Global Extra Neutral Alcohol ENA Market By Raw Material (Grain-Based, Sugarcane-Based, Fruit-Based, Others), By Type (Type I, Type II), By Purity (95%-98%, 98%-99%, More than 99%), By Production Capacity (Small Scale (50,000 liters per year), Medium Scale (50,000 - 500,000 liters per year), Large Scale (>500,000 liters per year)), By Application (Potable Alcohol, Pharmaceuticals, Flavors and Fragrances, Cosmetics and Personal Care, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2024-2033

- Published date: Dec 2024

- Report ID: 134688

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

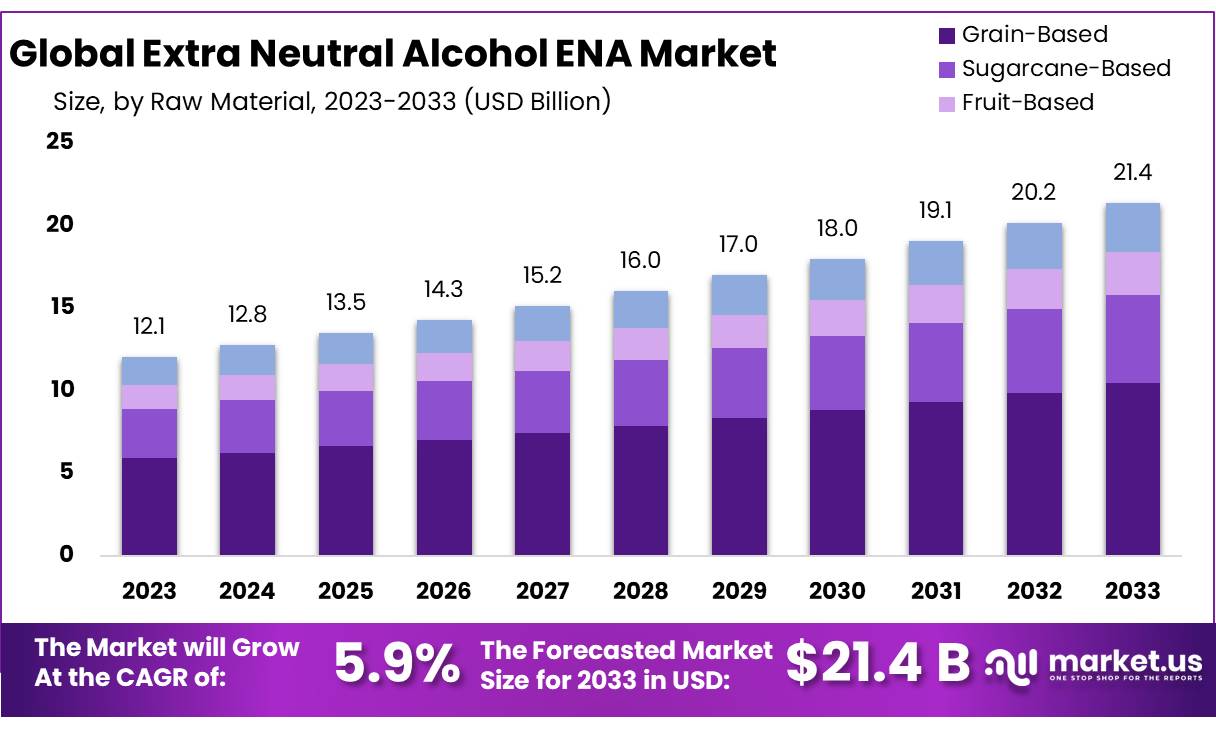

The Global Extra Neutral Alcohol ENA Market size is expected to be worth around USD 21.4 Bn by 2033, from USD 12.1 Bn in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

Extra Neutral Alcohol (ENA) is a high-quality, highly refined form of ethyl alcohol, essential in the production of alcoholic beverages, pharmaceuticals, cosmetics, and as a base for industrial solvents. The distinctive feature of ENA is its extremely low levels of flavor and odor, achieved through multiple stages of distillation and rectification from sources like grains and molasses.

