Global Liquid Biofuels Market Size, Share, Strategic Business By Type (Biodiesel, Bioethanol, Others), By Feedstock (Sugar Crops, Starch Crops, Vegetable Oils, Animal Fats, Others), By Process (Fermentation, Transesterification, Others), By Application (Transportation, Power Generation, Heat, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135756

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

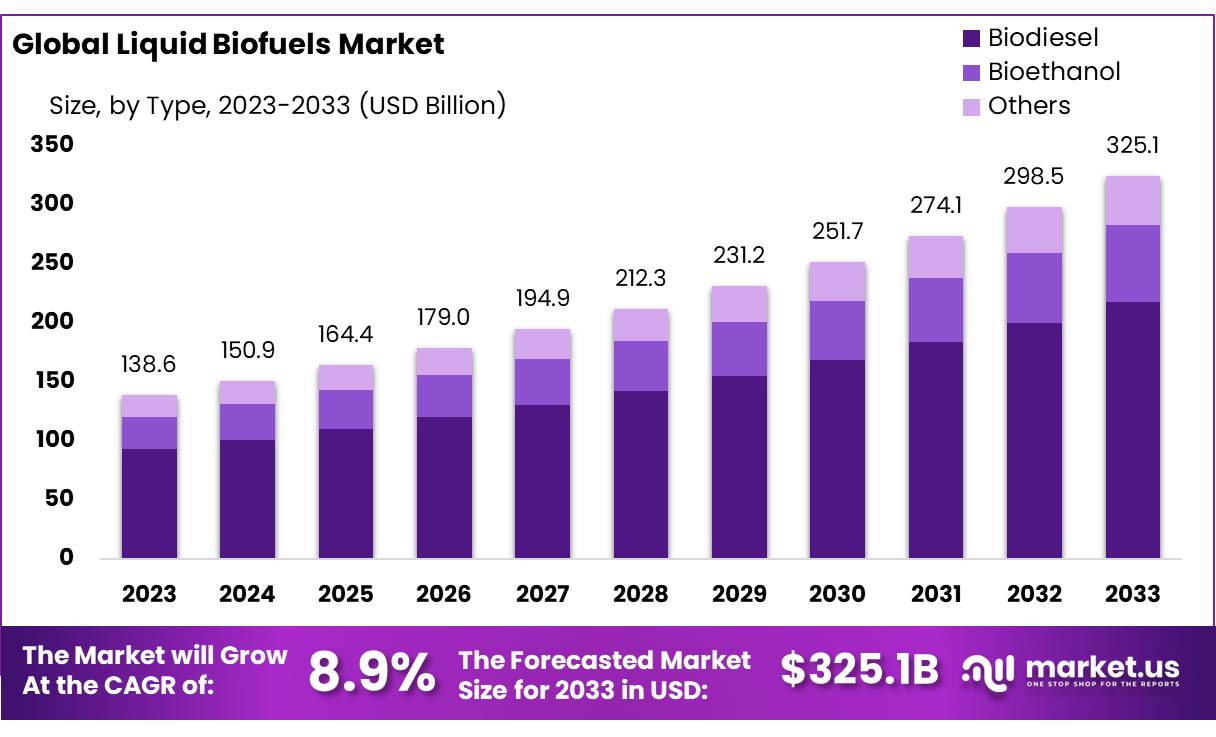

The Global Liquid Biofuels Market size is expected to be worth around USD 325.1 Bn by 2033, from USD 138.6 Bn in 2023, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

Liquid Biofuels are renewable energy sources derived from organic materials such as plant biomass, agricultural waste, or algae. These biofuels are processed into liquid form to replace or supplement conventional fossil fuels, such as gasoline or diesel, in transportation and industrial sectors.

The most common types of liquid biofuels are ethanol and biodiesel. Ethanol is primarily made from sugarcane, corn, or other plant starches, while biodiesel is produced from vegetable oils, animal fats, or waste oils. Liquid biofuels play a key role in reducing greenhouse gas emissions, as they emit lower levels of carbon dioxide (CO2) compared to fossil fuels.

