Global Natural Gas Compressor Market Size, Share, And Business Benefits By Type (Reciprocating Compressors, Centrifugal Compressors, Rotary Compressors, Screw, Axial, Others), By Power (Upto 500 kW, 500 to 1,000 kW, Above 1,000 kW), By Stage (Single Stage, Two-Stage), By Cooling Type (Air-Cooled, Water-Cooled), By Application (Gas Transmission and Distribution, Gas Storage, Gas Gathering, Gas Processing, Others), By End-Use (Oil and Gas, Power Generation, Manufacturing, Transportation, Petrochemical, Chemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143855

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

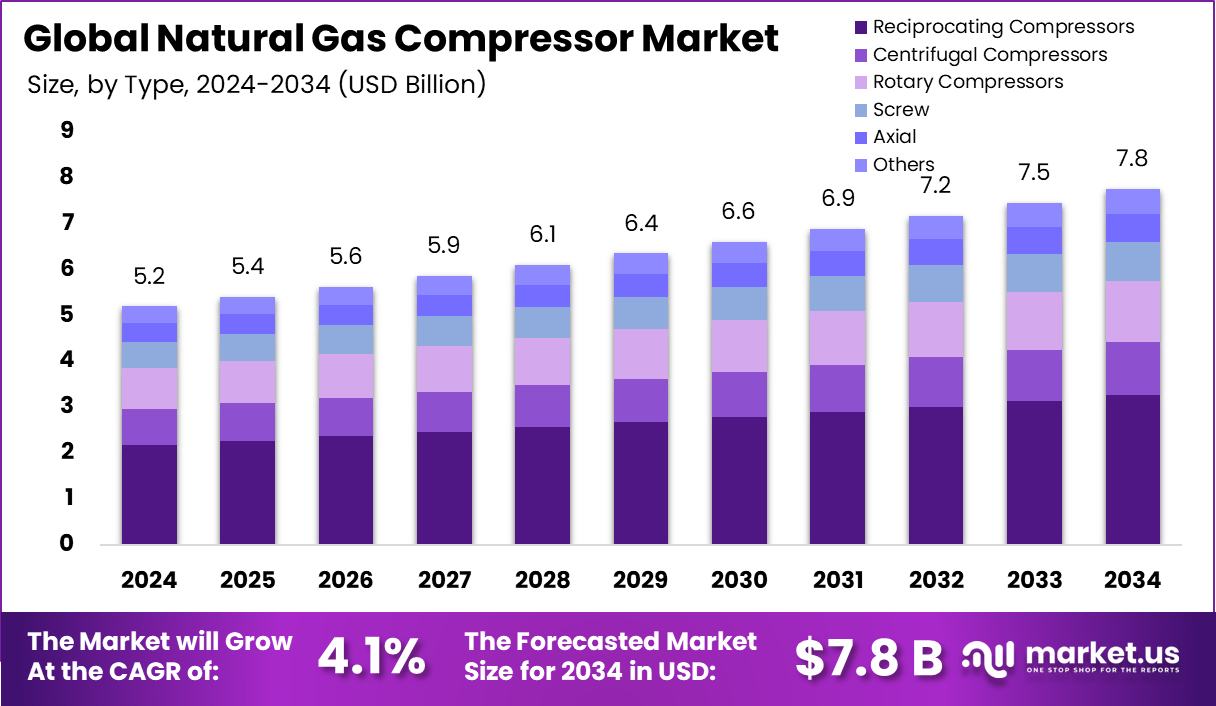

Global Natural Gas Compressor Market is expected to be worth around USD 7.8 billion by 2034, up from USD 5.2 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034. High shale gas production in North America USD 2.2 Bn continues to boost compressor demand across upstream operations.

A natural gas compressor is a mechanical device that increases the pressure of natural gas by reducing its volume, enabling efficient transportation and storage. These compressors are crucial in the natural gas supply chain, aiding in the transfer of gas from production sites to residential, commercial, and industrial end users. By compressing natural gas, it can be transported over long distances through pipelines or stored in tanks under high pressure, making it an integral part of the energy sector.

The natural gas compressor market encompasses the demand for these devices across various applications including upstream oil and gas operations, midstream transportation, and downstream processing. The market is driven by the expanding global energy infrastructure and the increasing adoption of natural gas as a cleaner alternative to other fossil fuels.