In terms of regulatory standards, ENA production is tightly controlled, with specific legal requirements varying by region. For instance, in India, the Food Safety and Standards Authority of India (FSSAI) mandates strict guidelines to ensure the quality and safety of ENA used in beverages and spirits. These guidelines help maintain the integrity of ENA, ensuring it meets the required purity levels for consumption and industrial use.

According to the International Trade Centre (ITC), global ENA exports reached USD 5.3 billion in 2022, with India, the European Union, and the United States as leading exporters. India is particularly notable, accounting for over 45% of the total exports valued at around USD 2.4 billion, largely fueled by its expansive production capacities geared towards both domestic consumption and exports.

The alcoholic beverage industry remains the largest consumer of ENA. The International Spirits and Wine Federation reported that the global spirits market generated about USD 550 billion in revenue in 2023, a significant portion of which came from ENA-based products.

The neutral taste of ENA makes it a preferred alcohol base for flavor-sensitive drinks. Additionally, the rise in consumer interest in premium spirits has spurred demand for high-quality ENA, with forecasts predicting a 5% annual growth in premium vodka sales from 2023 to 2028.

Government regulations play a critical role in shaping the ENA market. In countries like India and Brazil, stringent standards are in place to oversee the production of ENA, focusing on minimizing impurities to ensure product safety.

For instance, India imposes an excise duty of 12-18% on ENA used for beverage production. Brazil has also increased its imports of ENA, which amounted to USD 800 million in 2022, to support its growing alcoholic beverage sector.

Investments from both private and governmental sectors have significantly contributed to the expansion of the ENA market. For example, in 2023, Archean Chemical Industries Ltd. in India received a substantial investment of USD 35 million to enhance its production capabilities.

The U.S. government has also introduced tax incentives for bioethanol production, a critical component of ENA, helping to boost domestic production. These financial injections and policy supports are pivotal in meeting the escalating demand for clean, high-quality alcohol.

The ongoing growth of the ENA market is further supported by continuous innovations, partnerships, and mergers within the chemical industry. These developments are crucial as they enhance production capabilities and expand the global reach of ENA suppliers, ensuring they can meet the increasing demands of diverse industries worldwide.

Key Takeaways

- Extra Neutral Alcohol ENA Market size is expected to be worth around USD 21.4 Bn by 2033, from USD 12.1 Bn in 2023, growing at a CAGR of 5.9%.

- Grain-Based held a dominant market position, capturing more than a 49.1% share of the Extra Neutral Alcohol (ENA) market.

- Type I held a dominant market position, capturing more than a 64.2% share of the Extra Neutral Alcohol (ENA) market.

- 98%-99% purity held a dominant market position, capturing more than a 57.1% share of the Extra Neutral Alcohol (ENA) market.

- Large Scale (>500,000 liters per year) held a dominant market position, capturing more than a 56.1% share.

