Global High Protein Yogurts Market Size, Share, And Business Benefits By Nature (Organic, Conventional), By Product Type (Spoonful, Drinkable), By Source (Dairy-Based, Plant-Based), By Flavor (Regular, Flavored(Blueberry, Strawberry, Peach, Honey, Key Lime, Berry, Vanilla, Pumpkin, Pomegranate, Orange, Others)), By Protein Content (Upto 15 grams, 15 grams to 20 grams, Above 20 grams), By Sales Channel (Supermarket and Hypermarket, Online Retail, Food Service, Food and Drink Specialty Store, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142952

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Nature Analysis

- By Product Type Analysis

- By Source Analysis

- By Flavor Analysis

- By Protein Content Analysis

- By Sales Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

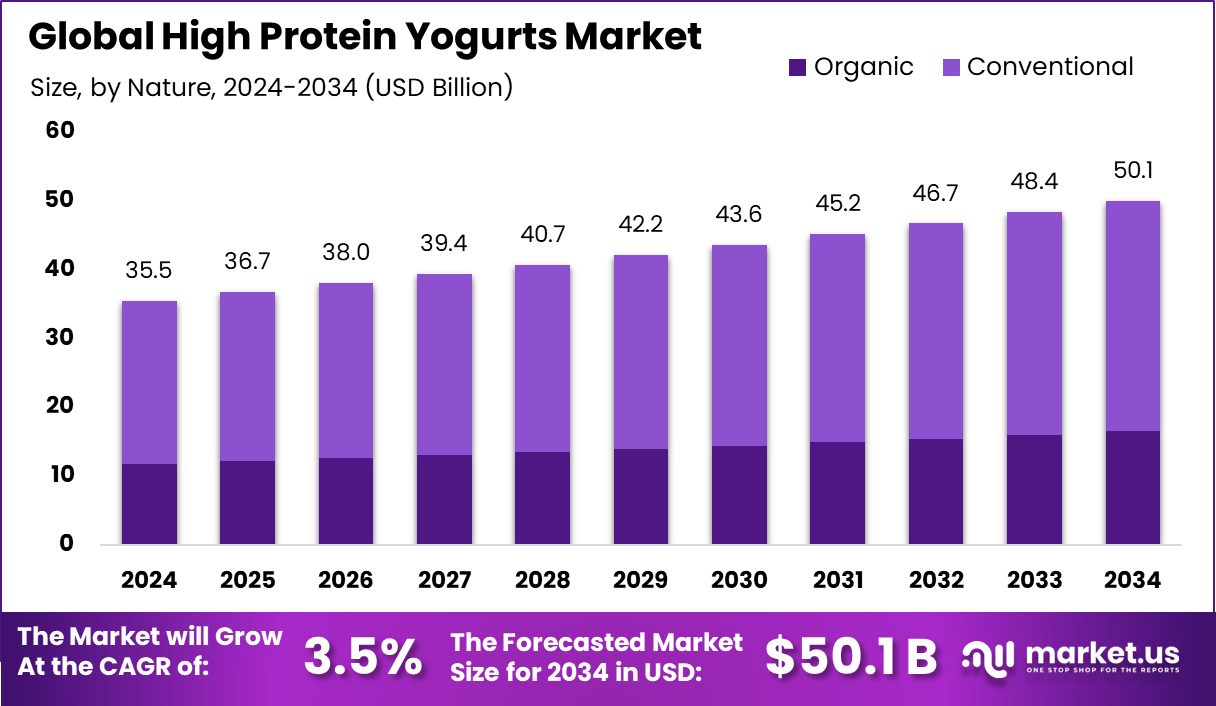

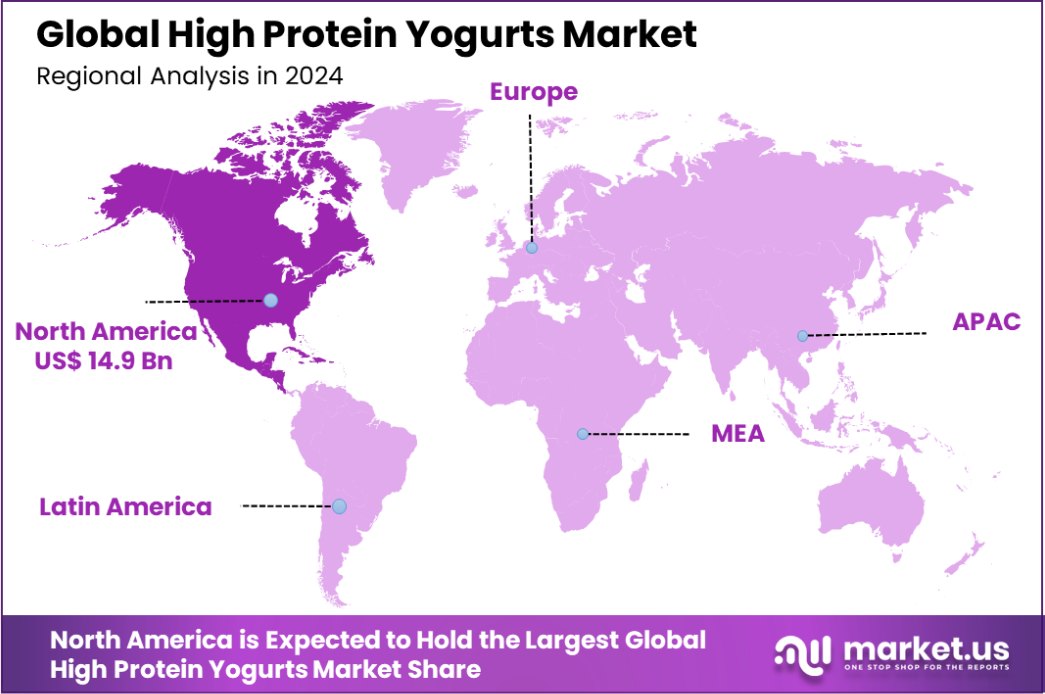

Global High Protein Yogurts Market is expected to be worth around USD 50.1 billion by 2034, up from USD 35.5 billion in 2024, and grow at a CAGR of 3.5% from 2025 to 2034. North America captured 42.20% of the Protein Yogurts Market, totaling a robust USD 14.9 billion in sales.

High Protein Yogurts are a category of yogurt products that are fortified with additional proteins, often appealing to health-conscious consumers looking to enhance their protein intake. These yogurts are typically made by adding protein-rich ingredients such as milk protein concentrate or whey protein, making them a favored choice for individuals following fitness regimens, athletes, or those seeking satiating, nutritious snack options.

The high-protein yogurts Market is experiencing robust growth driven by rising awareness of the benefits of protein in diet and an increasing consumer shift towards healthier eating habits. This market segment caters primarily to those seeking meal replacements or nutritious snacks that support an active lifestyle, with an emphasis on low sugar and high protein content.

