Italy Power Purchase Agreement Market By Type (Physical Delivery PPA, Virtual PPA, Portfolio PPA, Block Delivery PPA, and Others), By Location (On-site and Off-site), By Category (Corporate, Government, and Others), By Deal Type (Wholesale, Retail, and Others), By Capacity (Up to 20 MW, 20-50 MW, 50-100 MW, and Above 100 MW), By Application (Solar, Wind, Geothermal, Hydropower, Carbon Capture and Storage, and Others), By End-Use (Residential, Commercial, and Industrial), By Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141163

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

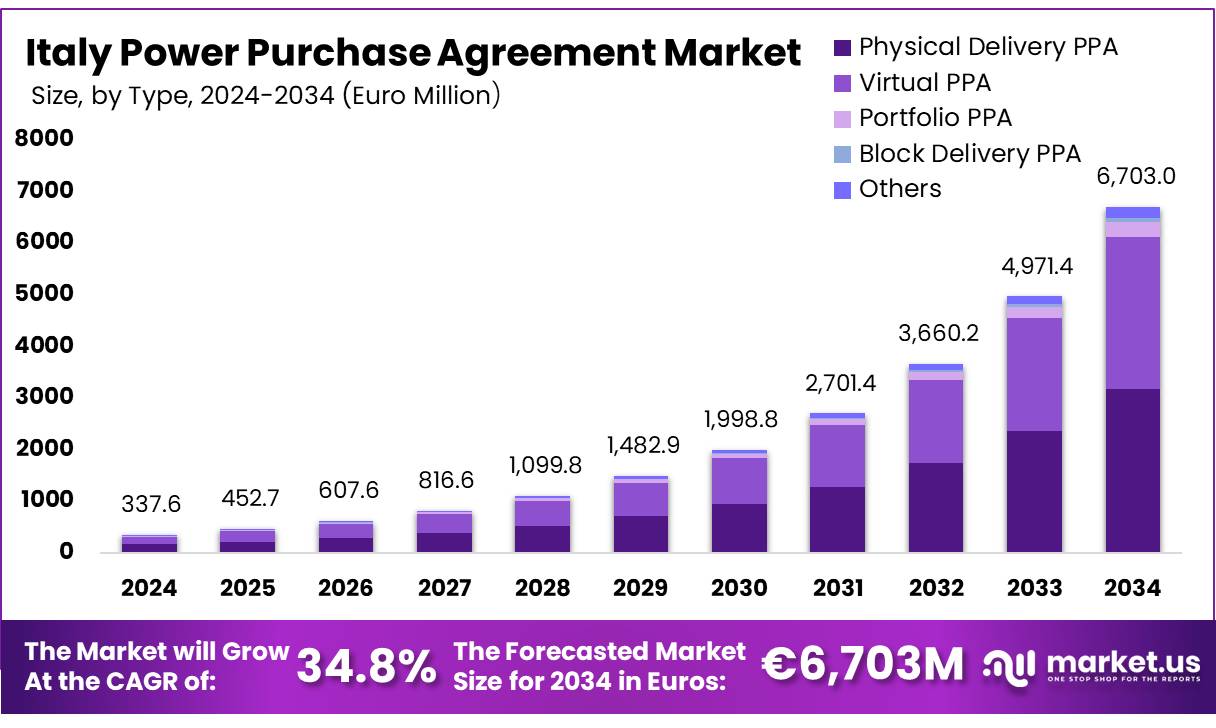

Italy Power Purchase Agreement Market size is expected to be worth around Euro 6,703.0 Million by 2034, from Euro 337.6 Million in 2024, growing at a CAGR of 34.8% from 2025 to 2034.

Italy’s Power Purchase Agreement (PPA) market is experiencing significant growth, driven by the country’s ambitious renewable energy targets and favorable regulatory changes. The Italian government aims to achieve 70% of its electricity production from renewable sources by 2030, a goal that has accelerated the adoption of PPAs as a mechanism to secure long-term renewable energy procurement.

The introduction of the “FER X” legislation in 2024, which seeks to add 60 GW of new renewable capacity by 2028, has been pivotal in this expansion. This decree allocates 45 GW to solar energy and 16.5 GW to onshore wind, streamlining approval processes and incentivizing investments in renewable projects. The market has seen a surge in both corporate and utility-driven PPAs.

