Global Wet Waste Management Market By Service(Collection and Transportation, Disposal and Landfill, Processing, Sorting, Storage), By Source( Industrial, Municipal, Commercial, Healthcare and Medical, Others), By Waste Type(Food scrap, Meat and bones, Agricultural waste, Medical waste, Shredded paper, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132676

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

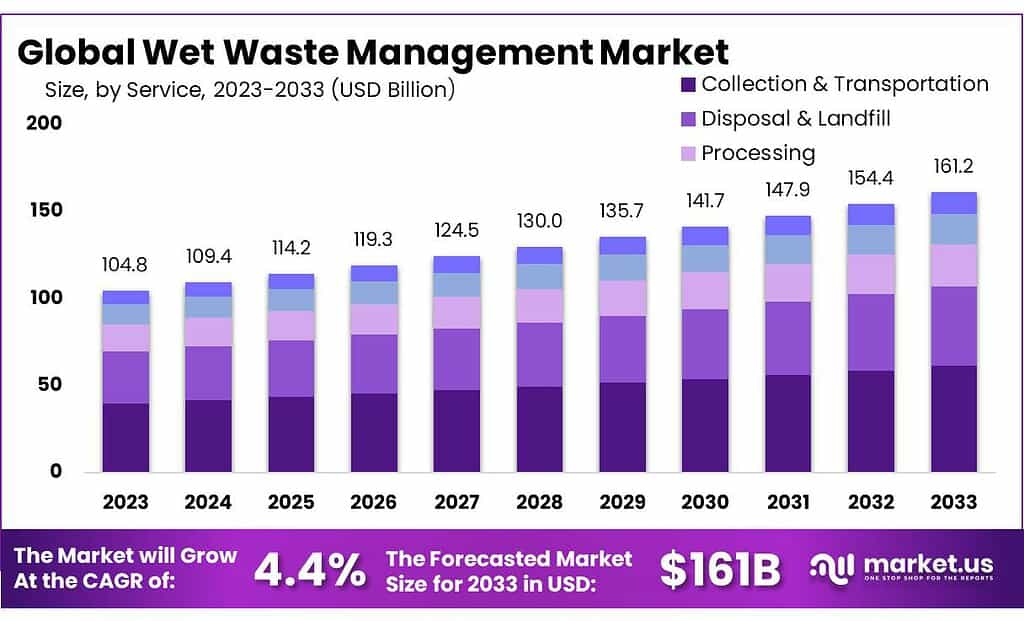

The Global Wet Waste Management Market size is expected to be worth around USD 161.2 Bn by 2033, from USD 104.8 Bn in 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

Wet waste management involves handling and disposing of organic materials like food scraps and yard waste, which have a high moisture content and can naturally decompose. This sector is pivotal for reducing environmental impacts, such as pollution and landfill usage, and is critical for fostering sustainable practices in waste handling.

There are various methods to manage wet waste, including composting, anaerobic digestion, and conversion to bioenergy, each contributing to more effective and environmentally friendly waste processing.

For instance, in 2021, U.S. private sector investment in food waste management solutions surged to $4.8 billion, up from $3.7 billion the previous year. This growth not only highlights the escalating commitment to innovative waste management techniques but also points to a broader recognition of their importance in tackling challenges related to climate change and resource conservation.

Government involvement has also been significant. The United States Department of Agriculture (USDA), for example, allocated around $11.5 million toward composting and food waste reduction projects across 23 states.

These initiatives are designed to boost local recycling efforts and promote sustainability at the community level. Such funding is indicative of a strategic shift towards integrating waste reduction more prominently within both policy frameworks and practical applications, aiming to overhaul traditional waste management systems into more sustainable and efficient ones.

Key Takeaways

- Wet Waste Management Market size is expected to be worth around USD 161.2 Bn by 2033, from USD 104.8 Bn in 2023, growing at a CAGR of 4.4%.

- Collection and Transportation held a dominant market position in the wet waste management sector, capturing more than a 38.3% share.

- Industrial sector held a dominant market position in the wet waste management market, capturing more than a 37.2% share.