In 2022, global transport biofuel capacity increased by 7%, primarily driven by investments in renewable diesel. This represents the largest annual increase in over a decade, with a significant number of new facilities focusing on renewable diesel due to favorable policies in the United States and Europe.

Alongside this, several ethanol plants are enhancing their carbon capture capabilities, projecting an increase from less than 1 million tonnes of CO2 captured per year to more than 15 million tonnes by 2030.

Policy-wise, more than 80 countries have implemented measures to support biofuel demand, which helped offset 4% of global road transport oil use in 2022. The dominant markets for biofuels, accounting for 85% of total demand, are the United States, Brazil, Europe, and Indonesia.

Both Indonesia and Brazil have been particularly proactive, with Indonesia raising its biodiesel blending target to 35% and Brazil aiming to increase its biodiesel blending to 15% by 2026

Key Takeaways

- Liquid Biofuels Market size is expected to be worth around USD 325.1 Bn by 2033, from USD 138.6 Bn in 2023, growing at a CAGR of 8.9%.

- Biodiesel held a dominant market position, capturing more than a 67.2% share.

- Sugar Crops held a dominant market position, capturing more than a 28.3% share of the global liquid biofuels market.

- Fermentation held a dominant market position, capturing more than a 54.2% share of the global liquid biofuels market.

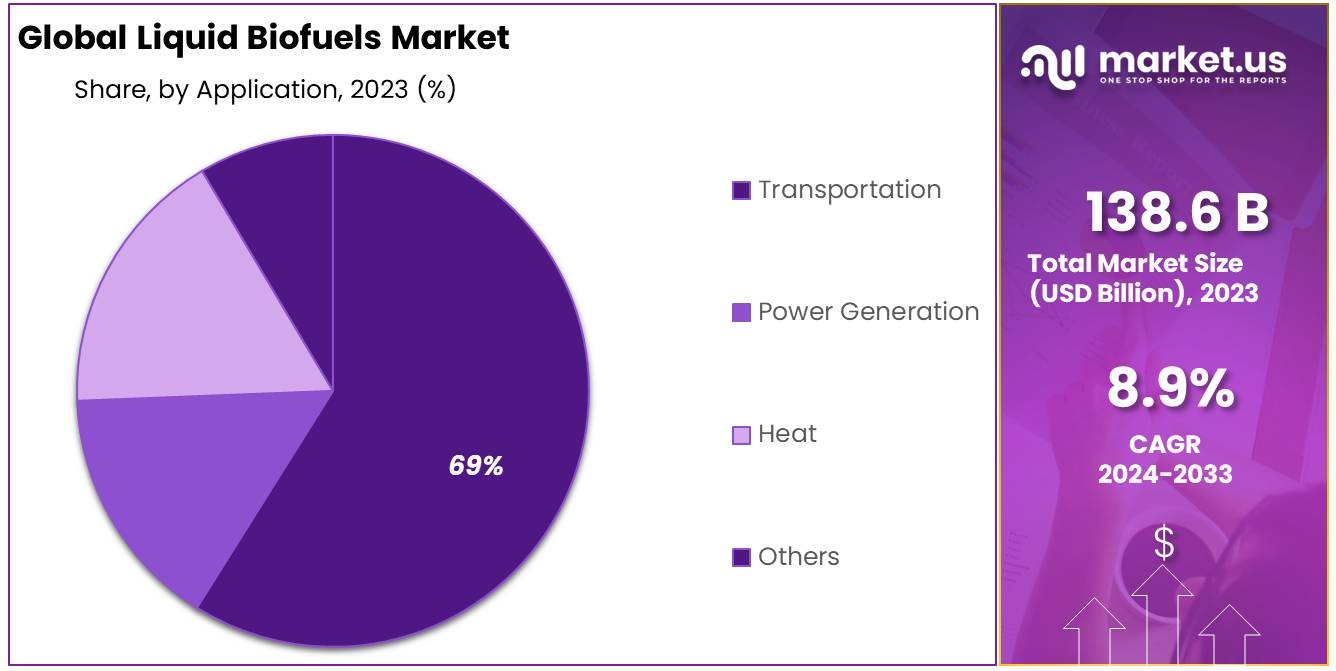

- Transportation held a dominant market position, capturing more than a 69.1% share of the global liquid biofuels market.

