Global Synchronous Condenser Market Size, Share, And Business Insights By Insulation Type (New Synchronous Condenser, Refurbished Synchronous Condenser), By Cooling Technology (Hydrogen-Cooled Synchronous Condenser, Air-Cooled Synchronous Condenser, Water-Cooled Synchronous Condenser), By Starting Method (Static Frequency Converterm Pony Motor, Others), By Cooling Type (Air Cooled, Hydrogen Cooled, Water Cooled), By Power Rating (Less than 50 MVAR, 50 to 80 MVAR, 80 to 100 MVAR, 100 to 150 MVAR, 150 to 200 MVAR, Above 200 MVAR), By End-use (Electrical Utilities, Industrial Sector), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135489

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Synchronous Condenser Strategic Business Review

- By Insulation Type Analysis

- By Cooling Technology Analysis

- By Starting Method Analysis

- By Cooling Type Analysis

- By Power Rating Analysis

- By End-Use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

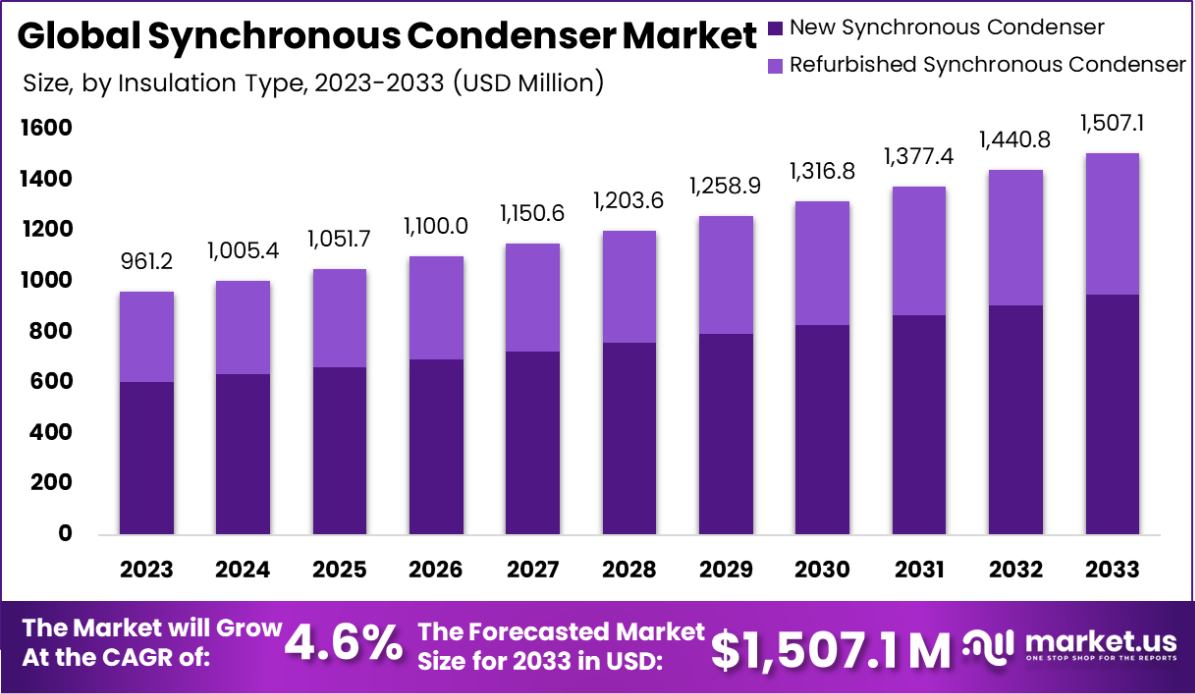

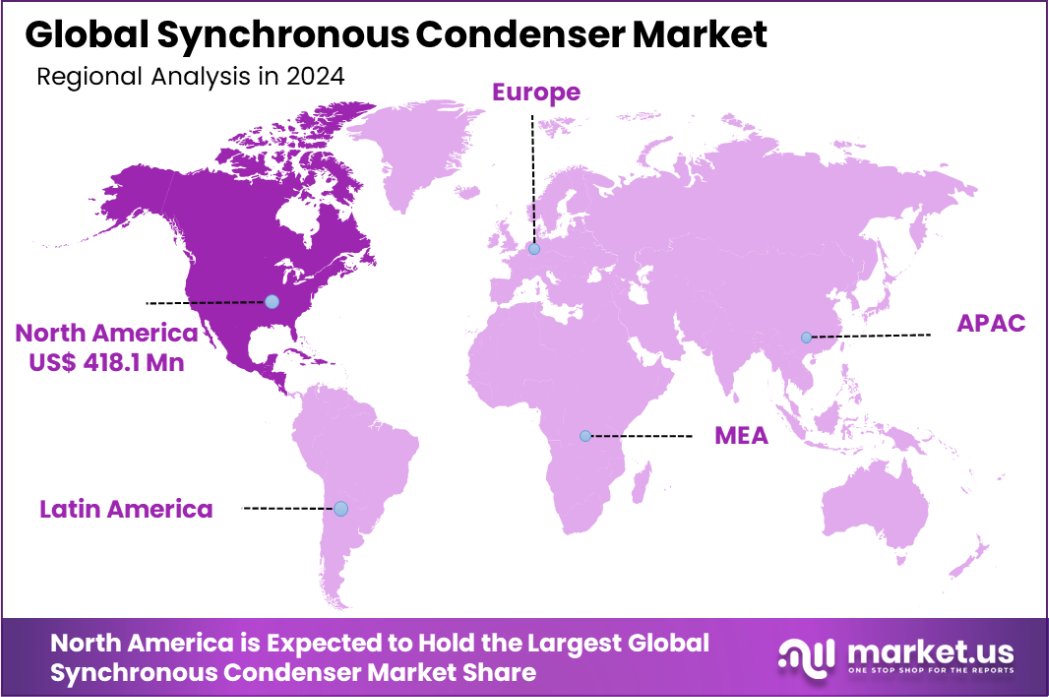

The Global Synchronous Condenser Market is expected to be worth around USD 1,507.1 Million by 2033, up from USD 961.2 Million in 2023, and grow at a CAGR of 4.6% from 2024 to 2033. North America holds 43.5% of the market, totaling USD 418.1 million.

A synchronous condenser is a device used in power grids to manage and enhance power quality by providing reactive power. Unlike typical capacitors, it operates by spinning freely at synchronous speeds with the grid. This device can adjust conditions on the power network such as voltage levels and phase angles, stabilizing the system and improving efficiency.

The synchronous condenser market is experiencing growth due to several factors. Increasing demand for renewable energy sources, which often generate variable and intermittent power, necessitates technologies like synchronous condensers to ensure grid stability.