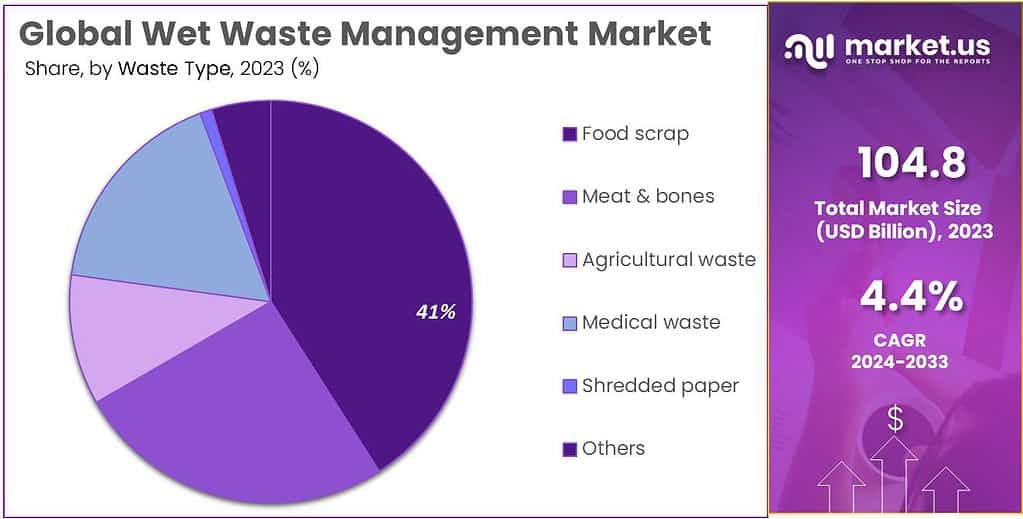

- Food Scrap held a dominant market position in the wet waste management market, capturing more than a 43.3% share.

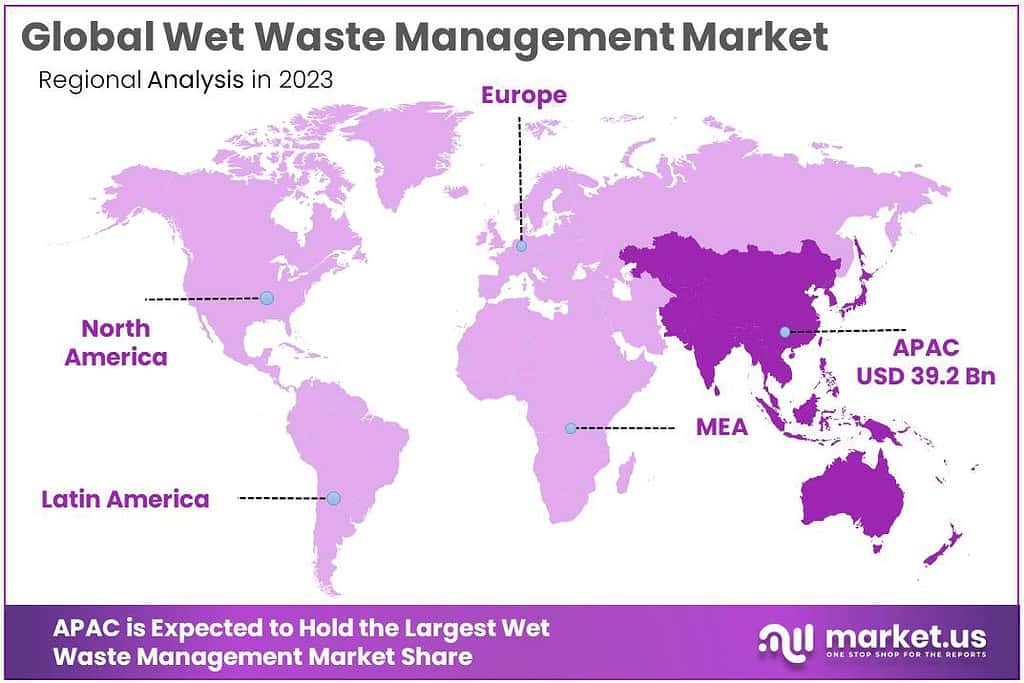

- Asia Pacific (APAC) leading the way. As of 2023, APAC holds a dominant market share of 37%, valued at USD 39.2 billion.

By Service

In 2023, Collection & Transportation held a dominant market position in the wet waste management sector, capturing more than a 38.3% share. This segment is crucial due to its role in efficiently moving waste from its source to facilities where it can be processed or disposed of. Efficient collection and transportation systems are essential for reducing the time that wet waste spends in transit, thereby minimizing odor and the risk of contamination.

Disposal & Landfill services, while necessary, are increasingly complemented by more sustainable practices. However, they still play a significant role in managing waste that cannot be recycled or composted, focusing on minimizing environmental impact through modern landfill technologies.