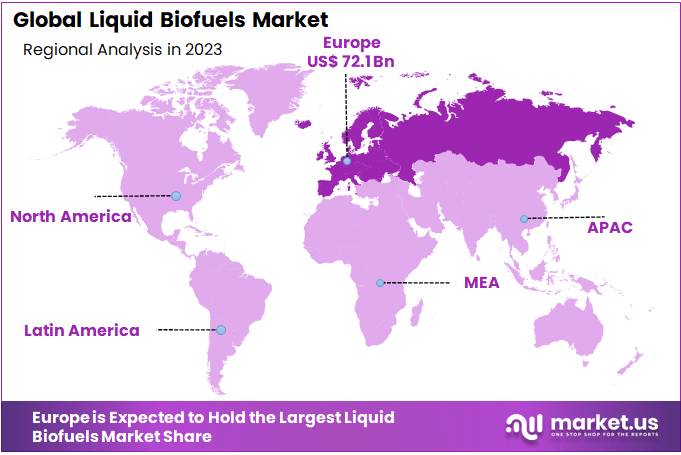

- Europe is the dominating region in the global liquid biofuels sector, holding a market share of 52.2% and valued at USD 72.1 billion.

By Type

In 2023, Biodiesel held a dominant market position, capturing more than a 67.2% share of the global liquid biofuels market. This growth was driven by increasing demand for renewable energy sources, particularly in the transportation sector, where biodiesel serves as an effective alternative to conventional diesel. The rising awareness of environmental concerns and the push for reduced carbon emissions further supported the growth of biodiesel. Additionally, favorable government policies and incentives for biodiesel production contributed to its strong market share.

Bioethanol, on the other hand, accounted for a significant portion of the market, although it was slightly behind biodiesel in 2023. Bioethanol is primarily used in the automotive industry as a fuel additive and in blending with gasoline. The demand for bioethanol is largely fueled by the growing shift towards cleaner fuels and government mandates in several regions. However, challenges such as the need for large agricultural land use for its production, and competition with food crops, have slightly limited its broader adoption.

By Feedstock

In 2023, Sugar Crops held a dominant market position, capturing more than a 28.3% share of the global liquid biofuels market. Sugar crops, such as sugarcane and sugar beets, are one of the most widely used feedstocks for bioethanol production.

Their high sugar content makes them ideal for fermentation processes, leading to more efficient fuel production. The strong market share of sugar crops can be attributed to their high yield, cost-effectiveness, and established production infrastructure, particularly in regions like Brazil, where sugarcane is a key raw material.

Starch Crops, including corn and wheat, followed closely behind, representing a significant portion of the market. These crops are primarily used for bioethanol production, especially in the United States, where corn is the leading feedstock. The use of starch crops has been driven by government policies supporting renewable fuels and the increasing focus on reducing carbon emissions. However, concerns over food versus fuel debates and the impact of crop price volatility remain key challenges for this segment.

Vegetable Oils contributed a notable share to the market as well, particularly in biodiesel production. Oils from soybeans, rapeseed, and palm are commonly used to produce biodiesel due to their high lipid content. This segment benefits from the increasing shift towards sustainable energy solutions, although competition with food production and land-use concerns can limit its expansion.

Animal Fats, while a smaller segment, are gaining traction in biodiesel production. These fats are often sourced as by-products from the meat and poultry industry, providing an environmentally friendly solution to waste management. The rising demand for eco-friendly fuels is expected to support the growth of this segment, although availability and consistency of feedstock remain challenges.