The need for improved power quality and voltage control in utilities and industrial plants also drives demand. Opportunities in the market are expanding with the modernization of old power infrastructure and the installation of new power lines, requiring advanced solutions for reactive power compensation and grid support.

The Synchronous Condenser market is experiencing robust growth, driven by increased investments and favorable government initiatives aimed at enhancing grid stability and integrating renewable energy sources. Recent funding from the U.S. Department of Energy, which allocated $800,000 to the SuperFACTS project at the National Renewable Energy Laboratory, underscores the strategic importance of advanced grid technologies.

Similarly, a collaborative project in Hawaii, supported by federal funds amounting to $3.35 million, is set to demonstrate the potential of Synchronous Condenser Conversion Technology to bolster grid resilience.

These investments are not merely fiscal injections but are pivotal in advancing the technical capabilities of synchronous condensers. For instance, devices like those engineered by Andritz are capable of delivering up to five times (500%) their rated capacity in short-circuit power, a stark contrast to the 110% delivered by non-synchronous generators such as wind or smart solar. This substantial capacity to enhance grid stability and manage reactive power effectively positions synchronous condensers as a critical component in modern power networks.

Moreover, operational flexibility is a key attribute of synchronous condensers. They can operate at 110-120% of their capacity for durations of up to 30 minutes and can momentarily surge up to 200% of rated reactive power, providing essential support during peak demand times or in the event of sudden power fluctuations.

Most units connected to electrical grids offer a range of 20 MVAR to 200 MVAR and are often hydrogen-cooled to ensure safety and efficiency, with hydrogen levels typically maintained above 91% to prevent any explosion hazard.

