Global Rubber Compound Market By Type(Styrene Butadiene Rubber, Nitrile Butadiene Rubber, Silicone Rubber, EPDM Rubber, Natural Rubber, Others), By Application(Tires, Automotive (Non-Tire), Belts and Hoses, Consumer Goods, Wire and Cable, Footwear, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Mar 2024

- Report ID: 14778

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

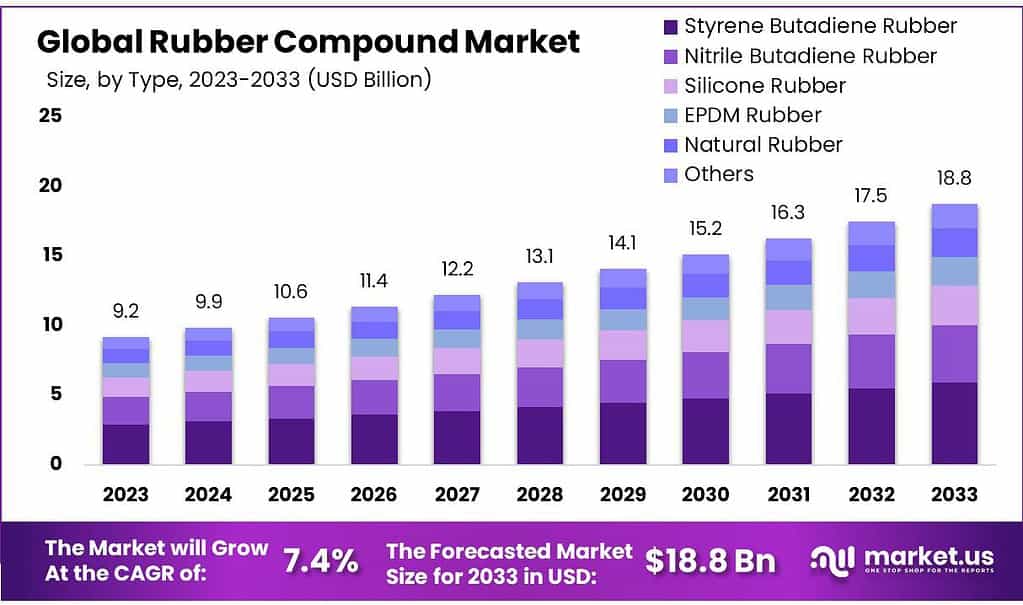

The global Rubber Compound Market size is expected to be worth around USD 18.8 billion by 2033, from USD 9.2 billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2023 to 2033.

The rubber compound market refers to the industry involved in the production and supply of rubber compounds, which are mixtures of natural or synthetic rubber with a variety of additives and fillers.

These compounds are designed to enhance specific properties of rubber, such as strength, durability, resistance to temperature, chemicals, and abrasion, flexibility, and electrical conductivity. The formulation and blending of these compounds require precise control and expertise to meet the specific needs of diverse applications across various industries.

Rubber compounds are critical components in the manufacturing of a wide range of products, including tires and automotive parts, industrial and medical gloves, seals and gaskets, hoses, and a variety of consumer goods.

The market for rubber compounds is driven by factors such as advancements in material science, increasing demand from the automotive and transportation sector, the need for higher-performance materials in industrial applications, and the growth of the healthcare industry, particularly in medical devices and equipment.

The rubber compound market is characterized by its focus on research and development activities aimed at improving the performance characteristics of rubber compounds and expanding their application areas. This includes the development of eco-friendly rubber compounds that minimize environmental impact, as well as compounds that meet stringent regulatory standards for health and safety.

Key Takeaways

- Market Expected to Reach USD 18.8 Billion by 2033 at 7.4% CAGR.

- Styrene Butadiene Rubber (SBR) Holds a 31.5% Market Share is favored for Tire Manufacturing.