By Process

In 2023, Fermentation held a dominant market position, capturing more than a 54.2% share of the global liquid biofuels market. Fermentation is the most common method used for producing bioethanol, primarily from sugar and starch crops. The process involves converting sugars into alcohol using microorganisms, making it highly efficient for producing fuel-grade ethanol. The widespread use of fermentation is driven by its cost-effectiveness, scalability, and established infrastructure in key regions such as North America and Brazil.

Transesterification followed as the second-largest process, accounting for a significant portion of the market. This method is primarily used for producing biodiesel from vegetable oils, animal fats, and other lipid-based feedstocks. The process involves converting triglycerides into biodiesel through a reaction with methanol or ethanol. Transesterification is favored for its ability to produce high-quality biodiesel that meets industry standards. Its popularity continues to rise due to the increasing demand for renewable energy and cleaner fuels.

By Application

In 2023, Transportation held a dominant market position, capturing more than a 69.1% share of the global liquid biofuels market. Biofuels, especially biodiesel and bioethanol, are widely used in transportation as alternatives to conventional fuels like gasoline and diesel. The high demand for biofuels in the transportation sector is driven by growing concerns about reducing greenhouse gas emissions and dependency on fossil fuels. Moreover, government mandates and incentives in several countries continue to promote biofuels as part of their clean energy strategies.

Power Generation accounted for a significant share of the market as well, though it was smaller than the transportation segment. Biofuels are used in power plants to generate electricity, particularly in regions where renewable energy sources are being prioritized. Biomass-based fuels, such as bioethanol and biodiesel, are increasingly being adopted for power generation as a cleaner alternative to coal and natural gas. However, the segment faces challenges related to fuel cost and the competition from other renewable energy sources like wind and solar.

Heat applications also contributed to the liquid biofuels market, primarily in residential and industrial heating. Biomass-derived fuels, such as wood pellets and bio-oil, are used to generate heat in boilers and furnaces. The demand for biofuels in this sector is driven by their lower environmental impact compared to traditional heating fuels, like coal or heating oil. While the share of this segment is smaller, the market for biofuels used for heating is expected to grow as the world shifts toward cleaner, renewable energy sources.

Key Market Segments

By Type

- Biodiesel

- Bioethanol

- Others

By Feedstock

- Sugar Crops

- Starch Crops

- Vegetable Oils

- Animal Fats

- Others

By Process

- Fermentation

- Transesterification

- Others

By Application

- Transportation

- Power Generation

- Heat

- Others

Drivers

Enhanced Energy Security

One of the major driving factors for the liquid biofuels market is the enhancement of energy security. Governments are increasingly recognizing biofuels as crucial for reducing reliance on imported fossil fuels, which can be volatile in price and supply.

For instance, the U.S. and European Union have been actively promoting biofuels to diversify their energy sources and bolster domestic energy production capabilities. The U.S. Environmental Protection Agency (EPA) set increased biofuel volume requirements for 2023-2025, aiming to enhance the country’s energy independence and security

Policy Initiatives Boosting Demand

Government policies significantly contribute to the growth of biofuel demand, particularly in emerging economies like India, Brazil, and Indonesia. These countries have introduced various measures to increase biofuel use to cut down on oil imports and strengthen their energy security.

For example, Brazil has set progressive targets for biodiesel blending, aiming to reach 15% by 2024. Indonesia plans to raise its biodiesel blending mandate to 35% in 2023, up from 30% in 2022

Increasing Biofuel Capacities

The U.S. has seen a notable increase in biofuel production capacities, particularly for renewable diesel, which surpassed biodiesel in 2023. The U.S. Energy Information Administration reported a 7% overall increase in biofuel production capacity, emphasizing a strong push towards renewable diesel. This trend is supported by technological advances and scaling of production facilities to meet the growing demand.

Renewable Diesel and Biojet Fuel

The expansion of the renewable diesel and biojet fuel sectors is particularly noteworthy. Driven by stringent policy support and technological innovations, these sectors are witnessing significant growth.

