Global Organic Deodorant Market By Type (Sprays, Roll Ons, Sticks and Creams), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online), By End User (Women, Men, Unisex), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134779

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

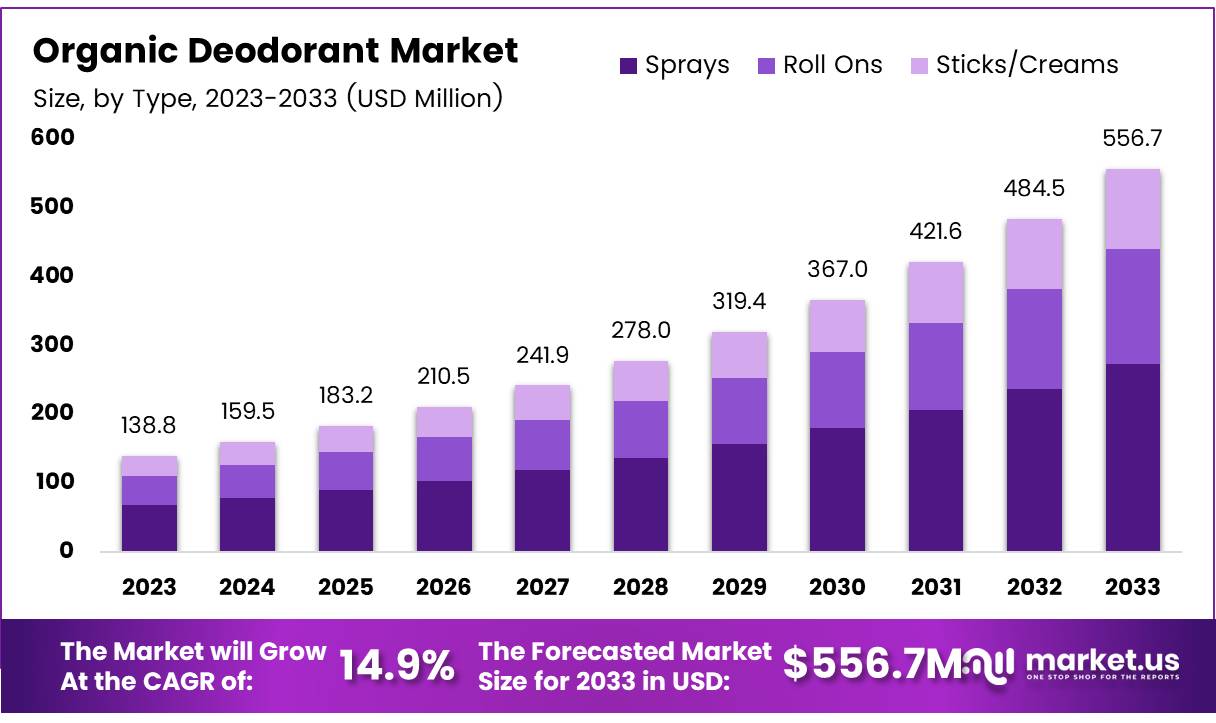

The Global Organic Deodorant Market size is expected to be worth around USD 556.7 million by 2033, from USD 138.8 Million in 2023, growing at a CAGR of 14.9% during the forecast period from 2024 to 2033.

Organic deodorants are personal care products formulated without synthetic chemicals, parabens, or aluminum salts, which are often found in traditional deodorants.

These deodorants rely on natural ingredients like baking soda, arrowroot powder, essential oils, and plant-based extracts to neutralize odor and provide freshness. Consumers increasingly prefer organic deodorants due to their perceived safety, environmental friendliness, and absence of potentially harmful additives.

The Organic Deodorant Market encompasses the production, sale, and consumption of deodorant products made from organic and natural ingredients. This market has seen rapid growth as consumers become more health-conscious and aware of the environmental impact of personal care products. The shift towards organic options is being driven by changing consumer preferences, growing concerns over chemical exposure, and the rise of the natural and sustainable beauty trend.

Companies are responding by launching new products that feature clean, eco-friendly, and cruelty-free certifications, along with more transparent ingredient sourcing. The market includes a variety of product types, including sprays, sticks, and creams, all marketed to appeal to consumers looking for safer and more sustainable options.

There are also significant opportunities in emerging markets, where disposable income is increasing, and consumers are becoming more concerned about the ingredients in their personal care products.

