Global Frac Manifold Market By Integration Type (Horizontal Frac Manifolds, Vertical Frac Manifolds), By Material (Carbon Steel, Stainless Steel, Others), By Outlet (Single-Outlet Systems, Multiple-Outlet Systems), By Product Type (Pressure control equipment, Flow control equipment, Others), By Location (Onshore, Offshore), By End-use (Oil and Gas, Shale Gas, Coal Seam Ga, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: December 2024

- Report ID: 134714

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Integration Type Analysis

- By Material Analysis

- By Outlet Analysis

- By Product Type Analysis

- By Location Analysis

- By End-use Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

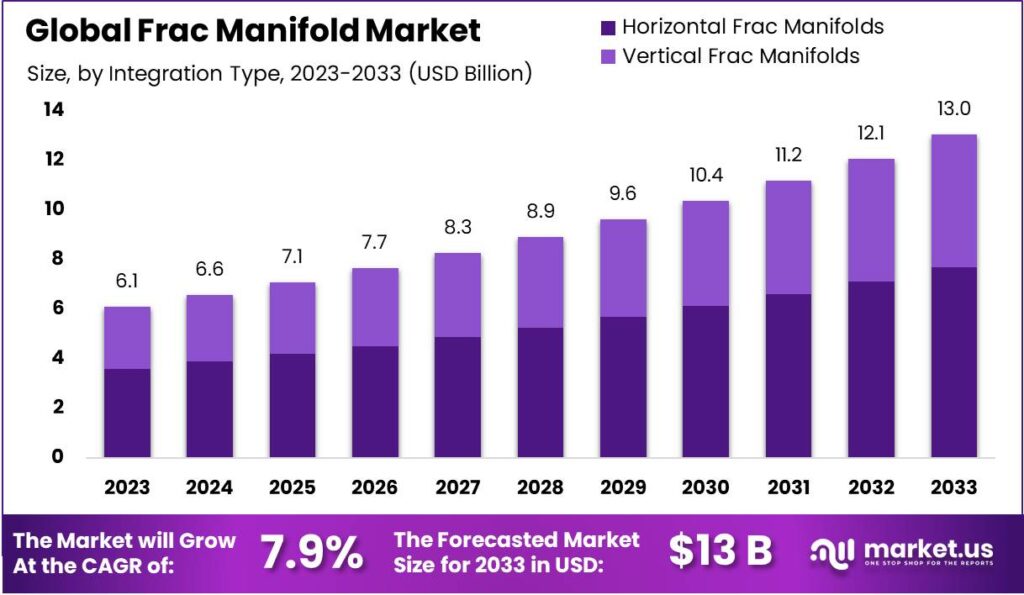

The Global Frac Manifold Market size is expected to be worth around USD 13.0 Billion by 2033, from USD 6.1 Billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

The frac manifold market is essential in the oil and gas industry, primarily for hydraulic fracturing operations. These manifolds manage the flow of fluids into wellbores, crucial for safe and efficient fracking.

The demand for frac manifolds is increasing, driven by the need for oil and gas from unconventional reserves like shale. Countries are adopting hydraulic fracturing to meet energy needs and reduce oil imports. The popularity of horizontal drilling and multi-stage fracking techniques also boosts demand for these manifolds.

Frac manifolds are vital in handling high-pressure conditions during fracking operations, making them indispensable in the oil and gas sector. As the industry grows, there is a shift towards using advanced, durable manifolds capable of withstanding tough drilling environments. This adaptation is part of a broader trend towards integrating more robust and environmentally friendly technologies.

The frac manifold market is poised for expansion, especially in regions like North America, Latin America, and the Middle East, driven by increased oil and gas exploration and production. Enhanced recovery techniques in mature fields also present new opportunities for deploying advanced frac manifold systems. As a result, the market is expected to see steady growth, fueled by both new and replacement equipment demands.