Processing services are vital for converting wet waste into reusable materials and energy. This segment involves composting, anaerobic digestion, and other conversion technologies that transform organic waste into valuable byproducts like compost or biogas.

Sorting services ensure that wet waste is appropriately separated from dry waste, enhancing the efficiency of recycling processes and the quality of the resulting products. Proper sorting is critical for effective recycling and processing, as contamination can significantly hinder these operations.

Storage services provide temporary containment of wet waste, ensuring that it is held in controlled conditions before processing or disposal. This segment is essential for managing the accumulation of waste, particularly in urban settings where space constraints and sanitation are significant concerns.

By Source

In 2023, the Industrial sector held a dominant market position in the wet waste management market, capturing more than a 37.2% share. This segment includes waste generated from manufacturing processes and industrial activities, which often requires specialized handling and treatment due to the nature and volume of the waste produced.

The Municipal segment follows, dealing with waste from residential areas, schools, public offices, and parks. This type of waste is typically managed by local government authorities and involves both organic and inorganic waste, necessitating broad and efficient collection and processing systems to support large populations.

Commercial waste management encompasses waste from businesses like restaurants, markets, and retail stores. This sector demands robust management strategies to handle the high volume of organic waste, particularly food waste, which requires timely and effective processing to prevent spoilage and odor.

Healthcare & Medical waste management is critical due to its hazardous and infectious nature. This segment requires stringent regulations and methods for handling, treating, and disposing of medical waste to ensure public health and safety.

By Waste Type

In 2023, Food Scrap held a dominant market position in the wet waste management market, capturing more than a 43.3% share. This segment includes leftovers, peels, and other food residues from residential, commercial, and industrial sources. The management of food scraps is crucial due to their high biodegradability and potential for methane production if not properly handled.

Meat & bones represent another significant category, requiring specialized disposal and treatment methods due to their composition and the potential for attracting pests and causing odors. This type of waste is often processed through rendering to recover valuable materials or converted into pet food and fertilizers.

Agricultural waste includes organic residues from farming and horticulture, such as plant stalks, leaves, and husks. Managing this type of waste often involves composting or anaerobic digestion, turning it into a resource for soil amendment or renewable energy.

Medical waste encompasses a variety of waste products from healthcare facilities, including soiled bandages, sharps, discarded surgical gloves, and other materials that may be contaminated with bodily fluids and are typically incinerated or treated in specialized facilities to prevent disease transmission.

Shredded paper, while not typically classified strictly under wet waste, includes paper products that have been contaminated with food or other waste products making them unsuitable for traditional recycling. These are often composted to avoid landfilling.

Key Market Segments

By Service

- Collection & Transportation

- Disposal & Landfill

- Processing

- Sorting

- Storage

By Source

- Industrial

- Municipal

- Commercial

- Healthcare & Medical

- Others

By Waste Type

- Food scrap

- Meat & bones

- Agricultural waste

- Medical waste

- Shredded paper

- Others

Driving Factors

Government Initiatives and Environmental Regulations

Governments are intensifying regulations related to waste management to mitigate environmental impacts. For instance, the U.S. government, under the Biden-Harris Administration, has announced a comprehensive National Strategy to reduce food loss and waste by 50% by 2030. This initiative includes actions to divert organic waste from landfills to reduce methane emissions, a significant factor in global warming.

Technological Advancements in Waste Processing

Technological innovations are playing a crucial role in transforming wet waste management. Advanced technologies such as anaerobic digestion facilities are being increasingly adopted to process wet waste more effectively, turning organic waste into biogas and other valuable byproducts. This not only helps in reducing the volume of waste sent to landfills but also supports the production of renewable energy.

Economic Incentives and Funding

Significant investments and funding are being allocated to support wet waste management initiatives. For example, the EPA announced $93 million in grants to enhance recycling and composting efforts as part of its broader strategy to tackle climate change and promote circular economy practices. Such financial incentives are crucial for developing the necessary infrastructure to support advanced waste management systems.

Public and Private Sector Collaboration

There is a growing trend of collaboration between public agencies and private companies to enhance wet waste management. Public-private partnerships are being formed to implement and enhance recycling and composting programs, demonstrating a collective effort to address waste management challenges effectively and sustainably.

Restraining Factors

High Capital Investment

Establishing modern waste management facilities often involves substantial capital expenditure, which includes the cost of acquiring advanced technologies for waste sorting, anaerobic digestion, and recycling processes. These costs can be prohibitive, especially for lower-income regions or smaller municipalities that may lack the necessary financial resources.