One key growth factor for the natural gas compressor market is the global shift towards cleaner energy sources. Natural gas emits fewer pollutants compared to coal and oil, making it a preferred choice for reducing greenhouse gas emissions. This environmental benefit drives the demand for infrastructure that supports the extraction, transportation, and distribution of natural gas.

Additionally, the development of unconventional gas sources like shale gas has created a surge in the need for natural gas compressors. These compressors facilitate the efficient movement of gas from remote and difficult-to-access fields to major consumption centers, enhancing the market’s growth prospects.

There are significant opportunities in the natural gas compressor market due to technological advancements. Innovations in compressor design and materials have led to more efficient, reliable, and cost-effective compressors. These improvements not only enhance operational efficiencies but also extend the lifespan of the equipment, thereby attracting investment from gas handling and transportation sectors.

Key Takeaways

- Global Natural Gas Compressor Market is expected to be worth around USD 7.8 billion by 2034, up from USD 5.2 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034.

- The reciprocating compressors hold a significant 42.30% share in the natural gas compressor market.

- In the power category, compressors up to 500 kW dominate, accounting for 56.30% of the market.

- Single-stage compressors are preferred, with a substantial market share of 58.30% in their segment.

- Air-cooled compressors lead the cooling type segment, capturing 64.30% of the market share.

- In applications, gas transmission and distribution is a major segment, holding 47.20% of the market.

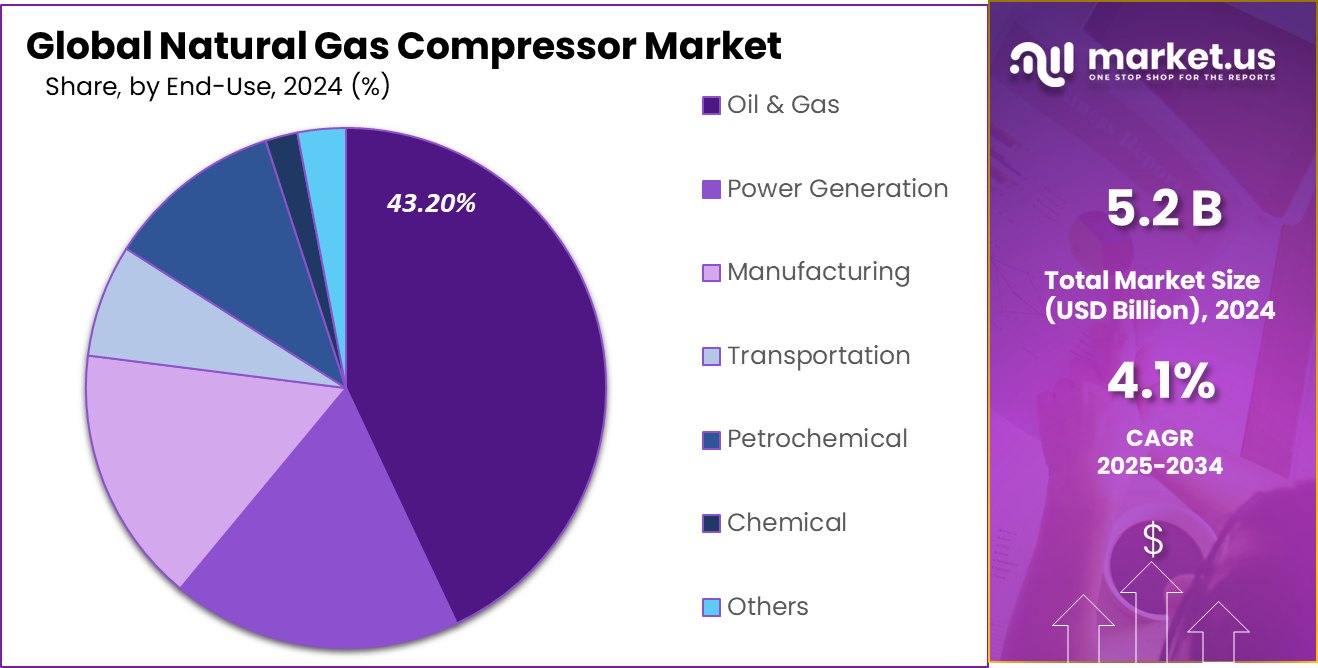

- For end-use, the oil and gas sector prominently utilizes these compressors, contributing to 43.20% of the market.