Moreover, government investments in sustainability and organic agriculture could provide a supportive regulatory framework for the market. As consumer demand continues to evolve, manufacturers are increasingly innovating with new formulas and packaging designed to meet the growing demand for organic personal care products.

Government regulations and investments are expected to play a critical role in the growth of the Organic Deodorant Market. Regulations surrounding product labeling, ingredient transparency, and environmental sustainability are becoming stricter worldwide, especially in the European Union and North America.

These regulations are pushing companies to ensure that their organic claims are backed by certified organic ingredients, thereby increasing consumer trust and driving market demand.

The Organic Deodorant Market is witnessing a strong upward trajectory, driven by increasing consumer awareness of the benefits of natural and chemical-free products. With a 9% rise in the adoption of natural deodorants, reflecting an increase of two percentage points in just a short time according to Civicscience, the demand for these products is growing rapidly.

According to ThinkWithGoogle, searches for the “best deodorants” surged by over 60% in the last two years, signaling a significant increase in consumer interest and awareness of deodorant options.

Furthermore, the U.S. imported $320 million worth of deodorants in 2022, while Germany imported $264.7 million, showcasing the substantial market size for deodorant products, including the organic segment.

Key Takeaways

- Global Organic Deodorant Market size expected to reach USD 556.7 million by 2033, growing at a CAGR of 14.9% from 2024 to 2033.

- Sprays dominate the By Type Analysis segment with a 48.6% market share in 2023 due to their convenience and quick-drying properties.

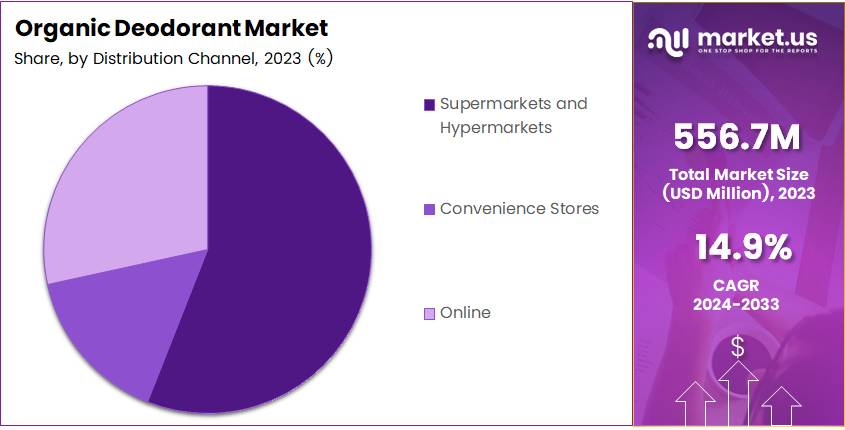

- Supermarkets and Hypermarkets lead the By Distribution Channel segment in 2023, driven by variety, convenience, and accessibility.

- Women hold a dominant market share in the By End User Analysis segment, fueled by growing awareness of health and wellness.