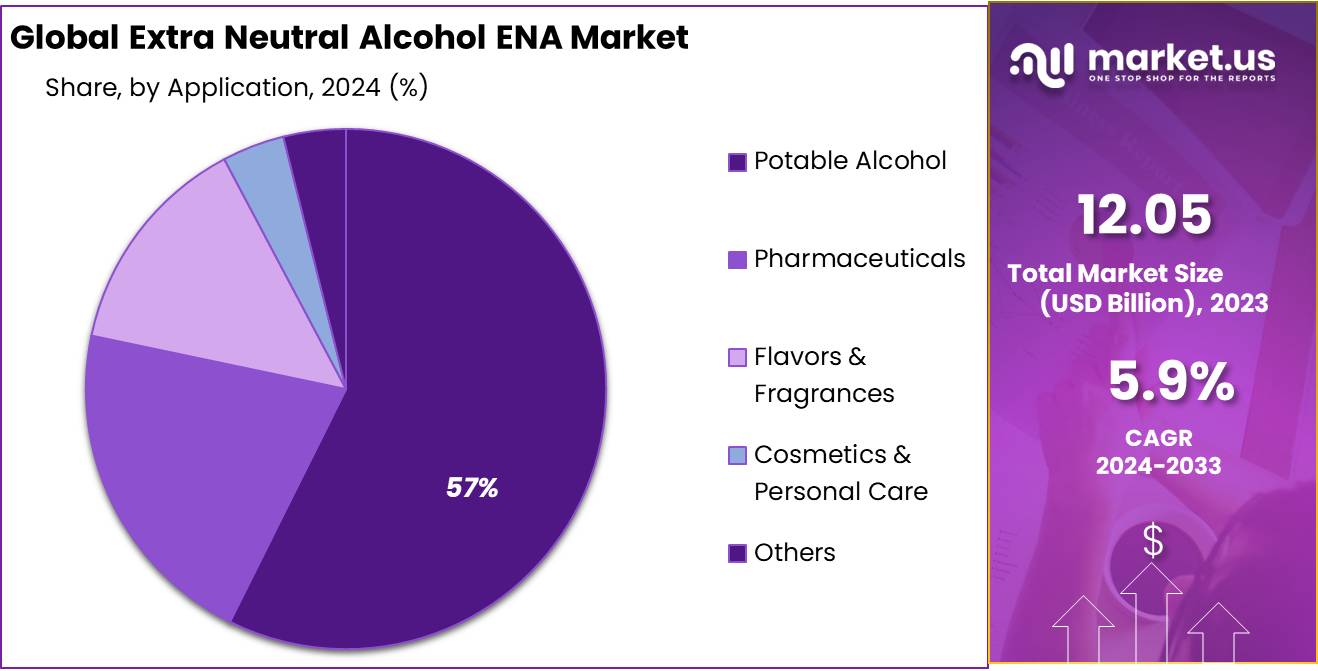

- Potable Alcohol held a dominant market position, capturing more than a 59.1% share of the Extra Neutral Alcohol ENA market.