The Italian electricity market’s structure, divided into seven bidding zones, introduces complexities such as the Corrispettivo Capacità di Trasporto (CCT), reflecting transmission capacity constraints. These factors influence PPA pricing and risk assessments, necessitating careful consideration by market participants.

- Italy aims for 72% of its electricity to come from renewable sources by 2030. However, the National Energy and Climate Plan (NECP) indicates a more conservative target of 55% renewables in the electricity mix by the same year.

- To achieve these targets, Italy needs to increase its renewable capacity significantly. Estimates suggest that an additional 90 GW of renewable capacity is required by 2035, bringing the total to 250 GW2.

- By 2030, projections indicate that Italy could reach around 107.7 GW of renewable capacity, with a generation share of approximately 59% from renewables.

Key Takeaways

- Italy power purchase agreement market is valued at Euro 337.6 million in 2024 and is estimated to register a CAGR of 34.8%.

- Italy power purchase agreement market is projected to reach Euro 6,703.0 million by 2034.

- Among types, physical delivery PPA dominated the Italy power purchase agreement market, holding a 47.5% revenue share.

- In 2024, solar energy dominated the Italy Power Purchase Agreement (PPA) market, among other applications, accounted for 54.0% of the total share.

Regulatory Framework

Region/Country Regulatory Body/ Regulation Description European Union Renewable Energy Directive (EU) 2018/2001 by Directive (EU) 2023/2413 These directives aim to streamline the permitting processes for renewable energy projects, thus facilitating the establishment and execution of PPAs. The amendments and recommendations from the European Commission are part of a broader effort to reduce the EU’s dependency on fossil fuels and to accelerate the transition to renewable energy, especially in response to rising energy prices and energy security concerns. Italy Legislative Decree No. 28/2011 This law sets the framework for the development and support of renewable energy projects in Italy, including the legal foundations for PPAs. It allows for feed-in tariffs (FiTs) and other incentives that support the financial viability of PPAs for renewable projects. Type Analysis

Physical Delivery PPA Accounted For The Largest Market Share

Italy power purchase agreement market is segmented based on type into, physical delivery PPA, virtual PPA, portfolio PPA, block delivery PPA & others. Among these, physical delivery PPA dominated the Italy power purchase agreement market, holding a 47.5% revenue share. This was primarily driven by their ability to provide direct and reliable electricity supply to off-takers, ensuring stability, price security, and regulatory compliance in a market increasingly focused on renewable energy procurement. One of the key reasons for the preference for physical delivery PPAs is their alignment with Italy’s renewable energy transition goals.

With the FER X scheme aiming to add 60 GW of renewable capacity by 2028, large energy buyers, including utilities, industrial sectors, and corporate off-takers, sought long-term contracts to secure clean energy at predictable costs.

Italy Power Purchase Agreement Market, By Type, 2020-2024 (Mn Euros)

Type 2020 2021 2022 2023 2024 Physical Delivery PPA 54.9 71.9 94.0 122.8 160.3 Virtual PPA 40.9 56.2 77.5 107.1 148.5 Portfolio PPA 4.7 6.2 8.3 11.0 14.7 Block Delivery PPA 1.4 1.8 2.3 2.9 3.8 Others 3.9 5.0 6.4 8.1 10.3 Location Analysis

Off Site Power Purchase Agreement Are Majorly Preferred Over Others Due to Their Scalability, Cost Efficiency

Based on a location, the market is segmented into on-site and off-site. Among these types, off-site accounted for the majority of the market share, with 81.7% due to their scalability, cost efficiency, and alignment with Italy’s renewable energy expansion policies. Off-site PPAs allow energy buyers to procure electricity from large-scale renewable projects located away from their premises, offering greater flexibility and access to cheaper and more abundant renewable energy sources compared to on-site installations.

One of the primary reasons for the dominance of off-site PPAs is the limited space and high costs associated with on-site renewable energy generation. Various businesses, especially in urban and industrial areas, lack the physical space to install large-scale solar panels or wind turbines. Off-site PPAs provide a viable solution by enabling companies to source energy from utility-scale renewable projects without the need for direct infrastructure investments.

Italy Power Purchase Agreement Market, By Location, 2020-2024 (Mn Euros)

Location 2020 2021 2022 2023 2024 On-site 22.6 29.1 37.4 48.1 61.7 Off-site 83.2 112.1 151.1 204.0 275.8

Category AnalysisCost-Effectiveness and Price Predictability That Corporate Ppas Offer, It Was The Major Dominating Sector.