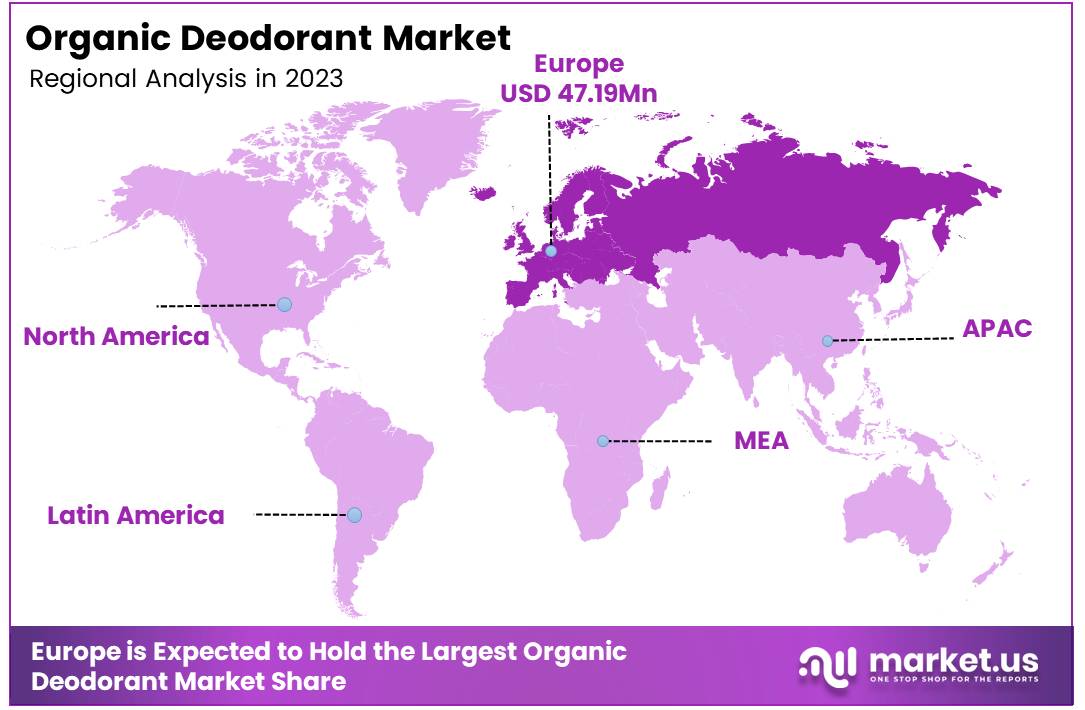

- Europe is the largest market, accounting for 34.8% of the total market value, driven by consumer awareness of health and environmental issues.

Type Analysis

Sprays Lead Organic Deodorant Types with 48.6% Market Share in 2023, Highlighting Consumer Preference for Convenience

In 2023, Sprays held a dominant market position in the By Type Analysis segment of the Organic Deodorant Market, with a 48.6% share. This substantial market share is attributed to consumer preferences for quick-drying, non-sticky formulas that offer convenience and effective odor control.

Sprays are particularly favored for their ease of application and fast absorption, characteristics that align well with the busy lifestyles of health-conscious consumers.

Following sprays, Roll-ons captured a significant portion of the market, with their appeal largely due to their precision application and economical usage. Consumers who prioritize direct application without overspray tend to prefer roll-ons, which are perceived as offering a more controlled and waste-minimizing option.

Sticks and creams, while less dominant, maintain a steady market presence. These formats are prized for their portability and less likelihood of leakage, making them ideal for travel and gym use.

Sticks and creams often feature natural ingredients, aligning with the increasing consumer demand for organic and chemical-free products. Their texture and consistency provide a soothing application experience, which remains a compelling factor for many users within the organic sector.

Distribution Channel Analysis

Supermarkets and Hypermarkets Dominate Organic Deodorant Market Distribution Channels

In 2023, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Organic Deodorant Market. The convenience, variety, and accessibility offered by large retail chains continue to drive their popularity among consumers. These outlets provide a wide range of organic deodorant brands, allowing customers to compare options and make informed purchasing decisions.

Convenience Stores, while accounting for a smaller share, have seen steady growth due to their focus on providing quick, easy access to personal care products. As consumers increasingly prioritize convenience, the demand for organic deodorants in convenience stores has risen, especially in urban and high-traffic areas.

The Online segment has emerged as a fast-growing channel, fueled by the increasing trend of e-commerce platform. Consumers are drawn to the convenience of home delivery and the ability to explore a variety of organic deodorant options without the constraints of in-store availability. The segment’s rapid expansion is expected to continue with the growing digital penetration and preference for online shopping.

End User Analysis

Women Lead the Organic Deodorant Market in 2023

In 2023, women held a dominant market position in the By End User Analysis segment of the Organic Deodorant Market. This segment represented a significant share of the market due to growing consumer awareness of health and wellness, driving the preference for natural and chemical-free personal care products.

Women have increasingly adopted organic deodorants as part of their daily skincare routines, largely influenced by concerns about the harmful effects of synthetic chemicals and the desire for eco-friendly alternatives. This shift is supported by a rise in eco-consciousness and demand for clean beauty products.

Men also made considerable inroads into the organic deodorant market, though their share was comparatively smaller than that of women. The appeal to men lies in the increasing availability of natural, effective, and subtly-scented products designed to suit their preferences.

Meanwhile, unisex products are gaining traction as well, with manufacturers offering versatile options that appeal to a broad demographic. These products cater to both men and women who seek an all-natural, sustainable deodorant without compromising on performance or scent. The growth of this category reflects the ongoing demand for inclusive and adaptable products in the organic deodorant space.

Key Market Segments

By Type

- Sprays

- Roll Ons

- Sticks/Creams

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

By End User

- Women

- Men

- Unisex

Drivers

Drivers of Growth in the Organic Deodorant Market

The organic deodorant market is experiencing significant growth, driven by several key factors. First, there is rising consumer awareness about the harmful effects of synthetic chemicals found in traditional deodorants.