In terms of trade, the U.S. recorded a 12% increase in frac manifold exports in 2023, amounting to about $320 million. This rise reflects growing international demand, especially in oil-rich areas of the Middle East, South America, and the Asia-Pacific. Innovations are central to this market’s growth, with manufacturers incorporating technologies like IoT for real-time monitoring, enhancing operational efficiency and environmental sustainability.

Government support and private investments are also significant, with funds directed towards developing cleaner and more efficient fracking technologies. For example, in 2023, the U.S. government invested $80 million in fracking technology research. Moreover, private equity investments in oil and gas technology firms, including those specializing in frac manifolds, exceeded $500 million in 2022.

Key Takeaways

- The Global Frac Manifold Market size is expected to be worth around USD 13.0 Billion by 2033, from USD 6.1 Billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

- Horizontal Frac Manifolds dominated the market in 2023 with a 59.3% share, leading the segment in integration type.

- Carbon Steel dominated the material segment of the Soluble Corn Fiber Market in 2023 with a 54.5% share.

- Multiple-outlet systems dominated the market by the Outlet segment in 2023, capturing 69.1% of the share.

- Pressure Control Equipment led the market in 2023 with a 58.2% share By Product Type segment.

- Onshore locations dominated the market in 2023, capturing 75.4% of the market share.

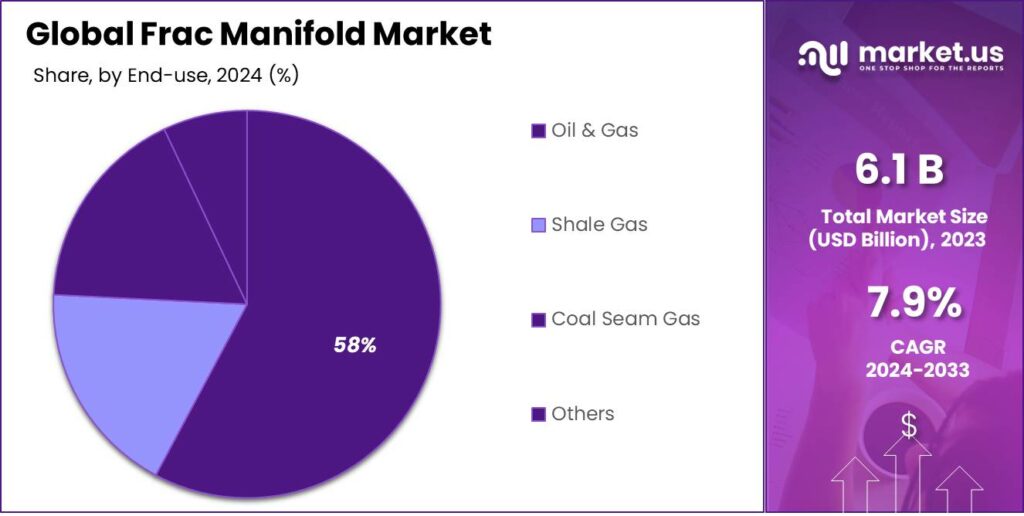

- Oil & Gas dominated the end-use segment in 2023, capturing 58.4% market share.