One significant growth factor in the market is the increasing consumer demand for functional foods. Danone SA, for instance, reported 2024 sales of 27.376 billion euros, marking a like-for-like increase of 4.3%. This indicates a strong consumer preference for brands that offer health-enhancing benefits, such as high-protein yogurts, which are perceived as contributing positively to personal health management.

In terms of market demand, the ongoing expansion projects by major players underscore the growing appetite for high-protein yogurts. For example, Stonyfield Organic’s $7 million investment to expand its plant in Londonderry by 17,000 square feet will enable the production of an additional 46 million yogurt pouches annually. Such expansions reflect the rising demand and potential for increased market share.

Furthermore, the market opportunities are augmented by strategic investments by key companies. Chobani’s investment in a new 120,000-square-foot headquarters, Chobani House, set to open in the fourth quarter of 2025, exemplifies strategic positioning to harness innovation and growth in the high-protein yogurt sector.

Additionally, Danone’s record cash flow of 3 billion euros in 2024, surpassing expectations, highlights the financial viability and promising prospects within this market, suggesting a favorable environment for continued investment and innovation.

Key Takeaways

- Global High Protein Yogurts Market is expected to be worth around USD 50.1 billion by 2034, up from USD 35.5 billion in 2024, and grow at a CAGR of 3.5% from 2025 to 2034.

- Conventional high-protein yogurts hold a significant market share of 67.10% by nature.

- Spoonful yogurts dominate the product type segment, capturing 73.20% of the market.

- Dairy-based sources are preferred in the high-protein yogurts Market, with a share of 70.20%.

- Regular flavor remains the most popular in high-protein yogurts, accounting for 69.20% of sales.

- High-protein yogurts with up to 15 grams of protein constitute 48.30% of the market.