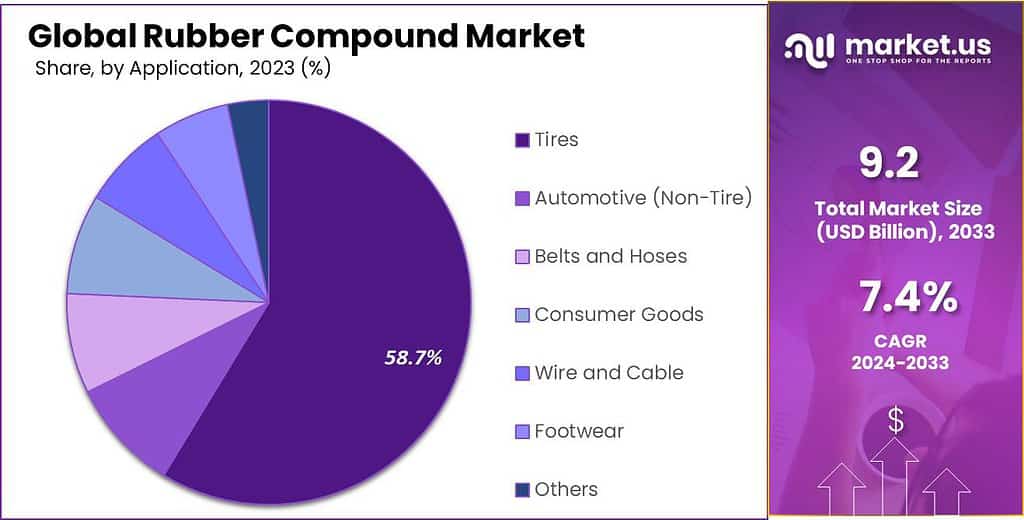

- Tires Dominate Market with 58.7% Share in 2023, Driven by Global Vehicle Demand.

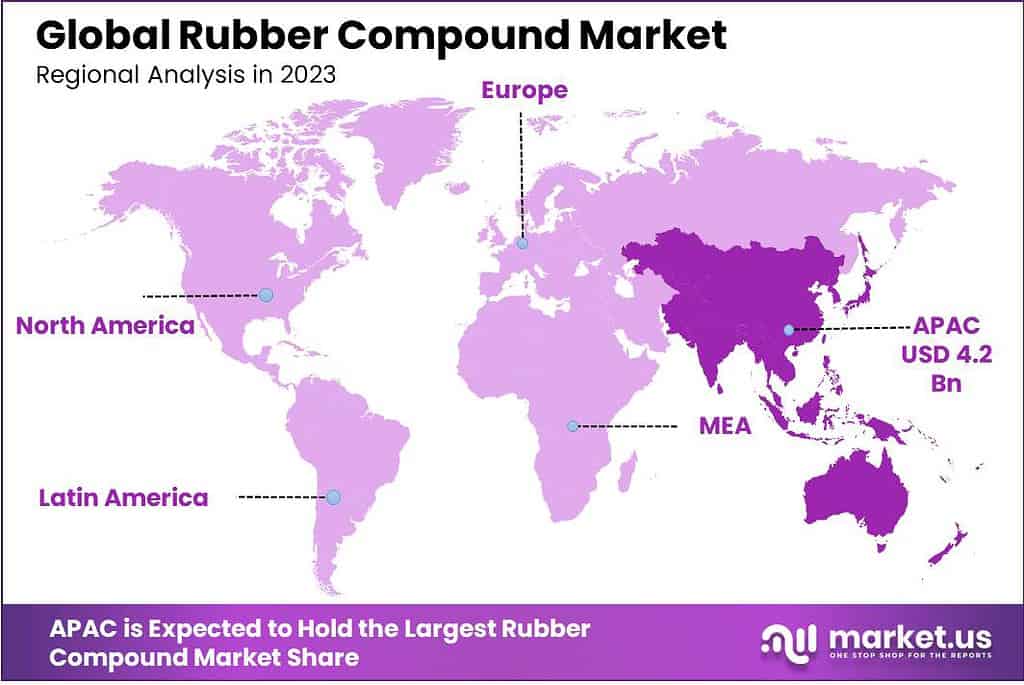

- Asia Pacific Leads with 45.7% Market Share, Fueled by Automotive and Consumer Goods Industries.

- North America Witnesses Growth in High-Quality Rubber Compound Demand, Emphasizing Innovation.

By Type

In 2023, Styrene Butadiene Rubber (SBR) held a dominant market position, capturing more than a 31.5% share. SBR’s popularity is attributed to its extensive use in tire manufacturing, due to its optimal balance of durability, abrasion resistance, and cost-effectiveness. The automotive sector’s steady demand underscores SBR’s significant market share, with emerging applications in industrial goods further supporting growth.

Nitrile Butadiene Rubber (NBR) also secured a substantial segment of the market, prized for its exceptional oil and fuel resistance. This makes NBR ideal for automotive seals, gaskets, and hoses. The ongoing expansion in the oil and gas industry, coupled with the rise in automotive production, propels NBR’s demand, positioning it as a key material in specialized applications.