- The North American market value reached USD 2.2 billion, driven by strong gas infrastructure development.

By Type Analysis

Reciprocating compressors hold a 42.30% share in the natural gas compressor market.

In 2024, Reciprocating Compressors held a dominant market position in the by-type segment of the Natural Gas Compressor Market, with a 42.30% share. This significant market share highlights their widespread adoption across midstream and downstream operations, driven by their superior efficiency in handling high-pressure gas transfer in intermittent duty cycles.

Reciprocating compressors remain a preferred choice in applications where gas flow rates fluctuate, providing reliability and ease of maintenance in natural gas transmission, storage, and distribution.

Their robust presence is also attributed to their compatibility with both low and high horsepower requirements, enabling flexible deployment across upstream gathering systems and large-scale processing units.

In addition, advancements in control systems and integration with predictive maintenance technologies have further enhanced their operational efficiency and reduced downtime, supporting higher adoption across global markets.

While other types such as centrifugal and rotary compressors are gaining traction due to compactness and suitability in continuous flow environments, reciprocating compressors remain unmatched for high compression ratio requirements.

By Power Analysis

Up to 500 kW compressors account for 56.30% of the market by power.

In 2024, Upto 500 kW held a dominant market position in the By Power segment of the Natural Gas Compressor Market, with a 56.30% share. This segment’s leading position is primarily due to the high demand for compact and energy-efficient compressors in small- to mid-scale natural gas applications. These units are widely used in gas gathering, boosting, and distribution networks where lower horsepower is sufficient for effective gas compression.

Their suitability for decentralized gas infrastructure, especially in remote and developing regions, has significantly contributed to their dominance. The lower installation and operating costs of compressors within this power range make them an economical choice for operators seeking reliable performance without heavy capital expenditure. Additionally, their simplified maintenance and easy integration into existing systems have increased their appeal in both urban and rural pipeline setups.

By Stage Analysis

Single stage compressors dominate, with a 58.30% market share by stage.

In 2024, Single Stage held a dominant market position in the By Stage segment of the Natural Gas Compressor Market, with a 58.30% share. This significant share can be attributed to its compact design, lower maintenance requirements, and cost-efficiency, making it ideal for applications where pressure ratios are moderate. Industries prefer single-stage compressors for tasks involving pipeline transmission, gas gathering, and gas-lift operations in upstream and midstream sectors, where reliability and ease of operation are critical.

Moreover, the growing demand for energy-efficient systems has led to increased adoption of single-stage compressors, especially in regions prioritizing streamlined operations. Their simple configuration facilitates quick installation, making them suitable for decentralized gas facilities and mobile applications. With rising investments in gas infrastructure and expanding exploration activities, single-stage units have gained traction across both onshore and offshore sites.

In contrast, multi-stage compressors serve applications requiring higher pressure outputs but held a comparatively lower market share in 2024. Though they offer greater compression efficiency at elevated pressures, their high installation and maintenance costs remain a limiting factor for many end users. However, in high-demand environments like large-scale processing plants, multi-stage compressors continue to see steady utilization, driven by their ability to deliver consistent pressure performance over longer operational cycles.

By Cooling Type Analysis

Air-cooled compressors lead cooling types, comprising 64.30% of the market.

In 2024, Air-Cooled held a dominant market position in the By Cooling Type segment of the Natural Gas Compressor Market, with a 64.30% share. This leading position was driven by its low operational complexity, cost-effectiveness, and suitability in remote or arid environments where water availability is limited. Air-cooled systems eliminate the need for complex water management infrastructure, making them ideal for off-grid and mobile gas compression setups.

Their minimal maintenance requirements and reduced risk of corrosion from water-based systems further contribute to their widespread adoption, particularly in midstream applications like gas gathering and transmission. Industries operating in regions with high ambient temperatures or restricted water access rely heavily on air-cooled compressors due to their consistent performance and lower environmental dependency.

On the other hand, Water-Cooled compressors, though effective in high-load and continuous operations, held a comparatively smaller market share. Their requirement for a constant water source and additional auxiliary systems increases operational costs and complexity.