This data not only highlights the technical merits and safety features of synchronous condensers but also illustrates their critical role in future-proofing electrical grids against the challenges posed by high renewable penetration and increasing demand for reliable power supply.

Key Takeaways

- The Global Synchronous Condenser Market is expected to be worth around USD 1,507.1 Million by 2033, up from USD 961.2 Million in 2023, and grow at a CAGR of 4.6% from 2024 to 2033.

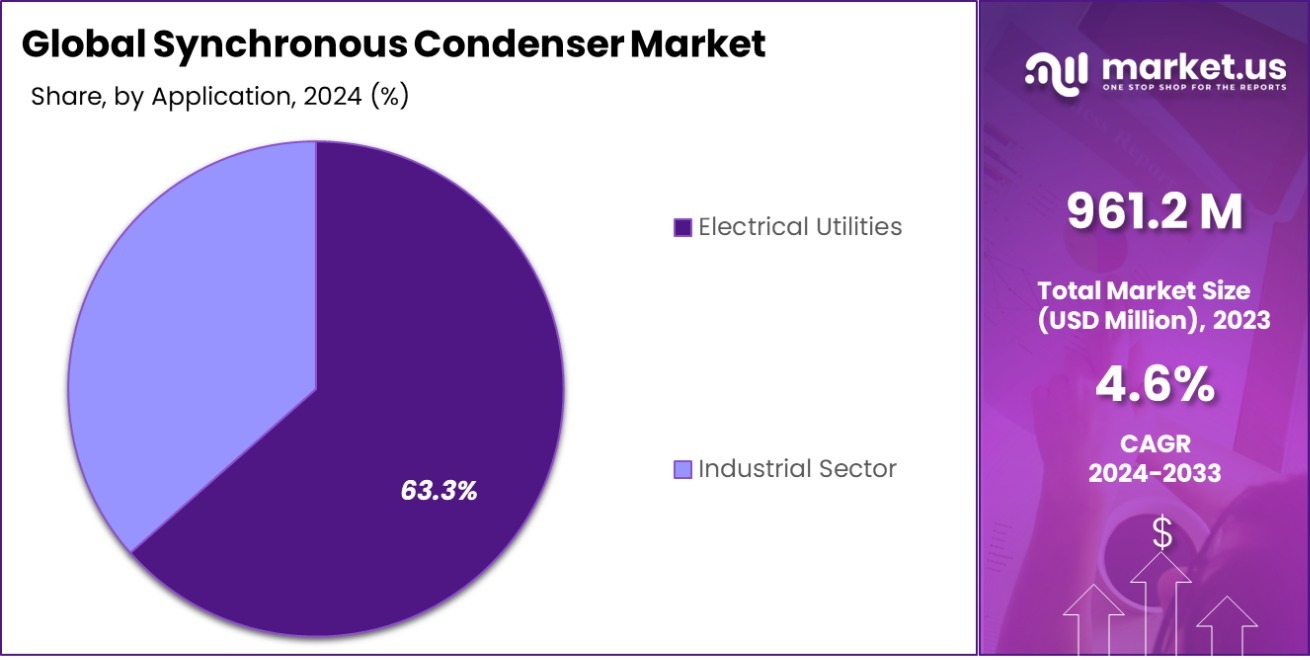

- The Synchronous Condenser market is predominantly driven by new units, capturing 63.3% of the sector.

- Air-cooled synchronous condensers lead in cooling technology, holding a 47.4% share of the market.

- A majority of synchronous condensers utilize static frequency converters for starting, accounting for 51.3%.

- Air-cooled systems dominate the cooling type segment in the market, with a 45.3% share.

- Synchronous condensers with a power rating above 200 MVAR represent 38.4% of the market.

- Electrical utilities are the main end-users of synchronous condensers, making up 63.3% of demand.

- In North America, the synchronous condenser market holds 43.5%, valued at USD 418.1 million.

Synchronous Condenser Strategic Business Review

The Synchronous Condenser Strategic Business Review highlights the growing importance of synchronous condensers in modern power systems. Synchronous condensers, rotating electrical machines that operate without mechanical load, are essential for providing reactive power to stabilize grid voltage, improve power factor, and maintain system reliability. With the increasing penetration of renewable energy sources, their role in balancing intermittent power generation has become more critical.

