Global Power to Gas Market By Technology (Electrolysis, Methanation), By Capacity (Less than 100 kW, 100–999 Kw, 1000 kW and Above), By Use Case (Wind, Solar, Biomass), By Application (Industrial, Commercial, Utility), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144516

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

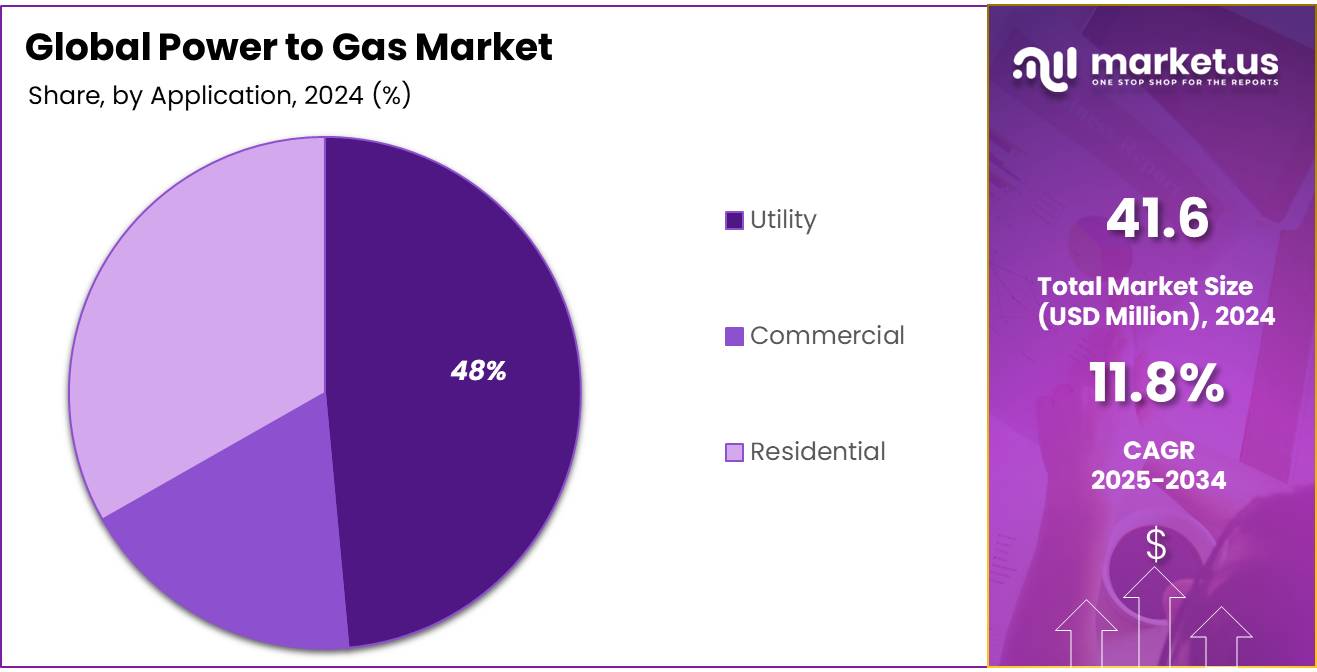

The Global Power to Gas Market size is expected to be worth around USD 126.9 Mn by 2034, from USD 41.6 Mn in 2024, growing at a CAGR of 11.8% from 2025 to 2034.

Power-to-gas market is an emerging technology that converts excess renewable electricity, especially from wind and solar power, into gases such as hydrogen or methane, which can be stored and used in various sectors such as transportation, households, and industry. This process involves using electrolysis to split water into hydrogen, which can be injected into natural gas pipelines or further processed into methane through methanation. Power-to-gas plays an important role in addressing the intermittent nature of renewable energy sources, providing an opportunity to store energy for long periods and balance supply and demand fluctuations in the grid.

Furthermore, Power-to-Gas ability to store large amounts of energy over extended periods, as gases such as hydrogen and methane can be easily stored and transported widely applicable in the energy industry. Their flexibility in integrating renewable energy into existing infrastructure and decarbonizing sectors traditionally reliant on fossil fuels.