As a result, their use is typically confined to large-scale industrial setups or regions with abundant water resources. Despite this, water-cooled systems remain relevant in specific high-capacity applications where thermal stability and sustained high output are critical over long operational periods.

By Application Analysis

Gas transmission and distribution applications represent 47.20% of the market.

In 2024, Gas Transmission and Distribution held a dominant market position in the By Application segment of the Natural Gas Compressor Market, with a 47.20% share. This dominance was primarily due to the increasing global demand for reliable gas pipeline infrastructure and the expansion of cross-country transmission networks. Compressors play a critical role in maintaining pressure across long distances, ensuring uninterrupted flow from production sites to end users.

The segment benefited significantly from investments in pipeline expansion projects, particularly in emerging economies focused on energy security and cleaner fuel alternatives. Additionally, rising urbanization and industrialization boosted the demand for natural gas in residential and commercial sectors, further driving compressor installations for distribution purposes.

Gas transmission and distribution applications require continuous and stable pressure levels, making compressors an essential component in midstream operations. Their ability to operate efficiently over extended periods under varying environmental conditions contributed to higher adoption in this segment.

In contrast, other applications such as gas storage, gas processing plants, and enhanced oil recovery held lower shares, as they typically require more specialized or intermittent compression solutions. However, these secondary applications remain vital in supporting overall system efficiency and maintaining the supply-demand balance within the natural gas value chain.

By End-Use Analysis

The oil and gas sector constitutes 43.20% of the market by end-use.

In 2024, Oil and Gas held a dominant market position in the By End-Use segment of the Natural Gas Compressor Market, with a 43.20% share. This leadership was driven by continued upstream and midstream infrastructure development, especially in regions rich in shale gas and tight oil resources. Compressors are critical in exploration, production, and transportation processes, enabling consistent gas flow across long pipelines and boosting pressure levels in drilling and processing operations.

The oil and gas sector’s reliance on natural gas as both a product and fuel source significantly supports compressor deployment. As countries strive to shift toward cleaner energy sources, natural gas has become a preferred transitional fuel, resulting in expanded compressor usage across LNG plants, refineries, and petrochemical complexes.

Moreover, oil and gas operators are investing in pipeline upgrades and gas-lift technologies, further reinforcing compressor demand. The segment also benefits from compressor applications in flare gas recovery and reinjection processes aimed at enhancing reservoir output and minimizing environmental emissions.

Key Market Segments

By Type

- Reciprocating Compressors

- Centrifugal Compressors

- Rotary Compressors

- Screw

- Axial

- Others

By Power

- Upto 500 kW

- 500 to 1,000 kW

- Above 1,000 kW

By Stage

- Single Stage

- Two-Stage

By Cooling Type

- Air-Cooled

- Water-Cooled

By Application

- Gas Transmission and Distribution

- Gas Storage

- Gas Gathering

- Gas Processing

- Others

By End-Use

- Oil and Gas

- Power Generation

- Manufacturing

- Transportation

- Petrochemical

- Chemical

- Others

Driving Factors

Growing Natural Gas Demand for Power Generation

The top driving factor for the Natural Gas Compressor Market is the rising global demand for natural gas in power generation. As countries shift away from coal to reduce carbon emissions, natural gas is becoming the preferred alternative due to its cleaner-burning nature. This transition is creating a strong demand for compressors that help transport natural gas efficiently through pipelines to power plants.

In developing countries, rapid urbanization and industrial expansion are pushing electricity demand higher, further supporting this trend. Additionally, advancements in combined-cycle gas turbine (CCGT) technology are making gas-based power plants more efficient, increasing reliance on natural gas.

Restraining Factors

High Installation and Maintenance Costs Limit Growth

One of the major restraining factors in the Natural Gas Compressor Market is the high cost of installation and ongoing maintenance. Compressors, especially those used in large-scale operations like gas transmission or processing plants, require significant capital investment. The costs include not only the equipment itself but also infrastructure, safety systems, and skilled labor.

Additionally, routine maintenance, spare parts, and system upgrades can add to operational expenses over time. For smaller operators or projects in early development stages, these financial barriers can delay or even cancel compressor deployment. This challenge is more prominent in developing regions with limited budgets, which can slow overall market growth despite rising demand for natural gas infrastructure.

