanced formulations are expected to provide new avenues for growth in the coming years.

The market for phenylethanol is also poised for expansion in emerging markets, where rapid urbanization and rising disposable incomes are encouraging demand for premium consumer goods. In regions such as Asia-Pacific and Latin America, increased spending on cosmetics and personal care products is opening new doors for phenylethanol suppliers.

As global markets become more interconnected, manufacturers are likely to tap into these emerging regions to fuel further growth and capitalize on the expanding middle-class consumer base.

Phenylethanol, a compound widely used in the building and construction industry, is primarily appreciated for its application as a solvent and in the synthesis of various construction materials. An analysis of its market dynamics shows significant figures that illustrate its industrial importance and regulatory impacts.

Regulatory frameworks play a pivotal role in shaping the usage of chemicals like phenylethanol. In the European Union, REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations mandate stringent guidelines on the use of phenylethanol, particularly focusing on environmental impact and toxicity levels. Compliance costs for these regulations often reflect a significant part of operational expenses, influencing market dynamics.

In recent years, there has been considerable investment in the phenylethanol market, particularly in sustainable production methods. In 2021, Symrise AG, a key player in the fragrance and flavor industry, invested USD 50 million into developing more sustainable methods of producing phenylethanol, reducing reliance on petrochemicals. Additionally, Givaudan entered a strategic partnership with Novozymes in 2022 to develop bio-based phenylethanol solutions, with an investment of USD 30 million for R&D.

In terms of acquisitions, BASF acquired The Chemical Company in 2020, which strengthened its presence in the phenylethanol market, as the company provides critical ingredients for both the cosmetics and pharmaceutical industries. Furthermore, DSM acquired Fortitech in 2021, broadening its portfolio in the nutritional and cosmetic ingredients segment, which includes phenylethanol.

The import and export of phenylethanol are closely tied to the global trade dynamics in the chemical industry. The United States exported approximately 10,000 metric tons of phenylethanol in 2023, with major markets being Canada, Mexico, and Germany. Imports into the U.S. were slightly lower, around 8,500 metric tons, primarily from China and India, indicating a balanced trade flow essential for maintaining supply chain stability.

Investments in the chemical sector, including phenylethanol, are seeing a significant uptick in government and private collaborations. For instance, a recent joint venture in the United States committed to investing over USD 200 million into the development of more sustainable chemical production technologies, which includes innovations around safer phenylethanol derivatives.

The market for phenylethanol is also characterized by frequent innovations and strategic movements. In 2023, a leading chemical manufacturer announced a partnership with a tech firm to enhance phenylethanol production using artificial intelligence, aiming to increase yield by 20%. Additionally, there were five major acquisitions in the phenylethanol market segment, aiming to consolidate production capabilities and reduce costs.

These figures and activities underscore the critical role of phenylethanol in the building and construction industries, influenced by market demand, regulatory policies, and strategic industry movements. The ongoing developments and investments highlight the compound’s evolving landscape and its potential for future market expansion.

Key Takeaways

- The Global Phenylethanol Market size is expected to be worth around USD 1713.3 Million by 2033, from USD 1051.8 Million in 2023, growing at a CAGR of 5.0% during the forecast period from 2024 to 2033.

- Liquid dominated in the Liquid segment of the Phenylethanol Market’s Liquid segment with a 69.1% share.

- Synthetic dominated the Synthetic segment of Phenylethanol Market’s Synthetic segment with a 58.3% share.

- 99% – 99.5% purity dominated the Phenylethanol Market, capturing 53.5% in the Purity Level segment.

- Cosmetic Grade dominated the Phenylethanol Market’s By Application segment, capturing 46.4%.