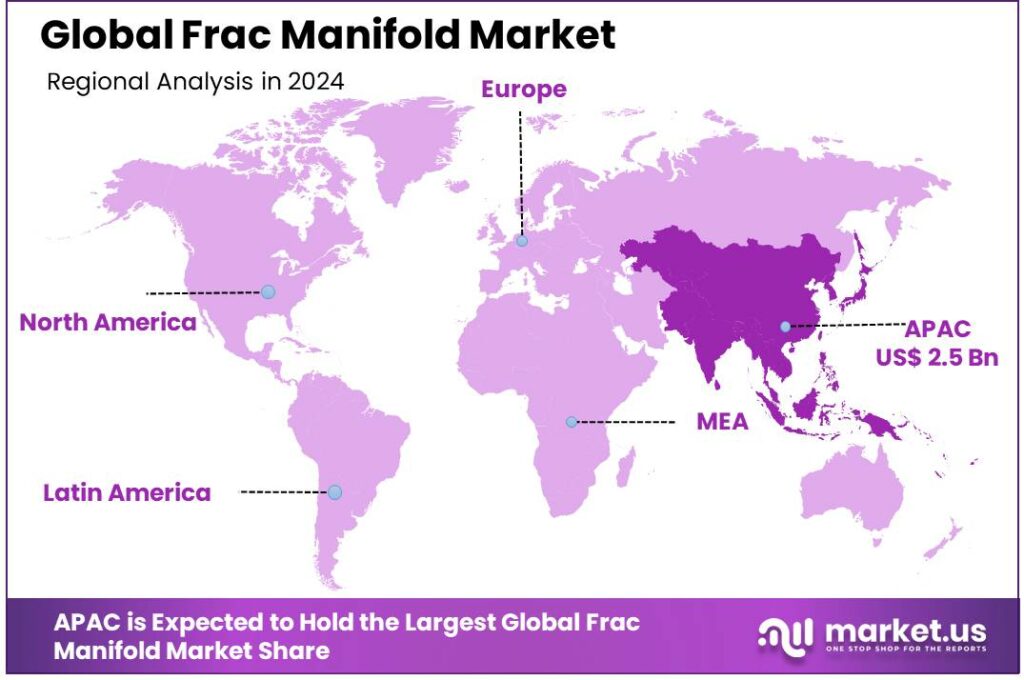

- Asia Pacific dominated the frac manifold market with a 41% share, USD 2.5 billion.

By Integration Type Analysis

In 2023, Horizontal Frac Manifolds held a dominant market position in the By Integration Type segment of the Soluble Corn Fiber Market, capturing more than a 59.3% share. This robust performance can be attributed to the increasing demand for efficient, high-capacity manifold systems used in various applications, including fracking operations where high pressure and controlled flow management are essential.

Horizontal Frac Manifolds are preferred for their enhanced operational capabilities, superior flow distribution, and ability to handle higher pressure, making them ideal for large-scale, complex industrial projects.

Vertical Frac Manifolds accounted for a smaller portion of the market. While they are typically used in smaller-scale operations or environments with limited space, vertical manifolds are less efficient than horizontal ones in handling large-scale pressure demands and high-volume throughput.

By Material Analysis

In 2023, Carbon Steel held a dominant market position in the By Material segment of the Soluble Corn Fiber Market, capturing more than a 54.5% share. The preference for carbon steel in manufacturing soluble corn fiber processing equipment can be attributed to its cost-effectiveness, durability, and strength, which make it ideal for heavy-duty applications.

Carbon steel is also resistant to wear and tear, offering long-lasting performance even under extreme conditions. As a result, it remains the material of choice for large-scale production environments where performance and cost-efficiency are critical.

Stainless Steel followed as the second-most preferred material. Although more expensive than carbon steel, stainless steel offers superior resistance to corrosion and higher durability, especially in industries where hygiene and resistance to chemicals are paramount. Its long-term reliability makes it the preferred choice for premium manufacturing environments where product purity and equipment longevity are prioritized.

By Outlet Analysis

In 2023, Multiple-Outlet Systems held a dominant market position in the By Outlet segment of the Soluble Corn Fiber Market, capturing more than a 69.1% share. The widespread preference for multiple-outlet systems is primarily driven by their ability to optimize production efficiency.

These systems are highly favored in large-scale manufacturing processes where simultaneous distribution of materials to multiple channels is essential for maintaining high throughput and reducing operational costs. Multiple-outlet systems also provide flexibility in handling varying production requirements and ensure more consistent output in high-demand environments.

In contrast, Single-Outlet Systems are often utilized in smaller-scale operations or where specific material flow control is needed, single-outlet systems tend to be less efficient for large-scale production. However, they remain popular in niche applications where lower volumes or more controlled material delivery are prioritized. Single-outlet systems are typically easier to install and maintain, which adds to their appeal for specific use cases with less complex production needs.