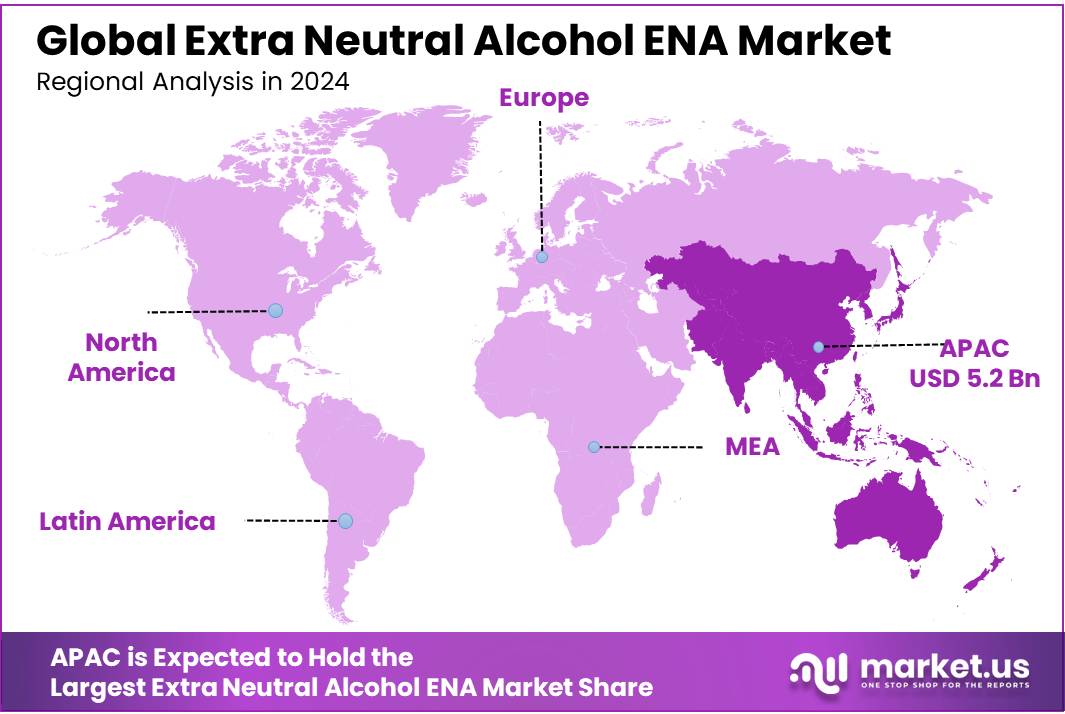

- Asia Pacific (APAC) region dominated the Extra Neutral Alcohol ENA market in 2023, capturing 43.5% of the global market share.

By Raw Material

In 2023, Grain-Based held a dominant market position, capturing more than a 49.1% share of the Extra Neutral Alcohol (ENA) market. Grain-based ENA is widely used in the production of alcoholic beverages, including vodka and whiskey, making it the preferred raw material in many regions. Its abundance, cost-effectiveness, and ease of production have contributed to its significant market share.

Sugarcane-Based ENA is another major segment, accounting for a notable share of the market. It is commonly used in the production of rum and other spirits. Sugarcane-based ENA benefits from the availability of raw materials in tropical regions and its ability to produce a smoother final product. This segment is expected to grow steadily, driven by increasing demand for rum and other sugarcane-derived spirits.

Fruit-Based ENA, while smaller in market share, is gaining traction. The growing popularity of flavored spirits and the demand for high-quality, organic products are expected to boost the segment. Fruit-based ENA offers a unique flavor profile, making it a preferred choice for premium beverages.

By Type

In 2023, Type I held a dominant market position, capturing more than a 64.2% share of the Extra Neutral Alcohol ENA market. Type I ENA is widely used across a range of applications, including the production of alcoholic beverages and industrial products. Its high purity and consistent quality make it the preferred choice for manufacturers, contributing to its strong market share.

Type II ENA, although smaller in comparison, is gaining traction. It is primarily used in specialty applications where a lower purity is acceptable, such as in the production of certain flavors, fragrances, and pharmaceuticals. The segment is expected to grow as demand for diverse, niche products increases. Type II ENA offers cost advantages, making it attractive for specific industries that do not require the highest levels of purity.

By Purity

In 2023, 98%-99% purity held a dominant market position, capturing more than a 57.1% share of the Extra Neutral Alcohol ENA market. This level of purity is highly sought after for a wide range of applications, including the production of alcoholic beverages, pharmaceuticals, and personal care products. Its consistent quality and versatility make it the preferred choice for most manufacturers.

The 95%-98% purity segment is also significant but accounts for a smaller share. This lower purity is typically used in industrial applications and for certain types of alcohol-based products that do not require the highest levels of purity. The segment is expected to grow steadily, especially as demand increases for cost-effective alternatives in non-premium applications.

The “More than 99%” purity segment is the smallest but is growing in importance. This ultra-high purity ENA is essential for premium products where the highest quality and clarity are required. Its use in specialized industries, such as high-end spirits and medical applications, is driving growth in this segment.

By Production Capacity

In 2023, Large Scale (>500,000 liters per year) held a dominant market position, capturing more than a 56.1% share of the Extra Neutral Alcohol ENA market. Large-scale production benefits from economies of scale, allowing producers to meet high demand efficiently. This capacity is essential for meeting the needs of major industries such as alcoholic beverages and pharmaceuticals, where large volumes are required.

The Medium Scale (50,000 – 500,000 liters per year) segment also plays a significant role in the market. Companies in this segment often cater to regional or niche markets, providing flexibility while still meeting moderate demand. The medium-scale production is favored by companies seeking a balance between capacity and operational costs, making it a popular choice for businesses in emerging markets.

The Small Scale (50,000 liters per year) segment is the smallest but still relevant. This scale is often used by specialized or artisanal producers, especially in regions with lower demand. Small-scale production is more flexible and cost-effective for niche applications, such as craft spirits or local industries. However, its market share is limited due to the higher cost per unit compared to larger-scale operations.