Operationally, synchronous condensers are capable of providing 100-300 MVAr of reactive power, significantly contributing to voltage stability. They also enhance the short-circuit strength of the grid, with contributions typically ranging from 5 to 10 times their rated power. These systems operate at efficiencies between 95% and 98% under optimal load conditions and have an impressive lifespan of over 40 years, making them a reliable long-term solution for grid stability.

Financially, the capital cost for installing synchronous condensers ranges between USD 30,000 to 60,000 per MVAr, while annual operational costs amount to approximately 1-2% of the capital cost. Return on investment (ROI) is generally achieved within 7-10 years, depending on the scale and location of the installation.

By Insulation Type Analysis

The Synchronous Condenser Market sees 63.3% of new units employing synchronous condenser technology for efficiency.

In 2023, the New Synchronous Condenser held a dominant position in the “By Insulation Type” segment of the Synchronous Condenser Market, capturing 63.3% of the market share. This segment outperformed the Refurbished Synchronous Condenser, highlighting a clear preference for new units across various industries.

The market’s inclination towards new synchronous condensers can be attributed to their advanced technology, higher efficiency, and lower maintenance costs compared to refurbished models.

Companies are increasingly investing in new synchronous condensers due to their enhanced capabilities in stabilizing power supply and improving voltage regulation, which is crucial for modern power grids. Furthermore, stringent environmental regulations and the need for more reliable energy solutions have also steered the market towards these new units.

As industries continue to expand and upgrade their infrastructure, the demand for new synchronous condensers is expected to remain robust, ensuring their significant role in the global market. This trend is particularly pronounced in regions experiencing rapid industrialization and modernization of energy systems, positioning new synchronous condensers as key components in future energy strategies.

By Cooling Technology Analysis

Air-cooled synchronous condensers dominate the market, accounting for 47.4% of installations, favored for their reliability.

In 2023, the Air-Cooled Synchronous Condenser held a dominant market position in the “By Cooling Technology” segment of the Synchronous Condenser Market, with a 47.4% share. This technology surpassed both Hydrogen-Cooled and Water-Cooled Synchronous Condensers, reflecting its widespread acceptance and implementation across various sectors.

The preference for air-cooled synchronous condensers stems from their cost-effectiveness and simplicity in design, making them a practical choice for many companies. These units require less maintenance and are less complex to install compared to their hydrogen-cooled and water-cooled counterparts, which often involve more intricate systems and higher operational costs.

Moreover, air-cooled synchronous condensers are well-suited for regions with less stringent cooling requirements and where water resources are scarce, making them environmentally sustainable options. Their robust performance in diverse climatic conditions and lower dependency on external cooling resources contribute to their popularity.

As the market continues to evolve, the demand for air-cooled synchronous condensers is expected to grow, driven by their reliability and the ongoing expansion of power grids in both developed and developing regions. This trend indicates a sustained preference for air-cooled technology shortly.

By Starting Method Analysis

Over half of the market, 51.3%, prefers using static frequency converters to start synchronous condensers.

In 2023, the Static Frequency Converter held a dominant market position in the “By Starting Method” segment of the Synchronous Condenser Market, commanding a 51.3% share. This technology led the market over the Pony Motor, demonstrating its pivotal role in contemporary power management systems.

The preference for static frequency converters is primarily due to their efficiency and reliability in handling variable frequency drives, which are essential for modern electrical applications. These devices facilitate smooth and efficient power conversion, crucial for maintaining stability in power grids and ensuring consistent energy output.

Their ability to minimize power losses and enhance overall system performance makes them a favored choice among industries looking to optimize their energy setups.

Moreover, static frequency converters are easier to integrate into existing infrastructures compared to pony motors, which often require more complex installations and maintenance. This ease of integration, coupled with their superior operational capabilities, has helped cement their position in the market.

As industries continue to seek more energy-efficient and cost-effective solutions, the role of static frequency converters is expected to expand, reinforcing their status as a key component in the evolving landscape of the synchronous condenser market.

By Cooling Type Analysis

Air cooling remains a popular choice in the synchronous condenser market, representing 45.3% of the cooling types.