Based on categories, the market is further divided into corporate, government & others. Among these PPA categories, corporate accounted for the largest market share in 2024, with 86.7%. This strong dominance is primarily driven by the increasing sustainability commitments of large corporations, the need for cost-effective energy procurement, and favorable regulatory support for corporate renewable energy adoption. One of the key factors behind corporate PPA dominance is the growing emphasis on sustainability and carbon neutrality goals.

Several multinational companies and large industrial players in Italy, including STMicroelectronics, Equinix, and other manufacturing, technology, and retail giants, have pledged to achieve 100% renewable energy consumption in line with their Environmental, Social, and Governance (ESG) commitments. Corporate PPAs provide a reliable mechanism to directly procure renewable energy, helping businesses reduce their carbon footprint while ensuring long-term energy cost stability.

Italy Power Purchase Agreement Market, By Category, 2020-2024 (Mn Euros)

Category 2020 2021 2022 2023 2024 Corporate 88.7 119.5 160.9 216.8 292.7 Government 4.8 6.1 7.7 9.8 12.4 Others 12.2 15.6 19.9 25.4 32.4 Deal Type Analysis

By deal types, the market is further divided into wholesale, retail, others. Among these, wholesale accounted for the largest market share in 2024, with 59.9%. This dominance is driven by large-scale energy procurement needs, cost advantages, and alignment with Italy’s renewable energy expansion policies. One of the key factors behind the strong performance of wholesale PPAs is their suitability for large energy buyers, such as utilities, industrial consumers, and energy suppliers, who require bulk electricity purchases to meet their long-term demand.

These agreements allow buyers to procure renewable energy at lower per-unit costs compared to retail PPAs, leveraging economies of scale and ensuring price stability amid market volatility. With energy prices fluctuating due to geopolitical and economic uncertainties in Europe, wholesale PPAs provided a strategic advantage for securing cost-efficient and predictable energy supplies over extended contract durations.

Italy Power Purchase Agreement Market, By Deal Type, 2020-2024 (Mn Euros)

Deal Type 2020 2021 2022 2023 2024 Wholesale 66.1 87.5 115.8 153.1 202.1 Retail 25.3 35.5 49.8 70.1 98.8 Others 14.4 18.2 23.0 28.9 36.6 Capacity Analysis