Complexity of Managing Wet Waste

The management of wet waste is complex due to its perishable nature and potential to generate odors and attract pests. This requires continuous innovation and updating of facilities to handle the waste effectively, adding to the operational costs.

Economic Feasibility

The economic feasibility of investing in advanced wet waste management systems can be challenging. While these systems are essential for environmental sustainability, the return on investment can be slow, and the financial benefits might not immediately offset the initial costs.

Regulatory and Compliance Costs

Compliance with stringent environmental regulations also adds layers of costs related to waste treatment and disposal standards. Meeting these regulations often requires additional processes and technologies that increase the overall expense of waste management operations.

Growth Opportunity

Adoption of Waste-to-Energy Technologies

Waste-to-energy initiatives are increasingly being recognized as a sustainable solution for managing waste. These technologies not only help in reducing the volume of waste sent to landfills but also support renewable energy generation. For example, the Waste-to-Energy sector has shown resilience and growth potential by providing stable energy outputs and employment opportunities, especially in Europe.

Government Initiatives and Support

Various government initiatives are encouraging the growth of the wet waste management market. For instance, significant funding and regulatory support are being directed towards recycling and composting, as well as the conversion of wet waste into bio-based products and organic fertilizers. This is part of broader governmental efforts worldwide to enhance waste management infrastructure and promote sustainable practices.

Technological Advancements

Innovations in wet waste processing technologies, such as anaerobic digestion and advanced composting techniques, are making the processing of wet waste more efficient and environmentally friendly. These advancements are crucial for the scalability of waste-to-energy solutions, which are expected to play a significant role in the future of waste management.

Market Growth Projections

The global wet waste management market is forecasted to grow significantly, with projections indicating a continued increase in market size due to rising urbanization and industrial activities that generate substantial wet waste. This trend underscores the need for effective management solutions that can handle the increasing volumes of waste.

Latest Trends

Focus on Sustainability and Renewable Energy

Governments worldwide are implementing policies that promote the conversion of waste into energy, viewing it as a key component of sustainable waste management strategies. This is supported by investments and financial incentives that encourage the development of WtE facilities. The global market for WtE is expected to see significant growth, with an increase in installations and the adoption of advanced technologies to improve energy efficiency and environmental compatibility.

Technological Advancements in WtE

There is a growing emphasis on improving the efficiency and environmental footprint of WtE technologies. Innovations such as thermal-based waste-to-energy processes, which include advanced incineration methods with energy recovery, are being optimized to increase their energy output and reduce emissions. These technologies are crucial in regions with high waste production rates, where they can significantly contribute to energy generation while addressing waste disposal challenges.

Regional Growth Opportunities

The Asia-Pacific region, in particular, is experiencing rapid growth in the WtE sector due to urbanization and industrialization, which have led to increased waste generation. Countries like China and India are investing heavily in WtE projects as part of their urban waste management strategies. These investments are not only aimed at tackling the rising waste volumes but also at supporting the region’s energy needs through renewable sources.

Market Expansion and Forecast

The market is expected to continue expanding, with significant growth projected through 2027. This expansion is fueled by both the rising volume of waste generated globally and the increasing recognition of the economic and environmental benefits of converting this waste into energy.

Regional Analysis

The wet waste management market exhibits distinct characteristics and growth patterns across various global regions, with Asia Pacific (APAC) leading the way. As of 2023, APAC holds a dominant market share of 37%, valued at USD 39.2 billion. This region’s leadership is driven by rapid urbanization, industrialization, and significant investments in waste-to-energy technologies. Countries like China, India, and Japan are aggressively pursuing innovations in waste management to cope with the rising volumes of urban waste and associated environmental impacts.

In North America, the market is propelled by stringent environmental regulations and a well-established infrastructure for waste management. The United States and Canada are focused on enhancing recycling and waste reduction programs, integrating advanced technologies such as anaerobic digestion facilities to convert organic waste into renewable energy.

Europe also showcases a strong commitment to sustainability, with countries like Germany, Sweden, and the Netherlands leading in recycling and waste management initiatives. The European market benefits from favorable government policies that encourage waste processing and conversion, aiming to minimize landfill usage and carbon emissions.

The Middle East & Africa (MEA) region, while still developing in terms of waste management infrastructure, is beginning to recognize the potential of waste-to-energy solutions. Investments in urban waste management systems are gradually increasing, driven by urban growth and the need to diversify energy resources.