By Product Type Analysis

In 2023, Pressure Control Equipment held a dominant market position in the By Product Type segment of the Soluble Corn Fiber Market, capturing more than a 58.2% share. This dominance can be attributed to the critical role pressure control equipment plays in ensuring optimal processing conditions in the production of soluble corn fiber. These systems help regulate the pressure within manufacturing processes, preventing potential damage to equipment and maintaining consistent product quality.

As the demand for high-quality, cost-efficient production grows, the adoption of pressure control equipment has become increasingly important in large-scale production facilities, driving its market leadership.

Flow Control Equipment Followed This type of equipment is essential for managing the flow of materials within production systems, ensuring that the soluble corn fiber is processed efficiently and evenly. While slightly less critical than pressure control equipment, flow control equipment still plays an important role in maintaining the accuracy and consistency of the manufacturing process, especially in high-volume operations.

By Location Analysis

In 2023, Onshore held a dominant market position in the By Location segment of the Soluble Corn Fiber Market, capturing more than a 75.4% share. Onshore production facilities are the preferred choice due to their lower operational costs, ease of accessibility, and proximity to key supply chains. These advantages make onshore locations more favorable for large-scale, cost-effective production of soluble corn fiber. Additionally, onshore operations benefit from better infrastructure, including transportation networks and regulatory support, which further strengthens their market position.

Offshore locations are still significant, especially in regions where labor costs are lower or where proximity to raw material sources can reduce overall production expenses. Offshore operations can sometimes provide tax incentives or other benefits that attract investment. However, offshore production is often associated with higher transportation costs, regulatory complexities, and longer lead times, which can limit their competitiveness compared to onshore facilities.

By End-use Analysis

In 2023, Oil & Gas held a dominant market position in the By End-Use segment of the Soluble Corn Fiber Market, capturing more than a 58.4% share. The oil and gas industry’s extensive use of soluble corn fiber for applications such as drilling, fracturing, and fluid control has driven this dominance. Soluble corn fiber is commonly used in hydraulic fracturing fluids to improve viscosity and enhance flowback properties.

Its strong performance in such critical applications, combined with the sector’s size and demand, contributes significantly to its large market share. The oil and gas industry also benefits from the scalability and cost-effectiveness of soluble corn fiber, which is critical in maintaining efficient operations in high-pressure, high-volume environments.

Shale Gas followed as the second-largest end-use segment, accounting for around 22.9% of the market share. Shale gas production involves techniques such as horizontal drilling and hydraulic fracturing, where soluble corn fiber plays a key role in enhancing fluid properties for better extraction.

Coal Seam Gas contributed to the market in 2023, with soluble corn fiber being used to improve flow rates and fluid efficiency in coal seam gas extraction.

Key Market Segments

By Integration Type

- Horizontal Frac Manifolds

- Vertical Frac Manifolds.

By Material

- Carbon Steel

- Stainless Steel

- Others

By Outlet

- Single-Outlet Systems

- Multiple-Outlet Systems

By Product Type

- Pressure control equipment

- Flow control equipment

- Others

By Location

- Onshore

- Offshore

By End-use

- Oil & Gas

- Shale Gas

- Coal Seam Gas

- Others

Driving factors

Growth in Oil & Gas Industry Demand

One major driver for the frac manifold market is the increasing demand for hydraulic fracturing (fracking) in the oil and gas sector. Hydraulic fracturing is a key technique used to extract oil and natural gas from deep underground reserves, particularly in shale formations. As global energy demand rises, many countries are turning to unconventional oil and gas resources, driving the need for efficient, high-performance frac equipment.

Frac manifolds play a crucial role in controlling the flow of fluids under high pressure during the fracking process, ensuring both safety and operational efficiency. Additionally, rising exploration activities in new, untapped reserves are likely to boost the demand for fracking services, which, in turn, will increase the need for frac manifolds.

With oil prices rebounding and new technologies improving fracking efficiency, this demand is expected to continue growing over the next few years. The global focus on energy security and diversification of energy sources also fuels the adoption of hydraulic fracturing techniques, further supporting the positive outlook for frac manifolds.