The U.S., Europe, and Japan are leading this surge, with expectations for biojet fuel use to dramatically increase by 2028. Policy frameworks like the Renewable Fuel Standard and Low Carbon Fuel Standard in the U.S. are instrumental in this growth, supporting a substantial rise in demand for these biofuels.

Restraints

High Feedstock Costs

One of the significant challenges facing the liquid biofuels market is the high cost of feedstocks, which are the raw materials used in the production of biofuels. Essential feedstocks like corn, sugarcane, vegetable oils, and animal fats have variable costs, which can significantly impact the overall production expenses. For example, the use of food-grade crops as feedstocks also raises ethical concerns regarding food security and prices, further complicating the economic feasibility of biofuels.

Competition from Electric Vehicles

The rising adoption of electric vehicles (EVs) presents a substantial competitive challenge to the biofuels market. EVs, which are increasingly supported by government policies and improvements in technology, offer a cleaner alternative to combustion engines that traditionally use biofuels. This shift could potentially limit the growth of the biofuel sector, especially in markets that are aggressively pushing for electrification as part of their decarbonization strategies.

Technological Challenges in Production

While biofuels are praised for their renewable attributes, the actual production process involves complex and sometimes costly technologies. The fermentation process, although effective, requires specific conditions and careful management to ensure efficiency. Innovations are continuously needed to enhance the biofuel yield and reduce operational costs, which currently pose a barrier to scaling up production without significant investment.

Regulatory and Market Barriers

Regulatory issues and market dynamics also play a crucial role as restraining factors. Policies that support biofuel use are not uniformly implemented across all regions, leading to disparities in market growth opportunities.

Additionally, the fluctuating political landscape can affect subsidies, mandates, and incentives that are critical for the biofuels industry. Without consistent policy support, the industry faces challenges in planning and development, making it difficult to compete with more established fossil fuels and emerging renewable energy technologies.

Opportunity

Expansion in Ethanol Production and Use

A significant growth opportunity in the liquid biofuels market is the continued expansion in ethanol production and utilization, particularly in transportation. Ethanol is increasingly recognized as a cleaner and more sustainable alternative to fossil fuels, blending seamlessly with gasoline to power vehicles without the need for engine modifications.

The United States and Brazil, which together account for about 82% of global ethanol production, are leading this shift towards sustainable energy sources. The push towards ethanol is not just about reducing environmental impact but also about enhancing energy security by reducing dependence on imported oils.

Advancements in Biofuel Production Technologies

Technological advancements are crucial drivers in the liquid biofuels market, expanding the addressable market and making the production processes more efficient. Innovations, particularly in enzyme technologies, are enhancing the business case for biofuels.

These advancements help in lowering production costs and improving yields, making biofuels more competitive against traditional energy sources. The adoption of these advanced technologies is expected to bolster the market significantly in the coming years.

Supportive Policies and Renewable Energy Legislation

Legislative support remains a pivotal growth area for liquid biofuels. Governments across the globe are formulating policies that encourage the production and use of biofuels. For instance, the United States and European countries have set mandates for blending biofuels with traditional fuels, which drive the demand for biofuels. Such policies are not only aimed at reducing carbon emissions but are also structured to lessen the dependency on fossil fuels, thereby enhancing the energy security of nations.

Increase in Global Biofuel Demand in the Transport Sector

The transport sector presents a substantial opportunity for the growth of the liquid biofuels market. With rising awareness of climate change and the increasing adoption of clean energy sources, biofuels are poised to play a significant role.

For instance, bioethanol and biodiesel are expected to account for a 10% share of energy usage in the transportation sector by 2030. This shift is largely driven by stringent government regulations aimed at reducing carbon emissions, which in turn fosters a greater reliance on renewable energy sources like biofuels.

Trends

Rising Demand for Advanced Biofuels

One of the most prominent trends in the liquid biofuels market is the increasing demand for advanced biofuels, including biojet fuels, which are expected to play a significant role in reducing greenhouse gas emissions. With global aviation and transportation sectors under pressure to decrease their carbon footprint, biojet fuel demand is anticipated to surge, potentially reaching up to 15 billion liters by 2028.