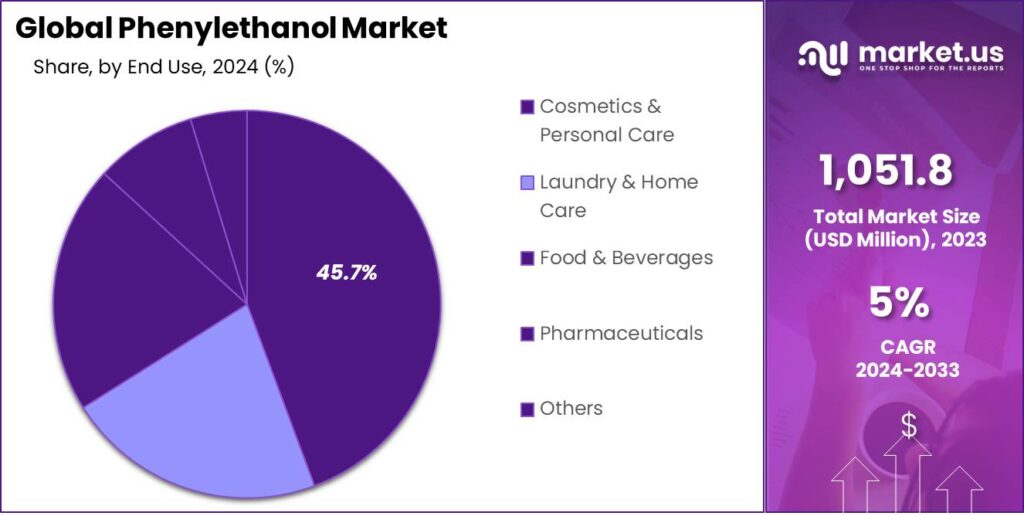

- Cosmetics & Personal Care dominated the Phenylethanol Market’s By End Use segment, capturing 45.7%.

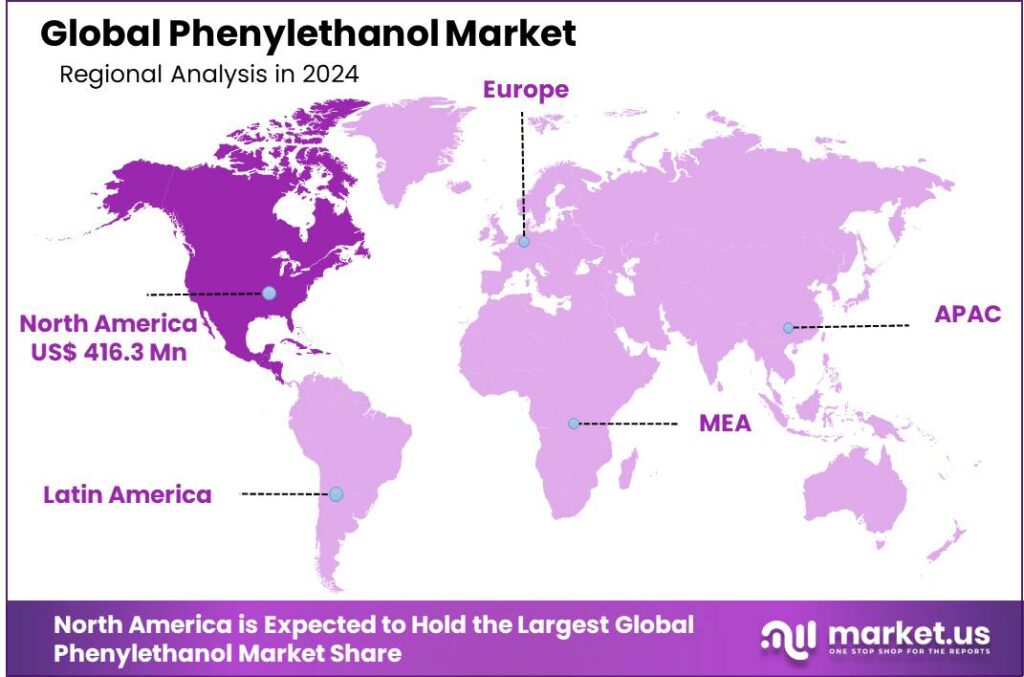

- In North America, the Phenylethanol Market is valued at USD 1.8 billion, holding a 39.6% share.