In 2023, Air Cooled technology held a dominant market position in the “By Cooling Type” segment of the Synchronous Condenser Market, securing a 45.3% share. This category outperformed both hydrogen-cooled and Water Cooled options, highlighting its significant role in meeting market demands.

Air-cooled synchronous condensers are favored for their operational simplicity and cost-effectiveness, which make them particularly attractive in economic terms. They do not require the complex infrastructure that water-cooled systems need, nor do they entail the safety considerations associated with hydrogen-cooled systems. This ease of use and lower installation cost contribute to their widespread adoption across various industries.

Additionally, the versatility and minimal environmental impact of air-cooled systems enhance their appeal in regions where water resources are scarce or where environmental regulations are stringent. They are capable of performing under diverse climatic conditions without the need for extensive cooling resources, which further solidifies their market position.

As the energy sector continues to evolve, the demand for reliable and efficient cooling solutions like air-cooled synchronous condensers is expected to grow. Their ability to provide stable performance with minimal upkeep makes them a practical choice for future energy infrastructure developments.

By Power Rating Analysis

In the higher power segment, synchronous condensers rated above 200 MVAR constitute 38.4% of the market share.

In 2023, the “Above 200 MVAR” category held a dominant market position in the “By Power Rating” segment of the Synchronous Condenser Market, with a 38.4% share. This segment led the market over other categories including Less than 50 MVAR, 50 to 80 MVAR, 80 to 100 MVAR, 100 to 150 MVAR, and 150 to 200 MVAR, underscoring its critical role in large-scale energy systems.

The robust performance of the Above 200 MVAR synchronous condensers is primarily due to their high capacity and efficiency in managing and stabilizing large power networks. These units are indispensable in applications requiring substantial reactive power supply, such as in stabilizing grids with high penetration of renewable energy sources and in large industrial plants.

Additionally, the economic advantages of deploying high-power condensers, such as reduced operational costs and improved efficiency across extensive power systems, have made them a preferred choice for major power generation and distribution companies. Their ability to enhance power quality and reliability in larger grids also contributes to their leading position in the market.

Given the ongoing expansion of renewable energy projects and the modernization of power infrastructure globally, the demand for Above 200 MVAR synchronous condensers is expected to continue growing. This trend highlights their pivotal role in meeting the evolving needs of an increasingly complex energy landscape.

By End-Use Analysis

Electrical utilities are the primary end-users of synchronous condensers, making up 63.3% of the market demand.

In 2023, Electrical Utilities held a dominant market position in the “By End-Use” segment of the Synchronous Condenser Market, with an impressive 63.3% share, outpacing the Industrial Sector. This segment’s lead underscores the critical role that electrical utilities play in the modern energy landscape.

Electrical utilities favor synchronous condensers for their ability to enhance power stability and improve voltage regulation across extensive power grids. This technology is essential for maintaining system integrity and reliability, especially in grids that are increasingly integrating renewable energy sources, which can introduce volatility in power supply.

The preference for synchronous condensers among electrical utilities is also driven by their long operational life and their ability to provide reactive power compensation, which is crucial for efficient energy transmission. This helps to minimize energy loss over long distances and maintain optimal operational conditions, thereby reducing operational costs and enhancing overall grid performance.

As the global demand for stable and reliable power supply continues to grow, the role of synchronous condensers in electrical utilities is expected to expand further. Their continued adoption is pivotal for supporting sustainable energy transitions and meeting the increasing energy demands of a digitally driven world.

Key Market Segments

By Insulation Type

- New Synchronous Condenser

- Refurbished Synchronous Condenser

By Cooling Technology

- Hydrogen-Cooled Synchronous Condenser

- Air-Cooled Synchronous Condenser

- Water-Cooled Synchronous Condenser

By Starting Method

- Static Frequency Converter

- Pony Motor

- Others

By Cooling Type

- Air Cooled

- Hydrogen Cooled

- Water Cooled

By Power Rating

- Less than 50 MVAR

- 50 to 80 MVAR

- 80 to 100 MVAR

- 100 to 150 MVAR

- 150 to 200 MVAR

- Above 200 MVAR

By End-use

- Electrical Utilities

- Industrial Sector

Driving Factors

Increasing Demand for Power Stability in Grids

The synchronous condenser market is experiencing growth primarily due to the increasing need for power stability in electrical grids. As renewable energy sources, which are inherently intermittent, become more prevalent, the demand for devices that can provide reactive power and stabilize voltage fluctuations intensifies.