By Application

In 2023, Potable Alcohol held a dominant market position, capturing more than a 59.1% share of the Extra Neutral Alcohol ENA market. Potable alcohol is primarily used in the production of alcoholic beverages such as vodka, gin, and whiskey. Its high purity and versatility make it the preferred choice for beverage manufacturers, driving significant demand globally.

The Pharmaceuticals segment is also a key contributor to the market, although it holds a smaller share. ENA is used as a solvent and in the preparation of medicines, including cough syrups, tinctures, and vaccines. The pharmaceutical industry’s growing need for high-quality, safe ingredients has led to steady growth in this segment.

Flavors & Fragrances is another important application. ENA serves as a carrier in flavoring and fragrance products, ensuring the proper dissolution of flavor compounds. As the global demand for natural and organic flavorings increases, this segment is expected to see continued growth, especially in the food and beverage industry.

The Cosmetics & Personal Care segment utilizes ENA in the formulation of skincare, haircare, and fragrance products. Its ability to act as a solvent and enhancer makes it ideal for high-end cosmetic formulations. This segment is poised to grow as consumer demand for premium, alcohol-based personal care products rises.

Key Market Segments

By Raw Material

- Grain-Based

- Sugarcane-Based

- Fruit-Based

- Others

By Type

- Type I

- Type II

By Purity

- 95%-98%

- 98%-99%

- More than 99%

By Production Capacity

- Small Scale (50,000 liters per year)

- Medium Scale (50,000 – 500,000 liters per year)

- Large Scale (>500,000 liters per year)

By Application

- Potable Alcohol

- Pharmaceuticals

- Flavors & Fragrances

- Cosmetics & Personal Care

- Others

Drivers

Growing Demand for Alcoholic Beverages

One of the major driving factors for the Extra Neutral Alcohol ENA market is the increasing global demand for alcoholic beverages, particularly spirits.

In 2022, the total market for spirits was valued at over USD 650 billion. ENA, with its high purity and versatility, is a critical ingredient in the production of various spirits, including vodka, gin, and whiskey, which contribute to a significant portion of this growth.

The demand for premium and craft spirits is particularly notable. The United States Distilled Spirits Council (DISCUS) reports that the U.S. spirits market alone grew by 8% in 2022, reaching an all-time high of USD 31 billion.

Vodka and gin, which are typically made from grain-based ENA, have shown steady growth, with vodka consumption rising by 1.2% year-over-year in 2022. This demand is further supported by younger consumers’ increasing preference for high-quality, craft spirits, a trend that is also observed globally. As a result, ENA continues to be in high demand for both mainstream and craft alcoholic beverage production, driving market growth.

Government Initiatives and Regulatory Support

Government policies and initiatives that support the alcohol and beverage industry have also played a key role in driving the demand for ENA. Many governments have introduced regulations to support local production, increase tax revenues, and boost export opportunities for alcoholic beverages.

For example, in the European Union (EU), the introduction of the European Alcohol Strategy aims to promote sustainable alcohol production, including the use of high-quality ENA in the production of spirits. This strategy, in place since 2018, highlights the importance of maintaining product quality, which directly benefits the ENA market.

In the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTB) supports the U.S. spirits industry by providing favorable taxation policies. The TTB’s 2023 statistics show that spirits exports from the U.S. reached USD 2.5 billion in 2022, a 9.7% increase over the previous year.

These favorable policies encourage the continued use of ENA in alcoholic beverage production, boosting demand for high-purity alcohol in domestic and international markets. Additionally, many countries in South America, Asia, and Africa have introduced initiatives aimed at boosting local alcohol production, which further promotes the use of ENA in these regions.

Increased Demand for Natural and Organic Products in the Food and Beverage Sector

Another significant factor contributing to the rise in ENA consumption is the growing demand for natural and organic ingredients in the food and beverage sector. According to the Organic Trade Association (OTA), U.S. sales of organic food and beverages reached USD 61.9 billion in 2022, marking a 5.8% growth from the previous year.