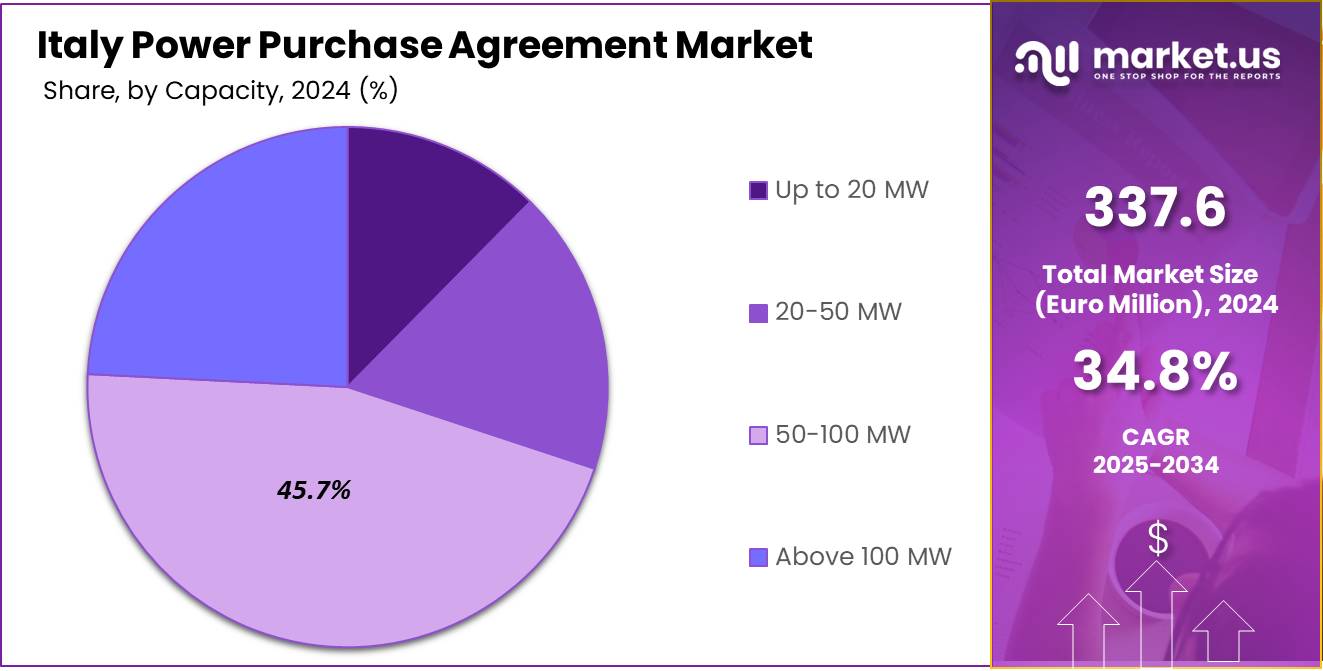

Based on capacities, the market is further divided into Up to 20 MW, 20-50 MW, 50-100 MW & above 100 MW. Among these capacities, 50-100 MW accounted for the largest market share in 2024, with 45.7%, primarily due to its ideal balance between scalability, cost-efficiency, and regulatory approvals for renewable energy projects.

This capacity range aligns well with Italy’s growing demand for mid-to-large-scale renewable energy installations that can efficiently supply power to large corporate buyers, utilities, and industrial consumers while remaining manageable in terms of infrastructure and permitting complexities. With the continued growth of corporate PPAs, government-backed renewable incentives, and grid-ready mid-scale projects, this segment is expected to maintain strong demand in the coming years.

Italy Power Purchase Agreement Market, By Capacity, 2020-2024 (Mn Euros)

Capacity 2020 2021 2022 2023 2024 Up to 20 MW 16.9 21.1 26.5 33.2 41.9 20-50 MW 19.6 25.8 34.2 45.1 59.7 50-100 MW 48.2 64.7 86.5 115.7 154.3 Above 100 MW 21.1 29.5 41.4 58.1 81.7 Application Analysis

By applications, the market is further divided into solar, wind, geothermal, hydropower, carbon capture and storage & others. In 2024, solar energy dominated the Italy power purchase agreement market, accounting for 54.0% of the total share, driven by favorable policies, declining solar technology costs, and the country’s geographical advantage. Italy has one of the highest solar potentials in Europe, with over 2,000 sunlight hours annually, making it an ideal location for large-scale solar power generation.

The Italian government’s FER X scheme, which aims to install 60 GW of new renewable capacity by 2028, has allocated 45 GW specifically to solar projects, boosting market growth. Additionally, corporate buyers and utilities prefer solar PPAs due to their lower capital costs, quicker deployment, and predictable output compared to wind or other renewables. Technological advancements, such as bifacial solar panels and improved energy storage solutions, have further enhanced solar’s competitiveness.

Italy Power Purchase Agreement Market, By Application, 2020-2024 (Mn Euros)

Application 2020 2021 2022 2023 2024 Solar 61.2 80.6 106.0 139.1 182.2 Wind 29.2 40.9 57.3 80.5 113.4 Geothermal 2.0 2.4 3.0 3.8 4.7 Hydropower 4.7 5.9 7.5 9.4 11.8 Carbon Capture & Storage 1.3 1.6 2.1 2.7 3.5 Others 7.4 9.7 12.7 16.6 21.9 End-Use Analysis

Based on end-uses, the market is further divided into residential, commercial & industrial. the industrial sector accounted for 48.9% of the Italy Power Purchase Agreement (PPA) market, primarily due to high energy consumption and sustainability commitments from manufacturing, automotive, and technology industries. Industrial operations require large and stable energy supplies, making long-term PPAs an attractive option for cost control and carbon footprint reduction.

With Italy’s push for decarbonization and stricter carbon regulations, industries increasingly adopted renewable energy PPAs to align with Environmental, Social, and Governance (ESG) goals. Companies like STMicroelectronics, Fiat, and other major manufacturers secured PPAs to ensure stable energy pricing and reduce exposure to volatile fossil fuel markets. The growing demand for data centers and energy-intensive industries, such as chemicals and metals production, also drove PPA adoption. As Italy continues its industrial decarbonization efforts, the industrial sector is expected to remain the largest PPA consumer in the coming years.