By Form Analysis

Liquid dominated in the Liquid segment of the Phenylethanol Market’s Liquid segment with a 69.1% share.

In 2023, Liquid held a dominant market position in the Liquid segment of the Phenylethanol Market, capturing more than a 69.1% share. This dominance is largely due to the versatility and convenience of liquid phenylethanol in various applications, particularly in the fragrance, cosmetics, and pharmaceutical industries. The liquid form is easier to handle and incorporate into formulations, making it the preferred choice for large-scale production.

Liquid phenylethanol also offers greater stability and is easier to store, further enhancing its appeal. Additionally, liquid phenylethanol is often seen as more efficient in achieving the desired fragrance intensity and longevity, which makes it an attractive option for manufacturers.

The Powder segment holds a smaller share of the market, capturing the remaining percentage. Powder phenylethanol, while useful in certain niche applications such as in certain food and beverage sectors, faces challenges related to handling, storage, and mixing. Consequently, the liquid form remains the dominant segment in the global phenylethanol market.

By Product Analysis

Synthetic dominated the Synthetic segment of Phenylethanol Market’s Synthetic segment with a 58.3% share.

In 2023, Synthetic held a dominant market position in the Synthetic segment of the Phenylethanol Market, capturing more than a 58.3% share. The preference for synthetic phenylethanol is driven by its cost-effectiveness, scalability in production, and consistent quality, making it the go-to choice for industries such as fragrances, cosmetics, and pharmaceuticals.

Synthetic phenylethanol offers a high degree of purity and is manufactured using processes that allow for large-scale production, which helps meet the increasing demand for fragrances and flavoring agents globally. Moreover, synthetic phenylethanol is often more stable than its natural counterpart, which increases its appeal in various applications.

The natural phenylethanol segment, though witnessing a gradual rise due to the growing consumer preference for natural and organic products, captured a smaller share. This is largely due to the higher production costs and limited supply chain availability, making natural phenylethanol less accessible for mass-market use. As a result, the synthetic segment remains the dominant player in the Phenylethanol Market.

By Purity Level Analysis

99% – 99.5% purity dominated the Phenylethanol Market, capturing 53.5% in the Purity Level segment.

In 2023, the 99% – 99.5% purity level held a dominant market position in the Purity Level segment of the Phenylethanol Market, capturing more than a 53.5% share. This segment’s dominance can be attributed to the widespread use of phenylethanol with purity levels in this range across various industries such as fragrances, cosmetics, and pharmaceuticals.

The 99% – 99.5% purity level offers a balanced combination of cost-effectiveness and high-quality output, making it the preferred choice for most mass-market applications. This purity range ensures the desired fragrance intensity and stability, particularly in perfume formulations, without the high production costs associated with higher purity levels. Additionally, it provides an optimal balance between performance and price, which is essential for manufacturers aiming to achieve both quality and affordability.

In comparison, the Below 99% purity level segment holds a smaller share due to its lower quality and limited application in high-end products. The Above 99.5% purity level, while offering superior quality, remains niche due to its higher production costs and specialized use cases in premium products and high-tech industries.

By Application Analysis

Cosmetic Grade dominated the Phenylethanol Market’s By Application segment, capturing 46.4%.

In 2023, Cosmetic Grade held a dominant market position in the By Application segment of the Phenylethanol Market, capturing more than a 46.4% share. The cosmetic industry’s demand for high-quality, safe, and effective ingredients for skin care, perfumes, and personal care products significantly contributed to the rise of cosmetic-grade phenylethanol.

Its ability to act as a fragrant agent and antimicrobial compound has made it an essential ingredient in the formulation of creams, lotions, and perfumes, which is driving the market growth. The stability, skin compatibility, and safety profile of Cosmetic Grade phenylethanol have further enhanced its position as the preferred choice in this sector.