Power-to-gas also reduces grid congestion, provides long-term energy storage, and helps achieve carbon-neutral goals by replacing fossil fuels in industries, heating, and transportation. As technology evolves, Power-to-Gas is poised to play a crucial role in the energy transition, supporting the shift to a more sustainable and decarbonized energy system globally.

Key Takeaways

- The global power-to-gas market was valued at USD 41.6 million in 2024.

- The global power-to-gas market is projected to grow at a CAGR of 11.8% and is estimated to reach USD 126.9 million by 2034.

- By technology, electrolysis accounted for the largest market share at 74.2%.

- By capacity, 1000 kW and above accounted for the majority of the market share at 49.3%.

- By use case, solar accounted for the largest market share of 63.1%.

- By application, utility accounted for the largest market share of 48.2%.

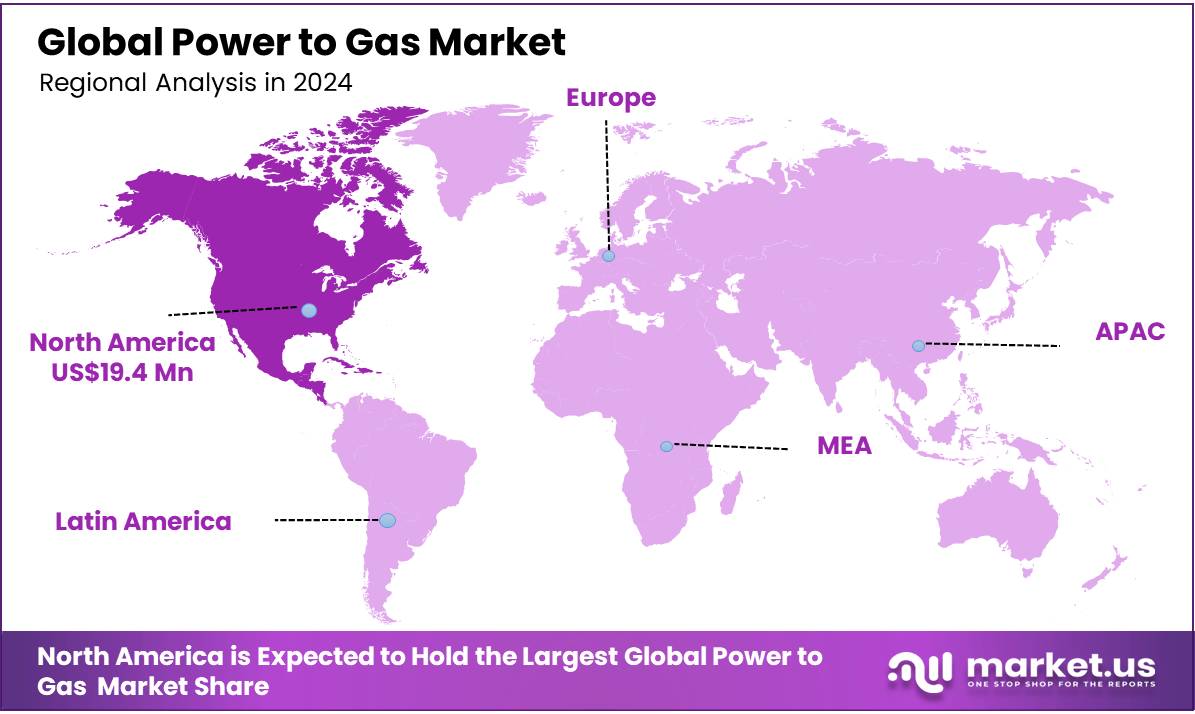

- North America is estimated as the largest market for solar-powered trains with a share of 46.8% of the market share.

Technology Analysis

The power-to-gas market is segmented based on technology into electrolysis and methanation. In 2024, the electrolysis segment held a significant revenue share of 74.2%. Due to its efficiency in producing renewable electricity (typically from wind or solar energy) to split water (H2O) into hydrogen (H2) and oxygen (O2) through an electrochemical reaction. This process produces green hydrogen, which can be used as a fuel for industries, transport, or stored for future use. Electrolysis is a crucial part of the Power-to-Gas market due to its efficiency in generating clean hydrogen, which can then be stored or used in fuel cells, industrial processes, or transportation.