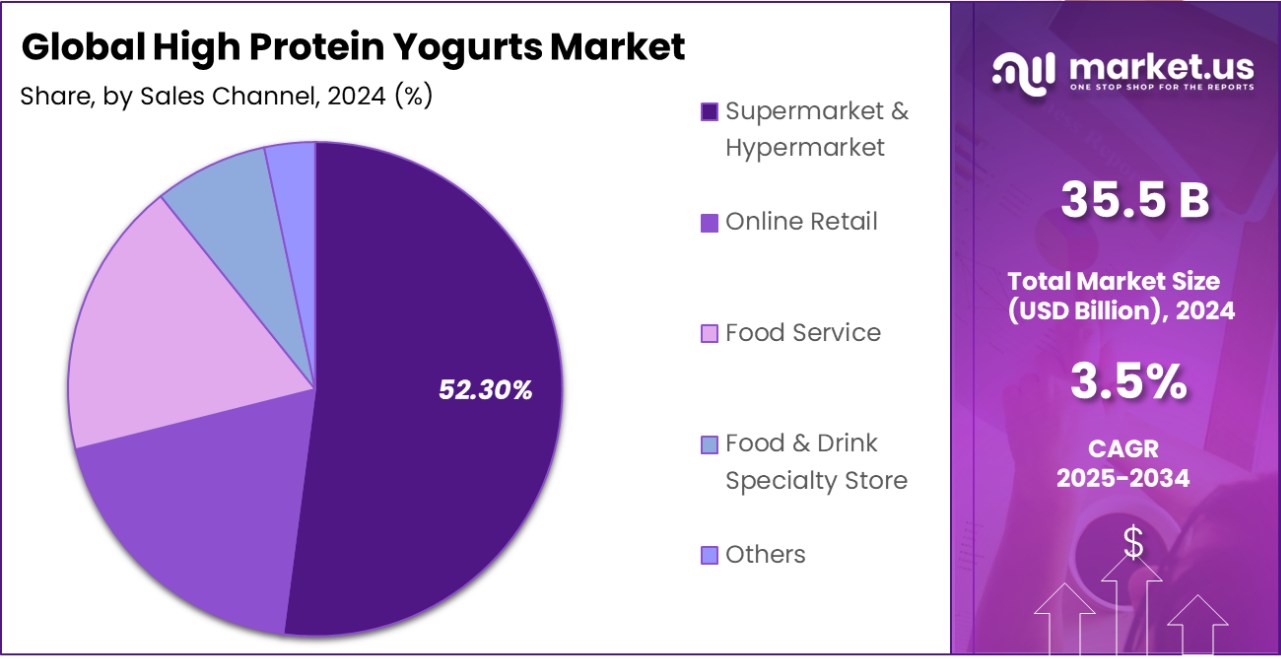

- Supermarkets and hypermarkets are the leading sales channels, holding a 52.30% market share.

- Holding a 42.20% share, North America dominated the Protein Yogurts Market with earnings of USD 14.9 billion.

By Nature Analysis

Conventional high-protein yogurts dominate the market with a 67.10% share.

In 2024, Conventional held a dominant market position in the By Nature segment of the High Protein Yogurts Market, with a 67.10% share. This significant market share reflects a strong consumer preference for traditional dairy-based yogurts, which are widely available and familiar to most consumers. Conventional high-protein yogurts, typically made from cow’s milk, are favored for their creamy texture, variety of flavors, and nutritional benefits, including high calcium and essential amino acid content.

This preference is driven by established consumption habits and the broad accessibility of conventional dairy products through extensive distribution channels, ranging from supermarkets to local convenience stores. Additionally, conventional high-protein yogurts often benefit from more competitive pricing compared to their organic counterparts, making them a more accessible option for a larger segment of consumers focused on health without compromising on budget.

The dominance of the conventional segment is further supported by aggressive marketing campaigns by leading dairy brands, which emphasize the health benefits of protein-rich diets and actively promote their high-protein yogurt products as essential for anyone leading an active lifestyle or seeking balanced dietary options. This strategic focus ensures continued consumer engagement and market growth within this segment.

By Product Type Analysis

Spoonful High Protein Yogurts lead product types, holding a 73.20% market share.

In 2024, Spoonful held a dominant market position in the By Product Type segment of the High Protein Yogurts Market, with a 73.20% share. This substantial market share is indicative of the enduring popularity of traditional, spoonable yogurt formats among consumers who prioritize both convenience and health. Spoonful yogurts are particularly favored for their ease of use and portability, making them an ideal choice for consumers seeking nutritious meal options or snacks that can be enjoyed on the go.