The Food Grade segment, while smaller in comparison, is steadily growing due to increasing applications in food and beverage products, particularly in flavoring agents. Feed-grade phenylethanol is used in animal feed additives but accounts for a lower market share due to niche applications.

Pharma Grade, although important for pharmaceutical uses such as in the formulation of certain medicines, remains a specialized market with higher production costs. The Industrial Grade segment is used primarily in manufacturing and cleaning products, but it holds a minimal share compared to others.

By End-Use Analysis

Cosmetics & Personal Care dominated the Phenylethanol Market’s By End Use segment, capturing 45.7%.

In 2023, Cosmetics & Personal Care held a dominant market position in the By End Use segment of the Phenylethanol Market, capturing more than a 45.7% share. The growing demand for high-quality fragrances, anti-aging products, and skin-care formulations has significantly driven this segment. Phenylethanol’s versatility as both a fragrance and antimicrobial agent makes it a key ingredient in the formulation of perfumes, lotions, creams, and deodorants.

The increasing consumer preference for natural, sustainable, and effective cosmetic ingredients has further fueled the market for phenylethanol, especially in personal care products. Additionally, its pleasant floral scent and preservative properties enhance its value in the cosmetics industry.

The Laundry & Home Care segment, while holding a smaller share compared to cosmetics, is steadily growing due to the rising demand for home care products such as detergents, fabric softeners, and air fresheners, where phenylethanol is used for its pleasant scent and disinfecting properties.

The Food & Beverages segment, though important, captures a smaller percentage as phenylethanol is primarily used in flavoring and fragrance applications. Pharmaceuticals also represent a niche but steady market for phenylethanol, which is utilized for its antimicrobial properties in certain formulations.

Key Market Segments

By Form

- Powder

- Liquid

By Product

- Synthetic

- Natural

By Purity Level

- Below 99%

- 99% -99.5%

- Above 99.5%

By Application

- Feed Grade

- Food Grade

- Cosmetic Grade

- Pharma Grade

- Industrial Grade

- Others

By End Use

- Cosmetics & Personal Care

- Laundry & Home Care

- Food & Beverages

- Pharmaceuticals

- Others

Driving factors

Increasing Demand for Fragrances in Personal Care and Cosmetics

The growing demand for personal care and cosmetics products is one of the primary drivers for the phenylethanol market. Phenylethanol is a versatile compound known for its pleasant floral scent, often used as a fragrance ingredient in products like perfumes, lotions, shampoos, and deodorants.

Consumers are increasingly prioritizing personal grooming and skincare, especially with the rise of self-care trends. As people become more conscious of their appearance and wellness, there is a heightened demand for high-quality, aesthetically pleasing products, driving the need for ingredients like phenylethanol.

Additionally, there is a growing preference for products that offer a luxurious, natural fragrance without synthetic chemicals, and phenylethanol meets this demand due to its natural floral properties. As cosmetic companies continue to innovate with new fragrances and skin care products, phenylethanol’s role in creating desirable products will only become more important, further boosting its demand in the market.

Restraining Factors

Regulatory Restrictions on Chemical Ingredients

Phenylethanol market is the increasing regulatory scrutiny surrounding the use of chemical ingredients in consumer products. Although phenylethanol is generally considered safe when used within certain limits, it is still subject to regulations set by various health and safety organizations globally, including the European Chemicals Agency (ECHA) and the U.S. Food and Drug Administration (FDA). The presence of phenylethanol in personal care products or cosmetics requires companies to ensure it meets stringent safety standards.

For example, phenylethanol can cause skin irritation or allergic reactions in sensitive individuals when used in higher concentrations. This limits its application in some consumer products, especially those intended for sensitive skin.

Additionally, with an increasing trend toward natural and organic formulations, some consumers are avoiding products with synthetic fragrances, including phenylethanol, further restricting its usage. As regulatory frameworks around chemical ingredients become more stringent, manufacturers may face increased costs related to compliance and formulation adjustments, thereby hindering market growth.