Additionally, advancements in electrolyzer technologies and reductions in costs make electrolysis more competitive and attractive for large-scale implementation. Electrolysis is also highly compatible with fluctuating renewable energy sources, offering flexibility for energy storage and grid balancing. Methanation is another important technology segment that holds a prominent share as these processes produce synthetic methane (CH4, which is chemically identical to natural gas. This synthetic methane can be injected into existing gas infrastructure, used for heating, or converted into power. While it allows integration with current systems, methanation is less widely used than electrolysis due to its reliance on a stable supply of CO2, limiting its scalability. Nonetheless, it plays a key role in incorporating renewable energy into existing gas networks.

Capacity Analysis

Based on capacity, the market is further divided into less than 100 kW, 100–999 Kw, and 1000 kW and Above. The predominance of the 1000 kW and Above, commanding a substantial 49.3 % market share in 2024. Due to its ability to produce large-scale, high-efficiency energy outputs. Larger systems are essential for industrial-scale applications, enabling the production of significant volumes of green hydrogen or synthetic methane. These capacities are ideal for projects that require substantial energy to support decarbonization efforts in industries like heavy manufacturing, transportation, and power generation. Furthermore, large-scale systems offer better economies of scale, making them more cost-effective for large projects, and contributing to their dominant share in the market.

Use Case Analysis

Based on the use case, the market is further divided into wind, solar, and biomass. The predominance of the photovoltaic solar, commanding a substantial 63.1% market share in 2024. Due to the widespread availability and efficiency of solar energy. Solar power systems are highly scalable, cost-effective, and increasingly affordable with advancements in solar panel technology. Additionally, the ability to generate solar power in a variety of locations, particularly in regions with abundant sunlight, makes it an attractive option for renewable energy production. PV solar is often paired with electrolysis in Power-to-Gas systems, permitting the production of green hydrogen, thus supporting its strong position in the market.

Additionally, wind energy is another significant segment in the Power-to-Gas market. The Wind turbines convert wind energy into electricity, which can be used for electrolysis to produce green hydrogen. Wind energy is highly scalable and efficient, especially in areas with consistent wind patterns, and complements the intermittent nature of solar power, making it a valuable renewable resource for Power-to-Gas systems. Furthermore, biomass involves using organic materials, such as agricultural waste or wood, to generate electricity. This energy can also be used for hydrogen production through gasification or other methods. The biomass segment is less dominant than solar or wind, but their consistent and renewable energy source offering, especially in regions with abundant organic waste, contributes to a diversified renewable energy mix in Power-to-Gas systems.

Application Analysis

Based on Application, the market is further divided into Industrial, commercial, and utility. The predominance of the Utility commanding a substantial 48.2% market share in 2024. Due to its large-scale capacity to integrate renewable energy into the grid. Utility-scale applications often involve large, centralized plants that produce green hydrogen or synthetic methane using renewable energy sources such as wind and solar. These systems can support grid stability, enhance energy storage, and provide a reliable source of clean energy for industrial and Industrial use.

The utility sector benefits from economies of scale, government incentives, and the growing demand for clean energy, making it a key driver of power-to-gas market growth. Industrial and commercial are other important segments of the power-to-gas market where powered-to-gas technology is applicable on a small scale as compared to utility applications. The Industrial sector involves home-scale energy storage and hydrogen production, typically through solar-powered electrolysis, for personal use or backup power. In addition, the commercial sector includes businesses and buildings that use Power-to-Gas systems for energy efficiency, cost savings, and sustainability.