Silicone Rubber emerged as a critical material, particularly valued for its thermal stability, flexibility, and resistance to extreme temperatures. Its adoption in healthcare, electronics, and automotive industries is notable, driven by its unique properties that cater to stringent specifications. The growing need for high-performance materials in these sectors supports silicone rubber’s market expansion.

EPDM Rubber (Ethylene Propylene Diene Monomer) is recognized for its excellent weather, ozone, and aging resistance. Its use in automotive weather stripping, roofing membranes, and outdoor applications signifies its importance. The push for more durable and longer-lasting materials in the construction and automotive industries fuels the demand for EPDM rubber.

By Application

In 2023, Tires held a dominant market position, capturing more than a 58.7% share. This segment’s strength lies in the global demand for both passenger and commercial vehicles, where tires are essential. The tire industry’s continuous innovation and expansion into new markets have solidified its lead in the rubber compound market.

The Automotive (Non-Tire) segment also showcased significant importance, with a focus on components like seals, gaskets, and mounts. The rise in vehicle production and the push for more durable and efficient automotive parts have driven the demand for rubber compounds in this sector, highlighting its critical role in enhancing vehicle performance and safety.

Belts and Hoses represent another key application area. These components are vital for the smooth operation of machinery and vehicles, ensuring the transfer of fluids and power within systems. The industrial and automotive sectors’ growth supports the steady demand for high-quality rubber compounds in belts and hoses.

Consumer Goods, encompassing a wide range of products from household items to sports equipment, also make substantial use of rubber compounds. The versatility and adaptability of rubber to various applications underscore its value in creating durable, flexible, and safe consumer products.

Wire and Cable insulation benefits greatly from the electrical insulating properties of rubber compounds, protecting and ensuring the reliability of electrical systems. The expansion of telecommunications and power networks globally drives the need for advanced wire and cable solutions.

Market Key Segments

By Type

- Styrene Butadiene Rubber

- Nitrile Butadiene Rubber

- Silicone Rubber

- EPDM Rubber

- Natural Rubber

- Others

By Application

- Tires

- Automotive (Non-Tire)

- Belts and Hoses

- Consumer Goods

- Wire and Cable

- Footwear

- Others

Drivers

Increasing Demand in the Automotive Industry

The rubber compound market is significantly driven by the burgeoning demand within the automotive industry, which utilizes rubber compounds extensively for tires, seals, gaskets, and hoses. Firstly, the global expansion of the automotive sector, fueled by rising vehicle production and sales, particularly in emerging economies, underpins the robust demand for rubber compounds.

This growth is not just limited to traditional vehicles but extends to electric and hybrid vehicles, which also rely on specialized rubber components for insulation and vibration control, showcasing the material’s versatility.

Secondly, advancements in automotive technologies and the push for more durable, efficient vehicles have led to an increased emphasis on high-performance rubber compounds. These materials are essential for meeting the stringent safety, performance, and environmental standards set by regulatory bodies, further propelling the demand in this sector.

Restraints

Volatility in Raw Material Prices

The rubber compound market faces a significant restraint due to the volatility in raw material prices. First, natural rubber prices are susceptible to fluctuations due to climatic conditions, political instability in producing countries, and changes in global demand.

Such unpredictability can lead to cost pressures for manufacturers of rubber compounds, impacting their profit margins. Second, synthetic rubber, derived from petroleum, is subject to the volatility of oil prices. This dependence makes the cost of synthetic rubber compounds vulnerable to the global oil market’s fluctuations, posing challenges in price forecasting and cost management for producers.

Trends

Eco-friendly and Sustainable Rubber Compounds

A notable trend in the rubber compound market is the shift towards eco-friendly and sustainable materials. First, there’s a growing awareness and regulatory pressure to reduce environmental impact, leading manufacturers to explore bio-based rubbers and recycling processes.

These initiatives aim to decrease reliance on petroleum-based products and reduce waste and emissions associated with rubber production. Second, consumer preference is increasingly leaning towards sustainable products, influencing industries, especially automotive and consumer goods, to adopt greener materials.

This trend is not only driving research and innovation in developing new rubber compounds but also opening up markets for sustainable rubber products, reflecting a broader shift towards environmental responsibility in material selection.

Regional Analysis

The Asia Pacific region emerges as a powerhouse in the global rubber compound market, securing the largest market share at 45.7%. This impressive expansion is primarily fueled by the soaring demand for rubber compounds, catalyzed by their widespread use across critical sectors such as automotive, consumer goods, industrial applications, and construction.