Many people are becoming more conscious of the long-term impact of chemicals like aluminum, parabens, and artificial fragrances on their health and the environment. As a result, consumers are actively seeking healthier alternatives, which has led to an increasing demand for natural and organic deodorants.

In addition, there is a growing preference for products that use natural ingredients, such as essential oils, plant-based extracts, and minerals, over synthetic compounds. This shift reflects a broader trend toward natural and clean-label beauty products, with consumers now more informed and discerning about what goes into their personal care items.

Furthermore, the rising focus on health and wellness is fueling the demand for safer, eco-friendly products. With more people prioritizing self-care and overall well-being, organic deodorants are seen as a safer, gentler option, especially for those with sensitive skin or allergies.

This growing demand for health-conscious and eco-friendly products is set to continue driving the expansion of the organic deodorant market, as both mainstream consumers and niche groups look for alternatives that align with their values of sustainability, health, and transparency.

Restraints

Limited Shelf Life of Organic Deodorants

The organic deodorant market faces a few key restraints that may impact its growth. One significant challenge is the limited shelf life of organic products. Unlike synthetic deodorants, which often contain preservatives that extend their usability, organic deodorants typically lack these additives.

As a result, their shelf life tends to be shorter, making it harder for manufacturers to maintain stock and manage inventory effectively. This shorter lifespan could deter retailers from fully investing in organic deodorants, as they may prefer products that stay viable longer on store shelves.

Another notable barrier is consumer skepticism about efficacy. Many potential customers still question whether organic deodorants can offer the same level of odor protection as conventional ones. Despite growing awareness of natural products, some consumers remain concerned that organic ingredients might not provide the same lasting effectiveness, particularly in high-activity situations.

This hesitation can lead to slower adoption rates among those who are used to the proven performance of synthetic deodorants. These factors, while not insurmountable, pose challenges for growth in the organic deodorant segment, requiring manufacturers to find innovative ways to address these concerns and convince consumers of the benefits and reliability of organic alternatives.

Growth Factors

Expanding Distribution Networks A Key Growth Driver in the Organic Deodorant Market

The organic deodorant market is witnessing substantial growth due to a variety of factors. One key opportunity lies in expanding distribution networks, particularly in emerging markets. As consumers become more health-conscious, there’s a rising demand for natural and organic products, creating room for brands to increase their retail and online presence.

Expanding into these markets allows companies to tap into a new and growing consumer base. Another opportunity lies in collaborations with influencers.

By partnering with social media personalities, organic deodorant brands can engage with a broader audience, particularly younger consumers who value authenticity and transparency in their purchasing decisions. Influencers can promote products in a more relatable and engaging way, boosting brand visibility and sales.

Additionally, the introduction of gender-neutral products offers a fresh opportunity. As consumer preferences evolve, many individuals are looking for products that cater to diverse gender identities, reflecting broader cultural shifts towards inclusivity.

By offering deodorants that appeal to all genders, brands can attract a larger customer base and differentiate themselves in a competitive market. These strategies expanding distribution, influencer partnerships, and gender-neutral product offerings—are key drivers of growth for the organic deodorant market.

Emerging Trends

Zero-Waste Packaging Driving Growth in Organic Deodorant Market

The organic deodorant market is experiencing rapid growth, driven by various trends reshaping consumer preferences. One key factor is the rising demand for zero-waste packaging.

As consumers become more environmentally conscious, they are opting for deodorants with plastic-free or sustainable packaging, aligning with the sustainability movement. This trend is supported by brands offering innovative packaging solutions, such as biodegradable containers and refillable options.

Another trend is the growing popularity of all-natural scents, where consumers are increasingly seeking deodorants with unique, naturally sourced fragrances, avoiding synthetic chemicals. These fragrances are often derived from plants, herbs, and essential oils, appealing to those looking for safer, eco-friendly alternatives.

Additionally, the subscription service model is gaining traction, with deodorant subscription boxes providing consumers with a convenient way to receive personalized products delivered regularly. This model ensures variety, ease of use, and reduces the need for frequent store visits.

Finally, the integration of technology in organic deodorants is making waves, as brands are developing smart deodorants that release fragrance based on factors like body temperature or activity level. This technology enhances the consumer experience by ensuring that the deodorant’s scent is always fresh and relevant, catering to active lifestyles. Overall, these trends reflect a shift toward more sustainable, personalized, and tech-enhanced products in the organic deodorant market.