Key Market Segments

By Technology

- Electrolysis

- Methanation

By Capacity

- Less than 100 kW

- 100–999 kW

- 1000 kW and Above

By Use Case

- Wind

- Solar

- Biomass

By Application

- Industrial

- Commercial

- Utility

Drivers

Rising Demand For Energy Storage Solutions

The growing demand for energy storage solutions is a key driver propelling the expansion of the global power-to-gas market. As renewable energy sources such as wind and solar power gain prominence, their intermittent nature presents challenges for maintaining a stable and reliable power supply. power-to-gas technology, which converts excess renewable electricity into hydrogen or methane for storage, plays an important role in addressing these challenges. By providing the storage of renewable energy, power-to-gas offers a long-term solution to balance supply and demand, enhance grid reliability, and facilitate the integration of renewable energy into existing infrastructure.

This growing emphasis on energy storage is further driven by the need for cleaner, more sustainable energy solutions to reduce reliance on traditional fossil fuels and mitigate environmental impacts such as global warming and rising carbon emissions.

- For instance, the European Clean Hydrogen Alliance, launched in 2020, aims to deploy hydrogen technologies by 2030, focusing on production, demand, and infrastructure. It also targets a 17.5 GW electrolyzer capacity by 2025 through its Electrolyser Partnership. These initiatives are favorable for the growth of the Power-to-Gas market.

Furthermore, rapid urbanization and industrialization, coupled with rising energy consumption globally, are also contributing to the increasing need for efficient energy storage systems. Power-to-gas technology provides a long-term solution for storing renewable energy, ensuring a steady energy supply even when renewable generation is low. Their ability to store excess electricity when demand is low and release it during peak demand times helps balance supply and demand. Moreover, power-to-gas technology supports the decarbonization of hard-to-electrify sectors, such as transportation and industrial processes, by providing green hydrogen or synthetic methane as alternative fuels.

As governments and industries prioritize sustainability, and with ongoing advancements in energy storage technologies, the power-to-gas market is expected to witness robust growth. These developments are important in meeting both the demand for a stable energy supply and the transition to a low-carbon energy system.

- For instance, according to news, the Indonesian government recently announced their development of the hydropower plant on the Kayan River will be a key enabler for power-to-gas technology in North Kalimantan by providing renewable energy for green hydrogen production. Its integration of sustainable practices, such as pumped storage and floating solar, supports power-to-gas market growth by ensuring reliable, low-impact energy for decarbonization.

Restraints

High Operational And Maintenance Cost

High operational and maintenance costs are one of the key challenges restricting the growth of the global Power-to-Gas (P2G) market. The technology behind converting surplus renewable energy into hydrogen or synthetic fuels, like methane, requires specialized equipment and infrastructure, which can be expensive to install and maintain. This not only increases the initial capital investment but also results in ongoing high maintenance costs, which can be a significant deterrent for potential investors and stakeholders.

Additionally, the complexity of integrating renewable energy sources, such as wind and solar, into the Power-to-Gas systems adds another layer of operational challenges. The intermittent nature of renewable energy makes it difficult to ensure a continuous, reliable energy supply for powered-to-gas systems. These factors combine to create economic barriers, limiting the scalability of powered-to-gas technologies and hindering their widespread adoption as a solution for decarbonizing industries and the energy sector.

Opportunity

Green hydrogen adoption in heavy industries

The adoption of green hydrogen in heavy industries presents a significant opportunity for the growth of the power-to-gas market. As sectors such as steel, cement, mining, manufacturing, and transportation shift towards clean energy, these transitions raise the need for efficient, sustainable, and scalable energy solutions. Green hydrogen, produced through the electrolysis of water using renewable energy sources such as wind, solar, and hydroelectric power, offers a promising alternative to fossil fuels in these energy-intensive industries. By replacing traditional fossil fuel-based processes with green hydrogen, industries can significantly reduce their carbon emissions and align with global decarbonization targets, including those regulated in the Paris Agreement.

Moreover, the integration of green hydrogen into industrial operations provides an opportunity to enhance energy security and reduce dependence on imported fossil fuels. Countries like India, with their National Green Hydrogen Mission, are already recognizing the economic and strategic benefits of green hydrogen adoption. This mission, aimed at producing 5 million metric tons of green hydrogen annually by 2030, highlights the significant economic potential, including job creation, investment attraction, and reduction in fossil fuel imports. As these government-led initiatives gain traction globally, the power-to-gas market is poised for substantial growth, driven by the increasing demand for green hydrogen in industrial applications.