This trend is driving the need for high-quality, neutral alcohol that is both organic and pure, making ENA the preferred choice for manufacturers of organic spirits and other food products. ENA, which can be produced from a variety of raw materials, including grain, sugarcane, and fruit, offers manufacturers a flexible and high-quality option that meets consumer demand for organic, clean-label products.

Restraints

Regulatory Challenges and Environmental Concerns

One of the significant restraining factors for the Extra Neutral Alcohol ENA market is the increasing regulatory scrutiny and environmental concerns associated with the production and use of ENA, particularly in the food and beverage industry.

Several governments worldwide have introduced stringent regulations to limit alcohol-related harm, environmental impact, and ensure safety standards. These regulations can impact ENA production, especially for companies in regions with strict rules.

In the European Union (EU), the production of alcohol is heavily regulated. For example, the European Commission has set specific standards for alcohol production, including environmental sustainability measures that require distilleries to reduce their carbon footprint and implement waste management strategies.

The EU’s Green Deal aims to make Europe the first climate-neutral continent by 2050, placing additional pressure on alcohol producers, including those using ENA. According to the European Environment Agency, greenhouse gas emissions from the EU’s food and beverage sector accounted for 13% of the total emissions in 2020.

In the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTB) enforces strict regulations regarding alcohol production, particularly concerning the purity of ENA used in food and beverage products. The FDA also regulates ENA use in food and cosmetics, ensuring safety standards for consumer products. Such regulations, while ensuring consumer safety, can increase operational costs, limiting the ability of smaller producers to enter the market.

Increasing Competition from Alternative Raw Materials

According to the United Nations Food and Agriculture Organization (FAO), global production of biofuels, including ethanol from corn and other grains, has been increasing at a rapid pace. The U.S. Department of Agriculture (USDA) estimates that in 2023, the U.S. alone will produce more than 15 billion gallons of ethanol, which is derived primarily from corn.

As ethanol production increases, it competes with ENA production for the same raw materials, pushing up costs for ENA producers who rely on grains as their primary source of alcohol. This creates pricing pressure for traditional ENA manufacturers, limiting their profitability and competitiveness in the global market.

Additionally, alternative alcohol production methods, such as those using waste products or less traditional crops, are gaining attention due to their lower environmental impact. For example, China has made significant investments in alternative alcohol production, with research indicating that by 2024, over 2 million metric tons of waste could be converted into bioethanol for various applications.

Opportunity

Rise in Demand for Organic and Premium Spirits

According to the Distilled Spirits Council of the United States (DISCUS), the organic spirits market in the U.S. alone grew by 12% in 2022, with organic vodka, gin, and rum seeing substantial growth. The value of organic spirits was reported to be over USD 500 million in 2022 and is expected to reach USD 750 million by 2025. ENA is a critical component in the production of these organic spirits, as it provides the necessary purity and consistency required for high-end products.

In Europe, the European Union Organic Action Plan aims to expand organic agriculture, with an emphasis on the food and beverage sector. The plan targets a 25% share of the total agricultural land in Europe being devoted to organic farming by 2030, significantly boosting demand for organic alcohols. As a result, the organic ENA market is expected to grow, providing manufacturers with opportunities to produce high-quality, sustainable alcohol for premium products.

Moreover, the growing trend for craft spirits, driven by younger, more affluent consumers seeking unique, artisanal products, also presents a significant growth opportunity for ENA. According to the American Craft Spirits Association (ACSA), the U.S. craft spirits market grew by 7.1% in 2022, and craft distillers often rely on ENA due to its versatility and quality.

Increase in Demand for ENA in Pharmaceuticals and Healthcare

Another growth opportunity for the ENA market lies in its increasing use within the pharmaceutical and healthcare sectors. ENA’s high purity makes it an ideal solvent and base for the production of pharmaceutical products such as cough syrups, tinctures, and vaccines. The growing global demand for health-related products and the increasing focus on wellness are driving this demand.