This growth is supported by strong policy frameworks in regions such as the United States, Europe, and parts of Asia, where governments are actively promoting the adoption of sustainable aviation fuels through various incentives and blending obligations.

Integration of Biofuels with Electric Vehicles (EVs)

Another significant trend is the integration of biofuels with renewable electricity to meet domestic transport policies aimed at reducing oil demand. By 2028, it is expected that biofuels will contribute significantly to decreasing oil consumption in the transport sector, complementing the energy provided by electric vehicles. This synergy between biofuels and EVs is critical as it helps achieve low-carbon fuel standards and supports the broader transition towards renewable energy sources in significant markets like the United States, Europe, and China.

Technological Advancements in Production

Technological innovations in biofuel production processes, particularly the fermentation process, are set to transform the industry. The widespread adoption of advanced fermentation techniques is enhancing the efficiency and scalability of biofuel production, making it a more viable and competitive alternative to fossil fuels. These advancements are crucial for increasing the production capacity of biofuels like ethanol, which continues to dominate the market due to its compatibility with existing vehicle technologies and infrastructure.

Government Policies and Market Growth

Government policies remain a driving force behind the growth of the liquid biofuels market. In regions like North America and Europe, supportive regulations, financial incentives, and mandatory blending requirements are significantly boosting the production and use of biofuels. For instance, the Inflation Reduction Act in the United States has allocated billions in investments for biofuel production, underlining the strategic importance of biofuels in achieving energy independence and sustainability goals.

Regional Analysis

Europe is the dominating region in the global liquid biofuels sector, holding a market share of 52.2% and valued at USD 72.1 billion. The market here is propelled by stringent environmental regulations and ambitious targets for reducing greenhouse gas emissions. The European Union’s Renewable Energy Directive (RED) has been a critical policy tool in fostering the adoption of biofuels across member states, encouraging both production and consumption within the region.

North America is a significant player in the liquid biofuels market, particularly driven by the United States, which is home to some of the largest producers of ethanol and biodiesel. The region benefits from advanced technological infrastructure and supportive government policies, including the Renewable Fuel Standard (RFS) which mandates the blending of renewable fuels with gasoline. In 2023, North America maintained a robust production framework, positioning it as a key exporter of biofuels, especially to Europe and Asia.

Asia Pacific presents significant growth potential in the liquid biofuels market, driven by increasing energy demand and a growing emphasis on sustainable energy solutions. Countries like Indonesia, China, and India are rapidly expanding their biofuel production capacities, leveraging abundant agricultural resources and government mandates to integrate biofuels into their energy mix.

Middle East & Africa and Latin America are emerging regions in the biofuel landscape, with each showing unique growth trajectories. Middle Eastern countries, despite their oil-rich reserves, are beginning to explore biofuels as a part of diversifying their energy resources.

Africa’s market is still nascent but shows potential due to its vast arable land and favorable agricultural conditions. Latin America, led by Brazil, a global leader in ethanol production from sugarcane, continues to expand its influence in both production and technological innovation in the biofuel sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The liquid biofuels market is characterized by a wide range of key players, each contributing to the sector’s growth through innovation, large-scale production, and strategic partnerships. ADM (Archer Daniels Midland Company) and Green Plains are among the largest players, with ADM being a leading producer of bioethanol and other bio-based products globally.

ADM’s extensive production facilities in the U.S. enable it to dominate the bioethanol market, while Green Plains has a strong foothold in both bioethanol and biodiesel production. POET is another significant player, one of the largest ethanol producers in the world, with a robust presence in the U.S. ethanol market.

Companies like Algenol, Gevo, and Enerkem are pioneers in the development of advanced biofuels, focusing on cellulosic ethanol and algae-based biofuels. These firms are at the forefront of innovation, with Gevo leading in sustainable aviation fuels and Algenol working on algae-based ethanol production.