Restraining Factors

Environmental Concerns and Regulations

One significant restraint affecting the frac manifold market is the growing environmental concerns and the increasing stringency of regulations surrounding hydraulic fracturing. The fracking process itself has been criticized for its potential impact on water resources, soil contamination, and seismic activity. As environmental awareness rises, governments and regulatory bodies worldwide are tightening regulations on hydraulic fracturing operations.

These regulations often include stricter monitoring, water use restrictions, and emissions control, which can slow the rate of adoption of new fracking equipment, including frac manifolds. In regions where the oil and gas industry faces the most stringent environmental laws, operators may find themselves limited in their ability to deploy hydraulic fracturing methods without incurring higher operational costs to meet compliance standards.

These legal and regulatory barriers could thus hamper the demand for frac manifolds, particularly in areas where fracking is being scrutinized or banned.

Furthermore, rising public opposition to the environmental risks of fracking may lead to increased pressure on oil and gas companies to reconsider their drilling and extraction methods, reducing their reliance on hydraulic fracturing.

Growth Opportunity

Technological Advancements in Frac Equipment

Technological advancements present a key opportunity for the frac manifold market. The continuous improvement in materials and manufacturing processes is driving the development of more efficient, durable, and cost-effective frac manifolds.

Advanced materials like corrosion-resistant alloys and composites, along with better sealing technologies, are increasing the reliability and lifespan of frac manifolds. This, in turn, reduces maintenance costs and increases the overall efficiency of fracking operations.

Moreover, innovations in automation and remote monitoring technologies are becoming more integrated into hydraulic fracturing equipment, including frac manifolds. These advancements allow for real-time data collection, enabling operators to better monitor the equipment’s performance, identify potential failures before they occur, and optimize operations. The adoption of such smart technologies can help oil and gas companies increase safety, reduce downtime, and lower operational costs.

Furthermore, as the industry moves toward more sustainable practices, there is an opportunity to develop greener, less environmentally invasive technologies in frac equipment, aligning with global sustainability trends and responding to growing pressure from environmental groups and consumers alike. This combination of technological progress and increased focus on sustainability creates a promising growth opportunity for the frac manifold market.

Challenge

Volatility in Oil & Gas Prices

A key challenge for the frac manifold market is the volatility in oil and gas prices. The price of crude oil, natural gas, and other energy commodities can fluctuate significantly based on various factors, including geopolitical tensions, changes in supply and demand, and shifts in global economic conditions. This price volatility can have a direct impact on the level of investment in exploration and production activities, as oil and gas companies may delay or scale back their drilling projects during periods of low commodity prices.

Since frac manifolds are essential components in hydraulic fracturing operations, any reduction in fracking activity due to price instability directly affects the demand for frac equipment. For instance, a significant drop in oil prices may lead to cost-cutting measures and a delay in the expansion of fracking operations, thereby slowing the growth of the frac manifold market.

Conversely, when oil prices rise, there may be a surge in fracking activity, which can drive demand for frac manifolds. However, the cyclical nature of the oil and gas market presents challenges for manufacturers and suppliers of frac equipment, who must navigate these unpredictable market conditions to maintain consistent sales and profitability.

Emerging Trends

Emerging trends in the frac manifold market include automation, IoT integration, environmentally friendly technologies, and the rise of modular, customizable systems to improve efficiency, safety, and sustainability.

The frac manifold market is seeing several emerging trends, driven by advancements in technology, environmental concerns, and shifts in the oil and gas industry. One key trend is the increasing adoption of automated frac manifolds. These systems are designed to improve the accuracy and efficiency of fluid control during hydraulic fracturing operations.

Automation allows for faster response times, reduced human error, and better monitoring of high-pressure systems, ultimately improving operational safety. The trend towards digitization is also growing, with manufacturers incorporating IoT (Internet of Things) sensors into frac manifolds for real-time monitoring. This helps operators track performance, detect potential failures before they happen, and make data-driven decisions to optimize the process.