According to the World Health Organization (WHO), the global pharmaceutical market is expected to exceed USD 1.5 trillion by 2025, with a 5.4% annual growth rate. As the pharmaceutical sector expands, there will be a greater need for high-quality ingredients such as ENA. In 2021, the global market for alcohol in pharmaceuticals was valued at USD 2.9 billion and is projected to grow at a CAGR of 4.3% through 2028.

According to the U.S. Department of Health and Human Services (HHS), the need for alcohol-based disinfectants surged during the pandemic, and the pharmaceutical industry has shown sustained growth in alcohol-based products, further boosting ENA demand.

Trends

Expansion of ENA Use in Pharmaceuticals and Cosmetics

Another significant trend for ENA is its expanding application in the pharmaceutical and cosmetics industries. The purity and neutrality of ENA make it an ideal base for products in these sectors, where precision and quality are paramount.

In 2023, the global pharmaceutical market was valued at approximately USD 1.5 trillion, with a portion of this market utilizing ENA in the production of tinctures, tonics, and medicinal alcohol-based products. ENA is also widely used as a solvent in the preparation of various cosmetic formulations, including perfumes, lotions, and creams.

The demand for ENA in these sectors is being driven by the growing trend towards natural and safe products. For example, the clean beauty movement, which prioritizes the use of safe, non-toxic ingredients, has led many cosmetic manufacturers to use ENA as a key ingredient.

In 2023, the global clean beauty market was valued at USD 12 billion, with a CAGR of 7.5%. As consumers continue to prioritize purity and sustainability in their beauty and healthcare products, ENA’s role in these industries is likely to increase.

Regulatory Support and Government Initiatives

Governments across key markets are playing a supportive role in the growth of the ENA market, particularly through regulatory frameworks that ensure the safety and quality of alcohol-based products. In India, the Food Safety and Standards Authority of India (FSSAI) enforces strict regulations governing the production of ENA for use in alcoholic beverages.

These regulations help standardize quality, ensuring that ENA meets the necessary purity levels for safe consumption. Additionally, India’s government has introduced several initiatives to boost the export of ENA, which contributes significantly to its growth. In 2023, India’s ENA export volume increased by 7.2%, contributing USD 2.4 billion to the global market.

Regional Analysis

The Asia Pacific (APAC) region dominated the Extra Neutral Alcohol ENA market in 2023, capturing 43.5% of the global market share, valued at approximately USD 5.2 billion. This dominance can be attributed to the region’s strong demand for alcoholic beverages, particularly in countries like China, India, and Japan.

The growing preference for spirits, such as vodka and gin, along with the increasing consumption of traditional spirits like sake and baijiu, has boosted the need for high-quality ENA. The expanding middle class, rapid urbanization, and the rising trend of premium alcoholic products in APAC further contribute to the market’s growth in this region.

North America holds a significant share of the market, driven by the United States’ robust spirits industry. The U.S. spirits market was valued at USD 31 billion in 2022, according to the Distilled Spirits Council of the United States (DISCUS). With increasing consumer preference for craft and organic spirits, ENA’s role in the production of high-purity alcohol is pivotal. North America’s market is expected to grow steadily, with a rising focus on organic and premium alcoholic beverages.

Europe is another key market, with countries like Germany, France, and the UK contributing to the significant demand for ENA. The European market is valued at USD 3.8 billion and is projected to continue expanding, driven by the demand for both traditional and premium spirits. Stringent regulations on sustainability and production practices in Europe are also shaping the market’s evolution, pushing for more eco-friendly manufacturing processes.