Synchronous condensers are essential in maintaining the reliability and efficiency of the power grid, thereby preventing outages and ensuring consistent power supply, making them increasingly vital in energy management strategies.

Expansion of Renewable Energy Installations

With the global push towards sustainable energy, the expansion of renewable energy installations like wind and solar farms is another significant driver for the synchronous condenser market. These condensers facilitate the integration of renewable sources into the power grid by improving power quality and mitigating issues related to voltage regulation.

As countries aim to increase their share of renewable energy in the power mix, the demand for synchronous condensers is expected to surge, supporting the grid’s adaptation to these cleaner energy sources.

Aging Power Infrastructure and Retrofit Needs

A considerable portion of the existing power infrastructure in developed countries is aging, prompting urgent needs for upgrades and retrofits. Synchronous condensers offer a cost-effective solution to enhance the capacity and efficiency of old power systems without the need for complete overhauls.

They are particularly useful in extending the life of the grid and improving its performance, thus driving their market as utilities and power companies invest in maintaining their infrastructure’s reliability and effectiveness.

Restraining Factors

High Installation and Maintenance Costs

One of the primary challenges facing the synchronous condenser market is the high cost associated with their installation and ongoing maintenance. These devices require significant initial investments and skilled personnel for their operation, making them less appealing, especially for smaller utilities or regions with limited financial resources.

These costs can deter potential new entries into the market and slow down the adoption rates, as stakeholders weigh the benefits against the substantial upfront and operational expenses.

Competition from Alternative Technologies

Alternative technologies like STATCOMs and other flexible AC transmission systems offer similar benefits as synchronous condensers, such as voltage control and reactive power compensation, often at lower costs and with higher efficiency. As these technologies continue to advance and become more cost-effective, they pose a competitive threat to the adoption of synchronous condensers.

The market could see a shift in preference towards these newer technologies, especially in regions prioritizing innovation and cost efficiency in grid stabilization.

Regulatory and Environmental Challenges

The operation of synchronous condensers, especially those that are gas-powered, can face significant regulatory and environmental hurdles. Stricter emissions standards and regulatory frameworks focusing on reducing carbon footprints can limit the use of certain types of synchronous condensers.

Additionally, the environmental impact of non-renewable power sources and the push for greener alternatives can further restrict market growth, compelling companies to explore more environmentally friendly but potentially less familiar solutions.

Growth Opportunity

Development in Emerging Markets Boosts Market Expansion

Emerging markets present a significant growth opportunity for the synchronous condenser market. These regions are rapidly expanding their electrical infrastructure to support economic growth and urbanization, creating a demand for efficient grid solutions.

Synchronous condensers can play a pivotal role in stabilizing these new and often volatile grids, offering manufacturers and service providers a vast new customer base. Investments in infrastructure development, particularly in Asia, Africa, and South America, could drive substantial growth in the synchronous condenser sector.

Technological Advancements Enhance Product Appeal

Technological advancements are continuously improving the efficiency, reliability, and cost-effectiveness of synchronous condensers. Innovations such as digital controls and improved materials can make these systems more attractive to potential buyers by enhancing their functionality and reducing operational costs.

As technology evolves, the ability of synchronous condensers to integrate seamlessly with modern and future grid technologies could significantly expand their market. Companies that invest in these innovations may capture greater market share and open new avenues for deployment.

Retrofitting Aging Infrastructure Offers Lucrative Prospects

In developed countries, much of the electrical grid infrastructure is aging and in need of upgrades or replacements. Synchronous condensers are uniquely suited for retrofit applications where the goal is to enhance the existing grid rather than rebuild it entirely.

This presents a lucrative opportunity for companies specializing in synchronous condenser solutions, as utilities seek cost-effective ways to extend the life and capacity of their current systems. The retrofit market is extensive and continues to grow, providing ongoing opportunities for engagement and profit in the sector.