Italy Power Purchase Agreement Market, End-Use Analysis, 2020-2024 (Mn Euros)

Deal Type 2020 2021 2022 2023 2024 Residential 4.7 5.9 7.5 9.4 11.9 Commercial 57.4 74.3 96.1 124.3 160.6 Industrial 43.7 60.9 84.9 118.3 165.1 Key Market Segments

By Type

- Physical Delivery PPA

- Virtual PPA

- Portfolio PPA

- Block Delivery PPA

- Others

By Location

- On-site

- Off-site

By Application

- Corporate

- Government

- Others

By Deal Type

- Wholesale

- Retail

- Others

By Capacity

- Up to 20 MW

- 20-50 MW

- 50-100 MW

- Above 100 MW

By Application

- Solar

- Wind

- Geothermal

- Hydropower

- Carbon Capture and Storage

- Others

By End-Use

- Residential

- Commercial

- Industrial

Drivers

Italy’s Renewable Energy Targets and Decarbonization Goals

One of the key drivers propelling the growth of the Power Purchase Agreement (Italy’s PPA) market in Italy is the country’s ambitious renewable energy targets and its commitment to decarbonization. Italy has set a national target to source at least 30% of its total energy consumption from renewable sources by 2030, a goal that is aligned with the European Union’s broader Green Deal and the Renewable Energy Directive (RED II). This policy framework aims to reduce greenhouse gas emissions by 55% by 2030 compared to 1990 levels, creating significant demand for renewable energy generation across all sectors of the Italian economy.

In response, power purchase agreements are increasingly being viewed as a key mechanism to help meet these targets by facilitating the direct procurement of renewable energy. The Italian government has implemented several policies to promote the uptake of renewable energy. Particularly, the “FER 1” incentive scheme, launched in 2019, aims to support the development of new renewable energy plants, especially in the wind and solar sectors. Under this scheme, renewable energy projects benefited from competitive auctions that enable developers to secure long-term contracts at favorable rates. By ensuring stable, predictable revenues for energy producers, PPAs complement such incentives, reducing the financial risks associated with renewable energy projects.

Restraints

Impact of Zonal Pricing on Power Purchase Agreements (PPAs) in Italy

The Italy’s transition from a PUN-based pricing system to zonal pricing in Italy’s electricity market introduces significant restraints for Power Purchase Agreements (PPAs) market growth. In Italy’s current PUN-based system, producers take on the basis risk due to the difference between zonal prices and the national PUN price. This has generally been more predictable in northern and central regions.

However, with the upcoming shift to zonal pricing, both producers and buyers will need to adapt to a more complex pricing structure that reflects regional demand and grid constraints. This change introduces the potential for increased basis risks, particularly for companies that are not experienced in managing these new variables. As a result, there could be hesitation in signing new contracts, as businesses navigate these more unpredictable pricing dynamics. This factors could discourage corporate buyers, particularly those unfamiliar with managing the complexities of CCT risk, from entering into new PPAs.

Opportunity

Growing Demand for Corporate Sustainability and ESG Initiative Is Estimated to Create More Opportunities

A major opportunity for the growth of the PPA market in Italy lies in the increasing demand for corporate sustainability and ESG initiatives. Over the past few years, businesses across various sectors have come under growing pressure from investors, consumers, and regulatory bodies to demonstrate their commitment to sustainability and reduce their carbon footprints. As a result, more companies are adopting ambitious sustainability targets, with several setting goals for carbon neutrality and renewable energy procurement. This trend is creating a significant opportunity for PPAs, particularly in the corporate sector, as businesses seek reliable and cost-effective ways to source renewable energy and meet their ESG commitments.

Corporate PPAs offer a powerful tool for companies looking to achieve their sustainability goals. By entering into long-term agreements with renewable energy producers, corporations can directly support the development of new renewable energy capacity while securing stable energy prices. This is especially important in industries with high energy consumption, such as manufacturing, technology, and retail, where energy costs represent a significant portion of operational expenses.

- According to the Business Climate Survey for 2024, 81% of Swedish companies operating in Italy believe that environmental concerns significantly influence customer purchasing decisions. This statistic highlights how sustainability is becoming integral to business strategy and consumer behavior.