The preference for spoonful yogurts is also supported by the versatility they offer. Available in a variety of flavors and textures, these yogurts cater to a wide range of taste preferences and dietary requirements. They serve as an excellent base for customizable breakfasts or snacks, where consumers can add fruits, nuts, and other toppings to enhance nutritional value and taste.

Moreover, the dominant position of spoonful yogurts in the market is bolstered by extensive product availability across all major retail channels, from supermarkets to online platforms, ensuring easy access for consumers. This segment’s strength is further reinforced by targeted marketing strategies that focus on the health benefits of high protein intake, such as muscle maintenance and improved satiety, which are key selling points for health-conscious buyers.

By Source Analysis

Dairy-Based High high-protein yogurts are preferred by consumers, with a 70.20% share.

In 2024, Dairy-Based held a dominant market position in the By Source segment of the High Protein Yogurts Market, with a 70.20% share. This dominance underscores the strong consumer preference for dairy-based yogurts, which are traditionally recognized for their rich, creamy texture and high nutritional value, including natural calcium and essential vitamins.

Dairy-based high-protein yogurts are particularly appealing due to their well-established reputation for enhancing muscle growth and maintenance, making them a popular choice among health-conscious consumers, including athletes and fitness enthusiasts.

The success of dairy-based high-protein yogurts is also attributed to the widespread availability and variety of these products in the market. Consumers appreciate the extensive flavor options and the perceived natural quality of dairy ingredients, which are often marketed as free from artificial additives. This segment benefits significantly from robust supply chains and the strong backing of established dairy producers who ensure high-quality standards and consistent product innovation.

Furthermore, the marketing strategies employed by leading brands have effectively communicated the benefits of protein-rich diets, further driving the demand for dairy-based high-protein yogurts. These efforts include engaging health and wellness influencers, sponsoring sports events, and creating educational campaigns about the benefits of protein, which resonate well with the target market segments.

By Flavor Analysis

Regular flavor remains the most popular in high-protein yogurts, at 69.20%.

In 2024, Regular held a dominant market position in the By Flavor segment of the High Protein Yogurts Market, with a 69.20% share. This dominance highlights the strong consumer preference for unflavored or plain high-protein yogurts, which are often chosen for their versatility and natural taste. Regular high-protein yogurts serve as a preferred base for consumers who like to personalize their yogurt with additions like fruits, nuts, and seeds or use it as an ingredient in smoothies and other recipes.

The preference for regular flavor can be attributed to the growing trend toward healthier and cleaner eating. Consumers increasingly opt for products with fewer additives and sugars, where regular high-protein yogurt fits perfectly. This segment benefits from the consumer perception that plain yogurt is healthier, contributing to its substantial market share.

Moreover, the widespread availability of regular high-protein yogurts across various retail channels, from supermarkets to health food stores, ensures that they are accessible to a broad audience.

Marketing strategies focusing on the natural and pure aspects of regular yogurt, along with its benefits linked to gut health and protein intake, further strengthen its position in the market. This approach has effectively tapped into the health-conscious demographic, solidifying regular high-protein yogurt’s leading status in the flavor segment.

By Protein Content Analysis

High-protein yogurts with up to 15 grams of protein hold 48.30%.

In 2024, “Up to 15 grams” held a dominant market position in the By Protein Content segment of the High Protein Yogurts Market, with a 48.30% share. This segment caters primarily to consumers seeking a moderate increase in their protein intake without committing to the higher levels found in more niche products. This level of protein content strikes a balance, appealing to a broad audience that includes not only fitness enthusiasts but also the average consumers looking to enhance their diet.

The popularity of yogurts with up to 15 grams of protein can be attributed to their suitability for everyday consumption. They provide a practical option for meal replacements, snacks, or part of a balanced breakfast. The versatility and moderate protein level make these yogurts a go-to choice for those who are health-conscious but do not require the higher protein amounts that might be aimed at bodybuilders or those on specialized diets.

Moreover, this segment’s success is bolstered by widespread product availability and strong marketing campaigns that highlight the benefits of maintaining a moderate protein intake for overall health and wellness. These campaigns often focus on the accessibility and ease of integrating these yogurts into a regular diet, ensuring their appeal to a wide demographic, thereby sustaining their leading position in the market.