Latest Trends

Integration of Renewable Energy Drives Adaptation Strategies

The increasing integration of renewable energy sources into the power grid is a major trend influencing the synchronous condenser market. As solar and wind power become more prevalent, the need for grid stabilization technologies becomes crucial.

Synchronous condensers are proving to be effective in managing the variability and intermittency of renewable energy sources, ensuring grid reliability. This trend is pushing utilities to adapt their systems to handle these new challenges, with synchronous condensers playing a key role in these modernization efforts.

Smart Grid Technology Adoption Enhances Efficiency

The adoption of smart grid technologies is another significant trend in the synchronous condenser market. Smart grids utilize real-time data analytics and communication technologies to optimize the performance of the electrical network.

Incorporating synchronous condensers into smart grids can enhance their efficiency by improving voltage control and reactive power management. This synergy between smart technologies and traditional grid stabilization tools like synchronous condensers is creating more dynamic and responsive power systems, ready for the demands of modern energy consumption.

Increased Focus on Sustainability Influences Market Dynamics

There is a growing trend towards sustainability in the energy sector, which affects the synchronous condenser market. Stakeholders are increasingly considering the environmental impact of their operations and equipment. This shift is leading to innovations in synchronous condenser design to make them more energy-efficient and environmentally friendly.

As regulations on emissions and energy efficiency tighten, the market is seeing a push towards developing greener and more sustainable condenser solutions, aligning with global efforts to reduce carbon footprints in energy production and distribution.

Regional Analysis

In North America, the synchronous condenser market holds a 43.5% share, valued at USD 418.1 million.

The synchronous condenser market exhibits distinct regional dynamics, reflecting varying levels of infrastructure development, energy policies, and technological adoption across the globe.

North America leads the market with a substantial share of 43.5%, amounting to USD 418.1 million, driven by the U.S. and Canada’s push towards stabilizing renewable energy integrations and modernizing aging grid infrastructure. This region benefits from advanced technological infrastructure and stringent regulatory standards that mandate efficient power management solutions.

In Europe, the market is propelled by the continent’s aggressive renewable energy targets and the modernization of its power systems. Countries like Germany, the UK, and France are heavily investing in grid stability to accommodate the surge in renewable power, making Europe a significant player in the synchronous condenser market.

The Asia Pacific region is experiencing rapid growth, fueled by extensive developments in power grid infrastructure in China, India, and Southeast Asia. These countries are focusing on enhancing grid capacity and stability to support urbanization and industrial growth, positioning the Asia Pacific as a crucial market for future expansions.

Meanwhile, the Middle East & Africa are emerging markets with potential growth due to increasing investments in infrastructure projects and renewable energy. Countries like Saudi Arabia and South Africa are beginning to adopt more sophisticated grid solutions, including synchronous condensers, to ensure energy stability and support economic diversification plans.

Latin America, though smaller in comparison, shows promise with countries like Brazil and Argentina making strides in modernizing their electrical infrastructure to prevent power outages and integrate more renewables, suggesting a growing awareness and need for smart grid stabilization solutions like synchronous condensers.

Each region’s focus on enhancing grid efficiency and integrating renewable sources shapes the market’s landscape, reflecting diverse strategies and opportunities for market players.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global synchronous condenser market in 2023, key players such as ABB, Siemens Energy, and GE continue to dominate due to their robust technological capabilities and extensive market reach. ABB leads with innovative solutions that enhance grid stability and efficiency, leveraging advanced technologies to cater to the increasing demand for renewable integration and grid modernization.

Siemens Energy’s focus on sustainability and energy efficiency positions them as a pivotal player in markets prioritizing environmental compliance and advanced energy solutions.

GE’s expertise in power conversion technologies allows them to offer highly efficient synchronous condensers that are critical for maintaining voltage stability in complex power networks. Eaton and Voith Group are also significant contributors, with Eaton advancing in North American markets through their reliable power quality solutions, and Voith Group strengthening its position in Europe and Asia through strategic partnerships and technology advancements.

Emerging players like WEG and BRUSH Group are carving niches by focusing on specific regional needs and developing cost-effective, adaptable solutions that appeal to developing markets. Similarly, companies like ANDRITZ and Ansaldo Energia are expanding their market share by leveraging their expertise in heavy machinery to offer durable and high-performance synchronous condensers.