Latin America is focusing on improving its waste management frameworks, with countries like Brazil and Argentina making strides in urban waste processing initiatives. Though challenged by financial constraints, the region is gradually adopting more sustainable waste management practices to address its urbanization challenges.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The wet waste management market is diversified and competitive, featuring a range of key players who specialize in various aspects of waste collection, processing, and disposal. Among them, Waste Management Inc. and Veolia Environnement SA are leading players known for their extensive operations and advanced waste management solutions. These companies have a robust presence across multiple regions, providing services that range from regular municipal waste collection to complex industrial and hazardous waste treatment.

Companies like Clean Harbors Inc. and Covanta Energy Corporation focus more on hazardous and industrial waste, offering specialized services that include recycling, treatment, and energy recovery from waste. Clean Harbors is notable for its environmental cleanup services, while Covanta is recognized for its waste-to-energy facilities which convert municipal and industrial waste into electricity.

Top Key Players in the Market

- Advanced Disposal Services Inc.

- Biffa Plc

- Clean Harbors Inc

- Covanta Energy Corporation

- Daiseki Co. Ltd.

- Earthrecycler

- Eco-Wise Waste Management Pvt. Itd

- Evac Oy

- FCC SA

- Fomento de Construcciones Contratas

- GEPIL

- Hasiru Dala Innovations Pvt. Ltd.

- Hitachi Zosen Corp.

- Panda Recycling

- ProEarth Ecosystems Pvt. Ltd.

- Progressive Waste Solution Itd

- Remondis SE and Co. Kg

- Republic Services Inc.

- RETHMANN SE and Co. KG

- SAAHAS WASTE MANAGEMENT Pvt. Ltd.

- Sampur(e) Environment Solutions Pvt ltd

- Stericycle Inc.

- SUEZ Environnement Co. S. A.

- Valicor Inc.

- Veolia Environnement SA

- Waste Management Inc.

- Waste Ventures

Recent Developments

Advanced Disposal Services Inc., now part of Waste Management Inc., has been a significant player in the wet waste management sector. The acquisition by Waste Management, finalized in 2020 for approximately $4.6 billion, integrated Advanced Disposal’s operations, enhancing their collective capabilities in waste management and recycling services.

Biffa reported substantial growth, with revenues reaching £1.68 billion, marking a significant 16% increase from the previous year.

Report Scope

Report Features Description Market Value (2023) USD 104.8 Mn Forecast Revenue (2033) USD 161.2 Mn CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Collection and Transportation, Disposal and Landfill, Processing, Sorting, Storage), By Source ( Industrial, Municipal, Commercial, Healthcare and Medical, Others), By Waste Type (Food scrap, Meat and bones, Agricultural waste, Medical waste, Shredded paper, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advanced Disposal Services Inc., Biffa Plc, Clean Harbors Inc, Covanta Energy Corporation, Daiseki Co. Ltd., Earthrecycler, Eco-Wise Waste Management Pvt. Itd, Evac Oy, FCC SA, Fomento de Construcciones Contratas, GEPIL, Hasiru Dala Innovations Pvt. Ltd., Hitachi Zosen Corp., Panda Recycling, ProEarth Ecosystems Pvt. Ltd., Progressive Waste Solution Itd, Remondis SE and Co. Kg, Republic Services Inc., RETHMANN SE and Co. KG, SAAHAS WASTE MANAGEMENT Pvt. Ltd., Sampur(e) Environment Solutions Pvt ltd, Stericycle Inc., SUEZ Environnement Co. S. A., Valicor Inc., Veolia Environnement SA, Waste Management Inc., Waste Ventures Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wet Waste Management MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Wet Waste Management MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Advanced Disposal Services Inc.

- Biffa Plc

- Clean Harbors Inc

- Covanta Energy Corporation

- Daiseki Co. Ltd.

- Earthrecycler

- Eco-Wise Waste Management Pvt. Itd

- Evac Oy

- FCC SA

- Fomento de Construcciones Contratas

- GEPIL

- Hasiru Dala Innovations Pvt. Ltd.

- Hitachi Zosen Corp.

- Panda Recycling

- ProEarth Ecosystems Pvt. Ltd.

- Progressive Waste Solution Itd

- Remondis SE and Co. Kg

- Republic Services Inc.

- RETHMANN SE and Co. KG

- SAAHAS WASTE MANAGEMENT Pvt. Ltd.

- Sampur(e) Environment Solutions Pvt ltd

- Stericycle Inc.

- SUEZ Environnement Co. S. A.

- Valicor Inc.

- Veolia Environnement SA

- Waste Management Inc.

- Waste Ventures