Growth Opportunity

Expansion of LNG Infrastructure Across Emerging Economies

A key growth opportunity for the Natural Gas Compressor Market lies in the rapid expansion of liquefied natural gas (LNG) infrastructure across emerging economies. Countries in Asia-Pacific, Africa, and Latin America are investing heavily in LNG terminals, pipelines, and distribution networks to meet rising energy demand and reduce dependence on coal and oil. Natural gas compressors are essential in LNG processes—from gas extraction and transportation to liquefaction and regasification.

As these regions aim to secure stable energy sources and support cleaner energy policies, the need for efficient gas compression systems is growing. This opens up strong opportunities for compressor manufacturers and service providers to tap into new projects and long-term infrastructure developments in high-growth markets.

Latest Trends

Rising Use of Electric-Driven Compressor Systems

A major trend in the Natural Gas Compressor Market is the rising use of electric-driven compressor systems. Companies are shifting from traditional gas engine-driven compressors to electric models due to their energy efficiency, lower emissions, and easier maintenance.

As global environmental regulations tighten and industries aim to reduce their carbon footprint, electric compressors are becoming more attractive—especially in regions with stable power grids and clean electricity sources.

These systems also operate more quietly and require fewer moving parts, leading to longer equipment life and lower operating costs. This trend reflects the market’s move toward cleaner, smarter technologies and is expected to continue as more operators seek sustainable solutions in gas compression operations.

Regional Analysis

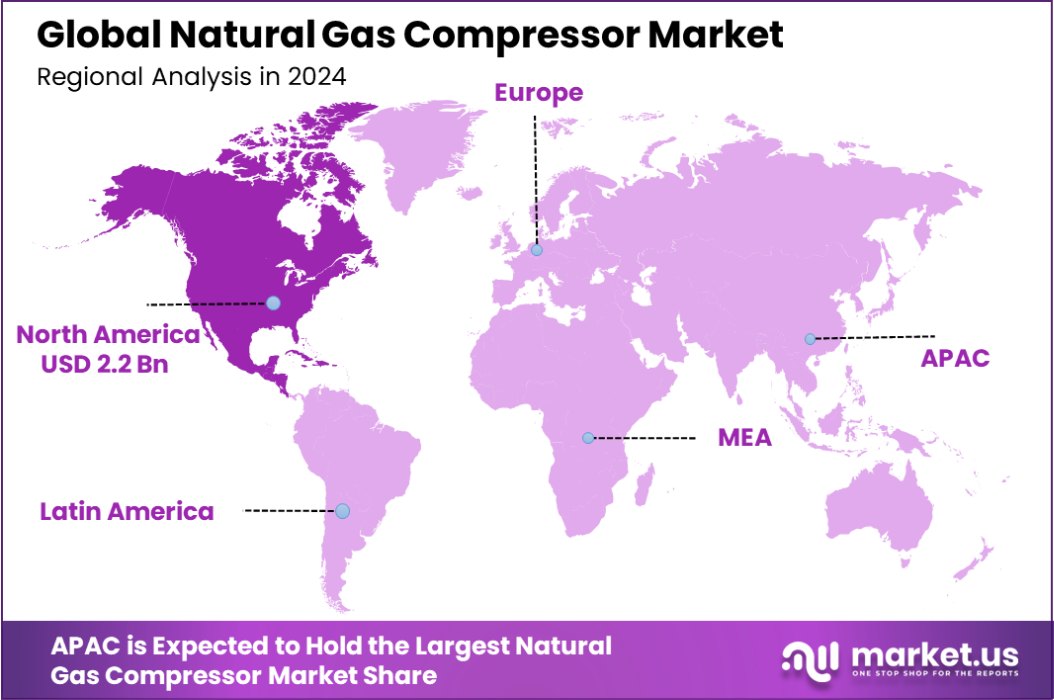

In 2024, North America led the Natural Gas Compressor Market with a 43.70% share.

In 2024, North America dominated the global Natural Gas Compressor Market, accounting for 43.70% of the total share, with a market value of USD 2.2 billion. This leadership was driven by extensive shale gas exploration, robust pipeline infrastructure, and high investments in midstream operations across the United States and Canada. The region continues to benefit from advanced compression technologies and strong participation from key industry players.