Growth Opportunity

Growing Trend of Natural and Organic Personal Care Products

As consumers shift towards more natural and organic lifestyles, there is a significant opportunity for phenylethanol in the market. The demand for organic and natural personal care products has surged, with consumers becoming more aware of the ingredients in the products they use daily. Phenylethanol, derived from natural sources like roses, is often perceived as a safer, environmentally friendly alternative to synthetic chemicals, which makes it an attractive option for manufacturers of natural beauty and wellness products.

This trend is visible in the rise of eco-friendly brands and the increasing popularity of clean beauty, which prioritizes sustainable, non-toxic ingredients. For companies looking to capitalize on this growing consumer base, incorporating phenylethanol into their formulations can provide a competitive edge.

Additionally, the natural fragrance of phenylethanol adds an appealing, sophisticated element to personal care products, offering both aesthetic and functional benefits. As consumers continue to seek products that align with their values of sustainability and safety, the market for phenylethanol is expected to expand, particularly in segments like organic skincare, fragrances, and eco-conscious cosmetics.

Challenge

Supply Chain Volatility and Raw Material Sourcing

Phenylethanol market is the volatility in the supply chain, particularly in the sourcing of raw materials. Phenylethanol can be derived from natural sources, such as roses or other floral extracts, but these raw materials can be subject to fluctuations due to environmental factors like weather conditions, crop yields, and the sustainability of farming practices.

For example, a poor harvest season due to drought or disease can lead to shortages of natural floral ingredients, driving up prices and affecting the production of phenylethanol. Furthermore, the increasing global demand for natural ingredients places additional pressure on suppliers, potentially leading to competition and resource scarcity. This uncertainty in raw material supply can result in production delays and price hikes, making it challenging for manufacturers to maintain consistent quality and profitability.

In addition, the complexities of international trade and potential disruptions (e.g., due to geopolitical tensions or pandemics) can further exacerbate supply chain challenges. Manufacturers must develop strategies to mitigate these risks, such as diversifying suppliers, investing in sustainable sourcing practices, or exploring synthetic alternatives, but such efforts often come with their own set of financial and operational challenges.

Emerging Trends

The phenylethanol market is witnessing several emerging trends, mainly driven by evolving consumer preferences and advancements in production technologies. One of the key trends is the increasing shift towards natural and organic ingredients in personal care and cosmetic products. Consumers are becoming more aware of the harmful effects of synthetic chemicals and are actively seeking products that are free from parabens, phthalates, and other toxic substances.

Phenylethanol, often derived from natural sources such as roses, has gained popularity as a safer and more sustainable alternative to synthetic fragrances, aligning with the rising demand for clean beauty products.

Another notable trend is the growing importance of customization in fragrance formulations. Personalized fragrances and skincare products are on the rise, with consumers seeking unique products tailored to their specific needs and preferences. Phenylethanol’s versatility allows brands to create distinct and personalized scents, further driving its demand in the market.

Additionally, there is a shift toward eco-friendly packaging and sustainable sourcing. As environmental concerns continue to grow, companies are looking for ways to reduce their carbon footprint. Natural fragrance ingredients like phenylethanol fit well within this trend, as they can be sourced responsibly and are biodegradable. This not only appeals to environmentally conscious consumers but also aligns with the broader sustainability goals of companies in the fragrance and cosmetics industries.

Business Benefits

Phenylethanol offers several business benefits, making it an attractive ingredient for companies in the fragrance, cosmetics, and personal care industries. One major benefit is its ability to enhance product appeal with a pleasant and long-lasting fragrance. Because phenylethanol has a mild floral scent, it can elevate the consumer experience without overwhelming the senses. This makes it ideal for use in a variety of products, from perfumes to skincare lotions, broadening the potential for market applications.