- For instance, The European Union (EU) has developed an ambitious Hydrogen Strategy to achieve a climate-neutral economy by 2050. The strategy aims to scale up green hydrogen production and use across sectors like industry, transport, power generation, and buildings, with clear targets and measures to support the development of hydrogen technologies.

Trends

Growth of power to –X (PtX) Technologies

The growth of Power-to-X (PtX) technologies is transforming the global energy market by permitting the conversion of excess renewable energy into synthetic fuels, gases, and chemicals like hydrogen, methane, and ammonia. These products can be stored, transported, and utilized in industries that are challenging to electrify, such as heavy industry, aviation, and shipping. PtX technologies address the intermittency of renewable energy by providing a reliable energy supply even when renewable generation is low, offering a versatile solution for carbon-neutral energy storage and utilization. Unlike traditional battery storage, PtX creates energy-dense fuels compatible with existing infrastructure, making it a valuable tool for sectors like automotive, aerospace, and industrial manufacturing, which are exploring ways to reduce emissions through renewable energy sources.

Furthermore, advancements in Research and development activities in PtX technologies are growing rapidly, with a focus on enhancing efficiency, scalability, and cost-effectiveness. Energy companies are investing in Power-to-Gas (PtG) systems to convert renewable electricity into hydrogen and synthetic natural gas, providing flexibility in managing energy supply and demand on the grid.

Geopolitical Impact Analysis

Geopolitical Conflicts And Trade Disputes, Interrupt Energy Supply Chains, Impact The Feasibility Of Power-To-Gas Technologies, and Reduce Efforts Toward Energy Security and Decarbonization.

Geopolitical risks have a significant impact on the Power-to-Gas (PtG) market, as they influence energy policy decisions and can disrupt the stability of energy supply chains. Conflicts, such as trade disputes, and diplomatic tensions often create uncertainties in energy markets, including the availability and pricing of essential feedstocks such as natural gas and electricity.

For instance, geopolitical conflicts in key gas-producing regions can limit the smooth flow of natural gas, which is important for PtG systems that convert electricity into synthetic fuels like hydrogen or methane. Such disruptions can lead to price volatility, affecting the profitability and feasibility of PtG technologies, particularly in regions that are heavily reliant on imported energy resources. Moreover, sanctions and trade policies can limit the development and deployment of PtG infrastructure, slowing progress toward a sustainable and diversified energy system. These impacts of especially noticeable in emerging economies, such as those within the BRICS nations, where energy security is a critical concern.

In these regions, the demand for alternative energy solutions like PtG is increasing as countries seek to reduce dependence on fossil fuels and ensure reliable energy supplies. However, geopolitical tensions can complicate the adoption of PtG technologies, as governments may face challenges in securing the necessary investments, technologies, and international collaborations required to scale these systems. Furthermore, political instability and trade barriers can delay the integration of PtG solutions into national energy strategies, potentially hindering efforts to transition towards decarbonized and resilient energy networks.

Regional Analysis

North American Global Power to Gas Market driven by robust investments in energy sectors

In 2024, North America dominated the global power-to-gas market, accounting for 46.8% of the total market share, driven by the region’s significant investments in renewable energy projects, such as wind, solar, and hydropower, which provide strong support for the development of P2G systems. Government policies, incentives, and a commitment to achieving net-zero emissions goals have further accelerated the adoption of clean energy technologies. Especially countries like the U.S. and Canada have implemented various federal and state-level programs to encourage the transition towards green hydrogen and the integration of P2G technology.

- For instance, recently Canada launched the Smart Renewables and Electrification Pathways Program (SREPs) provides up to $964 million over four years for smart renewable energy and grid modernization projects. These programs support the growth of Power-to-Gas technologies by promoting efficient energy management and facilitating the integration of renewable energy into the grid.