Europe followed with a steady demand for natural gas compressors, supported by energy transition goals and the need to modernize aging gas infrastructure. In the Asia Pacific, rising energy consumption in China and India, along with LNG infrastructure development, contributed to growing compressor installations. The region showed promising growth potential, especially in new gas-fired power plants and pipeline expansions.

The Middle East & Africa saw moderate growth, led by natural gas development projects in the UAE, Saudi Arabia, and Nigeria, focusing on both domestic supply and exports. Latin America remained a smaller but emerging market, with demand supported by gas production in Brazil and Argentina.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Coltri, Ariel Corporation, and Atlas Copco played a pivotal role in shaping the global Natural Gas Compressor Market. Each of these companies brought distinct strengths that contributed to their market influence and competitive positioning.

Coltri, known for its compact and high-performance compressor solutions, continued to cater to niche segments requiring portable and light-duty gas compressors. Their strong focus on quality engineering and energy-efficient designs has earned them traction in small-scale applications and remote operations, particularly in developing regions and decentralized gas facilities.

Ariel Corporation, a longstanding leader in reciprocating gas compressors, maintained a dominant presence across midstream and upstream sectors. With a reputation for reliability and durability in large-scale pipeline and processing applications, Ariel’s products remained the first choice for high-pressure operations. In 2024, Ariel expanded its global footprint through enhanced service offerings and strategic collaborations, especially in North America, where gas transmission projects continue to surge.

Atlas Copco leveraged its technological expertise and global distribution network to serve a wide range of gas compression needs. Its diversified product portfolio, spanning both oil-injected and oil-free solutions, made it a strong player across industrial and energy sectors. In 2024, Atlas Copco focused on sustainability by promoting electric-driven compressor systems, aligning with global emission reduction goals.

Top Key Players in the Market

- Coltri

- Ariel Corporation

- Atlas Copco

- Bauer Compressors, Inc.

- Elliot Company

- Flowserve Corporation

- Fornovo Gas

- General Electric Company

- IMW Industries Ltd.

- Ingersoll Rand Inc.

- Jereh

- Kaishan Group

- Kerui

- Kobelco Compressors America Inc.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd.

- Quincy

- Siemens

- Tianyi

- Xi’an Shaangu Power

Recent Developments

- In 2024, Kerui introduced an innovative truck-mounted pipeline natural gas recovery compressor unit, designed for quick deployment and operation within two hours. This advancement minimizes environmental impact and reduces economic losses during pipeline maintenance.

- In December 2023, Fornovo Gas operates in 60 countries, reflecting its global reach. The company has also committed to sustainability initiatives, such as installing a 252 kW photovoltaic system to reduce greenhouse gas emissions.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Billion Forecast Revenue (2034) USD 7.8 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Reciprocating Compressors, Centrifugal Compressors, Rotary Compressors, Screw, Axial, Others), By Power (Upto 500 kW, 500 to 1,000 kW, Above 1,000 kW), By Stage (Single Stage, Two-Stage), By Cooling Type (Air-Cooled, Water-Cooled), By Application (Gas Transmission and Distribution, Gas Storage, Gas Gathering, Gas Processing, Others), By End-Use (Oil and Gas, Power Generation, Manufacturing, Transportation, Petrochemical, Chemical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Coltri, Ariel Corporation, Atlas Copco, Bauer Compressors, Inc., Elliot Company, Flowserve Corporation, Fornovo Gas, General Electric Company, IMW Industries Ltd., Ingersoll Rand Inc., Jereh, Kaishan Group, Kerui, Kobelco Compressors America Inc., MAN Energy Solutions SE, Mitsubishi Heavy Industries Ltd, Quincy, Siemens, Tianyi, Xi’an Shaangu Power Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Natural Gas Compressor MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global Natural Gas Compressor MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Coltri

- Ariel Corporation

- Atlas Copco

- Bauer Compressors, Inc.

- Elliot Company

- Flowserve Corporation

- Fornovo Gas

- General Electric Company

- IMW Industries Ltd.

- Ingersoll Rand Inc.

- Jereh

- Kaishan Group

- Kerui

- Kobelco Compressors America Inc.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd.

- Quincy

- Siemens

- Tianyi

- Xi’an Shaangu Power