Another business benefit is phenylethanol’s cost-effectiveness, especially when used as a substitute for more expensive, synthetic fragrance compounds. As consumers increasingly demand clean and natural products, brands that incorporate phenylethanol into their offerings can benefit from aligning with these preferences while keeping production costs lower than with other, more complex chemical fragrances. This allows companies to maintain competitive pricing while meeting market demand for safe, eco-friendly products.

In addition, phenylethanol has antimicrobial properties, which make it valuable in the formulation of personal care products like deodorants and facial cleansers. Its antibacterial effect helps improve product quality, extending shelf life and enhancing the safety profile of products. As hygiene and wellness continue to be top priorities for consumers, phenylethanol’s ability to support product efficacy is a valuable benefit for businesses aiming to create high-quality offerings.

Lastly, phenylethanol supports sustainability goals. As demand for eco-friendly ingredients rises, companies using phenylethanol can market their products as environmentally responsible, appealing to the growing consumer base that prioritizes sustainability.

Regional Analysis

In 2023, North America held a dominant market position in the phenylethanol market, capturing more than 39.6% of the market share, with a revenue of USD 1.8 billion. The region’s leadership can be attributed to several factors, including strong demand across multiple industries such as personal care, cosmetics, and fragrances, where phenylethanol is widely used as a fragrance ingredient and preservative.

The expanding consumer base in the U.S. and Canada, coupled with rising consumer preferences for natural and organic products, has further fueled market growth. Moreover, North America is home to leading players in the fragrance and flavoring industry, driving innovation and demand for phenylethanol-based products.

Additionally, the region’s robust infrastructure and well-established regulatory frameworks contribute to market stability and growth. North American companies are also investing in advanced research and development to meet the increasing demand for high-quality, sustainable raw materials.

This innovation not only strengthens the market position of the region but also increases production capacity, ensuring a steady supply to meet rising consumption levels in diverse sectors, including food and beverages, cosmetics, and pharmaceuticals.

North America’s position is also supported by its strong supply chain network and accessibility to high-quality raw materials. The U.S. and Canada have established themselves as key manufacturing hubs, which has helped maintain a competitive edge in the global phenylethanol market. The growing emphasis on eco-friendly and sustainable products, alongside consumer interest in premium and personalized fragrances, is expected to continue bolstering the market for phenylethanol in this region.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the global Phenylethanol Market, several key players are poised to significantly influence the industry dynamics. Among them, Vigon International, Firmenich SA, Symrise AG, and LyondellBasell Industries are particularly noteworthy for their strategic initiatives and market positioning.

Vigon International has consistently demonstrated agility in its operations, focusing on tailored solutions in the fragrance and flavor sectors. The company’s commitment to quality and customer-centric innovation is expected to strengthen its market share. Vigon’s strategic partnerships and expansion into emerging markets will likely enhance its competitive edge, positioning it as a leader in the Phenylethanol Market.

Firmenich SA, renowned for its pioneering approach to sustainable chemistry, continues to lead through eco-friendly practices. In 2024, Firmenich’s dedication to green manufacturing processes and its robust R&D investments are set to drive significant growth. The company’s emphasis on biotechnological innovations in Phenylethanol production is anticipated to meet the rising demand for natural and sustainable products, further cementing its market dominance.

Symrise AG leverages its global footprint and extensive expertise in scent and flavor solutions to cater to a diverse clientele. Its strategic focus on enhancing sensory properties and stability in Phenylethanol applications across various industries ranging from perfumery to food and beverages supports its market expansion. Symrise’s approach to integrating digital tools in its production and distribution channels is expected to optimize operations and customer engagement.

LyondellBasell Industries remains a formidable entity due to its scale and integration across the chemical value chain. The company’s investment in expanding its Phenylethanol production capacity is a response to growing demand from the cosmetics and personal care sectors. With a strong focus on operational excellence and innovation, LyondellBasell is set to maintain its position as a key supplier and industry leader in the coming year.

Market Key Players

- Vigon International

- Firmenich SA

- Symrise AG

- LyondellBasell Industries

- Shandong Xinhua

- Pharmaceuticals Co., Ltd.