Another important factor significantly contributing the North America’s P2G market growth is the increased demand for hydrogen as a clean fuel source for industries like transportation, heavy manufacturing, and agriculture. As sectors like shipping, aviation, and freight seek alternatives to fossil fuels, P2G technology offers a viable way to produce hydrogen from renewable electricity.

Additionally, the North American hub of the various global energy industries, along with a region’s robust infrastructure for renewable energy generation and storage, supports the scaling of P2G systems. The U.S. has also committed to creating a national hydrogen strategy, with a focus on scaling up hydrogen production and storage capacity. Moreover, Canada’s hydrogen and clean energy initiatives, including investments in carbon capture and storage (CCS), further enhance the growth potential for the P2G market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the power-to-gas market focus on technological innovation, strategic partnerships, and scalability to promote eco-friendly energy production.

Key players in the power-to-gas market are focusing on expanding their technological capabilities, such as improving renewable energy efficiency and energy storage systems. They are also investing in sustainable infrastructure and forming strategic partnerships with governments and Green hydrogen adoption to support the transition to cleaner transportation. Innovation in power-to-x technologies, combining the integration of power-to-gas technologies in smart cities, is gaining momentum.

Additionally, market players are working towards reducing operational costs and enhancing the scalability of powered-to-gas technology to meet the growing demand for eco-friendly transportation solutions. The integration of power-to-gas into existing energy systems is a major strategy for accelerating market adoption.

Major players in the industry

- AquaHydrex

- Avacon AG

- CarboTech

- Siemens

- Cummins Inc

- Electrochaea

- ENTSOG AISBL

- Exytron GmbH

- FuelCell Energy Inc.

- Green Hydrogen Systems

- GRTgaz

- Hitachi Zosen Inova AG

- Hydrogenics

- Ineratec

- ITM Power

- MAN Energy Solutions

- McPhy Energy

- Nel ASA

- Nel Hydrogen

- Siemens

- ThyssenKrupp AG

- Others

Recent Development

- In March 2025- Storm Fisher Hydrogen partnered with MAN Energy Solutions to develop a 200 MW Power-to-X plant in North America, producing green hydrogen and e-methane. The plant will utilize renewable electricity and biogenic CO₂, advancing e-fuel production and enhancing methane purity for seamless integration into existing infrastructure.

- In March 2024- ABB is collaborating with Green Hydrogen International on the Hydrogen City project in Texas, which will produce 280,000 tons of green hydrogen annually using renewable energy. ABB will provide technology to optimize efficiency and support global decarbonization.

- In November 2023- Strata Clean Energy is developing a Power-to-X (P2X) platform to produce low-carbon hydrogen derivatives like ammonia, e-methane, and SAF for hard-to-decarbonize sectors. The company is advancing projects with Tier 1 partners and focusing on ammonia production initially, with plans for alternative e-fuels to support the net-zero transition.

Report Scope

Report Features Description Market Value (2024) USD 41.6 Mn Forecast Revenue (2034) USD 126.9 Mn CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Electrolysis, Methanation), By Capacity (Less than 100 kW, 100–999 Kw, 1000 kW and Above), By Use Case (Wind, Solar, Biomass), By Application (Industrial, Commercial, Utility) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape AquaHydrex, Avacon AG, CarboTech, Siemens, Cummins Inc, Electrochaea, ENTSOG AISBL, Exytron GmbH, Fuel Cell Energy Inc., Green Hydrogen Systems, GRTgaz, Hitachi Zosen Inova AG, Hydrogenics, Ineratec, ITM Power, MAN Energy Solutions, McPhy Energy, Nel ASA, Nel Hydrogen, Siemens, ThyssenKrupp AG, etc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AquaHydrex

- Avacon AG

- CarboTech

- Siemens

- Cummins Inc

- Electrochaea

- ENTSOG AISBL

- Exytron GmbH

- FuelCell Energy Inc.

- Green Hydrogen Systems

- GRTgaz

- Hitachi Zosen Inova AG

- Hydrogenics

- Ineratec

- ITM Power

- MAN Energy Solutions

- McPhy Energy

- Nel ASA

- Nel Hydrogen

- Siemens

- ThyssenKrupp AG

- Others