By Sales Channel Analysis

Supermarkets and hypermarkets are the main sales channels, capturing 52.30% of sales.

In 2024, Supermarket and Hypermarket held a dominant market position in the By Sales Channel segment of the High Protein Yogurts Market, with a 52.30% share. This dominant position underscores the importance of traditional retail formats in the distribution of high-protein yogurts. Supermarkets and hypermarkets, with their broad geographic footprint and extensive product assortments, provide consumers with convenient access to a variety of high-protein yogurt brands and formats.

The success of these retail channels is driven by their ability to offer competitive pricing, frequent promotional deals, and a one-stop shopping experience that appeals to the average consumer. This is particularly attractive for busy shoppers who appreciate the convenience of finding all their groceries, including specialized items like high-protein yogurts, under one roof.

Furthermore, supermarkets and hypermarkets have enhanced their appeal by improving store layouts and increasing the visibility of healthier food options. The strategic placement of high-protein yogurts in prominent sections, often accompanied by educational signage highlighting nutritional benefits, helps to attract health-conscious consumers and those following specific dietary regimens.

Key Market Segments

By Nature

- Organic

- Conventional

By Product Type

- Spoonful

- Drinkable

By Source

- Dairy-Based

- Plant-Based

By Flavor

- Regular

- Flavored

- Blueberry

- Strawberry

- Peach

- Honey

- Key Lime

- Berry

- Vanilla

- Pumpkin

- Pomegranate

- Orange

- Others

By Protein Content

- Upto 15 grams

- 15 grams to 20 grams

- Above 20 grams

By Sales Channel

- Supermarket and Hypermarket

- Online Retail

- Food Service

- Food and Drink Specialty Store

- Others

Driving Factors

Increasing Health Awareness Boosts High-Protein Yogurt Sales

The primary driving factor for the high-protein yogurts Market is the increasing health consciousness among consumers globally. As more individuals become aware of the importance of maintaining a balanced diet and leading a healthy lifestyle, high-protein yogurts have surged in popularity.

These yogurts are not only seen as a convenient and tasty option but also as a beneficial one, offering essential nutrients that aid in muscle repair, weight management, and overall health.

This trend is particularly pronounced among millennials and Gen Z, who prioritize wellness and are always on the lookout for food products that align with their health goals. As a result, the demand for high-protein yogurts continues to grow, making it a key driver in the market.

Restraining Factors

High Costs Limit High-Protein Yogurt Consumption

One significant restraining factor in the high-protein yogurts Market is the relatively high cost associated with these products compared to regular yogurts. The additional processes involved in enhancing the protein content, along with the use of premium ingredients, contribute to higher production and retail prices. This pricing issue can deter budget-conscious consumers who might find the cost prohibitive, despite the health benefits of high-protein yogurts.

The economic accessibility of these products is particularly challenging in regions with lower disposable incomes, where consumers are less likely to spend extra on specialty food items. As a result, the high cost remains a key barrier to broader market penetration and consumption growth within the high-protein yogurt segment.

Growth Opportunity

Plant-Based Alternatives Expand High-Protein Yogurt Market

A significant growth opportunity within the High Protein Yogurts Market lies in the development and promotion of plant-based high protein yogurt alternatives. As veganism and vegetarianism gain traction globally, there is increasing demand for dairy-free options that align with ethical, environmental, and health-related dietary preferences.

By tapping into the plant-based trend, yogurt manufacturers can attract a broader audience, including those with dairy allergies, lactose intolerance, or those simply seeking plant-derived protein sources. This diversification allows brands to differentiate themselves and capture a niche market that is rapidly expanding.

Investing in innovative plant-based formulations that do not compromise on taste or texture can significantly boost market share and meet the evolving preferences of health-conscious consumers.

Latest Trends

Snackification Trend Elevates High-Protein Yogurt Demand

A leading trend in the High Protein Yogurts Market is the increasing preference for snacking on nutritious foods, a behavior often referred to as “snackification.” This trend reflects a shift in consumer eating habits, where traditional meal times are being supplemented or replaced by more frequent, smaller meals throughout the day. High-protein yogurts fit perfectly into this lifestyle as they are convenient and portable and provide a substantial nutritional boost.

They are ideal for busy consumers looking to sustain energy levels and curb hunger between meals without resorting to less healthy options. This trend has encouraged yogurt manufacturers to introduce a variety of new flavors and convenient packaging, making high protein yogurts an even more attractive snack choice.