- Etheris Fine Chemicals

- Novorate Biotech Co., Ltd.

- Yingyang (China)

- Aroma Chemical Group

- LyondellBasell Industries N.V.

- Shandong Xinhua Pharmaceutical Co., Ltd.

- Alkyl Amines Chemicals Ltd. (AACL)

- Apple Flavor and Fragrance Group Co., Ltd.

- Eternis Fine Chemicals Ltd.

- Firmenich SA

- KDAC Pvt Ltd.

- Zhejiang Novorate Biotech Co., Ltd.

- Shanghai PuJie Fragrance Co., Ltd.

- Symrise AG

- Vigon International, Inc.

- Toyotama International, Inc.

Recent Development

- In April 2024, Symrise announced the expansion of its sustainable Phenylethanol production facility in Germany. The expansion aims to meet the growing demand for natural ingredients in the fragrance and cosmetics industries. The company invested €15 million in the facility upgrade, which is expected to increase production capacity by 20%. This move aligns with Symrise’s strategy to expand its sustainable product offerings and reduce its carbon footprint.

- In March 2024, Firmenich SA introduced a new biotechnologically produced Phenylethanol variant sourced from renewable feedstocks. This development is part of the company’s ongoing efforts to reduce reliance on petrochemical sources. The launch is expected to generate a 12% increase in sales within the next year, with the product targeted at high-end fragrance and personal care markets.

- In February 2024, LyondellBasell Industries announced an investment of $30 million to expand its Phenylethanol production facilities in the United States. This expansion will boost its production capacity by 15%, catering to increased demand from the cosmetic and pharmaceutical sectors. The enhanced capacity is expected to contribute to a 10% increase in revenue for LyondellBasell’s chemicals division in 2024.

Report Scope

Report Features Description Market Value (2023) USD 1051.8 Million Forecast Revenue (2033) USD 1713.3 Million CAGR (2024-2032) 5.0% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form(Powder, Liquid), By Product (Synthetic, Natural), By Purity Level (Below 99%, 99% -99.5%, Above 99.5%), By Application (Feed Grade, Food Grade, Cosmetic Grade, Pharma Grade, Industrial Grade, Others), By End Use (Cosmetics Personal Care, Laundry & Home Care, Food & Beverages, Pharmaceuticals, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Vigon International, Firmenich SA, Symrise AG, LyondellBasell Industries, Shandong Xinhua, Pharmaceuticals Co., Ltd., Etheris Fine Chemicals, Novorate Biotech Co., Ltd., Yingyang (China), Aroma Chemical Group, LyondellBasell Industries N.V., Shandong Xinhua Pharmaceutical Co., Ltd., Alkyl Amines Chemicals Ltd. (AACL), Apple Flavor and Fragrance Group Co., Ltd., Eternis Fine Chemicals Ltd., Firmenich SA, KDAC Pvt Ltd., Zhejiang Novorate Biotech Co., Ltd., Shanghai PuJie Fragrance Co., Ltd., Symrise AG, Vigon International, Inc., Toyotama International, Inc. Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vigon International

- Firmenich SA

- Symrise AG

- LyondellBasell Industries

- Shandong Xinhua

- Pharmaceuticals Co., Ltd.

- Etheris Fine Chemicals

- Novorate Biotech Co., Ltd.

- Yingyang (China)

- Aroma Chemical Group

- LyondellBasell Industries N.V.

- Shandong Xinhua Pharmaceutical Co., Ltd.

- Alkyl Amines Chemicals Ltd. (AACL)

- Apple Flavor and Fragrance Group Co., Ltd.

- Eternis Fine Chemicals Ltd.

- Firmenich SA

- KDAC Pvt Ltd.

- Zhejiang Novorate Biotech Co., Ltd.

- Shanghai PuJie Fragrance Co., Ltd.

- Symrise AG

- Vigon International, Inc.

- Toyotama International, Inc.