A significant increase in manufacturing activities and the dynamic expansion of end-use industries are key factors propelling the rubber compound market in the Asia Pacific. Nations such as China, India, Korea, Thailand, Malaysia, and Vietnam are experiencing a surge in rubber processing and production, which is a crucial driver for the market’s growth in the region. The automotive, consumer electronics, and construction sectors, in particular, demand advanced rubber compounds for various applications, significantly boosting the market.

In North America, the rubber compound market witnessed notable growth, spurred by the region’s economic development. The demand for high-quality rubber compounds is driven by the automotive, manufacturing, and consumer goods industries in North America, reflecting the region’s emphasis on innovation and sustainable practices.

Europe is set for considerable growth in the rubber compound market, with an increasing demand originating from various industries, including automotive and construction. The European market’s progress is further supported by the region’s dedication to sustainability and the rising adoption of green building practices, which enhances the demand for advanced rubber technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The rubber compound market is characterized by the presence of several key players who play a pivotal role in shaping the industry’s dynamics through innovation, strategic expansions, and a deep focus on meeting the evolving needs of various end-use sectors. Among these, companies such as Lanxess, Bridgestone, Goodyear, Sinopec, and Kumho Petrochemical stand out due to their significant contributions and market presence.

Lanxess, a global specialty chemicals company, is renowned for its high-performance rubber compounds, catering to a wide range of industries with its advanced solutions. Bridgestone and Goodyear, both leaders in the tire manufacturing sector, not only demand vast quantities of rubber compounds but also engage in the development of innovative materials to enhance tire performance and sustainability.

Sinopec, one of the largest petrochemical conglomerates, has expanded its footprint in the rubber compound market by leveraging its extensive petrochemical capabilities to produce synthetic rubber compounds. Kumho Petrochemical, known for its synthetic rubber and polymer products, focuses on research and development to introduce high-quality rubber compounds suitable for various applications.

Market Key Players

- Exxon Mobil Corp.

- Continental AG

- Shin-Etsu Chemical Co. Ltd.

- Cooper-Standard Holdings Inc.

- HEXPOL AB

- AirBoss of America Corp.

- POLYMERTECHNIK ELBE GMBH

- Jiangsu Guanlian New Material Technology Co. Ltd.

- Rex Hide Inc.

- SPC Europe Group

- DRI Rubber

- SSJ Rubber

Report Scope

Report Features Description Market Value (2022) US$ 9.2 Bn Forecast Revenue (2032) US$ 18.8 Bn CAGR (2023-2032) 7.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Styrene Butadiene Rubber, Nitrile Butadiene Rubber, Silicone Rubber, EPDM Rubber, Natural Rubber, Others), By Application(Tires, Automotive (Non-Tire), Belts and Hoses, Consumer Goods, Wire and Cable, Footwear, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Exxon Mobil Corp, Continental AG, Shin-Etsu Chemical Co. Ltd., Cooper-Standard Holdings Inc., HEXPOL AB, AirBoss of America Corp., POLYMERTECHNIK ELBE GMBH, Jiangsu Guanlian New Material Technology Co. Ltd., Rex Hide Inc., SPC Europe Group, DRI Rubber, SSJ Rubber Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Rubber Compound Market?Rubber Compound Market size is expected to be worth around USD 18.8 billion by 2033, from USD 9.2 billion in 2023

What is the CAGR for the Rubber Compound Market?The Rubber Compound Market expected to grow at a CAGR of 7.4% during 2023-2032.Who are the key players in the Rubber Compound Market?Exxon Mobil Corp., Continental AG, Shin-Etsu Chemical Co. Ltd. , Cooper-Standard Holdings Inc., HEXPOL AB, AirBoss of America Corp., POLYMERTECHNIK ELBE GMBH, Jiangsu Guanlian New Material Technology Co. Ltd., Rex Hide Inc. , SPC Europe Group, DRI Rubber, SSJ Rubber

-

-

- Exxon Mobil Corp.

- Continental AG

- Shin-Etsu Chemical Co. Ltd.

- Cooper-Standard Holdings Inc.

- HEXPOL AB

- AirBoss of America Corp.

- POLYMERTECHNIK ELBE GMBH

- Jiangsu Guanlian New Material Technology Co. Ltd.

- Rex Hide Inc.

- SPC Europe Group

- DRI Rubber

- SSJ Rubber