Regional Analysis

In 2024, North America’s High high-protein yogurts Market reached USD 14.9 billion, accounting for 42.20% of the global market.

The High Protein Yogurts Market is segmented into several key regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Dominating the global landscape, North America holds a significant lead with a market share of 42.20%, translating to a revenue of USD 14.9 billion. This dominance is fueled by a well-established health and wellness culture combined with high consumer spending power and widespread awareness about the benefits of protein-rich diets.

Europe follows, with a strong emphasis on dietary health and an increasing number of consumers turning towards nutritious dairy products. The market here benefits from stringent food quality regulations and a robust dairy industry, which ensures the availability of high-quality high protein yogurt products.

In contrast, the Asia Pacific region is witnessing rapid growth due to rising health consciousness among its massive population and increasing urbanization, which brings Western eating habits and health trends into the mainstream.

The Middle East & Africa, and Latin America are emerging markets where growth is driven by gradual changes in consumer lifestyle choices and the slow but steady adoption of protein-rich diets, influenced by global health trends.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Stonyfield Farm has carved a niche for itself by focusing on organic high-protein yogurts, appealing to health-conscious consumers who value organic and environmentally friendly products. Their commitment to sustainability and non-GMO ingredients resonates well with a growing demographic that prioritizes eco-conscious dietary choices, thereby strengthening their market presence.

Yoplait continues to be a formidable player by leveraging its extensive distribution network and strong brand recognition. The company’s strategy to continuously innovate in flavor and packaging has allowed it to maintain significant shelf appeal and consumer loyalty. Yoplait’s ability to cater to a wide range of consumer tastes and preferences helps it to remain competitive in this crowded market.

Fage is distinguished by its focus on Greek yogurt, which naturally contains higher protein levels. Its emphasis on authenticity and quality, combined with a robust marketing approach that educates consumers on the benefits of Greek yogurt, has enabled Fage to capture a substantial share of the market.

Chobani, a leader in the Greek yogurt segment, has expanded its market share by constantly innovating and launching new products that align with current consumer trends, such as plant-based and low-sugar options. Their aggressive marketing and commitment to quality have made them a household name in high-protein yogurt.

Lastly, Icelandic Provisions introduces a unique angle with its traditional skyr, an Icelandic dairy product that’s naturally high in protein and low in fat. Their focus on authenticity and a unique product offering differentiates them in a market that values variety and specific health benefits.

Top Key Players in the Market

- Stonyfield Farm

- Yoplait

- Fage

- Chobani

- Icelandic Provisions

- The Greek Gods

- Arla Foods

- Danone

- Kite Hill

- Noosa

- Ripple

- Novonesis Group

- Nestlé

- The Kroger Co.

- Wallaby Yogurt Company

Recent Developments

- In October 2024, Chobani launched a high-protein line with 20g protein cups and drinks up to 30g protein. Uses no added sugars or preservatives. The nationwide rollout continues through early 2025.

- In January 2024, Yoplait Protein was introduced, with 15g of protein and 3g of sugar per serving, targeting Chobani’s Greek yogurt dominance. Marketed as a “dairy snack” with a smoother texture.

Report Scope

Report Features Description Market Value (2024) USD 35.5 Billion Forecast Revenue (2034) USD 50.1 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Product Type (Spoonful, Drinkable), By Source (Dairy-Based, Plant-Based), By Flavor (Regular, Flavored(Blueberry, Strawberry, Peach, Honey, Key Lime, Berry, Vanilla, Pumpkin, Pomegranate, Orange, Others)), By Protein Content (Upto 15 grams, 15 grams to 20 grams, Above 20 grams), By Sales Channel (Supermarket and Hypermarket, Online Retail, Food Service, Food and Drink Specialty Store, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Stonyfield Farm, Yoplait, Fage, Chobani, Icelandic Provisions, The Greek Gods, Arla Foods, Danone, Kite Hill, Noosa, Ripple, Novonesis Group, Nestlé, The Kroger Co., Wallaby Yogurt Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High Protein Yogurts MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

High Protein Yogurts MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Stonyfield Farm

- Yoplait

- Fage

- Chobani

- Icelandic Provisions

- The Greek Gods

- Arla Foods

- Danone

- Kite Hill

- Noosa

- Ripple

- Novonesis Group

- Nestlé

- The Kroger Co.

- Wallaby Yogurt Company