Another trend is the push towards environmentally friendly technologies. Amid growing concerns about the environmental impact of hydraulic fracturing, there is a focus on developing more sustainable frac equipment. Companies are exploring waterless fracking technologies and eco-friendly materials to reduce the environmental footprint of their operations. As stricter environmental regulations are being implemented in various regions, the demand for low-impact and energy-efficient solutions is expected to increase.

Finally, the market is seeing an increased focus on modular and customizable frac manifolds. These flexible systems allow for quick adaptation to different well types and operational requirements. This trend is in response to the growing diversity of shale formations and complex well designs, allowing operators to scale up or down as needed while maintaining efficiency.

Business Benefits

Investing in frac manifolds enhances efficiency, safety, cost-effectiveness, and adaptability in operations.

Investing in frac manifolds brings significant benefits to businesses operating in the oil and gas sector. One of the primary advantages is the enhanced operational efficiency they offer. Frac manifolds are designed to regulate high-pressure fluid flow precisely, ensuring that the hydraulic fracturing process is carried out without unnecessary delays or interruptions. By ensuring a smooth and controlled flow of fluids, businesses can optimize the number of wells drilled and the speed at which operations are completed.

Additionally, frac manifolds help improve safety in hazardous environments. They provide better control over high-pressure systems, reducing the risk of accidents like blowouts or equipment failure. These systems are also equipped with safety features such as pressure relief valves and automatic shut-off mechanisms, which are critical in preventing catastrophic failures during fracking operations. This not only protects workers but also minimizes the risk of environmental damage, which could be costly for companies in terms of fines, reputational damage, and cleanup costs.

The cost-effectiveness of frac manifolds is another major benefit. Automated and modern frac manifolds reduce the need for manual labor and help in reducing operational downtime. This allows companies to allocate resources more effectively and lower labor and maintenance costs over time. Moreover, the precise control these systems offer leads to better resource management and less waste, ultimately improving the bottom line.

Furthermore, investing in frac manifolds can give companies a competitive edge by enhancing their flexibility and adaptability. Modular designs and the ability to tailor frac manifolds to different well types or operational needs ensure that businesses can respond quickly to market changes and different drilling conditions, ensuring both efficiency and scalability.

Regional Analysis

Asia Pacific dominated the frac manifold market with a 41% share, USD 2.5 billion.

In 2023, Asia Pacific held a dominant market position in the frac manifold market, capturing more than 41% of the global share, with a revenue of USD 2.5 billion. The region’s dominance can be attributed to the booming oil and gas industry, particularly in countries like China, India, and Australia, which continue to invest heavily in upstream exploration and production.

The growing demand for energy and natural resources in the region has led to an increasing number of hydraulic fracturing (fracking) operations, driving the need for advanced equipment such as frac manifolds. Additionally, Asia Pacific is witnessing significant investments in shale gas exploration, further fueling the market’s growth.

North America follows as a key player in the frac manifold market, contributing a substantial share of the global revenue. In 2023, the region accounted for approximately 28% of the market share, primarily driven by the United States, where hydraulic fracturing activities are at their peak.

The region’s well-established oil and gas infrastructure, combined with technological advancements in fracking, has led to a continued rise in demand for efficient frac manifolds. With oil and gas exploration being a crucial part of the U.S. economy, North America remains a key market in the global industry.

Europe and Latin America also contribute to the global frac manifold market, although at smaller scales. Europe’s market share was around 15% in 2023, primarily due to exploration activities in the North Sea and increasing unconventional gas exploration in countries like Poland. Latin America, with countries like Argentina and Brazil focusing on shale gas, held around 10% of the market, driven by rising investments in oil and gas exploration and production.

The Middle East and Africa, while holding a smaller market share, are emerging markets. The growth in fracking activities in Saudi Arabia, the UAE, and South Africa is expected to gradually increase demand in these regions, contributing to future market growth.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, several key players continue to shape the global frac manifold market, each contributing unique strengths to meet the growing demand for advanced equipment in hydraulic fracturing operations. Notable players include Halliburton, FMC Technologies, Schlumberger, and NOV (National Oilwell Varco), all of which have a significant influence on market dynamics.