Additionally, Wilmar International and Bio-Oils Energy S.A. stand out for their focus on biodiesel production, leveraging their expertise in vegetable oil-based feedstocks. Companies like Renewable Energy Corp. and Renewable Biofuels Inc. are also making strides in the market by producing high-quality biofuels from renewable sources. As the demand for sustainable and renewable energy sources continues to grow, these players are poised to drive the future expansion of the liquid biofuels market.

Top Key Players

- Air France-KLM

- Air India Ltd

- AirAsia

- AISIN

- Alaska Airlines Inc

- AVL

- Ballard Power Systems

- Batik Air

- Bloom Energy

- Blue World Technologies

- Bosch

- Ceres Power

- China Eastern Airlines

- Convion

- EasyJet PLC

- Elcogen

- ElringKlinger

- Emirates

- Etihad

- FuelCell Energy

- Horizon Fuel Cell Technologies

- Hydrogenics

- IndiGo

- ITM Power

- Jetstar Asia Airways

- Korean Air

- Mitsubishi Hitachi Power Systems

- Nedstack Fuel Cell Technology

- Nexceris LLC

- Nuvera Fuel Cells, LLC

- Plug Power

- Pragma Industries

- Proton Motor Fuel Cell GmbH

- Roland Gumpert

- SFS Energy AG

- Singapore Airlines

- SOLIDpower Italia

- W.L. Gore & Associates

Recent Developments

In 2023, ADM produced approximately 4.7 billion gallons of bioethanol, contributing significantly to the U.S. biofuels industry. The company operates over 10 ethanol production facilities across the United States, with an annual production capacity of about 1.9 billion gallons of bioethanol.

In 2024, Algenol aims to scale up its production to 300 million gallons of algae-based bioethanol per year, with plans to build commercial production plants in multiple locations.

Report Scope

Report Features Description Market Value (2023) USD 138.6 Bn Forecast Revenue (2033) USD 325.1 Bn CAGR (2024-2033) 8.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Biodiesel, Bioethanol, Others), By Feedstock (Sugar Crops, Starch Crops, Vegetable Oils, Animal Fats, Others), By Process (Fermentation, Transesterification, Others), By Application (Transportation, Power Generation, Heat, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Air France-KLM, Air India Ltd, AirAsia, AISIN, Alaska Airlines Inc, AVL, Ballard Power Systems, Batik Air, Bloom Energy, Blue World Technologies, Bosch, Ceres Power, China Eastern Airlines, Convion, EasyJet PLC, Elcogen, ElringKlinger, Emirates, Etihad, FuelCell Energy, Horizon Fuel Cell Technologies, Hydrogenics, IndiGo, ITM Power, Jetstar Asia Airways, Korean Air, Mitsubishi Hitachi Power Systems, Nedstack Fuel Cell Technology, Nexceris LLC, Nuvera Fuel Cells, LLC, Plug Power, Pragma Industries, Proton Motor Fuel Cell GmbH, Roland Gumpert, SFS Energy AG, Singapore Airlines, SOLIDpower Italia, W.L. Gore & Associates Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air France-KLM

- Air India Ltd

- AirAsia

- AISIN

- Alaska Airlines Inc

- AVL

- Ballard Power Systems

- Batik Air

- Bloom Energy

- Blue World Technologies

- Bosch

- Ceres Power

- China Eastern Airlines

- Convion

- EasyJet PLC

- Elcogen

- ElringKlinger

- Emirates

- Etihad

- FuelCell Energy

- Horizon Fuel Cell Technologies

- Hydrogenics

- IndiGo

- ITM Power

- Jetstar Asia Airways

- Korean Air

- Mitsubishi Hitachi Power Systems

- Nedstack Fuel Cell Technology

- Nexceris LLC

- Nuvera Fuel Cells, LLC

- Plug Power

- Pragma Industries

- Proton Motor Fuel Cell GmbH

- Roland Gumpert

- SFS Energy AG

- Singapore Airlines

- SOLIDpower Italia

- W.L. Gore & Associates