Trends

Blockchain-enabled Power Purchase Agreements

Blockchain-enabled Power Purchase Agreements (PPAs) trends rising as smart contract technology these help to automate contract administration and payments between signatories, providing agreements transparency, mitigating risks, and reducing transaction costs. In renewable PPAs corporate buyers could use blockchain technology, supporting further PPA market growth. This could lead to an increase in smaller organizations contracting renewable power as simplified blockchain PPAs become more accessible and affordable. Blockchain PPAs facilitate peer-to-peer transactions, revolutionizing the electricity sector by enabling more efficient and secure transactions, achieving renewable energy integration, empowering prosumers, cost savings, grid resilience, innovation in technology, and regulatory evolution.

- Recently in 2023 Sofidel, Italian based paper company signed a 10-year Power Purchase Agreement (PPA) with ACCIONA, these agreement aligns with ACCIONA Energeia’s GREENCHAIN® blockchain platform for real-time tracking of renewable energy sources.

Geopolitical Impact Analysis

The Geopolitical Tensions Significantly Impacted the Global Power Purchase Agreement Market

Geopolitical tensions significantly impacted the Italy Power Purchase Agreement (PPA) market, influencing energy prices, supply chains, investment flows, and renewable energy adoption. The ongoing Russia-Ukraine conflict, rising tensions in the Middle East, and global trade disruptions led to heightened energy security concerns, pushing Italy to accelerate its transition towards renewable energy procurement through PPAs. One of the most immediate impacts was the volatility in energy prices, particularly in natural gas, which still plays a crucial role in Italy’s energy mix.

As Italy historically relied on Russian gas imports, European sanctions on Russia, coupled with supply chain disruptions, caused fluctuations in wholesale electricity prices. This increased the attractiveness of long-term renewable PPAs, as businesses and utilities sought stable, predictable energy costs to mitigate financial risks. Additionally, supply chain disruptions impacted renewable energy projects, as essential components like solar panels, wind turbines, and battery storage systems faced delays and price hikes due to trade restrictions and logistical bottlenecks.

Several of these components are sourced from China, Southeast Asia, and the U.S., making the renewable energy sector vulnerable to geopolitical instability. In response, Italy’s government accelerated its renewable energy initiatives, particularly through the FER X scheme, which aims to install 60 GW of renewable capacity by 2028. Corporate and industrial buyers increased their PPA commitments to reduce reliance on volatile fossil fuels and align with sustainability goals.

Key Players Analysis

Companies are Strongly Focusing On Product Portfolio Expansion Through Various Strategies To Maintain their Dominance as Industry Leaders

leading companies in the Italy Power Purchase Agreement (PPA) market adopted several strategic approaches to maintain their dominance, focusing on renewable energy expansion, technological innovation, long-term partnerships, and regulatory alignment. These strategies have been crucial in securing market leadership amid growing competition and evolving energy policies. Another significant approach is technological innovation and digitalization. Industry leaders are incorporating smart grid technology, AI-driven energy management systems, and advanced energy storage solutions to optimize energy distribution and enhance efficiency.

Market Key Players

- General Electric

- Siemens AG

- Shell Plc

- Statkraft AS

- Ameresco

- RWE AG

- Enel Italy Trading

- Iberdrola, S.A.

- Ørsted A/S

- Vestas

- ERG SpA

- Drax Energy Solutions Limited

- Other Key Players

Report Scope

Report Features Description Market Value (2024) Euro 337.6 Mn Market Volume (2024) Tons XX Forecast Revenue (2034) Euro 6,703 Mn CAGR (2025-2034) 34.8 % Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Physical Delivery PPA, Virtual PPA, Portfolio PPA, Block Delivery PPA, and Others), By Location (On-site and Off-site), By Category (Corporate, Government, and Others), By Deal Type (Wholesale, Retail, and Others), By Capacity (Up to 20 MW, 20-50 MW, 50-100 MW, and Above 100 MW), By Application (Solar, Wind, Geothermal, Hydropower, Carbon Capture and Storage, and Others), By End-Use (Residential, Commercial, and Industrial) Competitive Landscape General Electric, Siemens AG, Shell Plc, Statkraft AS, Ameresco, RWE AG, Enel Italy Trading, Iberdrola, S.A., Ørsted A/S, Vestas, ERG SpA, Drax Energy Solutions Limited Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Italy Power Purchase Agreement MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Italy Power Purchase Agreement MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- General Electric

- Siemens AG

- Shell Plc

- Statkraft AS

- Ameresco

- RWE AG

- Enel Italy Trading

- Iberdrola, S.A.

- Ørsted A/S

- Vestas

- ERG SpA

- Drax Energy Solutions Limited

- Other Key Players