Regional Analysis

Europe Dominates Organic Deodorant Market with 34.8% Share Valued 47.19 Million

The global organic deodorant market exhibits diverse growth patterns across regions, each contributing uniquely to the overall expansion of the industry. Europe holds the largest share of the market, accounting for 34.8%(47.19 million) of the total market value. The demand for organic deodorants in Europe is largely driven by increasing consumer awareness of health and environmental issues.

This shift toward natural and sustainable products is reinforced by the region’s strong regulatory framework, which emphasizes product safety and eco-friendly manufacturing processes. Countries such as Germany, the UK, and France are at the forefront, where the popularity of organic and cruelty-free products is soaring.

Regional Mentions:

North America follows closely, with the U.S. being a key driver of market growth. Consumer preference for natural personal care products, particularly among younger, health-conscious demographics, is significantly contributing to the demand for organic deodorants. This market is expanding as consumers become more attuned to the potential health risks associated with synthetic chemicals in personal care products.

In the Asia Pacific region, organic deodorants are gaining traction, albeit from a smaller base compared to North America and Europe. The rise in disposable income, particularly in urban areas of countries like China and India, is fueling the growth of organic personal care products. Moreover, an increasing number of consumers are seeking out alternatives that align with wellness trends and environmental concerns.

The Middle East & Africa market for organic deodorants remains relatively niche but is gradually expanding, especially in regions with a growing middle-class population and increased exposure to Western consumer trends. Finally, the Latin American market is poised for moderate growth, with a focus on natural beauty products as consumers become more conscious of sustainability and health.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global organic deodorant market has witnessed significant growth in 2023, driven by rising consumer awareness regarding personal care products and a growing preference for eco-friendly, chemical-free alternatives.

Key players in this space have successfully capitalized on the demand for natural, sustainable products, positioning themselves to cater to a health-conscious and environmentally aware customer base.

Unilever, a major player in the global personal care market, continues to make strides with its Dove and Schmidt’s brands, leveraging its established distribution network to bring organic deodorant options to mainstream consumers.

Lavanila and Weleda also remain strong contenders, focusing on premium, plant-based formulations that appeal to consumers seeking both efficacy and luxury. These brands emphasize the use of organic ingredients such as aloe vera oil, coconut oil, and shea butter, which not only provide odor protection but also nourish the skin.

Sebamed, known for its dermatologically tested products, and EO Products, with a reputation for sustainable practices, offer additional value propositions that resonate with health-conscious and eco-aware consumers. Smaller, niche players like Elsa’s Organic Skinfoods and Alverde also contribute by focusing on specialized organic products, often offering highly customizable, locally sourced ingredients.

The market is also seeing innovative newcomers like Laverana Digital GmbH & Co. KG, which leverage digital platforms for product personalization, tapping into the growing trend of tailored beauty solutions.

Top Key Players in the Market

- Unilever

- Lavanila

- Sebamed

- EO Products

- Buyindusvalley

- Elsa’s Organic Skinfoods

- Alverde

- Speick Naturkosmetik

- Weleda

- Laverana Digital GmbH & Co. KG

Recent Developments

- In September 2024, Akt London, a leading innovator in personal care products, secured $7 million in funding to accelerate its expansion into the U.S. market. The company plans to use the funds to scale operations, enhance its product range, and increase its presence in key U.S. retail markets.

- In November 2024, Unilever announced a €100 million investment aimed at bringing fragrance capabilities in-house to strengthen its product development and innovation processes. The move is part of the company’s broader strategy to reduce reliance on external suppliers and improve control over its fragrance formulations.

- In September 2024, Parfumado, a leading perfume and beauty sampling platform in Europe, raised €3.2 million to expand its offerings and solidify its market position. The company plans to use the funds to enhance its technology, grow its user base, and increase partnerships with major fragrance brands.

Report Scope

Report Features Description Market Value (2023) USD 138.8 Million Forecast Revenue (2033) USD 556.7 million CAGR (2024-2033) 14.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sprays, Roll Ons, Sticks and Creams), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online), By End User (Women, Men, Unisex) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Unilever, Lavanila, Sebamed, EO Products, Buyindusvalley, Elsa’s Organic Skinfoods, Alverde, Speick Naturkosmetik, Weleda, Laverana Digital GmbH & Co. KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Unilever

- Lavanila

- Sebamed

- EO Products

- Buyindusvalley

- Elsa's Organic Skinfoods

- Alverde

- Speick Naturkosmetik

- Weleda

- Laverana Digital GmbH & Co. KG