Halliburton, a global leader in oilfield services, remains a dominant force in the frac manifold market due to its broad range of hydraulic fracturing solutions and strong customer base across North America and international markets. The company’s ability to deliver efficient and reliable frac manifold systems has solidified its position as a top player, particularly in the U.S. shale sector.

FMC Technologies, now part of TechnipFMC, is recognized for its cutting-edge technologies in pressure control and manifold systems. With a focus on both safety and operational efficiency, FMC’s manifold solutions are highly sought after in the energy sector, particularly in deepwater and unconventional oil and gas exploration.

Schlumberger, another leading force, offers a wide array of frac equipment, including innovative manifold solutions designed to optimize well performance. Known for its extensive research and development capabilities, Schlumberger’s frac manifolds are built for harsh operating conditions, making them a go-to choice for large-scale hydraulic fracturing projects.

NOV (National Oilwell Varco) continues to expand its footprint in the global frac manifold market, leveraging its advanced engineering expertise and comprehensive service offerings. NOV’s manifolds are highly regarded for their durability and adaptability, making them ideal for diverse fracking applications, from conventional oil fields to complex shale plays.

Market Key Players

- Dixon

- FMC Technologies

- GOES GmbH

- Halliburton

- Jereh Group

- Landrill Oil Tools Co. Ltd.

- Neeco Industries

- NOV (National Oilwell Varco) FMC Technologies

- Schlumberger Limited

- SLB

- Weatherford International

- Worldwide Oilfield Machine (WOM)

- Yancheng Qihang Petroleum Machinery Co. Ltd.

Recent Development

- In April 2024, NOV secured a major deal with a large oil and gas company in the Middle East, valued at USD 120 million, to supply advanced frac manifold systems. This contract marks NOV’s entry into the growing fracking market in the Middle East, expected to contribute to a 15% increase in regional revenue.

- In March 2024, Halliburton expanded its frac manifold production capacity by 25%, increasing its manufacturing output to meet the rising demand in North America and Asia Pacific. This expansion is expected to contribute an additional USD 150 million in revenue to Halliburton’s frac equipment division.

- In February 2024, Schlumberger introduced a new high-performance frac manifold system designed for deepwater operations. This new technology reduces operational downtime by 20% and increases system efficiency by 15%, aimed at expanding their market share in offshore fracking projects.

- In January 2024, TechnipFMC, after merging with FMC Technologies, announced a contract to supply frac manifold equipment worth USD 200 million for a large-scale shale exploration project in Texas. This deal underscores the company’s strengthening position in the U.S. frac market, particularly in unconventional resource development.

Report Scope

Report Features Description Market Value (2023) USD 6.1 Billion Forecast Revenue (2033) USD 13.0 Billion CAGR (2024-2032) 7.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Integration Type (Horizontal Frac Manifolds, Vertical Frac Manifolds), By Material (Carbon Steel, Stainless Steel, Others), By Outlet (Single-Outlet Systems, Multiple-Outlet Systems), By Product Type (Pressure control equipment, Flow control equipment, Others), By Location (Onshore, Offshore), By End-use (Oil and Gas, Shale Gas, Coal Seam Ga, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Dixon, FMC Technologies, GOES GmbH, Halliburton, Jereh Group, Landrill Oil Tools Co. Ltd., Neeco Industries, NOV (National Oilwell Varco) FMC Technologies, Schlumberger Limited, SLB, Weatherford International, Worldwide Oilfield Machine (WOM), Yancheng Qihang Petroleum Machinery Co. Ltd. Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dixon

- FMC Technologies

- GOES GmbH

- Halliburton

- Jereh Group

- Landrill Oil Tools Co. Ltd.

- Neeco Industries

- NOV (National Oilwell Varco) FMC Technologies

- Schlumberger Limited

- SLB

- Weatherford International

- Worldwide Oilfield Machine (WOM)

- Yancheng Qihang Petroleum Machinery Co. Ltd.