In the Asia-Pacific region, players like Mitsubishi Heavy Industries and Fuji Electric are pivotal, driven by local demands for infrastructure improvements and industrial growth. Their deep understanding of regional market dynamics enables them to deliver tailored solutions that address specific grid challenges.

The presence of specialized companies like Ideal Electric Power Co. and Power Systems & Controls highlights the market’s depth, with these firms providing niche products that enhance grid reliability and performance tailored to unique customer needs. Overall, the synchronous condenser market in 2023 is characterized by a mix of established giants and emerging challengers, each contributing to a competitive and technologically evolving market landscape.

Top Key Players in the Market

- ABB

- Siemens Energy

- GE

- Eaton

- Voith Group

- Fuji Electric

- WEG

- BRUSH Group

- ANDRITZ

- Ansaldo Energia

- Mitsubishi Heavy Industries, Ltd.

- BHEL

- Ideal Electric Power Co.

- Power Systems & Controls

- Electromechanical Engineering Associates

- Anhui Zhongdian (ZDDQ) Electric Co.

- Shanghai Electric

- Ingeteam

- Doosan Škoda Power

- Hangzhou Jingcheng Electrical Equipment Co.

- Doosan Skoda Power

- Fuji Electric

- Mitsubishi Heavy Industries

- Voith Group

- WEG

Recent Developments

- In 2023, ABB will remain a leader in the synchronous condenser market, enhancing grid stability and integrating renewable energy. Their compact units, equipped with advanced control systems like the AC500 PLC, improve power quality and grid stability worldwide, supporting compliance with diverse grid codes.

- In 2023, Siemens Energy enhanced its leadership in the Synchronous Condenser market by focusing on integrating renewable energy and improving grid stability. Key projects include a hybrid grid stabilization system in Shannonbridge, Ireland, and North America’s largest synchronous condenser project at the Intermountain Power Project, supporting a shift from coal to greener energy sources.

Report Scope

Report Features Description Market Value (2023) USD 1,507.1 Million Forecast Revenue (2033) USD 961.2 Million CAGR (2024-2033) 4.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Insulation Type (New Synchronous Condenser, Refurbished Synchronous Condenser), By Cooling Technology (Hydrogen-Cooled Synchronous Condenser, Air-Cooled Synchronous Condenser, Water-Cooled Synchronous Condenser), By Starting Method (Static Frequency Converterm Pony Motor, Others), By Cooling Type (Air Cooled, Hydrogen Cooled, Water Cooled), By Power Rating (Less than 50 MVAR, 50 to 80 MVAR, 80 to 100 MVAR, 100 to 150 MVAR, 150 to 200 MVAR, Above 200 MVAR), By End-use (Electrical Utilities, Industrial Sector) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, Siemens Energy,GE , Eaton, Voith Group, Fuji Electric, WEG, BRUSH Group, ANDRITZ, Ansaldo Energia, Mitsubishi Heavy Industries, Ltd., BHEL, Ideal Electric Power Co., Power Systems & Controls, Electromechanical Engineering Associates, Anhui Zhongdian (ZDDQ) Electric Co., Shanghai Electric, Ingeteam, Doosan Škoda Power, Hangzhou Jingcheng Electrical Equipment Co., Doosan Skoda Power, Fuji Electric, Mitsubishi Heavy Industries, Voith Group, WEG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Synchronous Condenser MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Synchronous Condenser MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Siemens Energy

- GE

- Eaton

- Voith Group

- Fuji Electric

- WEG

- BRUSH Group

- ANDRITZ

- Ansaldo Energia

- Mitsubishi Heavy Industries, Ltd.

- BHEL

- Ideal Electric Power Co.

- Power Systems & Controls

- Electromechanical Engineering Associates

- Anhui Zhongdian (ZDDQ) Electric Co.

- Shanghai Electric

- Ingeteam

- Doosan Škoda Power

- Hangzhou Jingcheng Electrical Equipment Co.

- Doosan Skoda Power

- Fuji Electric

- Mitsubishi Heavy Industries

- Voith Group

- WEG