In the Middle East & Africa and Latin America, the ENA market is smaller but growing steadily. These regions are seeing a rise in alcohol consumption, particularly in emerging markets, but face challenges related to regulatory restrictions and cultural factors influencing alcohol production and consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Extra Neutral Alcohol ENA market features a mix of key players involved in the production and distribution of high-purity alcohol, particularly for use in the beverage, pharmaceutical, and cosmetic industries. Agro Chemical and Food Company Limited, BCL Industries Ltd, and Enterprise Ethanol (Pty) Ltd are some of the leading players in the market, contributing significantly to the global supply of ENA.

These companies benefit from strong regional production capabilities and well-established distribution networks, particularly in markets like Asia Pacific and Africa. Illovo Sugar Limited and Kakira Sugar Works Ltd are key suppliers in the sugarcane-based ENA segment, with a focus on leveraging their extensive sugar processing operations to produce high-quality ENA for various applications.

In addition to these, Radico Khaitan Limited, Sasol Solvents (Pty) Ltd, and NCP Alcohols (Pty) Ltd are prominent players, especially in the Indian and African markets. These companies are increasingly focusing on sustainable production practices and innovation, responding to growing consumer demand for premium, organic, and environmentally-friendly products.

Swift Chemicals Ltd, Tag Solvent Products Pvt Ltd, and USA Distillers LLC are expanding their footprints in both regional and global markets by offering a diverse range of ENA products tailored to various industrial applications, from alcoholic beverages to cosmetics and pharmaceuticals. These players are continuously investing in production capacity, expanding into emerging markets, and enhancing product offerings to meet the evolving demands of consumers.

Top Key Players in the Market

- Agro Chemical and Food Company Limited

- BCL Industries Ltd

- Enterprise Ethanol (Pty) Ltd

- Greenpoint Alcohols

- Illovo Sugar Limited

- Kakira Sugar Works Ltd (KSW)

- Mumias Sugar Company

- NCP Alcohols (Pty) Ltd

- Radico Khaitan Limited

- Sasol Solvents (Pty) Ltd

- Sugar Ltd.

- Swift Chemicals

- Swift Chemicals Ltd

- Tag Solvent Products Pvt Ltd

- USA Distillers LLC

Recent Developments

In 2024 Agro Chemical and Food Company Limited, the company is expected to expand its production capacity by an additional 10-12%, targeting a volume of 165 million liters by the end of the year.

In 2024, BCL Industries Ltd is expected to further ramp up production by 10%, targeting a volume of 77 million liters by the end of the year.

Report Scope

Report Features Description Market Value (2023) USD {{val1}} Forecast Revenue (2033) USD {{val2}} CAGR (2024-2033) {{cagr}}% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Grain-Based, Sugarcane-Based, Fruit-Based, Others), By Type (Type I, Type II), By Purity (95%-98%, 98%-99%, More than 99%), By Production Capacity (Small Scale (50,000 liters per year), Medium Scale (50,000 – 500,000 liters per year), Large Scale (>500,000 liters per year)), By Application (Potable Alcohol, Pharmaceuticals, Flavors and Fragrances, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agro Chemical and Food Company Limited, BCL Industries Ltd, Enterprise Ethanol (Pty) Ltd, Greenpoint Alcohols, Illovo Sugar Limited, Kakira Sugar Works Ltd (KSW), Mumias Sugar Company, NCP Alcohols (Pty) Ltd, Radico Khaitan Limited, Sasol Solvents (Pty) Ltd, Sugar Ltd., Swift Chemicals, Swift Chemicals Ltd, Tag Solvent Products Pvt Ltd, USA Distillers LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Extra Neutral Alcohol ENA MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Extra Neutral Alcohol ENA MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Agro Chemical and Food Company Limited

- BCL Industries Ltd

- Enterprise Ethanol (Pty) Ltd

- Greenpoint Alcohols

- Illovo Sugar Limited

- Kakira Sugar Works Ltd (KSW)

- Mumias Sugar Company

- NCP Alcohols (Pty) Ltd

- Radico Khaitan Limited

- Sasol Solvents (Pty) Ltd

- Sugar Ltd.

- Swift Chemicals

- Swift Chemicals Ltd

- Tag Solvent Products Pvt Ltd

- USA Distillers LLC